It has been a busy, productive week of shipping multiple stories for us.

Here’s a breakdown

On Tuesday, we released our primer on chain abstraction in collaboration with Socket Protocol.

Yesterday, we released our podcast episode with Pacman from Blur.

And today, we are releasing a breakdown of intersubjectivity and how it ties to Eigenlayer’s ecosystem. This article is a follow-up to our conversation with Robert Drost from the Eigen Foundation.

As always, we are looking to collaborate, invest in and work with the brightest founders in our industry. If you are spending the weekend hacking together something cool, make sure to reach out via the button below.

On to the article now,

Joel

TL;DR

Blockchains like Ethereum allow people to collaborate without needing to trust each other. However, they are limited by what is provable on-chain. EigenLayer scales this trust by enabling collaboration with expanded boundaries of 'what is the truth.'

Restaking ETH on EigenLayer enhances capital efficiency by allowing the same staked ETH to secure multiple services (AVS), creating a more interconnected and resource-efficient ecosystem.

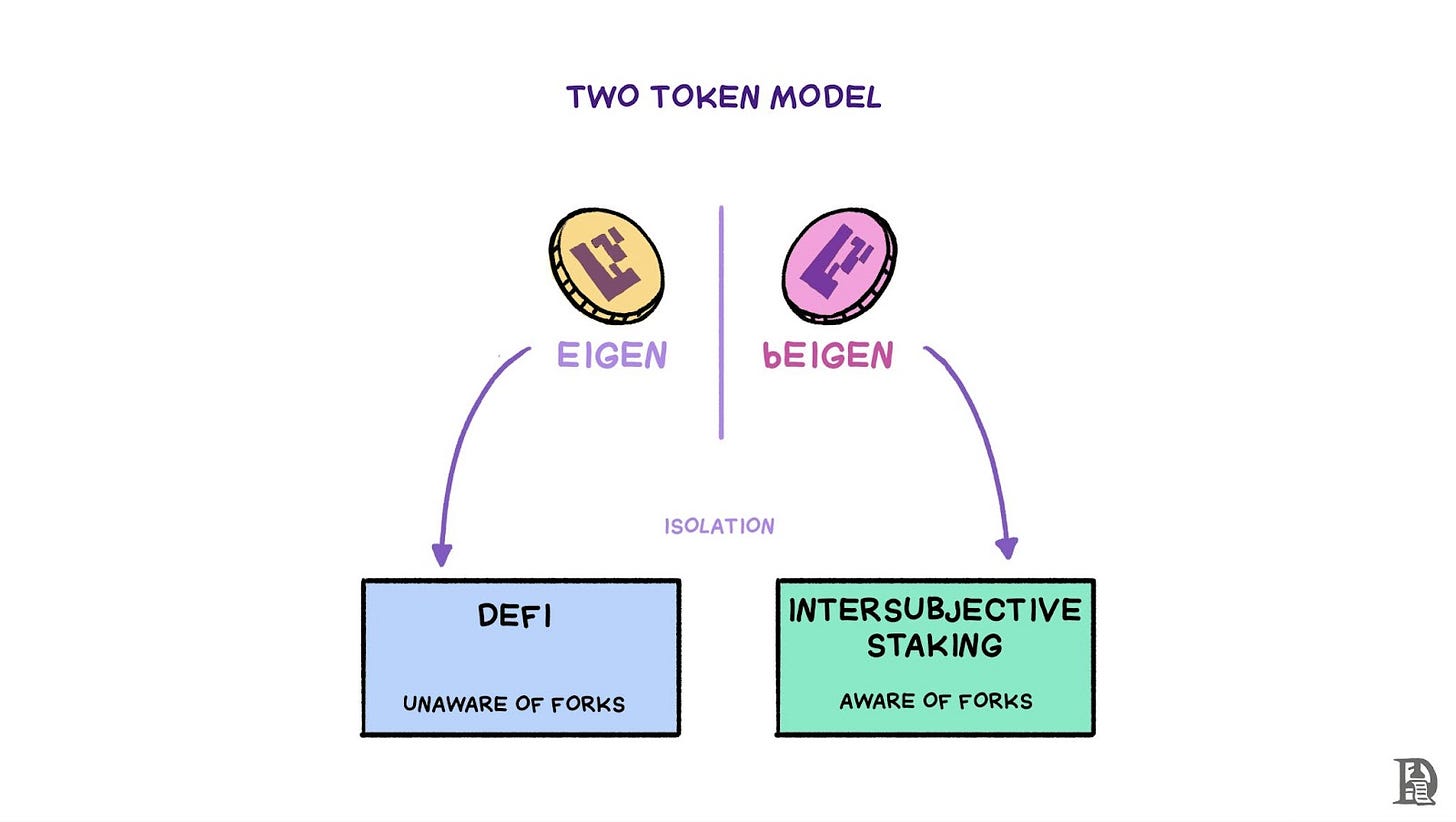

EigenLayer addresses intersubjectivity or social truths by employing a two-token model. The staking token forks whenever an outcome is challenged.

AVS reduce the barrier to entry for new projects. However, projects also need to pay for liquidity or security by sharing revenue or token inflation with EIGEN or ETH stakers.

Acknowledgements -

Thanks to Soubhik for getting on a call and answering my questions.

Thanks to Pratik and the Eigen Foundation team for reviewing.

Hello,

Restaking and Liquid Restaking Tokens (LRTs) have dominated the narrative throughout 2024, largely driven by the new primitives introduced by one project—EigenLayer. The chart below shows how the narrative mindshare shifted for LRT and Liquid Staking Derivatives (LSD).

If you ask me what the project is about in one sentence, I’d say it is about expanding the boundaries of decentralised trust. On the one hand, the restaking primitive expands the scope (efficiency) of DeFi capital. The EIGEN token, on the other hand, expands the scope of governance.

I’ve been following these developments closely and wanted to share my thoughts on what restaking means for validators and the broader ecosystem. But beyond just explaining the mechanics, I want to delve into the idea of intersubjectivity. It’s a concept that sounded academic to me when the EigenLayer whitepaper first dropped, but it’s incredibly relevant to how we think about blockchain governance and decentralised trust in general. So, let’s dive in.

What Restaking Really Means

Before we get into the weeds of restaking, let me take you back to something I explored in my article on layered Bitcoin. The crypto world has always been about pushing the boundaries of what’s possible. We have layered blockchains with new functionalities that change the game. Restaking is another layer—one that could redefine how we think about validator dynamics and capital efficiency.

Blockchains are a proxy for trust. They are designed to allow you to do business or collaborate without needing trust. This is done by asking stakeholders to put something valuable into a system (think of it as collateral) that replaces the need for trust. If they behave, they get rewarded. On the other hand, the system can penalise these stakeholders if they don’t behave according to the rules by confiscating whatever value they put into the system to participate.

If you’re like me, you might consume a lot of audiovisual content, podcasts, and texts to wrap your head around new concepts. One of the resources that helped me grasp the nuances of EigenLayer was Jordan McKinney’s video. He breaks down EigenLayer at a high level, making it accessible to those who might not have the time to dive deep into all the technical details. For those who prefer a quicker summary, here’s the TL;DR:

EigenLayer allows validators to use the same ETH that secures Ethereum to also secure Actively Validated Services (AVS). This isn’t just about earning more yield—it’s about creating a new layer of responsibility and opportunity for validators. Around 28% of circulating ETH, i.e., 34 million ETH, is currently staked by Ethereum validators. EigenLayer has ~4.7 million ETH or ~$12 billion locked for restaking.

From Bitcoin to EigenLayer

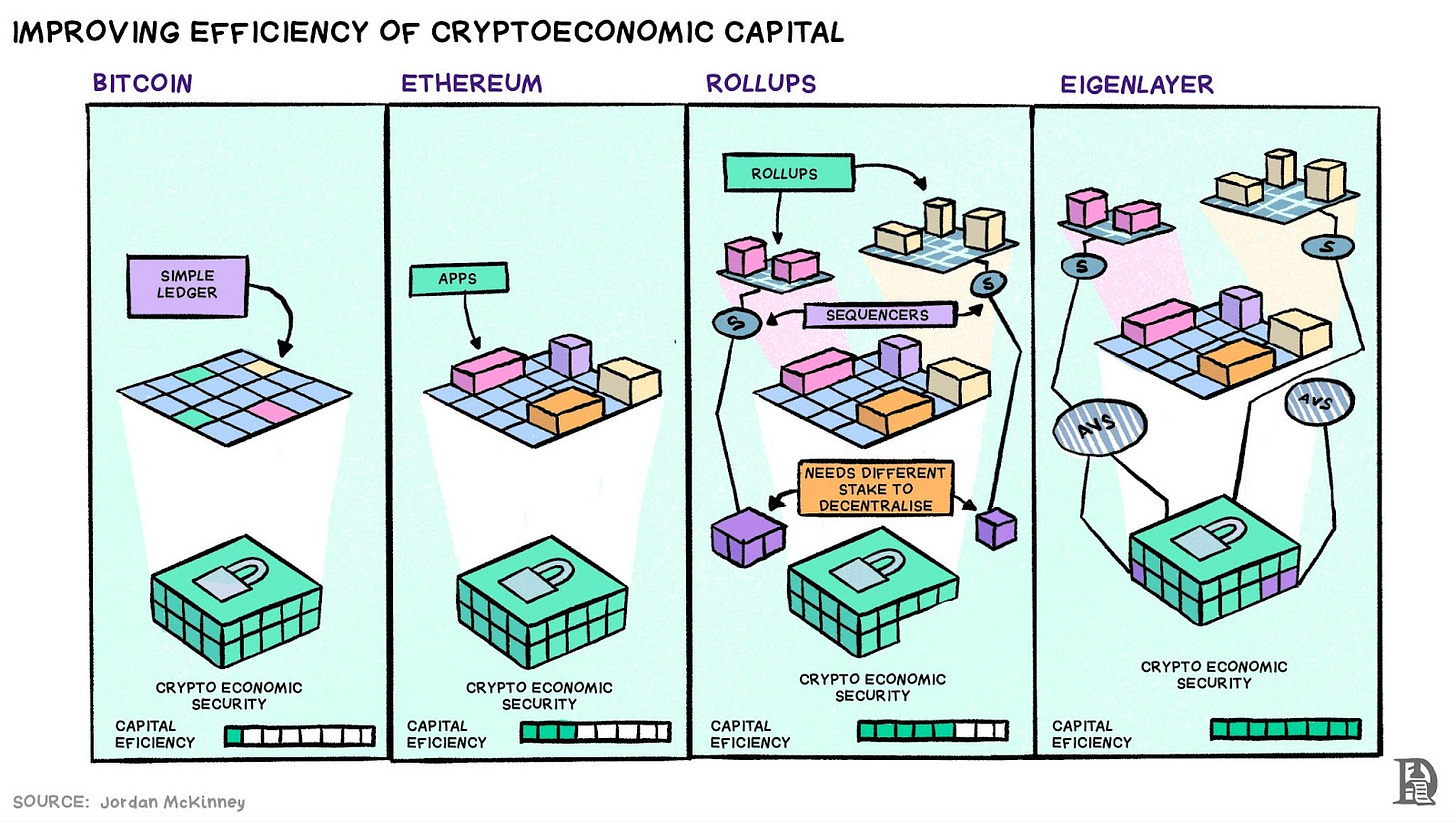

To truly understand what EigenLayer brings to the table, it’s worth reflecting on how far we’ve come in the blockchain space. When Bitcoin first launched, it introduced the concept of proof-of-work (PoW), where miners secured the network by spending electricity and employing high-performance hardware. This was groundbreaking, but it had its limitations—Bitcoin didn’t do much besides storing value and facilitating payments. Bitcoin doesn’t do much by design. It is how it can maintain its status as one of the most secure and decentralised networks.

Bitcoin’s design was revolutionary, but it was also rigid. The miners were locked into their roles with no opportunity to repurpose their hardware for anything beyond securing the Bitcoin network, which limits its capital efficiency. Capital efficiency is about getting the most value or output from the money you invest. Limited capital efficiency is a feature, not a bug—it ensures that miners work in the network's best interests. This set the stage for the next big leap in blockchain technology.

Ethereum, the next innovation in cryptoeconomics, introduced general-purpose computation. This allowed us to build applications on top. Validators stake ETH, which secures not just the Ethereum blockchain but also the myriad applications built on top of it. Suddenly, the same capital used to secure the blockchain could also be leveraged to power a burgeoning ecosystem of apps. This was a massive leap forward, but it wasn’t without its challenges—Ethereum could not bring in the scale.

The evolution of blockchain didn’t stop there. We saw the rise of layer two solutions like rollups, which significantly increased Ethereum’s transaction throughput. With L2s, Ethereum’s throughput increased from 12-15 transactions per second (TPS) to ~200 TPS with rollups. However, rollups introduce a centralisation vector in the form of the sequencer—a single entity, often controlled by the rollup provider, responsible for ordering transactions.

One way to mitigate this risk is by requiring multiple sequencers to stake capital for the right to produce blocks and capture fees. But this approach doesn’t improve capital efficiency, as the capital staked by sequencers is separate from the ETH securing Ethereum.

Restaking: Enhancing Capital Efficiency

Think of it this way: in traditional PoS systems, validators stake their assets to secure the network. But what if that staked capital could do more? What if the same ETH could be used to secure other services, increasing the capital’s efficiency? That’s the idea behind restaking. Validators don’t just secure Ethereum; they can also opt into securing additional services by restaking their ETH through EigenLayer. If you want to read more about staking or understand how it works, read this article from Shlok.

Restaking in this context is a natural progression. It’s about making the most of the resources we already have. Validators can earn additional yield by taking on more responsibility, and in doing so, they contribute to the overall security and efficiency of the network.

EigenLayer provides a solution by allowing validators to use the same ETH that secures Ethereum to secure Actively Validated Services (AVS). The way this works is—when a validator stakes ETH to participate in consensus and block production, instead of providing their externally owned address (EOA), they must provide the EigenPod smart contract as the withdrawal address. The EigenPod contract acts as the intermediary between the validator and the different AVS the validator chooses to work with. The EigenPod smart contract judges the validator’s performance based on pre-determined criteria and decides if any ETH is to be slashed at the time of withdrawals.

It is critical to understand that restaking isn’t just about stacking yields on top of yields. It’s about fundamentally changing the way we think about capital in a blockchain ecosystem. Traditionally, once the capital was locked up in staking, it could only secure the network. Restaking flips this on its head by allowing that same capital to take on multiple roles, thereby maximising its utility.

But this approach is not without its challenges. By allowing staked ETH to secure additional services, we’re also increasing the surface area for potential risks. Validators now have to be mindful of not just Ethereum’s consensus rules but also the requirements set by the AVS they choose to secure. This added layer of responsibility means that validators have to be more diligent than ever, as a failure on any front could lead to slashing and loss of funds.

The Quantitative Impact

Let’s be honest—real businesses are often driven by numbers. With a basic understanding of restaking, let’s consider its potential impact on the broader crypto ecosystem. AVS offers an additional yield to ETH validators on top of the base yield from staking.

Take the current situation: around 27% of the total circulating supply of ETH is staked. As more ETH gets staked, the base yield decreases. This is because, by design, the base yield increases at a lower rate than incremental capital. Validators will need other sources of yield to stay ahead. This is where restaking comes into play.

The sensitivity chart below tells you the incremental benefit for validators due to AVS. It takes three variables as inputs – ETH market cap, percentage ETH staked, and additional AVS yield. Imagine AVS providing a 1% additional yield at a $600 billion market cap with 50% ETH staked. That’s an extra $3 billion annually for validators. This quantitative boost underscores the value restaking adds to the ecosystem, making it a crucial innovation for the future of PoS networks like Ethereum.

Furthermore, the additional yield from restaking isn’t just about making more money—it’s about creating a more robust and resilient network. In a scenario where Ethereum’s base yield diminishes due to an influx of staked ETH, restaking could be the difference between validators staying profitable or dropping out of the network. By giving validators more avenues to earn, EigenLayer helps ensure that the network remains secure and that validators are incentivised to stay engaged.

However, the introduction of restaking adds layers of complexity to the staking process. Validators must now consider the performance and security of the AVS they’re securing, as well as the potential risks associated with each service. This requires a more sophisticated approach to staking, where validators must balance potential rewards with the risks they’re willing to take on.

Please note that slashing is not live for AVS at the moment, so there’s no cost for validators to opt into a new AVS for yield. Once slashing is live, validators may not have the luxury of opting in for every new AVS. As the number of AVS they can provide services to decreases, so will the opportunity to generate new yield.

Intersubjectivity: The Truth that Can’t Be Proven On-Chain

At a time when memecoins and speculative trading often dominate headlines, it’s easy to forget that tokens are supposed to serve a function. Ethereum's ETH, for instance, isn't just a gas token; it's integral to the network's PoS consensus, offering cryptoeconomic guarantees that keep the chain secure and operational. Without ETH, Ethereum as we know it wouldn't exist.

When designing a token, the team or community must decide upfront what functions the token will perform. These constraints are crucial—they shape the token's utility from the outset. While changes can be made later, rallying social consensus around major updates is no easy feat, especially in the context of blockchain's core principles of immutability and predictability.

Now, let’s shift gears a bit. In my previous articles, like Humpy vs Compound DAO, I’ve touched on the idea that blockchain is about more than just technology—it’s about the people and the community. This is where the concept of intersubjectivity comes into play. I know it sounds like a term you’d hear in a philosophy class, but it turns out it can be relevant to blockchain governance.

Intersubjectivity refers to truths that cannot be proven on-chain. Think of them as social truths that any reasonable actors can agree upon. For example, take the claim that ETH is priced at $10. Objectively, the data might say otherwise, but what if there’s a dispute? It’s not entirely subjective either—most (all) of us reasonable actors would agree that the claim is incorrect. EigenLayer’s EIGEN token is designed to address these kinds of intersubjective issues.

What’s fascinating about EigenLayer’s approach is that it acknowledges the reality that not all decisions can be made purely based on objective data available within blockchain environments. Consider a case of a data availability service. Network nodes need to prove that data is stored and can be retrieved when requested. But these service nodes may collude and provide on-chain proof that the data exists. Still, when the user actually goes to download the data, it is absent. In such a case, the user should have recourse to challenge this “tyranny of the majority.”

It refers to situations where the majority of stakers or participants in a network could impose decisions that are not necessarily in the best interest of the overall ecosystem or that unfairly penalise minority groups or individual participants. EigenLayer equips users with the ability to challenge such systemic issues.

Does that mean you can challenge anything you don’t like? No. The challenger has to pay a price. Because challenging is a non-trivial event, they have to burn a certain amount of tokens to show that they have skin in the game. This way, the system can assert judicious use of intersubjective challenges.

In the real world, there are often scenarios where the truth isn’t always provable on-chain. Blockchain systems, which have traditionally been designed to handle precise binary decisions, struggle in areas where things are not provable on-chain. EigenLayer’s introduction of intersubjectivity into blockchain governance is an attempt to bridge this gap. Blockchains like Ethereum allow humans to collaborate without having to trust each other. But they are limited by what is provable on-chain. EigenLayer scales this trust by allowing people to work with each other with expanded boundaries of ‘what is the truth.’

