Enter The Sanctum

Everybody gets a stake.

Hey there!

TL;DR: Liquid staking is one of the core security and DeFi primitives of any proof-of-stake blockchain. In this piece, we contrast the liquid staking landscapes on Ethereum with that of Solana. One has a strong ecosystem, while the other is at a more nascent stage and evolving differently.

We explain the differences in the approach taken by both. Finally, we break down Sanctum, a novel protocol on Solana that is rethinking liquid staking from the ground up.

Transactional networks require a high degree of security to be trusted. If anybody could alter SWIFT wire instructions or Visa transactions, people would lose trust in these systems. The same applies to blockchains, too. Security determines how users embrace them. For instance, Bitcoin’s blockchain has the highest hash rate behind it.

So, there’s a baseline of understanding that malicious actors cannot manipulate transactions once they are recorded on the network. But it costs a lot of money to transact on Bitcoin.

In recent years, lower-cost networks such as Solana and Ethereum have transitioned to the proof-of-stake (PoS) consensus mechanisms. Unlike Bitcoin, which relies on computing power, these networks use staked capital to measure economic security.

Before we dig into how all of this works, here’s a quick refresher on some of the jargon you may see throughout this piece.

Validators: users who secure a PoS chain.

Stake: validators earn the right to create blocks, process transactions, and secure the network by locking up a certain amount of the blockchain’s native currency as collateral. This collateral is called their “stake.” Some networks (like Ethereum) impose a minimum stake, while others (like Solana) don’t.

Leader: the network chooses a validator, known as the leader, to create the next block. The probability of being chosen to be a leader is proportional to the size of their stake and other network-specific factors. Once the leader creates a block, other validators in the network verify the validity of its transactions.

If the network accepts the block, the leader receives a block reward issued by the network and transaction fees paid by users.

Slashing: if other validators consider the block invalid, the leader may lose a portion of their stake as a penalty in a process called slashing. Validators often have huge economic exposure to the networks they are helping secure. So they have little incentive to pass on faulty data to the network. If they do, they’d stand to lose tokens through slashing.

When a PoS blockchain is functioning as intended, the rewards earned by honest validators accumulate to form a steady yield on the staked tokens, usually expressed as an annual percentage yield (APY). On Ethereum, for example, this yield typically ranges between 2-4%.

These returns from staking serve three functions. First, they secure the network. Second, they incentivise long-term participation within the ecosystem. Third, they help make sure long-term participants are not diluted by inflation.

If you think of networks as cities, staking is kind of like building a house within that city. It keeps you there for the long run, and appreciates in value over time.

The Delegation Dilemma

Staking has its advantages, but they don’t come cheap. Much like building a house in the real world, people may not have the resources of time, energy, capital, and skill sets to set up a validator node. Everybody wants yield, but expecting to run a validator for it may not be feasible. This is where delegated stake comes in.

The concept is straightforward: the user lends (delegates) their stake to a validator, who then passes on the earned rewards back to the user after deducting a percentage of the earnings as a fee.

While delegated staking solves one problem for the user, it creates a different one.

When a user holds the native token of a chain, it’s liquid. They can either sell it whenever they want to or deploy it to earn additional yield in DeFi protocols, such as lending and liquidity pools. However, once a token is natively staked, it becomes illiquid. Stakers have to wait for the bonding period — a cooldown period during which the token cannot be moved or traded — to elapse before being able to withdraw their stake.

On some PoS chains, this can be up to 21 days. They also forgo the opportunity to earn additional yield on their tokens while they are staked. I guess you can’t have your stake and eat (yield) it, too, in this game.

Liquid staking is a solution that allows users to stake their tokens through a protocol that mints liquid staking tokens (LSTs) representing the staked assets. These LSTs can be traded freely on exchanges and used in DeFi applications, providing liquidity to the user. When desired, users can redeem their LSTs for the native tokens with the staking protocol, which then burns the LSTs.

If too many users rush to exit their liquid staked assets by trading it on exchanges, it can lead to a depeg. Last year, Lido’s token famously had a situation where the price of their liquid staked token was below what it could be redeemed for — a bank-run of sorts.

