Year In Review - 2024

Metamorphosis

There are two kinds of people in the world right now. The ones plugging off for the holidays. And the ones hustling through the winter. We like both. Today’s newsletter is a breakdown of how 2024 went for us and what could be expected in the months to come. If you decide to download the PDF, read up, get inspired and spit out code like Eminem battling it to pay rent, drop us a note in response to this email.

Even better, fill up the form below to get in touch.

On to the issue…

Hey there!

Much like inflation over the last few years, our existence has been transitory. We started out as a newsletter that wrote about what made us curious. This year, we grew into a prop fund, simultaneously deploying out of our balance sheet and building a portfolio of advisory companies. We even shipped a few products and dodged a few acquisition offers. Eventful, to say the least.

It’s the end of the year. Most newsletters are either busy spamming you with their year-end reports. Or bragging about how the year went for them. I get it. You have time for neither. Winter is here, your family is hopefully nearby, and well, there are better things to do with your time than read yet another rant about how every number is going up for every other publication in a year where humanity often came close to collectively losing its mind multiple times. So I’ll keep this short.

For the readers who simply want the annual PDF export of all our writing, click the button below. It has all our articles, ready to be printed. Chop it, remix it, steal it, translate it. Heck, build something with it. We don’t mind. Just make sure to drop us a note about what you’re cooking when you do. Download it, and off you go!

Touch some grass, and eat some good food. Have fun!

For the ones still around, here’s what we learned in 2024. There’s the writing of business. Then, there’s the business of writing. To survive as a newsletter you probably need a good view of both. Art, we have learned, derives value from financial platforms. Nobody would care about George Soros ranting about reflexivity in markets, had he not broken the Bank of England. The architects of the Renaissance were as much bankers as they were artists. A lot about trying to build a form of media, for a curated audience subset is learning to balance the two. So let’s start with the raw numbers.

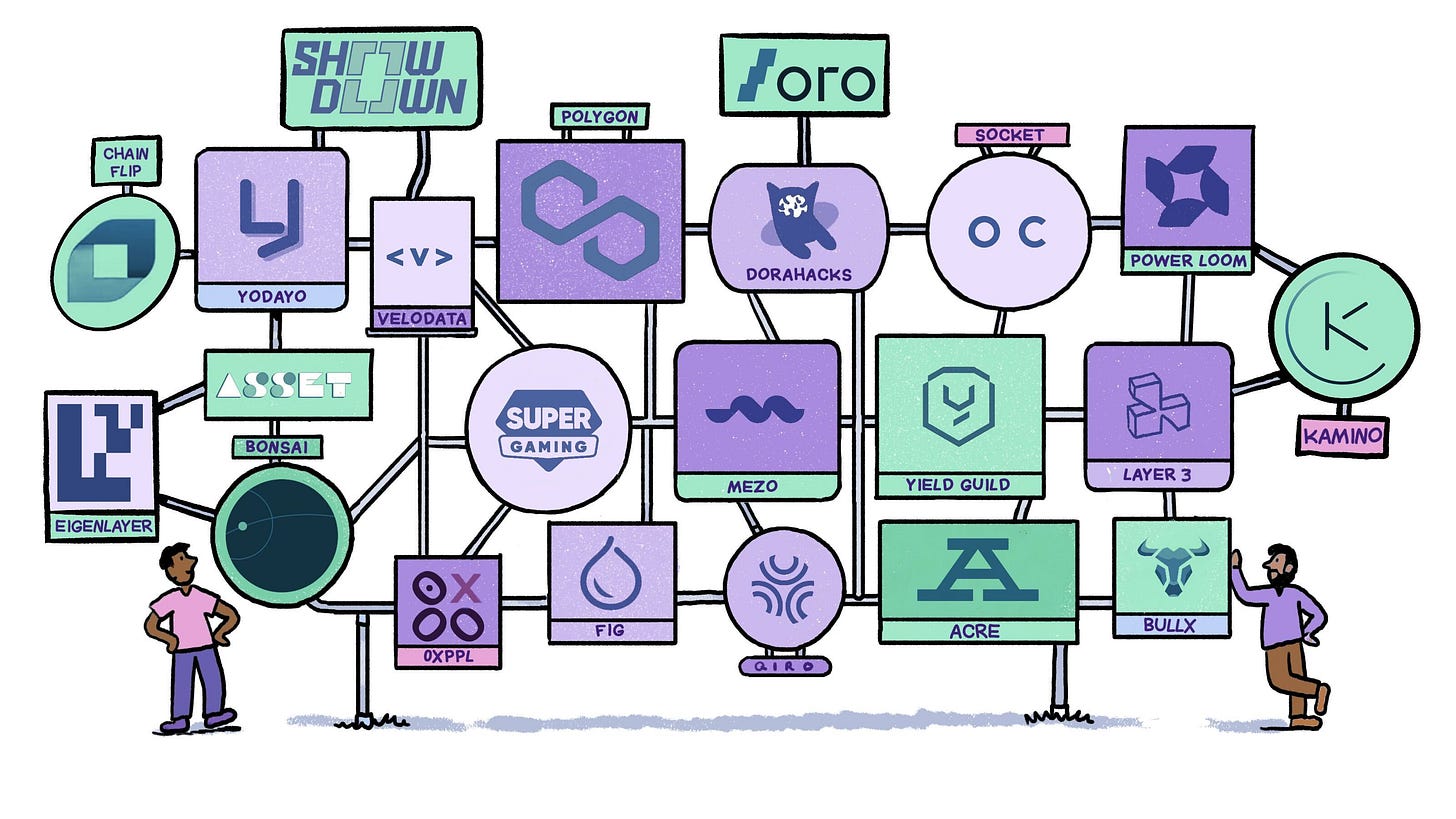

In 2024, the average month had us reaching close to 75,000 individuals. We were read in 165 countries. Saurabh launched a podcast which ranks 42 in India, and 15 in the UAE and cracked the top 100 for its category in the US, albeit for a brief moment. We were paid (well) by fifteen brands, compared to the one in 2023. We also wrote collaborative, sponsored pieces with EigenLayer, Thesis, Socket, Layer3, Chainflip and Zircuit among others.

And most importantly, the number of companies we are actively advising grew to a little over 20. Earlier this month, Shlok launched SentientMarket, a tracker for projects building at the intersection of crypto and AI.

Internally, we describe what we do to be “founder-centric, crypto-native media”. It’s a big word that simply means we do the job of breaking down stories for founders and their stakeholders in a way that is native to people working in crypto. Mainstream media tends to have mood swings about the industry depending on Bitcoin’s price. Crypto media opines aggressively about matters depending on where attention and capital are going.

We like to obsess about telling stories that add value to founders when nobody celebrates them. Looking back at the year, we have come true on that promise. It is the reason why brands work with us. And we are always looking for more to collaborate with. So reach out to Sid on Telegram if you are a founder looking to work with us.

Where do we go from here? Here’s a mental model to think of it. Money sustains and enables great art. But if the reason why you do art in the first place is the money, you’d probably make terrible art. We understand that risk quite well. It’s the reason why we never raised funding, never took on “ecosystem” funds to pay the bills, and took the slow path of building a portfolio (of companies, and writing) over the years. It is also why we dodged a few acquisition offers.

But looking at 2025, we have a different evolution to make. One that is more explicit and true to the nature of what we have been doing.

If we are to be only writing, we stand the risk of being economists in a financial market. Individuals who look at things in hindsight and draw conclusions. But that is not what we do. We were early to call the rise of Web3 social networks. Early to write about the Bitcoin ecosystem’s expansion. And really early on crypto x AI. If you have conviction in your ability to predict the future, your best bet is to co-build it with others doing the same.

So in 2025, we will be actively investing out of a pool of capital kept internally for investing. We will also be talking more about the companies we have been working with. This year, the podcast gave us an avenue to learn from some of the best investors in the industry. We were joined by Kyle Samani of Multicoin, Arthur Chong from DeFiance, Tomasz Tunguz from Theory Ventures and Gin Chao from NLH.

This builds on the ±75+ investors who exist within a venture investor network Siddharth has been building over the last year. We are in a unique position to learn from and invest with some of the best minds in the industry.

The best way to protect and continue the art then, is to grow the balance sheet with the resources at our disposal. People often describe A16z as a venture company with a media arm. We are a media arm, expanding into a venture company. With capital from our balance sheet. That means we can stay true to our curiosities, pursue stories that are worth your time and enable collaborative research that would otherwise go undiscovered. The capital enables the story.

Media in 2024 is heavily focused on virality. But architecting sensationalism does not help if you are writing about frontier technologies. The price for virality in the modern day is nuance. Our edge is in understanding. And understanding often takes a commitment of time & patience. We will continue to take the time and persevere to write hard stories in the coming year. Monetising through venture capital as an asset class reduces the burden of needing eyeballs so they can be packaged and sold to marketing managers.

In early 2023, a few weeks before we wrote our first story, I tweeted that nature tames chaos by taking the time for sufficient iterations. It was a few weeks after FTX collapsed. In hindsight, it was prophetic. A lot about our existence has been about shipping embarrassing V1s so we make sufficient iterations to an end product we take pride in.

In 2025, we hope to do more of the same. Embarrassing V1s. Followed by multiple iterations. Till we are proud.

See you next year,

Joel & Sid

If you liked reading this, check these out next:

- Introducing SentientMarketCap

https://open.substack.com/pub/unchainedcrypto/p/coinbase-teases-onchain-stock?utm_source=share&utm_medium=android&r=2a2clm