Beyond Stablecoins

The Dollar’s New Skin

Hello!

Stablecoins have been all the rage in the recent past. Some hail it as the best thing since toast bread. Others (like me) think it is just a sneaky way to export dollars. We have been thinking long and hard about how financial markets will evolve in the wake of tokenisation.

A few weeks ago, I explored how an increase in monetary velocity will affect markets. And prior to that, Saurabh dug into what happens when tokens have a business model.

Today’s piece by Sumanth expands on that body of work.

The story lays out the historical context for how stablecoins came to be, then goes on to explore what tokenisation could mean for markets. We have been investing, advising and helping scale several businesses, building on these verticals. If you are one of them, drop us a note at venture@decentralised.co.

If you enjoy the piece, press the heart button at the bottom of the article so the algorithm gods at Substack show us mercy.

Joel

In July 1944, delegates from 44 Allied nations met in the rustic ski town of Bretton Woods, New Hampshire, to rewire the world’s money. They pegged every currency to the dollar while the US pegged its currency to gold. This regime, architected by the British economist Keynes, ushered in an era of stable currency exchange and frictionless trade.

Imagine that summit as a GitHub project. The White House forks the repo, the Treasury Secretary submits a pull request, and finance ministers from every nation smash merge, hard-coding USD into every future trade loop. Stablecoins are that merge commit in today’s digital era as the rest of the world tries to debug their codebase for a future without the dollar.

Within 72 hours of returning to the Oval Office, President Trump signed an Executive Order that included a directive that sounded more like CT fanfiction than fiscal policy: “promote and protect the sovereignty of the United States dollar, including through lawful, dollar-backed stablecoins worldwide.

Congress followed with the GENIUS act “Guiding and Establishing National Innovation for U.S. Stablecoins” - the first ever bill that sets ground rules for a stablecoin framework and encourages stablecoins payments across the world.

The act is up for debate on the Senate floor with a possible vote sometime this month. Staffers believe suggestions from the Democratic coalition have been incorporated into the latest draft, and the bill will pass.

But why did Washington start a love affair with stablecoins? Is it just political theatrics or is there a deeper strategic play involved?

Why Foreign Demand Still Matters

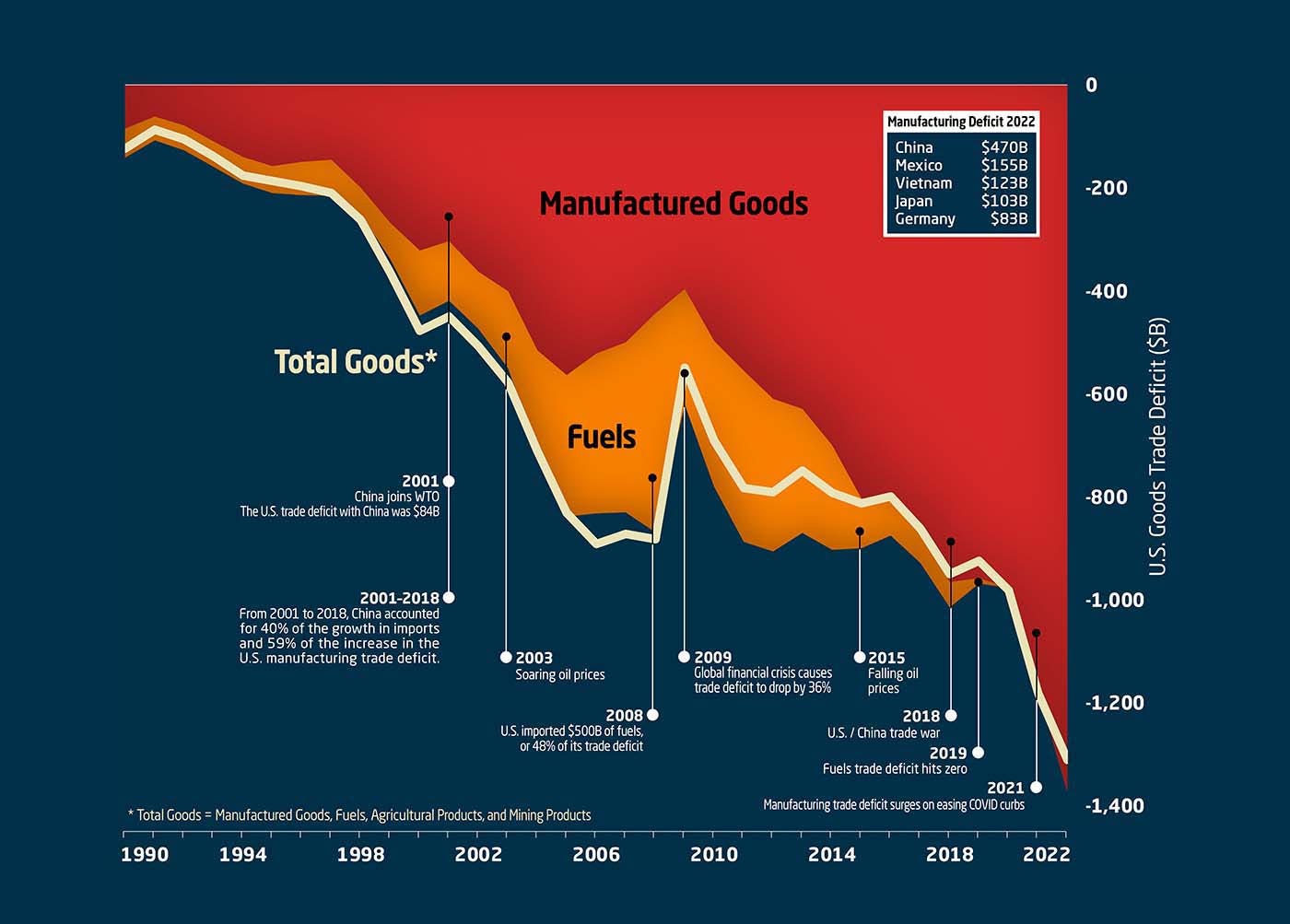

Since the 1990s, America has outsourced production to nations like China, Japan, Germany, and the Gulf states, paying for every container of imports with freshly minted dollars. Since the US imports more than it exports, it runs fat trade deficits. A trade deficit is the gap between what a country buys from the world and what it sells back.

These dollars pose a dilemma for export nations as converting those dollars back to local currency would drive exchange rates higher, gut competitiveness and undercut their own exports. Instead, the central bank scoops up dollars and reinvests them in Treasuries, recycling the cash without rocking the forex market. This also gives these banks the T-bill yield with virtually the same credit risk as holding idle dollars.

These incentives create a nice self-reinforcing loop. Ship stuff to the U.S., earn in dollars and park them in Treasuries to earn interest. Keep the home currency weak so you keep selling more.

This vendor-financing loop with exporters has accounted for roughly a quarter of Washington’s $36 trillion debt stock, locking in key advantages. Break that loop through a protracted trade war, and Washington’s cheapest source of funding starts to dry up.

Financing the Deficit: The U.S. government spends more than it collects in taxes, running persistent budget deficits. Selling Treasuries to foreigners is how it shares the burden of a deficit. T-bills are short-term securities that mature within one year, while Treasury bonds are long-term securities that mature in 20 to 30 years.

Low Interest Rates: High demand for Treasuries keeps their yields (interest rates) low. When buyers like China bid prices up, yields fall, reducing borrowing costs for the government, businesses, and consumers. This affordability sustains economic growth and funds expansive fiscal policies.

Dollar Supremacy: The dollar’s reserve status hinges on confidence in U.S. assets. Foreign holdings of Treasuries signal trust in the U.S. economy, ensuring the dollar remains the preferred currency for trade, oil pricing, and reserves. This privilege allows the U.S. to borrow cheaply and wield economic influence globally.

Without this demand, the U.S. would face higher borrowing costs, a weaker dollar, and diminished geopolitical leverage. There are already warning signs. At the time of stepping down, Warren Buffett confessed that his biggest worry is a looming dollar crisis. For the first time in a century, the US has lost its AAA credit status from all major rating agencies. An AAA grade is the bond market’s gold medal. It tells investors this debt is about as safe as it gets. With this downgrade, the US Treasury must dangle richer yields to keep buyers interested. This means inflating the nation’s interest bill just as the debt meter keeps spinning.

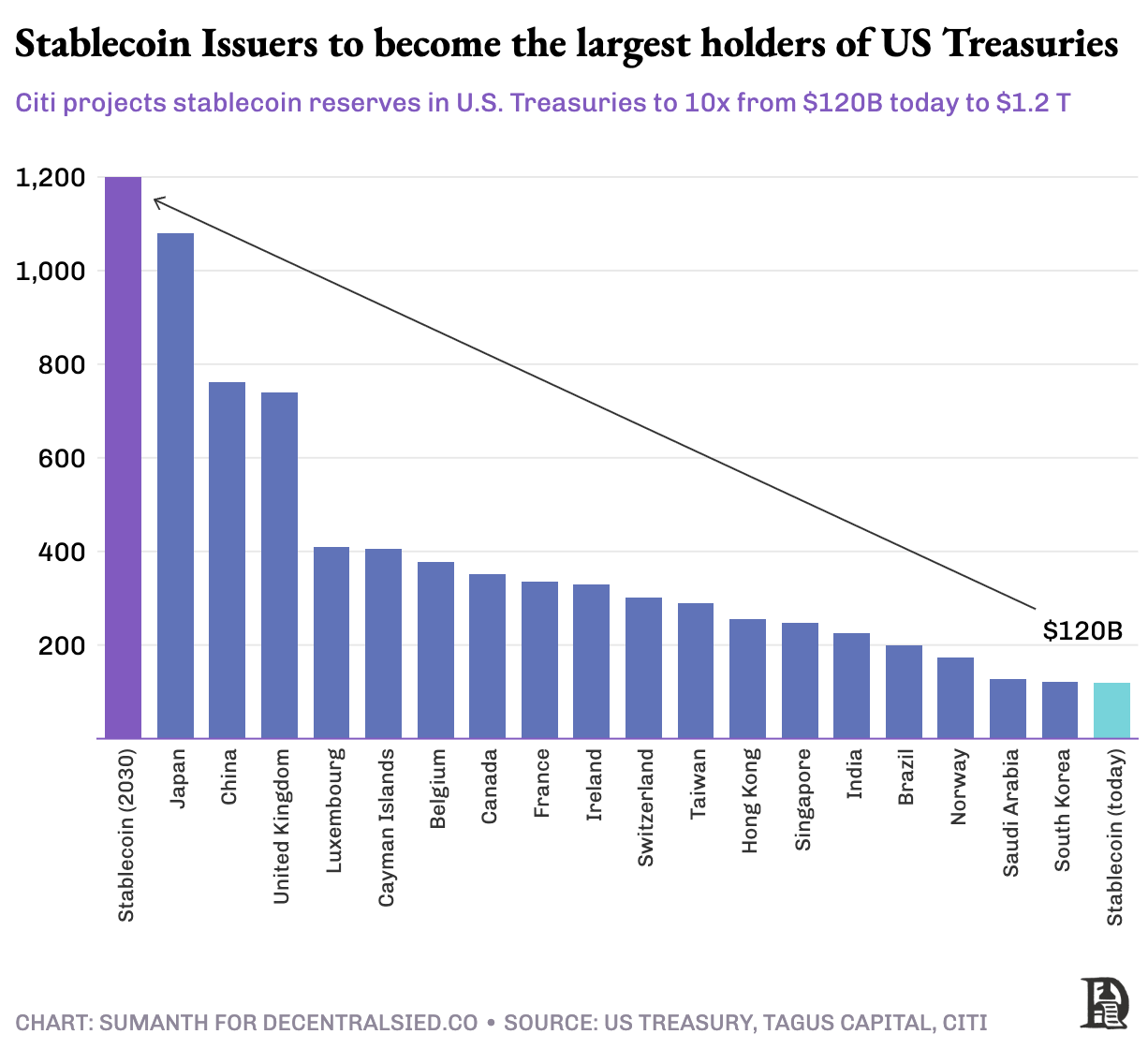

If traditional buyers start abandoning the Treasury market, who will soak up the next trillion in fresh issuance? Washington’s wager is that a regulated wave of fully-backed stablecoins will open a new pipeline. The GENIUS Act forces stablecoins issuers to buy T-bills. That’s why the administration’s tough trade talk is paired with its warm embrace of digital dollars.

The Eurodollar Legacy

This type of financial innovation isn’t new to the US. The $1.7 Tn Eurodollar system also went through a similar journey of outright dismissal to assimilation. Eurodollars are USD-denominated deposits held in overseas banks, primarily in Europe. These deposits are not subject to US banking regulations.

Eurodollars started in the 1950s when Soviet dollars were deposited in European banks to avoid U.S. jurisdiction amidst the Cold War. By 1970, Eurodollars represented a $50 billion market, a fifty-fold increase in just a decade.

The initial US response was suspicion. French Finance Minister Valéry Giscard d'Estaing famously called it a "hydra-headed monster." These concerns were temporarily shelved after the oil shock of 1973, when OPEC's actions quadrupled global oil trade value in mere months and the world looked for a stable means of conducting trade; the dollar.

The Eurodollar system enhanced America's ability to project power by non-kinetic means. This system expanded as international trade and the Bretton Woods framework cemented dollar dominance. Though Eurodollars facilitated payments between foreign entities, these transactions flowed through the global correspondent banking network, which always passed through U.S. banks.

This created powerful leverage for U.S. national security objectives, allowing officials to block not just direct U.S. transactions but also sanction bad actors from the entire global dollar system. Since the US acted as the clearing house, they could track flows and financially sanction countries.

The Stabledollar Update

Stablecoins are today's Eurodollar with a public block explorer. Instead of parking dollars in a London vault, the dollar is ‘tokenised’ on blockchain rails. That convenience has real scale: on-chain dollar tokens settled roughly US $15 trillion in 2024, barely edging past Visa’s network. Today, there’s $245B of stablecoins in circulation, with 90% of them being fully collateralised and dollar-denominated.

Demand for stables increased with time as investors wanted to convert their gains and escape the cyclical nature of the market. Unlike crypto’s volatile market cycles, stablecoin activity keeps growing, indicating that stablecoins are being used for much more than just trading.

The earliest demand came in 2014, when Chinese crypto exchanges needed a bank-free way to shuttle dollars between their order books. They turned to Realcoin, a USD wrapper on Bitcoin using the Omni protocol.

Realcoin (which later rebranded to Tether) routed on-ramping and off-ramping through the Taiwanese banking network. This worked until Wells Fargo ended its correspondent banking relationship with these banks, spooked by the regulatory pressure that followed Tether’s growth. In 2021, the CFTC eventually fined Tether $41 million for overstating its reserves, alleging the token was not fully backed.

Tether’s playbook is classic banking: collect deposits, invest the float, keep the interest. Tether converts about 80% of every Tether printed into Treasuries. With the short-term T-bill rate at 5%, its $120B holdings can yield $6B a year. Doing this, Tether earned a net profit of $13 billion in 2024. Goldman Sachs reported a net income of $14.28 billion during the same time. The difference is that Tether has ~100 employees and Goldman Sachs has ~46,000. Per employee, Tether generated a profit of $130 million per employee against Goldman’s $310 thousand.

Competitors have tried to win trust with transparency. Circle publishes monthly attestation reports for USDC, listing every mint and redemption. Even so, the sector still runs on issuer promises. In March 2023, the collapse of Silicon Valley Bank trapped $3.3 billion of Circle’s reserves and briefly knocked the token to 88 cents before the Fed stepped in and made SVB holders whole.

Washington now wants a rulebook. The GENIUS Act establishes clear rules for issuance, transparency and reserve requirements.

100% reserves in High-Quality Liquid Assets (HQLA) like Treasuries and reverse repos.

Real-time attestation via permissioned oracles.

Regulatory hooks: issuer-level freeze features, FATF Rules compliance.

Compliant stablecoins get access to Fed master accounts and liquidity through reverse repo lines.

A graphic designer in Berlin no longer needs a U.S. bank account, or even a German one, or the SWIFT paperwork that comes with it to hold dollars. A Gmail login and a quick KYC selfie will do, as long as Europe allows it without shoving everyone into its euro CBDC. Money is migrating from bank ledgers to wallet-based apps, and the companies that control those apps will look a lot like global banks, minus the branches.

If this regime becomes law, today’s issuers face a choice: register in the U.S, submit to quarterly audits, AML checks, and reserve proofs or watch American trading desks migrate to compliant tokens. Circle, which already parks most USDC collateral in SEC-regulated money-market funds, looks far better positioned.

But Circle won’t run alone. Big Tech and Wall Street have every reason to join the playing field. Picture Apple Pay with “iDollars”: top up $1000, earn rewards and spend anywhere tap-to-pay works. The yield on idle cash balances is worth far more than today’s swipe fees, and it slices traditional middlemen out of the loop. Maybe this is the reason Apple is ending its card partnership with Goldman Sachs. When a payment moves as an on-chain dollar, the old 3% transaction fee shrinks to a flat blockchain fee measured in cents.

Major US banks like Bank of America, Citibank, JP Morgan, and Wells Fargo are already exploring jointly issuing a stablecoin. The Genius Act prohibits issuers from passing on interest to users, which should make the banking lobby breathe easier. Think of it as a super cheap checking account: instant, global, and always on.

No surprise that the incumbents are scrambling. Mastercard and Visa rolled out stablecoin settlement networks. Paypal minted its own stablecoin, and Stripe just acquired Bridge this year in the biggest crypto deal to date. They know what’s coming.

So does Washington. Citi Bank estimates that Stablecoins will grow by 6x to hit $1.6 Tn by 2030 in the base case scenario. The US Treasury’s own research puts the figure higher at $2 Tn by 2028. If GENIUS forces issuers to keep 80% of those reserves in Treasuries, stabledollars would displace China and Japan to become the single largest holder of U.S. debt.

Assets on the Token Queue

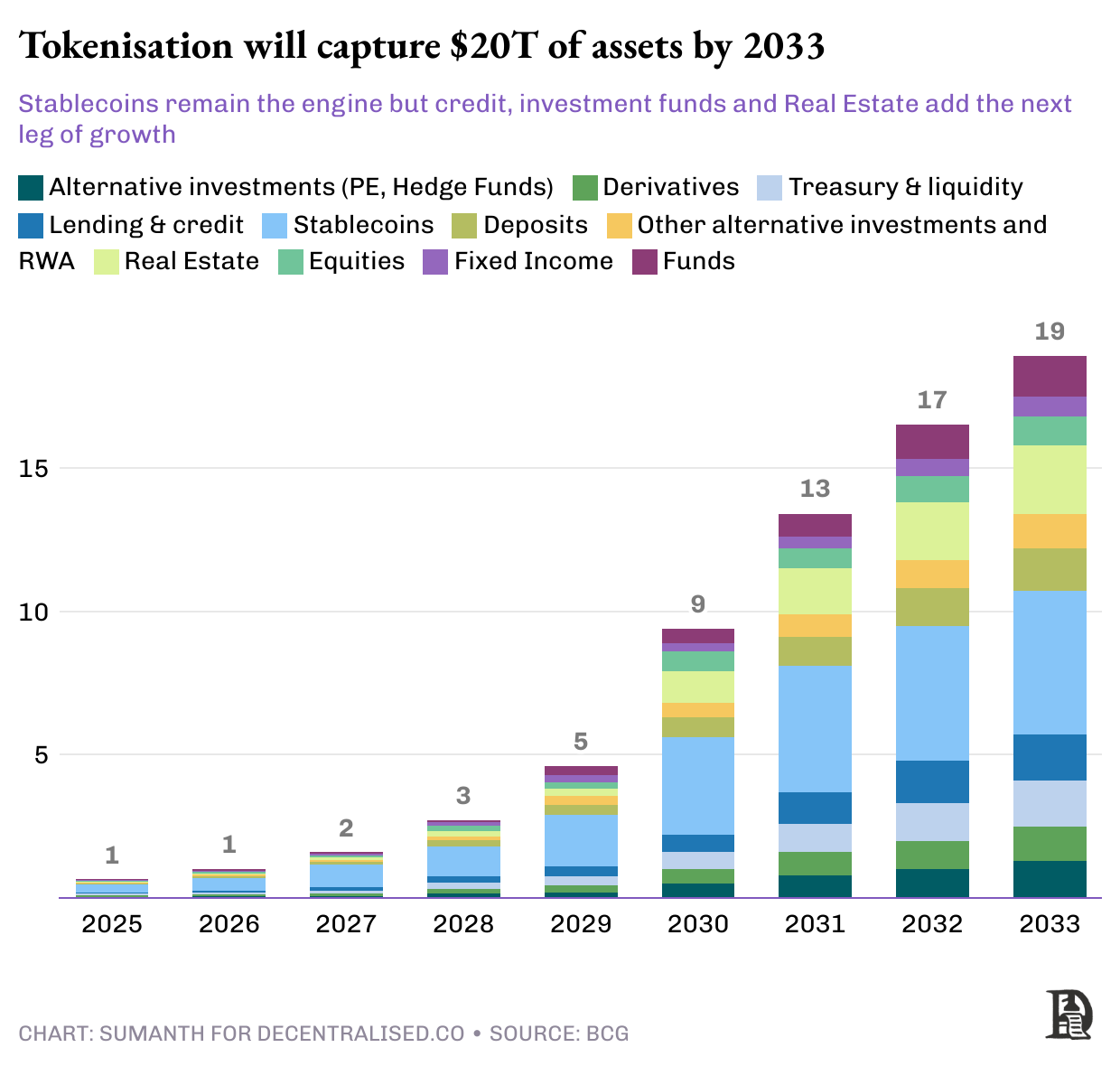

As these “stabledollars” spread, they become the working capital that powers the rest of the token economy. Once cash is tokenised, people treat it exactly as they would off-chain: save it, lend it, and pledge it as collateral, but at internet speed instead of banking speed. That restless liquidity then looks for the next thing to tokenise, pulling more “real-world assets” (RWAs) onto blockchains and giving them the same advantages.

24/7 settlement - The traditional T+2 settlement cycle becomes obsolete as blockchain validators confirm transactions in minutes, not days. A trader in Singapore can purchase a tokenised New York apartment at 6 PM local time and receive ownership confirmation before dinner.

Programmability - Smart contracts embed behaviour directly into assets. This enables complex financial logic like coupon payments, distribution rights and built-in compliance parameters at the asset level.

Composability - A tokenised Treasury bond can serve as collateral for a loan while splitting interest payments amongst multiple owners. An expensive beachfront villa can be fractionalised amongst 50 partners and leased out to a hospitality provider that manages bookings through Airbnb.

Transparency - The 2008 financial crisis emerged partly from opacity in derivative markets. Regulators can monitor real-time collateralisation ratios on-chain, track systemic risk, and observe market dynamics without waiting for quarterly filings.

“Every stock, every bond, every fund—every asset—can be tokenised.” - Larry Fink

The main hurdle is regulatory clarity. Investors know what to expect on legacy exchanges where guardrails were hammered into place through hard lessons.

Take the case of the 1987 Black Monday Crash when the Dow Jones crashed 22% in a single day because automated programs dumped stocks the moment prices buckled, triggering a series of sell-offs. The SEC’s fix was a circuit breaker, a pause in trading for investors to reassess the situation. Today, the NYSE halts trading for 15 minutes if there’s a 7% drop.

Tokenising an asset is the easy part, the issuer guarantees the real-world claim to the token. The hard part is ensuring the rails honour every rule that applies off-chain. That means wallet-level whitelists, national ID feeds, cross-border KYC/AML, citizen caps, and real-time sanction screens baked into the code.

Europe’s Markets in Crypto-Assets (MiCA) provides a full playbook for digital assets in Europe, while Singapore's Payment Services Act is a starting point in Asia. But the global map is still patchy.

The rollout will almost certainly come in waves. Phase 1 is where the most liquid, low-risk instruments like money-market funds and short-dated corporate debt will be brought on-chain. Operational gains are immediate with instant settlement cycles, and compliance is relatively straightforward.

Phase 2 moves up the risk curve to higher-yield products such as private credit, structured finance, and longer-dated bonds. Here, the prize is not just efficiency but unlocking liquidity and composability.

Phase 3 is a step change expanding to illiquid asset classes: private equity, hedge funds, infrastructure, and real estate-backed debt. Getting there will need universal acceptance of tokenised assets as collateral and a cross-industry stack that can service these assets. Banks and financial institutions will need to custody RWA assets as collateral while giving credit.

While the timing varies by the asset class, the direction is set. Every new pool of stabledollars pushes the token economy one phase further down that road.

Stablecoins

Dollar-pegged tokens are a duopoly with Tether (USDT) and Circle (USDC) controlling a combined 82% of market share. Both are Fiat-collateralised stablecoins: a euro-denominated coin works the same way, parking euros in a bank to support every token in circulation.

Beyond the fiat model, builders are working on two experimental approaches to maintain the peg in a decentralised way without using any off-chain custodians.

Crypto-backed stables: Backed by reserves of other cryptocurrencies, usually over-collateralised to absorb price swings. MakerDAO is the flag bearer with $6Bn DAI issued. After the 2022 bear market, Maker quietly rotated more than half of its collateral into tokenised Treasuries and short-dated bonds to smooth away ETH’s volatility and harvest yield. This shift now supplies about 50 % of the protocol’s income.

Algorithmic-stables: Rather than hold any collateral, these coins try to maintain the peg through algorithmic mint-and-burn mechanics. Terra’s stablecoin UST hit $20Bn before its depeg triggered a sudden loss of confidence and a run for the exit. While newcomers like Ethena have grown to $5B through new models, this segment needs time before it's accepted widely.

If Washington grants a “qualified stablecoin” label only to fully fiat-backed tokens, others might be forced to give up the ‘USD’ in their name to comply. It’s not clear what will happen to algostables, the GENIUS Act asks the Treasury to study these protocols for a year before making a final decision.

Money Markets

Money markets are highly liquid, short-term assets like Treasury bonds, cash and repo agreements. On-chain funds ‘tokenise’ these assets by wrapping ownership interests in ERC-20 or SPL tokens. These vehicles enable round-the-clock redemptions, automated yield distributions, seamless payment integrations, and easy collateral management.

Asset managers keep the old compliance stack (AML/KYC, qualified-purchaser limits), yet settlement now happens in minutes instead of days.

BlackRock’s USD Institutional Digital Liquidity Fund ( BUIDL) is the market leader. The firm appointed Securitize, an SEC-registered transfer agent, to handle KYC onboarding, token mint/burn, FATCA/CRS reporting for tax compliance and cap-table maintenance. Investors need at least $5 million in investable assets to qualify, but once whitelisted, they can subscribe, redeem, or transfer tokens around the clock, something no legacy money-market fund allows.

BUIDL has grown to roughly $2.5 billion AUM spread across 70+ whitelisted holders on five chains. Around 80% of the funds are deployed into Treasury bills (mostly 1- to 3-month), 10% into longer-term Treasury notes and the remaining sits in cash.

Some like Ondo (OUSG) act as investment management pools, deploying into a set of tokenised money market funds like Blackrock, Franklin Templeton, WisdomTree, and offer free offramp/onramping onto stables.

While $10B looks microscopic next to the $26 trillion Treasury market, it’s directionally huge: Wall Street’s largest asset managers are choosing public chains as the distribution channel.

Commodities

Tokenising hard assets is pushing these markets into full-time, click-to-trade venues. Paxos Gold (PAXG) and Tether Gold (XAUT) let anyone buy a tokenised sliver of a Gold bar. Venezuela’s PETRO experiment wraps barrels of crude; smaller pilots are linking token supply to soybeans, corn, even carbon credits.

Today’s model still leans on old-world plumbing: bullion sits in vaults, oil in tank farms, auditors sign off on monthly reserve reports. That custodial choke-point creates concentration risk, and physical redemption isn’t always practical.

Tokenisation brings fractional ownership and makes it easy to collateralise traditionally illiquid physical assets. The space has grown to $145Bn, almost all of it gold-backed. Put that next to the $5 trillion worth of physical gold and the headroom becomes clear

Lending and Credit

DeFi lending began with overcollateralised crypto-backed loans. Users lock up $150 in ETH or BTC to borrow $100. The model works much like gold backed loans. Users want to hold onto digital assets believing the price appreciates, but need liquidity to pay their bills or enter new positions. Around $17Bn is borrowed on Aave, making up nearly 65% of the DeFi lending space.

In the traditional credit markets, banks dominate lending by underwriting risk through models tested over decades and tightly regulated capital buffers. Private credit is a new asset class that has grown to $3 Tn in global AUM alongside traditional credit. Instead of going to banks, businesses raise capital by issuing higher-risk loans that come with higher yields. This appeals to institutional lenders like PE funds and asset managers seeking higher returns.

Bringing this segment on-chain expands the lender pool and increases transparency. Smart contracts can automate the entire lifecycle of a loan: disbursing funds, collecting interest payments while ensuring that liquidation triggers are visible on-chain.

Two flavours of on-chain private credit

“Retail-routed” direct loans

Platforms such as Figure tokenise home improvement loans and sell fractional notes to yield-hungry wallets worldwide. Think of it as a Kickstarter for debt. Homeowners get cheaper financing by slicing a loan into smaller chunks, retail savers collect monthly coupons, and the protocol automates servicing.

Pyse and Glow bundle solar projects, tokenise the power-purchase agreements, and handle everything from panel installation to meter readings. Investors sit back and collect a 15–20 % APY paid straight from the monthly electricity bills.Institutional liquidity pools

Private-credit desks, but on-chain and transparent. Protocols like Maple, Goldfinch and Centrifuge bundle borrower requests into on-chain credit pools run by professional underwriters. Depositors are mostly accredited investors, DAOs and family offices who earn a floating yield ( 7–12 %) while tracking performance on an open ledger.These protocols focus on bringing down the cost of operations by having underwriters come on-chain to conduct due diligence and issue loans within 24 hours. Qiro uses a network of underwriters, each with their own credit models who are rewarded for their analysis. This segment hasn’t scaled as fast collateralised loans because of the higher default risk. When defaults occur, protocols don’t have access to traditional collection mechanisms like court orders and need to involve legacy collection agencies that drive up the cost of servicing.

As underwriters, auditors, and collection agents keep stepping on-chain, the cost of running these markets falls, and the pool of lenders gets a whole lot deeper.

Tokenised Bonds

Bonds and loans are both debt instruments, but they differ in structure, standardisation, and how they are issued and traded. Loans are one-on-one agreements, while bonds are one-to-many fundraising. Bonds follow a fixed format. A 10 year bond at 5% annual coupon is easier to rate and trade in the secondary market. They are public instruments subject to market regulation, often rated by agencies like Moody’s.

Bonds are used for large-scale, long-term capital needs. Governments, utilities, and blue-chip corporations issue them to fund budgets, factories, or bridge loans. In return, investors collect periodic payments and receive their principal back on maturity. The asset class is colossal: about $140 trillion in notional value as of 2023, roughly one-and-a-half times the global equity market cap.

Today, the market crawls through a plumbing system designed in the 1970s. Clearing corporations like Euroclear and DTCC route these through multiple custodians, adding latency, and creating a T+2 settlement system. A smart-contract bond can settle atomically in seconds, stream coupons to thousands of wallets simultaneously, carry compliance logic, and plug into global liquidity pools.

Operational savings run 40–60 basis points per issue, and treasurers get a 24/7 secondary market without paying an exchange listing fee. Euroclear is Europe’s core settlement and custody rail, safeguarding €40 Tn of assets and linking 50 markets for 2,000+ participants. They are working on a blockchain-based settlement platform across issuers, brokers, and custodians that kills duplication, slashes risk, and gives clients real-time digital workflows.

Firms like Siemens and UBS issued bonds on-chain as part of the ECB’s trial. The Japanese government is also testing the market, partnering with Nomura to bring bonds on-chain.

Equity Markets

This segment feels naturally promising because equity markets already enjoy significant retail participation, and tokenisation can power 24/7 ‘internet capital markets’.

The snag is regulation. The SEC's custody and settlement rules were written for a pre-blockchain era, requiring intermediaries and T+2 settlement cycle.

This is starting to crack. Solana has asked the SEC to green light on-chain shares issuance, complete with KYC, educational onboarding, broker-dealer custody requirements, and instant settlement.

Robinhood piled on with its own filing. Treat a token representing a U.S. Treasury strip, or a single share of Tesla, as the security itself, not a synthetic derivative.

Outside the U.S., the appetite is even louder. Foreigners already own around $19Tn in US equities thanks to the lack of restrictions. The traditional route is to use a home brokerage like eTrade, which partners with US financial institutions and pays expensive FX spreads.

Startups like Backed are offering a substitute— synthetic assets. Backed buys an equivalent amount of underlying shares in the US markets and has done $16M. Kraken just launched a partnership with them, offering US shares to non-US traders.

Real Estate and Alternative Assets

No asset class is more locked up in paper than real estate. Every deed sits in a government registry, and every mortgage in a bank vault. Until those registries accept a hash as legal proof of ownership, large-scale tokenisation can’t happen. This is why only around $20 billion of the world’s $400 trillion property stack has made it onto blockchains so far.

UAE is one of the regions leading this change, where $3Bn worth of property title deeds are registered on-chain. In the U.S, real estate startups like RealT and Lofty AI have tokenised over $100 million in residential properties, streaming rent to wallets.

Money wants to Move

Cypherpunks see “stabledollars” as a regression to bank custody and permissioned whitelists. Regulators don’t want permissionless rails that can move a billion dollars in a single block. Yet the truth is that adoption lives in the overlap between those two discomfort zones.

Crypto purists will still grumble, just as early internet purists hated TLS certificates issued by central authorities. And yet, HTTPS is why your parents can safely use online banking today. In the same way, stabledollars and tokenised treasuries may feel “impure,” but they are how billions of people will first touch a blockchain quietly, through an app that never utters the word crypto.

Bretton Woods locked the world into one currency, blockchains unlock that currency’s clock speed. Every asset we push on-chain shaves hours off settlement, frees collateral that used to nap in clearing houses, and lets the same dollar backstop three trades before lunch.

At Decentralised.co, we keep circling back to the same thesis that monetary velocity is ultimately crypto’s killer case, and bringing RWA’s on the chain matches the same theme. The faster value clears, the more often it can be redeployed, and the bigger the pie everyone slices. When dollars, debt, and data all spin at network speed, business models stop charging for motion and start earning on momentum.

Signing out,

Sumanth Neppalli

Disclaimer: DCo and/or its team members may have exposure to assets discussed in the article. No part of the article is either financial or legal advice.

This was a fantastic read 👏🏾

I learned alot here, well put together as always guys 🙌