It is All Derivative

What's holding the industry back

Hello!

‘I bought the call options’, said one of the characters in the movie Dumb Money, which narrates a David versus Goliath tale set in the financial markets. It is about how an army of Reddit users took sophisticated investors head-on. Consequently, one of the larger hedge funds, Melvin Capital, had to shut shop after losing billions of dollars.

I have been constantly thinking about crypto derivatives since last Friday. Maybe we could all rally together and hunt down hedge funds like the GameStop crowd did last year.

Currently, the market landscape for derivatives feels lethargic. While thinking through how the landscape is likely to change, I started to think about how financial primitives in crypto are nothing but replications of TradFi primitives with different infrastructures. Generally, it is safe to assume that crypto financial primitives will follow the same course as TradFi.

Following what happened in traditional derivatives markets like India in the last decade will explain what we can expect in crypto. Why do I say India? Because in the last decade, India’s derivatives market has evolved substantially, and I had a front-row view of it in Mumbai - India’s financial capital.

Emerging A Market

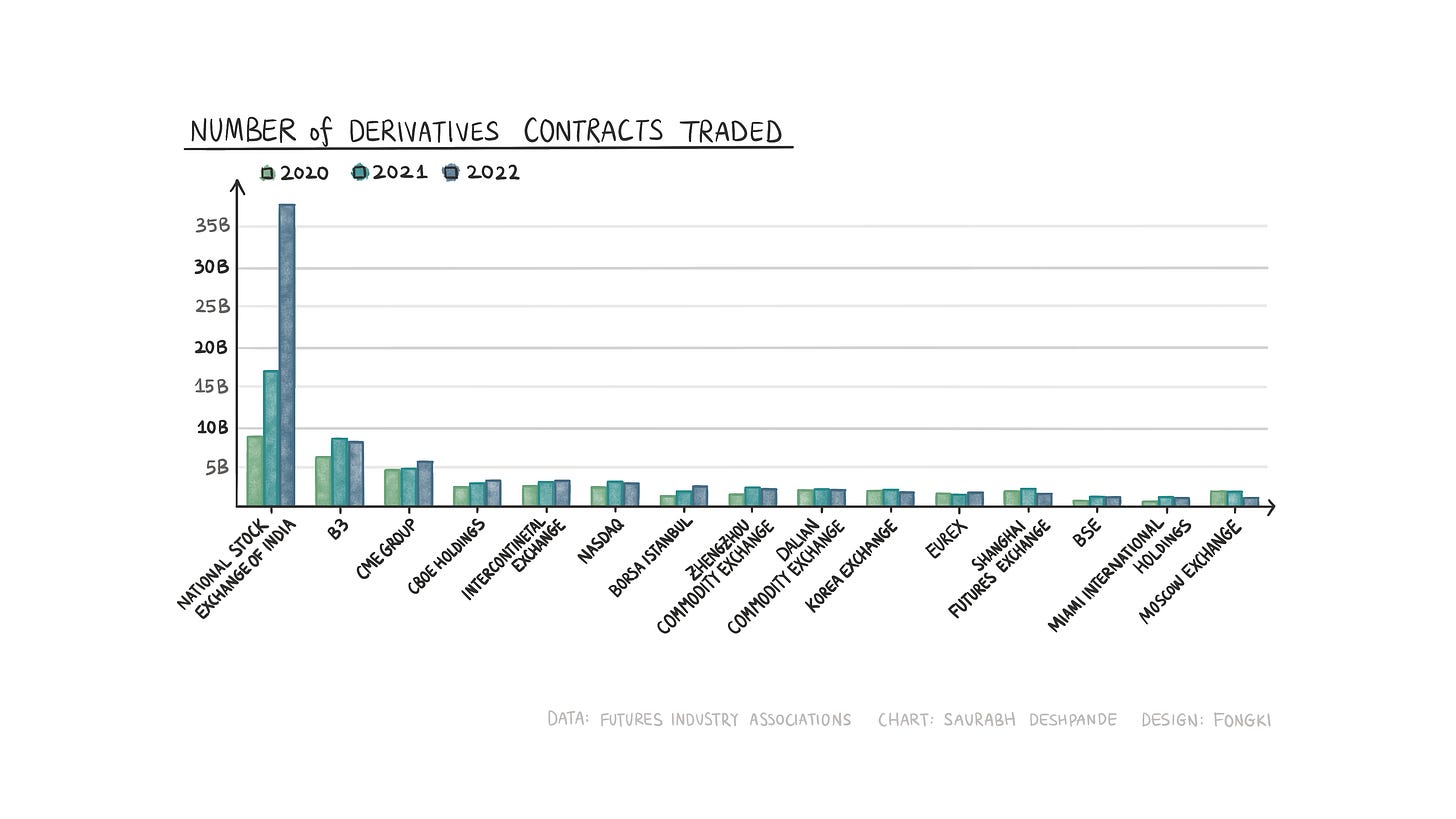

India’s National Stock Exchange (NSE) is the leading market regarding the number of contracts traded (this is not the notional value). Equity derivatives volume has picked up in India in the last few years.

According to the Economic Times, India’s derivatives market volume is ~400 times the underlying cash or spot market. Usually, this number is five to ten times the underlying cash market. Derivatives volume constitutes 99.6% of the overall volume in India, compared to ~70% in the US. Options dominate the derivatives volume with a 99% share.

But why did this change happen in the first place? Maybe we could replicate some of it with products in DeFi.

