How To Take Over A DAO?

Asking for a friend.

Hello!

This is the last of the beta versions of our paid newsletter. We will be announcing this to the broader community on Tuesday. We may or may not have some goodies for readers that have sent in feedback.

Physicists claim that about 13.8 billion years ago, our universe was condensed in an almost infinitely dense spot. Today, the observable universe has over a trillion galaxies, each with billions of stars on average.

In much the same way, projects start with a few members who control and steer it initially, then gradually add more members to reduce power concentration with each member. Projects seek what Jesse Walden calls progressive decentralisation.

But why decentralisation? Sometimes, it is self-evident as it is with Bitcoin and Ethereum. You want more minor participants to understand whether they independently get what’s due to them. You want people to be able to run light nodes on everyday computers. But in many cases, the motivation for decentralisation is different and quite apparent to those who see through the (frequent) layers of nonsense.

When a project is “sufficiently decentralised”, its token is (claimed to be) less likely to be termed a security. And why do you need a token? The more decentralised you appear to be, the lower your perceived risks from legal actors. One challenge with “not being a security” is ensuring your token captures no value. Dividends? Not allowed. Fee shares? Nope. Often, not even a claim to the IP rights of a product.

It is one of the reasons why we don’t flick the fee switch in favour of UNI token holders. Because if we do that, UNI holders have a reasonable expectation of profits to be derived from the efforts of others. That is one of the criteria of the Howey test used to determine whether an asset is a security.

The easiest way to get out of this is to have the token as a utility token (think casino chips) or a governance token.

A DAO working properly does not always translate to price action as their tokens are not designed for value capture. During the ICO boom, many projects raised money in ETH. Years later, their treasury ballooned to be worth hundreds of millions - due to appreciation of ETH’s price. In bear markets (like the one we are in right now), the value of these governance tokens falls quicker than the value of assets like ETH or BTC. This results in treasury value being higher than the value of circulating tokens or the market cap of the governance token.

This reminds me of Microstrategy’s Bitcoin holdings. The stock itself could prove to be worthless, but the Bitcoin being held by the firm can grow to be of tremendous value in the years to come

In financial terms, the book value of the token is higher than its market value. This is where the governance gets messy. Because the situation creates a divide between token holders and those who control the treasury. Those who control and rely on the treasury for operational expenses are not as incentivised as token holders to increase value going to the tokens.

DigixDAO, Gnosis, Aragon, and Rook were similar in that they faced conflicts because the market value of the tokens was lower than the value controlled by the treasury.

Apathy Everywhere

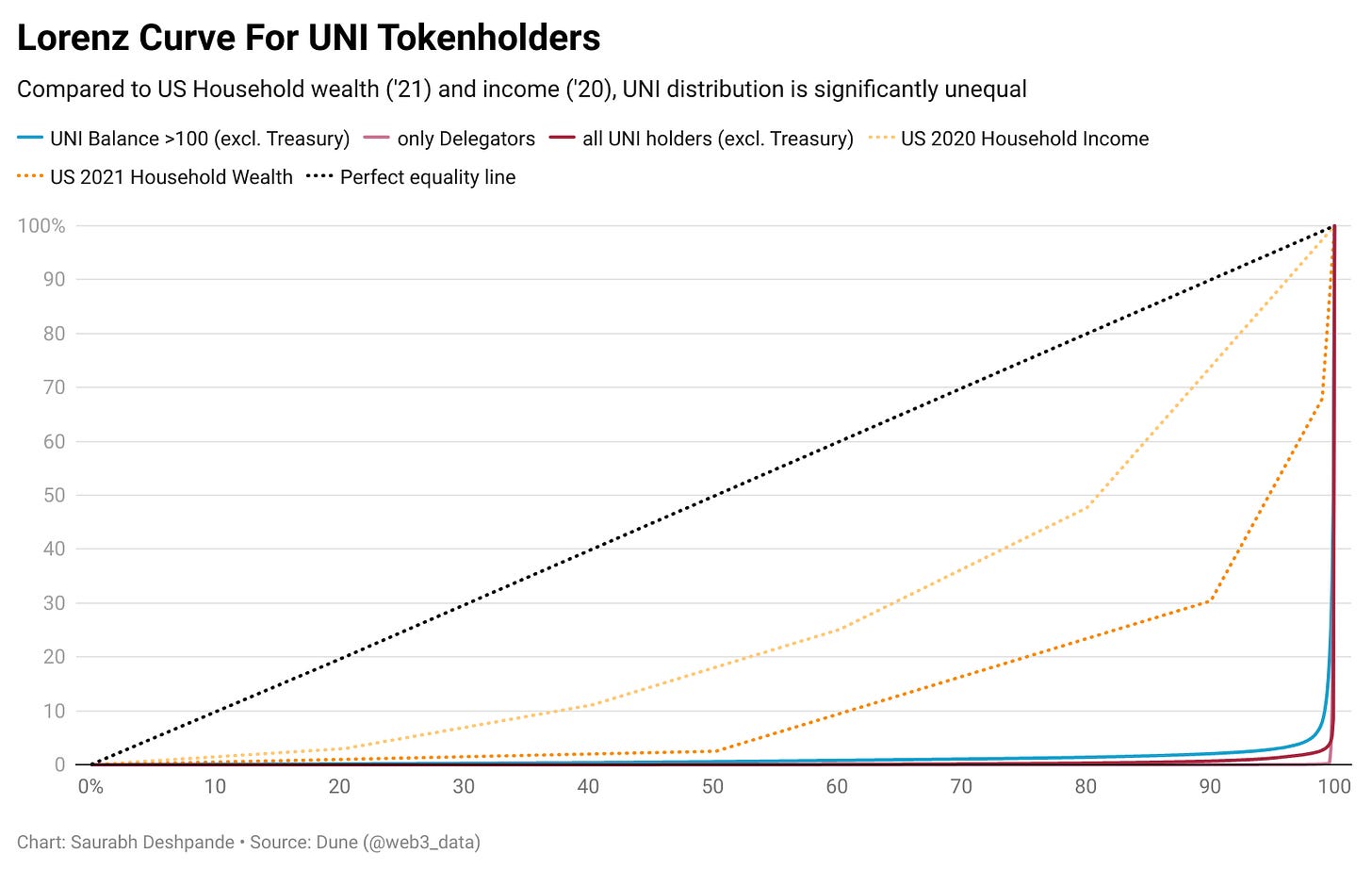

DeFi tokens have a high gini coefficient. It is a fancy way to say that a few control many tokens. Here’s an example of the UNI token holder pattern. The following chart plots the Lorenz curve for the UNI token and compares it against other curves like US Household wealth.

Lorenz curve shows how the ownership changes as more population is added. The X-axis represents the population percentage, and the Y-axis represents the ownership percentage. The perfectly equal line shows the distribution in an ecosystem where everyone is an equal owner.

For example, in the case of UNI (whether it is delegated, holders with more than 100 tokens or all holders), almost 98% of the holders control less than 10% of the supply.

The top 2% control more than 90% of it.

This paper studied token holding patterns, tokens and coins and found that tokens like LINK and MATIC are significantly concentrated in the hands of a few. The following table shows the GINI coefficients of multiple tokens. 84.6 for Top 100 LINK holders indicates that 84.6% of the LINK are with top 100 addresses.

Smaller token holders do not feel their vote matter as the top holders will always get their way. So, they don’t bother with voting and keeping up with what is happening with the project. Voter apathy is not a crypto-native issue. In the equities world, retail participation hovers around 28% compared to 90%+ involvement of institutional investors.

Having more skin in the game and being able to impact the outcome drive participation in the governance process.

The voting patterns for three leading DeFi protocols suggest a clear pattern across the board. More than 90% of token holders do not bother voting. Quorums for Compound and Uniswap are 4% each and set at a variable for Aave. As of writing this, of the 62 DAOs being tracked by Nansen, only four had active proposals. Only two of those four had more than ten active voters on live proposals. It appears people don’t want to govern.

The token’s price and treasury balances get disconnected over an extended period. Low token prices combined with uninterested voters create a vulnerable combination for DAOs. As risk-free value (RFV), raiders can now target these DAOs by –

Creating a divide within the community with treasury controllers on one side and token holders on the other.

And acquiring tokens cheaply to effect any governance outcome.

You get the story. A very small fraction of token holders bother with voting when it comes to governance. When the treasury value is higher than the market cap, it is possible to convince some token holders that liquidating the DAO benefits them since they get more than a dollar for every dollar of their current market value.

The assumption is that on the dissolution of a DAO, the treasury’s ETH (or other asset) holdings will be distributed to token holders in proportion to how many tokens they have. So activist groups often buy tokens at low prices, then rally other token holders for a dissolution. The difference between the cost to acquire tokens and the ETH received through a dissolution is their profit margin.

The dissolution of RookDAO is an apt example here. Without getting into who was right and who was wrong, here’s what happened

Some community members or the RFV raiders thought the DAO was poorly managed. Their points of contention were constant development delays, lousy communication and spendings of the DAO.

They started acquiring ROOK tokens from the open market and making their voice heard.

Finally, they managed to take over the treasury through governance. A deal was cut. And the DAO was split in two – the new entity with 60% of the treasury and the original entity with 40% of the treasury to be claimed by ROOK token holders.

There has also been an instance where the attacker took a page of LBOs (leveraged buyouts) and attacked Beanstalk using flash loans to drain $182 million.

The following chart shows how most projects had only about 5000 active voters in the last six months. BitDAO and Uniswap, with billions worth of treasury, had 10,000 and 18,000 active voters in the previous six months. All DAOs do not need votes occurring every month, but it highlights the extent to which voter apathy exists.

Private Interest vs Public Good

A weak community often lacks strong voices that can gather people. It becomes easy to sway votes in a malicious actor’s direction. When the community is strong, it has opinionated voices guiding people, much like a democracy. Forming a consensus in support of, or against a critical vote is difficult. One of the ways to create a more robust governance process is to involve more members who understand the market dynamics.

Remember the bar scene from A Beautiful Mind when John Nash corrects Adam Smith? He says the best result will come when everyone does what is best for themselves and the group. This would be known as the Nash Equilibrium. Every individual doesn’t get what is best for themselves, but the group, as a whole, does better when it acts as per the Nash Equilibrium.

In reality, many individuals don’t care for the group, especially when they are in a position of power. People acting in self-interest is not a ground-breaking realisation. With crypto, it just becomes easier to observe these behaviours.

An attempt to structure a discounted sale of SUSHI tokens to some of the VCs comes to mind. If you dig up the thread on their forum, you can see that the newcomers could not sway the community's vote. After Chef Nomi (the pseudonymous creator of Sushiswap) tried to sell all his tokens and move on, community members scrambled to shed its old image of being "just another Uniswap clone".

Some thought that adding VCs who bring expertise in different areas would be a good idea for the growth of the protocol. This would have achieved two purposes.

Decentralise the treasury to an extent.

Bring additional expertise that the team didn't have.

The deal was to offer a 25% discount to VCs with lockups. But after much debate, it wasn't clear to many community members what they brought to the table, and if VCs believed in the team, why they couldn't buy tokens from the open market just like others. The proposal was eventually withdrawn.

It would have been an interesting transaction considering how the token's price performed in the months that followed as you can see from the chart above

Dissolving DAOs

All DAOs don’t have sad deaths. Some DAOs are created for specific purposes such as buying the constitution. (Yes, we tried that). Sometimes the vision doesn’t work out. Or they are no longer needed after a point in time. Failure is not a crime. We have instances of DAOs coming to closure without much drama, even when they are handling millions of dollars.

ICOs during 2016 and 2017 raised significant amounts of ETH. DigixDAO raised ~450,000 ETH to launch a gold-backed token. Digix held physical gold, which was represented on-chain by the DGX token. The DAO’s governance token was DGD. Based on the community’s feedback, a way had to be created for DGD token holders to break away from DigixDAO.

After considering options, the team proposed to dissolve the DAO and distribute ETH on a pro-rata basis of DGD holdings. Due to the team’s bias against dissolving, they did not vote, but the community decided to vote for the proposal, which passed. The DAO was dissolved, and DGD holders could claim ETH from the DAO’s treasury.

As with most things in crypto, DAOs are an experiment. As long as profit motives exist, we will see individuals trying to take over them. In 2021, when Sushi was hot, every VC wanted a piece of it. As prices have cooled down, the focus is on the brand-new narrative. For founders, it is becoming increasingly clear that part of what makes a “token” valuable is how difficult it is to take over its DAO.

One of the things we noticed in writing this piece is the lack of data on proposals, active voters & the amount of capital at risk. The industry has invested billions of dollars into DAOs and tooling around running them. But the most primitive data sets around how decentralised they are, do not exist. That is something we should work with our data partners on fixing. But for now, we log off for the weekend.

Try not to get wrecked trading altcoins over the weekend.

Touch grass, and find time for hobbies.

If you liked reading this, check these out next:

- Humpty Dumpty Took Over a DAO

- Ep 16 - On making decentralised governance more accessible

Copying from a Notes comment

I suspect there is much to learn from Sociology and Political Economics history. Mechanisms for creating consensus or consent as well as active engagement and alignment of actors need gains( profit / utility ), subsidiarity ( lowest group can decide) , social reputation or social capital as well as culture (Values/ Norms) , Institutions and Markets.

Subject matter sub groups may function better and tiered voting with different sub groups having weights to assure a broader consensus may help but also be more bureaucratic .

Crypto allows lot of experimentation and quadratic voting is a good find .

in this age we are living with far greater complexity and volatility ( Change both technology and other ways) and need to develop tools and procedures to manage better . Tools to simulate outcomes under different scenarios ( Agent based models with more granular and faster visualization ) may help in shaping narratives

Experiment ahoy Luck for the most of us