Hey there,

Few categories are as polarising as Web3 gaming. The chart below should explain why. Much of the interest in the industry has rapidly declined as consumers realised there’s no money or games to play in the short run. An interesting game has one core function – to be fun. A lack of fun can be compensated by a different function – being profitable. When you have neither is where consumer apathy enters the equation.

The data above from Santiment shows the rapid decline in gaming and metaverse related conversations. It queries the number of times gaming or Metaverse is discussed in crypto-native communities, and as you can see, that figure has trended to almost zero. We have been debating internally if the sector is dead and whether there is any opportunity for the market. Here are some of our observations.

When it comes to consumer applications, you generally tweak on two levers

Optimise for the largest targetable market or

Obsess about a market (10x) improvement in experience

If you look at the internet through this lens, most of the behemoths we know and use daily serve both these functions well

Uber: Markedly improved the experience of finding a cab

Amazon: Shop from any corner of the world with little worries about fraud

Google: Indexes the world’s information and makes it accessible at the click of a button

Early-stage products in Web3 find a baseline of users primarily from early adopters and speculators. An early adopter is usually interested deeply in what the technology can offer. They are curious users with the patience to use a broken product. The speculator crowd is a vast spectrum. You can define them as anyone using capital as a lever to make a return. This would involve the guy making fifty accounts on your dApp in hopes of an airdrop to the VC sitting on a $100 million fund with a mandate to deploy them in Web3 games.

Here’s the problem. The state of Web3 games today neither retains adopters nor drives speculation high enough to warrant growth. Combined with the fact that the average gaming consumer has much better alternatives than clicking wallet permissions 30 times and hoping they don’t get hacked, we have today’s Web3 gaming landscape. The philosophy most Web3 gaming pundits have is that it is okay for Web3 games to be subpar because of profit motives.

That is indeed true. If you are trying to rebuild UBI with your product, the odds are high that users will put up with many broken features. Democracy is a testament to this. The problem is the same users will riot if the assets you give them crash rapidly. (The democratic equivalent to this is hyperinflation)

You can summarise why we have no AAA titles in Web3 (yet) with two simple arguments.

Creating a successful title at scale takes years and tens of millions of dollars. If you take Axie Infinity’s 2020 boom as a starting point, we are barely three years into the movement.

Large studios with know-how and expertise do not want to burn their reputations by associating with NFTs. Gamers want fun games, not financial products when they log off work and play. The theme has a branding problem among consumers.

Original source for the meme is this tweet by @Playtern on X (formerly known as Twitter).

So does that mean the industry is dead? Are all the VCs that raised money for Web3 gaming going to have to return their money? Not really. Far from the noise of Twitter and the ever-decreasing price of gaming-related tokens, shifts indicate a resurgence of the industry.

Here’s what we have noticed.

Studios Are Experimenting

Large gaming studios have a data problem when it comes to Web3. Most of the data around product lines in the industry presume profit motives are the sole drivers for gamers. But how do you test how a user that does not care about the hyper-financialisation of games would behave in your app? One way they solve this is by repurposing older titles or releasing lower-budget versions of games with a Web3 angle. What it does is it solves two problems:

It creates enough data to understand what an actual retail user would want from an NFT-enabled game.

It generates a baseline of users that understand NFT concepts well enough to test and be onboard with newer NFT-linked titles.

There are two places where we can see this trend quite clearly. The first is Ubisoft releasing ChampionTactics. This is interesting because Ubisoft is the studio behind multiple large and well-known brands like Far Cry 6 and Assassin’s Creed. Similarly, Com2US is releasing a game named Summoner’s War Chronicles with its token. The War Chronicles brand has been around since at least 2014 and has seen close to 600k users, although MAUs are now down to 10k – just large enough to source data and call it off if things fall apart.

This is not to suggest all studios are rushing into tinkering. Last month, Sega’s COO clarified that none of the studio’s larger IP (including Sonic the Hedgehog) would be open for Web3 native games to use. He argues that blockchains don’t have much to offer gamers, but the possibility of moving assets between games may be intriguing. He was instrumental in launching the PlayStation, and it is fair to suggest his opinion holds weight.

A different way we are seeing this play out is with talent. In the last cycle, most of the developers we met in our deal flow were one of two:

Seniors at a large organisation (like EA Games) are moving out to start their venture

Indie devs that have been tinkering with game releases for a while

While both hold promise, the challenges we saw with both were:

Neither had seen a large-scale game go from 0 to 1 and could claim complete ownership of a game and its IP over its release and growth cycle.

We felt both kinds of founders were looking for a new way to tinker with monetisation models instead of embracing blockchain as a technology.

This is changing with games like Shrapnel coming to market. It is a AAA title being launched by an interesting team. Many of the members have been on Emmy award-winning teams. There are multiple individuals with over two decades of experience building games.

And the Head of Blockchain (we wonder what that role is) claims to have led blockchain APIs and developer tools at Consensys. We have not seen such large teams in Web3 gaming. Much can’t be said about the game, but a whitepaper is live, and there are plans to integrate NFTs and a token economy. Remember, Shrapnel is a AAA title like Battlefield 2042, not a turn-based strategy game. The market for such titles is far bigger than the smaller games we have seen in the industry.

The caveat here is that with most new categories, it is not industry insiders but outsiders that take on the risk and establish it. Bankers did not build Paypal. Real estate developers did not build Airbnb. And Uber’s founder did not have much to do with taxis.

You get the gist. Credentials alone don’t build great firms.

Improvements in Distribution & Tooling

The immutability of blockchains is both a feature and a bug. A recurring problem we heard from multiple developers last year was that they had little control over a game’s economy if a hack occurred. Since a large portion of the gaming industry contains users that are possibly vulnerable to hacks and fraud, developers require an alternative infrastructure that helps them ‘undo’ fraudulent transactions. A smaller indie dev may not replicate Ronin’s ability to put together $700 million when their bridge was hacked.

Developers building blockchain games in 2018 had limited options. Sky Mavis, the creators of Axie Infinity, spent months waiting on Loom, a blockchain network, before going ahead with thier own scaling solution - Ronin, for their game's economy. The difference in the current cycle is that L2-based networks like Immutable and Polygon have now come of age. So you can have drastically cheaper transactions and ease of deployment. Shrapnel uses an Avalanche Subnet, which has helped them keep the focus on building the game than the infra needed to run it.

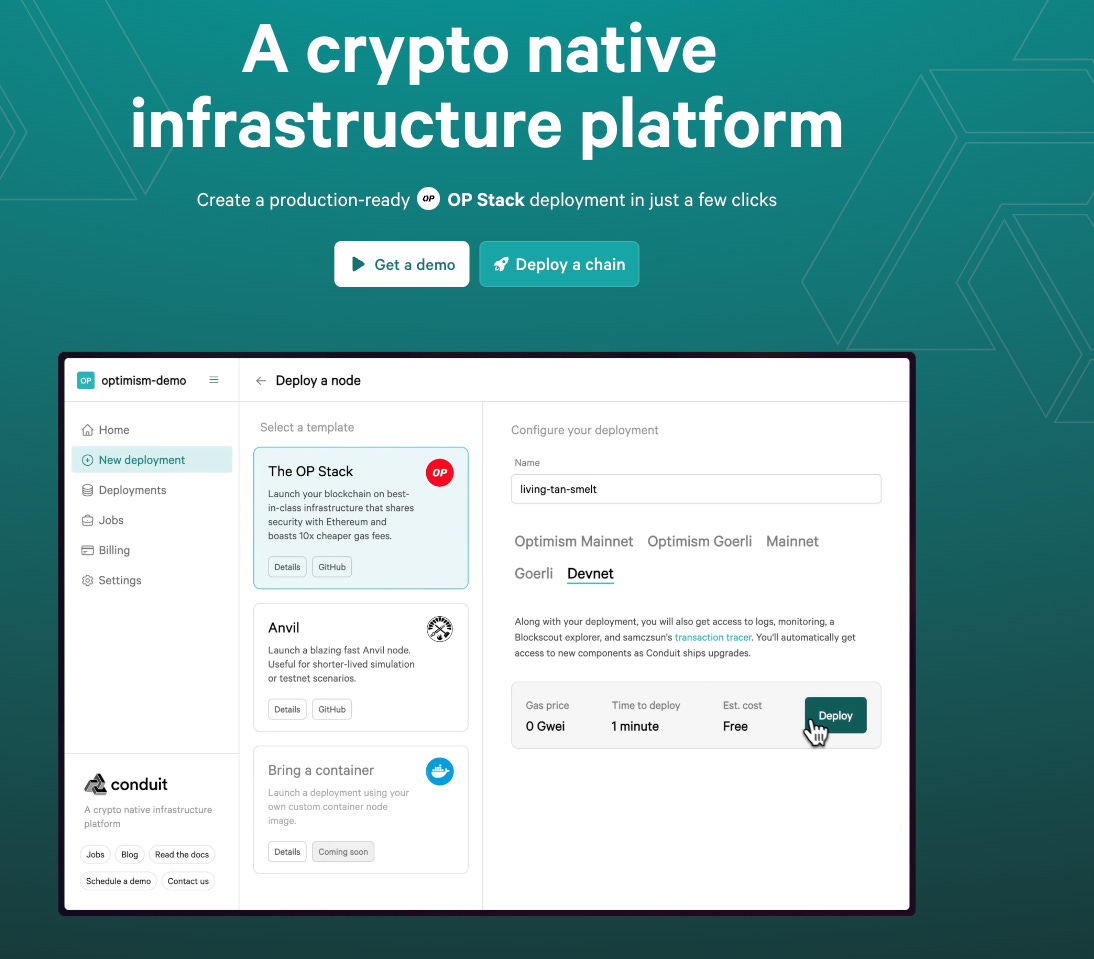

What takes this even further are services like Conduit. These services allow developers to drop their L2 roll-ups with the ease of spinning up an AWS server.

The developer controls the game economy’s checks and balances in such a model while having predictable transaction costs. In cases of massive outright fraud or users hacking one another, a complete rollback of the ledger is well within possibility. The thesis of every game studio launching its own roll-up is very similar to the app-chain thesis – the idea that all apps will launch their chain at scale.

The problem is that roll-ups do cut into app interoperability. You can play GTA 5 with a Rockstar Games login and Assassin’s Creed with a Ubisoft login, but there’s no way to move in-game balances between the two. If studios release separate roll-ups, we’ll replicate this issue with blockchain.

One way studios address this is by releasing their own blockchain ecosystems. Oasys is another example - Executives at Bandai Research and PlayStation are behind its development. Part of what makes the chain interesting is that Sega seems to be embracing it for their Sangokushi Taisen title. Remember I mentioned Com2US? They also seem to be releasing their game on a customised chain named XPLA.

While no ‘standard chain’ is being used for gaming yet, it is interesting to see multiple vendors creating a mix of gaming options for gamers. One way the industry could aggregate is by using cloud service vendors (like Google Cloud or AWS) or adding blockchain-as-a-service offerings to game studios soon.

Naturally, building incredible games with robust infrastructure only matters if you have the means to distribute them. In the past, Android and iOS restricted blockchain native games, given that they had strong elements of financialisation. Apple’s store policy changed over the last year to allow apps to display, transfer and mint NFTs through mobile devices. Users can still not buy NFTs without paying the Apple tax of 30%, but this is a massive step from a complete ban.

Similarly, Google's Play Store policies have now shifted to allow apps to have NFTs. The caveat is that the value proposition of the NFT should be clear, and elements of speculation should not be embedded with it.

It is pretty hard to say how these policies would reflect at scale. If you buy skin in CS: GO, there’s a liquid market. And that liquid market would mean people trade to a point where speculation becomes the norm. App store policies today are focused on ensuring financial speculation is restricted with games, but it is a likely outcome that cannot be eradicated. Epic’s and Steam’s game stores have similarly begun listing games with NFTs. If you go to Epic’s game store, there are explicit identifiers for games that use blockchains or NFTs.

The impact of all of these changes is already evident. There’s a game titled Mir4 on Steam as of this writing with 24,000 players on it. That is a far cry from the 1 million gamers Fortnite sees active on a good day, but it is something when we think of the 8000 users Decentraland had, according to their statement last year.

Our point is that Web3 gaming is in a state of evolution. Unlike DeFi or NFTs, it has many moving parts, some of which take years to get where we need them. Profit motives (of speculators) and rising interest from retail may make us want to accelerate the speed at which these changes happen.

Blockchain Games vs GambleFi

All of this ignores a broader point – what even is Web3 gaming? None of the documents we referred to for researching this piece mentioned a definition. The only ones repeatedly using that phrase are crypto-native investors with a thesis (or a fund) to deploy into games. Outside the industry, it is referred to as blockchain or NFT games. A game has only two core functions. The first is accumulating as much of the user’s attention as possible, and the second optimises for the small subset of users that would transact on it. You could do these transactions on a blockchain, a notepad or an abacus device for a ledger. They are all just infrastructure.

As these studios evolve, Web3 native investors may get sidelined because the DNA of building great games and riding waves in the digital asset space are quite different. A corollary here is how Steve Jobs was asked never to attend Pixar’s brainstorming events because he could not contribute to the creative process at Pixar. This was the guy that gave us Apple, and he was excluded. At least until a point in time when he could contribute meaningfully to what was being built at Pixar. (Primarily, that involved negotiations with Disney and giving much-needed cash infusions).

What do you think a capital allocator that has made his bread speculating on the possibility of a token’s rising price can bring to the table for a game? Games are cumulations of good stories, great art and a sound economy. Crypto native investors can contribute to it, much like Jobs did for Pixar, on the sidelines, through capital and commercial partnerships.

This is not to suggest that Web3 games are dead. Our interpretations as capital allocators of these games may be wrong. There was a recent run-up in a hamster-based betting app. Users would bet on which hamster would win, much like you would with horse racing. Similarly, apps like Rollbit have been on the rise. With high transaction frequency and low production costs, these applications are speculatory apps catering to adult users looking to gamble.

Can blockchains be crucial there? Yes. Do we have PMF there? Quite possibly. But when we think of the large gaming titles—the ones you look forward to playing on XBOX or PS5—there are years to go before they become a reality. And when they do, the positioning of smaller investors will be quite strange because you need late-stage ticket sizes to build AAA titles. It is similar to movies or when launching rockets. It is hard to place the bets right when your investment size is small.

Naturally, the opportunity space is to look at infrastructure. Tools for onboarding, payments, analytics and dev-tooling will likely see massive growth via the gaming sector. You can meaningfully invest in products focused on account abstraction, hoping their BD process onboards good games and thus build exposure, even as a seed-stage fund. But can you see a AAA title as an angel investor? Quite possibly not, given how different the DNA is and the amount of capital needed to play that game. Indie games are a different conversation altogether.

It is becoming evident that the next wave of Web3 gaming will be far more retail-oriented and quite different from the mania we saw in 2019. It is quite possible that the kind of speculation we saw with NFTs doesn’t repeat on those games because of the policy of the app stores responsible for their distribution.

The question remains: how much of any value generated will accrue to the firms we see trending on Crypto-Twitter today?

We don’t quite have the answer, but we will drop you an e-mail when we have a thesis. We are patiently watching the sector until then.

Signing out,

Joel

If you liked reading this, check these out next: