Bearproof Treasuries

Surviving 90% Drawdowns

Hello!

Few things before we begin

We will be at Token2049 next week.

Drop in an e-mail response to this newsletter if you’d like to meet.There will be no paid pieces next week (Tuesday and Friday).

The long form will arrive mid-week.Use this link to share the article with friends for free.

Back to the article now..

Nima Capital received a SYN token grant from Synapse for agreeing to provide $40 million in bridge liquidity for 12 months starting in March 2023. On September 5, the SYN token suffered a ~25% drop after its partner Nima Capital breached the agreement by removing liquidity and selling its grant.

We don't know whether Nima Capital suffered a hack or consciously walked away from the agreement, but it got us thinking about the challenges of maintaining token treasuries. This piece explores why treasury diversification becomes critical and what projects can do to survive harsh crypto winters like the one we are in right now.

When the going gets tough, selling seems to be the only option. During the good times, you use Nansen to understand who else has bought the token to buy before it is too late. Similarly, during the bad times, you check Nansen to see who is offloading tokens and to get out before the liquidity dries up. Selling seems like the equilibrium for you in this game-theoretic situation.

A matrix for the game theoretical outcomes would look like the visual below.

Tokens tend to lose over 90% of their value in due time, much like SPACs of the years past. Investors don't want to hold on to their inventory of tokens if they do not have high conviction on the asset. If you don't sell before or when others sell, you'll end up 'bag holding' and hoping for a market recovery.

Of course, timing the top is almost always impossible. The next best thing is to sell around the top because prices start dropping due to a lack of buyers. Every incremental sale causes a more significant drop in the price. Strategically, it is better to sell early than late if a downtrend becomes obvious.

The fear of losing capital drives investors to sell while the opportunity still exists. (Fiduciary duty is what the cool kids seem to be calling it.)

Investors can diversify and rebalance portfolios to ensure low drawdowns. However, most Web3 protocols cannot do this, and their treasuries are vulnerable to the token's price performance. The following chart shows treasuries and their breakdowns for some DeFi protocols. Arbitrum and Mantle stand out – they have around the same in respective treasuries, but their distributions differ.

Mantle has only ~40% in its token, whereas Arbitrum's treasury comprises entirely of ARB. As with most things in life - token treasuries, are a spectrum.

Protocols have operational expenses in both bull and bear markets. These expenses are usually incurred in fiat currencies. Ideally, the treasury value should not swing wildly as the token price finds its fair value. Holding the entirety of the treasury in a native asset (like UNI) exposes the team’s morale to swinging prices.

Something you don’t exactly want to do. This is why compensation in the traditional world is a mix of dollars (fiat) and equity-based. Teams have been trying to work around this problem for quite some time in crypto. We studied several approaches that have emerged in the market over the years and their after-effects.

Treasury token sales

Selling a part of the token’s treasury is similar to a follow-on round in the equity world. Teams sell a portion of the tokens they hold to willing buyers at prices they are willing to buy. Since these sales happen at a higher valuation from launch, they sell only a smaller portion of their holdings. For investors, the upside is that they have a functional token with active listings when purchasing tokens.

The “premium” is for the liquidity profile of the asset. Generally, these sales solve two problems for a token. They -

Convert part of the protocol's treasury to stable assets

Use the VC or fund's network for things outside the core team's competence

Keeping part of the treasury in stable assets matters because expenses always remain stable. (There's inflation, but it's not as volatile as token prices.) For example, say a protocol has a treasury of $100 million with a yearly burn of $3 million. If the token price drops by 95%, the treasury will now be worth only $5 million. (5% of $100 million)

Their runway just went from 33 years to less than two years. If 15–20% of the treasury is converted to stable assets during a bull market, the team can ensure a five- to six-year runway, regardless of market conditions.

Selling tokens in the open market is almost always a bad idea. Others can frontrun you and cause panic in the markets. Also, the liquidity is usually low for large treasuries to diversify meaningfully.

According to CoinGecko, the -2% depth for Uniswap (UNI) across the top five venues is less than $5 million, and the same is less than $1 million per CoinMarketCap. Even if we consider the higher estimate ($5 million), Uniswap can only diversify 0.2% of its treasury without impacting the price by more than 2%.

The team at Uniswap would not go and dump it directly on an exchange. Service providers like OTC desks and prime brokers facilitate such transactions. But without a healthy ecosystem of growth-round investors (like Tiger Global or Coatue from last year), that order flow would eventually find its way to an exchange where it adds to sell pressure.

The following chart shows some projects that raised funds from investors and whether it has helped them. BadgerDAO raised $21 million in March 2021 from investors. This amount was 6% of the market capitalisation then. The token has lost 96% of its value since its raise.

Currently, the treasury has ~$4.6 million (~26% of the total treasury) worth of stablecoins. On-chain analysis shows that one of the investors received $1.25 million in BADGER tokens, and they moved all tokens to an OTC desk (presumably to sell). The investor's address did not hold any BADGER tokens at the time of writing.

The obvious caveat for the data above is that the market has had a draw-down over the last few years. Tokens may have seen a dip in price regardless of their treasury sales. We are not trying to show that investors sell their tokens here. The point is that treasury diversification sales do not guarantee that investors will hold on to their tokens. When projects sell tokens to investors, there is no guarantee that investors will hold them for eternity.

There are examples where investors sold within months (Badger) and held on for longer (Lido). As market conditions change, they can sell tokens as they see fit, as long as they do so outside the lock-up periods. Although these types of sales do not insulate token price from the same fate as the broader market, because the treasuries of teams making such sales now comprise stable assets, they help protocols power through the bear markets.

Raising money from investors is easier said than done. When the protocol is out in the open, it has a live community that usually discusses and debates when it is time to raise new funds using treasury tokens. In the age of “decentralised governance”, selling a token’s treasury for fundraising requires convincing community members.

Sushi is an example of how governance can get messy. In July 2021, a proposal for a strategic raise was put forward by 0xMaki. After a lot of back and forth, the proposal was withdrawn. The plan was to sell $60 million worth of SUSHI tokens (25% of the developer treasury was initially to be allocated to community members).

The token's market price was ~$8, whereas the proposed selling price to investors was ~$6, a 25% discount. The discount came as a package deal with a lockup for which the investors could not sell their SUSHI tokens. As of September 7, 2023, the price of the SUSHI token is ~$0.6.

Had the community passed the proposal, it would have saved ~25% of the treasury from a 93.5% drawdown.

Selling tokens doesn’t always mean investors or funds are the counterparty. One can make a case for different DeFi protocols swapping each other’s tokens to diversify treasuries. This approach has limitations because almost all DeFi tokens are highly correlated. Swapping one for another is unlikely to protect any protocol treasury from severe drawdowns.

Using Derivatives

Financial markets have already figured out clever ways to hedge things. Oil and gas companies, airlines, agricultural product manufacturers, and many other manufacturing industries rely on commodities as inputs to their production units. They often engage in hedging using futures and options.

Hypothetically, the same can be done for treasury tokens. The most straightforward strategy is to sell out-of-the-money (OTM) calls and puts. This way, the treasury sells high and buys low. Of course, one can combine futures and multiple dated options to try to achieve the ideal delta for the portfolio, as the aim is not to make money from trading operations but to ensure that the protocol always has sustainable capital and price drops don't force shutting shop.

An OTM derivative is a bet that the token’s price will not fluctuate wildly within a short period. A call option sold at an all-time high (ATH) of the token’s price (like in the chart below) should generally be acceptable, as any loss is covered by the appreciation of the token’s treasury. The challenge is with the signalling of such an operation. It could create complexities regarding information asymmetry between a team selling options for its token and buyers of such an asset.

Would you buy call or put options from Apple if they sold it to you? Would that be ethical? We don’t know, but here’s what we do know: Despite derivatives being an elegant solution, the state of options markets in Web3 leaves much to be desired. The lack of liquidity except for ETH and BTC means that this solution is perhaps far out in the future. Market makers have tried to engage with protocols to devise derivative strategies to maintain treasuries. Still, the efforts have not yielded any results as far as we could see.

It also doesn’t help that several prominent market makers in crypto have stepped back from active presence in the industry.

Joel’s note: I strongly suggest following long-time supporters of this blog - Laura and Samneet to stay updated on all things options

Use debt financing

Companies often use debt as a tool to finance their ongoing operations. For founders and companies, borrowing against their tokens is often a more tax-efficient option than selling tokens/shares. Using any form of leverage or debt is not without disadvantages.

When tokens lose value (in crypto, tokens often lose 90% of their value), there's always a risk of margin calls and their cascading effects. One instance of a token’s founder using debt has been quite public recently. While not a case of “treasury diversification,” it is a good study of what happens when tokens are used for debt.

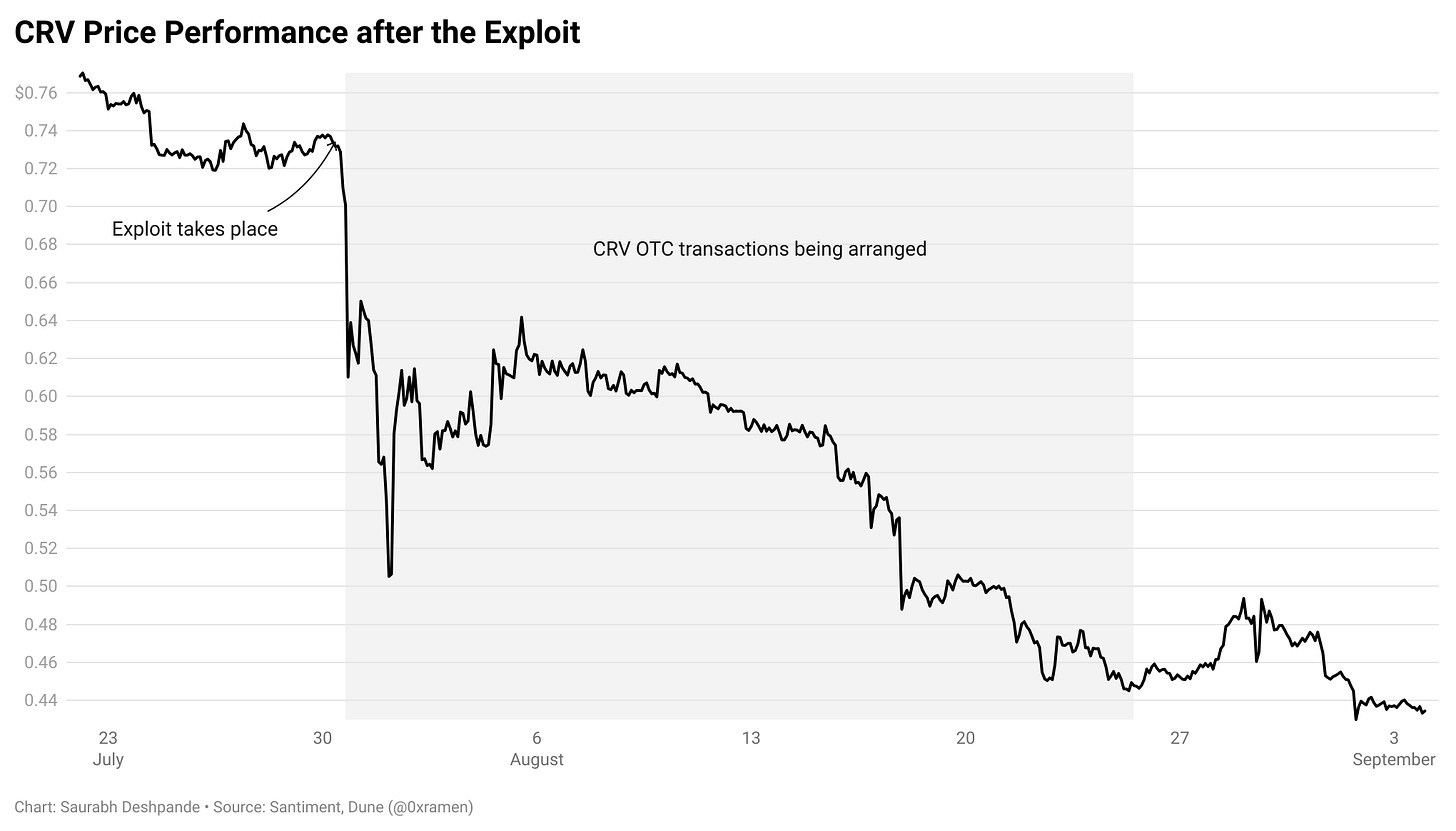

Recently, Curve was hacked for ~$50 million. Curve's CEO, Michael Egorov, had borrowed against ~427.5 million CRV (~49% of the total market capitalisation). After the exploit, the token price started to drop, and there was a risk of contagion emanating from Micheal's forced CRV liquidations. Protocols like Frax increase interest rates exponentially when the utilisation factor reaches 100%. Frax's model doubles the interest rate every 12 hours at 100% utilisation (which was hit as the price dropped).

Micheal had to sell his tokens to investors and market makers through OTC desks. As of August 25, $64.2 million worth (160.6 million CRV) OTC deals have been arranged.

Unlike stocks in the equity market, tokens are highly volatile. Despite the current low volatility environment, Bitcoin's volatility (30D annualised) is around 40%, and the same for the S&P 500 is ~14%. Altcoins like Curve’s tokens are typically more volatile than Bitcoin. It is not far-fetched to say that crypto markets are not mature enough to pledge tokens to raise debt in a personal capacity or for the project without jeopardising events like Curve.

Long story short: using tokens as collateral will not help in meaningfully diversifying the treasury without risks, but they can issue convertible notes where, after certain events trigger, the debt converts into tokens. The general risk with such an approach is that market participants are incentivised to pursue it once a liquidation price becomes evident.

Use of range tokens

Range tokens, introduced by the UMA protocol, borrow from options and convertible notes. They are called range tokens because the buyer is protected within a range. They are exposed to the downside and upside on either side of the range.

A seller (like a token’s treasury) optimises to avoid suffering when prices drop. There's no free lunch in markets. If they are to stop this suffering (which means someone is willing to bear the cost), they must also let go of the upside (the counterparty benefits here). In a nutshell, this is how range tokens work:

There's a cap to the number of tokens the DAO will give away on expiry. The investor is also guaranteed a minimum number of tokens. There will be a predetermined expiry date at the time of issuance.

Say the DAO defines its range as $20 to $40. For a $100 loan, the investor receives a minimum of 5 and a maximum of 2.5 tokens.

If the price on expiry is below $20, the investor gets 5 tokens (per $100 invested) and 2.5 tokens for any price above $40. The number of tokens in between is 100/(price on expiry).

This is what the payoff would look like for the investor:

Range tokens are similar to selling call and put options (as in the previous chart). They are simple versions of selling options since complications around the time decay of options pricing are not involved. Despite being a more straightforward instrument, range tokens' adoption to diversify treasuries remains low.

Issue new tokens

We have discussed four mechanisms to raise money. None of which have scaled. Maybe it’s worth looking at what happens in the traditional world at this point.

In public markets, companies can raise more money via equity even after their IPOs in two broad categories of ways – non-dilutive and dilutive. When a company wants to raise money without issuing new shares (non-dilutive), typically, companies can issue their treasury stock (the company's stock in its treasury) to the public. This increases the outstanding stock on the open market, but the total number of shares remains the same, bringing in capital for the company.

Companies can also raise money via a follow-on public offering (FPO). In this case, the number of outstanding shares and the total number of shares increase. It is a dilutive process as the denominator increases. Companies need to justify how the raised capital will increase the value for investors despite reducing their share in the company.

Most of the crypto protocols are not at a 'revenue-generating' stage. Therefore, issuing new tokens to raise more money will likely be met with much scepticism.

When a protocol diversifies its treasury, someone else is willing to take a piece of the treasury. Why would anyone do that? Because they think that owning this token will be profitable for them.

Though it seems obvious, the best way to help your diversification is to ensure the protocol has some revenue or the possibility of earning revenue.

Projects like Lido and Blur fit the bill. If Blur goes out to sell its treasury tokens, it will probably be able to do so on favourable terms because even though it no longer makes money, it will likely make money in the future. Lido already has a cash flow as it charges fees on rewards earned by stakers. This is why investors held on to the tokens they bought in Lido's treasury diversification token sale last year.

Part of the challenge with diversifying treasuries is that, too often, the tokens have not vested for founders or investors. So, at any point, doing complex financial strategies with assets that are not yet liquid becomes difficult. When they become transferable (through vesting), the markets rapidly price in any strategic sale, yield farming strategy or loan conducted by the time. It is simultaneously a bug and a feature.

For token projects with liquid treasuries, the learning is quite simple. Diversification helps when valuations are in your favour. They may leave money on the table by selling the tokens at less-than-peak valuations, but they also extend their runway long enough to survive market cycles.

Currently, there is no magical solution for treasury diversification (if you have one, please let us know). But here’s what’s becoming evident. The market has just two kinds of projects at this point. The ones that can survive a steep draw-down and not be bothered due to existing runway. (Uniswap fits that description well. Their treasury went from $20 billion to $1.5 billion.) And the ones that may have to consider selling their tokens at steep discounts to ensure they can continue operating.

Until next time,

Saurabh

If you liked reading this, check these out next:

- Financial Derivatives in Crypto