Signing out for 2025

.. and notes on what's in store for 2026

Hey there,

This time of the year is like Thursday every week. Everybody knows the weekend is just around the corner. Some have dates planned. Some look forward to meeting family. And many simply wonder what to do with the existential dread that comes with holidays. Writing over the next few weeks will be choosing to battle the conflicting demands of attention from family and brands putting out reports.

So we will be taking a break until early January to plug off. There are birds outside the office we need to catch up with—the mountains beckon. Breaks and plugging off are crucial to the creative process.

As has been the tradition for the past two years, here is a PDF of everything we wrote in 2025 for those who want to export it to a reader, print it, or feed it into an LLM. If you are new here, you can grab the 2024 issue here and the 2023 version here. You can get the epub version and PDF version on Google Drive here in case you want to sync it to an external reader.

This year, we published fewer things, but with higher accuracy. For instance, we wrote about interface fees and embedded markets in April, months before prediction markets took off. Saurabh wrote about mergers and acquisitions in May, a quarter before Coinbase decided it was the season to buy out startups. In August, we wrote about the emergence of neo-banks. We wrote about the divergence of protocols generating revenue and ones without in July, almost two quarters before it was trending on X.

Admittedly, we may have been too late to catch the DAT party.

The Wall Street-ification of crypto is a trend we are watching from a distance and building a better understanding of.

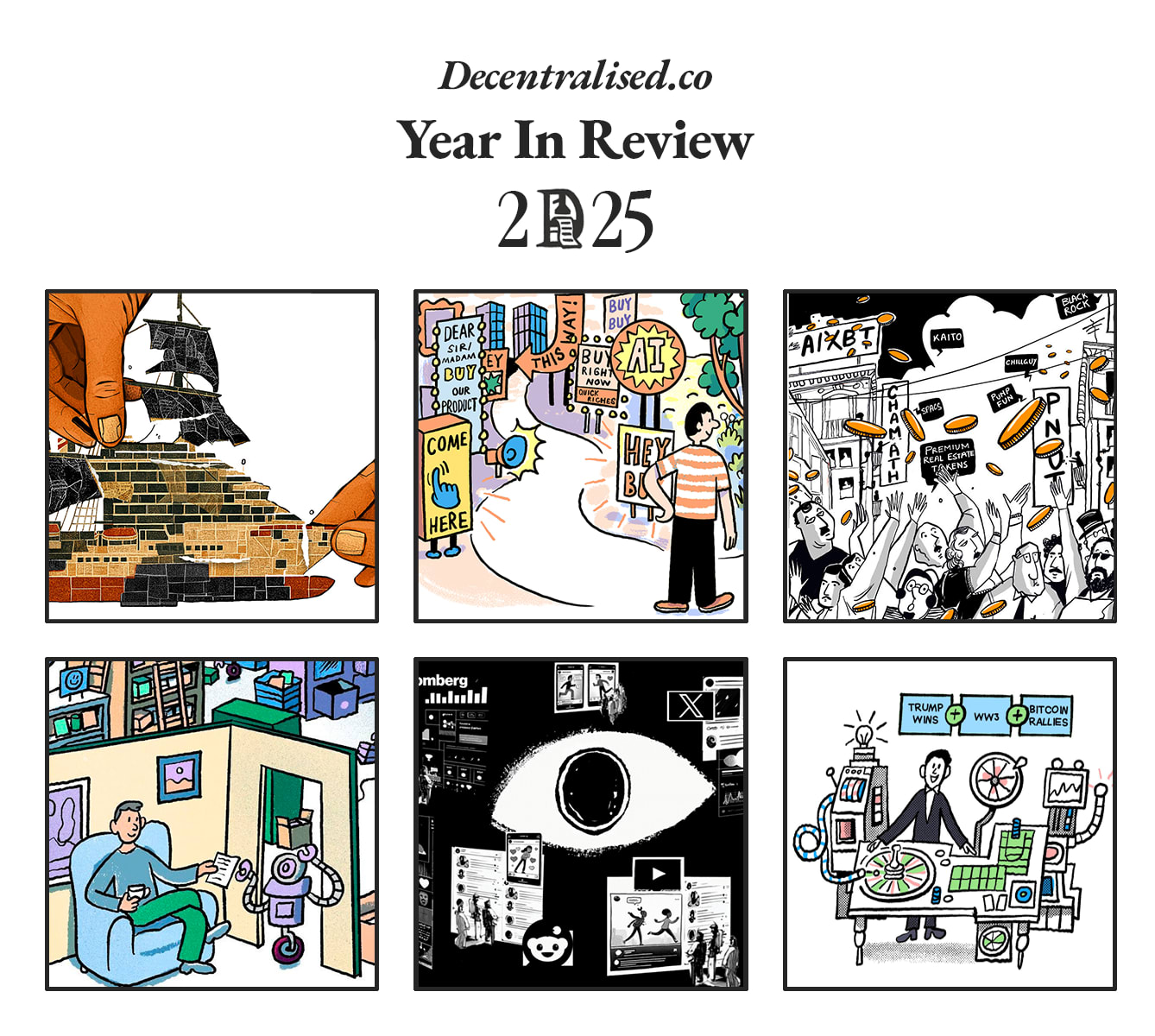

Everything we wrote boils down to three themes that represent the disruptive cycles crypto is undergoing. These themes guide how we think about startups and our involvement with them:

Distribution and Scale Are King

When a technology first emerges, simply using it makes it novel. Mobile apps and the internet were once novel. So were crypto apps. But those days are behind us. Firms and founders are now judged by the scale and moats of their distribution. They are also heavily punished if they do not have it. The reason why many tokens are in down-only paradigms post-listing is that they confuse exchange listings with distribution.

