The Alchemy of Tokens

Mechanics, Metrics, and Mistakes

Hello!

Happy Diwali to those of you celebrating back home!

Be mindful of the dogs if you’re bursting crackers.

Today’s issue looks at Digital Asset Treasuries or DATs. Earlier this quarter, it became apparent that venture funds that dabble in DATs tend to outperform those that don’t due to the liquidity they offer. Some of our own portfolio companies have been considering them. I wanted a single note that could be shared with anyone trying to understand what they are, how they are used and why they matter. The issue is what came of it.

Saurabh has done an incredible job breaking down the numbers behind them and explaining how the premia in these assets tend to perform. It is equal parts market commentary and a breakdown of the alchemy that goes behind these assets. We conclude with a sceptical note on how everything might fall apart and what founders need to know if they are looking to them for potential exits.

If you are a large asset considering a DAT, or a founder building around TradFi and crypto rails, reach out to venture@decentralised.co.

Joel

P.S. - Huge thanks to Joe from Anagram for pulling a lot of strings to ensure this publication had all it needed to create this story. He was kind enough to put us in touch with the CEOs of the four largest DATs for research. You should tune into his views on markets here. His brain is one I steal a lot of ideas from for our articles.

Thank you to James Zhang (Strategic Advisor to Sharps Technology) and Brian Rudick (Chief Strategy Advisor at Upexi) for sharing their views.

A business is an engine that takes in money and produces income that beats what simply keeping it at the bank does. Hopefully, the business makes a multiple of 4%, which justifies the risk of investing capital into it. In the early 2000s, some internet stocks traded at a 600 price-to-earnings ratio. It would take six centuries for the earnings to reflect what the price implied, assuming all variables stayed the same. That is the “optimism” premium.

Such premiums can be architected. DATs are one way of doing it. Here’s how it works:

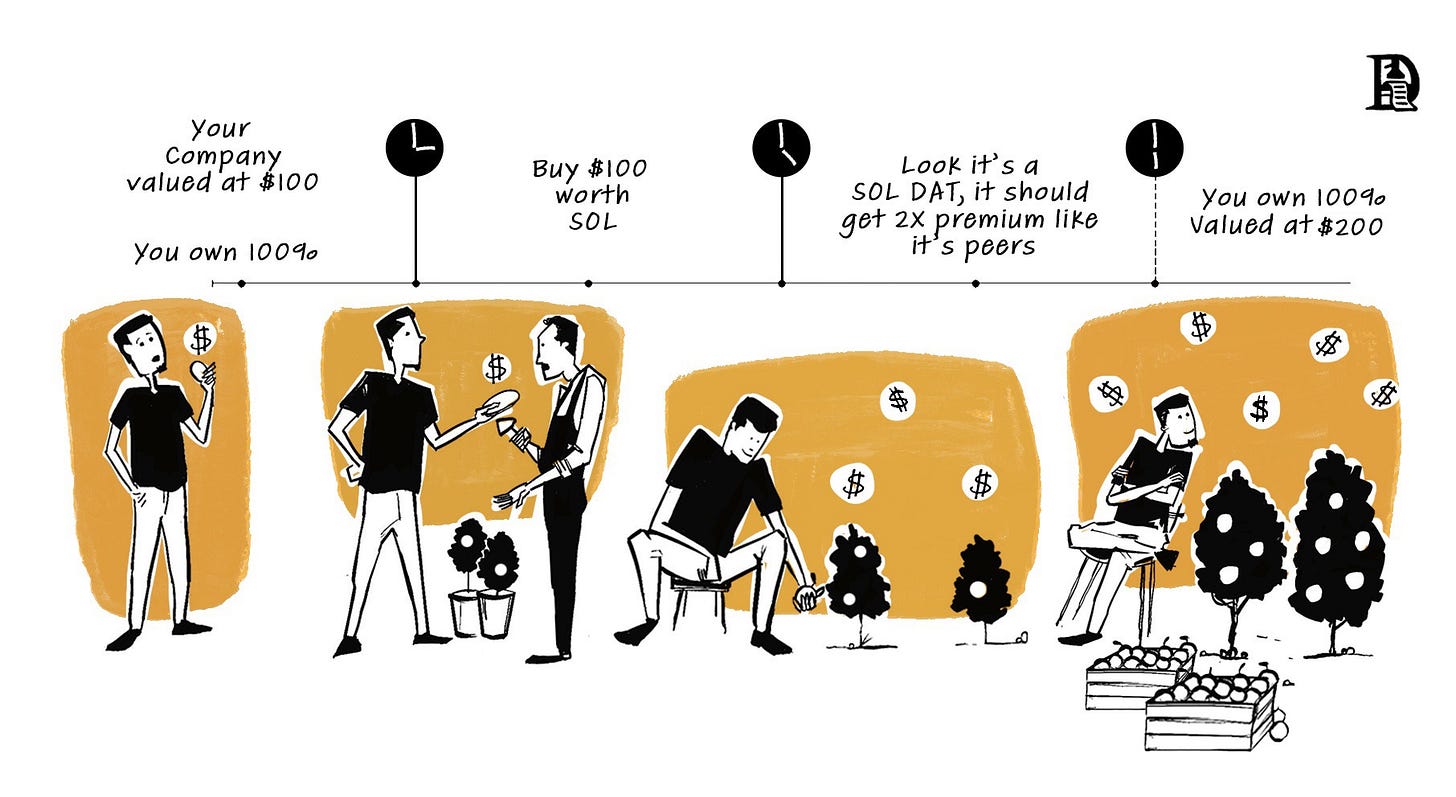

Assume that you want to create a Solana treasury company. You have a company worth $100, and you own 100% of it. You take that $100 and buy Solana. Now you own $100 worth of Solana DAT company.

