Take 1 of something new.

Mic check 1,2,3

Hello!

Around May, we noticed that many users read the newsletter but never signed up for the mailing list. Annoyed, we tried to tinker with Substack’s settings to make it possible only for those on the mailing list to read our older articles. Substack doesn’t let you do that for free readers alone. So unknowingly, we ended up setting up a paywall for access to our archives.

Since then, some $750 have flowed through Stripe to us. Not a large sum, but enough to validate a few theses. A large chunk of that pool of money came through two of our friends. (Thanks Laura and Eden)

The writing on the wall became quite clear.

People are willing to pay for content that saves them time if you write for executives in a niche industry.

Issuing a paid newsletter reduces our reliance on advertisement dollars, creating a baseline from which we can operate.

We shall save you the nitty-gritty of how we are thinking of scaling the paid newsletter. But for the ±120 people on the mailing list, this is what it would look like.

We will be beta-testing a paid version of the newsletter until mid-August. These smaller newsletters will be in addition to the long forms we already write.

The paid newsletters we write are what we have been hoping to see in the industry for a long time. Brief, comprehensive overviews backed by data about what needs to be known about Web3 on any given week.

You can expect them to be in your inbox twice every week. Since the audience base is presumed to be crypto-native, we will dive deeper and use more jargon than the long form we write. Think of these newsletters as the nerd max pro version of what you are used to reading from us.

One hundred of the most engaged readers of Decentralised.co will have free lifetime access to all paid newsletters we release. We went through two years of data to see who reads and clicks links from our newsletters the most to identify those readers.

Everybody that has paid for access to the archives will also be given two months of free beta access as we tinker and iterate on the final version's appearance. We appreciate you being here.

Saurabh Deshpande, who heads research at Decentralised.co, will lead this side of the newsletter. You may see a few hiccups along the way. Think of these newsletters as a collaborative effort. If you find something you like or hate, reply and let us know as an e-mail response.

We are keeping the paid iteration of the newsletter a secret until its launch in August. So we’d appreciate it if you do not leak out its existence. We are not ready yet for a large mailing list on the paid version. With all that out of the way, here’s Issue 1.

Joel John

It is the week Zuckerburg launched Threads. Everyone’s eyes are peeled on Meta’s alternative to Twitter, but the bankers seem hard at work. Our issue today looks at how forex markets may embrace DeFi native innovation, a possible hypothesis on why most on-chain analysis is flawed and a venture we find intriguing.

TradFi Meets DeFi

Innovations often find more use cases and users than desired when they are born. A great example is the internet itself. It has evolved from being a mode of communication for academia and the military to one plagued by TikTok videos and Twitter cancellations.

Bancor launched the first automated market maker (AMM) in 2017. The idea was to facilitate trading via pooled capital instead of traditional order books, allowing users to trade assets without losing custody. Incidentally, the AMM model was championed by Uniswap, and it became one of the most used building blocks of DeFi.

Recently, signs have emerged that using AMM may transcend the realm of DeFi. The Bank of International Settlements (BIS) recently published an interim report on Project Marinara titled “Cross-border exchange of wholesale CBDCs using automated market-makers”. It is a joint proof of concept (PoC) among the BIS Innovation Hub, the Bank of France, the Monetary Authority of Singapore and the Swiss National Bank.

The PoC has three objectives –

To examine wholesale CBDC (wCBDC, think of this as a wrapped/tokenised version of the currency that can be used on-chain) token design based on a uniform technical standard and incorporate governance features that meet central bank requirements

To design bridges for the seamless and safe wCBDC transfer between domestic platforms and an international network

To develop an FX interbank market using an AMM. The feasibility focus of the PoC is complemented by operational and policy considerations, such as wCBDC governance aspects, as well as trade-offs associated with bridges and FX trading and settlement using an AMM.

According to the BIS, the forex (foreign exchange) is the largest trading market, with a daily volume of $7.5 Tn. Forex settlements of today are complex and can take anywhere from a few hours to several business days, depending on the currencies and institutions involved. One of the goals of G20 is to improve cross-border payments, and this is where AMMs can help.

The AMM model allows instant settlement without the need for intermediaries that cause the fees to increase and add significant time delays. The model explores an AMM with three currencies – EUR, SGD, and CHF (wholesale CBDCs), analogous to Curve’s design of AMM, where the pool consists of three assets.

Commercial banks are liquidity providers (or market makers), and they can deposit currencies and receive LP tokens against their deposits. Takers are traders who wish to trade one currency for another. The bonding curve, used to price different assets in the pool, is based on Curve V2’s AMM design. That may have gone over your head, so here’s a simpler process breakdown.

Say you want to swap CHF for SGD. The AMM consists of wholesale wCBDCs.

CHF is converted to CHF wCBDC.

CHF wCBDC is then bridged (transferred) to the international network.

CHF wCBDC is swapped to SGD wCBDC.

SGD wCBDC is bridged to the domestic network

SGD wCBDC is then redeemed for SGD.

While this is in the pilot stages, the model significantly reduces the number of intermediaries involved and, in turn, the settlement time. If this proves to be as effective as we think (and gains enough political will) AMMs built for crypto-natives will end up powering settlements north of $7.5 trillion daily. Take that for PMF.

Snipers in DeFi

Twitter has been a go-to resource for those like me trying to understand what is happening in crypto. I’ve often come across threads that start like this – this XYZ address was worth $10k a few days ago, and today it is worth so many millions. Then the threadoor uses some tool to track the on-chain activity of the address to reveal that they bought some random token when the FDV (fully diluted valuation) was $100k, and now the FDV is $1 billion, achieving a casual 1000X in a matter of days.

Of course, for every such token, hundreds (perhaps thousands) go from $100K to $500k back into the abyss of anonymity below $100k. But still, I can’t help but ask how they find these 1000Xs.

Is there a pattern to it? There are a few explanations –

It’s the same person who “created” the token.

It’s someone with insider knowledge, i.e. someone close to the person who created the token.

One of the above, and then they actively formed a narrative that was bought by CT (crypto Twitter)

They track contracts and use a “spray and pray” approach.

They use the mix of tracking contracts and looking at wallets/addresses that have a history of getting “early” into tokens (memes) that did well.

There are more explanations, but only the last one seems reasonably replicable and safe (let us know if you have a different theory). One can combine products like Nansen and Unibot to reliably trade early-stage tokens. Nansen can identify and tag wallets with reasonable accuracy, and Unibot allows users to deploy bots via Telegram. These bots allow users to customise the conditions necessary to initiate a transaction.

The bot can also scan for transactions from addresses on the user’s watchlist (addresses the user wishes to copy trade). The bot tries to front-run transactions from target/watchlist wallets and tries to get into trades before them. This is one of the ways users can employ features from different products to trade early-stage tokens.

Think of it like this. Blockchain data allows you to scan or track any transactions. A tool like Unibot makes it possible for a retail user to front-run transactions with no code. Michael Lewis would have a fun time writing about this if he were to write a second version of Flashboys.

All of this hinges on two things. Firstly, you need to identify who owns these wallets accurately. It is common for analysts to wrongly presume that a large chunk of Bitcoin held by the US government may be on the move for sale. It has caused unnecessary panic in the market. The other is that of intention. A fund or a trader can choose to deceive users by buying or selling on one known wallet and do the exact opposite on a different one that is unknown to on-chain sleuths.

Yesterday, Arkham Intelligence launched a mechanism for wallet labels to be crowd-sourced. Users now have a marketplace where they can be rewarded in tokens for informing on the wallet addresses of other participants.

Another product where such bots make sense is the wallet providers like MetaMask. The primary source of revenue for wallet providers is the fee they charge for built-in swaps. But since users can go to a DEX and avoid additional fees, they can easily bypass in-wallet swaps. Using a trading bot, on the other hand, is about speed rather than how price efficient the trade is. Since users think they stand to gain much more than the fees they pay, combining a bot offering by a wallet provider will make users less sensitive about the fee, helping them to boost their revenue. Think of trading from your Telegram using a bot that interacts with Metamask in the background.

Composable Leverage

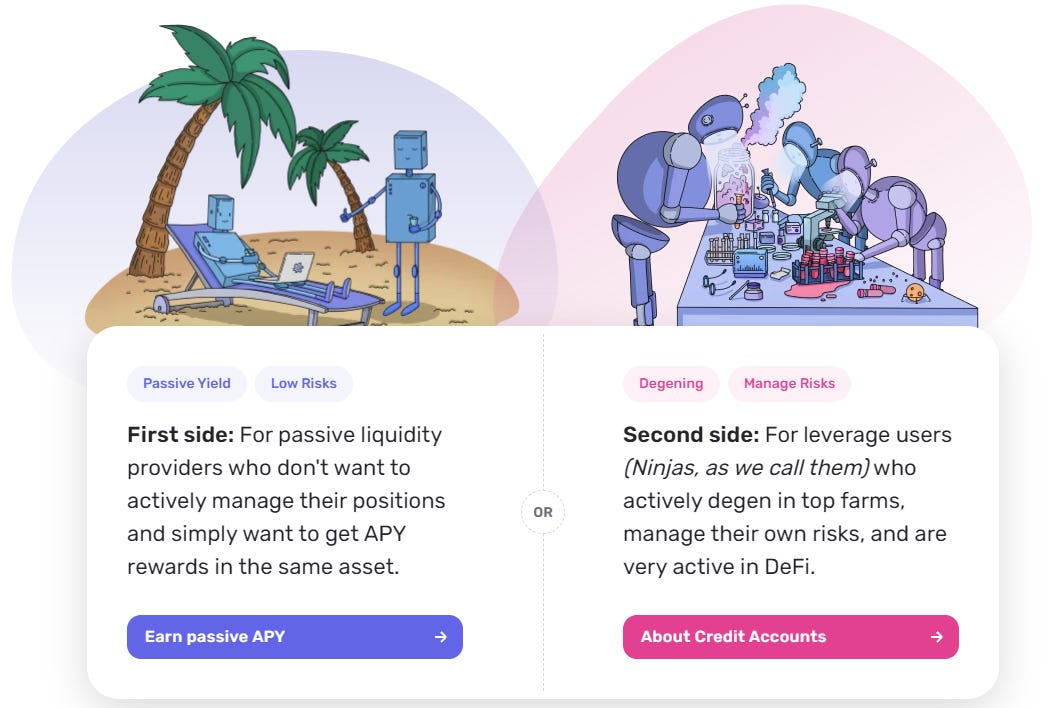

Speaking of trading, we have been keeping an eye on Gearbox. It is a generalised leverage platform. It caters to two types of users – those who want passive yields and those who want to use leverage to manage their DeFi positions actively. Passive positions are similar to how users provide liquidity in Compound or Aave lending pools. The leverage users can borrow up to two to four times their notional size.

Gearbox users can get leverage to trade or yield-farm on Curve, Convex, Yearn, Lido, Sushiswap, and Uniswap. So how does this work? It uses what's called a credit account. This account is a smart contract that contains the borrower's funds and the funds they borrowed. It also has liquidation thresholds and a list of approved tokens and contracts the user can interact with. So, whatever the user wishes to do with borrowed funds, can be done only via this credit account.

These accounts also have ready-made strategies that users can deploy with one click. For example, a user can initiate a leveraged ETH staking strategy with any listed collateral assets in one click.

Liquidity providers (passive) put their assets into pools, and active traders can borrow (at up to 10X leverage) from these pools into their credit accounts. Traders can interact with other applications only through their credit accounts. The health factor determines if their positions are safe. Liquidators are incentivised to liquidate credit accounts if the health factor drops below the threshold. Individuals lending capital to the protocol get returns from the interest rates paid by those using leverage on Gearbox.

Gearbox is expensive on a price-to-fee basis compared to its peers. But we are in the depths of the DeFi bear market, and the protocol is still relatively new. Remember, even Uniswap had to spend a couple of years in anonymity before it became the DeFi darling. Gearbox is a useful DeFi primitive looking for its users (and product-market fit). Given its composable and capital-efficient design, it doesn’t necessarily have to rely on individuals. It can serve as a building block for other DeFi protocols. It remains to be seen how a market recovery affects the product’s usage.

That’s all for this issue. Press reply and let us know what can be iterated to make these newsletters more useful.

Disclosures

Joel John was an early investor and contributor to Gearbox via Ledger Prime. Project mentions are not endorsements for investments.

Members of Decentralised. co’s editorial team may own tokens mentioned in the piece. What we write is for educational purposes only. None of it is financial advice.

If you liked reading this, check these out next:

Telegram and Pitch Decks

Join in with ±4000+ researchers, investors, founders & overall great human beings. We don’t exactly talk much, but it would help you stay close to what we are focusing on & connect with others building cool things.

We have been actively deploying money & advising a small crew of founders. Contact us through the form below to go 0 to 1 with your early-stage venture.

In India the cost of UPI ~ 3,000 Cr I was told is borne by the banking system with some assist by government. In USA this may not be the norm. Some countries may charge 0.3% for transfers. ( gas fees!)

The commercial banks fear that if they are not the first point of contact for retail users they may be bypassed for many banking services like loan etc. Private credit providers are circling. For example KKR took over the BNPL portfolio of Paypal. Also in high interest environment money may flow away from bank deposits to money market funds .

Many central banks do not want to eliminate commercial banks and become direct service point for retail. They do not have organizational culture and competence for that. Even in India e Rupee is supposed to be a bearer instrument and they are struggling on how to make that . The wallets need to be independent of banks and the technology or the laws need to make tracing small transfers impermissible.

Let me quote from Axios newsletter on the opinions of banks in USA on FedNow

- Instant payments aren't great for banks. They loose interest on floats

- 24/7 payments also exacerbate the risk of bank runs. When you can transfer up to $1 million out of your account instantly, even when the bank is closed, that means "the rate of deposit flight could be much faster,"

- Peer-to-peer payments are also commonly used for illicit activities, which naturally worries banks.

As of now most banks in USA are in receive only mode!!

Good intro to BIS cross country wCBDC. USA is tending towards Regulated Liability Network( RLN) with tokenized liabilities of 'regulated' banks and ECB prefers a 'Universal' Ledger.

The key is role of intermediary commercial banks as CBDC go retail. keeping them in the loop may increase adoption but defeats margin compression by 1/3 to 1/4 on FX payments available otherwise.

Lets see if a new banking and payments eco system emerges due to competition and technology. Narrow banking with 24X7 money transfers is most probable as no central banker can forestall a bank run with Real Time Payment (RTP ) like crypto markets. No off days and 4pm EOD close