Two Worlds Blending

A (possible) future of finance

Hey there,

December 2017 was a strange time. The ICO boom was coming to an end. And crypto kitties clogged ETH to a point where the market began wondering if they were better off being named crypto-quitties.

A few quiet years and multiple experiments later, Uniswap helped me figure out how to swap assets efficiently without an intermediary. Compound and Aave perfected borrowing and lending on Ethereum. But it was still expensive for everyone to use Ethereum..

Ethereum has 4.5 million monthly active users (MAUs) almost six years later. It pales in comparison with fintech applications. PayPal alone had 433 million MAUs in the first quarter of 2023. So in some sense, we have come a long way.

But there is still a long journey ahead of us if these financial primitives are to make a dent in people's lives.

Risk As a Product

But why is that? Decentralisation brings along with it both good and bad. It can be more inclusive for people of all backgrounds. But it could also be highly predatory for unknowing users. This is why we created a system insulated from the traditional financial world. The “user’ in DeFi is almost always comfortable “aping” into a new liquidity pool or “degening” into an unknown token.

Only primitives like swaps, leveraged futures, and borrowing and lending have somewhat achieved product-market fit (PMF) in DeFi. This is because we were able to attract a section of users who embrace risk. DeFi is not ready to take on hundreds of millions of users because it does not solve a meaningful enough problem for them, in an easy enough fashion today. Yes, stablecoins exist. But a large portion of it’s volume still comes from traders.

We have built applications for speculators, and they are already here. As we undergo cycles, the number of speculators will keep changing in tandem. Speculation is an everyday use case among all financial products, whether in traditional finance or DeFi. But in conventional finance, some part of speculation is valuable.

For example, when a bank lends to a startup or a mid-size company, they use the credit to produce something useful to people in their day-to-day lives. This is why credit creation is one of the most essential finance primitives. Both DeFi and NFT markets evolved with the arrival of lending products like Compound or Metastreet.

Blurring Boundaries

This tendency of focusing only on speculators is slowly shifting, though. PayPal launched its stablecoin, PYUSD, on August 7. And it will be using Ethereum as the settlement network. PYUSD can be used for P2P payments and fund purchases or converted to other crypto assets. This has mixed reactions because the smart contract allows PayPal to freeze or seize a user's funds.

But practically, PayPal is a regulated entity. They have to oblige if they are ordered to stop or freeze certain accounts. The big picture here is not that a large, listed fintech company is releasing a product on a public blockchain. What matters here, is the fact that crypto-native infrastructure seems to have evolved to a point where retail-scale applications can now be built on top of them.

But in case of an exploit, many will desire a point of control that allows the movement of funds to be stopped. Imagine, you lost $10k worth of $PYUSD to a phishing attack. Would you rather have Paypal block that transfer or not? Given Paypal’s large consumer base that is not DeFi savvy yet, the token would need to be designed to permit Paypal to blacklist or freeze it if they think something is going wrong. It happens today with Tether and Circle’s stablecoins too.

The challenges caused by the blurring of lines - between what happens on-chain and what occurs off-chain is evident with Real World Asset (RWA) loans. The combined TVL of RWAs just crossed $1 billion, according to DeFiLlama. In 2021, we saw prominent players becoming interested in crypto. In almost all developed countries, we were in a zero-interest-rate environment, leverage demand was high, and crypto offered higher interest rates.

The situation reversed when global interest rates rose due to sticky inflation and demand for leverage dropped in crypto. Suddenly, interest rates offered on USDC were lower than the US treasury bills.

When interest in crypto was low and higher in TradFi, MakerDAO saw an opportunity with RWAs. Soon, private credit, treasury offerings, and real estate applications emerged. Protocols like Maple and Ondo Finance started offering treasuries on-chain. Franklin Tempelton started an on-chain fund on Stellar called the Franklin OnChain U.S. Government Money Fund, representing about half of the on-chain treasury offerings.

But why bring products like treasuries on-chain? You can go to your brokerage portal or call the broker and get treasuries using dollars sitting in the brokerage account. Let’s examine the business models of two of the largest stablecoin issuers – Tether and Circle to understand.

When someone wants dollars on-chain, they go to either of the companies and ask them to issue stablecoins by transferring real dollars to company accounts. Once the transfer is confirmed, stablecoins are minted (sometimes, they are minted based on predicted demand).

A fee is charged to issue the stablecoins to you. When you are busy using stablecoins on-chain, dollars are still sitting in the bank account of Tether or Circle. They use these dollars to put into short terms instruments such as treasuries, overnight repo, money market funds, and a small portion even in assets like Bitcoin.

They make the bulk of their profits by earning interest from the money in these products. Naturally, when the interest rates are higher, stablecoin issuers make more money. According to Tether’s disclosures, their deposits are distributed as shown below. A large part of the cash and cash equivalents are in US treasuries (75%), overnight repo (12%), and money market funds (11%).

But when users like you, or I hold stablecoins, the interest is not passed on to us. Markets like Compound and Aave offered returns lower than the US Treasuries over the past few quarters, where interest rates have risen. Bringing treasuries on-chain allows for interest rate arbitrage and may help maintain parity between DeFi and off-chain interest rates.

But does bringing everything on-chain really transform finance as we know it? There are cracks in the system visible already.

Defaults Enter The Scene

When we try to merge the on-chain and off-chain worlds, we will encounter the problems both face. Thankfully, some features of one system will allow us to avoid the pitfalls of the other. For example, the traceability of blockchains makes it difficult for borrowers to obfuscate what they use the capital for. As long as the assets stay on-chain.

Recently, Goldfinch faced a situation where the covenants of a loan were broken. They were working with a motorcycle financing company called Tugende, which operates in Uganda (89% of the business) and Kenya (11%). Goldfinch made a loan of $5 million to Tugende Kenya, with October 2023 as the maturity.

In December 2022, Tugende Kenya made a loan of $1.9 million to Tugende Uganda to extend support to the struggling business in Uganda. It meant that the loan-to-value had exceeded the agreed threshold of 80%. You can offer a loan to a business, but very little can be done to determine what the business does with the money you give once the money goes off-chain.

The protocol has a predetermined way of handling defaults by systematically writing down defaults, and the amount will be written off in the next few months according to the schedule mentioned here.

Such incidents are why we need teams that understand how traditional finance works well. Teams with a combination of experience in building in DeFi and conventional finance are much better placed to avoid and manage undesirable situations.

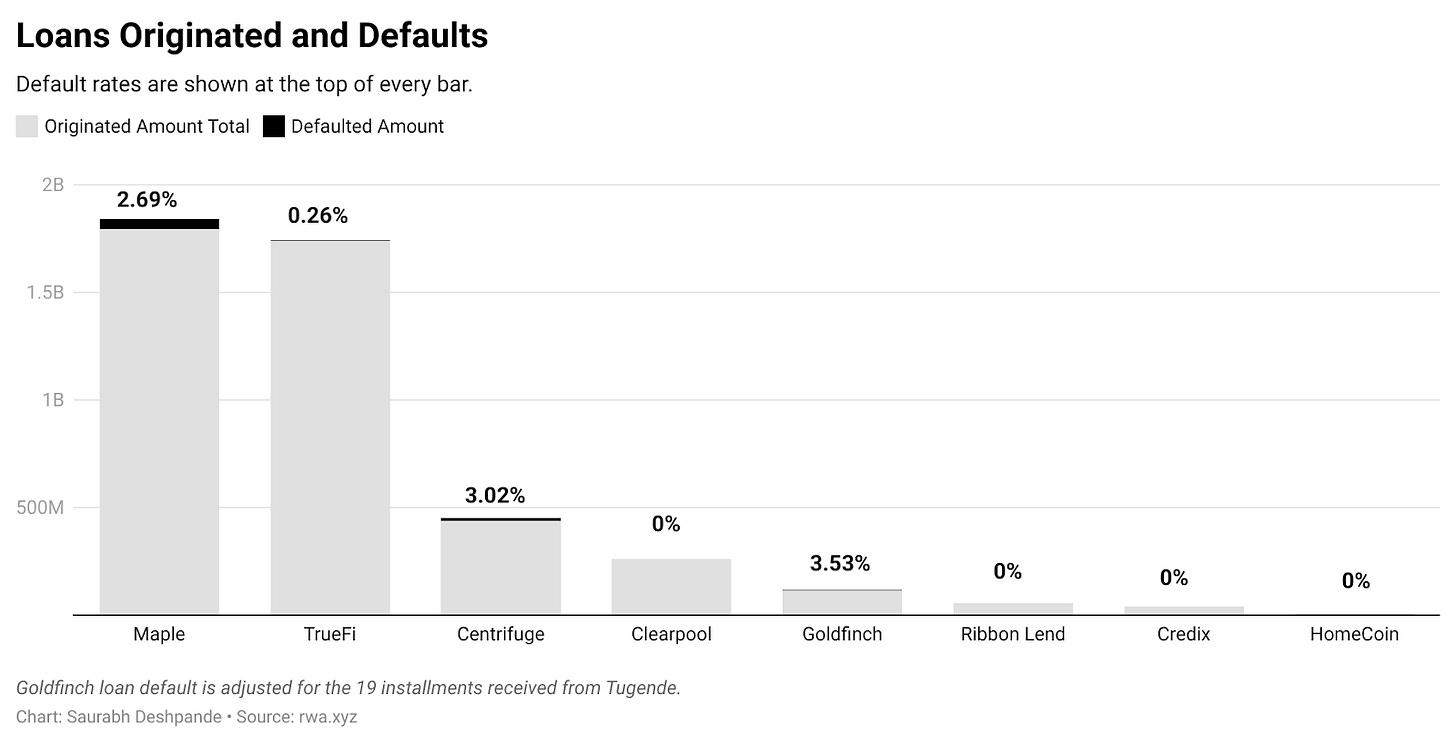

This incident prompted me to examine default rates in traditional finance and other DeFi-based RWA lending protocols. A study published in Harvard's Working Knowledge titled The Dark Side of Fintech Borrowing states that at a 3.53% delinquency rate, Fintech loans are twice as likely to face defaults as bank loans.

How does this compare with crypto? Although these are early days for RWA protocols, here are some numbers. So far, the default rates are in line with Fintech delinquency rates.

Timing It Right

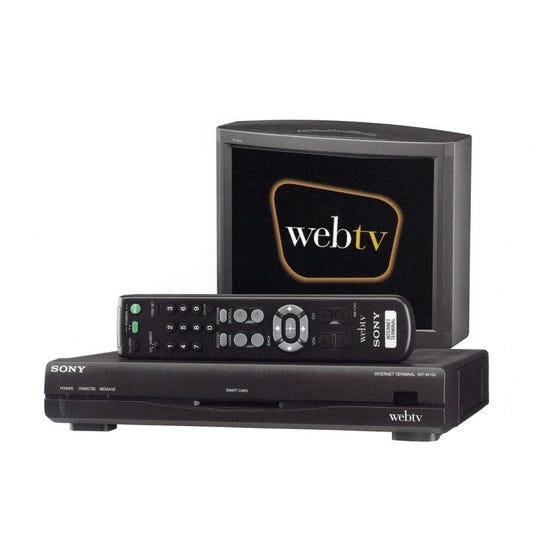

Remember WebTV? Me neither. I had to dig it up as an example. In the late 1990s, WebTV launched an internet-based TV with the hope that people would not want computers at home but would want a TV in their living room. But this was the pre-broadband era with slow dial-up connections and the clunky interface. It never found PMF.

During the 2017–18 boom, many ICOs raised money to solve “real-world” problems. One such ICO was Populous, which wanted to solve issues with receivables with invoice financing. Working capital problems can be life and death for small companies. The infrastructure was far from ready then, and it is no secret that it failed to gain any traction. The graveyard of projects like Populous is a reminder that forcing narratives when the infrastructure is not ready is a recipe for disaster.

We have come a long way since then. Several rollups scale Ethereum. Account abstraction projects are ensuring better UX. There is much more awareness of DeFi. Goldfinch recently announced defifortheworld.com, which incorporates several UX improvements that will allow tradfi folks to use DeFi:

It uses PassKey for authentication. This is simpler than current ways of using wallets.

There is no need to write 12 seed words on paper and guard it for eternity. We set up a wallet using our fingerprints through the biometric scanners of our mobile devices.

It is built on Base (an optimistic rollup by Coinbase) and uses 4,337 style accounts that allow users to pay for gas in assets other than ETH.

Solutions like them show the potential to remove the clunky and daunting blockchain wallet experience and expand the user base beyond those who already use fintech products.

The UX must reach a point where a billion people can use it. We are getting there, but for the industry to evolve, we would need to see crypto-native developers working with the networks and expertise of traditional bankers.

We are seeing a few emerging startups tackling these “transitory” issues and will soon be writing about them in a piece focused on real-world assets.

Signing out to touch grass,

Saurabh

If you liked reading this, check these out next:

- One click Checkout buttons for Web3

Defaults on loans are weighted to sector , have a small idiosyncratic weight and a lot more are systemic. Under macro stress defaults rise by 2-3X over a 12 -24 month cycle. This is inherent in TradFi as leverage is basic in fractional reserve banking and 'blows' up. Watch the US defaults into 2024 Q2 and lets see

One of the reasons 'insuring' credit defaults needs substantial capital and ability to recoup