The Inevitability of MEV

Inside Crypto’s Hidden Auction Houses

Today’s story builds on a recurring theme we have been speaking of. That of revenue and the flow of capital. Sumanth dives deep into the sources of miner extractable value (MEV) and the emergent approaches to mitigating it. He starts with a deep dive into how Google proposed a new mechanism for ad auctions in 2010, then proceeds to draw parallels with miner auctions. History repeats, as they say.

You may notice that, as of late, there is an obsession with primitives that move money frequently and in size in almost all of our writing. Our thesis remains that blockchains are money rails, and products that move money often will emerge as winners in the next chapter of crypto’s evolution. This aids how we think of mergers and acquisitions too.

If you are a founder building one of those primitives, make sure to drop us a note at venture@decentralised.co.

Time to study how value is extracted in every block now..

Joel

Hello!

The year is 2010. Google had just launched a second-price ad auctions system. The way it works was simple. The highest bidder for an ad would win, but would pay only what the runner up had bid.

This looked like an economist’s dream. Advertisers could bid rates without worrying about overpaying to win the auction. But secretly, behind closed doors, Google was quietly siphoning millions in hidden profits by exploiting the auction mechanism.

If the highest bid placed for an ad spot was $20 and the second highest was $16, the winning advertiser only had to pay $16. Behind the scenes, Google was paying the site publishers the third-highest bid (say, $10) while still charging the advertiser $16, thus pocketing the $6 difference. This hidden money went into a "Bernanke pool" that Google used to pursue its own objectives, like hitting Wall Street projections. It wasn't until a 2016 antitrust lawsuit that this manipulation came to light.

Google finally switched to a first-price system in 2019, paying the publisher whatever the top advertiser bid (minus fees), but the lesson still stands. Even the cleanest auction can be twisted when the auctioneer controls the plumbing.

Interestingly, we're repeating this same pattern in crypto. Blockchains face their own "Bernanke moment." Maximum Extractable Value (MEV)—profits extracted by reordering, including or excluding transactions in a block, has emerged as one of crypto's most critical yet least understood phenomena.

Like Google's hidden auction manipulation, this extraction happens largely out of sight of everyday users but impacts everyone participating in blockchain ecosystems; a hidden tax of sorts.

Will MEV follow Google's footsteps toward secrecy and centralisation, or can it evolve into a transparent, decentralised system where profits flow back to users? Can we design systems where the inevitable extraction of value benefits the ecosystem rather than concentrating wealth among a few insiders? Let’s dive in.

The Physics of Delay

Blockchains are decentralised networks where thousands of computers (called validators or miners) work together to process and record transactions. I previously wrote about how validators face a complex dual role, acting as communication hubs (receiving and broadcasting transactions) and computational nodes (executing and validating transactions).

There's always a lag in communication between validators because they are spread across the globe. This latency is unavoidable, limited by the speed of light.

These validators need a way to sync up and ensure they are following the same order of transactions. Each chain sets a ‘block time’ where one validator is selected to propose the next block of transactions. The remaining validators accept this block after they double-check that all the transactions follow the rules of the chain. The proposer is rotated amongst the validator set using a consensus mechanism(such as Proof-of-Stake) after every block to ensure the network stays secure.

Bitcoin every 10 minutes

Ethereum every 12 seconds

Solana aims for a blazing-fast 400 milliseconds

L2s like Arbitrum and MegaETH every 10ms- 250ms

Each timing window, regardless of length, creates opportunities for validators to rearrange transactions within the block to maximise their profits rather than prioritise user fairness. Ideally, it should be first-come-first-serve. But this is difficult to execute because nodes are distributed across the world. When a user initiates a transaction, it is almost guaranteed that not every node will see it at the same time due to network latencies. This means that an unfair transaction order (where users end up paying extra, and MEV exploiters capture the difference) can sometimes be included in a block without violating any rules of block building.

