Bootstrapping Networks

Solving the cold start problem with zkTLS

Before we begin…

Crypto Twitter is going through one of its more pessimistic phases. We are yet again asking ourselves: “is anything in crypto solving a real problem?” When you browse social media and the most interesting debate is about what to call Solana L2s, such sentiment is understandable.

However, you only need to take a quick look under the hood to realise that we are in the middle of very interesting period intellectually. Last week, we covered Chain Abstraction and improvements in crypto UX. Yesterday, I wrote about evolving wallets.

Today, Shlok discusses how advances in crypto can help make the internet a fairer place.

There have been few better times to build cool things and great companies (we will cover a few in today’s article). As always, we want to connect with founders doing so. If you want to work with us, please fill the form below.

Joel

Hello!

Would you want to return to a world without Uber? I would not.

The hassle of stepping outside, hailing a cab, haggling for prices (in places like my home country of India), giving directions, and making cash payments has been replaced by a vastly superior experience—a few taps on your phone, and transportation arrives at your doorstep. It is no surprise that Uber has amassed astonishing value in a short time—it launched less than 15 years ago and is now worth over $150 billion.

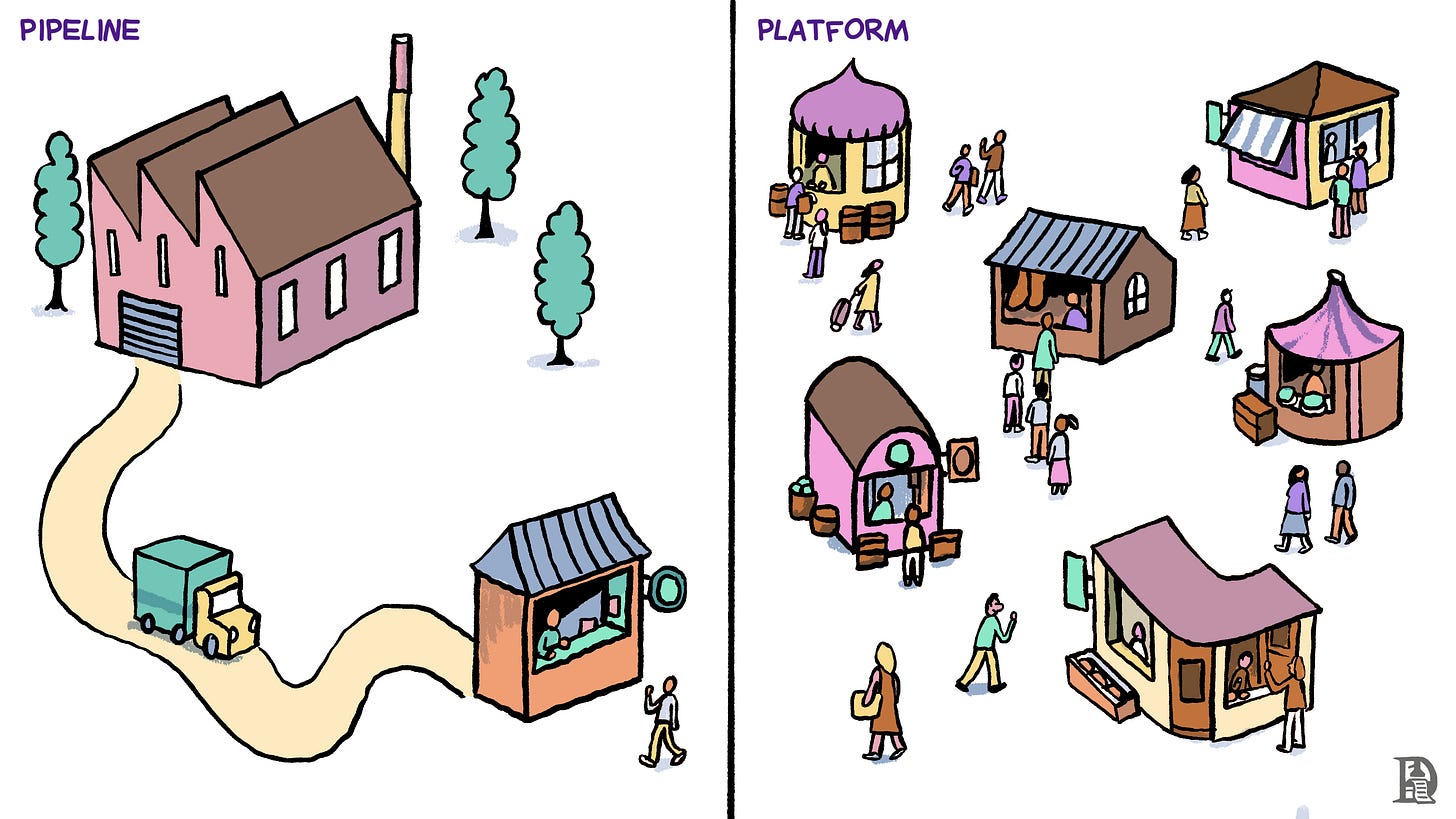

For thousands of years, the nature of human businesses remained static. The book Platform Revolution calls these businesses a “pipeline”:

A pipeline is a business that employs a step-by-step arrangement for creating and transferring value, with producers at one end and consumers at the other. A firm first designs a product or service. Then the product is manufactured and offered for sale, or a system is put in place to deliver the service. Finally, a customer shows up and purchases the product or service.

Pipeline businesses function as “linear value chains.” Selling products and services requires high upfront capital, holding and managing inventory, and building distribution channels. These constraints mean that revenue for pipeline businesses scales in proportion to resources and costs.

The internet changed this millennia-old status quo, opening up a new way of doing business: the “platform.” Platforms leverage the internet’s global reach to efficiently connect demand and supply, creating value without producing any goods themselves. Tom Goodwin’s words on this topic have been immortalised:

Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.

To grasp how deeply platform businesses are embedded into our lives, simply open your phone and browse through your apps. I have apps for 28 platform businesses. I suspect yours will be a similar number.

Ben Thompson explains why platforms dominate to this extent: They have zero distribution cost, enabling a direct relationship with the customer. Airbnb doesn’t rely on ads in the New York Times to sell rooms. Instacart’s success doesn’t depend on Walmart not placing its products on the bottom shelf.

Platforms also have negligible transaction and marginal costs. A thousand new users barely make a dent in Uber’s margins. These advantages have allowed platform businesses to grow exponentially and create more value than their decades-old, pipeline-based competitors in just a few years.

The prize for becoming the platform of choice for a category is massive, often in the billions. The competition is fierce. The path to beating rivals: building a bigger, better network faster than the rest. Step one in getting there: solving the infamous ‘cold start problem.’

Gallons of ink have been split, and millions of keys have been pressed writing about bootstrapping networks. This article takes a slightly different approach. Here, we will show aspiring network builders how a set of crypto tools—some that have been around for a decade, others on the cutting edge—can help them overcome the cold start problem.

But first, what exactly is this problem?

Cold Starts

Pipeline companies build moats by lowering costs (Andrew Carnegie made his wealth by making steel 90% cheaper) and/or by building extremely strong brands (Apple fans needed little convincing to clamour for Steve Jobs’ latest piece of magic).

For platform businesses with zero marginal costs, lowering product costs is irrelevant. And while a strong brand plays its part in fostering customer loyalty, no one goes to LinkedIn because it has a cool logo (it does not). For platforms, one force reigns supreme in building an enduring moat: network effects.

The “network” is the set of participants, both on the demand and supply side, using a platform. The “effect” is the platform becoming more valuable as more participants join. Amazon's vast range of products, enabled by its wide network of sellers, makes it more attractive to shoppers. This, in turn, attracts more sellers. As more teams in an organisation use Slack, its utility grows, making it likelier that the next communication from a colleague will be a Slack message instead of an email.

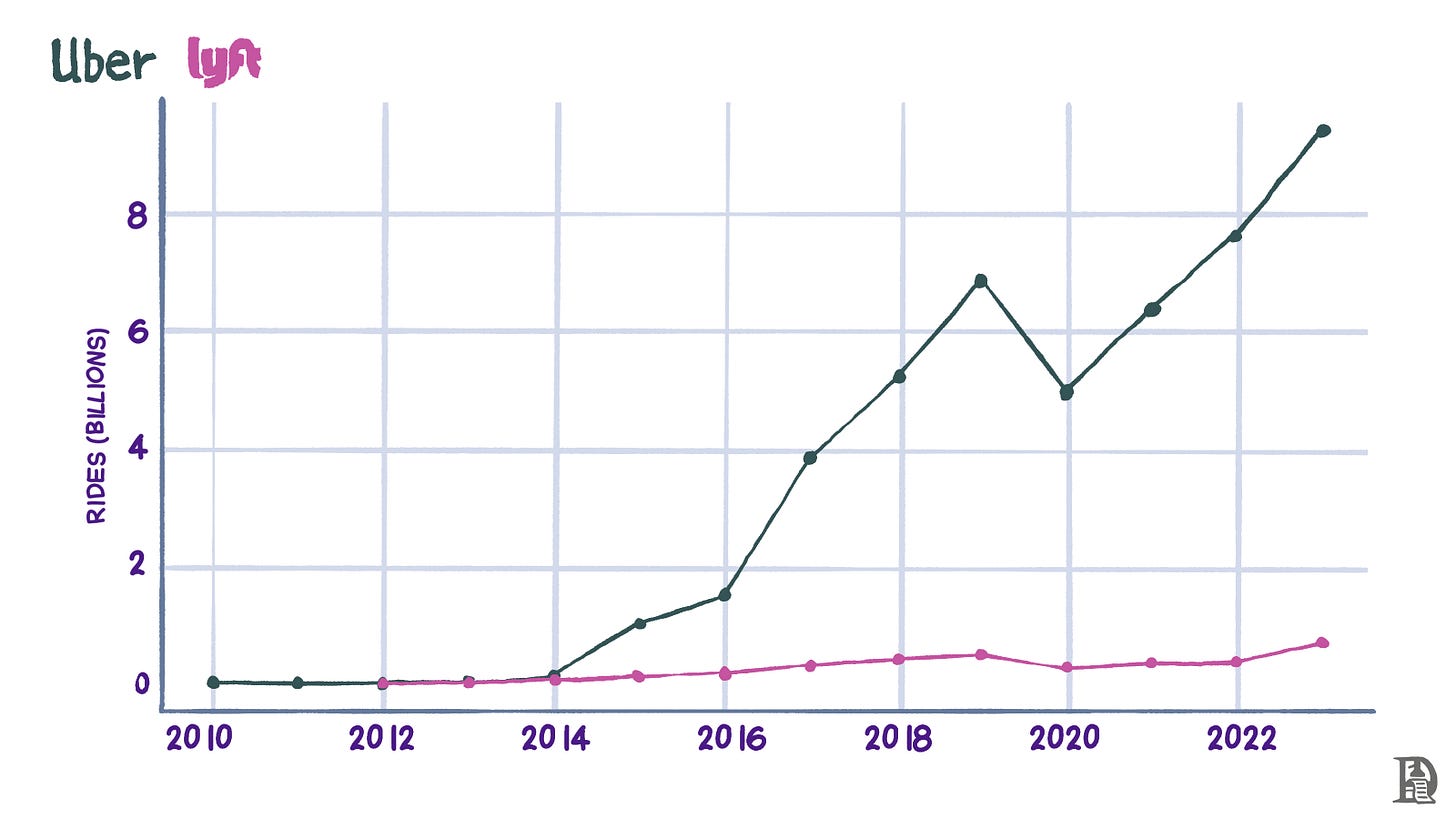

Because platform businesses grow exponentially, once these network effects are in place, they are notoriously difficult to displace. Just ask one of the many social media upstarts that tried to unseat Twitter and Instagram. Or the big-blockers when they forked Bitcoin into Bitcoin Cash. This leads to market structures that are “winner takes all.” Uber and Lyft, both backed by aggressive amounts of capital, battled for years to own the ride-hailing space. Lyft is worth $4.8 billion today. Uber is worth over 25 times that.

If a platform’s value grows as more participants join, then a new platform with only a few participants is, by definition, not very valuable. And if the platform lacks value, why would people join in the first place? Andrew Chen, a general partner at the venture capital firm A16Z and an early member of the Uber growth team, describes this conundrum as the “cold start problem.” Others call it the “chicken and egg problem.”

Solving the cold start problem is an exercise in hustling, scrapping, and, as we will see in many cases, bribing users to join a nascent network. It is the very definition of finding hacks and “doing things that don’t scale.” All with one objective—reaching a critical mass of users to make the platform valuable enough for the exponential growth magic of network effects to kick in.

Solving the cold start problem separates the haves of platform companies from the have-nots. For every Airbnb, there are countless others like 9Flats, Roomorama, and Wimdu—companies you have probably never heard of because they struggled to solve the cold start problem. Uber dominates ride-hailing because it could launch to a critical mass across 70 countries (and 10,000 cities) globally. Lyft could do it only in two.

Building networks and solving the cold start problem is excruciatingly difficult. For starters, you need an insight and a solid product that actually solves people’s problems. We cannot help you with that. Once you have those, you need tremendous grit and, in many cases, operational excellence to make the networks thrive. What we describe next is a set of tools. While these are not magic wands that will instantly solve your problems, they will provide ideas and pathways to making some of them easier.

Show me the Money

One tried-and-tested way to onboard an initial cohort of participants is to use financial incentives.

Both Uber and Lyft used a give/get referral structure where existing and new drivers each received a cash bonus when the existing driver onboarded a new one. During periods of intense competition, like in New York City around New Year's Eve, the two competitors often tried to outdo each other by ramping up incentives. PayPal famously reached 100 million users by giving $10 each to new users and their referrers.

Google, late entrants to the app-based mobile operating system market, realised that they needed a portfolio of high-quality apps to attract device manufacturers and kickstart Android’s network effects. They did this by running two editions of the Android Developer Challenge, with $10 million in prizes across categories for the best applications. Today, Android has over 70% of the smartphone OS market share. With AI, Google finds itself in a similar spot of being late to a high-potential market and is replicating its playbook of using developer competitions to bootstrap adoption.

Financial incentives are a powerful driver of human behaviour and, unsurprisingly, are a highly effective tool in bootstrapping networks. However, companies running such strategies need deep pockets. Uber raised over $20 billion in venture capital, while Lyft raised over $5 billion. Despite its astonishing growth, PayPal perpetually flirted with bankruptcy because of the high burn of its growth strategy. Google’s side quests are funded by its advertisement cash cow business (which accounts for over 75% of revenue).

In many ways, the Bitcoin (BTC) network is similar to platform-based tech companies. On the one hand, you have the supply—a global network of miners who invest time and resources in creating a scarce resource in BTC. On the other, a host of participants, including speculators, long-term holders, and even nation-states, drum up demand for BTC and indirectly compensate miners.

Without the backing of venture capital or a handy cash reserve, the incentives that drove the adoption of Bitcoin looked very different to the other examples we discussed. First, there was a steady emission of tokens to compensate miners. Second, to prevent the value of the network from being diluted by this increasing supply, there needed to be a constant influx of demand.

Where did this demand come from? Mostly from the Bitcoin community’s effort in spreading word about the network and creating tooling that made it easier to use. Yes, part of this stemmed from ideological reasons. However, in holding BTC and, by extension, being part owners of the network, they also benefited financially from growing demand.

This playbook of releasing a token and distributing it among network participants and contributors so that they become stakeholders in its success can create powerful flywheels.

December 2022 was a tough time for members of the Solana community. The project's reputation was tarnished because of its proximity to disgraced FTX founder Sam Bankman-Fried. The value of Solana (SOL), a coin most probably held in decent size, had capitulated 97% from its peak value. Given that the overall market was at its lowest point, layoffs were much more common than hiring posts. If someone had told you then that they were leaving Solana, or even crypto altogether, you would have empathised with them.

Crypto ecosystems are also networks that adhere to network effects. The more participants (developers, traders, evangelists) in an ecosystem, the likelier projects are to build in it. The higher the quality of projects, the easier it is to attract even more members. In Solana’s case, you had a dying network and reeling network effects, with projects shutting down and members leaving in droves.

On Christmas that year, a token called BONK was launched and airdropped (distributed for free) to various contributors in the Solana community—developers, NFT holders, artists, and early adopters. Like the detection of a pulse in a still heart, BONK proved that there were signs of life in a project most thought was dead. It marked a turning point in Solana’s fortunes, with SOL increasing in price by 34% in the two days following its launch. That was just the start. Solana capitalised on this momentum and, through a combination of protocol improvements and high-quality projects, became the success story in crypto over the next 18 months.

Why did BONK have this effect on the Solana community? Imagine you are an out-of-work and out-of-morale Solana developer. You have started looking for other opportunities, maybe in web2. Suddenly, you see $1,000 appear in your wallet. You try claiming it, and it is a seamless experience; the tech is still solid. Now you also have some money to pay bills. You decide to stick around for a bit. Aggregate this across thousands of cases and you have a revived community.

Today, BONK is worth over a billion dollars.

Blackbird is a startup that aims to improve the economics of the restaurant industry by reducing payment fees and building customer loyalty programs. In an attempt to build a network of restaurants and diners as the supply-and-demand side participants, they are using the $FLY token to drive desired behaviour. Every time a diner eats at a Blackbird-partnered restaurant, they earn some amount of $FLY. They can spend these tokens to either settle bills and earn perks or as a way to signal to other restaurants that they are valuable customers. Diners can also earn $FLY in various other ways, including signing up to the platform itself. Thus, $FLY acts as both an acquisition and retention tool for the network.

The recent emergence of “points” is another tool projects have to leverage the benefits of collective ownership before they are ready to release a token.

The Ethereum restaking protocol EigenLayer used the power of points to amass over $10 billion in locked assets as it looked to bootstrap its security marketplace (which directly derives its security from a healthy sum of locked capital). Users earned points based on the amount of capital they locked up. Then, once the EIGEN token launched, they could exchange these points for it. Other restaking followed in EigenLayer’s footsteps.