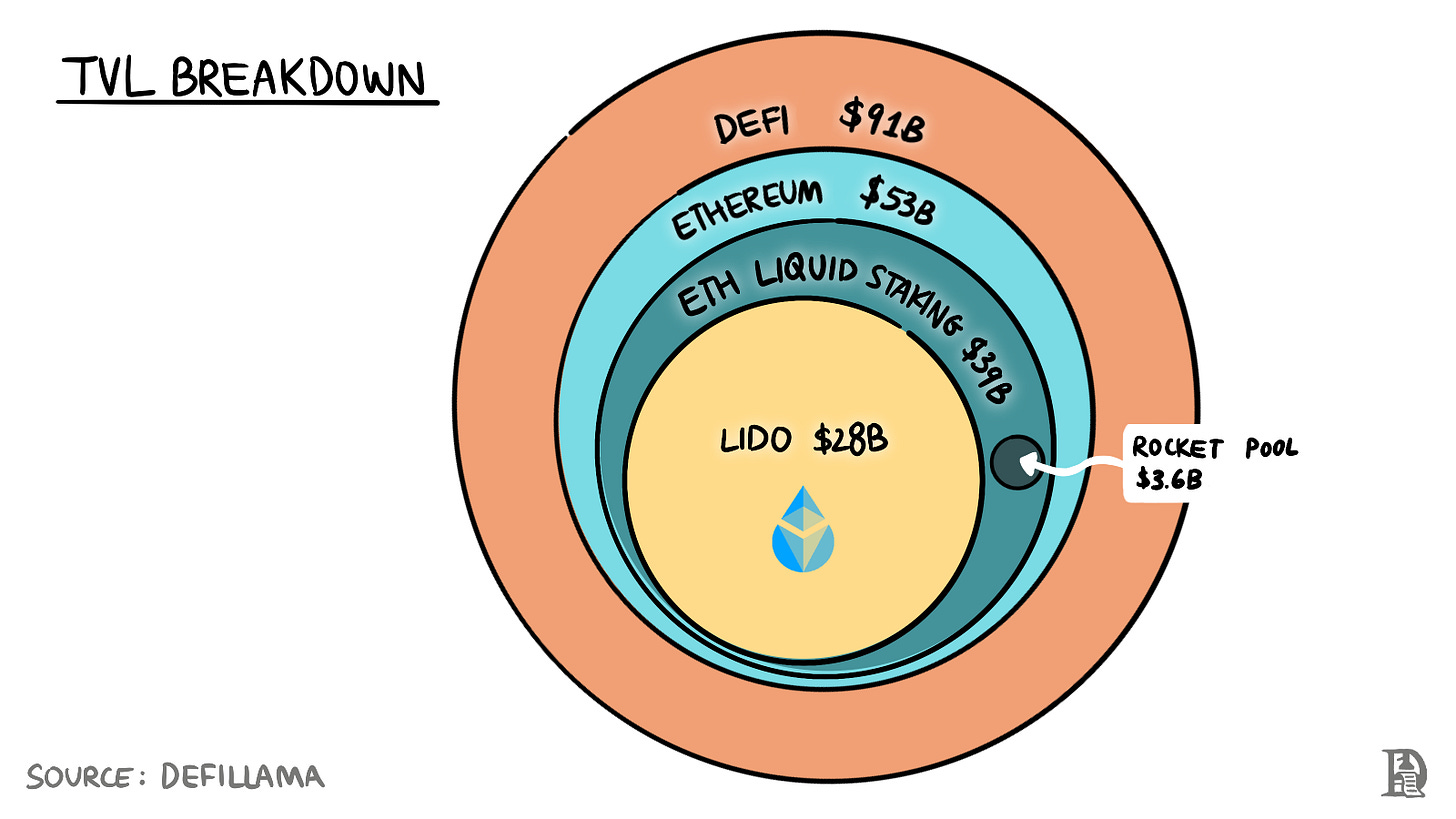

Staking plays a central role in securing PoS blockchain, and liquid staking, due to its fundamental utility of unlocking otherwise illiquid capital, has become one of the most important sectors in crypto.

The total value locked (TVL) in liquid staking protocols across chains accounts for more than 50% of the TVL across all DeFi protocols. Within that ecosystem, Lido accounts for some $28 billion in staked assets. But what does Lido do?

Becoming a validator on Ethereum requires a minimum stake of 32ETH (~100,000 USD as of May 7, 2024), technical knowledge, and comes with the risk of slashing. This makes solo-staking (running your own validator) an unattractive option for most users.

Ethereum does not support native delegation of stake. This means that you cannot directly stake your ETH with a validator but instead need an out-of-protocol service to facilitate the delegation for you. Those with the capital but lacking knowledge or intent can delegate node operations to a staking-as-a-service product like P2P or stakefish, which charges a monthly fee for their services.

Those without the required capital rely on a platform like Lido. Users can deposit ETH in Lido’s staking pool in exchange for the liquid staking token stETH. The pool of deposits is distributed equally among 39 trusted and vetted node operators. Lido charges a 10% fee on staking rewards, split equally between the node operators and the Lido DAO treasury.

Here are some numbers to help you grasp Lido’s scale:

27% of all ETH is staked. Out of the staked ETH, close to 30% is deposited in Lido.

Lido’s TVL of ~$28.7 billion is more than 7 times that of the second-biggest staking protocol (RocketPool at $3.71 billion) across all chains.

Lido accounts for more than half of Ethereum’s total TVL and close to one-third of the total DeFi TVL across all chains.

These numbers raise two questions.

First, how did Lido get so dominant?

Second, is this level of dominance healthy for a decentralised network like Ethereum?

The answer to the first question lies in the interplay between liquidity and distribution.

The biggest value proposition for LSTs is instant liquidity. Users should be able to sell the token whenever they want to, at the lowest slippage (best price) possible. Slippage is a function of the size of the liquidity pairs of the LST against other assets (ETH, stablecoins) on exchanges.

The larger these pairs, the lower the slippage and the wider the adoption of an LST.

Lido’s stETH has the highest liquidity among LSTs. One can buy or sell stETH worth over $7 million by incurring a less than 2% price impact (as seen by the ±2% depth numbers here) across multiple exchanges. For rETH, the second biggest LST, the same metric is less than $600,000.

High liquidity also helps with integrations into lending protocols. Users often give staked assets as collateral for loans. It serves two functions. Firstly, they receive yield on the underlying asset. Secondly, it gives them dollar liquidity for their staked assets. These dollars could then be used for trading or taking on leverage through buying more of the underlying asset (ETH or SOL) to stake and increase yield received.

But when the loan a user takes against an asset is liquidated, the protocol needs instant liquidity for the collateral to prevent the debt from going bad (becoming undercollateralized). If an LST has low liquidity, the likelihood of a lending protocol accepting it as collateral decreases. stETH is currently the single most supplied asset on Aave, the largest lending protocol on Ethereum.

The other half of the interplay is distribution. Users hold LSTs to either earn additional yield or take part in the broader DeFi landscape. Thus, the more protocols an LST can be used in, the more attractive it is to hold. Think of it like currencies around the world. The more accepted a region’s currency is, the more valuable it becomes.

Lido’s LST (stETH) is like the USD of staked assets. No LST in the Ethereum ecosystem is accepted as widely as Lido’s stETH.

One can use stETH in the Synthetix perpetual markets on Optimism, Venus money markets on BNB Chain, or Aave on Arbitrum. EtherFi, a staking protocol with ~4% of all staked ETH, accepts only ETH and stETH deposits. Similarly, even newer protocols like Morpheus, a peer-to-peer AI network, accept deposits only in stETH.

Liquidity and distribution feed into each other. The more liquid an LST is, the more attractive it becomes to users. The higher the number of users holding an LST, the greater the incentive for protocols to integrate it. This, in turn, leads to greater adoption, more users depositing into Lido, and even higher liquidity.