MEV refers to the profit that block producers (miners in proof-of-work or validators in proof-of-stake) and other participants (by bribing block producers to include their transactions before users’) can extract by strategically arranging transactions within blocks they produce.

MEV Is Big Business

Let’s say Joel is using a decentralised exchange(DEX) like Uniswap to buy ETH at $1800. He sets slippage tolerance to 10%, meaning he is okay with the price moving up to $1,980 by the time his trade goes through.

Joel’s transaction sits in the mempool, the public waiting room for pending trades before it’s scooped into a block and added to the chain. A bot sees it, duplicates his order, and sneaks in with a higher gas fee so it gets processed first. A higher gas fee is essentially a bribe for the validator to include this transaction before Joel’s. Its buy order pushes the DEX price of ETH up to $1,900. Joel’s trade executes at that inflated price, and the bot immediately sells its ETH back into the pool at this price, walking away with the spread minus the gas fee. Joel got ETH, but he’s out an extra $100, and the bot collected the profit. This happens thousands of times every day across crypto markets.

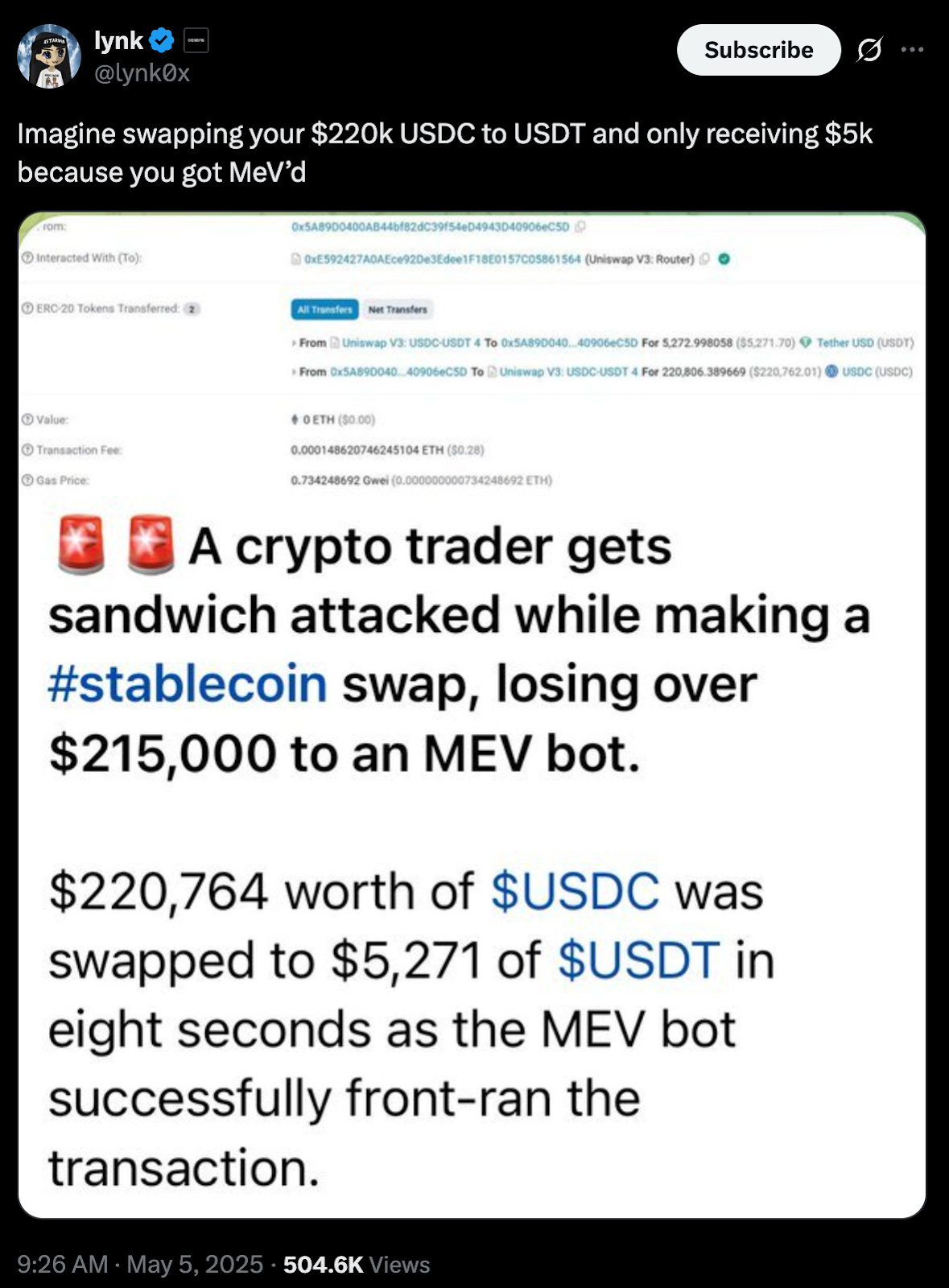

In extreme cases, like this poor trader who forgot to set slippage, a bot pocketed $200k on a single mistake. The culprit in this case is jaredfromsubway.eth, the bot which consistently tops the list of gas spenders on Ethereum to get ahead of transactions it wants to attack. Jared is expected to have made well over $10M through MEV attacks.