Founders should keep in mind that the incentives of any form—cash, tokens, or points—cannot compensate for the lack of a network solving a real problem. Incentives were effective for Uber and Lyft because they provided a 10x better experience for a drunk partygoer looking for a cab home at 4 AM on a Sunday morning. Compared to the pain of online payments, PayPal was magic, and once a user earned their $10, they were likely to stick around over inferior incumbents.

Bitcoin is where it is today because it provides money with characteristics that fiat-based alternatives simply cannot. BONK helped revitalise the community because Solana had superior technology and a clear value proposition over competitors. $FLY works for Blackbird because it solves pressing problems for restaurants and diners.

The problem all too often is that teams try to stick token incentives on a product that does not solve a user problem. Naturally, given the nature of crypto, this can drive temporary speculation and result in sky-high valuations. Yet, unless there is a reason to hold a token beyond just making a quick buck, the hype will soon die away (as one too many play-to-earn projects found out).

It bears repeating: only once you have a unique insight and a strong product can tools like incentives help you bootstrap a community.

Piggybacking

Our world is rich with networks, both physical and digital, and we’re all part of many of them at the same time. At a personal level, I belong to networks such as the various educational institutions I attended, previous employers, the apps I showed you earlier, my local neighbourhood, and my country’s identity and financial systems. Another powerful way for founders to bootstrap networks is to piggyback on these pre-existing ones.

In my home country of India, the government provides elaborate infrastructure for companies to access a user’s identity (Aadhar) and financial information with explicit consent. This powers operations for diverse companies—from mobile network operators issuing new connections to fintech upstarts offering improved financial services—to easily collect pre-existing user information and launch their respective networks.

To bootstrap its first set of users, Mark Zuckerberg launched Facebook exclusively for Harvard students. He piggybacked off this established network using student email addresses as membership identifiers. As the product gained popularity, he expanded to other universities and eventually to the whole world.

A few years later, once Facebook’s networks were global and extensive, Zynga, the social gaming company, used these pre-existing connections to enable users to play games with their friends. The company benefited greatly from these established networks and amassed millions of users rapidly.

In their early years, Tinder also required users to sign up with Facebook, automatically populating profile pictures, friends, and interests to facilitate more meaningful matches quickly.

However, relying on pre-existing networks, particularly the ones owned by private companies, is risky. Both Zynga and Tinder, built on APIs provided by Facebook, learned this the hard way. A major part of Zynga’s growth stemmed from the developer’s ability to automatically post in-game updates on a user’s behalf. Starting in 2011, Facebook restricted this capability, severely hampering Zynga’s growth to levels from which they arguably never recovered.

Similarly, after Facebook implemented API changes restricting the amount of data third-party apps could access, Tinder could no longer retrieve detailed information about users' friends and interests. This impeded their ability to onboard and profile users, hampering match quality. Countless other startups have faltered after such debilitating changes by the internet networks they relied upon.

As discussed earlier, blockchains are also networks of participants containing a wealth of information about their members. Where they differ from closed networks like Facebook is in their openness. All information on the blockchain is transparently visible to everyone in perpetuity, making them an ideal choice for app developers to piggyback on without stressing about their data sources vanishing.

Each blockchain application also has its own network that resides on-chain, and other developers can use that. This makes it attractive and popular to build platform businesses like aggregators (as Joel wrote about a couple of years ago).

However, the flip side to this openness is that it becomes harder for on-chain applications to build network-based moats due to the threat of vampire attacks. A vampire attack occurs when a new platform entices users and liquidity away from established competitors by leveraging token incentives and on-chain data.

OpenSea dominated the NFT market for years. However, a certain user persona—the high-frequency NFT trader—was underserved by their product. When Blur, a marketplace designed with these users in mind, launched, it vampire-attacked OpenSea, attracting these users with strong token incentives. It just so happened that these users also drove the most volume (and revenue), leading Blur to surpass OpenSea.

In other instances, such as when Sushiswap vampire attacked Uniswap, the incumbent, after temporarily stumbling, could recoup its market share by launching its own token and maintaining a superior product.

The lesson here is that if a new competitor with a meaningfully better offering for users emerges, vampire attacks give them an invaluable tool to bootstrap a network and take market share off of incumbents.

We are also witnessing the emergence of a new wave of social products like Farcaster and Lens that are open-network-first. While not all their data resides on the blockchain, these networks still adhere to the principles of openness and transparency, encouraging others to build products on them. Farcaster, in particular, has attracted a host of builders, including Decentralised.co portfolio company Wildcard and integrations with prominent consumer products like Zora.

While new crypto apps can piggyback off blockchain data, networks created by other blockchain apps, or open networks like Farcaster, each of these is still in its infancy and do not provide data as rich as semi-digital networks like India’s Aadhar or full-fledged digital networks like Facebook.

Consider DeFi. While crypto has created robust decentralised exchanges and overcollateralised lending schemes, it still cannot provide users with an easy way to secure undercollateralised loans. This limitation stems from the lack of a user’s off-chain identity and financial data. Partly, this is because crypto emerged from anti-establishment ideological forces, and bringing establishment data on-chain often meets resistance.

The bigger problem, however, is that there is no easy way for blockchains to access external data. This is by design. Blockchains are highly trusted environments where every data point on the ledger should be traceable back to its source and replicated across numerous independent computers. Allowing external data calls would compromise this chain of trust.

Oracle services, such as Chainlink, offer a solution for bringing off-chain information to the blockchain. They employ multiple nodes that aggregate data from diverse sources and coordinate to post verified information on-chain. However, Oracles are only useful for publicly available data like financial information. They cannot access private data such as a user’s Facebook friends. Moreover, such information should not reside on a transparent, public ledger anyway.

A recent innovation in cryptography called Zero-Knowledge Transport Layer Service (or zkTLS) alters this dynamic. Imagine if you could prove your bank balance or social media follower count to someone, and they could be certain that this information came directly from the bank or social media platform without any possibility of you tampering with it. That is what zkTLS enables. So, how does it work?

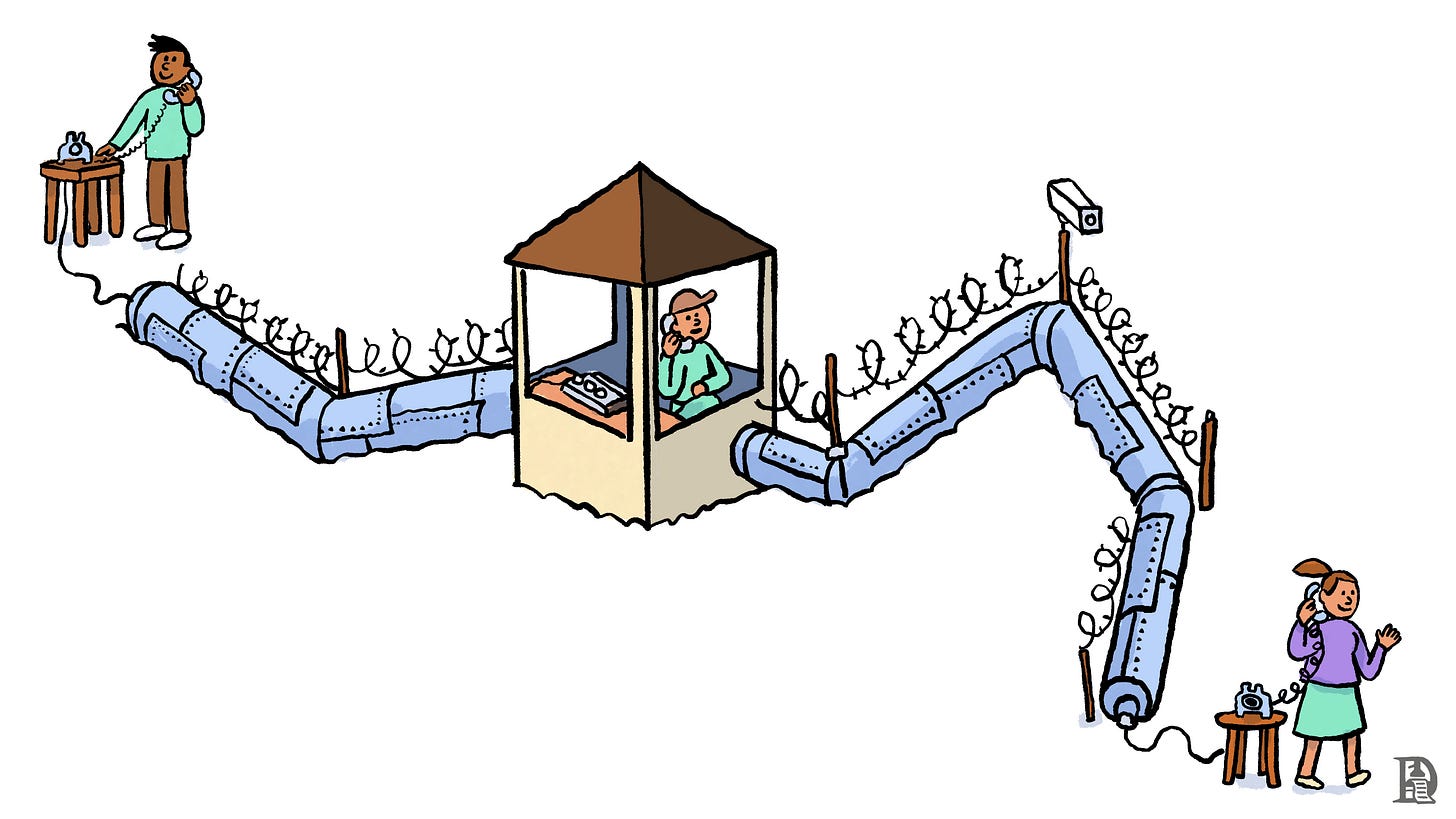

A TLS (Transport Layer Security) connection between a client (like your phone) and server (like your bank) provides assurances such as the server’s authenticity (your bank balance is coming from your bank) and the shared data’s confidentiality (no one could read the balance) and integrity (the balance is correct and untampered).

TLS has become the de facto security standard for the internet, securing over 95% of all connections. Notice the ‘s’ in ‘https’ in most URLs, indicating that the connection is secured by TLS. TLS is ubiquitous across every online interaction we have—from the web we browse to the apps we use and when applications communicate with each other using APIs.

zkTLS introduces a third party, a verifier, into the secure connection between a client and a server. This verifier can authenticate the communication without compromising its security.

There are two main approaches to implementing zkTLS. One method uses a proxy server that acts as an intermediary, observing the encrypted communication and partially decrypting it to verify the client's credentials.

The other approach employs multi-party computation (MPC), where the client and verifier communicate with the server, allowing the verifier to attest to the message’s authenticity without the server knowing about its presence.

To maintain privacy, the client uses zero-knowledge proofs to demonstrate specific facts about the data without revealing the actual information. For example, the proof could show that their bank balance is over $1000 on a specific date rather than disclosing the exact amount. Or, I could prove that my wallet is owned by a verified Indian citizen without revealing other details like my name or date of birth. These proofs can then be recorded on a blockchain, where they exist in perpetuity for other applications to access and verify.

zkTLS is extremely powerful for three reasons:

The proof of our belonging to many networks resides on the internet. This includes digital-first networks like social media, of course, but also physical networks like the university we attend.

We can generate these proofs without any permission from the platform.

zkTLS is not limited to blockchain applications. It can also be used by one web2 network looking to piggyback on another.

For instance, Amazon doesn't provide an API (Application Programming Interface) for others to view my purchase history. Yet I can use zkTLS to share parts of my Amazon purchase history with a newly opened camera store, securing a discount by proving I've spent over $1000 on equipment in the past year.

By allowing users to permissionlessly port any aspect of their identity on the internet, zkTLS provides new networks with a powerful way to piggyback on existing ones.

For instance, zkPass, a project implementing MPC-based zkTLS, lets users verify their traditional finance credit scores on-chain. Reclaim Protocol, which provides proxy-based TLS, powers Equal, a SaaS company that enables applications to verify a user’s address quickly by checking orders from Swiggy, a food delivery app, instead of the user having to upload an ID proof.

Curation

Compare the thought process of booking a room with a hotel chain like Hilton to Airbnb.

With Hilton, you have a set baseline of expectations—a clean room, a decent breakfast buffet, basic amenities like a gym, and respectable customer service. Beyond these, your only considerations are price and location. You do not need to read reviews for a specific room or even the hotel itself to make your decision. You know what to expect.

The booking experience for Airbnb could not be more different. There is no standard, and the variance is much higher. One listing could be a shack on a beach, while another a glass dome at the edge of a cliff. The possibility of having an exceptional and disappointing experience is much higher than with a hotel chain. How do customers make a decision?

They rely on ratings and reviews. The aggregate experiences of other users compensate for the lack of the uniformity a brand provides. Airbnb understands this well and provides tags like “Superhost” and “Guest Favourite” to aid users in their decision-making.

According to cofounder Nate Blecharczyk, 300 listings, with 100 reviewed listings, is the magic number for growth to take off in new markets. Booking.com is (in)famous for the number of nudges, some subtle, others not so much, they display on their platform.

Curation is a core feature for platform companies. Platforms typically offer an abundance of options spanning a wide range of qualities. Without a way for users to separate the wheat from the chaff, they will be overwhelmed and return to the safer havens of pipeline companies. Uber has driver ratings. Upwork has freelancer ratings and reviews. X has a range of verified account options. Reviews drive purchases on e-commerce sites.

The challenge for early-stage networks is that most curation data depends on prior customer interactions, so they lack sufficient information to give to early users. Similar to finding a critical mass of early adopters, this is a hard “chicken and egg” problem to solve. We’ve seen founders of successful platforms resort to various measures— from innovative to hacky—to overcome it.

In the early days of content platforms like Reddit and Quora, there was naturally an absence of content. In both cases, founders and early team members manually populated each platform with curated links and answers to questions.

Similarly, when LinkedIn first launched its content feed, it was only open to “top voices” rather than the general public. This ensured that the initial days of the feed had a minimum quality standard. Dan Romero of Farcaster manually boosted high-quality accounts in the algorithm in its early days.

Another way for platforms to kickstart curation is to build on the pre-existing curation of physical or digital networks. Bing and Yahoo partnered with Yelp to populate reviews for their local search. The real-estate platform Zillow populated its product by purchasing proprietary property data. Justdial, an Indian local business search engine service, borrowed its initial listings from the physical Yellow Pages. Amazon purchased Goodreads partly for their trove of high-quality book reviews and recommendations.

Given the importance of ratings and the painstaking measures platforms undertake to populate them, they are understandably protective about sharing them with outsiders. Very few provide APIs for others to access them.

In cases where reviews from one platform were integrated into another, like Yelp and search engines or Amazon and Goodreads, these were paid commercial deals. This makes it extremely difficult for founders of nascent networks to leverage the curation metrics of incumbent platforms.

zkTLS, once again, provides a solution.

Teleport, which is looking to build an on-chain ride-hailing app, is using zkTLS to allow drivers to port their Uber ratings. Nosh, an on-chain food delivery app, is doing the same for restaurant reviews from Doordash. The best (or worst, depending on whose side you are on) part is that there is nothing Uber or Doordash can do about this! Both Teleport and Noosh are using Opacity Network for the zkTLS tech.

zkTLS can be used for the curation of all forms of networks—from a new e-commerce store looking to onboard reputed Amazon sellers to a freelancer app looking to aggregate reviews from multiple platforms like LinkedIn, Upwork, and Fiverr.

Starting Afresh

In 2021, amid the pandemic, Joel participated in a landmark study surveying over 4,000 gig economy workers in India—the largest of its kind. The study aimed to uncover the challenges these workers face when employed by platform companies. At the top of the list: lack of data portability.

Gig economy workers often find themselves tethered to platforms where they've invested years building their reputations. When a new platform offering better opportunities emerges, these workers cannot easily transition without starting from scratch. This occurs because established platforms won’t let them export their data elsewhere. This dynamic enables mature platforms to maintain market dominance and increase their take rates while limiting worker mobility. Indeed, 78% of surveyed workers had held fewer than two jobs since 2015.

This lock in also has second-order effects. Unable to prove their work history, workers struggle to access essential financial services such as loans and insurance. Given that most come from low-income backgrounds, this further impedes their social mobility.

I don’t know about you but for me, such conditions border on digital servitude. In a tale as old as time, you have a powerful force exploiting the masses while holding all the cards. Only in today’s world, we can’t see these overlords. They are mere icons on our mobile phones.

This state of digital servitude extends beyond gig economy workers and also applies to you, me, and nearly every person or business we know—albeit in different forms. No matter how hard I try, I can’t stop scrolling through X for 30 minutes every morning. For my partner, the poison is Instagram. Businesses, both small and large, suffer without a social media presence. Even tourist destinations fall prey to this invisible hand.

For those of us who have grown up alongside the internet, it's difficult to envision a world without it. Yet, from a broader historical perspective, the internet—in its useful form—is less than 30 years old. Today's dominant platforms are merely the first iterations of businesses built upon this foundation. We embraced them for their convenience and unprecedented options. Few could have predicted that the trade-off would be digital servitude.

Now, we’re wiser. When the next iteration of these platforms emerge, we will demand better.

Earlier, I mentioned how hard it is to break network effects. Why then do I anticipate future iterations of platforms? Most empires, even the strongest ones, do eventually end up crumbling. We’re already seeing early signs of this digital decline. Google faces an existential threat from AI and potential antitrust action by the US government. Facebook is grappling with stagnating or declining user growth across its social platforms. TikTok’s geopolitical issues are well documented. After a brief honeymoon period, many now express a preference for hotels over Airbnbs.

Some of these changes are imminent; others will unfold over years. As is often the case, the revolution will be led by small teams with a powerful vision for reshaping the world.

When these new platforms arrive, they will have a powerful set of crypto tools to aid them in their mission.

Playing around with my new drone,

Shlok Khemani

If you liked reading this, check these out next: