Bitcoin Superconductor

How Chainflip is bringing BTC liquidity on-chain

Today's article is a sponsored deep dive into Chainflip. They build critical infrastructure to bring Bitcoin trading liquidity on-chain. The timing couldn't be more relevant, as BTC reaches new all-time highs and early signs of euphoria sweep through the crypto markets.

As the world turns its attention back to crypto, founders who've spent the bear market building something cool now have a unique window to capitalise on this momentum.

Onto Chainflip.

Hello!

In a 760-word Reddit post from 2016, Vitalik Buterin shared a radical idea that would reshape how we think about trading financial assets—the "on-chain automated market maker." Instead of traditional order books, prices would be determined algorithmically based on the ratio of assets in a pool, enabling direct peer-to-contract trading without intermediaries. At the time, this idea seemed almost heretical to established financial wisdom.

To understand why, we need to look at the role of exchanges. They lie at the core of financial markets, acting as the matchmakers between buyers and sellers. By aggregating trading activity to one venue, exchanges solve complex coordination problems and charge a fee for every trade they facilitate. From the first exchange in Amsterdam in 1602 to today's giants like the New York Stock Exchange, centralised entities have maintained an iron grip on market trading. They decide which assets get listed, who gets to trade, and when trading can occur.

The implementation of Vitalik's idea—first by Bancor and later popularised by Uniswap—represented a fundamental break from this centuries-old model. For the first time, we had a way to facilitate asset exchange without intermediaries. No exchange committee would decide what gets listed; anyone could create a trading pool for any token. No KYC requirements would dictate who could trade; anyone with a wallet could participate. No trading hours would restrict when trading could occur; markets would remain open 24/7/365. Finally, anyone could provide liquidity to these pools and earn fees, a role traditionally reserved for sophisticated financial institutions.

What follows is one of crypto's greatest ironies: blockchains enabled the creation of automated market makers—a development that eliminates the need for traditional exchanges. Yet most trading of blockchain assets still occurs through the very intermediaries this innovation was meant to replace. Binance, the leading centralised crypto exchange (CEX), processes three times more daily volume than the top five decentralised exchanges (DEXs) combined.

This paradox becomes even more striking when we consider Bitcoin. Despite bring close to almost $2 trillion in market cap and capturing roughly 50% share of all crypto trading volume, the vast majority (over 90%) of Bitcoin trading still flows through CEXs. While we can seamlessly swap thousands of tokens on Ethereum or trade millions of memecoins on Solana using AMMs, liquidity for native Bitcoin—representing the largest pool in crypto —remains trapped in the very exchanges blockchains were meant to disrupt.

Today's article is a sponsored deep dive into Chainflip, a cross-chain liquidity protocol that aims to solve this paradox and capture crypto's ultimate prize—bringing Bitcoin liquidity on-chain. The article is divided into two parts. First, we'll examine how we arrived at the current paradox: why do centralised exchanges still dominate Bitcoin trading, and what problems does this create? Then, we'll explore Chainflip's solution—which combines novel market-making mechanisms with cutting-edge cryptography to potentially solve this gaping hole in the crypto market.

Let's dive in.

How we got here

At first, Bitcoin was the only cryptocurrency. To buy Bitcoin, you had two options: either mine it yourself or arrange a trade with someone willing to sell it for fiat (or, in rare cases, a couple of pizzas!). To find such a counterparty, you would need to scour forums like BitcoinTalk or attend in-person meetups. Since BTC lacked a universally agreed-upon price, buyers and sellers would have to negotiate directly. The risk of getting scammed was also high.

As Bitcoin gained popularity (among both ideologists and speculators), the need for an exchange to consolidate informal BTC trading emerged. The Bitcoin protocol itself wasn’t designed to support an exchange. The only viable solution was to create a centralised exchange that connected buyers and sellers by allowing deposits and withdrawals of both BTC and fiat.

The first Bitcoin exchange, BitcoinMarket, launched in March 2010. It was quickly eclipsed by the infamous Mt. Gox exchange, which became the preferred CEX for traders due to its user-friendly interface and support for multiple fiat currencies. As demand grew and BTC started gaining prominence, market makers entered the fray, and exchanges became the avenue for price discovery.

In the following years, the industry expanded with the emergence of new blockchains like Ripple, Litecoin, and Ethereum. Exchanges began supporting the trading of these assets against fiat as well. However, in integrating multiple blockchains, exchanges also took on the role of transferring value between different blockchains. If you held BTC natively on the Bitcoin blockchain and wanted to buy ETH to try a new Ethereum application, the only way to do so was through an exchange supporting both assets.

Thus, for the first few years, there was no alternative but to use a centralised exchange for both trading and transferring value between.

The arrival of Uniswap in 2018 marked a turning point. By implementing Vitalik's AMM concept with elegant simplicity, Uniswap made decentralised trading accessible to anyone with an Ethereum wallet. Users could swap tokens directly from their wallets, without depositing assets to an exchange or completing KYC. Liquidity providers could earn fees by depositing assets into pools, replacing the role of traditional market makers.

The model proved wildly successful. Uniswap has facilitated over $1.5 trillion in trading volume while spawning dozens of competitors across multiple chains. Each blockchain ecosystem now has its own thriving DEX landscape—Uniswap and Curve on Ethereum, Raydium and Orca on Solana, PancakeSwap on BNB Chain.

This siloed success also had a fundamental limitation: AMMs could only facilitate trades between tokens on the same blockchain. If you held ETH and wanted to buy SOL, you couldn't use Uniswap or any other DEX directly. The assets lived on completely separate chains with no native way to communicate.

This gap led to the emergence of bridges—protocols designed to transfer assets between blockchains. Just as DEXs reduced the reliance on centralised exchanges for asset trading, bridges aimed to do so for cross-chain value transfer. These “money routers” have processed over $20 billion in volume since 2022.

CEXs still rule

Despite the substantial build-out of DEX and bridge infrastructure and the creation of a budding DeFi ecosystem, CEXs still dominate trading volumes by some margin. And while we don’t have precise figures for how much value is transferred between blockchains by users using CEXs as a bridge, it’s safe to assume the volume comfortably surpasses that of on-chain bridges.

Why is this still the case? It boils down to a few reasons.

Range of assets and BTC support. First is the range of supported assets. Today, an exchange like Binance supports nearly all blockchains, including Bitcoin, Ethereum, Solana, Tron, Ton, Avalanche, Binance Smart Chain, Near, and major L2s like Arbitrum, Optimism, Polygon, and Base. They allow both trading of these assets and moving funds across these chains. No decentralised solution comes close to matching this breadth. From a user's perspective, rather than spending time searching for a safe and reliable bridge to move funds from Ethereum to Tron, it's much easier to use a CEX (a problem I've personally encountered).

But the real advantage of CEXs becomes apparent when we look at Bitcoin. While dozens of DEXs compete for Ethereum and Solana trading volume, barely any support native trading of the largest cryptocurrency, Bitcoin. DeFi's Bitcoin "support" comes largely through synthetic versions like WBTC (Wrapped Bitcoin) and tBTC. More recently, major centralised exchanges have recognized the importance of bringing Bitcoin on-chain, launching their own wrapped versions like cbBTC (Coinbase BTC) and kBTC (Kraken BTC). However, these wrapped versions collectively represent less than 2% of Bitcoin's total supply despite existing for years. Most users prefer to hold BTC either on exchanges or natively on the Bitcoin protocol.

The reason for this gap isn't just lack of effort. The Bitcoin protocol is fundamentally different from chains like Ethereum and Solana. It's rigid and restrictive when it comes to building non-payment applications. Unlike newer blockchains that are Turing-complete (meaning they can run any computer program), Bitcoin deliberately limits what can be built on top of it. This makes implementing DEX functionality or bridges directly on Bitcoin extremely challenging.

Liquidity and Price. The second factor behind CEX dominance is the age-old adage in finance—liquidity begets liquidity. Because centralised exchanges support native Bitcoin trading, they naturally capture the deepest pool of crypto liquidity. This Bitcoin support also attracts market makers, who use BTC pairs as the foundation of their trading strategies—hedging positions, managing inventory, and capturing arbitrage opportunities across venues.

What follows is a powerful reinforcing loop: market makers' activity ensures better pricing and deeper liquidity, which attracts more users, which in turn brings more trading volume, making the venue even more attractive for market makers. The effect is visible in the numbers: Binance consistently offers better depth (higher liquidity, lower prices) than Uniswap even for the latter's biggest pairs like USDC-ETH. Since most DEXs can't support native Bitcoin trading, they remain locked out of this cycle.

To compete with centralised exchanges, a protocol needs to solve these two fundamental challenges: support a wide range of chains (especially Bitcoin) and give users CEX-like pricing.