MEV manifests in three primary forms:

Arbitrage: Spot a price mismatch between exchanges, buy low and sell high in the same block. For example, ETH is trading at $2,500 on Uniswap but $2,510 on Sushiswap. A bot can buy ETH on Uniswap and sell it on Sushiswap within the same block, locking in a $10 profit per ETH without taking on market risk. Note that this is good for the market because it ends up converging the prices of assets across venues.

Sandwich Attacks: See Alice’s big buy order in the mempool, buy before her (pushing the price up), let her pay that higher price, then sell right after. The bot pockets the spread, Alice eats the slippage. The example mentioned above is a sandwich attack. Joel paid $100 extra, which is essentially a profit for the MEV value chain. This is undesirable because users end up paying more than necessary.

Liquidations: In lending protocols, when a position becomes eligible for liquidation, MEV extractors race to liquidate first and claim the liquidation reward. Let’s say, Saurabh has borrowed $10,000 USDC against $15,000 worth of ETH on Aave. After a price drop, his ETH collateral falls to $11,000, breaching the liquidation threshold. A bot races to liquidate 50% of his loan. It repays $5,000 USDC and, in return, receives $5,500 worth of ETH (thanks to a 10% liquidation bonus). That’s a $500 profit, secured just by being the first to act. This can be good and bad depending on the context. The incentive in the form of liquidations is good for the overall health of DeFi. But most of this revenue ends up with validators.