So far, so good. Now the interesting part. Investors notice that similar Solana treasury companies in the market are trading at a 2x multiple to their net asset value, or the amount of assets they hold. That multiple is the “optimism premium”. So now, your company is worth $200, even though you still only have $100 worth of Solana. You still own 100 shares, but each share is now worth $2. You own 100% of a $200 company.

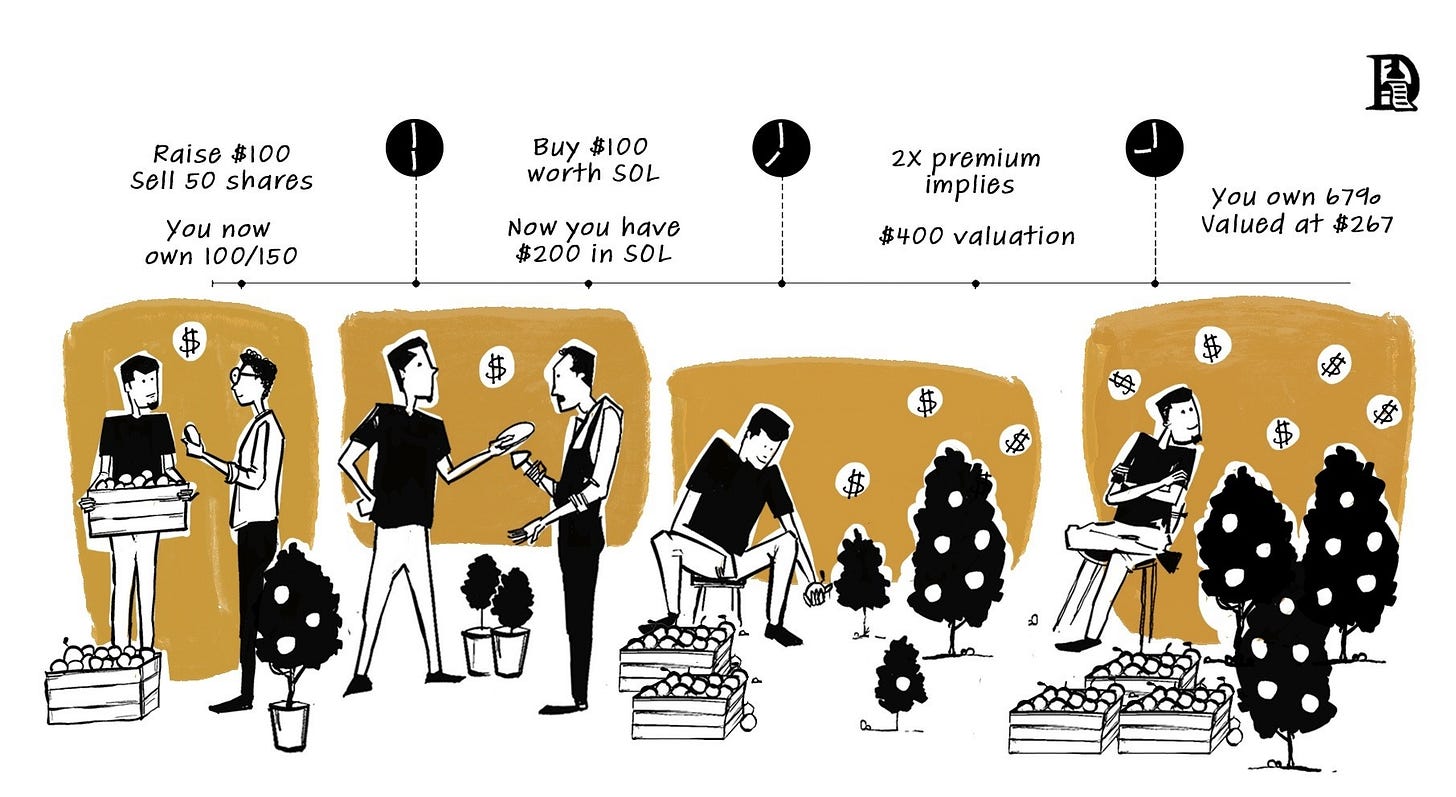

Now comes the accretive issuance. You want to raise another $100 to buy more Solana. Because you’re trading at 2x NAV, you only need to issue 50 new shares at $2 each to raise $100. You now own 100 shares out of 150 total, which means you’ve been diluted to two-thirds ownership. With that new $100, you buy more Solana, and that $100 worth of Solana also takes on the 2x valuation, adding another $200 to the company’s market value.

The company is now worth $400. Your two-thirds equals $267 in value. Your investment went from $100 to $267, a 167% increase, purely from one accretive equity issuance. Your ownership was diluted from 100% to 67%, but the value of your stake increased because the new capital came in at a premium multiple.

This value creation comes from intelligent capital issuance at premium multiples. The company issues shares above book value, uses the proceeds to buy more of the underlying asset, and as long as the premium multiple holds, every issuance increases the digital asset per share for existing holders.

In October 2024, Strategy (fka MicroStrategy) set a three-year goal to raise $42 billion to buy more bitcoin. $21 billion from equity and $21 billion from fixed-income securities. Before I get into how DATs raise capital, let’s understand their role in financial markets.

What purpose do DATs serve?

The most important function of DAT companies is to unlock different ways of accessing crypto markets. It comes in two primary forms.

Access to terms/deals that individual investors can’t put together. Upexi can negotiate a 15% discount on locked SOL. Saylor can raise money at a valuation higher than the current value of BTC the company holds, and increase the value per BTC.