Enter, Chainflip

Simon Harman was first drawn to the crypto space as a high school student, purchasing Bitcoin before he even graduated. When Ethereum launched, he began margin trading ETH on the centralised exchange Poloniex at just 18. By age 21, he became a crypto entrepreneur, launching the privacy-focused project Oxen, followed by developing the secure messaging app, Session. (Both are running to this day.)

In 2020, Harman founded Chainflip, recognizing the need for an improved cross-chain trading solution. Though initially inspired by Thorchain's early developments, Harman and his team pursued Chainflip as an independent project with a unique approach. Their first research paper predated DeFi Summer, the period that popularised AMMs. After three years of development, Chainflip finally launched its mainnet earlier this year.

To understand Chainflip’s approach, we'll explore an example Simon calls the "holy grail of the crypto space"—swapping USDC on Ethereum for native BTC on the Bitcoin blockchain in a fully decentralised manner. We’ll start by understanding a novel auction mechanism that lies at Chainflip’s core— the JIT AMM (Just-In-Time Automated Market Maker).

To understand how JIT AMM works, we'll take a quick look at how AMM design has evolved. Consider a USDC-USDT pool, where most trading happens around $1.00. In Uniswap V2, if a liquidity provider (LP) deposits $100,000, that capital is spread across all possible price points—from $0.01 to $100 and beyond. This means most of their capital sits idle, as trades rarely occur far from the $1.00 price point. It's like having parking spots scattered across an entire city when all the cars only park downtown.

Uniswap V3 solved this with "concentrated liquidity," allowing LPs to focus their capital within specific price ranges. That same $100,000 could be concentrated just between $0.99-$1.01, providing much deeper liquidity where most trading actually occurs. It’s like having a mobile parking tower that constantly relocates to different hotspots in a city based on demand throughout the day.

Uniswap V3 shifted the role of LPs from passive liquidity providers to something closer to traditional market makers, actively adjusting their positions based on market conditions. If the price moves outside their chosen range, LPs would stop earning fees until prices return.

Chainflip's JIT AMM extends the V3 design to the cross-chain space. When a user deposits 60,000 USDC on Ethereum to swap for BTC, there's an inevitable waiting period for security reasons—about 90 seconds for Ethereum deposits and 30 minutes for Bitcoin deposits. This delay exists because blockchains can occasionally experience 'reorgs,' where blocks are discarded and transactions become invalid. Chainflip turns this waiting period into an advantage.

During this interval, the order becomes visible to LPs active on the Chainflip protocol. These LPs—often with access to liquidity and price information from other sources like centralised exchanges, OTC desks, and prop shops—compete to offer users the best possible price while maintaining profitability.

For example, LP Joel might have access to a prop shop where he can buy BTC for 30,020 USDC, while LP Saurabh can acquire BTC at 30,040 USDC from Binance. Once the user deposits USDC on Ethereum, Joel places liquidity at the 30,100 USDC range in Chainflip’s pools. Saurabh, seeking to secure the trade (and profits) for himself, undercuts Joel by placing liquidity at 30,060 USDC. In response, Joel shifts his liquidity to the 30,040 USDC range. At this point, Saurabh cannot profitably execute the trade, so he holds his position.

Joel ends up winning the trade (the liquidity he offered is consumed). Having sold $60,000 worth of BTC at $30,040, he can now purchase BTC from his prop shop at $30,020, pocketing the difference as profit without incurring much price risk.

To understand JIT-AMM better, consider this analogy: You’ve placed an order for a custom gaming PC on an e-commerce site, specifying the CPU, graphics card, RAM, and memory you need, with delivery set for exactly two weeks. Instead of fulfilling your order from its inventory, the platform broadcasts it to multiple suppliers. These suppliers source components through various channels—some have direct manufacturer relationships, while others may hold excess inventory they're eager to discard.

As the delivery date nears, suppliers adjust their bids based on component availability and price shifts. Finally, just before the two-week deadline, the website selects the supplier with the best offer, who ships the PC directly to you. You benefit from this open competition, securing your PC at the lowest possible price.

Another way to look at JIT AMM is from the emerging intent-solver lens. User orders in Chainflip effectively function like "intents"—expressions of what a user wants to achieve (swapping one asset for another) rather than specific instructions about how to achieve it (they’re not concerned with where the liquidity comes from). Meanwhile, LPs act much like "solvers" in intent-based systems, competing to fulfil these orders in the most capital-efficient way possible.

The State Chain

Chainflip's trading system is powered by the State Chain, an application-specific blockchain (appchain). Unlike general-purpose blockchains that allow developers to build various applications, the State Chain is designed with a singular purpose: facilitating cross-chain swaps. It utilises Polkadot's Substrate SDK but operates independently from the Polkadot network (similar to how Blast uses the OP stack but isn't part of the Superchain).

The network is secured by 150 validators who stake the FLIP token as collateral, competing for positions through auctions held every three days (the minimum bid currently stands at around $235k). This group, known as the Authority Set, performs multiple critical functions. Beyond securing the chain and participating in consensus, validators act as oracles by continuously monitoring a predefined list of smart contracts and wallet addresses on external chains for incoming deposits.

When a deposit is detected, validators wait for the safety margin to elapse before submitting "witness extrinsics" to the State Chain. Only when 100+ validators confirm seeing the same deposit is it considered final, ensuring that even if some validators are compromised, the network remains secure as long as a supermajority stays honest.

The State Chain never directly holds user assets. Instead, it maintains a virtual ledger of balances, similar to how a traditional bank's database tracks customer deposits without physically storing cash in its servers (this is also how CEXs operate). When users and LPs deposit assets—whether it's USDC, BTC, or ETH—these funds are held in special vaults on their respective chains, while the State Chain records virtual balances in their accounts.

For example, when Joel deposits 2 BTC to provide liquidity, the BTC is secured in Chainflip's Bitcoin vault, while the State Chain credits his account with 2 BTC. When he places orders in the JIT AMM, his BTC is not actually moving around. Instead, his position is being adjusted based on these virtual balances. When his liquidity is consumed in our earlier example—selling $60,000 worth of BTC at $30,040—the State Chain simply updates the virtual balances: Joel's BTC balance decreases and his USDC balance increases. The actual BTC (or USDC) is only moved when either the user or Joel wants to withdraw funds from the system.

These vaults are essentially giant multi-signature wallets that require approval from a supermajority of validators to move funds. When a transaction needs to be executed on an external chain (like sending BTC to a user after a successful swap), 100 out of 150 validators must sign off.

Coordinating these many signatures across different blockchains is a significant technical challenge. Chainflip solves this using FROST (Flexible Round-Optimised Schnorr Threshold) signatures, cutting-edge cryptography that enables multisig transactions at a rate of one per second without requiring excessive computing power. Every three days, when a new set of validators is selected, the vaults' keys are updated through a modified version of the FROST key generation process, allowing the new validators to take control without requiring the previous set to stay online indefinitely.

To summarise, here is how a USDC to BTC swap unfolds from deposit to settlement:

The user deposits 60,000 USDC to Chainflip's Ethereum vault

During the 90-second safety margin (7 blocks on Ethereum):

The deposit becomes visible to LPs

LPs like Joel and Saurabh compete by adjusting their positions in the JIT AMM

Joel eventually wins by offering the best price at $30,040 per BTC

After 90 seconds:

100+ validators confirm seeing the same USDC deposit ("witness extrinsics")

The State Chain records the user's USDC deposit as a virtual balance

The trade executes against Joel's liquidity

The State Chain updates virtual balances:

User's USDC balance decreases, BTC balance increases

Joel's BTC balance decreases, USDC balance increases

Finally:

100+ validators sign a Bitcoin transaction

BTC is sent from Chainflip's Bitcoin vault to the user's destination address

Where things are at

Chainflip currently supports swaps across Bitcoin, Ethereum, Arbitrum, Polkadot, and its latest integration, Solana. All asset pairs are denominated in USDC (e.g., BTC-USDC, ETH-USDC). By using a common pair, the protocol reduces liquidity fragmentation, which ultimately results in lower slippage for users. The largest trading pairs on most exchanges, whether CEXs or DEXs, are USD-based. This makes it easier for LPs to offer competitive prices and efficiently hedge their trades. So, if a user wants to swap ETH for BTC, the protocol splits the transaction into two separate trades—ETH-USDC and USDC-BTC.

Chainflip also batches all transactions of the same asset in a single source block into one order. For example, if a particular Ethereum block has two USDC to BTC transactions—one for 60,000 USDC and the other for 40,000 USDC, Chainflip clubs this into one 100,000 USDC to BTC swap order. This approach prevents front-running and ensures uniform pricing for all users within the same block.

The protocol generates revenue by charging a 0.1% fee on swaps. This fee, collected in USDC (as all trades involve USDC), is used to automatically purchase and burn FLIP tokens. The token accrues value based on the protocol’s trading volume.

Chainflip has processed $610 million in volume since its launch, generating roughly $390,000 in fees. The bulk of this volume comes from BTC-USDC swaps, which align with the protocol's primary value proposition. The platform has experienced steady growth in trading volume, recently achieving its highest daily volume of over $18 million on October 15.

Daily volume is the key metric the team aims to optimise, with a target of $100 million in daily trades. Simon outlined the roadmap for achieving this goal in a recent blog post, while the team continues to deploy features to enhance the protocol and reach this milestone.

The first major challenge is long wait times for transaction confirmations, particularly on slower networks like Bitcoin. These delays can impact user experience and create frustration, especially when users are looking to execute time-sensitive trades. For example, Bitcoin transactions require up to 30 minutes or more to reach the necessary confirmation threshold, leaving users in a prolonged state of uncertainty about their swap status. This extended timeframe is also problematic for liquidity providers (LPs), who must bear higher price risk during these waiting periods.

To tackle this issue, Chainflip has introduced the Boost feature. Boost enables pre-witnessing of deposits after just one block confirmation, dramatically reducing user wait times. This is achieved by utilising collateral from LPs in shared Boost pools to execute swaps early—before the full confirmation process concludes. Users pay an additional fee for boosted trades, while LPs earn extra rewards for assuming the reorg risk.

You can see Boost in action in this transaction, where a user swapped $98.66 of native BTC to $98.14 of SOL in just 84 seconds.

The second challenge arises when swap sizes increase. While Chainflip can offer competitive prices for smaller swaps as LPs vie against each other using diverse liquidity sources, larger swaps (exceeding $50,000) force LPs to rely on common liquidity pools. This heightens their risk, as the required liquidity might become unavailable by the time the order is fulfilled, eventually resulting in higher prices for users. Moreover, if a swap's size surpasses the combined liquidity of multiple LPs, it could lead to price collusion among LPs, as they all benefit from inflated prices.

To address these issues, Chainflip has implemented a Dollar-Cost-Average (DCA) system for swaps. Large swaps are automatically divided into smaller segments, executed as separate orders over time. This reduces the impact of short-term price fluctuations and helps overcome the liquidity limitations often associated with large single-execution swaps. The trade-off here is between time and price: DCA orders offer improved pricing but take longer to execute (up to 30 minutes for BTC swaps).

For instance, this transaction, where a user swapped over $200,000 worth of BTC for USDC, took 18 minutes to complete with a less than 0.2% price slippage.

Closing the Gap with CEXs

Earlier, we identified two key advantages that keep users coming back to centralised exchanges: support for a wide range of assets (especially Bitcoin) and competitive pricing. Chainflip addresses both.

On asset coverage, Chainflip has systematically expanded its network support to include Bitcoin, Ethereum, Arbitrum, Polkadot, and most recently, Solana - a strategic selection targeting the most liquid and widely-used networks in crypto. Arbitrum was chosen as a cheap gateway to the EVM ecosystem, offering mature bridging and swap options between L2s while helping aggregators and integrators better access Chainflip's stack through its established ecosystem. Solana was added as it has become the go-to chain for retail trading over the past year.

The protocol's FROST-based vault system is highly extensible. Unlike bridges that require complex smart contracts on both sides of a transfer, Chainflip's architecture can integrate any blockchain that supports either Schnorr signatures natively (like Bitcoin) or verify them through smart contracts (like EVM or SVM chains). This positions the protocol to continue expanding its chain support based on market demand.

On pricing, Chainflip's JIT AMM can theoretically beat CEX rates. This is possible because Chainflip's liquidity providers can be professional market makers who actively source liquidity across multiple venues. When a user places a trade, these market makers compete to offer the best price, effectively aggregating liquidity from major centralised exchanges (Binance, Coinbase, etc.), OTC desks, Prop trading firms, and other DEXs.

By pooling liquidity from all these sources through competing market makers, Chainflip can often provide better pricing than any single venue. Features like DCA further improve pricing for users.

Outcompeting CEXs

The risks of relying on centralised exchanges are well-documented, from custody risks ("not your keys, not your crypto") to KYC restrictions, potential censorship, and vulnerability to hacks. Because Chainflip is fully decentralised, with software open-sourced and funds secured by 150 independent validators rather than a single entity, each of these risks is eliminated.

Truth be told, very few people choose protocols based on decentralization alone. For a protocol like Chainflip, simply being decentralised or matching existing exchange features isn't enough—it needs to offer compelling advantages that make users want to switch. And there are two important, yet less obvious problems that CEX dominance creates—problems that Chainflip is positioned to solve.

Building for Composability

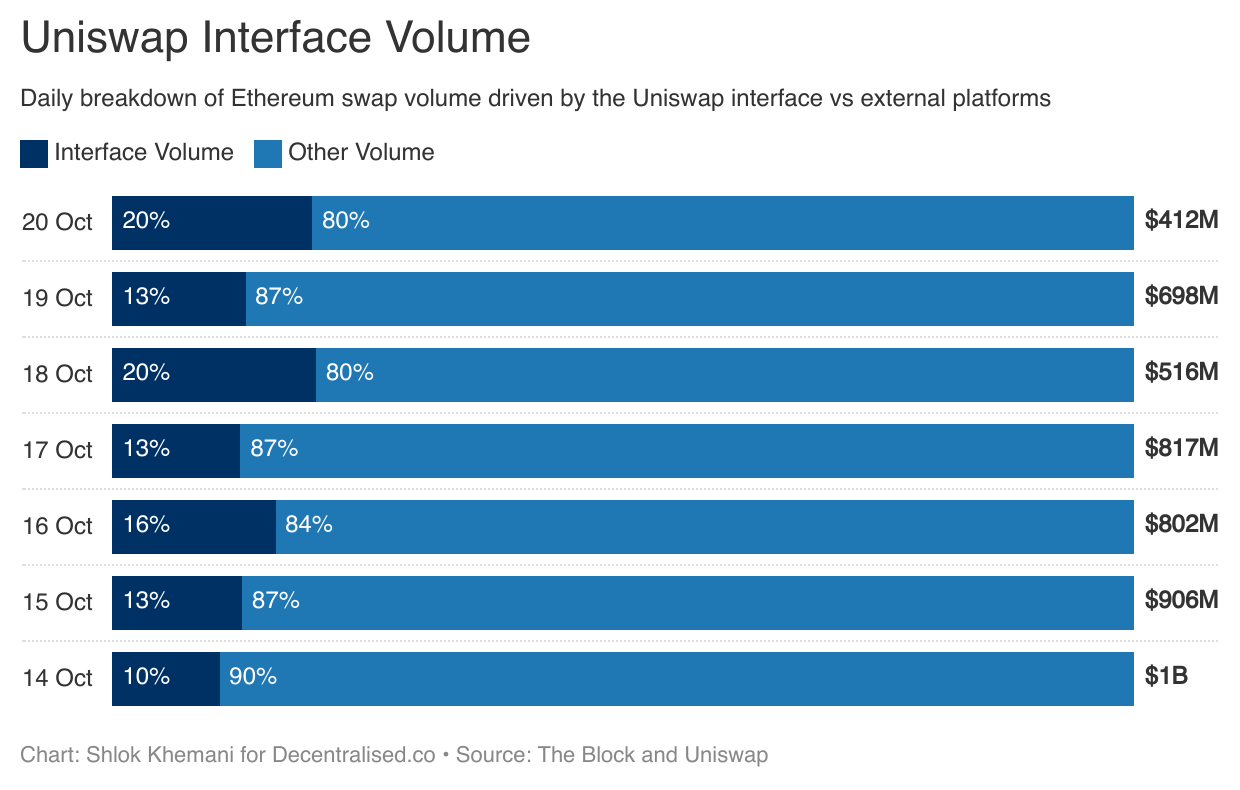

The first is the lack of composability. Most people think of Uniswap as a website where users swap tokens. Yet the front-end interface accounts for less than 20% of all Uniswap volume. The majority comes from other applications directly calling Uniswap's smart contracts. Lending protocols use it for liquidations, yield aggregators for rebalancing, and wallets for token swaps—all happening in the background. This is the power of smart contract composability: applications can build on top of each other, enabling more sophisticated products and increased capital efficiency.

CEXs, despite controlling the majority of crypto's liquidity, exist entirely outside this composable ecosystem. Their funds and functionality can't be accessed programmatically by other applications. The largest pool of crypto liquidity being locked away in a black box is a clear market inefficiency.