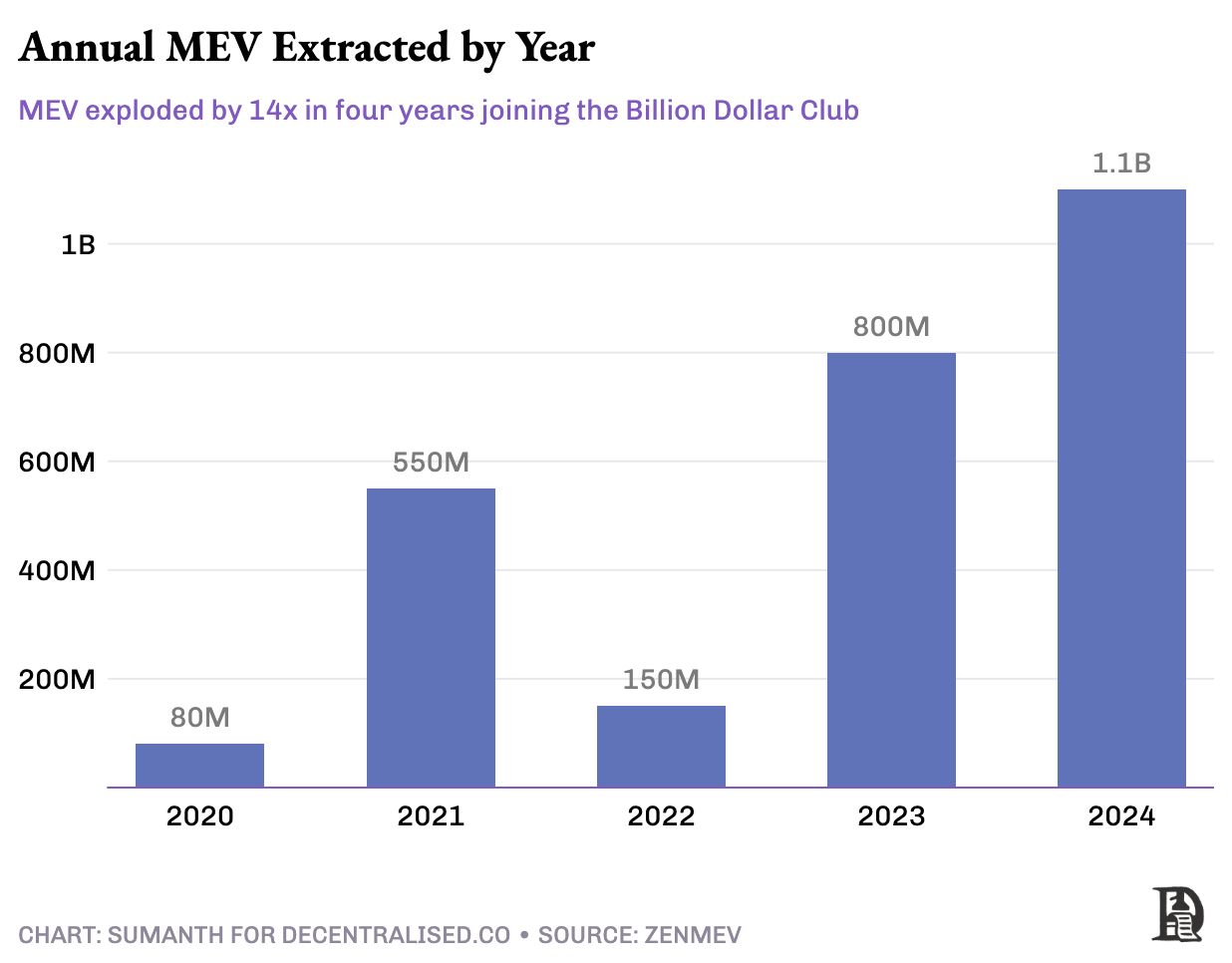

MEV extraction has doubled from $550 million in 2021 to $1.1 billion in 2024. Ethereum remains MEV’s ground zero with over 100+ active bots, due to its open mempool and deep DeFi liquidity, responsible for roughly 75% of all MEV extraction to date. Over the last 30 days, sandwich attacks accounted for 66% of MEV volume on Ethereum, arbitrage for 33% of volume, while liquidations were just under 1%.

As on-chain trading expanded on other chains, so did MEV. Solana, BNB Chain, and Ethereum roll-ups have all become hunting grounds for profit-seeking bots, even affecting CZ, who experienced a sandwich attack while swapping. Sandwich bots on Solana have made over $4M (24k SOL) over the last 30 days, around 50x of what bots have made on Ethereum ($80k) in the same time.

Cross-chain bridges have now turned the game into an inter-chain relay race, with bots hopping between ecosystems to capture every stray dollar. During December 2024 alone, MEV activity on Solana peaked past $100 million, fuelled by market volatility around Trump’s re-election bid.

Last year, around $1.5Tn was traded on DEXs, which puts MEV costs at around 0.1% of total activity traded. Frontier Labs puts this number at a lower range, suggesting that costs can go up to 1% of total activity, taking a toll on large-sized swaps. It is tempting to think of MEV as something bad and evil. But the fact is, in any financial market, there is value leakage. The point is to figure out how we can reduce it, and/or distribute it among market participants.