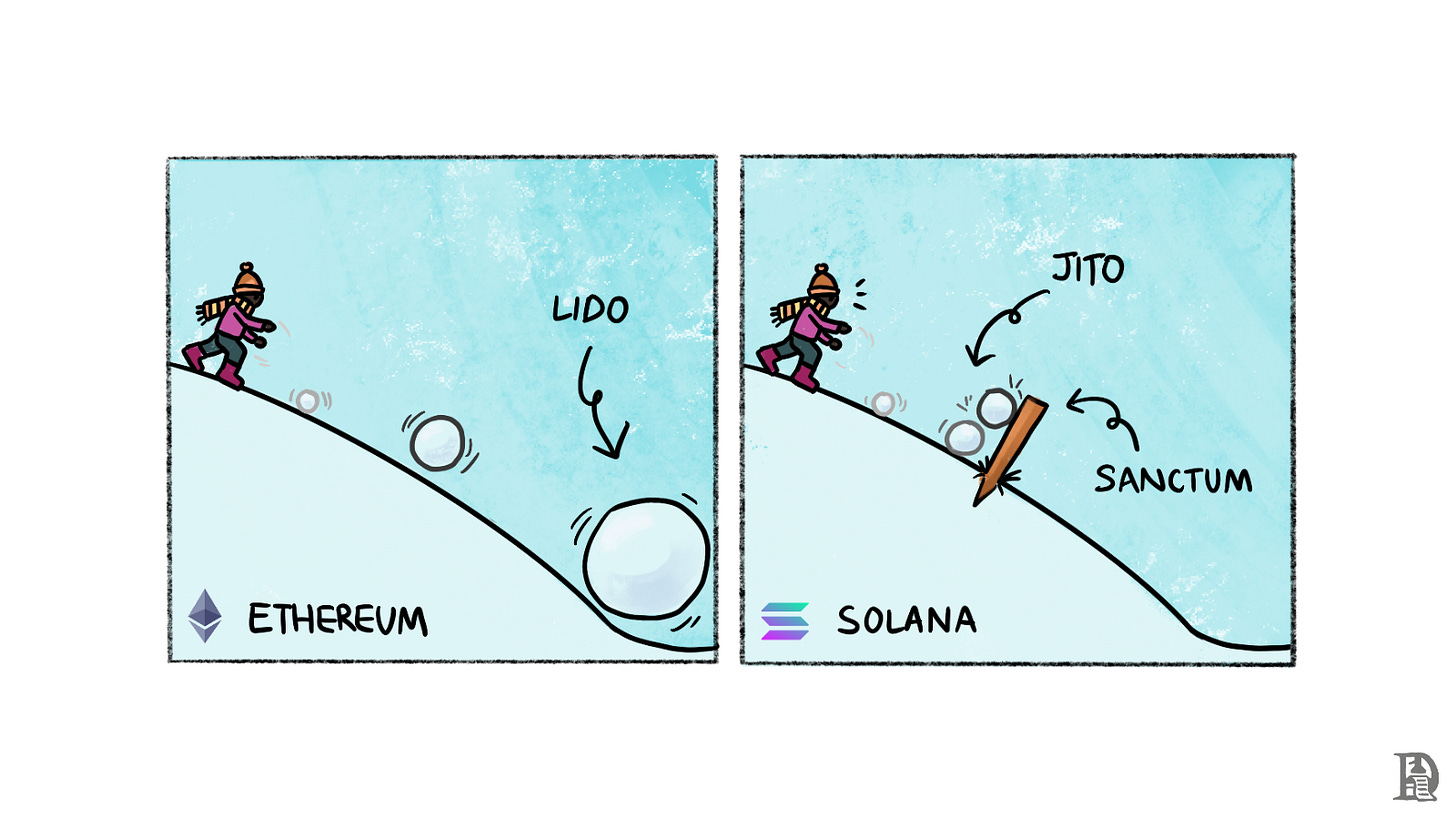

These compounding network effects lead to a centralising winner-takes-all market structure. Lido is a behemoth because it has captured this market on Ethereum, the chain with the most DeFi activity.

Lido’s network effects give it a massive moat. Breaking it down is not easy (just ask one of the hundreds of social network upstarts that tried to compete with Twitter or Instagram). New entrants need both deep pockets (to attract liquidity) and a unique value proposition if they want to take on the task of competing with the behemoth that is Lido.

But is Lido’s domination a threat to the decentralised nature of Ethereum? Some, like the author of this post, argue that it does. As the controller of ~30% of staked Ethereum, the Lido DAO potentially holds an outsized influence on the network.

Given that Lido currently has only 39 node operators, there is the risk of operators colluding for activities detrimental to the health of the network. They could theoretically engage in transaction censorship and cross-block MEV extraction. Should Lido continue to grow and capture 1/2 of all staked ETH, they could begin censoring entire blocks. At 2/3rd of staked ETH, they would be able to finalise all blocks.

Holders of LDO benefit from the 5% fee that the DAO retains from staking rewards. So, their incentive is to maximise the stake held by Lido and the fee generated by their operator set. Any decisions they make would be in service of this goal rather than for the benefit of the wider Ethereum ecosystem.

This presents a fundamental principle-agent problem. Lido is making changes to mitigate these risks.

First, they are working to increase the operator set, make it more geographically decentralised, and eventually make it permissionless for any validator to join.

Second, there is a proposal to bring dual governance to the protocol. Both stETH and Lido holders will have a say in the direction of the project.

However, despite these changes, Lido itself is trending towards becoming a monopoly on Ethereum staking. This carries the long-tailed risks we discussed.

So Long Solana

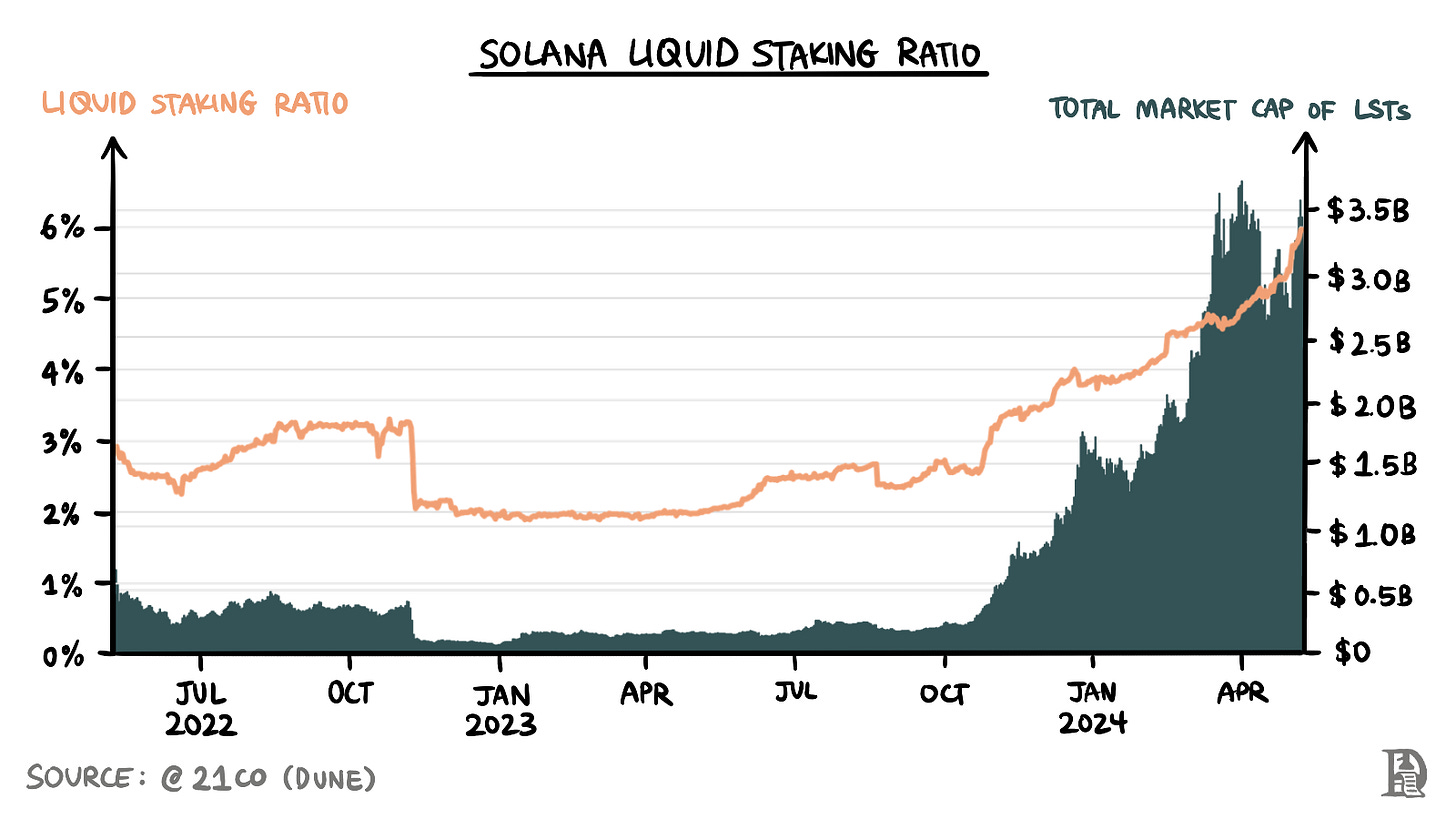

The staking and LST landscape on Solana differs significantly from that of Ethereum. Solana has a staking ratio (the percentage of circulating SOL staked) of over 70%, much higher than Ethereum’s 27%. Yet, LSTs make up only 6% of the staked supply (compared to over 40% on Ethereum).

It’s worth exploring the reasons behind this disparity.

First and most importantly, staking on Solana works very differently from Ethereum. Unlike Ethereum, Solana supports delegated proof of stake. This means that users can stake any amount of SOL, with no minimum requirements, directly with validators without using a third-party protocol. In fact, most wallets (including popular ones like Phantom and Backpack) allow staking directly through the wallet interface.

This makes it easy for users to natively stake their SOL. In contrast, because Ethereum lacks delegated staking, using a staking pool like Lido is the only feasible option for most stakers.

Second, slashing is not active yet on Solana. This means that validator selection is not as critical an issue on Solana, and one can stake with any validator that provides decent returns without incurring risk. On Ethereum, however, slashing is active, making validator selection an important function performed by staking pool solutions like Lido.

This also implies that the returns from a staking pool that allocates stake to multiple validators on Solana aren’t significantly different from directly staking with one of the top validators.Third, the Solana DeFi ecosystem just isn’t as mature as the one on Ethereum. This means that even if a user did stake their SOL for an LST, there are few protocols to utilise it. Why take the additional risk, such as a smart contract getting hacked, when there aren’t many opportunities to earn yield? Rather take the easy route and stake directly.

The first generation of Solana LSTs — mSOL by Marinade, stSOL by Lido, or bSOL by SolBlaze — emulated the strategies of liquid staking protocols on Ethereum. The problem was that the issues that Lido and its peers solved on Ethereum simply didn’t exist on Solana.

The best illustration of this is Lido leaving Solana in 2023 after a community vote. The primary reason was that the revenue generated didn’t justify the resources expended to maintain a presence on the chain (this was partly a function of Solana still being in its post-FTX slump). But I believe another equally important reason is that Lido and Solana were not a cultural match.

Going back to our discussion on why Lido dominates Ethereum, one reason was that stETH is integrated into all major DeFi protocols and projects in the ecosystem. This doesn’t happen automatically but requires years of groundwork and building trust and goodwill within an ecosystem. Industry participants within Web3 would refer to these as business development (BD) efforts.