Chainflip is designed to be a primitive for cross-chain value transfer that other applications can build on top of. Integrations are their primary growth strategy, with several key features in the protocol to enable this:

Cross-Chain Messaging (CCM): This feature allows developers to not just swap assets but also pass arbitrary messages and trigger smart contract calls on destination chains. For example, an application could allow users to add liquidity to a Uniswap pool on Ethereum using native Bitcoin—all in a single transaction. CCM opens up possibilities for complex cross-chain operations that were previously impossible.

Broker System: Any application integrating Chainflip can become a broker, earning fees on the swaps they facilitate. Brokers can charge between 0-1000 basis points on trades, creating a direct revenue stream from integration. This aligns incentives between Chainflip and its integration partners—as their volume grows, so do their earnings.

Affiliate Programs: Recently introduced "affiliate brokers" enable automatic splitting of fees between main brokers and their sub-integrators. This creates a flexible framework for partnership networks. For instance, a cross-chain infrastructure provider could split fees with multiple front-end applications building on their integration.

Despite this push, the Chainflip interface, at least so far, still drives most of the protocol's activity (~70% since launch). This gap is partially explained by the current state of integrations: many integrators have not yet fully implemented Chainflip's newest features like Boost and DCA, which make the protocol truly competitive. As a result, users accessing Chainflip through aggregators often aren't offered Chainflip routes since, without these features enabled, it may not appear as the most cost-effective option.

Major players in the cross-chain space like THORSwap, Squid, Rango and THORWallet have integrated Chainflip, with more partnerships in the pipeline. Exchanges are fundamentally a network effects business, and Chainflip is currently in the most critical phase—bootstrapping the network.

A New User Experience

The second key advantage of Chainflip becomes clear when we chart out the user experience of a cross-chain value transfer. Consider what it takes to move funds from Bitcoin to Solana using a CEX:

What should be a single fluid movement of value becomes a cumbersome multi-step process that can take up to an hour with a CEX. Wasn’t crypto's promise seamless value transfer?

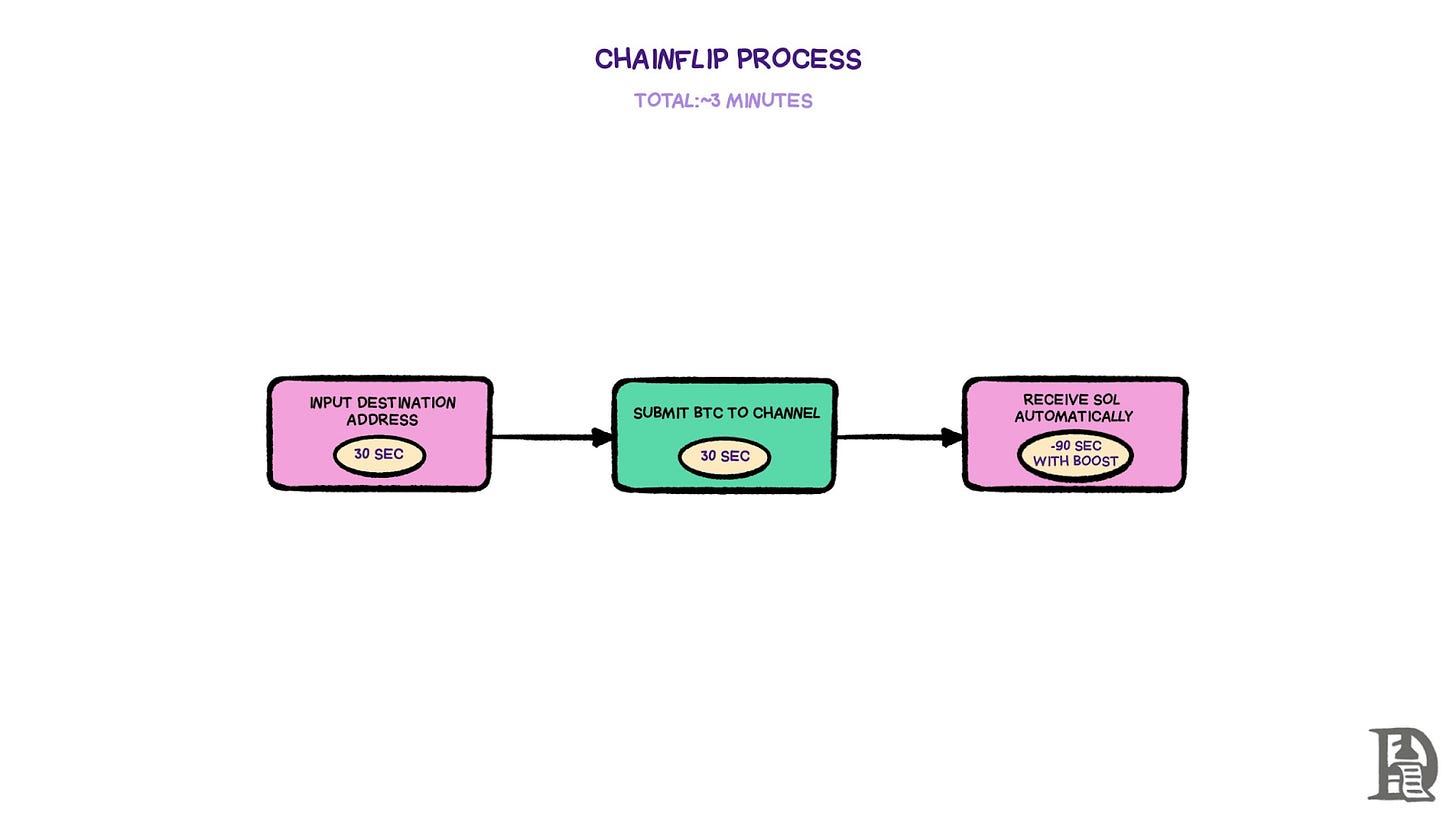

Chainflip radically simplifies this process. Users simply:

Input their destination address

Send funds to a deposit channel

Automatically receive their swapped assets

The key UX improvement here is Chainflip's "fire-and-forget" design. Once users send their funds, they don't need to take any further action—no monitoring confirmation screens, no executing additional transactions, no waiting for withdrawal approvals. The protocol handles everything automatically in the background.

Also notice that in the whole swap process, the user doesn’t need to connect their wallet to the protocol. Once they’re given a deposit address, they can send funds to that address from any source, including centralised exchanges!

With the introduction of Boost, Chainflip isn't just simpler than CEXs, but faster too. Traditional exchanges require multiple confirmations before crediting Bitcoin deposits, typically waiting for 3-6 blocks (30-60 minutes). Even after these confirmations, users still face delays in trading and withdrawal processing.

Boost allows trades to complete after just one block confirmation by utilising LP-provided collateral. This reduces the total process from nearly an hour to around 90 seconds for Bitcoin transfers.

The Competition

Chainflip is not the first mover in the Bitcoin cross-chain swap category. Thorchain is the current market leader, operating since 2018, and as we discussed earlier, an inspiration in Simon starting Chainflip. There are a few key differences (and similarities) in the approach of the two protocols.

While Thorchain is a direct competitor, Chainflip’s indirect competition comes from other bridges (like those between Ethereum and Solana) and various DEX and bridge aggregators.

The BTC Superconductor

When Stripe acquired stablecoin startup Bridge last month, Patrick Collison called stablecoins "room-temperature superconductors for financial services." This analogy is profound because stablecoins make the movement of value exponentially more seamless than its incumbents. One of Stripe's key motivations for acquiring Bridge was its non-opinionated, low-level APIs that allowed developers to build any stablecoin application they envisioned—basic infrastructure for an inevitable future.

Bitcoin liquidity today mirrors where the US dollar stood before stablecoins set it free. Despite being our industry's largest asset, its movement remains tightly controlled by incumbents and intermediaries. For Bitcoin to have any chance of becoming the de-facto reserve currency, it needs far better infrastructure to move in and out of other assets. Consider this: as we move toward a future of programmatic value transfer where most transactions will be AI-driven, will agents use an asset that requires KYC verification with an exchange? It's unlikely.

Protocols like Chainflip should be viewed as a hybrid of Bridge and Uniswap for the Bitcoin ecosystem. It creates a pathway for anyone—human or machine—to permissionlessly move value in and out of Bitcoin at competitive rates. It then provides developers with low-level APIs to leverage this primitive and build whatever applications they envision. Once again, it is basic infrastructure for an inevitable future.

A BTC superconductor, if you will.

Reading Crypto Confidential,

If you liked reading this, check these out next:

- Ep 24 - While Others Chased JPEGs, We Made Bitcoin Move