Access to crypto markets in brokerage accounts of traditional finance investors through different versions, like convertible notes that allow bond market participants to get crypto exposure. They hold crypto assets on their balance sheets and then act as wrappers for digital assets for equity market investors. These fundraising mechanisms and wrappers have created a new category of investment vehicle that enables investors to gain exposure to crypto assets in a different way.

Although buying crypto assets has never been easier, participants, such as pension funds, have restrictions on where they can deploy their assets. This is particularly important because, by the end of 2024, pension funds in the US alone were expected to control more than $43 trillion. With ETFs and DATs, digital assets are now viable investments for this massive pool of capital that was otherwise stranded. With funding mechanisms like convertible notes, DATs offer strategic optionality along with diversification.

Some DATs actively participate in blockchain networks by staking tokens as network validators or delegating their stake to existing validators. This improves the network’s security. Forward Industries recently announced the launch of its institutional-grade validator on Solana, powered by DoubleZero.

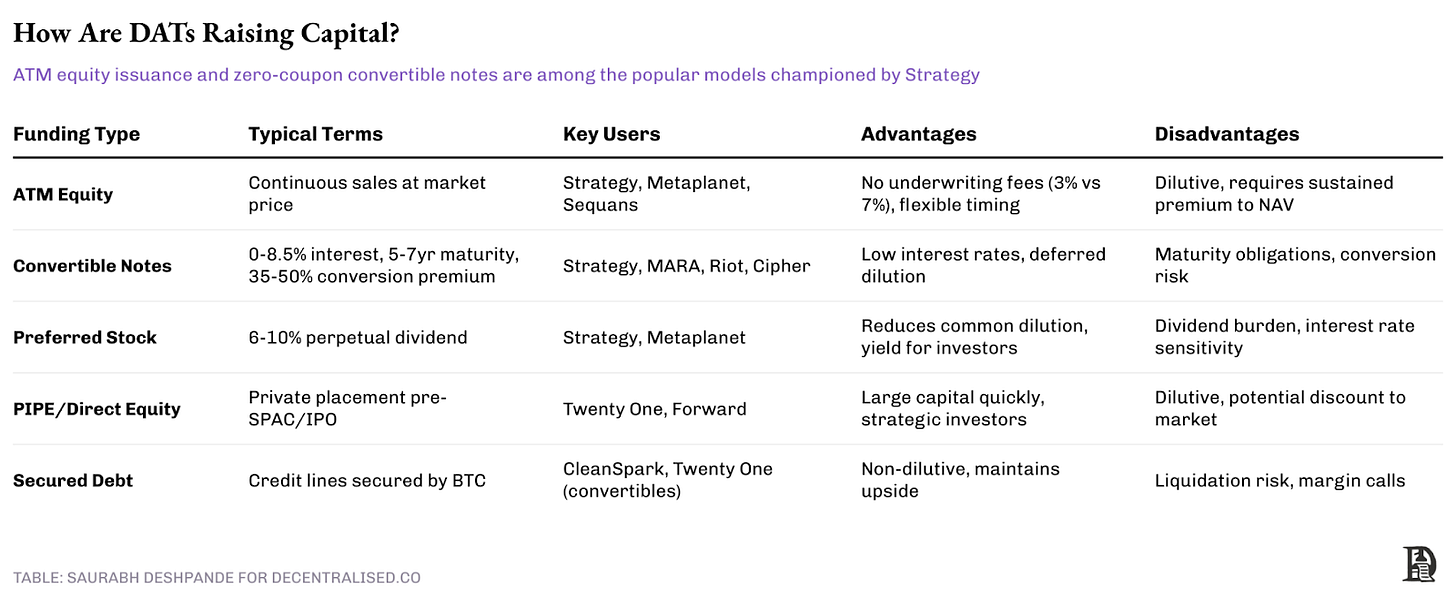

So far, we have seen five different capital-raising methods adopted by DATs. Four of them are used by Strategy.

An at-the-market (ATM) equity offering is the most flexible capital-raising mechanism for DATs. It allows incremental share sales into the market over extended periods, while avoiding large block offerings that might depress stock prices. Companies file shelf registration statements with governing bodies like the SEC and sell shares continuously as market conditions permit, adjusting timing and volume based on the premium to NAV calculations.

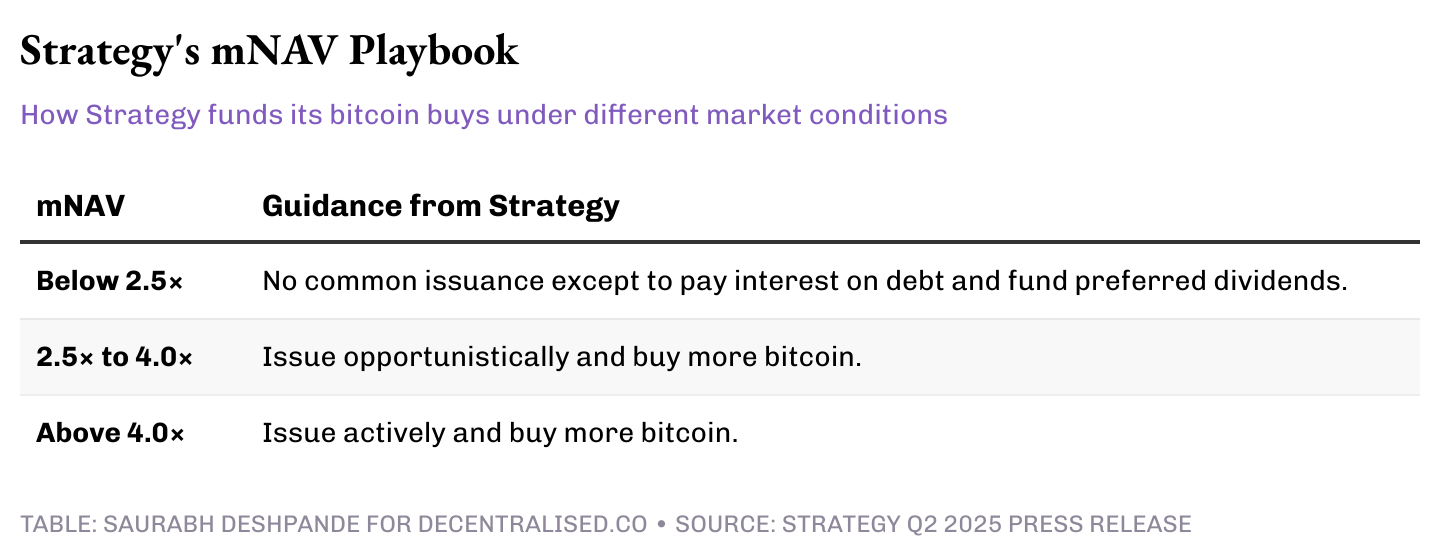

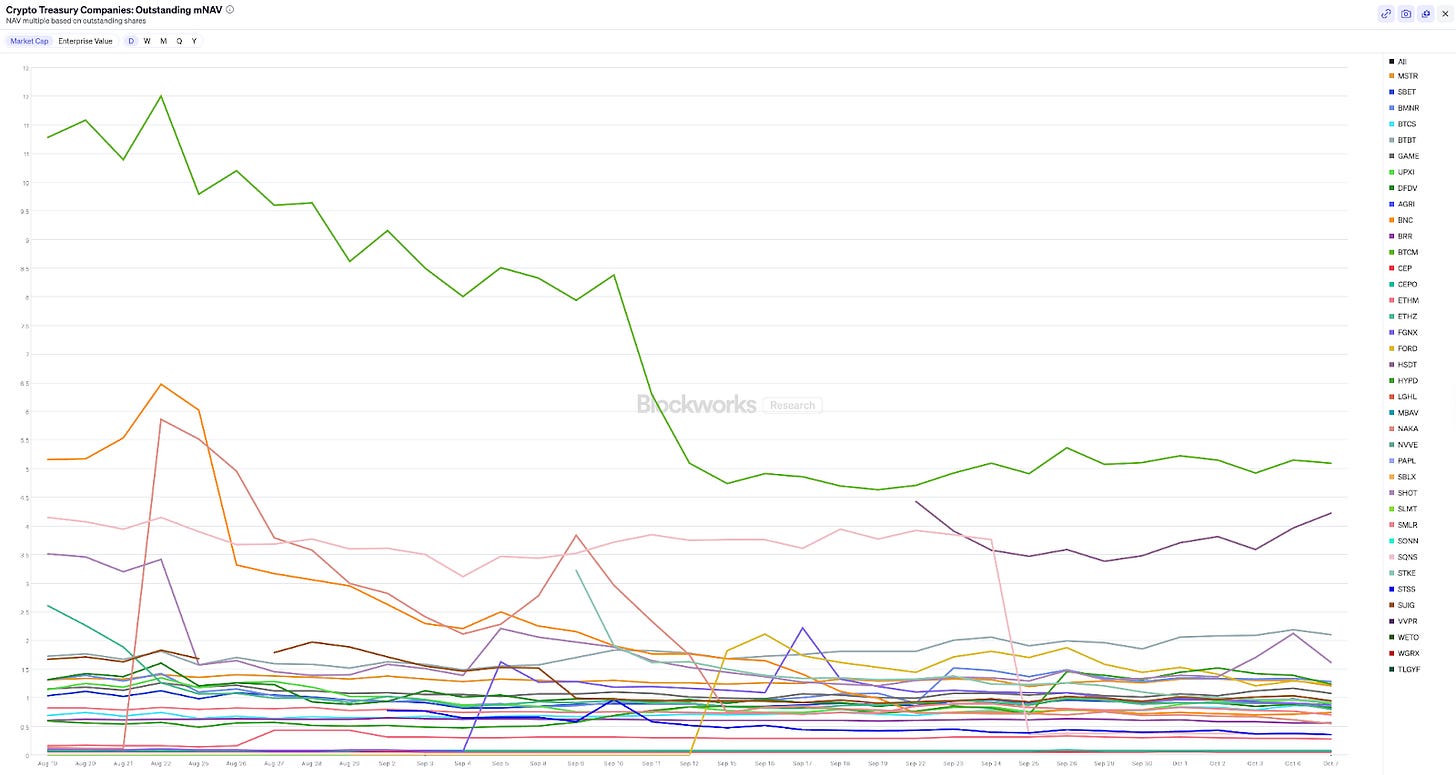

Strategy has a rulebook based on a ratio of market capitalisation of the stock to market value of bitcoin holdings, called mNAV (market-to-net-asset-value).

The second major financing vehicle is the convertible notes. They offer debt securities convertible into equity at predetermined prices and dates. Remarkably, many Bitcoin treasury companies issue near-zero-interest convertible notes despite benchmark rates near 5%, enabled by extreme stock price volatility, which creates profitable arbitrage opportunities for sophisticated investors.

What made Strategy convertible bonds work well so far

MicroStrategy has issued $8.2 billion in outstanding convertible notes with an average coupon of just 0.421%, despite the company holding a B minus credit rating from Standard & Poor’s. This rating was withdrawn in December 2024. Had Strategy borrowed pure debt, it would have had to pay 6 to 8% interest due to its B-minus credit rating. When MicroStrategy issued non-convertible bonds in June 2021, they paid interest of about 6.125%. The convertible structure enables the company to pay a significantly lower interest rate, making borrowing more feasible.

