On Solver Economics

How value flows in DeFi

Hello,

Today, we are joined by Jose Sanchez from Spartan Capital. This piece is our second collaboration - an extension of our first story on OEV together. Jose is the ideal partner to collaborate with! He has unique ideas that are extremely well-researched and fun to weave a story around. If you are an analyst and want to explore publishing with us, please fill out this form.

This article is technical. It is about how ERC-7683 can help create better UX across DeFi and change solver economics in the process. If you’re an early-stage founder building something that uniquely benefits from crypto, we’d love to talk to you.

Alright, let’s dig in.

Hello!

I spent the better part of my childhood playing Cricket and dreaming about it. But having made the rational choice of pursuing studies over the game I dearly love, I have now turned into an avid spectator. Every few years, there’s a mega auction in the Indian Premier League or IPL—the world’s biggest shortest-format tournament. Launched in 2007, IPL grew to be a $11 billion brand by 2023. The TV plus digital rights for the IPL are sold at ~$13 million per game. Things are heating up in anticipation of the upcoming mega auction in 2025.

I often think about the auction room where team owners hold their paddles, ready to bid on cricket's finest talents. Behind each raised paddle lies an intricate web of decisions— coaches analysing player statistics, strategists calculating team balance, and finance managers weighing budget constraints. While the audience sees just the final bid, teams are simultaneously solving multiple complex puzzles: how does this player fit our strategy? What's our maximum bid? How do we balance overseas and domestic talent?

Now imagine if, instead of team owners making these complex calculations, they could simply state their intent. "We need a left-handed opening batsman who can bowl spin and fits within $1 million". An automated system would then analyse all possible combinations, factor in team chemistry, evaluate performance data, and optimise the bid amount, all in real-time. Although tech has improved, this will remain a distant dream.

Why am I talking about auctions? Because this is where DeFi is headed. Want to trade USDC on Ethereum for WETH on an L2 network? Currently, you need to juggle multiple steps – transfer USDC to your wallet. Connect to a bridge. Move the tokens to L2. Find a DEX. And finally, execute your swap. It's like being an IPL team owner who has to personally negotiate with players, arrange their travel, sort out contracts, and manage training schedules.

Enter intent-based solutions—DeFi's equivalent to a perfectly optimised auction system. Instead of forcing users through this gauntlet of complexity, these systems let you simply state what you want ("I'd like to trade my USDC for WETH"), and then a network of specialised "solvers" compete to make it happen in the fastest, cheapest way possible—much like how modern sports management companies handle everything from player scouting to contract negotiations.

This article explores how a new standard called ERC-7683 is set to change this landscape by making these intent-based systems work together seamlessly. We'll examine why intent-based solutions are gaining traction in DeFi, how ERC-7683 could create a unified network for cross-chain transactions, the key players involved, and how value flows between them. We'll also dive into the potential market size, opportunities ahead, and important considerations for the future.

Why Intents?

The DeFi landscape has changed dramatically since its inception. What began as a simple concept of peer-to-peer financial transactions has evolved into a complex ecosystem spanning multiple blockchains, each with its own protocols and liquidity pools. Not long ago, I talked to Vishwa from Anera Labs about the potential of intents when they were just taking shape. While this growth has brought unprecedented opportunities, it has also introduced significant complexity for everyday users.

Today's DeFi users face a challenging environment. They must navigate multiple blockchains, understand bridging mechanisms, manage gas fees across different networks, and optimise transaction routes—all while protecting themselves from MEV (Maximal Extractable Value) exploitation. These technical hurdles often discourage newcomers and frustrate even experienced users. I must admit, while bridging was a better experience than using Poloniex every time I had to move from Bitcoin to Ethereum, I find myself reluctant to bridge these days.

Intent-based solutions offer an alternative. Let’s say I want to buy GOAT on Solana. But I have USDC on Arbitrum. Using traditional methods, I would need to connect to a bridge, move the USDC to Solana, connect to a DEX, and finally, execute the swap. This process is cumbersome and time-intensive.

Intent-based systems dramatically simplify this experience. It’s like ordering food online. I express my desired outcome: "Trade USDC on Arbitrum for GOAT on Solana." The system interprets this as an intent, and a network of solvers competes to fulfil my request. The most efficient solver executes all necessary steps automatically, just like how a delivery service handles everything behind the scenes when I order rolls, sometimes giving in to my late-night cravings.

Two Birds, One Stone

This new approach offers two key benefits. First, it provides a streamlined user experience with one-click execution, automated gas handling, and Just-In-Time (JIT) liquidity provision, delivering Web2-like simplicity. One-click execution means users no longer need to approve multiple transactions or navigate between different protocols. Instead of confirming several steps across different platforms, users complete their entire transaction with a single action. Much like making a purchase on Amazon.

Think about how banking used to be before mobile apps. You had to visit a bank branch, fill out forms, and wait in long queues just to make simple transactions. Now, you can do everything from your phone in seconds. DeFi is undergoing a similar transformation—intent-based systems are making what was once a cumbersome, multi-step process as easy as online banking.

Automated gas handling removes the complexity of managing transaction fees across different blockchains. Users don't need to worry about maintaining native tokens for gas fees or calculating optimal gas prices—the system handles all fee-related decisions and payments automatically.

JIT liquidity provision enables trades to execute at the best possible prices without requiring large amounts of capital to be permanently locked in pools. An example of this is Socket’s upcoming upgrade where specific solvers can burn tokens on one chain and mint tokens on another chain using Circle’s CCTP in the background. Another one is professional market makers being able to provide liquidity exactly when it's needed for a specific transaction rather than having funds sit idle in traditional liquidity pools.

Together, these three features represent a significant shift towards Web2-like simplicity in DeFi. What was once a complex, multi-step process can now be as straightforward as traditional online banking.

Second, it enhances execution efficiency through professional market makers who optimise transactions better than basic automated market maker (AMM) contracts. This improves capital efficiency through specialised routing. Professional market makers bring sophisticated trading expertise to each transaction. Unlike basic AMMs that follow rigid mathematical formulas (like XY = constant), these experts actively monitor and react to market conditions across multiple venues to find the best prices.

The optimisation of transactions extends far beyond simple token swaps. Market makers employ sophisticated strategies—bundling steps, discovering alternative routes, and splitting orders across multiple venues. Rather than executing a large trade through a single AMM pool and suffering significant price impact, they maintain connections to diverse liquidity sources, from decentralised exchanges to private pools. This comprehensive market access ensures each transaction takes the most efficient path possible, delivering better rates for users while requiring less locked capital.

Intent-based solutions are gaining traction in two key areas—spot DEXs and bridge transfers.

For token swaps, platforms like UniswapX, CoWSwap, and 1inch Fusion are reinventing how trades work. At their core, these platforms run what's called an order-flow auction (OFA). When a user wants to make a trade, instead of executing it directly on-chain, the platform broadcasts it to a network of specialised traders (called solvers). These solvers then compete in a rapid auction to offer the user the best possible deal. They search across both public and private liquidity sources, combining different trading routes to find optimal prices. The results are impressive—for example, CoW Swap users typically save an extra 0.5% on their trades compared to traditional methods, all while being protected from common trading pitfalls like MEV.

Bridge transfers have also been transformed by this approach. Platforms like Across, deBridge, and Router have made moving tokens between blockchains dramatically faster. When a user wants to move tokens from one chain to another, solvers spring into action—fronting their own funds to complete the transfer in just 3 seconds, instead of other designs that take over one minute. This is a massive improvement over traditional bridges that can take over a minute. The solver later collects the user's tokens from the starting chain along with a small fee for their service. It's like having a trusted friend who can instantly lend you money in a different currency, knowing you'll pay them back shortly.

Intents-based DEXs and bridges have reached ~20% and ~45% of their total respective markets as of October 2024.

Although intent-based DEXs and bridges have gained traction, we're far from realising their full potential. The current landscape resembles a city where each neighbourhood has its own transportation system—efficient within its borders but isolated from others. UniswapX, CowSwap, Across and other platforms operate as independent islands, each with its own specialised solvers who can't easily work across different platforms.

Think of solvers as highly skilled taxi drivers who know every shortcut in their neighbourhood. Currently, these drivers are restricted to operating in just one area, even though their expertise could benefit the entire city. Why? Because each neighbourhood has its own unique rules, signals, and systems. It is complicated and expensive for drivers to operate across multiple areas. A unified system like ERC-7683 is akin to a ride-sharing app that allows drivers to operate seamlessly across different regions, breaking down barriers and making the whole city accessible to them.

With a new standard, we can have solvers that can be shared across different applications. It’s like how Europe has similar rules for driving throughout. It allows the smooth flow of vehicles through the entire European Union.

Making Intents more useful with ERC-7683

This is where ERC-7683 comes in. It's like introducing a unified traffic system across the entire city. Under this new standard, a taxi driver licensed in one neighbourhood could easily operate throughout the city, using their expertise to serve a much larger customer base.

ERC-7683 introduces a universal "language" for intents. It changes traditional cross-chain transactions in three major ways.

First, it standardises how intents are written and processed. When a user says, "I want to trade Token A for Token B across these chains," every platform will express this intent in exactly the same way. For solvers, this means they can write their execution code once and use it everywhere—dramatically reducing the technical barriers to entry. It's like having a common set of traffic rules that allow drivers from different countries to navigate any city, ensuring that everyone knows what to expect and can operate seamlessly.

Second, it defines a common framework for how solvers prove they've completed a task. Currently, each platform has its own way of verifying if a solver has actually delivered what the user wanted. ERC-7683 creates a unified verification system, making it much easier for solvers to operate across multiple platforms with confidence.

Third, it standardises how solvers get paid for their services. Instead of dealing with different payment mechanisms on each platform, solvers have a clear, consistent way to collect their fees. This predictability makes it more attractive for new solvers to enter the market.

The real power comes from combining these elements. When solvers can easily work across multiple platforms using the same code and systems, we see:

More competition between solvers leading to better prices for users

More efficient use of capital, as solvers can use the same funds to serve multiple platforms

Faster innovation, as improvements made by one solver can be quickly adopted by others

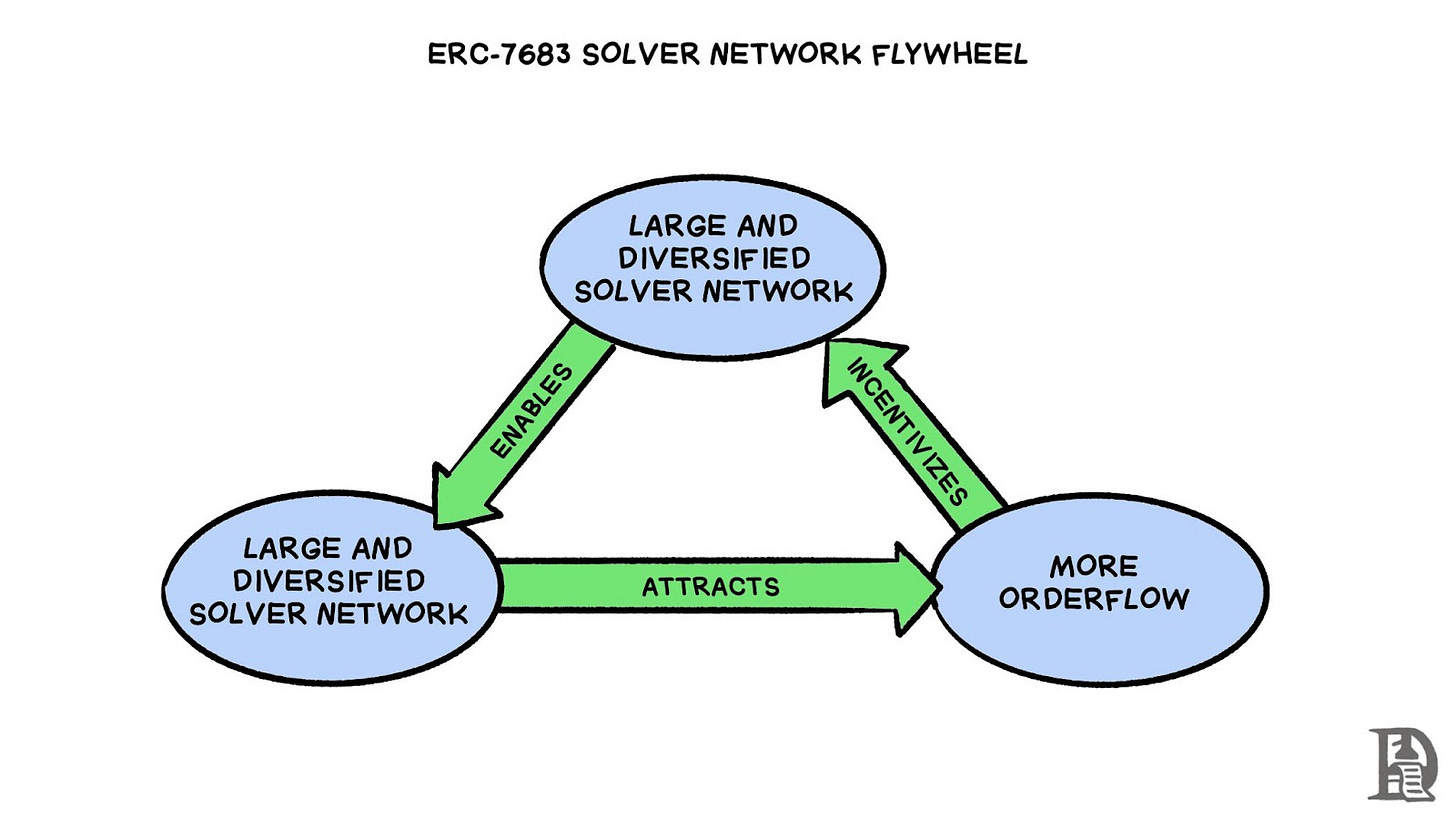

The beauty of this standardisation lies in its network effects. A busy marketplace attracts more traders, which in turn attracts more customers. Similarly, ERC-7683 creates a virtuous cycle. More solvers operating across multiple platforms leads to better execution speeds and prices. This attracts more users, which then attracts even more solvers. It's a self-reinforcing cycle that benefits everyone in the ecosystem.

By breaking down these barriers, ERC-7683 is fundamentally transforming how intent-based protocols can work together to create a more efficient and interconnected DeFi landscape.