The MEV Supply Chain

Early blockchains gave validators two super-powers:

choose which transactions make the next block and

decide their order.

This created a big problem that reminds me of the dark pools described in "Flash Boys." Just as stock exchanges created privileged access for high-frequency traders, Validators could secretly partner with bots and make sure bot transactions were processed before regular user transactions. This pay-to-play scenario meant insiders could always get the best prices while regular users got the leftovers.

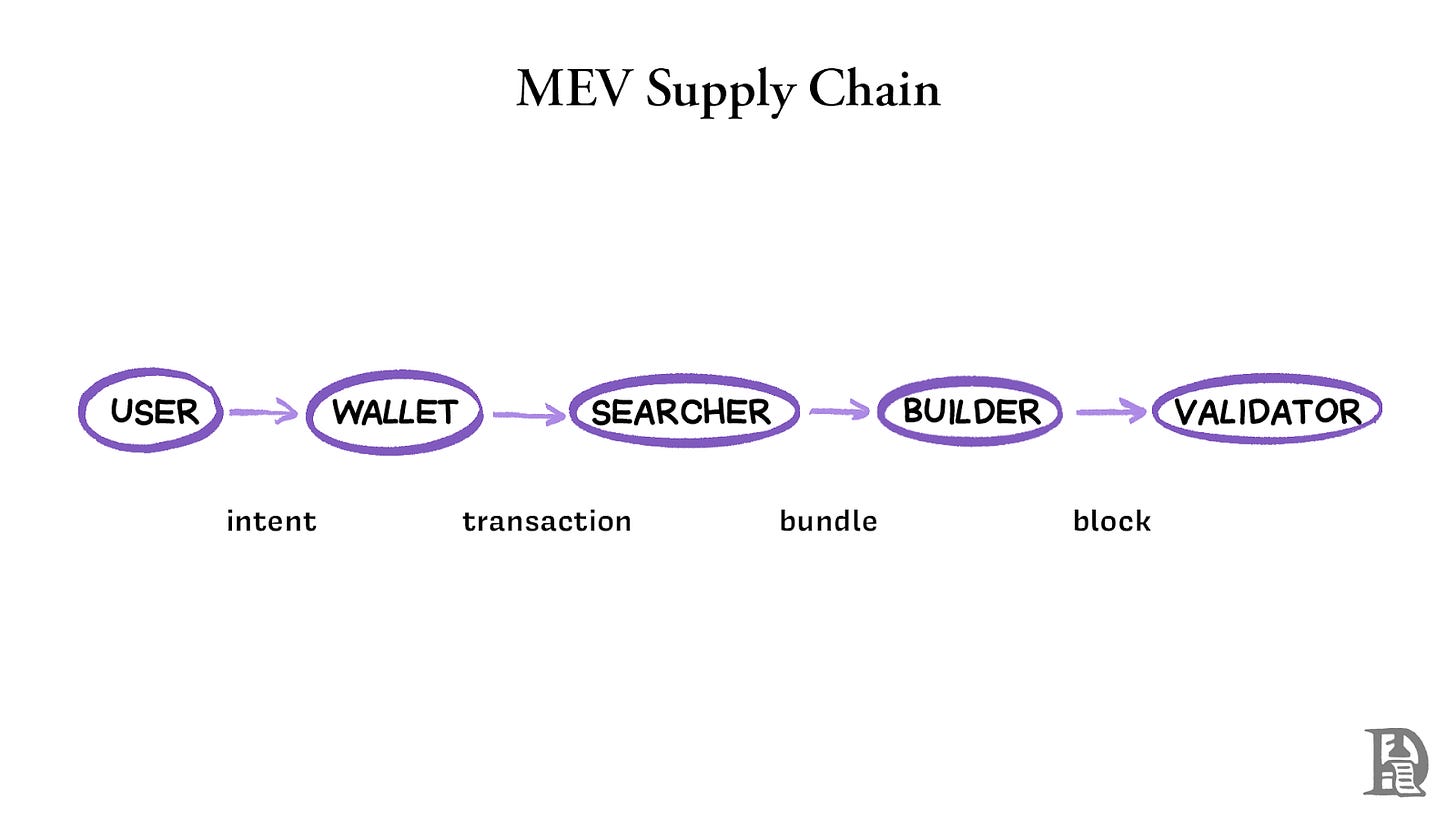

Recognising this centralisation risk, the Ethereum ecosystem is moving towards Proposer-Builder Separation (PBS). This splits up the roles of building blocks and adding them to the chain:

Users submit transactions or higher-level intents (e.g., "swap token A for token B at the best rate").

Wallets process this transaction and send it to a searcher/builder/mempool through a node.

Searchers scan the mempool for profitable opportunities and bundle related transactions together.

Builders construct complete blocks by aggregating bundles and auction them off.

Validators (or proposers) choose the most profitable blocks, double-check the validity of every transaction with the block and add the block to the chain.

This separation reduced the power of validators as they can only choose from pre-ordered blocks, distributing MEV opportunities more broadly and creating a competitive marketplace for block construction. The most widely used implementation of PBS is Flashbots' MEV-Boost, which has been adopted by over 90% of Ethereum validators as of early 2025.

What began as Miner Extractable Value has evolved into Maximum Extractable Value. It’s no longer just miners doing the extracting, but an entire cast of actors. When you hit ‘swap’, you’re almost never trading with another regular person like yourself, whether it’s an AMM (Automated Market Maker) DEX like Uniswap or an order book-based DEX like Raydium.

Behind the curtain sit professional market-making firms such as Wintermute, which supply liquidity and profit by capturing the spread, which is the small difference between bid and ask prices. On AMMs, they provide liquidity by depositing crypto into pools, earning fees from swaps.

Wishing away MEV isn’t realistic; it’s baked into block-time economics. On one hand, arbitrage helps keep prices consistent across CEX-DEX markets and even subsidises network security through MEV tips. The downside involves sandwich attacks and gas price wars that push regular users into paying higher prices.

MEV is an inevitable feature of efficient markets—wherever profit can be made, it will be made. The current ecosystem benefits professional searchers, builders, and market-making bots. Those who bear the costs are everyday traders who get frontrun, pay extra slippage, or see liquidity migrate into private “dark pools” they can’t audit. Bots flood mempools with rapid-fire transactions to win MEV opportunities by milliseconds. These latency races clog mempools with spam, waste bandwidth and drive up fees, introducing a hidden tax on every swap. The game is not to abolish MEV, but to decide who keeps the spoils and on what terms.

Strategies for Reducing MEV

The ecosystem has explored four main strategies to address MEV: hiding, exploitation, minimisation, and redirection. Each approach has its own trade-off between efficiency, fairness, and technical complexity.

MEV Hiding

The simplest approach is to keep transactions private until they're included in a block. Tools like Flashbots Protect and Cowswap MEV Blocker help with this.

Using these services is straightforward. Your transaction goes privately to builders instead of being visible to everyone. Bots won't see your transaction until it's already processed.

The downside is that you have to wait for a validator using these services to be selected as the proposer. On Flashbots Protect, this might take up to 6 minutes, but you can cancel anytime until it’s executed, as the transaction isn’t being sent to the mempool. Market makers and large traders typically use such services to avoid revealing their trades early. So far, users have sent over $43 billion through Flashbots Protect.

I'm sceptical about centralised privacy solutions because they remind me of dark pools in traditional finance. What starts as protection for users often evolves into Robinhood-esque privileged information for insiders.

Flashbots and Beaverbuild are working on using hardware (Trusted Execution Environment) that can cryptographically prove they're honest, which is promising but not yet proven at scale.

Some communities are stepping up and taking action. The BNB community voted for the Good Will Alliance, where validators accept block bids only from MEV-compliant builders. These builders filter out MEV-exploiting transactions, and the system penalises validators who don’t use MEV-compliant infrastructure.

MEV Exploitation

Rather than eliminating MEV entirely, some protocols aim to weaponise competition for these MEV profits through private auctions. It’s like turning the hunters against each other.

Imagine Joel wants to swap 100 ETH for USDC. In the traditional AMM model, this trade would hit the public mempool, where it’s vulnerable to sandwich attacks. But in an RFQ (Request-for-Quote) model, Joel instead submits his swap request to a network of market makers. Let’s say Wintermute quotes him $2000 per ETH, while DWF Labs offers $2010. Joel accepts the better quote and executes his trade at $2010, avoiding slippage and frontrunning.

Behind the scenes, each market maker is estimating the potential profit they can make with this swap. They want to give Joel the best execution price by drawing liquidity from different sources as long as it’s profitable, while outbidding other market makers.

RFQ systems come with their tradeoffs. They require a reliable, 24/7 network of active market makers with the liquidity to respond in real time. Without enough participants, the system can feel sluggish. Users are left waiting while prices move. RFQs are more commonly used in less liquid markets like Fixed Income Bonds where order books can’t offer sufficient depth. And if the pool of market makers isn’t credible or decentralised, RFQs risk becoming just another insiders’ club.

To address this, Pyth built Express Relay on Solana, an off-chain marketplace where any protocol can tap into a competitive pool of market makers. Instead of building custom integrations with each market maker, a DeFi app can outsource execution and still minimise MEV.

Jito took a different path to become the dominant validator client on Solana, now controlling over 90% of the network's staked SOL. We previously wrote about how Jito experimented with a mempool on Solana but gave up on the idea after it was gamed by attackers willing to pay well over $300k for block priority.

Now, Jito runs off-chain auctions every 200ms to select the most profitable transactions and include them in the next block. Users who want priority pay for speed by adding a ‘tip’ to block any MEV attack. The highest bidders get in, and these tips are channelled to validators, contributing as much as half of validator earnings on Solana.

MEV Minimisation

This approach builds on the previous method of auctioning order flow but aims to reduce the overall amount of MEV possible through clever auction design.

Processing transactions one by one creates opportunities for MEV because bots can observe and react to each transaction in sequence, inserting their own profitable trades in between. Protocols batch multiple orders together and process them simultaneously at a single price. Since all orders are clubbed into a batch with the same price, there's no opportunity for MEV bots to exploit ordering or timing differences.

CoWSwap pioneered batch trading with a simple insight: when one user wants to sell ETH for DAI and another wants to sell DAI for ETH, they can swap directly without using an exchange. CoWSwap collects trading intentions over short windows and looks for these natural matches before using on-chain liquidity for leftovers.

Even better, traders don't need to become crypto market structure experts. When using CoWSwap, you don't have to fine-tune complex parameters like slippage tolerance or routing paths across multiple liquidity pools. You simply express what you want to trade, and competitive "solvers" (specialised market makers who act as auction settlers) handle the execution details while bidding against each other to offer you the best possible price. These solvers provide the same price for every asset traded within the batch.

The results speak for themselves. Cowswap has processed around $100 Bn through its DEX. Barter, one of CoWSwap's leading solvers with about 15% market share, shows steadily increasing volume with over $11 billion processed through the protocol. This growth reinforces how CoWSwap’s batch auction mechanism reduces MEV, as solvers like Barter succeed by competing on price within fair, uniform execution rather than exploiting transaction timing.

This approach aligns with research by Eric Budish, an economics professor at Chicago Booth. He suggests that batch auctions conducted at frequent intervals, such as every second, eliminate the competition for speed by HFTs.

“Batching also resolves the prisoner’s dilemma associated with continuous limit order book markets, and in a manner that allocates the welfare savings to investors.”

In the context of crypto, continuous limit order book markets (like those used in many decentralised exchanges) reward those who can act the fastest. This creates an environment where traders constantly invest in better hardware, faster bots, or more direct node connections, resources that don't improve user outcomes but are required just to keep up. Batch auctions, such as those used by CoWSwap, flip this logic by executing all trades in a fixed time window at the same price. Speed becomes irrelevant, and the focus shifts to price discovery and user value.

MEV Recycling

Some innovators are taking a more pragmatic approach: if MEV extraction can’t be stopped, why not capture it and give profits back to the community?

Arbitrum's TimeBoost exemplifies this philosophy. They've created a 200ms "express lane" that gets auctioned off every minute through a sealed-bid, second-price auction. It is like a VIP checkout lane at a grocery store, where the highest bidder gets to skip ahead for a short time window. Searchers who want their transactions processed ahead of the crowd can bid for this priority access by predicting the MEV potential over a 60-second window rather than engaging in chaotic gas price wars.

This changes the game for attackers, who now miss out on MEV profits from anyone using the express lane. And because the auction rotates so frequently among all searchers, it becomes nearly impossible to form extraction cartels. The system transforms MEV from a shadowy tax into a public good, with 97% of Timeboost revenue flowing to the ARB DAO coffers, potentially generating an impressive $30 million in yearly revenue.

Even Jito, which we discussed earlier, implements a hybrid approach where 3% of the tips paid for transaction priority are redistributed to the Jito DAO and JitoSOL stakers.

Picking The Right Auction

Let’s look at five key auction designs that dominate today's MEV landscape, with an example where three agents (searcher/solver/builder) compete for a block slot with private values of $100, $80, $60.

The “best” auction isn’t universal; it depends on your protocol’s goals.

If you need headline revenue today, stay with sealed first-price.

If you need community legitimacy and sticky users, layer EIP-1559 like base fee + intent uniform price.

To break the latency cartel, adopt Frequent Batch Auctions and let price, not speed, decide the winner.

If speed matters as in the case of DEXes, private order flow is your best bet.

Where To Next?

The strategy of hiding and auctioning order flow to private market makers sounds eerily familiar. Wall Street’s dark pool story is replaying on-chain. As crypto gets more institutionalised and intersects with traditional auction models, this trend is likely to accelerate.

Only the most sophisticated teams can compete as searchers, builders, or solvers. This complexity advantage compounds over time, giving structural advantages to large firms that already have cutting-edge infrastructure and an army of developers working on new ML algorithms. Traditional market makers like Morgan Stanley and Goldman Sachs might enter the arena too.

Blockchains are beginning to take ideological stances on MEV. Solana, with its obsession for ultra-low latency, naturally leans toward private order flow mechanics that mirror NASDAQ’s speed advantage. Ethereum, by contrast, has embraced PBS and MEV-Boost to democratise access. Other chains are exploring novel directions based on their architectural priorities.

The most interesting innovations may happen at Layer 2s, where new chains can implement MEV-resistant designs from the start. Systems like Arbitrum's TimeBoost show that L2s can experiment more freely with different auction designs and value distribution models.

DeFi's composable, permissionless nature creates a laboratory where auction mechanisms can be iterated upon far more rapidly than in traditional markets. Frequent Batch Auctions have been a hot topic since 2015, but have been stymied by regulatory constraints. On-chain, we can implement and refine such innovations in months like Sei did.

Another solution is to create a decentralised network of market makers. We may see Builder Reputation Markets emerge where builders stake tokens to prove their honesty. Using systems like Eigenlayer, market makers could develop transparent reputation scores that protocols feed into.

If this sounds crazy, remember: two decades ago, nobody thought sub-millisecond microwave towers would rewire the S&P order book. Incentives find a way.

Checking FIFA World Cup ticket prices,

Sumanth Neppalli

Disclaimer: DCo and/or its team members may have exposure to assets discussed in the article. No part of the article is either financial or legal advice.

Just learned more about MEV than anything else I've read. I'm also waiting for World Cup tickets, lol