Strategy benefits from this, given that it has to pay much lower interest on the convertible debt. But there’s obviously the counterparty to this debt. Who is subscribing to these notes and why? Let’s break down the mechanics of these bond sales.

In November 2024, Strategy issued a note. Here’s how the note was structured.

The price of the issue was $433.8. The coupon was zero.

The conversion price was at a 55% premium at $672.40.

The notes mature in 2029. Strategy aimed for $1.75 billion. Investor demand took it to $2.6 billion with a $0.4 billion option for initial purchasers.

The company can redeem the notes and pay investors cash after 4 December 2026 if the share price has been at least 130% of the conversion price for a set period. That is roughly $874.

On 1 June 2028, holders can require the company to repurchase their notes for cash at par ($433.8) on that date. Think of this as an early exit. It shortens the actual duration for investors and creates a date the company must plan for. If markets are open and the stock is healthy, the company can refinance or call around this date.

The note is a call option with the conversion price serving as the strike price and a five-year expiry. The feature ensures that if the underlying doesn’t go above the strike, you get your money back.

During this time, my question was who is buying this worth $3 billion and why. My naive assumption was that bond traders get a nice call option here. It’s like a call option for them with a guaranteed premium back. So they either make more than 55% in five years or get a full refund. So, it’s a good deal. This is only the tip of the iceberg.

The main reason why hedge funds were piling on to this was the volatility of MSTR. As of October 2, MSTR has an implied volatility of 57% versus bitcoin’s 41%. Higher volatility implies that options are more valuable. So, they are not waiting five years for the note to mature. Instead, they are harvesting the volatility opportunistically.

Let’s take a little detour before I share how this works. There are two things we must know about options. Delta and gamma. Delta measures how much the option’s value moves when the share price moves by one dollar. Let’s say the delta for a call option priced at $1 is 0.5. When the underlying increases by $1, the options price will increase by 50% of this move, i.e., by $0.5. The new price will be $1.5.

Gamma measures how fast delta itself changes as the price moves. A high gamma means delta jumps quickly when the share ticks up or down. That jump is the engine that creates the hedge trades. For those who remember their physics class, if the underlying is distance, delta is velocity, and gamma is acceleration.

Now, let’s understand how the trade works. When you hold the note, you are long the embedded call. The share starts at $100, and the option delta is about 0.5, so you short 50 shares. The share rises to $110 and delta lifts toward 0.6, so you short ten more shares at $110. The share falls back to $100, and delta drops toward 0.5 again, so you buy those ten back at $100.

You have sold high and bought back lower. That round trip is a realised cash gain. The bond embedded with the call option gained value on the way up and gave it back on the way down. This is fine because the profits you book came from the short side or the hedge you employed. You want as many such round trips as possible to keep adding profits.

This is why you want high volatility. Volatility is the product in disguise here. Since MSTR trades at a volatility even higher than bitcoin, this trade works. You see every convertible note getting subscribed. If the volatility of the stock drops, there may not be takers for these notes. However, since bitcoin is leveraged, as long as it is volatile, MSTR will likely remain volatile too.

The third way of raising capital is preferred stock offerings. It emerged in 2025 as companies diversified their capital structures to areas beyond common equity and convertible notes. Strategy launched multiple preferred share classes. An example of this is the March 2025 “Perpetual Strike Preferred Stock“ with a $21 billion programme size, offering 8% fixed perpetual dividends convertible into Class A common stock. The idea here is to minimise common stock dilution while maintaining the ability to raise capital. It also provides yield-seeking investors with alternative instruments.

The fourth way is by issuing senior secured debt. Companies tend to pay higher interest rates as per their credit ratings, since this debt doesn’t convert to equity. This debt often gets refinanced when cheaper sources of capital are available. Strategy did this with notes. Strategy redeemed $500 million of 6.125% senior secured notes, due in 2028, during September 2024, using zero-coupon convertible proceeds to eliminate high-interest costs.

Lastly, during 2024-25, companies raised capital from direct equity raises and PIPE (Private Investment in Public Equity) transactions. These transactions typically involve strategic investors acquiring large stakes through private placements, often concurrent with SPAC (Special Purpose Acquisition Company) mergers or strategic pivots.

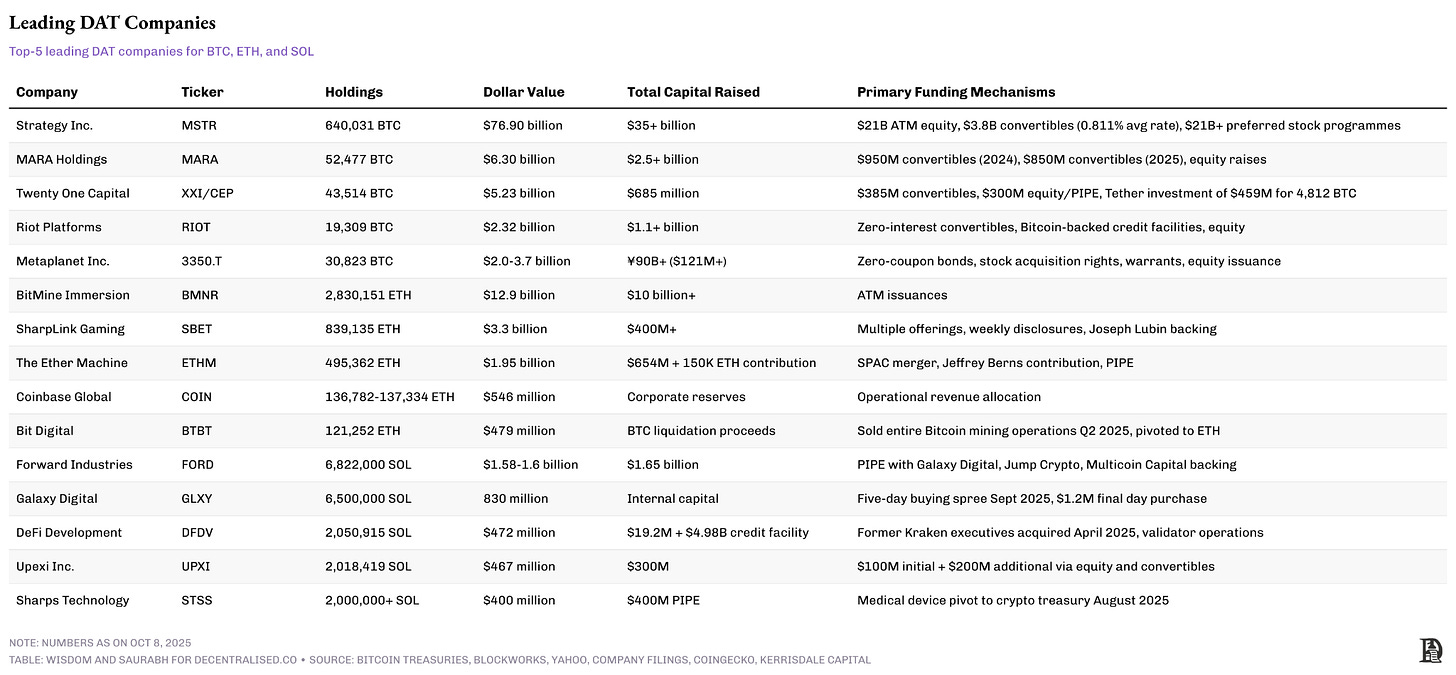

Forward Industries is an example of this type of capital raise. It was the largest Solana treasury PIPE transaction in September 2025, raising $1.65 billion specifically for SOL accumulation. This single financing created the largest corporate Solana holder with 6.822 million SOL, valued at approximately $1.6 billion. It validates that institutions are embracing the public wrapper for the digital assets thesis. Galaxy Digital, Jump Crypto, and Multicoin Capital led the investment. All SOL controlled by the entity are staked. The proceeds from the yield will be used to compound treasury positions over time. The company benefits from backers’ operational expertise in validator operations and staking optimisation, beyond just providing financial capital.

These funding mechanisms are only a part of the story. It is also important to understand where a wrapper solves a local problem. Rules and taxes can make a listed balance sheet the best way to own a token in a given market. Japan and Hong Kong are the clearest examples of that.

Japan is a tax wedge turned into a product. Listed equity gains for individuals are taxed at roughly 20%. Since 2024, the new NISA also makes equity gains and dividends tax exempt inside the wrapper up to ¥3.6 million a year, with a ¥18 million lifetime allowance that recycles when you sell. Personal crypto gains are treated as miscellaneous income and can reach about 55% at the top combined rate. A listed company that holds bitcoin turns that gap into a simple share that sits in the equity tax lane. Metaplanet leaned into this.

Hong Kong is about plumbing. In 2021, there were no spot crypto funds. Meitu bought crypto directly and disclosed the numbers. Through March and April 2021, it acquired about 31,000 ether and about 941 bitcoin, funded from cash. That turned crypto exposure into a listed share that local investors could buy and settle like any other equity. Hong Kong opened the fund rail in 2024 and allowed spot bitcoin and ether ETFs, including an in-kind model for creations and redemptions. Meitu unwound the treasury in November and December 2024, selling roughly 31,000 ether and 940 bitcoin for about $180 million, booking a profit of approximately $80 million.

DAT Landscape

Estimates of the total assets held by all the DATs vary greatly because tracking hundreds of companies and their asset purchases is difficult. The Block quotes the value of assets held by DATs at $155 billion versus Blockwork’s $113 billion. Bitcoin is by far the most dominant asset, comprising more than 85% of the aggregated NAV.

The combined liabilities of all DATs are ~$73 billion, which is about half of their combined NAV, according to The Block. Tom Lee, who led Bitmine Immersion Tech, is the second largest DAT, having raised more than $10 billion via ATM issuances in the last three months.

SharpLink holds over 800,000 ETH worth over $3.3 billion, making it the second-largest institutional ETH treasury. It has received SEC approval to sell up to $6 billion in new shares through ATM sales and initially raised $425 million through a private placement led by ConsenSys in June 2025.