ERC-7683 opens the door to a fundamentally simpler way of interacting with DeFi through natural language. I recently hosted Vaibhav from Socket on our podcast. He contends that five years out, frontends will not be as useful as they are today. On-chain AI agents will execute things on users’ behalf. Imagine being able to message a chat interface like WayFinder with a straightforward request like "Swap $1000 worth of ETH to USDC on Optimism and stake it in Aave." It's like using a virtual assistant such as Siri or Alexa. You just give a command. Everything else happens behind the scenes. An AI language model would interpret this everyday language. It would convert it into the precise technical instructions needed. Then, it would send these to solvers who compete to execute the transaction in the most efficient way possible.

This represents a significant leap forward in making DeFi accessible to everyday users. Currently, executing such a transaction requires understanding multiple technical concepts. How to bridge tokens between chains, how to swap currencies, and how to interact with lending protocols. I don’t need to know how an internal combustion engine works to know how to drive. With this AI-powered interface, users can focus on what they want to achieve rather than how to achieve it.

The solvers would handle all the complexity—finding the best routes, managing gas costs, and minimising slippage across different chains. Think of it as having a team of expert drivers competing to get you to your destination in the most efficient way possible while you simply state where you want to go.

But, this convenience must be balanced with security. Just as we wouldn't want a self-driving car to misinterpret our destination, we need robust verification systems to ensure the AI accurately translates user intentions into blockchain transactions. Integrating AI with ERC-7683 could transform how we interact with DeFi, but it must be built on a foundation of robust security measures and clear verification processes.

The Market

The true potential of ERC-7683 lies in a simple but powerful insight: almost everything in DeFi is fundamentally a swap. When you provide liquidity to an AMM, you're swapping tokens for LP shares. When you take out a loan, you're swapping collateral for borrowed assets. When you trade derivatives, you're swapping margin for position exposure. Even when you bridge assets across chains, you're essentially swapping tokens from one location to another.

This realisation transforms ERC-7683 from "just another cross-chain swap standard" into something far more significant. While it may have started as a way to standardise cross-chain transfers and swaps, its impact will likely extend to nearly every corner of DeFi. By creating a unified language for expressing these swaps, it becomes the foundation for how all cross-chain DeFi operations are conducted.

The market data supports this potential. Currently, intent-based bridges command about 15% of the bridging market. Given the user experience benefits these bridges provide, this share is expected to grow across different market conditions. For cross-chain swaps, the projections align with what we already see in single-chain environments, where intent-based solutions capture about 30% of Ethereum's non-toxic DEX volume1. Similar penetration rates of 20-30% are expected for cross-chain scenarios.

Let me break down how we can estimate the Total Addressable Market (TAM) for ERC-7683 across its two main use cases.

Bridging Market

The growth story for bridges is straightforward: as more Layer 2 networks launch, users need more ways to move assets between these ecosystems. Historical data shows bridge volume tends to grow in proportion to DEX spot trading volume. Intent-based bridges, with their superior user experience, are particularly well-positioned to capture this growth. So, for a billion dollars in volume, bridges can capture $700k in fees.

Currently, intent-based bridges hold 15% of the market. This can grow to 25-40%, varying with market conditions. Why do we think so? Recent developments indicate that the intent-based model will become more prominent. FlowTraders, a publicly traded company, joined Wormhole’s solver network to support the composable intents platform. LayerZero powers Mach Exchange, focusing on efficient cross-chain swaps through an intent-based approach.

This growth should favour protocols adopting the ERC-7683 standard, as they'll benefit from an established network of solvers— a significant competitive advantage. Bridge fees have found their floor at 7 basis points, which appears sustainable long-term.

Cross-Chain Swap Market

The story here is even more compelling, driven by the dramatic shift of trading activity to Layer 2s. Look at Uniswap's numbers. Layer 2 trading volume has grown from 19% of Ethereum volume in January 2023 to 57% in October 2024. With Unichain's launch approaching, this could reach 100% within six months.

UniswapX's cross-chain swaps should accelerate this trend by offering a seamless experience. Consider a small trade under $500—routing this through Ethereum mainnet makes little sense, given gas costs. Instead, solvers will automatically route these trades through Layer 2s, where costs are lower.

Expecting cross-chain swaps to capture 20-30% of Layer 2 DEX volume is not outrageous. This matches with what we've seen with single-chain intent solutions (which currently capture 30% of non-toxic Ethereum DEX volume). Fees here are more attractive than bridging. CowSwap has achieved up to 25 basis points. The actual rate typically depends on user-set slippage parameters, with 25 basis points being the default.

This combination of growing Layer 2 adoption, superior user experience, and attractive economics suggests that ERC-7683 is well-positioned to capture a significant share of the expanding cross-chain DeFi market.

The Value Chain

Before getting into how and who captures the value in the intent-based system, here’s a quick background on the general intent framework with an example of a cross-chain swap.

Think of ERC-7683 as a sophisticated delivery service that works across different cities (blockchains). Here's how it works:

The Customer's Order

Imagine you want to send $300 worth of goods from New York (Base) and receive something worth 0.1 ETH in London (Optimism). Instead of figuring out shipping routes and customs yourself, you simply state what you want. That's your "intent". This intent could be a simple delivery (bridging), an exchange of goods (swapping), or a complex series of actions (like delivering something, having it assembled, and placed in storage).

The Bidding War

Your order goes to an auction house (the Order Flow Auction), where different delivery companies (solvers) bid for your business. While you wait, your $300 is held safely in a secure vault (escrow) in New York. Think of it like a package delivery service where UPS, FedEx, and DHL compete in real-time for your business, each trying to offer the best combination of speed and cost.

The Delivery Process

The winning delivery company (solver) then gets to work. They might use their own warehouse stock (private liquidity) or source items from local markets (on-chain LPs) to fulfil your order in London. It's like having a delivery service that can either use their own inventory or buy from local shops to ensure you get exactly what you need.

Proof of Delivery

Once delivered, the solver needs to prove they've completed the job. This is like getting a signed delivery receipt but with different verification methods available. Across, for example, uses a system where anyone can challenge a claimed delivery within a certain timeframe (optimistic challenge mechanism) similar to how PayPal gives buyers time to dispute a transaction.

Final Settlement

Once the delivery is verified, the payment is released from the vault in New York to pay the delivery company. The delivery company's profit comes from the difference between what you paid and their actual costs, just like how traditional delivery services make their margin.

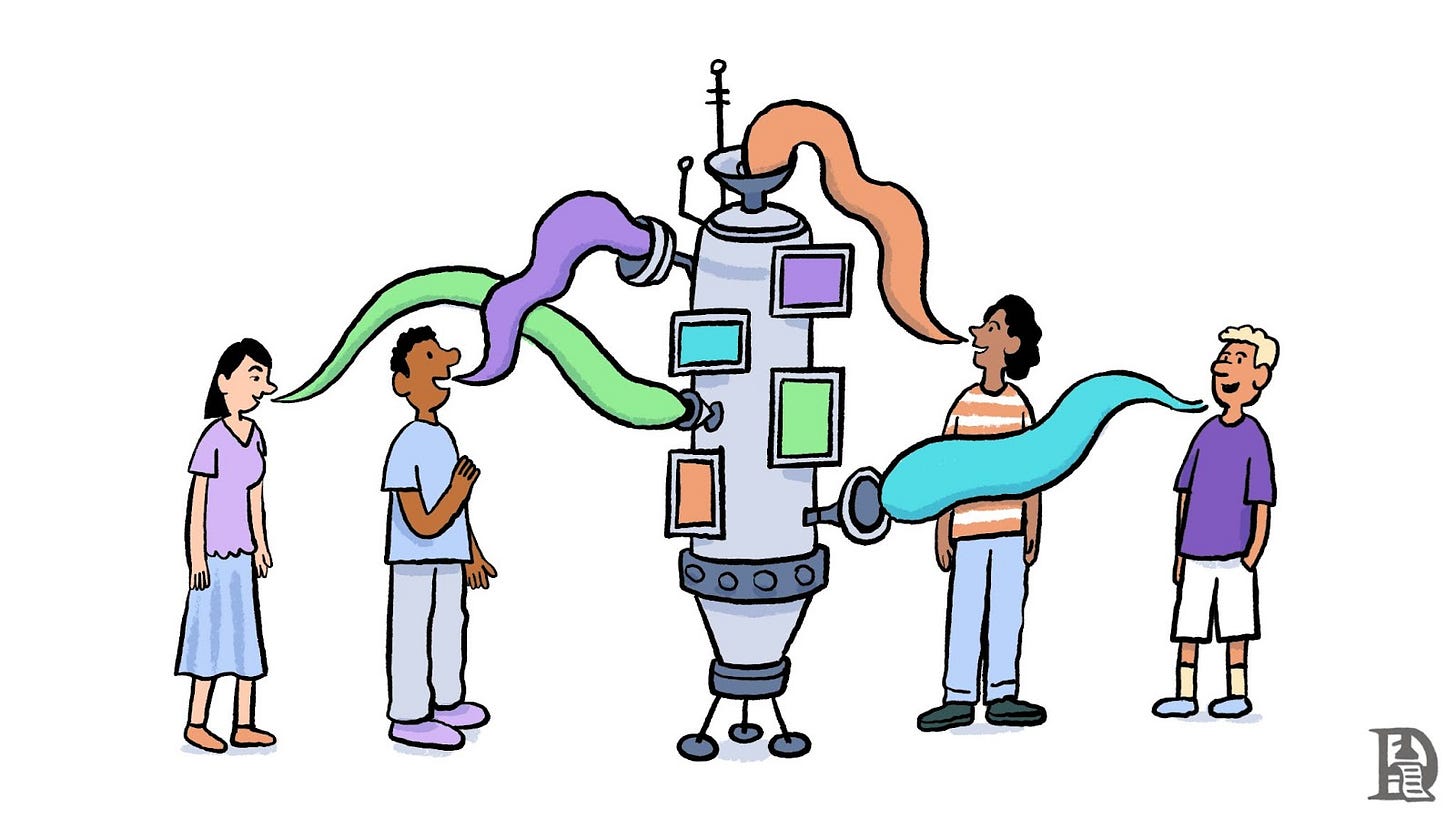

Let us expand on the key players in this cross-chain delivery system.

Key Players

Intent Generators (The Customers) These are everyday users who want to move or transform their assets across different blockchains. They might use Across's website to bridge some ETH, or UniswapX's interface to swap tokens across chains. Just like how you might book a flight without caring about air traffic control systems or fuel logistics, intent generators simply express what they want ("I want to turn my 300 USDC on Base into 0.1 ETH on Optimism") without needing to understand the complex machinery that makes it happen.

Solvers (The Delivery Companies) These are the sophisticated players in the market. Think of them as specialised logistics companies with advanced routing systems and global networks. They compete in real-time auctions to win your business, each with their own advantages. Some might have deep pools of their own inventory (like Amazon's massive warehouses), while others excel at finding and combining the best routes across different markets (like a smart travel agent who knows how to piece together the perfect flight itinerary). They make their profit from the spread—the difference between what you pay and what it costs them to fulfil your order.

Settlement Networks (The Infrastructure) Think of these as the combination of air traffic control, customs offices, and payment processors all rolled into one. They verify that deliveries actually happened (like tracking numbers and delivery confirmations), ensure everyone plays by the rules (preventing fraud), and handle the flow of payments between all parties. Across, for example, not only verifies successful deliveries but also manages the complex task of paying solvers, often allowing them to receive payment on their preferred chain, similar to how international businesses might prefer payment in their local currency.

This three-part ecosystem works together to make cross-chain transactions feel as simple as ordering something online while maintaining the security and efficiency needed for handling millions of dollars in digital assets.

Impact of ERC 7683 on the value chain and the players

As it becomes easier to become a solver (thanks to ERC-7683 and new inventory tools), we're witnessing the beginning of solver commoditisation.

The End of the Specialist Era – levelling the playing field

Solvers once operated like specialist antiquarian book dealers, each with their proprietary algorithms and unique technical expertise. But ERC-7683 is changing the game. By standardising how cross-chain transactions work and with tools like Titania Research's open-source routing code becoming available, the barriers to entry are dropping dramatically. The traditional solver's edge—their proprietary routing and execution strategies are eroding rapidly.

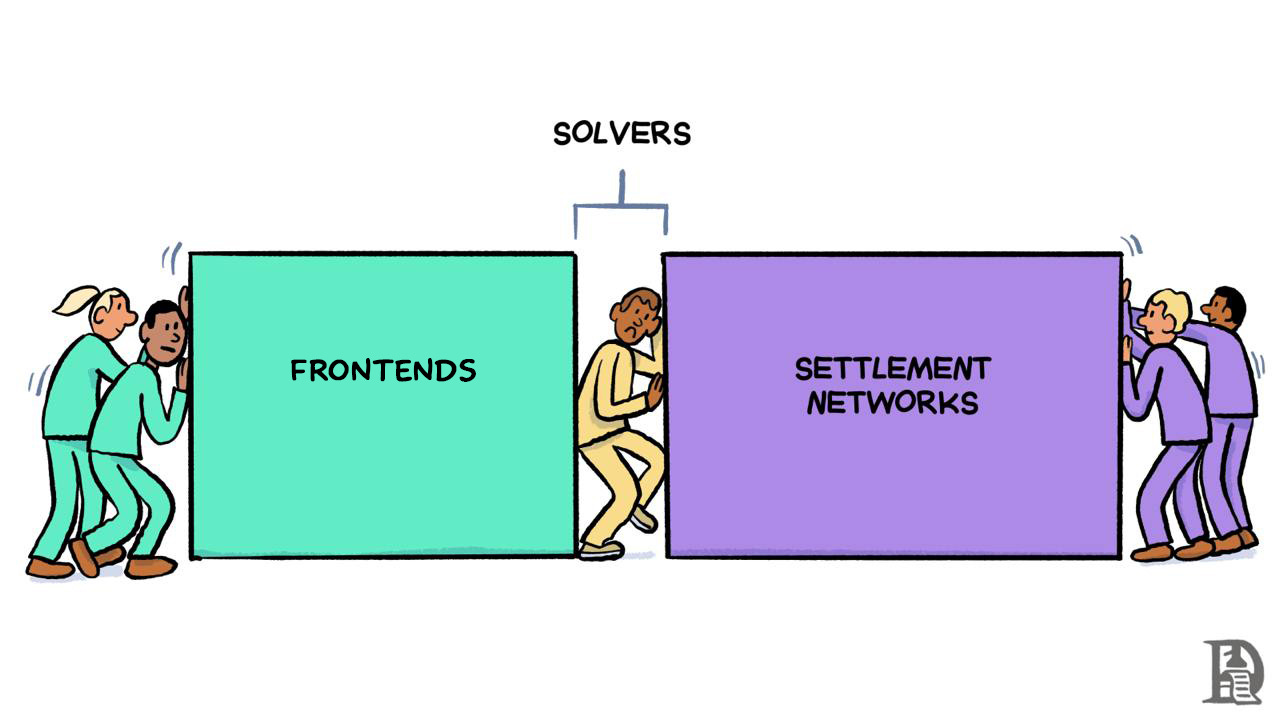

Much like how anyone can become a minicab driver once they meet basic requirements, the barriers to entry for solvers are dropping. When this happens, value naturally flows to the edges: to the platforms that bring in users (like Across and UniswapX) and to the networks that handle settlements.

With Solvers’ commoditised, the value in the middle layer is flowing upstream to the order originators and downstream to settlement networks.

Value Flow: Redistribution from Solvers to the Ecosystem

With solvers becoming commoditised, the value that was once concentrated in the middle layer is now flowing to two main areas:

Order Originators and Auction Platforms: Platforms like Across and UniswapX are positioned to capture more value by facilitating efficient order flow. These platforms can implement features like Request-for-Quote (RFQ) auctions to enhance competition among solvers, leading to lower fees for users or increased revenue through auction fees.

Settlement Networks: Settlement networks, such as Across, play a critical role in verifying intent fulfilment and handling solver repayments. As solvers compete on execution, the reliability and efficiency of settlement networks become a key differentiator. Across, for example, provides solvers with flexible repayment options, proven security guarantees, and backstopping mechanisms to ensure user intents are fulfilled even if a solver fails. This makes settlement networks indispensable for solvers, shifting value towards these networks.

The Economics of Solving in a Competitive Market

As per LI.FI podcast episode with Anera Labs, a solver with $40,000 in inventory needs to process $400,000 in daily volume— a 10x turnover—to remain competitive. At 3.5 basis points per trade, this could yield a 114% annual return, but only if they can maintain this aggressive turnover consistently. This is where the challenges begin. It is not always feasible to maintain turnover.

Data for Across shows that solver fees have come down significantly, from ~15 basis points in April 2023 to ~4 basis points in October 2024.

The total fees have gone down from 19 basis points (bps) in April to 7 bps in October 2024. The major affected party is the solvers. Other fees have remained more or less steady between 2.5 to 4 bps.

Even in terms of the percentage fees captured by solvers, there is a steady decline from 80% in February 2023 to ~65% in October 2024.

Currently, solvers compete in on-chain auctions, often engaging in costly priority fee wars on L2 networks. When two solvers spot the same opportunity, they bid up priority fees to front-run each other, leaking value to L2 sequencers. Across' solution is moving these auctions off-chain through an RFQ system. Moving these auctions off-chain means solvers don’t engage in gas wars. This could reduce user fees from 7 to 5.5 basis points, or maintain current fees while capturing the savings as platform revenue.

The Role of Settlement Networks

A settlement network like Across provides three fundamental features that make it indispensable for solvers.

First, there's the flexible repayment system. Rather than having capital locked on the user's origin chain, solvers can choose which chain they receive payment on. This is refreshing. Imagine being a global trader who can instantly collect payment in any currency at any location rather than being forced to accept payment where the customer is located. This flexibility dramatically improves capital efficiency and reduces operational friction.

Second, Across provides a battle-tested security model. For solvers, who are essentially fronting capital to fulfil user orders, this security is crucial. They need absolute certainty they'll be repaid and rewarded for fulfilling intents. It's like having a central bank guarantee on every transaction. Solvers can operate confidently, knowing their capital is protected.

Third, there's intent backstopping. Suppose a solver fails to fulfil an order, Across steps in with its own working capital to complete the transaction. This creates a robust safety net for the entire system, ensuring users get their orders filled while maintaining system reliability.

In addition to these core features, netting opportunities are absolutely critical for solver profitability and sustainability. Remember how we talked about solvers needing to do higher turnover to maintain profitability? If you are a solver with a $50,000 inventory, you need to achieve around $500,000 in daily volume (a 10x turnover) to be profitable. Without efficient netting and rebalancing, you would constantly need to bridge funds back and forth between chains, incurring high costs and delays that would make this turnover target impossible.

Netting is what makes the solver business model viable. Across leverages multiple types of netting opportunities to create these efficiencies.

First, there's the "Coincidence of Wants" (CoWs) system, which batches transactions in one-hour windows. When a solver wants payment on a chain where another user is depositing funds, these transactions can be netted. This eliminates bridging costs. Currently, Across doesn't charge for this service, though it might implement a small settlement fee in the future.

Second, when CoWs aren't available, solvers can access immediate payment through Across's working capital pool. While this incurs a fee, it's designed to be lower than traditional bridging costs. It allows solvers to maintain better profitability. The economics are revealing. Out of Across's current seven basis point bridge fee, about three basis points go to solvers (40%) and four to settlement/rebalancing.

Third, solvers can use Everclear, a post-execution marketplace, to find netting opportunities with other solvers. This creates a secondary market for solving positions, increasing overall market efficiency.

This combination of robust infrastructure and efficient netting makes Across attractive to solvers. As ERC-7683 standardises intent formats, solvers will naturally gravitate towards settlement networks that offer a blend of security, flexibility, and efficiency. This positions Across perfectly—solvers using their network can offer the most competitive fees and fastest fills, helping them win more orders in both Across's RFQ auctions and Uniswap's batch auctions.

In an increasingly competitive market, this infrastructure advantage becomes not just helpful, but essential for survival.

Navigating the Commoditised Solver Landscape

As the landscape evolves, solvers must adapt to survive. The commoditisation of the solver role means that solvers need to find new ways to differentiate themselves. Some are exploring emerging markets, such as supporting less popular asset pairs or expanding to newer chains like Solana. Others are building direct relationships with users by creating their own platforms.

The market is likely to evolve towards a mix of large, sophisticated solvers handling the majority of volume through advanced strategies and smaller, specialised solvers focusing on niche markets. The key to survival will be leveraging efficient infrastructure, such as Across's settlement layer while developing unique advantages. These can be gained by taking on more risks in emerging markets or building strong user relationships.

Ultimately, ERC-7683 is driving a shift towards a more efficient and interconnected DeFi ecosystem. By lowering the barriers to entry for solvers and standardising intent-based transactions, it enables a broader range of participants to enter the market. This creates a virtuous cycle: more solvers lead to better execution, which attracts more users, further incentivising solver participation.

The future of DeFi is one where complexity is abstracted away, and users can enjoy seamless, efficient cross-chain interactions, much like the transformation we saw in the travel industry with the advent of modern apps. While IPL auctions will remain messy and tedious, the solver landscape is about to change for the better.

Signing out,

Saurabh Deshpande

"Toxic" flow in DeFi typically refers to trades from sophisticated actors who have an information or speed advantage—imagine high-frequency traders or arbitrage bots that quickly spot and exploit price differences across exchanges. These traders tend to make a profit at the expense of market makers or liquidity providers.

For example, if a token's price moves up on Binance, arb bots will quickly buy from DEXs and sell on Binance, profiting from the temporary price difference. This is "toxic" to liquidity providers who end up selling at the lower price."Non-toxic" flow, by contrast, is typically from regular traders or retail users who are simply trying to exchange tokens for their own use—like someone swapping ETH for USDC to make a purchase, or swapping for another token they want to hold.

These trades don't come from information advantages and are generally seen as beneficial for market makers and liquidity providers.

If you liked reading this, check these out next:

- One click Checkout buttons for Web3

This is an incredibly insightful piece—intent-based solutions like those enabled by ERC-7683 are a critical step forward for simplifying DeFi and making it more user-friendly. I’ve been reflecting on these challenges myself, especially how fragmented systems and liquidity pools often create unnecessary complexity.

I work for Reality Network, and we take a different but complementary approach to solving these issues by rethinking the fundamental architecture of how blockchains interact.

Here’s how we’re addressing these challenges:

• True Cross-Ledger Interoperability: Reality natively supports seamless swaps across blockchains without needing external bridges or liquidity pools. Imagine trading USDC on Ethereum for SOL on Solana in a single, automated step—our protocol makes this possible at the base layer.

• More Robust than dApps: Enter rApps: Reality’s rApps (Reality Applications) go beyond traditional dApps by enabling:

• Independent networks with full developer freedom—no fixed token or node requirements.

• Native cross-ledger functionality, baked into the protocol.

• Remote execution of Turing-complete code, allowing applications to work across chains with no extra infrastructure.

For example, a DeFi rApp could manage staking rewards across Ethereum, Polygon, and Solana simultaneously, with no manual interaction from users or developers.

• Introducing 2MEME: A Smarter Consensus: Our 2MEME consensus algorithm dynamically rewards good behavior (nodes that optimize network consistency) and penalizes bad actors. It ensures reliability without requiring expensive hardware or staking large sums of capital. This makes the network accessible to more participants, from individuals to small-scale developers.

• Developer-Friendly Tools: With our Cell API, developers can build applications that integrate seamlessly across chains without worrying about interoperability, gas fees, or liquidity. For instance, an NFT platform could enable purchases in any token across multiple networks, all while keeping the user experience intuitive.

• Empowering Decentralized Ownership: Each rApp operates as its own network, enabling communities to design custom governance and consensus rules. Think of it as building your own blockchain ecosystem with none of the usual complexity.

By building these features directly into the protocol, Reality doesn’t just tackle the same challenges ERC-7683 addresses—it reimagines how blockchains and applications should work together.

Great article! I found fascinating where things are heading.