Better Instruments

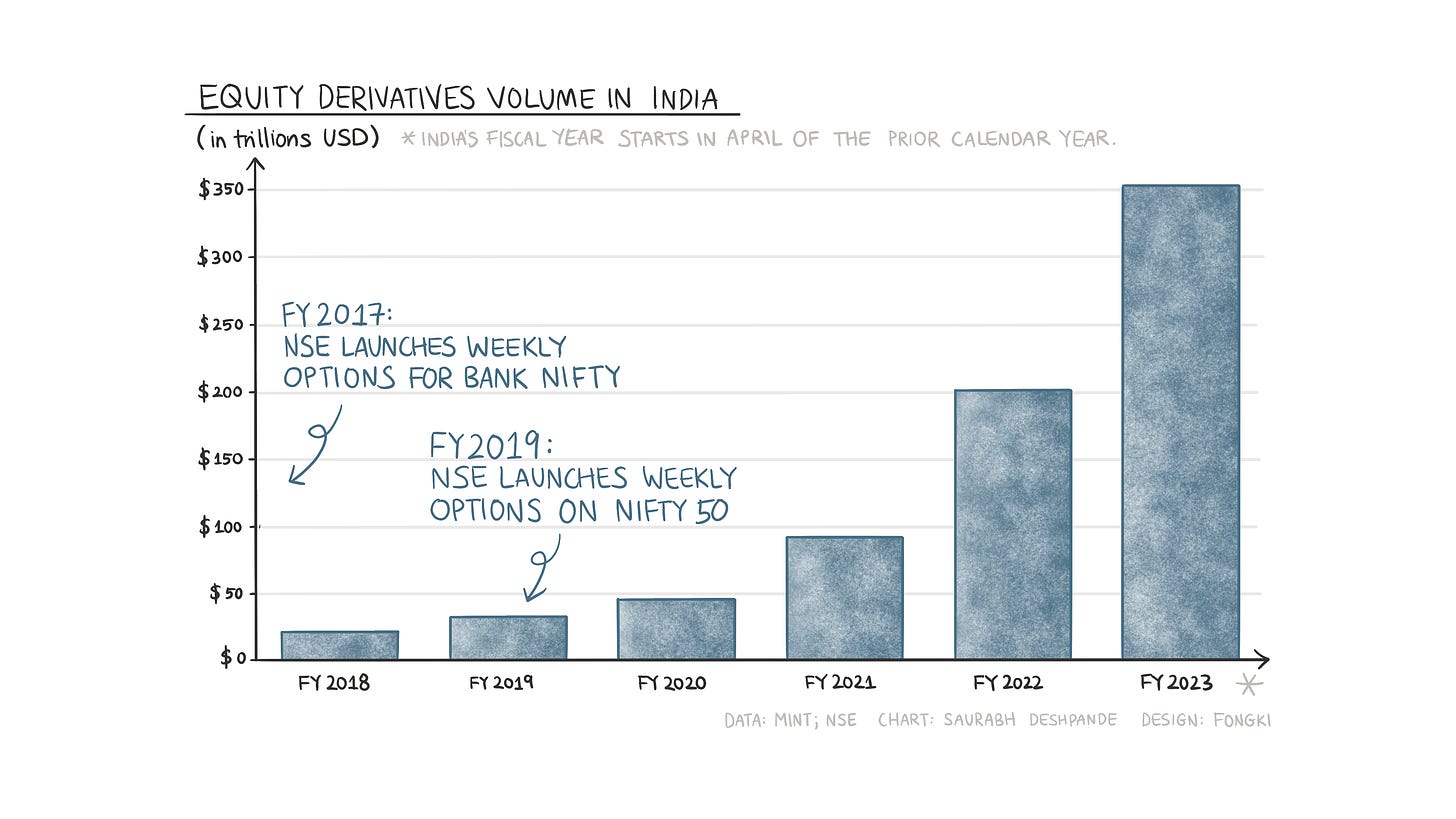

For a long time, India only had derivatives products with monthly expiry. One of India's exchanges, the NSE, started offering short-dated options in FY 2017 with weekly options for Bank NIFTY; it launched weekly options for the NIFTY 50 Index in FY 2019. As of FY 2023, weekly options account for 95% of the trades.

Improved Access

Opening a dematerialised (demat) account was tedious before the internet and mobile penetration. With the FinTech revolution in India, opening a demat account within minutes became the norm. This has been facilitated by access to financial markets via apps like Zerodha, coupled with increased internet access. As a side note, the average cost of 1GB of data in India is $0.16 compared to $6 in the US.

Zerodha was launched in 2010 with significant discounts on brokerage charges. By 2013, it was among the very few tech platforms with a user-friendly UX. By 2017, Zerodha had already launched an education platform (Varsity), a trading API (Kite.Trade), and a mutual fund investing platform (Coin). Zerodha’s strategy, in general, forced all major brokers to launch tech platforms that were more user-friendly.

Following Zerodha’s success, investment platforms like Groww, Dezerv, and Wint hit the market, trying to address the different needs of investors. This development contributes towards increasing the number of people participating in the markets. It was not a single app that improved the market.

The Growth Economy

India has a demographic advantage among the major economies. The dependency ratio of India (~48%), the percentage of dependents compared to the workforce, is among the lowest in major economies.

With the FinTech revolution and a huge workforce, India is often compared to China in the 1980s, with almost a consensus view that it will be among the fastest-growing major economies in the world in the near future, meaning India is likely to remain among the preferred investment geographies.

Despite the growth, the Indian market has significant room to grow. Paytm’s red herring prospectus states that as of 2020, only ~3% of the Indian population participated in the stock market vs 55% in the US. Although this number has grown over the last few years, it remains significantly low compared to developed markets like the US. India has a per capita GDP of ~$2400, compared to ~$77k in the US.

How It Relates To Crypto

What has this got to do with crypto? One may hypothesise that an average crypto user lies somewhere along the spectrum of emerging markets like India and developed markets like the US. Some drivers for the growth of India’s derivatives market can apply to crypto markets. While the share of derivatives volume (as a percentage of total spot + derivatives volume) in India is 99%, it is around 78% for crypto.

But unlike India’s derivatives volume mix, which is heavily skewed towards options, futures are more popular among crypto traders for reasons we describe later in the piece.

Options vs Futures

In traditional markets, the maximum available leverage depends on the nature of the underlying asset. It is essentially a function of the volatility of the underlying asset. For example, available leverage in the currencies market is typically much higher than in equities because currencies are much less volatile than equities. Typically, the initial margin for stock futures is 3–12% of a contract’s notional value.

This means the available leverage is capped at 33X. However, options inherently offer more leverage since the buyer knows exactly how much they stand to lose. When the options premia (the amount you pay to buy an option) are low, the leverage factor in options can be more than 100X. This is why options end up dominating the notional volume in many markets like India.

The story is different in crypto. Perpetual futures were a hit product with the launch of BitMex (probably because 100X leverage was easily available). It is likely that since leverage is so abundantly available in futures, a more straightforward product than options, options never took off.

CeFi vs DeFi

There’s a significant gap when you look at CeFi offerings and compare them to DeFi futures. Binance invariably conducts $20 billion in daily volume on its futures product, whereas the volume on the leading futures DEX, DYDX, hovers around $600 million, just ~3% of Binance. The problem is that the state of DeFi options is even worse (as shown in the following section).

Many of us are now mobile first. Over half of web browser traffic comes from mobile devices. It also explains why applications like Zerodha in India or Robinhood in the US have a huge user base. Trading options and futures from these applications is easy; you can do it from a beautiful UI on your phone. However, you can’t trade crypto derivatives as easily. Yes, I know Deribit has a cool app, but most DeFi is still designed for desktops first.

With centralised venues, this has never been a problem. Binance and Coinbase have prioritised both platforms — mobile and desktop. However, the regulatory dynamics forced them to limit where users can use their products.

Coinbase recently launched futures trading for non-US residents. Mainstream applications like Coinbase offering derivatives products will likely move the needle going forward. The issue is not that futures and options have been unpopular among crypto users. Centralised venues like Binance and Deribit lead categories in futures and options, respectively. The issue is with DeFi derivatives.

Where We Are At

DYDX has been the leading futures DEX. Unlike many other DEXs, it is based on order books and matches orders off-chain. This is one of the reasons why when you trade on DYDX, it barely feels like a DEX. It also offers similar spreads (the difference between the highest bid and lowest ask) to Binance on leading pairs like BTCUSD and ETHUSD.

The chart below compares fees on the leading futures DEXs. I’ve compared fees here because it is a good indicator of how much users are willing to pay to use the products. One can also look at volume as an indicator. Notice the periods when fees across exchanges expand. Typically, these are periods of increased volatility. The recent local peaks in fees came in July and April 2023, when the prices of crypto assets increased from their lows, sparking interest among traders.

DeFi options are significantly underdeveloped compared to DeFi futures and CeFi options due to a severe lack of liquidity and high volatility. These factors essentially mean that even though buyers would want to get options exposure to smaller assets as protection or speculation, sellers find it difficult to write options.

The combined weekly notional volume on the four leading DeFi options trading platforms is around $5 million. In contrast, on October 20, Deribit supported a volume of $820 million for BTC and $400 million for ETH, a combined notional volume of over $1.2 billion. Although a $1.2 billion notional volume isn’t much, DeFi options stand nowhere close to their centralised competitors.

The reason is the lack of liquidity in decentralised venues which occurs due to the horrendous capital efficiency and bad user experience in general. Let me explain what I mean by that….

Say you want to sell ETH calls on Deribit for a $1800 strike price, and the position requires an initial margin of 1 ETH. Now, if you want to buy calls for some other strike price (or expiry) or go long on ETH, Deribit doesn’t require you to put more collateral as long as the position sizes are commensurate. The logic is simple: since you are opening positions in opposite directions, gains and losses will offset each other to an extent.

And as long as they are not heavily skewed in one direction, you should not be mandated to put up more collateral. But for the same scenario, DeFi options require separate collateral. In addition to this, options protocols do not recognise collateral from futures. For all the composability claims of DeFi, derivatives in the sector have not been composable. The problem is futures and options are treated as separate buckets, and the margin used for them is isolated.

Currently, it may seem like there’s little hope for on-chain options. But there may be ways in which they can be made more functional, i.e., more capital efficient. If there were a liquidity layer in DeFi that allows protocols to recognise collaterals and positions from each other, then DeFi derivatives could function as a cohesive unit to provide a CeFi-like experience to power traders. But this also means that the risks of these protocols are no longer localised. A vulnerability in one protocol may affect other protocols.

If you ask traders why they don’t trade futures or options via their self-custodial wallets, typically, they will tell you lack of liquidity and subpar UX are some of the leading reasons. Liquidity comes with users, but projects that make their design suitable for users will likely attract liquidity.

I was interested to see which projects are addressing these core issues. Recent developments in Synthetix aim to address these issues.

On Synthetix v3

Synthetix has been one of the oldest DeFi products. But its design had a significant flaw. It used to let users stake SNX, Synthetix’s governance token, to mint its stablecoin Synthetic USD (sUSD). sUSD would then be used to trade futures and mint synthetic assets. The collateralisation ratio was 8X; that is, if you wanted to mint $100 worth of sUSD, you had to lock $800 worth of SNX.

This pooled SNX acted as counterparty or liquidity for trades facilitated by Synthetix, the exchange. So, if traders won, stakers lost, and vice versa. Although the overcollateralisation helped keep sUSD around $1, the design was highly inefficient. And since only SNX was allowed as collateral, there was a cap on how liquid it could be.

Recently, Synthetix shipped an upgrade that allows other assets to be used as collateral, essentially moving towards becoming a permissionless liquidity layer for DeFi.

This is where DeFi composability starts to materialise, where all kinds of markets like spot, futures, options, insurance and other exotic products can tap into a liquidity pool instead of trying to bootstrap it separately. But creating infrastructure is not enough. The experience has to be at par with the CEXs.

DeFi builders should not assume that users are willing to bear with subpar experience because they get to use non-custodial products. The idea should be that users choose DeFi because the experience is as good as the centralised alternatives. To that end, the upcoming Infinex exchange is leveraging the Synthetix ecosystem to create a CeFi-like DEX.

Another factor besides capital efficiency contributing to lower liquidity is that DeFi needs fiat onramps. It is either stablecoins like USDT or USDC, with centralised entities, or ones like DAI that are overcollateralised – which is capitally inefficient from the get-go.

Arthur Hayes proposed a solution: creating a stablecoin, Naka USD, which is $1 of Bitcoin + Short 1 Bitcoin per USD in Inverse Perpetual Swap. I won’t get into the design specifics, but it would need custodians and a DAO to act in good faith. Along these lines, BitMex has already launched Quanto Perpetual contracts that allow users to trade futures without stablecoins. Although this seems fine on paper, it has two issues:

It’s difficult to support the permissionless development of protocols using this design.

A lot of good actors need to come together to bring this to fruition – and remain good.

We need solutions that do not rely on centralised parties playing “good”. Last year, the industry placed its hopes on Terra and FTX. We have learned some harsh lessons from that. When you consider that MakerDAO’s DAI, has stuck around longer than some of these centralised alternatives, it becomes easier to understand why we need more decentralised primitives to scale DeFi.

Although the state of DeFi derivatives is not encouraging based on the numbers we have today, reflection on the previous cycle gives me hope. Back in 2018, there were no scaling solutions. Rollups are live now. Lower fees and account abstraction primitives will add towards creating a seamless, CeFi-like experience. Products like DYDX prove that DeFi products can feel like their centralised counterparts.

It doesn’t take too long for things to change in our industry.

Signing off,

Saurabh