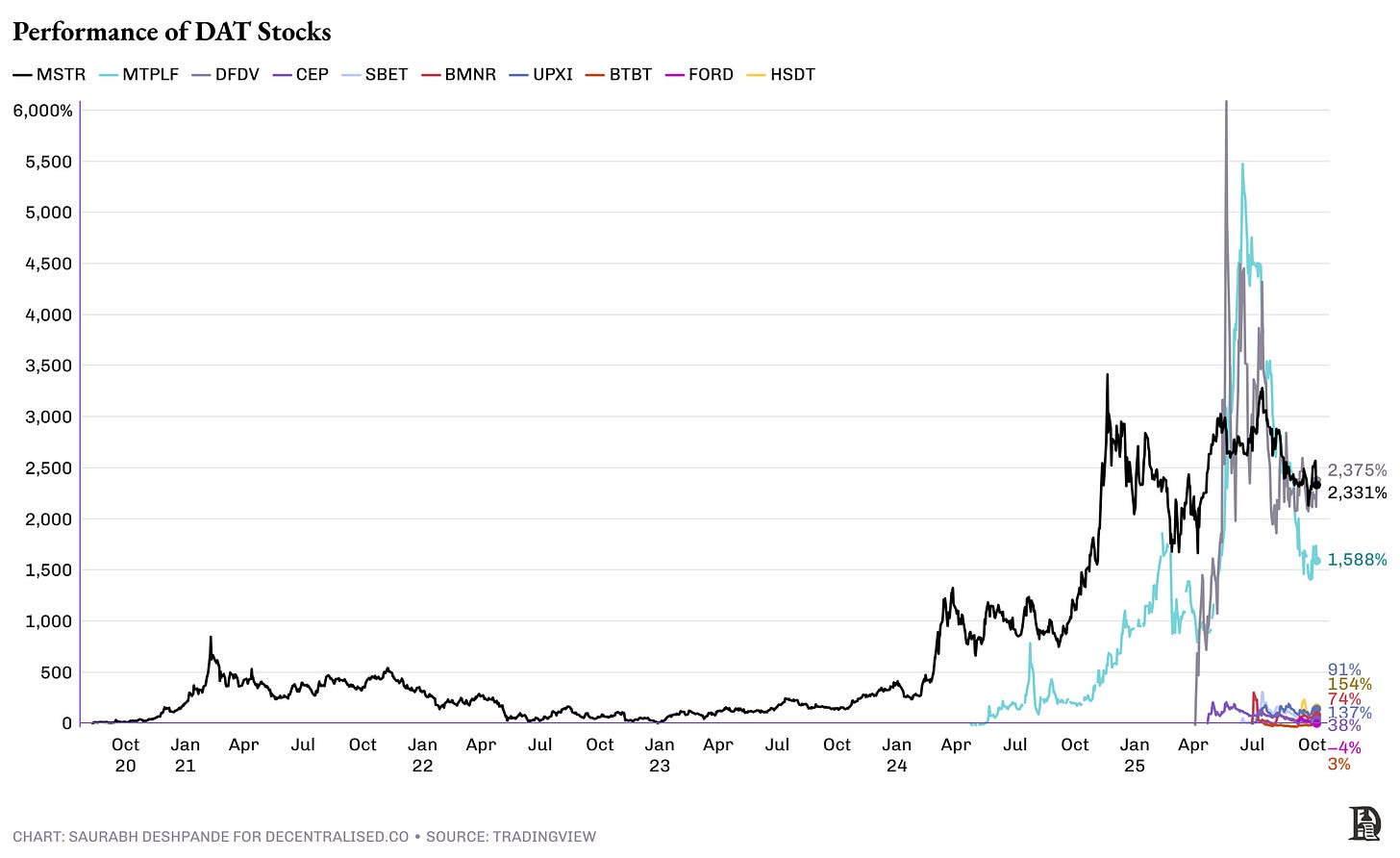

The performance of stocks after they announced DATs clearly suggests that there was a significant first-mover advantage. As the number of DATs increased, incremental new announcements didn’t move the needle for stocks.

Not all DATs are created equal. The asset they hold matters far beyond just the potential for price appreciation. Three distinct value accrual mechanisms separate sophisticated DATs from simple wrappers.

The first mechanism is capital issuance. This is what we covered earlier with the example of how you created increased original investors’ value from $100 to $267. When you issue equity above book value, you create value for existing shareholders.

The second mechanism is staking. Bitcoin DATs hold an inert asset. It sits there. Ethereum DATs can stake their holdings and earn roughly 2.5% to 3% annually. This turns the treasury into a productive asset. Solana DATs can stake and earn 7% to 9%. That difference compounds. A treasury earning 7% on its underlying asset is fundamentally more valuable than one earning zero. Of course, the volatility of the asset matters.

The third mechanism applies only to pre-mined assets like Solana. As mentioned earlier, these DATs can buy locked tokens at a discount to spot prices. When those tokens unlock over time and move to par, that discount translates into gains for shareholders. Put this locked token strategy together with staking, and you roughly double the effective yield. A Solana DAT earning 7% staking yield plus capturing 15% discounts on locked purchases is generating returns that a Bitcoin DAT simply cannot match.

What can go wrong

Leverage is a critical factor that will determine who survives the 60 to 70% drawdown. Strategy’s leverage is at 12% to NAV (this is the Debt/BTC NAV number). They have committed to never exceeding 20%. This is for Bitcoin, which is less volatile than other digital assets. If you believe Strategy has calibrated their leverage correctly for Bitcoin’s volatility profile, then a Solana DAT should run even lower leverage. Ethereum sits somewhere in between.

The type of debt matters as much as the amount. In-kind convertible notes eliminate basis risk. When Upexi issued convertible notes, the consideration was Solana. That SOL is held as collateral in a qualified custodian under a triparty agreement. If the notes do not convert to equity, Upexi simply returns the SOL. They are not on the hook for a specific USD amount.

Compare this to a USD-denominated convertible. If a company raises $80 million in a USD convertible and Solana crashes 70%, the company still owes $80 million. If they cannot refinance and the notes come due, they have to sell Solana into a depressed market. This is how forced selling cascades begin.

When Saylor started raising capital to scoop more BTC and offered an exciting trade to funds, they were quick to latch onto these raises. As I discussed earlier, Strategy provides them with two things: 1) volatility and 2) the ability to trade in size. Trader interest is what keeps MSTR trading above NAV and more volatile than bitcoin, both of which are critical for the continued success of the Strategy model. As more companies start offering similar raises, capital has more options to explore.

The newer DATs catering to assets that are further down the risk curve will have to stick to ATM equity issuances, as they may not find subscribers for convertible notes due to size and volatility constraints. Remember, traders need size and stock that is more volatile than the asset the company is trying to acquire. Their market cap can remain above NAVs only when traders are interested in them. mNAVs of most DATs have been trending lower, with many trading below 1. MSTR used to trade at an mNAV of more than 4, not too long ago. It now trades at 1.2.

What happens when they trade below NAV? It means that the market thinks the company is worth less than the assets it holds. It hampers the company’s ability to raise funds to buy more assets. Companies can take corrective measures.

First, you can convert to an open-ended fund, such as an ETF. This allows investors to redeem underlying assets at NAV, naturally eliminating the discount. It means that investors can acquire assets at a price lower than their prevailing market value. This is the route Greyscale went after the spot ETF for bitcoin was approved in 2024.

Second, the company can sell assets to repurchase its shares, ensuring they trade at parity with the assets. It also means that the company’s asset pool continues to decrease. This reduces outstanding shares and helps reduce the gap.

Third, we may see some activist shareholders push for mergers and acquisitions. This will help increase the asset pool, thereby raising the trading volume. Higher trading volume often comes with increased interest for the merged entity. We are already seeing this play out. Vivek Ramaswamy’s Strive bought Semler for $1.3 billion. Semler was trading at a discount to its 5048 bitcoin stash.

This is how the deal terms looked —

The transaction is valued at $1.3 billion in an all-stock deal

Each Semler share converts into 21.05 Strive Class A common shares, valuing each Semler share at $90.52, representing a 210% premium for Semler as per the closing price on September 19.

Strive gains 5048 BTC that Semler currently holds.

But 5048 BTC at ~$115,000 is approx $580 million. Then why is Strive paying $1.3 billion? Because it is issuing new shares to acquire a DAT.

There’s also a lot of misinformation or hidden information about DATs. For example, companies sometimes announce massive allocations to assets, but there’s no information on whether they are asset purchases, in-kind allocations from investors, or teams already holding assets. In September 2025, Flora Growth, a medicinal cannabis company, announced that it had raised $401 million to build a $0G token treasury with approximately $23 million in investment from DeFi Development Corp. The catch was that only $13.7 million was new capital. A staggering 96.5% was raised from existing token holders in kind. No new buy pressure. The $0G token’s price was set at $3 even before the token was traded. As of October 16, the token is trading at $2.

The days when the playbook like Flora worked are probably behind us. With enough options to invest in, smart money won’t bother chasing the long tail of DATs in the absence of ingenuity. There are costs to running a public company. Announcing a DAT made sense a couple of months ago when the market would immediately send the stock soaring, but not anymore. So, you’d venture into a DAT only if the benefit of announcing a DAT outweighs the cost of remaining public.

Most DATs will fail

The number one determinant of any DAT’s performance is the performance of the underlying asset. Capital structure and value accrual mechanisms matter, but they are secondary. If the asset goes to zero, the DAT goes to zero regardless of how clever the financing was.

Most altcoins do not survive five years. Go back and look at the top 50 cryptocurrencies from 2018. How many are still relevant today? How many are down 80% or 90% from their peak? Most alts get left behind as capital rotates to newer narratives. A treasury company built on a dying asset is just a slow liquidation.

This is why only a handful of assets can support long-term treasury strategies. Bitcoin obviously qualifies. It has survived multiple cycles and has the deepest liquidity. Ethereum qualifies despite questions about its roadmap. It is the settlement layer for most on-chain activity. Solana qualifies because of its speed, cost structure, and growing ecosystem. A few others may make the cut.

Even when you have the right asset, it’s not going to be easy with so much competition. Only a handful of DATs can access the complete toolkit of capital raising mechanisms. This creates a structural advantage that compounds over time. This can also be seen in the stock performance.

Strategy can issue convertible notes at near-zero interest rates because of three factors working together. First, the stock trades with higher volatility than Bitcoin itself. Second, they have liquid options markets that allow convertible arbitrage funds to delta hedge their positions. Third, they have sufficient trading volume to execute large hedges without moving the market. This combination lets them sell embedded call options to sophisticated buyers who profit from harvesting volatility.

Smaller DATs cannot replicate this. When a Solana DAT with a $500 million market cap tries to issue converts, the options market is either non-existent or too illiquid to hedge. Without the ability to hedge, convertible buyers cannot capture the value of the embedded option before maturity. The company either pays a much higher coupon or cannot access convertible financing at all. They are stuck with equity-only issuance.

This creates tiers in the DAT market. Top-tier companies like Strategy issue converts at 0% and drip equity through ATMs at premium multiples. Mid-tier DATs issue converts at 2% to 3% and rely more heavily on equity. Bottom-tier DATs can only issue equity, often at compressed multiples, because they lack the scale to attract institutional interest.

The flywheel creates a power law where the top tier keeps getting more favourable terms. Cheap capital from converts allows more accretive issuances. More issuances drive the stock price higher. Higher prices create more trading activity. More activity improves liquidity in both the stock and options. Better liquidity attracts the next round of convertible buyers, and the advantage compounds.

This scale advantage is not a permanent moat. Another DAT could reach critical mass and access the same mechanisms. Tom Lee’s Bitmine is a good example of that. Getting there, however, requires hitting thresholds for market cap, trading volume, and options liquidity. Most DATs will never reach these thresholds. They will remain trapped in equity-only financing while watching the top tier compound advantages through cheaper, more flexible capital structures.

The implication for investors is clear. The gap between top-tier and bottom-tier DATs will continue to widen. A premium asset is necessary, but not sufficient. You also need the scale to access all the avenues of capital markets. Companies that cannot issue converts at attractive rates, maintain enough trading volume, or support a liquid options market will struggle to compete with those that can. The winners will be companies that reach escape velocity early and use that advantage to pull further ahead.

Wishing everyone a happy Diwali,

Saurabh Deshpande