The Curator Economy

Making communities great again

Hello kids, millennials and fellow boomers,

In 2023, we published an article exploring a vision for a new internet. In the years since, AI-generated spam has taken over feeds, and social networks have become insufferable due the excessive amount of performative theatrics. The human mind seeks connection and depth in what it consumes.

Curation is the pathway to fixing the internet. In the age of abundance, taste and curation are what help pick and choose what should command our limited attention. Blockchains, as payrails and open social graphs, can help with this transition from algorithmic, randomised catering to our emotions to curated, user-owned ones. This is the basis for my article today.

In my previous story, I explored the role embedded markets will play in defining the web. Today, we will explore how curation & community will contribute to it.

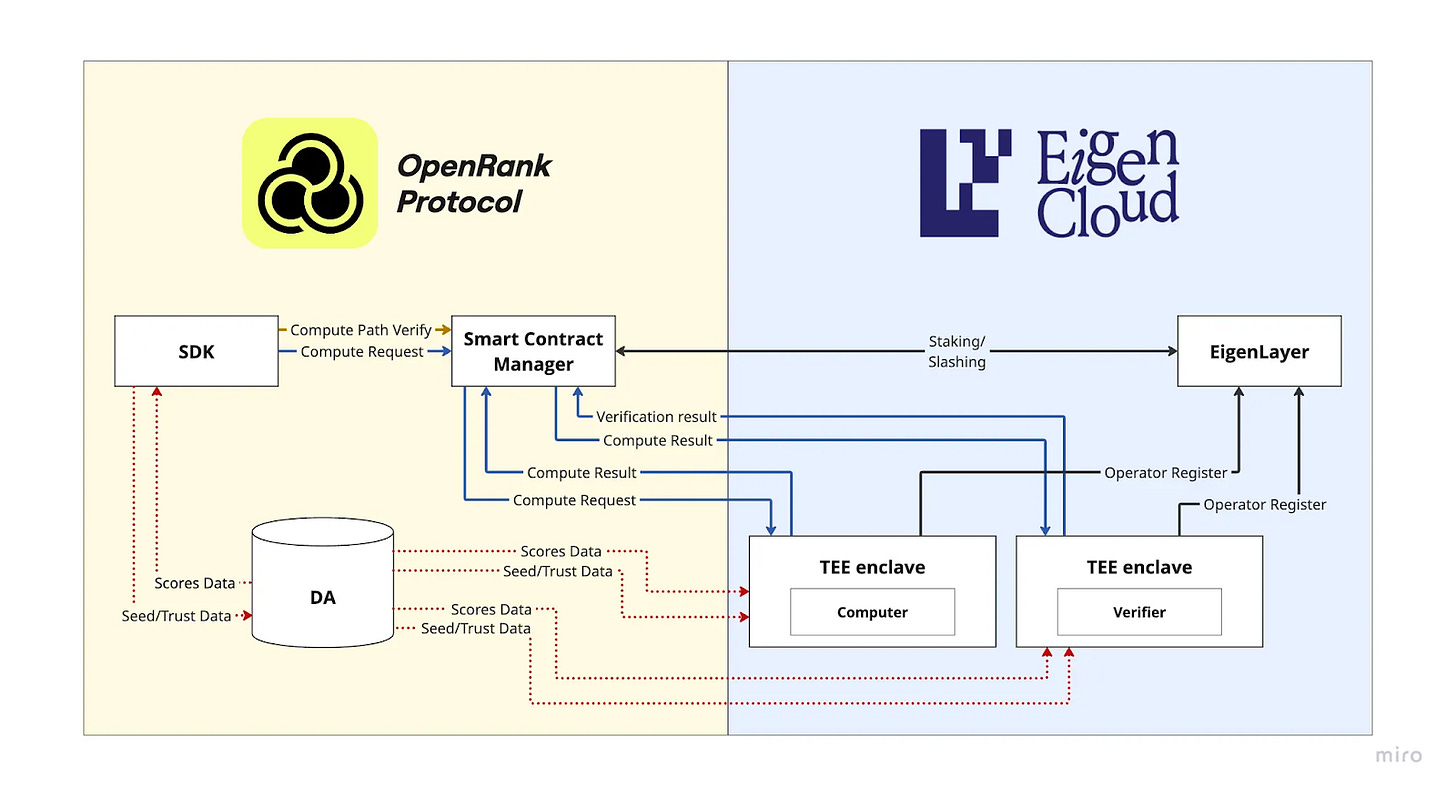

Sahil from Karma3 Labs was kind enough to offer notes, observations and a great amount of product insights. His team has been building OpenRank, an open ranking and reputation protocol. They power social feeds on Farcaster, provide token recommendations for wallets like Rainbow, and have recently launched Cura, a Reddit-like app for crypto communities. Why are they focusing on ranking? Because it is the foundational layer for all kinds of curation.

Cura is building the most cypherpunk vision of what a social network could look like. It allows users to customise, confirm, and verify where content originates from on social feeds like those on Farcaster. It also gives tooling for communities to incentivise the right members. Underlying Cura is OpenRank - a verifiable reputation system that combines web2 and web3 native forms of reputation.

Bitcoin lets you own your money. We are seeing the dawn of protocols and tools that let you own and incentivise your attention. Not using black box algorithms, but open, verifiable, and customisable algorithms.

OpenRank is one of our portfolio companies. The piece below is a summation of months of iterating on Web3 social networks and the primitives they will need to scale. If you are building along these lines, drop us a note at venture@decentralised.co. We’d love to chat.

Special thanks to Joe Gerber from IDEO CoLab for helping me think through the arguments here.

It’s February 2022. The weather in Dubai was all too pleasant, but my body couldn’t make use of it. My brain was on the verge of becoming pickled - or having a diabetic coma, given the amount of sugar in my body at the time. Normal sugar ranges tend to be around 100mg/dl; mine was averaging close to 400. If it weren’t for the timely recommendation to use a glucose monitor, my life would have turned out different.

Amidst the rush to move to a new country, build a life, maintain a career, find friends, set up a home and everything else that 20-somethings do, I didn’t realise I’d have to deal with being pre-diabetic. I was fortunate enough to get the best medical care, and my sugars are under control now.

Part of what helped was finding a community. Deep in the alleys of Reddit, I read about lovers wondering what to do for their partners who were diabetic. I read stories of parents wondering how a life will pan out if their child is diabetic. I also kept track of stories of sugar ranges trending to normal.

Reddit was human, curated and contextual.

I did not have to deal with the judgment of being diabetic at 27. No worried parents. No stern doctors. Just humans sharing stories with other humans. Most of them - anonymous. Faces I never knew, somehow delivered boxes of hope. Years later, I realise how valuable that was for me.

In fact, the markets recognise this too. The Dow Jones Internex Index is up 42% since Reddit’s IPO in March 2024. In contrast, Reddit is up close to 500%. Part of the reason is the fact that Reddit is the sixth most googled word. Consumers routinely add “+reddit” to their search queries. Millennials and Gen-Z alike flock to Reddit for reasons ranging from wondering if they were a jerk to seeking fashion advice. There’s even one on retiring early.

Why would a social network with mostly anonymous handles, no creator monetisation, broken sub-Reddits and overly opinionated individuals be the last bastion of hope for the web? Our understanding is that it does a better job at curation. This year, it sued Perplexity for using its data and generated close to $35M from data licensing deals alone. How does this extend to the web?

The web evolved onto what it is today due to algorithmic optimisations that enabled the development of social networks and the consumer Internet. If platforms could not surface content that was relevant, entertaining and useful for users, many of us would have stayed offline reading books. However, that has now gone to the extreme.

Curation offers an alternative. Why do we need it at all? To understand, we should know how the web monetises itself today and how the plumbing behind it came together.

Bidding Context

Why did Google become a verb, instead of AOL, MSNBC, Yahoo or AskJeeves? We clearly don’t use Bing for anything. Part of the reason is the algorithm used to decide page ranking on Google search. You can read the original paper here (from 1998) or refer to these slides. Put simply, Google began ranking pages that received a high amount of human traffic instead of maintaining a directory. It also started prioritising pages that had links to other prominent pages. It was practical, accurate and useful, much like ChatGPT or Claude today.

It was a whole new way of interacting with the world’s catalogue of information, but it needed a monetisation model. The web was racing to figure out how to do ads better than its traditional counterparts.

In 2007, Google acquired the ad-tech company DoubleClick for $3.1 billion. This was in addition to the acquisition of YouTube in 2006 for $1.65billion. One was a lovely creation that captures cultural icons, such as this video of how Charlie bit a finger. The other is a sophisticated exchange. What were the guys at Google doing? Keep in mind, this was also the crew that shipped Gmail, acquired Android, developed Google Maps and owned roughly 70% of US search traffic.

They were building context. To understand Google, you need to know how the financial plumbing under the behemoth works. Think of DoubleClick as the equivalent of Nasdaq for human attention. As of 2017, it was the largest advertising exchange.

When a user visits a website (like WSJ), it needs to quickly figure out three things quickly:

The best ad to serve.

The highest price it can derive for said ad.

The inventory for both advertisers and attention.

Contrary to popular belief, the auction for running an ad often happens on Google itself. There are multiple participants in the auction. Ninety per cent of all auctions are cleared through Google. The reason? They possess context most that others lack. It is knowing the exact stop losses or taking profits of an idle order in an exchange. This conflict, between gathering information on users and being the auction house where ads are cleared, is at the heart of what makes Google a monopoly.

Google has that context because it mines data from users. It knows about the videos you watch, the places you visit, the search queries you run, the emails you send and even the battery levels of your phone. It knows the meetings you skipped, the crush you’ve been hoping to take out on a date and even the fact that you searched for flower shops last week. Imagine a stockbroker targeting you with specific stock suggestions based on your purchase history and travel decisions. Google does that, with your time and attention.

In fact, the average person’s data is bid on 747 times each day. Google transmits location and browsing data of Europeans and Americans about 178 trillion times each year. By Google’s own admission, there are close to 4,700 companies that access your personal data via them.

Now imagine the said stockbroker also had life insurance, loans, and credit cards to sell to you. Google routinely prioritises its own products over its peers when serving ads. Google’s context trifecta has three components:

Being the central hub from where you peer at the Internet (search),

Being the exchange house that decides the ads you see (AdX), and

Being a behemoth with a multitude of products that build context on you (Nest, Android, YouTube).

Talk about a toxic relationship.

This paper by Dina Srinivasan provides a thorough breakdown of Google’s positioning in the advertising market. Google had a good run up until 2020 using these models. The digital ad economy market is approaching $1trillion in spending today. However, Google is capturing a decreasing share of it. In 2018, it was responsible for 60% of digital ad spends; as of 2025, that figure is below 50%.

In fact, in the US, Google is no longer the most visited website in the US. That title goes to TikTok, which commands only about 4% of digital ad spend.

In other words, websites that command much of the attention on the Internet do not make much money. The ones that do hold the financial plumbing are seeing a decline in attention.

What even is going on?

There are three broad factors:

Targeting became significantly more difficult with Apple’s update which began requiring consent from users to be tracked.

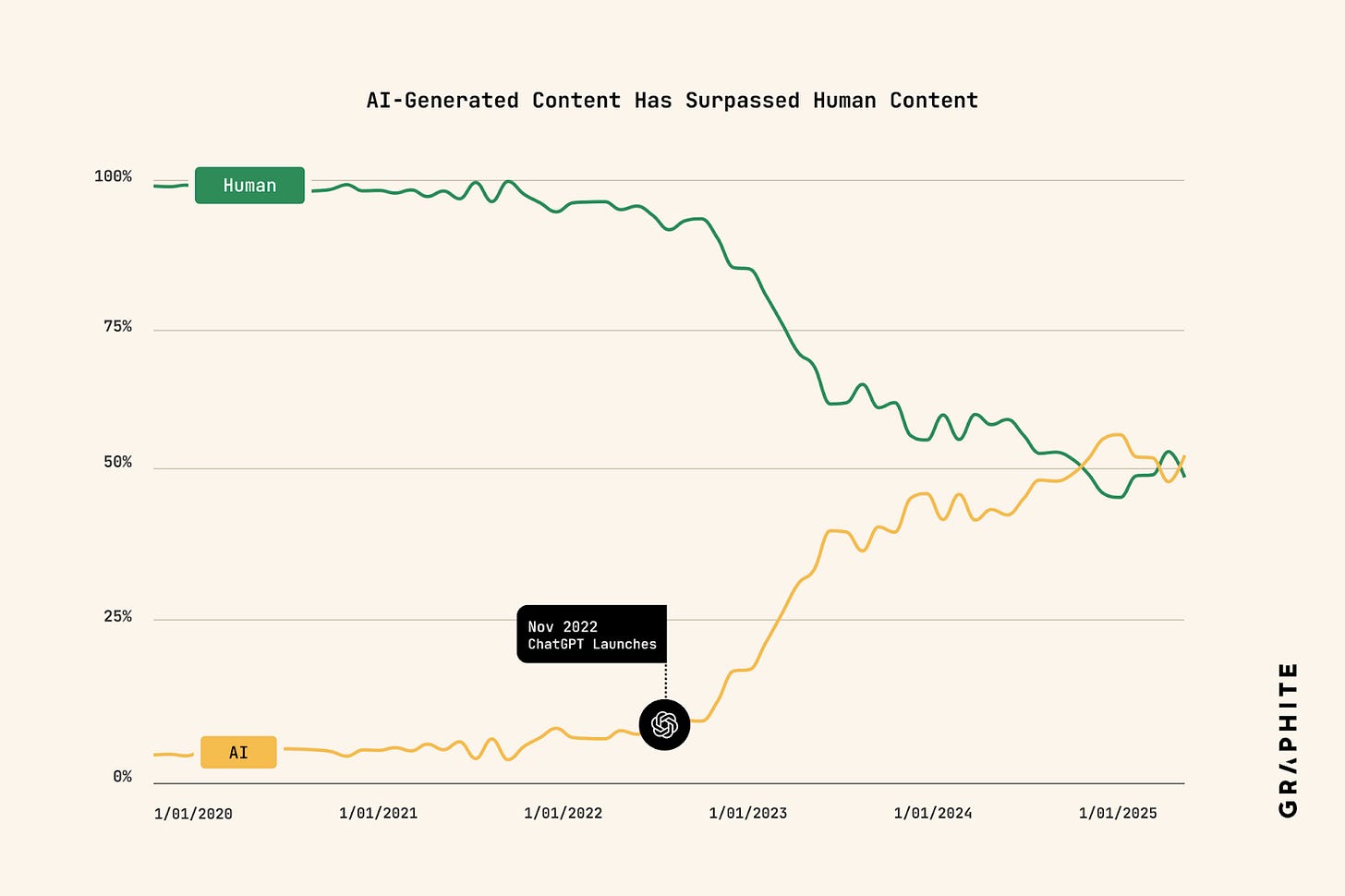

Human-generated content is declining. There is more AI-generated content on the web than there are human-generated bits.

Search itself has undergone a period of disruption owing to consumer preferences now being formed in LLMs (which in turn are trained on Reddit data). This is partly why, for both Alphabet and Meta, a huge chunk of their OpEx for 2025 is their investments in AI.

This is why Reddit matters. It gives individual users the ability to curate through upvote buttons. The platform itself is facing challenges from bots plaguing the platform. However, within its niche, with its strange hierarchy of anonymous handles, upvotes, and a lack of algorithmic newsfeed (to the extent that other social networks have), it has created a parallel web. One that runs on contribution and curation.

In 2006, the Nielsen group published an observation that for most communities, 90% of users are simply lurkers. 9% of users contribute from time to time, and 1% do the bulk of the contribution. The same blog post has other intriguing figures.

Back when the Internet had 1 billion users, only about 1.6 million blog posts were created. Or roughly 0.1% of users were posters. Wikipedia’s top 0.003% of users were responsible for 2/3rds of the site’s edits. It also notes that close to 167k reviews on Amazon were made by just the top one hundred reviewers. A single individual contributed 200k photos to Google Maps and gathered 11 billion views in the process.

When you look at these two patterns, you quickly realise something.

The web is undergoing a period of unbundling —one where large data-mines struggle to be as accurate as they could be. Reddit is the largest experiment in creating niche communities and having humans decide which contributors’ content is worth paying attention to.

The emergence of curated, niche communities is a real thing. We do not know what the business model for them could look like. Web3 native primitives may power them. There have been a few attempts to do this in the past.

I can almost hear some readers snickering and saying, ‘This is the part where he says curators should be rewarded in tokens and that blockchains fix everything!’ Perhaps the argument is that a prediction market can help determine who is the best curator, ultimately leading to better communities.

Or wait, I think every click should be tokenised and traded on Solana, instead of Google’s adX. We could call it internet click markets?

But calm down. I think it helps to understand where we are with Web3 native models of curation and how social networks within it are evolving.

Context Machines for Digital Assets

Every time a new is token released, teams scramble to identify the right people to give those tokens to. Remember how I said the web was built on identifying users and products that need one another? The mechanism for finding the right users has not yet fully matured within Web3. Part of the reason is that, unlike Google, the context required to find and serve the right pieces of content has not yet evolved.

Token generation events are wealth formation events. There is the proverbial “big boom” where a large amount of capital chases a few tokens at the launch of a new network. Due to the same reason, there is heavy demand and competition for it. Most tokens see their ATH in two weeks since launch. Who you give tokens to or allow purchases of tokens to be made from determines who contributes and aids in the evolution of a token economy.

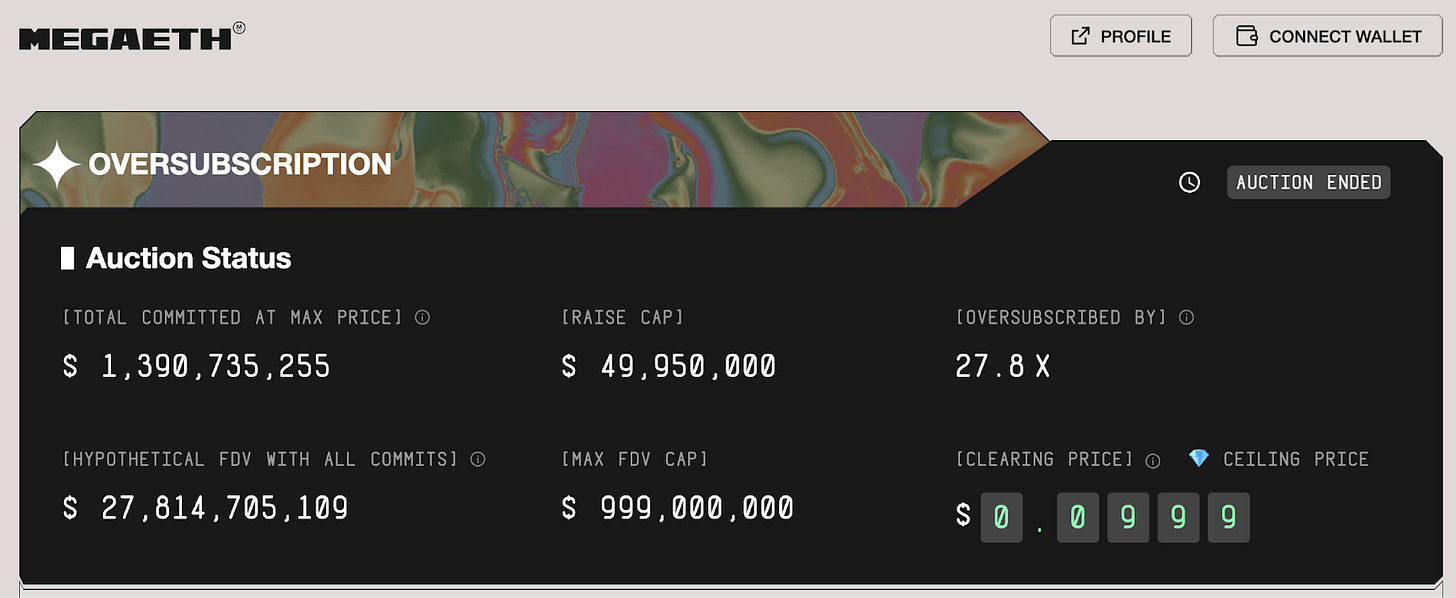

Take MegaETH’s token sale, for example. It was ~28 times oversubscribed. How do you decide who gets the allocation? MegaETH asked users to link their social profiles and wallets with on-chain history to curate a list of token holders who they believe are best aligned with the project.

Every serious project that wants to sell limited tokens and an upper cap on valuation would want to do that. This is similar to every project maintaining its own data indexer instead of using Dune. Open curation infrastructure will play a massive role in crypto’s capital formation.

It is practically king-making in the digital asset era.

This economy may not seem large from the outside, but consider this report shared by Dragonfly with the SEC. It is a fascinating read that explores how much the US citizenry has lost due to geoblocked airdrops. The figure that caught my attention is that approximately $26 billion in airdrops was distributed between 2021 and 2023. Conservatively, roughly $5 billion of value is distributed annually to users from protocols.

If one accounts for NFTs, token-purchase allocations and grants, the number is likely closer to $10 billion per year or approximately 1% of the digital ad economy online today. Can it grow 100 times from here? At which point will it be as big as the digital advertisement space today? I think so.

As assets go on-chain, stablecoin economies expand, and changing regulations around digital assets draw more founders to build within the ecosystem, we will likely see more ad spending within the ecosystem. However, we still don’t have the tooling needed to find users and content that are net beneficial. Before you argue that I’m suggesting moon math, consider that both stablecoin supply and prediction market volumes have evolved a hundred times in the last five years. So, we have seen it. These things are possible.

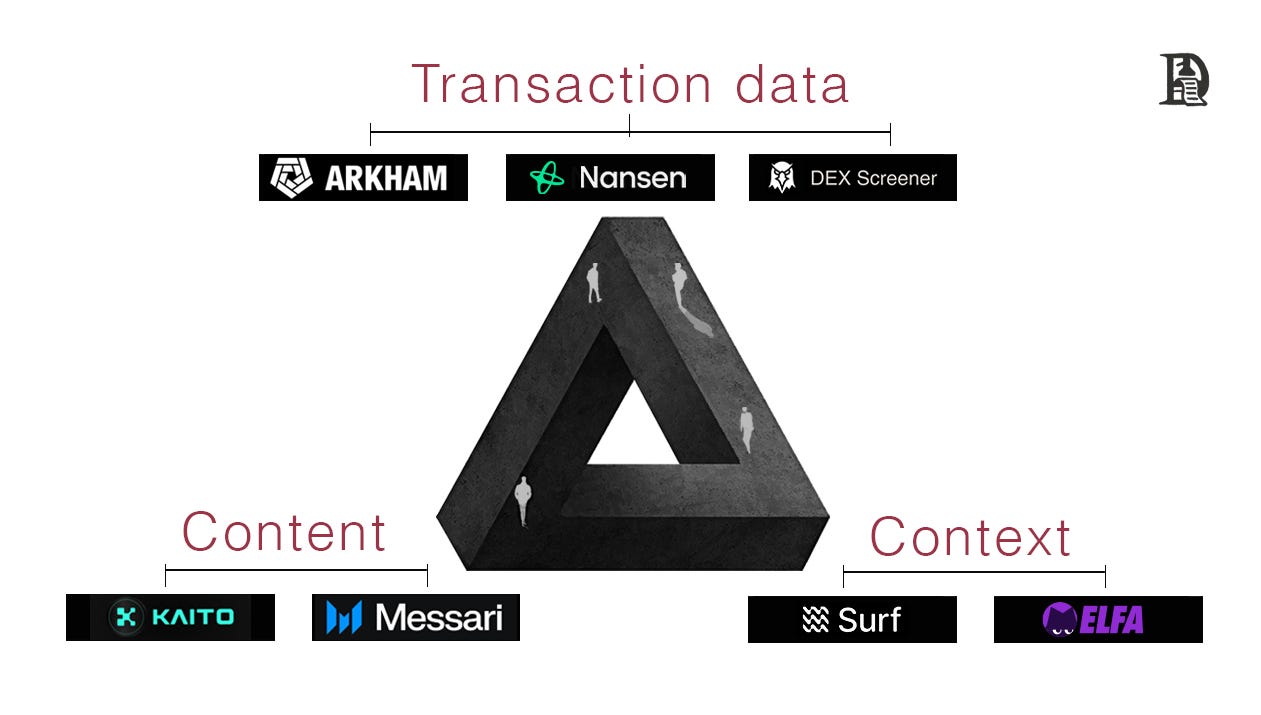

A handful of startups are currently targeting this problem. They are effectively the forerunners of the curation business. They dance on three verticals: context, transaction, and content. They shed light on what happens in our digital economies in real-time without human interaction, today.

Kaito scrapes through the entirety of X feed for Twitter-related content and ranks individuals on it. They weigh individuals based on reach but also consider the number of other high-value accounts that follow them. They call this metric a “smart follower”. This metric follows a logic similar to that of PageRank.

Large protocols need help finding creators who speak and raise awareness about them. Kaito maps these creators and gives them in a pre-curated fashion. In this regard, Kaito functions essentially like Google’s adX. It maps out creators (publishers), ties protocols (advertisers) and gives them verifiable metrics of reach. Instead of having its own distribution engine (like Google’s search), the avenue it uses is X.

More recently, they tied transaction revenue to its own avenue by having launchpads. Eligible users on Kaito get to invest more at lower valuations. Kaito built an economy around the nature of the content we consume on crypto-twitter. In curating content, they also enabled a parallel economy.

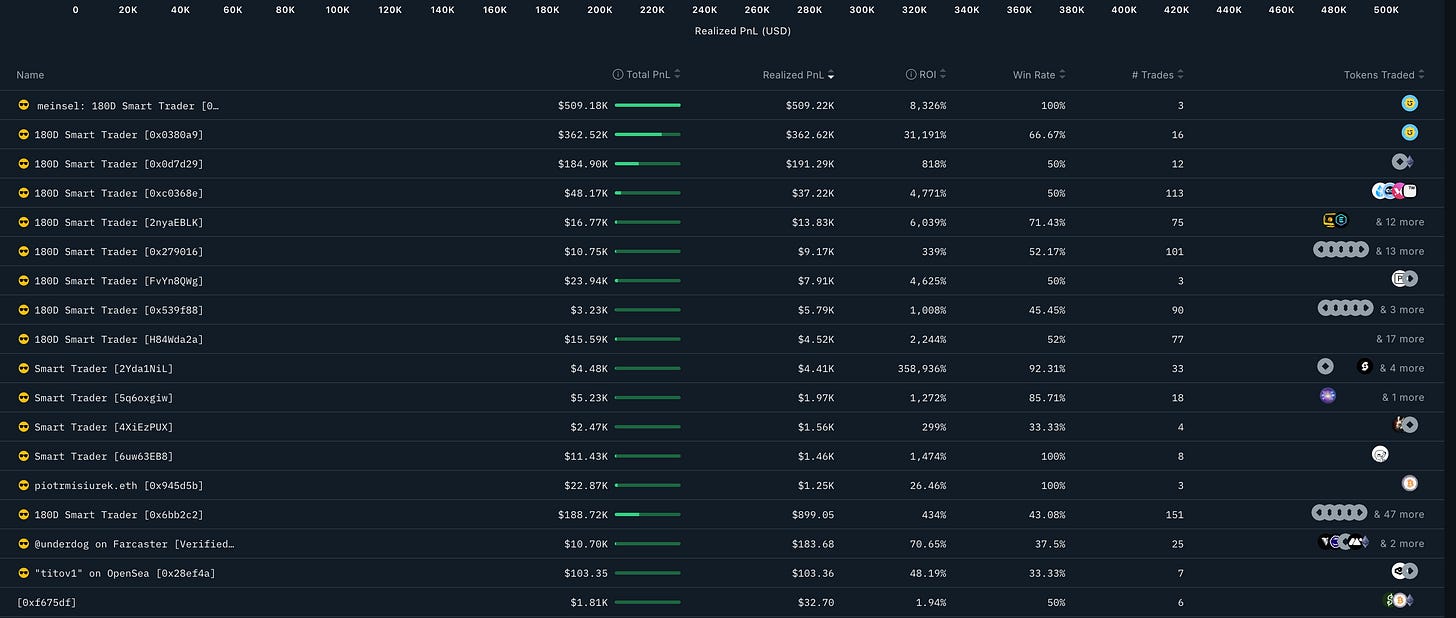

Nansen does a similar job with their AI product, which was launched in 2021 and focuses on labeling wallets for activity. In 2025, they pivoted heavily to an AI-centric focus, with the bulk of it being delivered through a mobile app. You can currently open their app and request tokens within a specific market-cap that has experienced a high degree of smart money flows.

This switch comes with a pricing collapse. From $1k for their premium product to $49. This retailification of their product partly occurred because AI can generate context from transaction data and provide it to users in real-time. Their pricing is probably not where the bulk of their revenue will be generated. Nansen has nearly $2 billion staked with it from close to 400k users.

Soon, users will be able to ask a query and purchase tokens directly from Nansen. The labels and AI integrations will still be integral to the business, but its revenue will come from the volume of assets traded. Users come for the AI, pay for the transaction. Again, Nansen is mimicking Google because its core value proposition for attracting users is the labels it holds on millions of wallets. Wallet addresses in this regard are like Google Maps. Nansen also receives a cut of the transaction that occurs when a customer walks into a location.

While Nansen focuses on transactional flows, AskSurf focuses on the qualitative side of crypto. Think of it as deep research for crypto. You could ask niche questions, such as APYs on a DeFi pool, the timing of an airdrop, or the projects with the highest revenue, and AskSurf would have the answers for you. It gathers highly niche, contextual information from the crypto industry and makes it readily available to the marginal user.

As crypto expands, it effectively becomes the context layer for individuals to understand what is going on. Why does this matter? A large exchange could integrate it with their product and have users ask about a token before buying it. It makes the process of doing due diligence on a token incredibly easier.

We have the necessary tooling to find creators, label wallets, and create context. However, they each exist in isolation. Humans don’t really live lives that are entirely detached from others. Part of what made Facebook powerful in the early 2010s was that you could overlay your personal, professional, and niche interests in a single product. These graphs, existing in isolation, restrict what crypto can be.

This matters when you consider that niche assets, such as concert tickets, product rewards, foreign currencies, and pieces of art, are all being tokenised. Motif, for instance, allows users to create custom, niche portfolios of investment products that are non-speculative using blockchain rails and AI.

Finance is coming on-chain. It is also safe to imply that much of where our attention goes — be it politics, sports, pop culture, or technology —has an underlying financial market around it.

Content is the substrate that brings these two worlds together.

Curation is what will make it safer for individuals to interact with these micro-markets, as everything steadily becomes a market.

Curation is the glue that ties together context, transaction data and content from creators in the digital realm. This happened in Web2 already. As buying gadgets transitioned from a store-first experience to a digital one, creators like Linus Tech Tips, Marques Brownlee, and Dave2D made it easier for buyers to know what they were getting into. Creators like Packy (NotBoring) and Ben Thomson (Stratechery) curate what is happening in technology and redirect attention there.

In Web2, attention markets (such as X feeds or Facebook) and transaction engines (like adX) remained isolated. Creators rarely received a significant portion of the transactions they powered. In Web3, capital markets (like Hyperliquid) directly share transaction revenue with users, but they struggle to have the scale of attention a traditional social network has.

Web3 social networks, like Farcaster, can bring together these three elements: a feed for context, transaction revenue, and a multitude of digital assets. Curation by individuals with both taste and knowledge is what will power that transition.

Curators Are Our Last Resort

The counterbalance for algorithmic content on the Internet has been individuals sharing good content. Perhaps, there’s something innately human with the act. We send reels to friends. Create playlists for lovers. Sharing reading material with colleagues. In the digital age, this is how we maintain bonds. We find ways to say, ‘This made me think of you.’

Tools like Sublime allow individuals to create lists that can be shared. It also surfaces similar content. Think of it as Pocket, but for 2025 (RIP). Communities that concentrate around chat groups have become hubs for curation. They combine reputation, context and content - without the tools to monetise any of it.

WhatsApp has steadily increased the size of a group from 32 to 256 over the years, as it see this transition. For such groups to scale, we will need three things.

A shared unit of value. This can be tied to social reputation as is often the case, or an actual on-chain asset that can be traded.

A social graph that is user-owned.

The ability to surface related content based on (1) and (2).

You see primitive versions of platforms trying to incentivise contributors across the web. Reddit has badges for long-term users who contribute directly, but it does not translate to actual capital. Twitter currently does allow creators to benefit commercially from their contributions.

On average, a user receives between $1 and $2 per million impressions. Last year, it distributed $45 million to its creators. It has close to 15k users on it. In comparison, YouTube paid close to $70 billion over the last three years to approximately 3 million channels. Surely, social networks have found a way of giving value back to users, but the fields creators sow - continue to be owned by third parties.

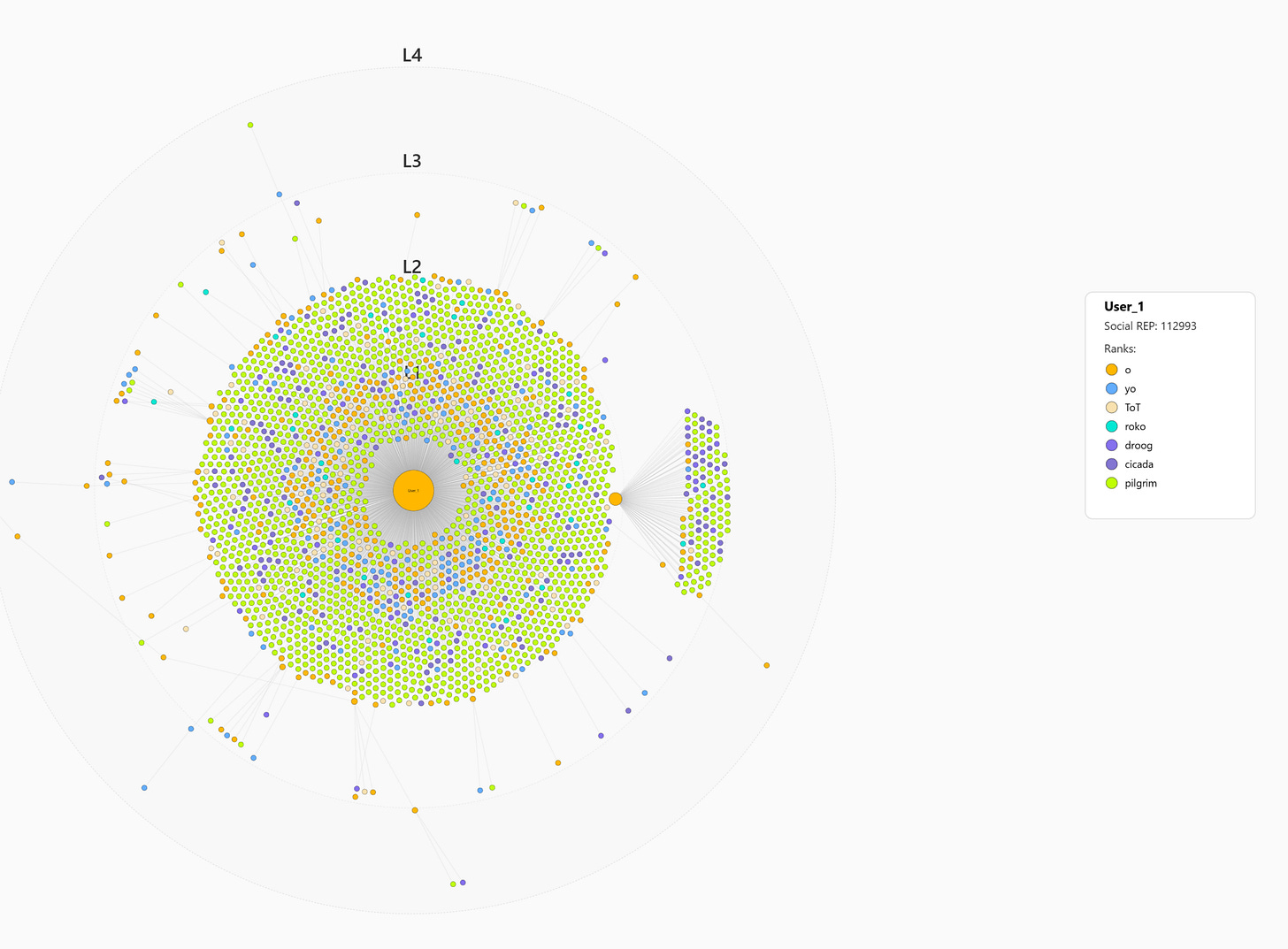

One of the projects doing interesting work in this regard is REP. They empower Telegram users to tie their platform reputation to on-chain activity. Therefore, a user who is active in a prominent chat (such as LobsterDAO) and has a history of contributing early to DeFi protocols could be identified and incentivised by them. They map out social graphs of users by having them invite friends.

The image below, shared by the team, illustrates how individual user profiles are linked to one another on Telegram.

Much like Google uses PageRank, REP utilizes proximity to other users and their combined activity to assess the legitimacy of an individual. They utilise Telegram Gifts, each of which requires manual purchase via the app store to verify if an account is genuine. Such systems of verifiability, identification, or value transfer do not exist in conventional Web 2.0 social networks today.

For products or protocols that are newly launching, REP offers a powerful mechanism for identifying which users are real.

How does this feed into reputation? Communities need verifiable mechanisms to confirm a user to scale. In the age of bots spamming feeds, reputation systems like REP’s enable the identification of potential members and the granting of access. On the web, you want systems to be open access. The possibility of anyone, from any corner in the world, interacting with a community is what makes it interesting in the first place.

However, without effective mechanisms to weed out bad actors or onboard the right ones, much of our communities will remain booted. This is where tools like the one enabled by REP step in. They combine reputation systems from both Web 2.0 and Web 3.0.

The fact is that, despite all the talk about community in Web3, the tools to verify, confirm, and incentivise community members have not matured. We barely know what algorithms are used to create Kaito dashboards or how Nansen ranks its wallets. The data is publicly available and accessible to anyone who runs an indexer. But the algorithms are black boxes.

Part of what the ecosystem will need to mature is verifiable credentialing systems that work in the context of social networks.

Tying Together Context, Content & Transactions

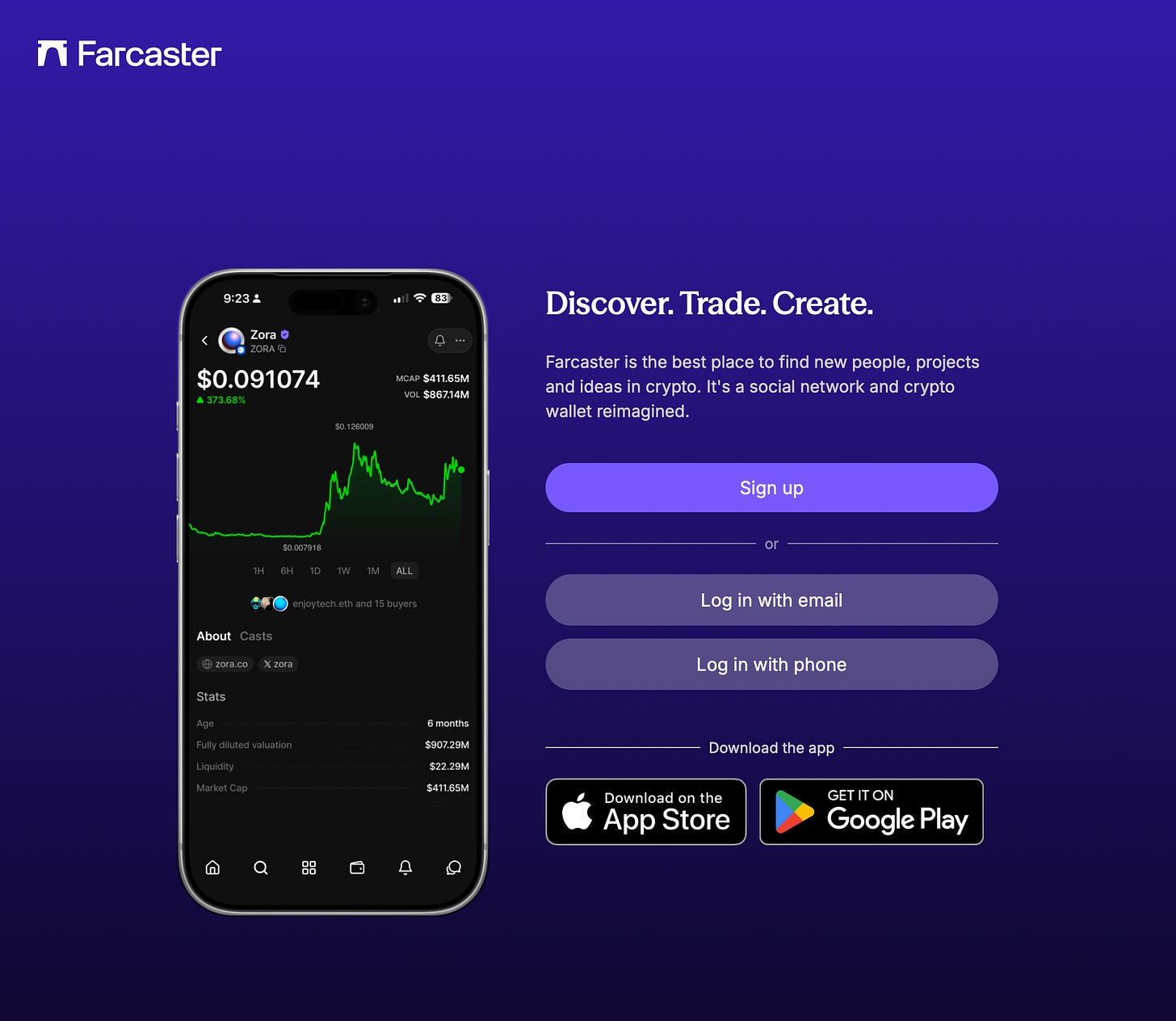

If you open Farcaster’s landing page, you’d see a transition that has been in the works for a while. Their copy makes their mission explicit: to discover new people, projects, and ideas in the crypto space. They are now focused on combining a wallet and a social network into a single interface.

