Everything is a Market

Sell, cell, excel

Hello!

If the world runs on money, and blockchains are money rails - then blockchains might soon run the world. Maybe Beyoncé would not be pleased to hear that. (It’s a reference to this track - in case you don’t listen to her).

We have been talking extensively about how revenue, margins and scale would matter over the past few months. Today’s issue explores that theme even further. We argue that everything on the web is trending towards being a market. Dating? There’s a market for it. Music? Yep, it could be traded. IP rights for medicines? We will tokenise that too.

We explore how and why blockchains enable better markets and the ways it is evolving present-day business models. We start with financial markets and scale all the way to news & social networks. If these themes interest you - make sure to reach out to us at venture@decentralised.co. We have been steadily advising and investing in some of the largest markets enabled by blockchain rails. We’d love to talk.

On to the issue..

Joel

If you ever have the great misfortune of being on a dating app long enough, you will eventually come across one of the deadliest financial instruments known to mankind. The boost button.

It lets single men and women get seen by more single men and women; a digital billboard for the singleton looking to meet the love of their life, hoping that swipes & pick-up lines would succeed where introductions and DMs once reigned. The reason why this odd little feature captures our attention is purely financial. ⅔ of DCo’s senior management is married, and the third can be presumed committed.. We are not dabbling in boosts ourselves. But let me explain why it has our attention.

You see, when you buy a financial contract, the terms are usually clear. You know what you are pricing in: interest rates, volatility, click-through rates. These are all mechanisms that quantify and explain the economic variables that affect a contract. But the boost button has none of that. It simply shows random faces flicker across the screen. And you are supposed to believe that all those faces somehow saw you. And rejected you. People are paying to be maybe-seen, maybe-swiped, maybe-not. It’s a product sold on hope, but monetised on ambiguity—a symbol of both the desperation and the loneliness epidemic that symbolises our time. In 2023, Match Group made $651 million. Much of it, enabled by these billboards for love.

But why are we talking about this? Because it is indicative of how everything has become a market. Advertisements turned attention into a commodity, packaged, quantified and bid on. The reason probably had to do with Wall Street crashing (2008) and social networks coming of age (early 2010s) around the same time. The same men who packaged CDOs were now betting on who would get more clicks. A decade later, everything has a market. Even love.

Few places symbolise this transition as much as flights do. You don’t need to do the thing, as long as you can create a market for the thing. For instance, the GDP of airline points is larger than the market capitalisation of the businesses that run those points. There is more money to be made in promising discounts on a business class ticket than in actually servicing the business class flight. For instance, in 2020, United Airlines' MileagePlus program was valued at $22 billion compared to the company’s market cap, which was at $10 billion then.

Crypto brings a new element to it. It allows everything to be represented as a token and traded. There are no creators, only “creator coins”. You don’t need to spend years perfecting an art form to make content. Just go ahead and release a content coin, and watch it burn. There are even markets where you can bet on dating outcomes. In other words, crypto rails have the power to convert commodities (like a dating app boosts) into markets you can speculate on (like the outcome of a match).

Though what happens to a society when everything is a market? For much of human evolution, our bets were paced by human agency and effort. Writing notes to a loved one is a bet. Pursuing a dream was a bet. Moving to a new country was a bet. But how does all of that change when the definition of a “bet’ is purely financial? And how does this play out in an age where the average individual is visibly, fiscally, mentally, spiritually and emotionally poorer than their parents?

Today’s issue tries to find answers to some of those questions. If blockchain rails make everything a market, what are the businesses that will emerge? And how does information play a role in all of it? Let’s dig in.

Tokenisation in Numbers

Before we go into hypotheticals, it helps to understand the size of the markets we are dealing with. Conventional financial products, like dollars on a blockchain (stablecoins) or houses on a blockchain (RWA loans), have reached a market size of tens of billions of dollars. What is more interesting is how they have evolved. But first, the numbers.

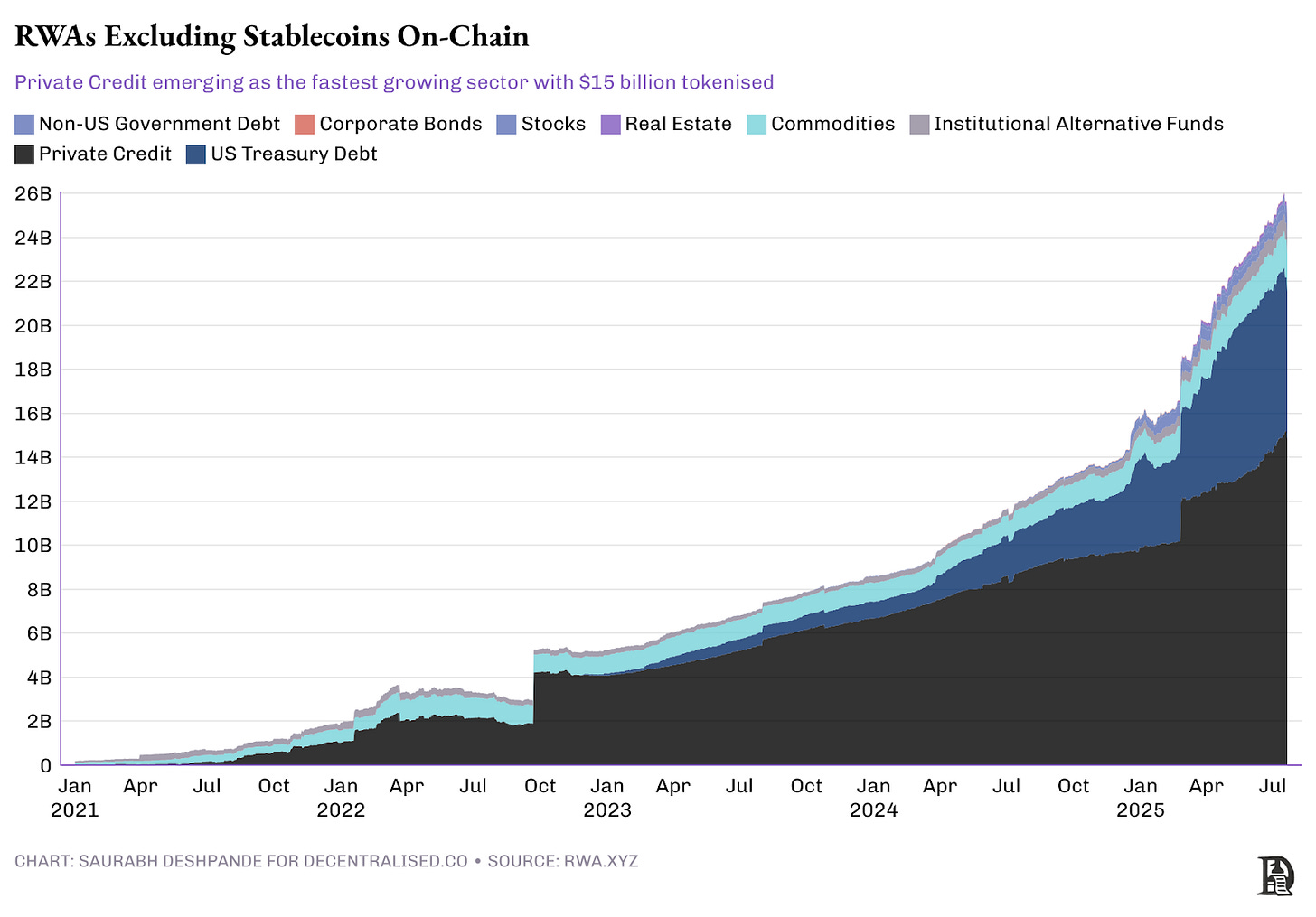

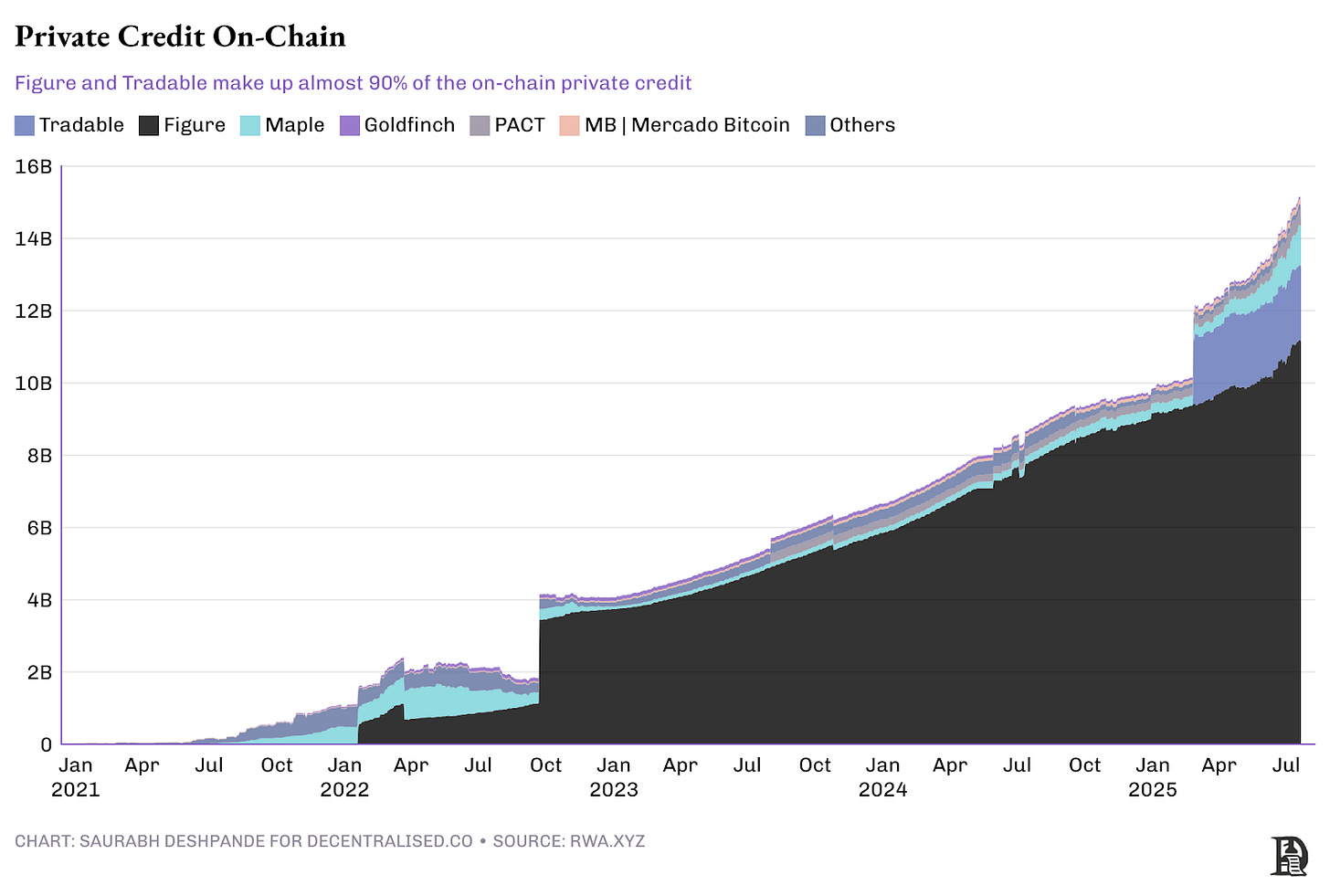

With the exception of stablecoins, the on-chain RWA market grew from about $5 billion in 2022 to over $25 billion by mid-2025. That’s a 400% increase, making RWAs one of crypto’s fastest-growing segments, second only to stablecoins. The growth was fueled by private credit and US Treasury debt. At approximately $15 billion, private credit has been the highest-growing segment within RWA, led by companies like Figure, Tradable, and Maple Finance with ~$11 billion, $2 billion, and $878 million in active loans, respectively.

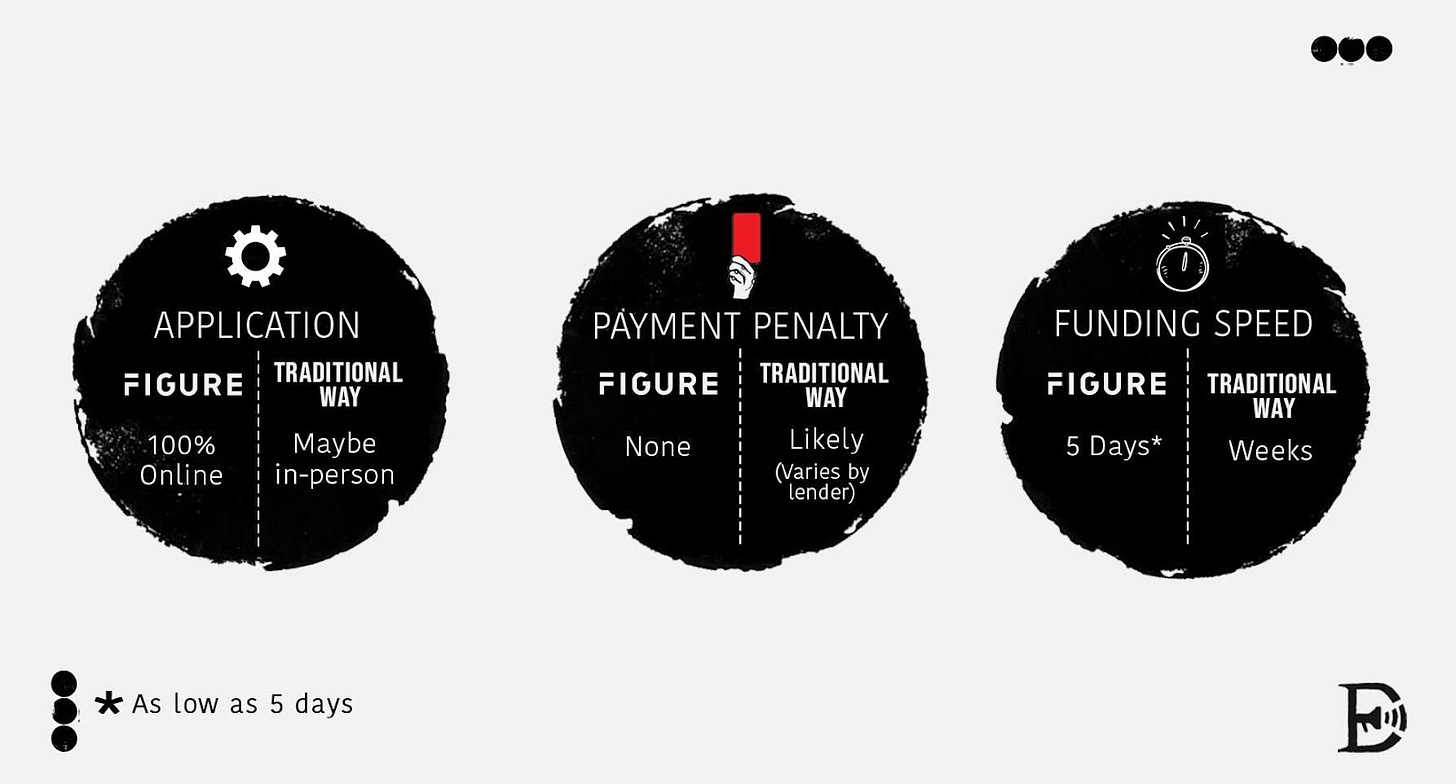

With the figures out, let me explain how Figure works. They are replacing legacy systems with blockchain to replace infrastructure that is notorious for causing delays and frustrations among consumers. There’s no token, no yield to farm. In fact, when you visit their website, you won’t see the word “blockchain” plastered all over. It looks, through and through, like a fintech company. Behind the familiar veneer of home‑equity lending, Figure takes minutes to apply and disburses funds in days.

At the heart of it is DART (Digital Asset Registration Technology), an electronic registry built on the Provenance blockchain. Think of DART as the ledger’s librarian, cataloguing every lien and eNote with cryptographic certainty, stamping time like a digital archivist. Over $15 billion in HELOCs (Home Equity Line of Credit) now have their histories etched on‑chain.

Figure Connect is an institutional loan marketplace, also built on the Provenance blockchain. It allows buyers like Goldman Sachs, Jefferies, and other credit investors to purchase pools of loans such as HELOCs and DSCR (Debt Service Coverage Ratio), with far less friction than traditional methods. Instead of navigating weeks-long settlement cycles, manual reconciliations, and fragmented custodial processes, these institutions interact with a platform where every loan is already recorded, verified, and tracked on-chain. The system relies on DART, Figure’s blockchain-based registry, which records ownership and lien positions in real-time and provides a single, verifiable source of truth for all transaction data.

For institutional buyers, the shift is measurable. In a typical secondary loan transaction, it can cost around $500 per loan to complete due diligence, verify ownership, audit lien positions, and reconcile documents. With Figure Connect, those costs drop dramatically to as low as $15. That’s savings of up to $485 per loan, or 48.5 basis points on a $100,000 mortgage. The blockchain’s immutability and real-time transparency reduce the need for third-party audits and enable faster settlement. It cuts timelines from weeks to mere days or even hours.

So who benefits, and how?

Goldman Sachs and Jefferies save both time and money at their disposal. They will reduce administrative overhead, improve settlement certainty, and gain the ability to access standardised, ready-to-trade loan pools.

Figure, on the other end of the market, gains instant liquidity and scalability. With over $2 billion in committed capital via a joint venture with Sixth Street, it can originate loans with greater confidence, knowing that institutional buyers are ready to purchase.

For borrowers, the benefits are indirect but meaningful. Lower transaction costs at the infrastructure level make it easier and potentially cheaper for lenders to offer competitive terms. And because everything is traceable on-chain, investors, auditors, and servicers operate with a clearer view of risk exposure.

In essence, Figure Connect turns a slow, paperwork-heavy capital markets workflow into a digitally native credit pipeline. Instead of reinventing the wheel altogether, it just makes the rails faster, cheaper, and more transparent for everyone involved.

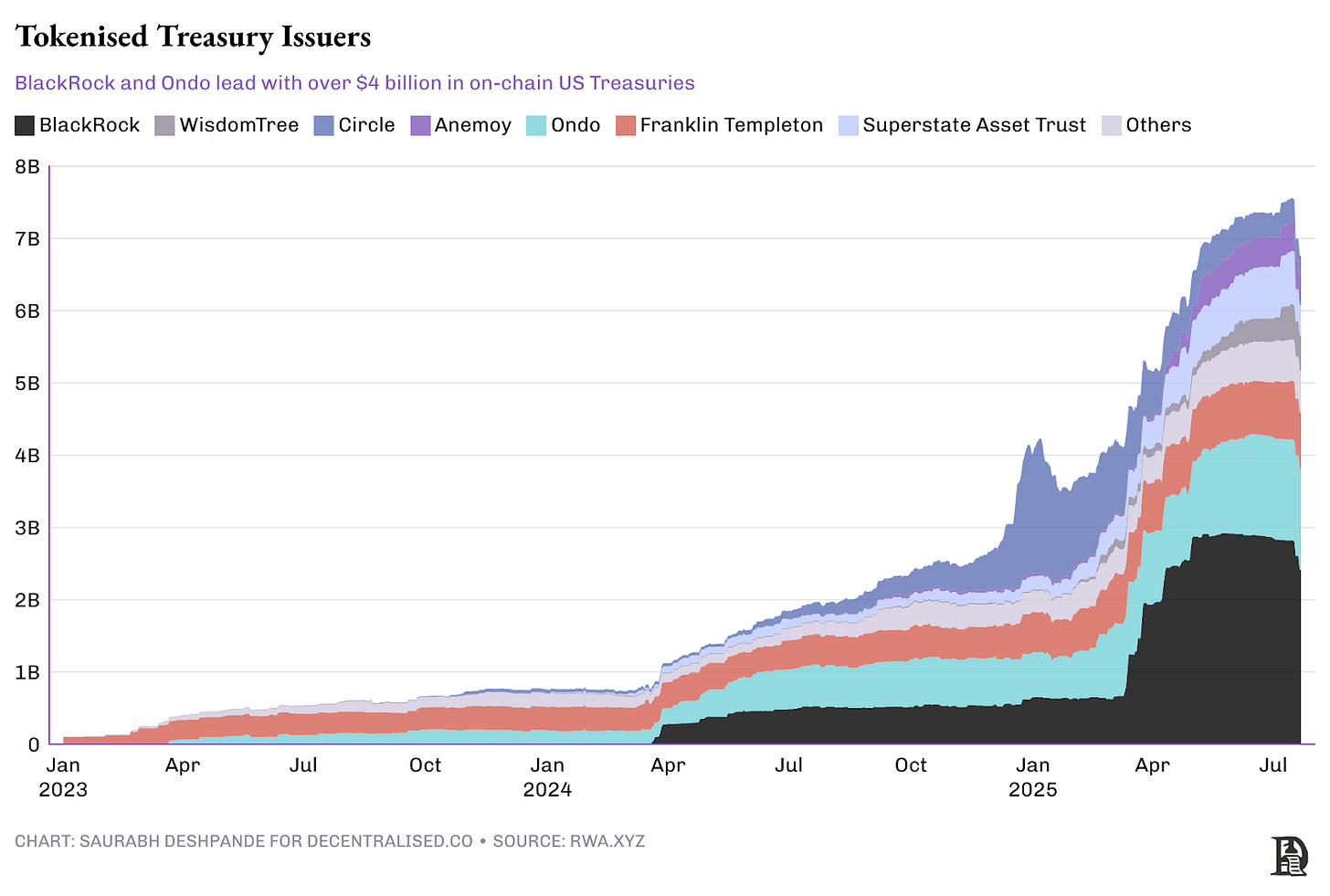

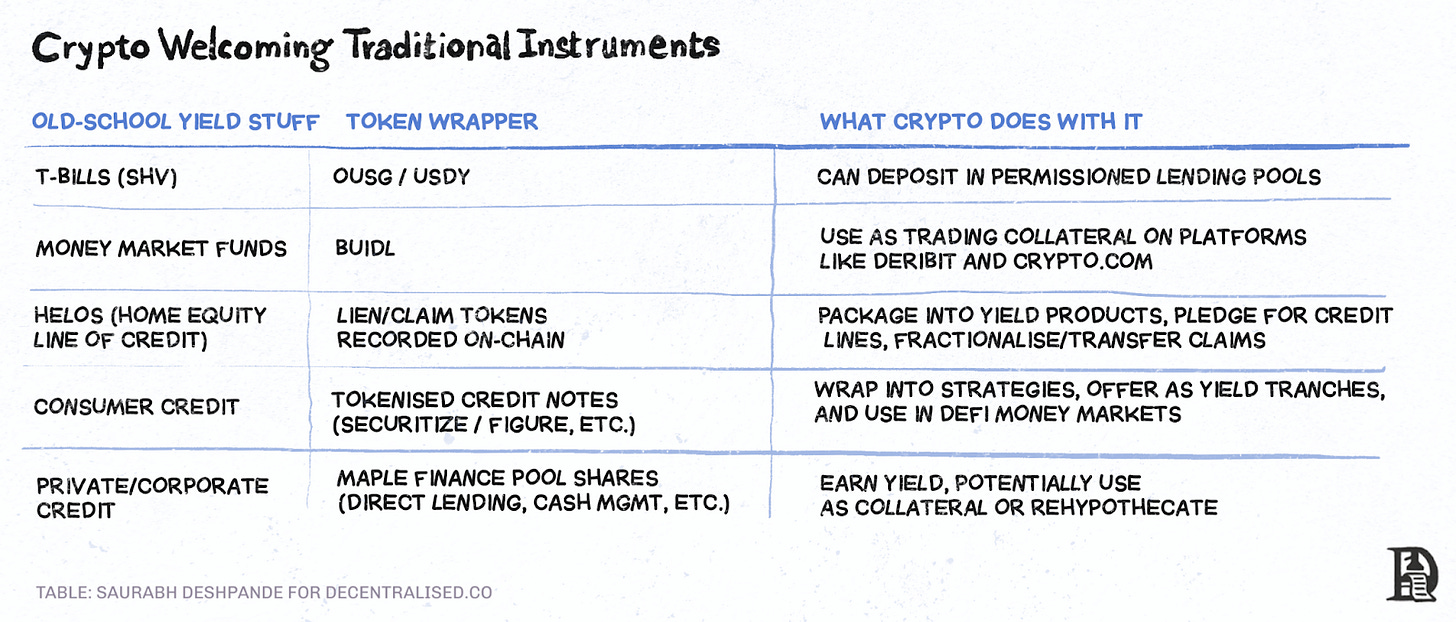

Government bonds are another big driver. Short-term U.S. Treasury yield products have been a hit on-chain, as evidenced by projects like Seciritize and Ondo Finance. They offer tokens like BUIDL (BlackRock USD Institutional Digital Liquidity Fund), OUSG (Ondo Short-Term U.S. Government Bond Fund) and USDY, a yield-bearing stablecoin backed by Treasuries.

These things belong to a category that resembles dollars, but aren’t quite stablecoins and aren’t quite cash either. They live on blockchains, they earn yield, and they’re issued by firms like Securitize and Ondo Finance, which are trying to bring the stuff of traditional finance, like government bonds, treasury funds, and money markets, onto crypto rails. You might’ve seen BUIDL, a tokenised fund launched by BlackRock in partnership with Securitize. It holds short-term U.S. Treasuries and repos—basically, the boring, safe stuff you’d find in a money market fund. But instead of being tucked away in your Fidelity account, BUIDL exists as a digital token on the Ethereum blockchain.

You can hold it in a crypto wallet. You can trade it on-chain. And, interestingly, you can even use it as collateral to trade on Deribit and Crypto.com. Which, if you think about it, is kind of wild: use capital to buy US treasuries, and then reuse it to bet on bitcoin’s volatility.

Ondo Finance has issued OUSG and USDY, a sort of high-yield stable-ish coin. OUSG is tokenised exposure to BlackRock’s U.S. Treasury ETF (SHV), and it pays yield directly to token holders. USDY is a step above—it’s designed to act like a stablecoin but is actually backed by real Treasuries and short-duration bonds, and pays out yield daily. So instead of holding USDC and earning nothing, you can hold USDY and get a drip of yield without doing anything fancy.

These tokens are fully on-chain, live on Ethereum and Solana, and are composable with DeFi, meaning they can be deposited into lending protocols, used as trading collateral, or wrapped and plugged into automated strategies. The catch is that most of these are restricted to qualified or accredited investors, particularly in the US, thanks to securities laws. But once you’re in, you can move these assets around the crypto ecosystem like any ERC-20 token.

What Securitize and Ondo are doing, essentially, is taking old-school yield instruments like Treasury bills and money market funds and giving them the same liquidity and programmability as tokens. Suddenly, the most boring assets in finance can talk to smart contracts. And that’s a pretty interesting upgrade.

What’s interesting is how similar all of this feels to what Figure is doing. Different asset classes, same playbook. Whether it’s BlackRock tokenising Treasuries with BUIDL or Figure recording lien positions for home equity loans, the point isn’t that these assets are suddenly new. It’s that they’ve been made readable to machines. Before, you needed back offices and intermediaries to verify who owned what, when, and why. Now, the blockchain just tells you all of that. A Treasury token knows it’s a Treasury. A HELOC token knows who signed it, what it’s worth, and who currently owns it. It’s all there, in real time, and nobody needs to email a PDF.

Much of this growth has come from assets that don’t usually get much attention: short-duration Treasuries, HELOCs, and consumer credit. They aren’t sexy, but are predictable, stable, and cash-flowing. Exactly the kind of instruments that lend themselves to on-chain packaging. And they’re starting to talk to smart contracts.

Talking to Smart Contracts

That’s the deeper thread connecting tokenised Treasuries and tokenised credit. Both are trying to make traditional finance assets more usable. BUIDL and USDY are wrappers around ultra-conservative debt instruments, made liquid and programmable. Instead of reinventing mortgages, Figure’s HELOC pools are just showing up with receipts. And once these assets live on-chain, they start behaving like every other crypto asset. You can plug them into lending markets, use them as collateral, or bundle them up with other things and create a basket of asset-backed securities. The effect is that age-old boring financial products suddenly become portable, composable, and always-on.

This opens up a more speculative question: if this works for Treasuries and home equity, what comes next? Maybe credit card receivables. Maybe equipment leases. Maybe my friend who is finishing up his superspecialty in urological surgeries can sign a financing agreement on-chain. Because when he performs a few surgeries every day, there’s a predictable stream of income. If it pays a predictable return and can be documented, there’s a case to tokenise it.

Though not because it needs to be on-chain, but because it’s cheaper, faster, and easier once it is. I wonder how many bank managers he will have to talk to and negotiate with about what he can offer as collateral. If everything becomes a token, then everything becomes a market. Suddenly, yield goes out to take a stroll beyond the institutional walled gardens. Smart contracts can chalk out routes for it. The spreadsheet era turns into the programmable finance era. All this, with a quiet, well-documented on-chain registry entry.

If debt instruments are already finding product-market fit on-chain, equities are still in the early innings. But even here, some signs are starting to emerge. Not just from crypto-native protocols, but from public companies themselves.

Programmability means that assets can plug into logic. They can trigger actions, interact with other contracts, or be permissioned dynamically. You don’t need a clearing desk or an admin panel — the rules are baked into the asset itself.

Tokenise The World

FTX had some of the highest value equity investments made in venture capital history. If it were tokenised (and trading in the open market) and returned to the people who lost money, it’d be a beautiful fairy tale. But none of that happened. Much of it was sold for a 60% gain at $800 million last year. As of writing, that position would have been worth $8 billion

It made me wonder: shouldn’t equities and stocks come on-chain? We are seeing early signs of this switch occurring already. This time, with a different venture SBF had invested in: Robinhood.

Robinhood once was the poster child for meme‑stocks and festive confetti, and onboarded GenZ to stock trading with Zero-Day options. But this was limited to America. It now aims to target investors across the world, with its own Layer 2 blockchain offering on-chain stocks. Although its chain will launch later, Robinhood already offers over 200 U.S. stocks and ETFs, tradable by eligible European investors 24/5, with zero commission and support for dividend payments. This move potentially gave Robinhood access to 150,000 customers in Europe. The stock jumped ~20% in three trading sessions following the news.

Soon, they’ll issue tokens tied to private companies like OpenAI and SpaceX. These aren’t equities in the legal sense. You don’t get voting rights, just economic exposure contracts issued via a special-purpose vehicle. Launching in Europe allows them to sidestep the strict U.S. rulebook on private markets, but once issued, these tokens move on-chain like any other asset.

Robinhood isn’t the only one carving out this territory, though. Republic launched tokens that mirror pre-IPO companies like SpaceX (rSpaceX) and OpenAI (rOpenAI) through a crowdfunding exemption. These are essentially digital IOUs: you pay $50–5,000, the token tracks the private valuation, and if there's a liquidity event like an IPO or acquisition, you get a payout in cash, not stock. No shareholder rights, no board seats. But there’s a clear path from exclusivity to liquidity. And while U.S. retail buyers are capped at low investment limits, these tokens aim to open access to pre-IPO value, even for people who are many time zones away.

Kraken now lets users trade tokenised versions of major U.S. equities— things like Apple, Tesla, and the S&P 500 ETF. These are real shares, held 1:1 by a custodian in Switzerland and issued on-chain by a company called Backed Finance. Backed calls them xStocks. The “x” is just a reminder that they aren’t exactly the underlying shares. They’re transferable tokens that represent ownership of shares held off-chain. You don’t get voting rights, and dividends, and if paid, might not be passed through. Instead, you get 24/7 liquidity, composability with DeFi protocols like Kamino, and the ability to move your assets between wallets like any other token.

Backed lists these tokens under regulatory exemptions in Europe, typically under the Swiss DLT Act. Each token, like AAPLx or TSLAx, is tied to a specific ISIN, the same way a brokerage account tracks actual securities. You can check the asset backing on-chain, see the proof-of-reserves, and redeem the token if you meet the eligibility criteria. They trade on platforms like Kraken and even on-chain platforms like Jupiter, and can integrate into lending markets, structured vaults, and automated trading strategies, because they run on blockchains like Ethereum and Solana.

The model works best for users outside the US. The ones that need access to US equity markets without needing a brokerage account or a local custodian. It also fits neatly into the broader story: real-world assets wrapped in code, plugged into a financial stack that doesn’t close on Fridays. Robinhood is starting with public stocks and moving into private equity. Republic is doing the same with pre-IPO tokens. Backed is taking the other side of that wedge, wrapping traditional financial instruments and putting them on-chain.

You don’t need to change how markets work, just the way assets move. And once those assets live on-chain, they start to behave more like software. You can borrow against them, swap them, bundle them, stake them. Stocks start acting like on-chain tokens, more programmable, more dynamic. And that’s a strange but very real shift.

In July 2025, JPMorgan's blockchain unit, Kinexys (formerly Onyx), launched tokenised carbon credits with partners like S&P Global and EcoRegistry. Carbon credits are notoriously opaque; tracking their origin, validity, and ownership can be a logistical nightmare. Putting them on-chain solves that. A token carries metadata, timestamps, and ownership history. It knows what it's worth, who owns it, and when it was last traded. Suddenly, an environmental offset becomes a tradable, auditable unit of value. It’s not hard to see how a $933 billion carbon market could scale into the trillions when the credits themselves become as easy to trade as ETH.

Apollo Global Management, the $700+ billion asset manager, partnered with Securitize to launch a tokenised feeder fund for its flagship credit strategy. The Apollo Diversified Credit Fund is now available as digital tokens issued on multiple blockchains. Qualified investors can access Apollo’s portfolio with a few clicks. No capital calls, no multi-week wire transfers, no paperwork sent from a lawyer’s inbox in the Caymans. It’s private credit for the internet age.

You get the gist. On-chain markets will run 24/7 with global liquidity and have access to the primitives that exist within crypto. When the right regulatory frameworks emerge, as they often do when the institutions we mentioned above are involved, new markets will emerge. Those that are as global, connected and fast as the web. In many ways, we are seeing a repetition of the past. Blockchains are doing to capital markets what the internet did to information and publication.

But are the men in suits the only ones benefiting from this? Or are there entirely new markets forming? We are seeing signs of markets forming around physical infrastructure, information, news & social networks. Let me explain how.

Pokémon Go With Dollars

Remember Pokémon Go? It had ±250 million users at peak. As of July 2025, that figure is down to ±50 million. The product makes half as much in revenue today. Using AR, the game required individuals to go around town, capturing mythical figures. It was a breakout application that made the technology mainstream. Now imagine if, instead of capturing mythical creatures, you were rewarded to walk around town, mapping parts of it, and actually got paid for it? This, in essence, is DePIN. It decentralises the physical infrastructure needed (the phone, as in Pokémon Go’s case) to get a certain amount of work done, either through humans or machines.

Decentralised Physical Infrastructure Networks (DePIN) are changing how infrastructure is built and monetised. They enable new markets where physical resources like storage, computing power, and wireless coverage become tradeable commodities. According to CoinGecko, as of July 2025, DePIN is a ~$20 billion market.

The underlying idea is to turn everyday users into micro-operators. You host a wireless node or share idle GPU power, and in return, earn tokens. Instead of renting infrastructure from someone else, it becomes the infrastructure. Instead of owning the physical infrastructure that is needed to run an operation, you simply have people buy the hardware and incentivise them for running it. What advantage does this bring? It distributes how information is collected & reduces the operational expenditure of your business.

By some estimates, investments in AI account for 1% of US GDP. DePIN is a means of socialising that incurs expense for frontier markets where data collection through physical hardware is a necessity. We are seeing early variations of this for mapping, telecom and possibly health data.

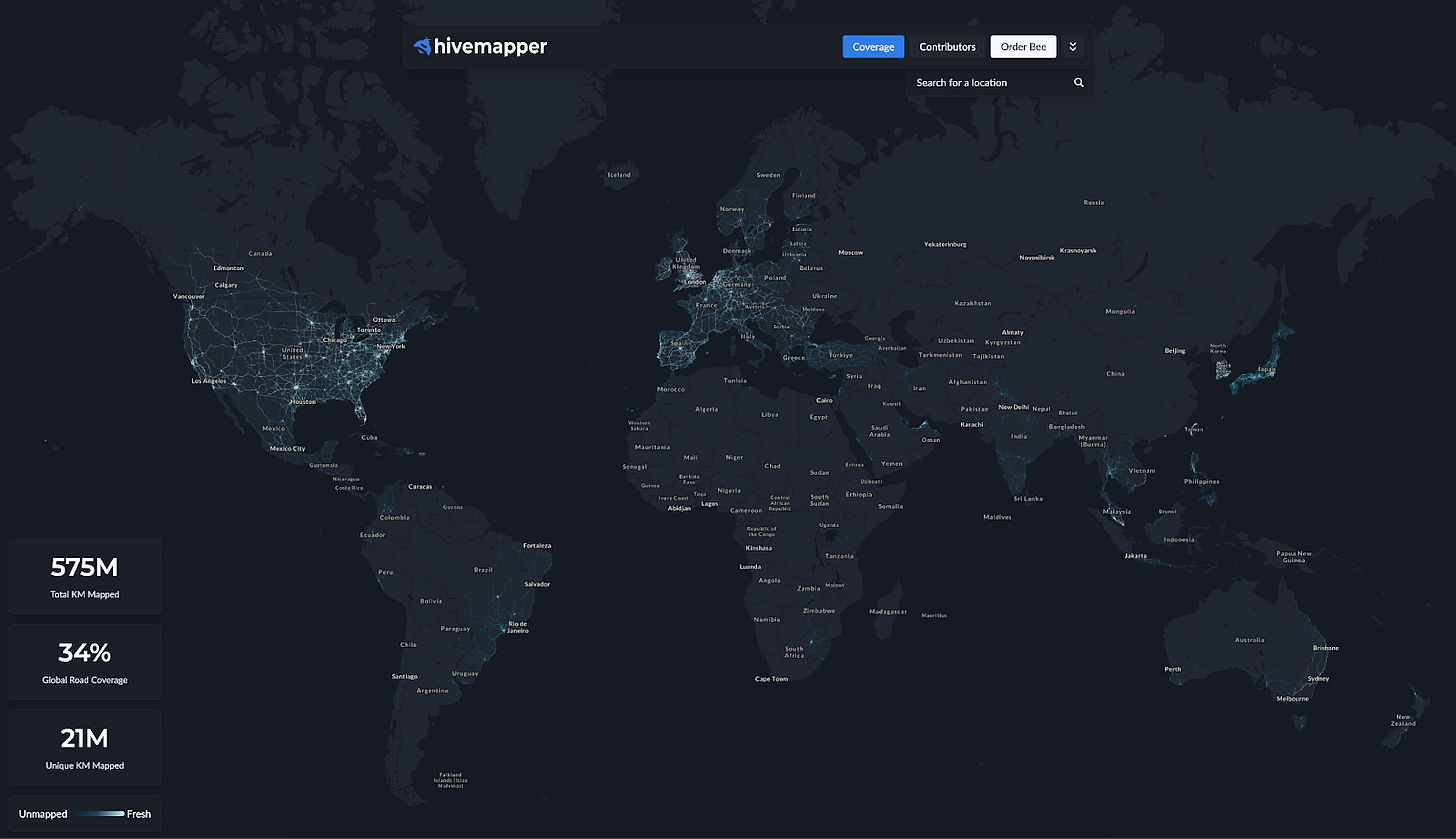

Can you incentivise people to put dashcams on their vehicles and map the world? Hivemapper has more than 20 million kilometres of unique roads mapped. Drivers install dashcams and passively collect street-level imagery as they go about their daily lives. In return, they earn HONEY tokens. It’s part Pokémon Go, part decentralised Google Maps, with an embedded token. Instead of relying on Street View vans and proprietary software, Hivemapper crowdsources global mapping at a fraction of the cost.

Contributors own their mapping rights, and the collective dataset is sold to enterprises that need mapping APIs. The more accurate, fresh, and expansive your map data, the more you earn. By rewarding collection with tokens, Hivemapper made global cartography legible to code and divisible into per-kilometre incentives, effectively turning the map into a market.

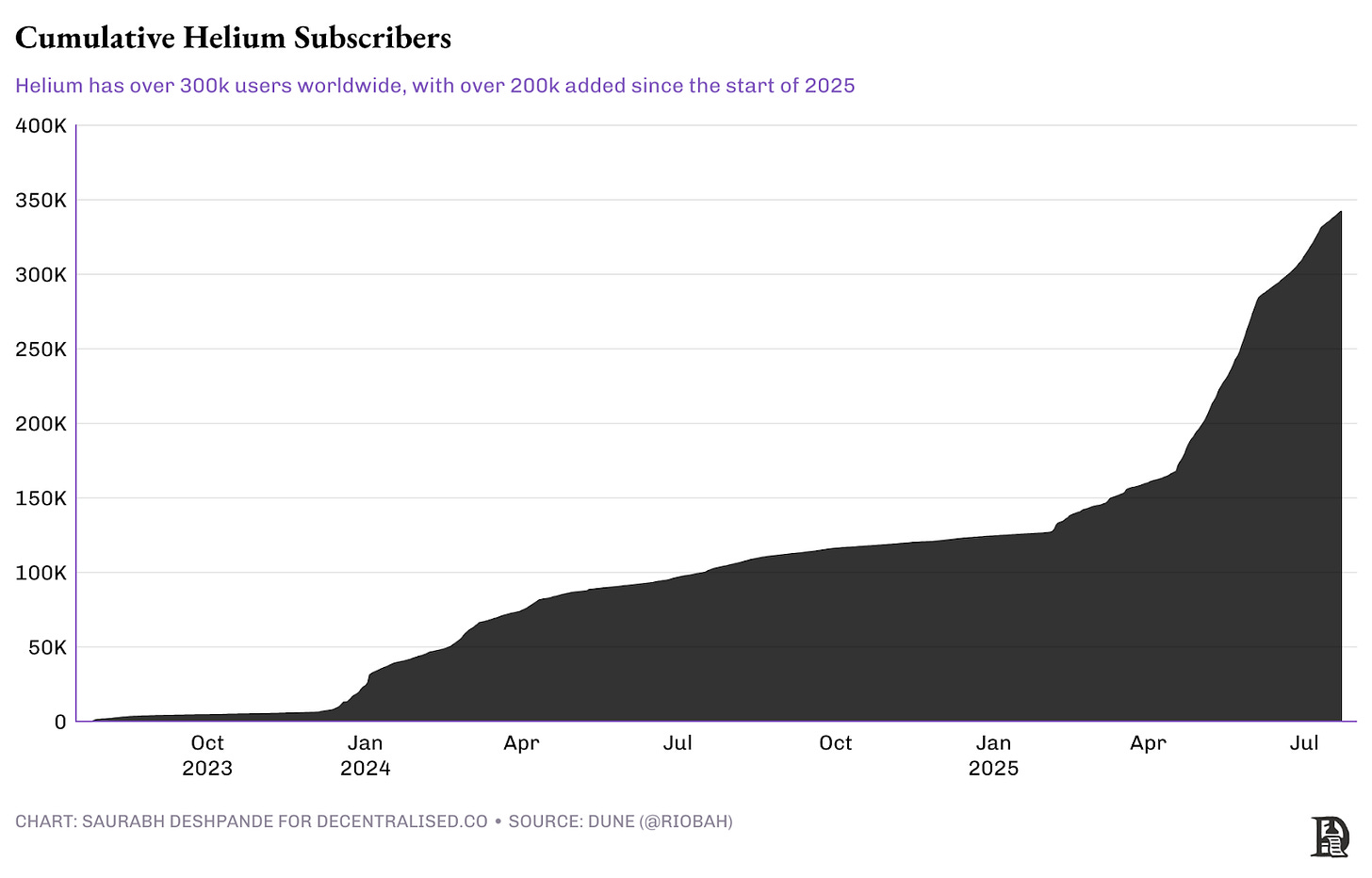

Helium follows a similar logic but applies it to wireless connectivity. It started with LoRaWAN (Long Range Wide Area Network) IoT networks and is now expanding into 5G. People install Helium hotspots (small, plug-and-play devices) to provide network coverage in their neighbourhoods. In return, they earn HNT tokens based on the value their hotspots contribute to the network. The protocol uses “proof of coverage” to ensure nodes aren’t faking it. You earn more when you’re in high-demand areas with fewer competing nodes.

What Helium did was to break the telecom capex model. It turned coverage from a sunk cost into a liquidity event: coverage as an income-generating asset.

Multiple projects are working in the whole AI value chain of compute, storage, data scraping, and more. Grass flips the value extraction of data collection. It’s a decentralised web-scraping network that rewards users for contributing unused bandwidth and compute to crawl the open internet. Traditionally, companies pay cloud providers or build expensive infrastructure to index the web. Grass decentralises this into a mesh of passive contributors. You run a lightweight agent that scrapes websites, and you get paid in tokens for that bandwidth. But that’s just the surface. Grass publishes provenance metadata— when, where, and how the data was scraped —onto its own rollup chain. That metadata makes the dataset auditable and sellable. In doing so, Grass turned the very act of scraping into an economic unit. The open internet, previously free to index but hard to value, became a marketplace.

USD.AI is a DePIN-native protocol that creates liquidity for AI compute. It lets GPU operators tokenise their rigs and stream verifiable compute supply data on-chain, turning idle hardware into financial collateral. By measuring uptime, performance, and contribution to inference workloads, USD.AI enables real-time credit scoring for machines. Operators mint USDS, a stablecoin backed by working compute. Instead of borrowing against off-chain cash flows or token emissions, they borrow against on-chain resource availability. What USD.AI enabled was a market where AI infrastructure generates income instead of being just a cost centre.

All of these projects are doing some variation of turning infrastructure into tokens, and tokens into markets. By tokenising physical resources (be it streets, bandwidth, GPU hours, or storage), they allow liquidity to form around what was previously inert or idle. It’s like an inert gas. Stable, overlooked, and often passive. But chemistry is beautiful. Under the right temperature and pressure, even inert gases react and form compounds with other elements. The conditions weren’t right enough for all of this infra to be democratised.

Betting on Missile Launches

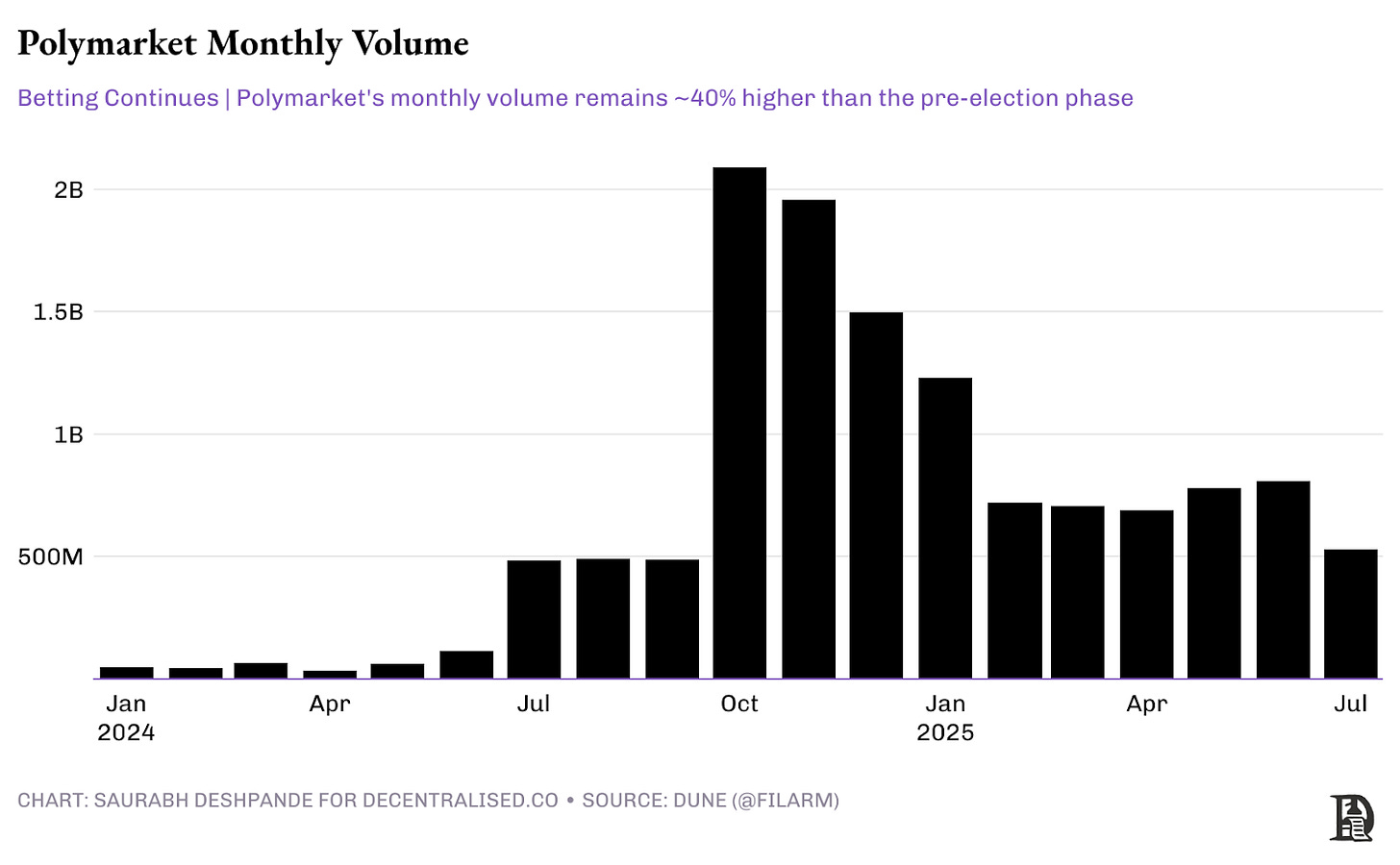

Remember how I said blockchains do to markets what the internet did to information? Few places make it as evident as Polymarket does. A few weeks ago, Elon Musk decided to integrate Polymarket into X. For those who haven’t heard of it, here’s how a prediction market works.

Prediction markets aren’t new. But until now, they were often legal grey zones or academic toys. Platforms like Polymarket and Kalshi changed that. One way to look at them is that they let people bet on outcomes. I like to think of it as pricing beliefs. I don’t think people at large study the events and carefully evaluate probabilities to bet on outcomes using scientific methods. There’s certainly an element of ‘winging it’. They are betting on what they believe will happen. Who will win the drivers' and constructors' championships in Formula 1 this year? Will the CPI in the US be below 2.5% in August? The price of a share reflects the crowd's perceived probability. When new information emerges, the market updates in real-time. What Polymarket did was turn opinions into investable positions. It made belief understandable to software and tradable by anyone.

Polymarket is one of the few on-chain markets that have crossed the chasm of conventional crypto-crowds and entered the mainstream. There have been markets to bet on global conflicts, elections & sporting events. When combined with social networks, prediction markets allow users to signal strong opinions alongside skin in the game. In fact, they may become a key primitive to resolving the extremely aggressive nature of social networks today, as it will be increasingly difficult to make overarching claims (like all immigration is bad) sound relevant, without backing them up with real stakes.

Kalshi took a different route through regulation. By getting CFTC approval in the US, they turned event contracts into financial instruments. You could hedge against inflation, layoffs, or even Fed decisions.

What both platforms enabled was a market for public attention and probabilistic truth. They turned information into something you could price. In the same way that oil futures hedge supply shocks, prediction markets hedge consensus. They allow traders to arbitrage reality, and by doing so, reveal what the crowd actually believes. In that sense, they brought volatility to information itself. As we argued in our previous article on Volatility as a Service, products that offer volatility over sustainable periods of time tend to win. And that’s what is at the core of Polymarket’s success.

A different version of such markets is evident in what Kaito AI is enabling. Put simply, Kaito gives you an API that allows you to track the levels of attention a certain trend, venture or individual gets on Twitter. Often used by marketers to identify who the most relevant creators are, the product also gives an algorithmic measure of what trends are going viral in real time. If you combine elements of prediction market design (the way it works on Polymarket) with Kaito’s ability to measure real-time engagement and virality of a topic, you get a market where you can speculate on how viral a concept might become.

Though you may ask, why do you need a market for virality? You don’t need it, of course, but in a world where everything trends towards absorbing more risk and speculation, we see such product categories continuing to dominate. One place where virality, marketing and markets came together was the craze surrounding Dubai Chocolate. In April of 2025, as TikTokers flocked in large numbers (as they often do with viral trends) to talk about the famous pistachio-laden chocolate, the commodity itself drove further up in price. In other words, the digital world had done an incredible job of creating demand for a physical commodity, such that its prices went up. Markets built on InfoFi, like the ones powered by Kaito, can be hedging platforms in the future.

Surely, not everyone wants to bet on the price of pistachio-laden chocolate. But what if you price bets on startups? For most startups, the hardest challenge is the cold start problem—cracking distribution and gaining early traction. If a startup is meaningfully going viral, wouldn’t it make sense to bet early on it? It would create incentive for individuals to “discover” a start-up early on, build a position and watch it as it goes viral. Think of it as ProductHunt, but with an element of prediction markets to it.

Turning social graphs into assets

If data and belief can be priced, reputation is not far behind. The idea that social capital can become liquid is still nascent, but early primitives are already forming. Web3 social networks like Lens and Farcaster are more than decentralised Twitter or Instagram. Rather, they reimagined what should be considered valuable or ownable in social media.

In Web2, the platform (e.g. Twitter) owns your profile, followers, and content. In contrast, Web3 social protocols like Lens and Farcaster allow you to own those elements directly as tokens or portable identity primitives. So the concept of “ownership” shifts from platform-controlled feeds to user-controlled networks and relationships.

Lens turned social profiles into NFTs. Your posts, followers, and reputation are all stored on-chain and portable across apps. If Twitter is the feed, Lens is the graph. And what Lens did was create a base layer where user attention and relationships could be priced, ranked, and traded across interfaces. It turned the social graph into composable infrastructure. The one that any app, not just the original host, could plug into and build atop.

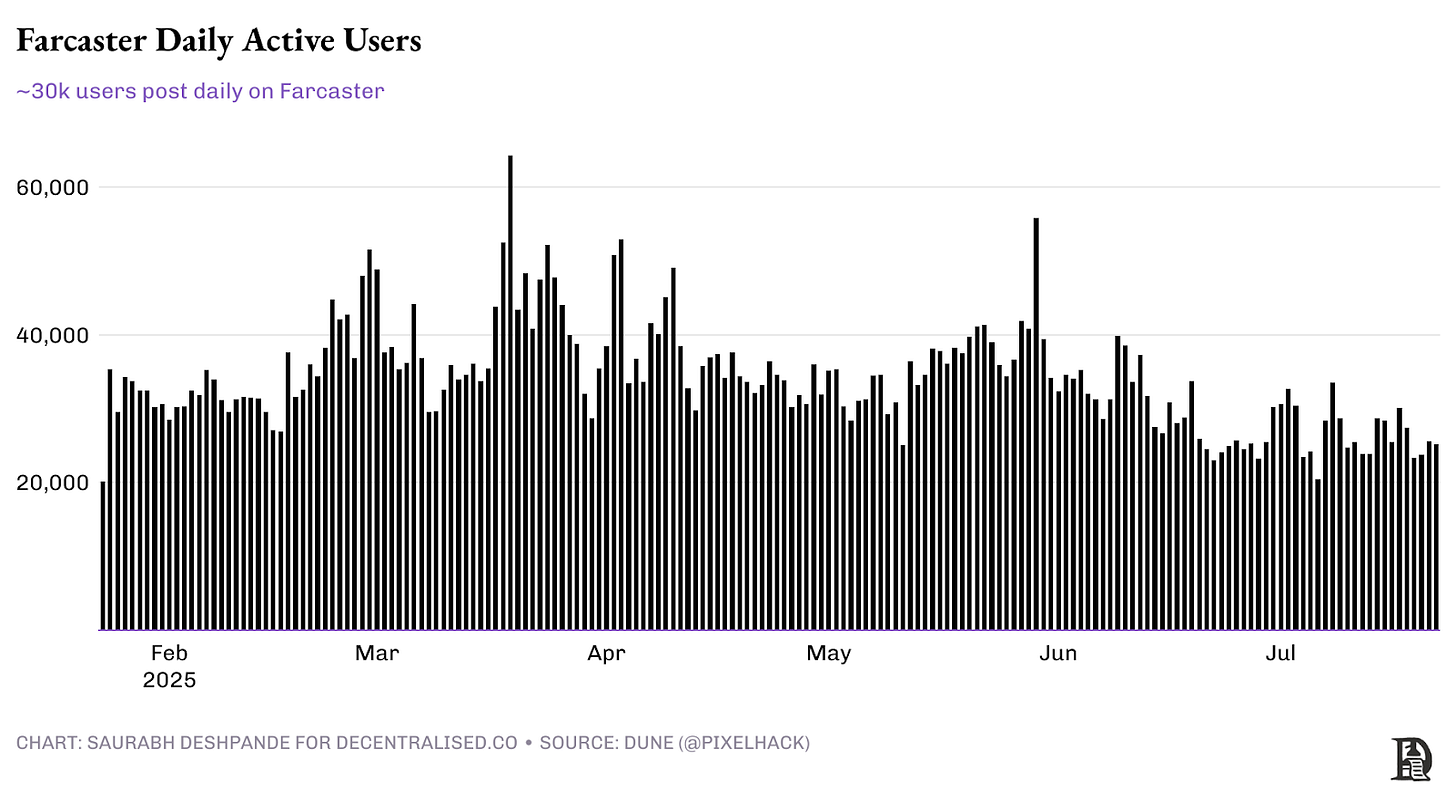

Farcaster takes a lighter approach. Minimal on-chain footprint, but full social portability. Clients read from the same shared network, and user identity is tied to Ethereum addresses. No platform lock-in. Farcaster's value addition is continuity (or the assurance that you can carry your online identity, social relationships, and audience with you wherever you go), not content. Farcaster consistently has ~30,000 users who cast (post) something daily.

What both protocols did was invert the Web2 logic: instead of monetising user attention through advertisers, they gave users the ability to monetise their own social graph. Web3 social applications introduced primitives like token-gated access, collectable posts, on-chain tipping, and identity-weighted governance. That meant the very act of engaging online, a follow, a like, a comment, could be routed through a network that preserved provenance, surfaced trust signals, and allowed value to move with context.

The effect is subtle but massive. Now, a piece of code understands social capital. Reputation is an asset with composability. Attention is something you can plug into lending markets, DAOs, or token distribution. Web3 social made the social layer itself programmable. And in doing so, turned it into a market.

Our internal assessment is that Web3 social networks can, and will, create better content networks than traditional Web2-based ones. If every social profile is a wallet, and creators can be directly incentivised through tipping, then it is inevitable that niches aggregate on-chain. Categories like crypto research and finance may almost exclusively take off in Web3 social networks because individual creators can be better tipped for their contributions to the network while being spared the general attention-grab tactics Web2 social networks require of them. Scroll through Farcaster and compare it with the quality of the content on X, and you will see what we mean.

But how will this category evolve into large social networks like Reddit? Our internal read of the matter has been that the equivalent of Reddit communities will emerge on protocols like Farcaster in the future. Primitives like DAOs and multi-sigs will be used by communities to coordinate resources. In the past, there were social networks (on X) and there were DAOs (on Discord). The blending of these two worlds, i.e., that of information and social feeds, has not happened yet. We are speaking to a few products that are trying to bridge that gap and expect to see them come of age in the upcoming quarters. But what would they be used for?

An obvious category is DeSci. Earlier this year, we wrote about how Decentralised Science (DeSci) lets research be priced, composable, re-routable, and move like capital does. It is trying to fix a broken funding loop of grant bureaucracy, inaccessible IP, and research locked behind paywalls.

Molecule and VitaDAO are two of the most prominent attempts. Molecule introduced IP-NFTs, a way to wrap research proposals and patent rights into tokenised containers. These could be crowdfunded, traded, licensed, or held by DAOs. Molecule turned early-stage biotech IP into an investable primitive. One that could be priced, tracked, and governed collectively.

VitaDAO ran with that model. It raised funds from a global community, invested in longevity research, and held the resulting IP in a DAO treasury. Contributors were tokenholders who governed the allocation of capital and the eventual monetisation of results.

But DeSci is evolving beyond IP ownership. Projects like Pump.Science are running on-chain experiments in longevity trials on worms, fruit flies, and mice in real time. DAO funding, data logging, and analysis are all public by default. Bio Protocol offers tooling for any researcher to spin up a BioDAO, giving them persistent access to capital and the ability to tokenise milestones as they progress.

We see niche communities involving research & collaboration emerging entirely through Web3 native forms of social networking as they combine reputation, on-chain incentives & capital markets in a single place. To suggest Farcaster has the power to upend universities is a bold vision. But if taken to the extreme, that is well within possibility. Bold vision, we know.

Market Everything

There is a fundamental truth we’ve held this publication over the past few months: blockchains are money rails. Now we are adding a second statement to it. We are in an age where everything is a market. If blockchains do to money what the web did to information, then the best business model will always be to create instances where high-frequency transactions occur. And therefore, all businesses will trend towards being transactional businesses.

DePIN, Web3 social networks, InfoFi and prediction markets all run under the same business model. One where users move money, and the platform captures a share of it. What remains to be seen is how this impacts human behaviour.

The natural evolution points toward more intimate forms of tokenisation. If social capital can be tokenised, what about other forms of human capital? Educational credentials are already being put on-chain through platforms like Learning Economy. Work histories via Velocity Network, though none have meaningfully scaled yet.

Each step seems reasonable in isolation. Each new market feels like a logical extension of the last. But zoom out, and it becomes harder to ignore what's happening. The gradual transformation of human experience into a set of tradeable attributes.

Perhaps, the most significant change is not the expansion of what can be traded, but how market logic changes behaviour. When Polymarket offers odds on whether a startup will raise funding, it doesn't just predict the future. It might influence it. VCs check prediction markets before making decisions. The market becomes self-referential.

Let’s go back to the Grass example. It is web scraping, but look closer, and you can see that it is making human attention legible to markets at the most granular level. If browsing becomes monetisable, then your child's first Google search is a financial event. Your parents' online habits become behavioural futures. Even the websites you don't visit have negative space value. Typos become signals—not errors, but patterns to trade on.

The efficiency gains from tokenisation are real. Figure saves $485 per $100k loan. Trading happens 24/7. Settlement is instant. But efficiency isn't the only metric that matters.

Remember how we started by explaining that dating app boosts are terrible financial investments? Here’s a different way to look at it. In spite of the financialisation and access that dating apps provide, we live in an age where fewer people marry under the age of 40. If financialisation and networks were indeed the solution to the age-old crisis of loneliness, we would have fixed it. Instead, most apps are currently in the process of adding AI agents to help seek better partners.

The truth is that in an age where everything is a market, we will require everyone to market themselves. This happened with journalism when writers were also expected to adopt Twitter personalities. But what happens when all labour is commoditised, tokenised and traded? What happens when the seasonal depression that hits founders who have released tokens becomes applicable to everyone? We don’t know.

What is apparent, however, is that in this new age, liquidity will be a lot similar to how attention works. Just as everyone once had “15 minutes of fame”, we may soon see products, ventures, and memes spike to $100 million valuations for a few hours. As attention shifts, so will liquidity. When liquidity declines, so will market caps. We don’t know how this will affect the human psyche. Perhaps in the distant future, most economic transactions will be carried out through agents. And therefore, human attention won’t be needed as much to engage in these new markets. But for now, it feels like a natural evolution for homo economicus.

Observing markets,

Saurabh

Disclaimer: DCo and/or its team members may have exposure to assets discussed in the article. No part of the article is either financial or legal advice.

Great article. Will be reading a lot more from you guys🔥