Margins Matter

The most common business model in crypto today is interface fees on trading products. Farcaster had to pivot from a social network protocol to a trading-oriented wallet. Hyperliquid is currently in a shaky position with Lighter competing on a zero-fee model. All apps will undergo a period of creative destruction as they compete on lower margins to acquire and retain users.

For founders, the most complex problem will not be scaling in markets with multiple peers. It will be creating margins that justify their valuations. We will see the emergence of two kinds of crypto in pursuit of margin. One would be cypherpunk money, which commands a premium due to the extent of decentralisation and privacy it offers. The other is what we call - enterprise cash. These would be real-world assets and fintechs being built with a blockchain in the back-end capturing small slices of high transaction volumes.

The Niche Leverage

Where does margin come from then? It will often be due to vertical integration. USD.AI focuses on equipment financing, with an emphasis on GPUs. Qiro underwrites lending in private credit. Semiliquid is building infrastructure for lending between institutions in crypto. As the infrastructure layer matures, founders will focus on niche pockets for higher margins and reduced competition. As Thiel puts it - competition is for losers.

So, what’s in plan for 2026?

There are a few broad strokes that affect storytelling in crypto today. For the first time, our niche industry is eating into fintech. And with it, the audience base we can write for is expanding. The way stories are communicated is no longer just for the person buying tokens on Binance. We are writing for everyone who takes an interest in how the way money moves affects systems. The market has expanded faster than our minds could grasp that shift.

Crypto has always been a global phenomenon. We are writing for the person in Mumbai as much as for the person in Manhattan. We want to continue to make the newsletter a breeding ground for great ideas, good people, and the leverage of capital to come together. We want to be the hub, where writing is still human, bleeding with curiosity - and probably riddled with typos in the age of LLM-generated perfection. We want to speak to a global culture, as much as we are constantly defined by it.

With that in mind, here are two core priorities for 2026:

A Galapagos for Antimemetics

Do you want to be famous, or be understood? What matters more if you are a startup? In the age of LLM-generated content and declining attention spans, long, well-researched, humane stories will continue to have their place. As our feeds become hostile ground, the written medium will serve as a wedge for uncomfortable conversations, sharing unpopular ideas, and fostering collaboration—a corner for nerds in the age of glitz and glam.

Nadia Aspraouhova defines these forms of ideas that are often not viral as antimemetics. Memes and antimemes are the yin and yang of the attention economy. We want to continue making the newsletter the best place for long-form research and discussion of unpopular, often uncomfortable ideas. As crypto goes mainstream, the publication will remain a curated, safe corner for people to enter and explore the industry. We may lean into the memetic side of distribution on X going forward because who doesn’t like attention? Distribution, after all, is influence.

Liquid Markets Investing

One of the ideas we teased in Crypto, capital and culture, is that a culture is preserved or represented best when it has capital backing it. As writers, our interests are best protected when there are healthy margins in what we spend time on. This is where our interests come into conflict. Or what the big kids call - a conflict of interest.

If we believe in what we publish and the accuracy of our research, we should be putting capital behind it. And that is what we are doing. As we pen these words, we are in the last leg of signing one of the largest term-sheets we have invested in from our entity.

In 2026, you will see us speaking more of the bets we have made and the ways we get involved with our portfolio of companies. More growth stage, less pre-seed - in line with crypto’s current expansionary arc. Capital and effective storytelling are two levers that help shape reality. As DCo grows, we want the two to intertwine.

Our priorities don’t exactly change year to year, as much of the work we set out to do remains to be done.

Most people don’t realise the extent to which crypto has grown in the past three years. In May 2022, we saw $40 billion in value wiped out because of a stablecoin that rhymed with a Ponzi scheme. In November of that year, the largest exchange disappeared, taking user deposits with it. As late as December 2023, the most remarkable thing on Solana was a dog with a hat.

In contrast, under the current administration in the United States, fintech firms have embraced stablecoins, Robinhood is integrating prediction markets, heck - ICE invested in Polymarket, Arbitrum is bringing thousands of stocks on-chain, and the DTCC is working towards settling treasuries on Canton. We are witnessing what can be considered cultural inertia. That feeling of not wanting to give up a way of being, during the early innings of a sector coming of age.

Crossing the chasm is as much a psychological feat as it is a technological and socio-economic one.

I don’t mean to imply that in 2026, we will have to swap our NFT display pictures on Twitter for suits. But we do need to realise that the ways of building a business, capturing value, and scaling it have shifted. For us at DCo, the priority is to stay slightly ahead of the curve as it evolves, so we can share what we see with our readers and apply it to our portfolio of companies that has now grown to over 25 in size. Perhaps that is the cost of winning.

In a year marked by change, we hope you found the fortitude to evolve. If these changes have disrupted your life, we hope you find the strength and calm needed to regain stability. In 2026, we hope to continue to be inspired by beauty and guided by the curiosity that has marked much of our writing. We will see you in January - with long form articles, more depth, more quadrants, and perhaps messier art accompanied by a bundle of typos.

Signing off for now,

Joel, Sid - and the DCo Team

Здравствуйте! С наступающими праздниками Вас! Всего Вам хорошего! Мне очень нравятся Ваши публикуемые материалы. На фоне той массы публикаций о крипторыке, криптовалюте и всего того, что с этим связано., я отдельно выделяю Ваши материалы как наиболее важные, интересные и полезные.С глубоким уважением к Вам.

Great recap of real crypto frontier!