Underlying this transition is the idea that crypto-natives love the financialisaton of everything. We enjoy content, but we enjoy trading even more.

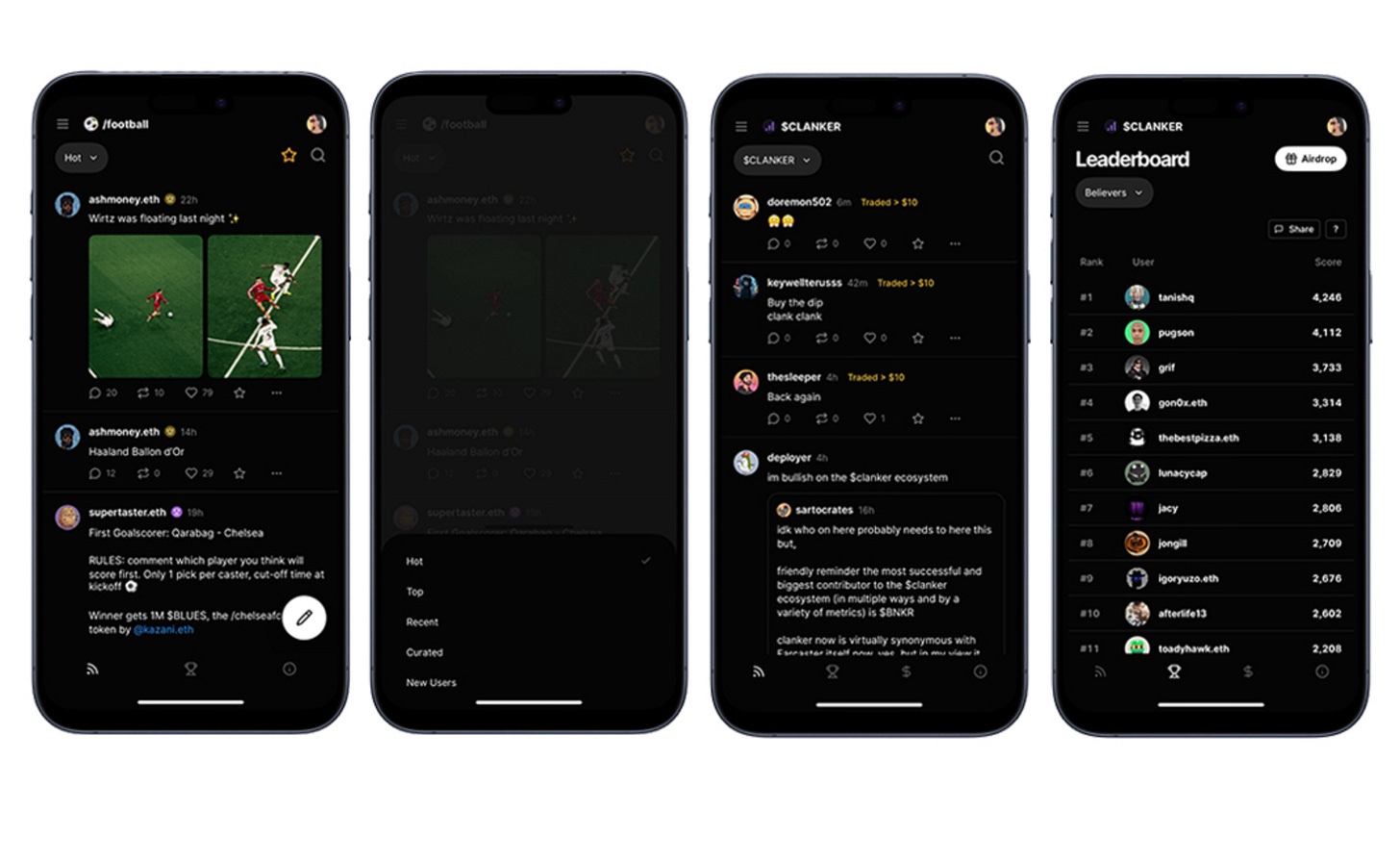

Farcaster is blending these two elements into a single interface. Earlier this month, Farcaster acquired Clanker—a tool for launching new tokens and managing liquidity. Tokens launched with Clanker pass on 40% of the token’s trading pool transaction fees to its creators.

What we are seeing on Farcaster is the slow, steady financialisaton of our social feeds. Unlike X or Meta, the product is not the primary focus of the user’s attention. The product is the user’s wallet. It’s the transactions that make the social network functional. However, as we saw last year, simply launching a token does not automatically create a sustainable community.

To understand communities, it may be helpful to explore how religion or sports bring people together. Both the catholic church and a football league (or soccer as some call it) are similar in that they offer members three core parts.

A sense of belonging through proximity to one another in shared spaces.

A shared language fuelled by culture.

Curation - of hierarchy, events and shared spaces.

Communities struggle to sustain in crypto as profit incentives fuel the culture. These incentives often last too short to create any sense of belonging. Since the formation and death of these communities usually occur in short spurts, there is neither shared space, lore, nor content that emerges from them. What we have is a frenzy to make as much money as possible, with numbers fluctuating up and down.

This is a good juncture in crypto’s evolution for us to pause and reflect. In culture, crypto and capital, I argued that crypto is now crossing the chasm and becoming relevant for the marginal person on the web. We are witnessing this transition in real-time as prediction markets encroach on both sports and politics.

How do we retain, sustain and empower these communities to stay? Web3 has cracked the financial rails well and is at the cusp of breaking into the mainstream. As it does, we can empower individuals to confirm and verify how content is served. Why should we do it? Because in its absence, we will have the conventional loop of capital incentives spiking attention, struggling to retain and leading to churn.

People tend not to return to places where they consistently lose money. There’s a reason why casinos are a once-a-year visit, while your local cafe is frequented much more often. Crypto’s obsession with hyper-speculation puts off people who could use these tools.

What is a fix?

There are three components.

Firstly, all communities run on hierarchies of influence. You need to find whose spheres of influence have the most impact. Said users also need to be incentivised to keep coming back and contribute. Leaderboards are an effective way of doing it. Token-based communities could offer tokens as compensation for sharing information and educating individuals.

A big part of fixing hierarchy is having openly verifiable ranking systems. All human communities eventually tend towards a hierarchy. Tribes have elders, kingdoms have kings. Corporations have CEOs. The reasoning behind the choice of the individuals at the helm is usually known. For social networks, platforms decide the hierarchy without a mechanism for understanding how and why an individual holds the weight it does. This is partly why open-ranking matters. It brings a sense of fairness to the great online game.Secondly, you need the ability to curate. This can happen from the ground up. Individuals can bring in content from any corner of the web and share it with others. On X, until recently, sharing a link was punished. It is a strange form of platform censorship. On Web3 native primitives, such behaviour can be incentivised instead. Individuals who discover, curate and share the best link can be given micro-tips.

Ranking allows individuals with higher ranks to be given more weight in their views. An individual who proactively contributes to and maintains a community is often more valuable than someone who constantly posts spam.Thirdly, users who rank high on hierarchy (direct posters) and curation (third-party content) should be routinely incentivised. Instead of Zora’s philosophy of coining all content, communities should have a single token that can be released over a period of time to their highest contributors.

In fact, Reddit explored this in 2020 but eventually shelved it as it pursued an IPO. Limiting the emission of a community token, while expanding the amount of attention a community gets, is the only way a healthy token-linked community can form.

Why would people even come to such communities? What does crypto have to offer other than tokens? Part of what gives me hope is the ability to verify source, distribution and validation of content. It also allows you to bring together users, traders and contributors with incentives that can be distributed based on verifiable reputation systems.

Web2 social networks routinely fall victim to fake news. Sadly enough, the long-term effects of that are the death of democracy and genocide. In the age of AI misinformation, blockchain rails enable mechanisms to identify the source of news, the individuals who distributed it, and the reason it appeared in your feed. This is not a hypothetical, distant vision. It exists here today on Farcaster.

On a community feed powered by Cura, you could not just confirm why a creator is valued higher. You could see the algorithms used to determine it and tweak how content surfaces on your feed. Instead of having an ad network determine what surfaces to the end user, Cura allows users to tweak what surfaces in their feed. Instead of “hoping” Google or Meta targets the right user, Cura uses on-chain activity and contributions to communities as a measure of who is incentivised. This is a rewiring of how the web itself monetises today.

On X, the owner (Elon Musk) holds the right to boost his own posts. These are black-box algorithms with no visibility that define how social networks run. Primitives like those being built by Cura allow for an alternative where the data that goes into ranking and the algorithms are verifiable. Additionally, users can customise how content appears on their feed.

A community of Football fans may want content that is specific to the game in which their own team is playing. Or a hyper-local community may want news that is only specific to that region. Surely these changes are done by algorithms on their own today. What happens to knowing why content emerged? Or verifying why it is there in the first place.

Why does that matter? We are seeing an evolution of how the web will monetise itself in the years to come. Instead of paying Google to mine consumer data and target them through black boxes, brands will have the mechanism to incentivise power users directly. Imagine you could visit Dubai’s sub-Reddit, find the users who talk about coffee the most, and give them free coupons to grab a cup of coffee.

Or if the top contributors to a fashion sub-Reddit were identified, such that labels gave them a discount to try the product.

Currently, platforms own that data. As social graphs and transaction data emerge on-chain, primitives used to find, distribute value, and incentivise users will become the new Google AdX.

Will this change in incentives change how social networks work today?

Quite possibly. I think it will enable smaller, niche communities to form, coordinate and govern themselves. Present-day communities begin to matter to brands only when they reach a specific size. The tooling to create niche communities (like cafe enthusiasts in Dubai) does not exist, because how will they be monetised? Combining on-chain micropayments (through behaviours like tipping) with verifiable social graphs is an alternative to the status quo.

Communities will need to aspire to be the hub for brands to drop goodies and communicate with individuals. Currently, that happens through creators who engage in hyperbole or platforms that own the data. Retaining a community’s attention for more extended periods is how this transition could occur. Curation is the wedge that makes that transition possible.

The influencer economy is a precursor to the curator economy. We already trust individuals and their taste. Curation allows influence, to be a multi-player game that is focused on specific niches. It turns cults of personality into collaborative effort.

A 1000 True Curators

In 2008, Kevin Kelly wrote an essay on finding 1,000 true fans, setting the stage for what we now consider the creator economy today. The dream was to find a thousand fans who cared enough to pay a few dollars, so that individual creators could sustain a livelihood. And yet, almost two decades later, we could not be farther from the truth.

Most creators never reach a thousand people paying them on the web. Scroll through Substack’s feeds and you’d find hundreds of writers lamenting about how the power laws on the internet work against them. Blockchain payrails make it easier to distribute payments, and with innovations like x402, we will probably see more creators getting paid. However, perhaps the solution is not better payment models. The fix is better communities.

True privilege as a creator on the web today is the ability to take a break. Most creators understand that producing high-quality content at a high frequency is a one-way street to burnout. This is why writers like Packy and Ben Thomson now have multiple associated brands. The core distribution is used to gather eyeballs, while other creators align themselves behind these established names. Effectively, these brands are also micro-communities where the creators are taste-makers who operate in a top-down manner.

They pick and choose what goes on a mailing list.

What if a community decided that in an open space, like a social network? You’d see individual creators having the rights to take breaks and plug off, while still having the ability to return to a curated, niche group of people who care. Instead of engaging in hyperbole, the creators would have the time to think and share good bits of art and thought that push humanity forward, rather than engaging in attention games.

In such a world, the creator goes from being the person who toils on the fields of algorithmic feeds to a landed owner. One where their work can be amplified by the community and also remixed by high-level contributors. A community’s GDP would ideally be proportional to the level of activity among its members. This may seem like a distant concept, but $11AM is already tinkering with such an approach to blending content and capital markets.

Substack is the only platform where writers can do this today, as their relationship with the end consumer is owned by the creator through mailing lists. We will see a version of this with on-chain primitives. The exciting part is that taste makers and curators will be able to incentivise and reward users directly for participation.

This is not a distant vision. LobsterDAO holders routinely get given airdrops. Most recently, they were rewarded by Monad. Users who contributed early on continue to be rewarded, as early participation is seen as a credible signal. Social spaces are increasingly closer to what we consider museums.

Early contributors are the tastemakers who set the tone, culture and nature of content that is shared within it. This model of balancing curation, creation and community is how the web would rewire itself from being a machine for outrage.

In 2023, I proposed a vision for the new internet. Part of my thinking was that blockchain rails would upend how value flows in social networks. I may have been a bit too early - but here’s what we have today.

You can verify, confirm and independently audit why a piece of content came on your feed.

You can examine a rank board and understand why individual creators are valued more highly than others.

You can tweak algorithms to surface different types of content.

Is this vision overly optimistic? It probably is. Cura is one of many social experiments being built on Farcaster. The user base there is smaller than that of a sub-Reddit. Many of these promises were also made in 2022, during the NFT boom.

The difference is that the underlying networks have since evolved, so low-cost payments are a possibility. The culture has also evolved, so instead of selling monkey pictures for $10k, we are now talking about paying $1 for curation. The fatigue caused by social media has risen and that has people flocking to social networks like Substack. Blend these elements, and you will realise that we are in just the right spot for a new social network to emerge.

Much like the meals served back home, perhaps the secret sauce to a better information diet is a bit of curation and people who make sharing it worth it.

Going to meet the Dalai Lama!

Joel John

Art by A. Lozano and Soham