These networks cannot be easily replicated in a new chain just because a protocol has succeeded in a competing one, especially given the tribal nature of crypto.

The assumption is often that technological standards are adopted purely on the basis of their efficiency. But underlying adoption is often human relationships. Few things make this as clear as Marinade’s dominance over Lido when it came to Solana staking.

In the initial months of Solana staking, there were two major players: Lido, a crypto unicorn backed by millions of dollars of venture capital, and Marinade - a bootstrapped project that emerged from a Solana hackathon. Yet, not once did Lido’s stSOL overtake Marinade’s mSOL in TVL.

This is partly because Marinade’s sole focus (and place of inception) was Solana. Lido, in comparison, was expanding from a network it had built by itself to a place of dominance.

More recently, with the resurgence of Solana, LSTs are making a comeback, led by a protocol we’ve written about before: Jito.

Jito is as Solana-native as a protocol can get. Their airdrop in 2023 woke Solana from its post-FTX slumber, creating wealth effects and a resurgence of activity on the chain. Backed by venture capital and the goodwill of the community, Jito is following Lido’s playbook, and looking to dominate LSTs on Solana (as pointed out in this great post by Tom Wan on Twitter).

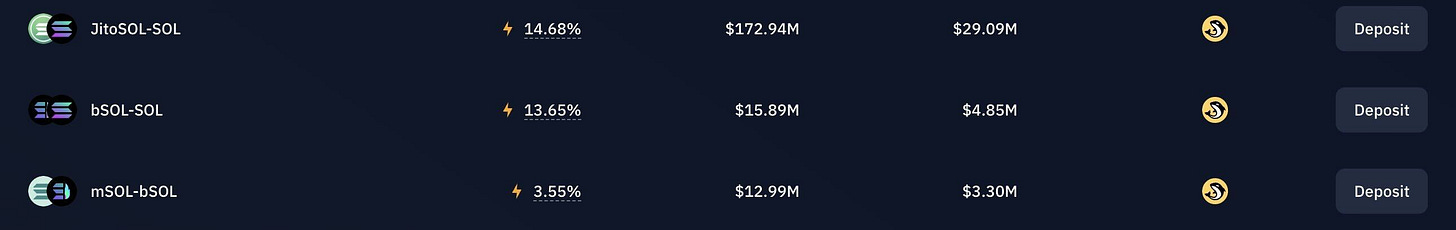

Jito began using its governance token, JTO, to incentivize liquidity for JitoSOL liquidity pairs on exchanges. They have the highest APY, TVL, and volume among all LSTs on Kamino liquidity vaults.

Second, Jito is partnering with other top protocols like Solend, Drift, Jupiter, and marginfi on Solana, deeply integrating JitoSOL into the ecosystem.

Third, it is going multichain by partnering with Wormhole to expand to Arbitrum, increasing the utility and attractiveness of JitoSOL.

With surging activity and liquidity now that Solana is back in the game, Jito timed the release and growth of JitoSOL perfectly. It has grown to become not only the most dominant LST on Solana but also the protocol with the single highest TVL on the chain.

By following Lido's playbook, early signs indicate that Jito could also be on course to replicate Lido's outcome — total dominance. If the current trajectory continues, it could be a highly favourable outcome for Jito. However, given the debates surrounding the healthiness of Lido's influence on Ethereum, would Jito being in a similar position, especially with them also owning the most popular MEV solution on the chain, be beneficial for Solana? Maybe not.

Jito’s ball is rolling, and given the nature of compounding of network effects, it can be very difficult to stop once it gets big enough. However, it is still relatively early, and there is a new force that has emerged that could potentially stop Solana from reaching the same LST end state as Ethereum.

Enter The Sanctum

Sanctum1 is fundamentally rethinking liquid staking with a mission to prevent Solana from going down Ethereum’s path of having a dominant staking protocol, and brings with it a vision of an ecosystem with infinite LSTs.

At the heart of their products lies a unique insight. Sanctum’s cofounder calls it an open “secret” — that LSTs are fungible. Let me explain what that means.

When you stake SOL with a validator, a stake account is created containing the SOL, which is then delegated to the validator. This way, the validator doesn’t have direct access to your SOL. It also means that staking is not instant. Stake accounts can only be activated at the beginning (and deactivated at the end) of epochs.

Each epoch in Solana lasts for approximately 2 days (you can read more about delegation timing here).

Similarly, when you deposit SOL into a staking pool like Jito, a stake account is created, and the stake is delegated to multiple validators as determined by the protocol2. In return, you get a liquid staking token. Another way to look at this is that the LST is a tokenized version of the stake account.

This means that each stake account, whether created when staking with a validator directly or when depositing SOL into a stake pool, has the same underlying content - locked SOL. This mechanism, unique to Solana, is what Sanctum uses to innovate in the liquid staking space.

The Reserve & Router

Normally, when a user wants to redeem an LST, they have two options.

1. They can either interact with the issuing protocol, deactivate their stake account, and wait for the cooldown period (2-4 days) to end for their SOL or,

2. They can trade it for SOL on a DEX with an LST-SOL pair for instant liquidity.

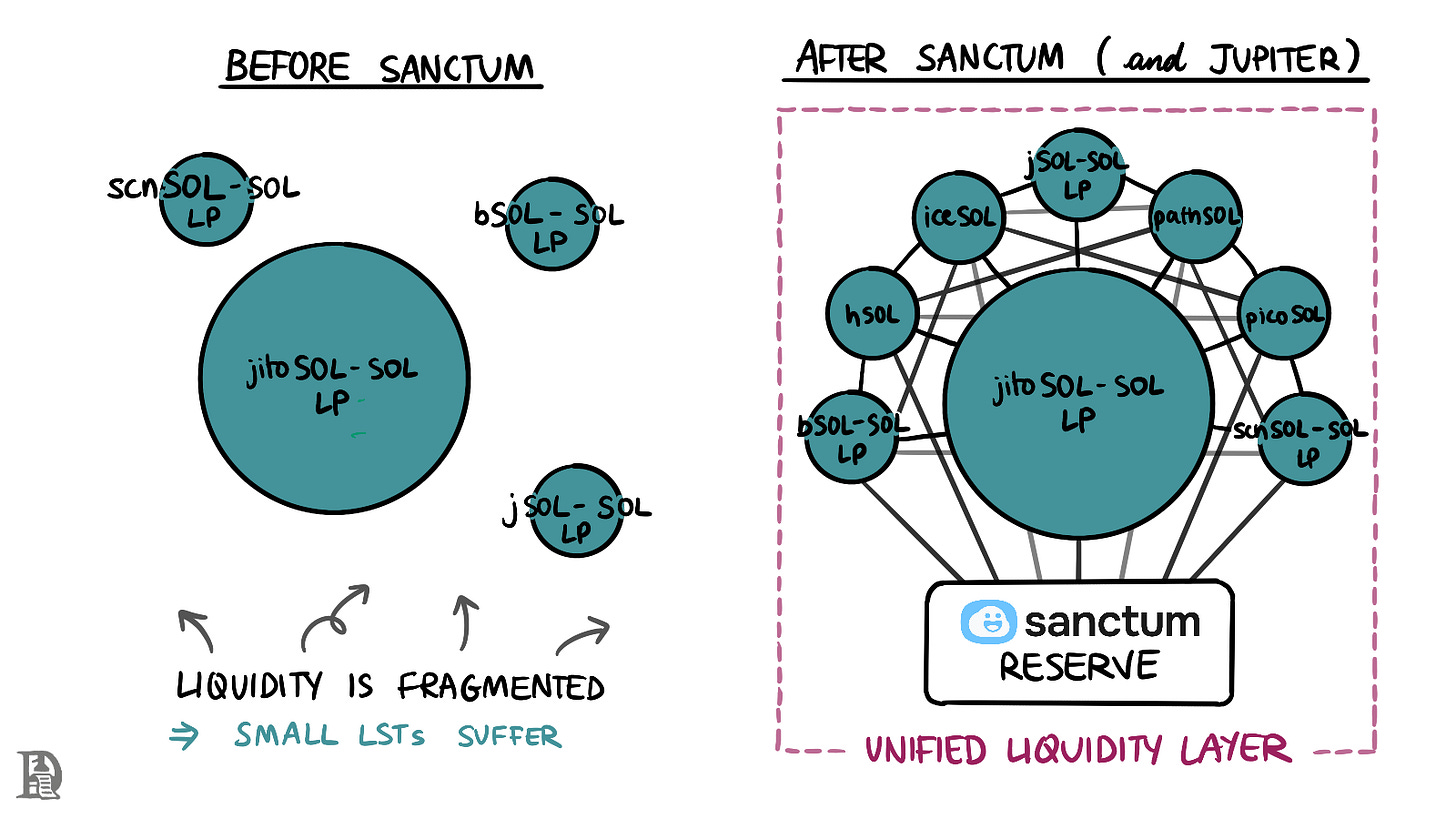

Since users are likely holding an LST for the benefit of instant liquidity in the first place, they would prefer the second option. This means that LSTs without liquidity will be inefficient to swap and unattractive to users. This benefits the big players and makes it difficult for an upstart to create an attractive LST. Liquidity begets liquidity.

The Sanctum Reserve changes this equation by providing a whole new method of redeeming LSTs. Recall that LSTs are nothing more than wrappers around stake accounts, which contain locked SOL. This means that an LST will always be redeemable for its value in SOL, just not immediately.

The Sanctum Reserve is a pool with over 200,000 SOL worth more than $30 million. When a user wishes to redeem an LST, they exchange their stake account with the Sanctum reserve for instant liquid SOL. Subsequently, Sanctum deactivates the stake account and receives the SOL it paid out whenever the cooldown period ends.

Thus, the Sanctum Reserve temporarily, for the duration of the cooldown period, faces a deficit in SOL, which is eventually recouped3 Sanctum charges a dynamic fee for the utilisation of the Reserve Pool, based on the percentage of SOL left in the pool. This ensures efficient usage of SOL in times of high liquidity demand.

The Sanctum Reserve is a significantly more capital-efficient way to liquidate LSTs compared to traditional liquidity pools. In traditional pools, the SOL in LST-SOL pairs is deposited by users who could otherwise be earning yield by staking it. Moreover, each LST requires its own liquidity pool, fragmenting liquidity across the ecosystem.

The Sanctum reserve, by providing a common pool to liquidate any LST, frees up SOL in exchange pairs to be staked while unifying liquidity across LSTs — all with minimal slippage. In simple terms, all forms of liquid staked tokens on Solana benefit from Sanctum’s reserve. But how do they get staking protocols to integrate them? This is where Router comes into play.

Sanctum’s second product is the Sanctum Router, which they built in collaboration with Jupiter. As you can guess by its name, it provides a mechanism to easily and efficiently swap between any two LSTs on Solana. This is what happens behind the scenes when a user wants to swap one LST, say JitoSOL, for another, say hSOL (issued by the Helius validator).

The stake account is withdrawn from JitoSOL into a new stake account

JitoSOL is burned

The new stake account is deposited into the Helius validator stake account

hSOL is minted

The minted hSOL is transferred to the user wallet

All of this happens in a single transaction and benefits from the insight that underlying different LSTs are interchangeable stake accounts. The Sanctum Router, combined with Jupiter’s routing system, ensures that any LST, irrespective of how liquid it is, can be swapped for any other LST.

Router and Reserve have cumulatively dispensed over 2.2 million SOL to date.

The existence of these two products has changed the game for smaller LSTs. They no longer have to rely on deep liquidity pools to attract users to purchase LSTs. Instead, their holders are guaranteed instant redemption and liquidity or frictionless swaps between any two LSTs with low slippage. This also makes LSTs more useful across the DeFi ecosystem. A lending protocol, for example, can rely on the Sanctum Reserve for liquidation of a loan taken against any LST.

The significantly reduced barriers to setting up an LST have resulted in a flurry of innovation in the Solana liquid staking space.

Single Validator LSTs

Since LSTs are just wrappers around stake accounts, each validator can have their own LST. But what is the point? When staking natively, the APY for most validators is more or less the same, which means that validators don’t have a way to differentiate themselves. Earlier this year, when I explored the world of Solana validators in-depth, multiple validators told me that the single biggest challenge they faced was attracting more stake.

LSTs, powered by Sanctum’s Router and Reserve, give them a way to do this. Issuing one’s own token allows stakers to participate in the broader DeFi landscape and come up with additional ways to reward holders of a staked asset.

Laine, one of the top validators on Solana, rewards laineSOL holders with extra block rewards (beyond what constitutes the APY), resulting in holders getting more than twice the native staking yields. Similarly, validator Juicy Stake recently airdropped SOL to all wallets that held at least 1 jucySOL.

Throughout this piece, I’ve kept mentioning how liquid staking is a tough landscape for small players. picoSOL, an LST by an independent validator based in Japan, went from a stake of 0 to $8.5m in less than 30 days by being an active community member and sharing higher-than-average rewards with holders. Recently, picoSOL has been integrated into marginfi, one of the top lending protocols on Solana.

By removing the burden of creating liquidity pools, LSTs allow small, new, struggling, or ambitious validators to compete with the big players. This makes the Solana validator set more decentralised and competitive. Ultimately, it also provides the user with more validator choices without giving up the optionality of liquidity and high APY.

Infrastructure issued LSTs

Infrastructure projects like Helius. a Solana RPC provider, and Jupiter have also released their own LSTs, but for somewhat different reasons.

Solana recently moved to a Stake-weighted Quality-of-Service implementation feature, which “allows leaders (block producers) to identify and prioritise transactions proxied through a staked validator as an additional sybil resistance mechanism.” This means that a validator with a 0.5% stake would have the right to transmit 0.5% of the packets to the leader.

As an RPC provider, Helius’ primary objective is to read and write transactions to the chain as fast as possible. Given these network changes, the fastest way to do so would be for them to run their own validator. The Helius validator takes no commission and passes on all rewards to their stakers4. For them, running a validator is an operational expense and not their core business.

With the hSOL LST and with the right partnerships, they can make it even easier to attract stake (Helius can also potentially experiment with schemes like giving RPC credit discounts to hSOL holders.)

Jupiter is running a validator and has released JupSOL for very similar reasons. The more stake Jupiter’s validator has, the easier it is for them to send successful transactions to the Solana network, leading to user orders getting fulfilled more quickly. Like Helius, Jupiter passes on all fees to stakers.

In fact, to attract more stake, they have delegated an additional 100,000 SOL to increase the yield on JupSOL, making it one of the highest-yielding LSTs on Solana. Despite launching less than a month ago, JupSOL has already attracted a TVL of over $150 million.

Project LSTs

We’re also seeing some experimentation with individual Solana projects releasing their own LSTs.

For instance, Cubik, a public funding protocol (similar to Gitcoin) on Solana, recently released the iceSOL LST with the help of Sanctum. All staking returns from iceSOL go entirely to fund public goods on Solana. So, for any Solana believers holding native SOL, they can instead convert it to iceSOL for no monetary loss while supporting public goods on the network.

Pathfinders, an NFT project on Solana, has their own LST called pathSOL. pathSOL holders not only get whitelist spots for the NFT mint but also have the LST will be locked in the NFT forever. If users wish to get a refund on their mint price, they can burn the NFT to redeem their SOL. In the meantime, the Pathfinders team earns yield on all locked SOL.

Finally, Bonk, one of the top meme coins on Solana, recently released their own validator and LST called bonkSOL. The perks of holding one? In addition to getting staking yield, holders also earn the $BONK token in rewards.

One can imagine this trend continuing. For example, Tensor, where a bunch of SOL lies idle in bids, could launch tensorSOL and accept bids in the token as a way for their users to earn more yield (or add a gamification layer where accumulated yield is given away as lotteries).

SocialFi x LSTs

One of the most interesting emerging trends in the Solana LST landscape is the possibility of individuals releasing their own LSTs.

An early proof of concept of this is fpSOL, released by Sanctum founder FP Lee. Those who hold at least 1 fpSOL get access to a private chat with FP Lee (similar to a Friend.tech key), while the staking rewards go to charity.

It is not far-fetched to imagine this becoming more common, with influential individuals releasing LSTs as a much safer bet for their followers compared to NFTs or meme coins. They can gain distribution through their socials (as seen with PicoSOL, it doesn’t take long to attract stake), provide exclusive perks to holders, and make money by keeping some or all of the yield.

Infinity Pool

Sanctum’s third product is Sanctum Infinity. It is a multi-LST liquidity pool that supports swaps between all LSTs that are a part of the pool. The team claims that Infinity has the most capital-efficient automated market maker (AMM) design possible. Let’s look at how it works.

Whenever you wish to purchase 1 SOL worth of an LST, you’ll always get less than 1 unit of the LST. This is because the LST, over its lifetime, accrues staking rewards, which are reflected in its price against SOL. As of 8th May, JitoSOL is valued at $162, while SOL is trading at $146. The JitoSOL/SOL ratio is 1.109, which means that since JitoSOL was released, it provided a ~11% return on SOL. As time passes, this ratio will keep increasing.

Each LST has a stake pool account with two parameters: poolTokenSupply (the total deposited SOL) and totalLamports (deposited SOL + accrued rewards). Lamports are to Solana what sats are to Bitcoin — the smallest unit of measurement. Dividing these two parameters gives us the staking ratio.

Sanctum Infinity uses this in-protocol information as an infallible on-chain oracle, giving them perfect pricing data for every LST in their pool. Traditional AMMs rely on the ratio of asset pairs in their pools for pricing. This can be inefficient if there is low liquidity or a temporary imbalance caused by a large trade. The stake pool account information allows Infinity AMM to perfectly price every LST, irrespective of its liquidity.

The Infinity Pool is currently a permissioned basket of select LSTs (as decided by Sanctum). Users can deposit allowed LSTs into the pool to get the INF token in return. INF accumulates both staking rewards from all deposited LSTs as well as trading fees for swaps made inside the AMM. Thus, INF itself is an LST with an additional source of yield.

Sanctum tries to maintain a target allocation of different LSTs inside the pool with the objective of providing good yields to INF holders while also kickstarting and providing liquidity for smaller LSTs. For this, 20% of the pool is allocated to new LSTs, while the remaining portion to all other LSTs weighted by TVL. Over time, the team aims to add more parameters to the allocation strategy.

Infinity maintains the target allocation by dynamically altering the swap fees from one LST to another until the target ratios are achieved. The fee for each LST is broken down into two components: an input fee, which is paid when the LST is being swapped out, and an output fee, which is paid when an LST is swapped in. The total fee is the sum of the two.

If I want to swap JitoSOL (with an input fee of 0.02% and an output fee of 0.03%) for JupSOL (input fee of 0.04% and output fee of 0.05%), I will have to pay JitoSOL’s input fee + JupSOL’s output fee, which comes out to 0.07%. By dynamically adjusting the input and output fees for LSTs, Sanctum maintains the target allocation of the AMM pool. You can read more about how this works here.

Since launching last year, Sanctum’s TVL across its product has grown to over $500 million, making it the 5th biggest protocol on Solana.

The Road Ahead

The term "democratising" is often used in tech circles to describe how a process with high entry barriers is being made accessible to those who historically could not access it. Sanctum5has democratised liquid staking by and large. The natural extension of that argument is often that Solana’s staking ecosystem is more innovative than that of Ethereum6. I think there is more nuance to it.

When Lido was coming of age, DeFi was still a nascent sector, and Ethereum, the chain itself, was undergoing a phase of transition from PoW to PoS. There simply were too many variables and few precedents. In contrast, Solana’s staking ecosystem built itself after years of Lido being around. As we saw, developers in Solana did try to replicate the Ethereum playbook. So, it is safe to say they took inspiration from it.

But replication does not give any competitive advantages. What we’ve seen between Lido, Jito, and Sanctum over the course of this piece is the story of how an incumbent (from Ethereum) was competed against and out-innovated by a smaller, nimbler player that was more native to a protocol. Will Sanctum’s edge on Solana stick? We don’t quite know. As with most innovation cycles, there will be newer players that emerge to compete with Sanctum’s positioning in staking.

But here’s what’s clear: between Sanctum’s reserve (of $30 million worth of SOL) and their router (which is integrated into Jupiter), Sanctum is growing beyond being “yet another staking provider.” And that holds value.

Can’t put down Project Hail Mary,

The Sanctum team are OGs of the Solana liquid staking ecosystem. They started by helping create the first stake pool contract on Solana, which is now used by almost all LSTs (with the exception of mSOL). They also ran a traditional stake pool called scnSOL before creating unstake.it, which is now Sanctum Reserve.

The allocation of LSTs in Solana stake pools is currently a centralised process, usually managed by a multisig wallet. Jito recently released StakeNet, a transparent and decentralised protocol for operating intelligent stake pools that allocate stake to validators based on historic on-chain data.

In this sense, Sanctum functions similarly to a category of bridges that connect optimistic rollups to the Ethereum mainnet. When users bridge natively, they need to wait for the challenge period (which can last several days) to end before gaining access to their funds. Some bridges provide users with instant liquidity while taking on the task (and some risk) of a delayed payout.

The Sanctum Reserve can also be thought of as a market-maker who holds inventory (SOL) of the asset they are making a market for (LST-SOL swaps).

Not all validators are happy about this, and understandably so. While projects for which validation is not a core business can afford 0% commission, this harms smaller validators who rely on commissions to sustain their businesses. I don’t think there is any simple solution to this. Users will flock to validators that provide higher yield. Innovation with LSTs is one of the few ways smaller validators can compete.

If you want to understand the vision for Sanctum better, I highly recommend reading FP Lee’s personal blog.

Heroglyphs, an upcoming project on Ethereum, aims to change this dynamic. It will incentivize the creation of independent ‘Complete Validators’ — those who solo-stake ETH— by allowing them to embed valuable information in the Graffiti field of the blocks they propose (similar to inscriptions on Bitcoin).

If you liked reading this, check these out next:

I don't know why this article hasn't gone viral or why it has no comment... probably because ur audience are more intelligent and I'm the first gullible person to read it... buh I enjoyed every piece of it.

It was great great great information.

Yunno, I knew something was special about Sanctum before they had any or much audience... I even have a tweet where the founder (I think) was replying my tweet about how to improve the UX on their product. Now, I definitely and squarely understand that special thing, and you(the writer or writers) made that possible. (I'll be shocked if this came from a single person)

Real talk... I love what you guys did with this writing, it was with the utmost simplicity.

It doesn't have much defi expert talk that makes me feel like, "even if i finish this long article, I won't get the much that was given", did you follow what I meant with that. I have just one writer I follow and appreciate his work like this, @yashhm on twitter, he has "beyond-the-best" stuff too.

This is the one thing about his writing that bothers me, they're TOO IMPACTFUL (for me, a grug brain person), big information dense into one paragraph, I also noticed that paragraph contains much than I got. I feel he should make his article into series instead or just create a class to educate his readers(or just dumb me) on the basis of Defi.

This work is real good, I'll check out more of your stuff , definitely. I'll try mentioning this to Sanctum, if it ever gets to them, this is worth rewarding, immensely(sorry, am grug brain and also poor 😔☹️). Thanks again for this. God bless the hand(s) behind it. Amen 🙏🏿.

Every major project needs an LST because of Stake-weighted Quality-of-Service, Bullish sanctum!