For example, consider a situation where a validator is accused of behaving maliciously. The evidence might not be clear-cut—perhaps it’s a case where the validator’s intentions are in question rather than their actions. In a traditional blockchain system, it would be difficult to resolve such a dispute because the system is designed to operate on objective data. However, with EigenLayer’s intersubjective approach, the community can weigh in and make a decision based on a combination of facts and collective judgment.

How Does It Work?

Typically, when there is an on-chain divide, the chain forks. Ethereum suffered the DAO hack in 2016. If we went by ‘code is law’, as is an implicit assumption when you use Ethereum, it should not have forked. However, the social consensus dictated that it was in the best interest of the network to fork.

In EigenLayer’s case, there is no base layer blockchain or an L2 that forks. It is a system designed on top of Ethereum. So, in the case of a dispute, the EIGEN token forks. The token is a contract on Ethereum. In the case of a fork, a new contract is deployed with changed ownership of the token, wherein the guilty or malicious party is penalised with reduced or no stake in the forked token. The mechanics of the fork are described in the later sections.

The Two-Token Model

Typical staking mechanisms and governance models often rely on a single native token to handle both staking activities and other uses like trading or participating in DeFi. However, this one-size-fits-all approach can lead to complications, particularly when dealing with complex disputes that aren't easily resolved by on-chain data alone. This is where EigenLayer introduces an underexplored solution: the use of two interconnected tokens, EIGEN and bEIGEN, to separate these concerns and enhance the system's flexibility and security.

EIGEN: This token is used primarily for non-staking activities. It can be traded, held in DeFi protocols, or used in other applications without being directly exposed to the risks associated with staking and governance disputes.

bEIGEN: This is the "backing" token specifically designed for staking within the EigenLayer system. When users want to participate in staking, they wrap their EIGEN tokens into bEIGEN, which then becomes subject to the rules and risks of the staking process, including the possibility of being slashed or forked in the event of a dispute.

By separating these functions, EigenLayer creates a more resilient and flexible system. EIGEN holders who are not interested in staking can continue using their tokens in the broader ecosystem without worrying about the complexities of governance and dispute resolution. Meanwhile, bEIGEN serves as a specialised token for those who want to participate in staking, with the understanding that it carries additional responsibilities and risks.

How the Dual-Token Model Works

When a fault occurs—whether it’s a data availability issue, a faulty price oracle, or another challenge that isn’t easily resolved on-chain—the bEIGEN token can be forked, creating two versions: one that represents the original state and another that reflects the community’s resolution of the dispute.

This separation ensures that only those who are directly involved in staking (bEIGEN holders) are affected by the outcome of the dispute, while EIGEN holders remain insulated from these governance decisions unless they choose to participate by converting their tokens to bEIGEN.

In essence, the dual-token model allows EigenLayer to tackle complex intersubjective issues without disrupting the broader ecosystem. It provides a clear boundary between staking-related activities and other token uses, enabling a more robust and adaptable platform for decentralised governance and dispute resolution.

Practical Example in EigenLayer

I’ve always been fascinated by the idea of forks—not just in Bitcoin but as a metaphor for choices and paths in life. In the blockchain world, forks represent significant decisions that can change the course of a network. EigenLayer’s forking mechanism is a brilliant example of how forks can be used to resolve disputes in a way that reflects community consensus.

Let’s dive into an example to see how this works in practice.

Prediction Markets: RFK Jr. Case and EigenLayer's Solution

Recently, Polymarket faced controversy when it resolved a prediction market about Robert F. Kennedy Jr.'s presidential campaign, declaring that he had dropped out of the race. This decision was based on an initial interpretation, despite RFK Jr.'s subsequent actions (such as filing for ballot access in new states and asserting in interviews that he was still running), causing significant debate among participants. Despite being challenged twice, the market still resolved to a ‘yes’. The resolution, confirmed by the UMA oracle, left many feeling that the outcome did not accurately reflect the ongoing situation, and participants had limited recourse to challenge it. This happened probably because UMA doesn’t have ‘skin in the game’ and doesn’t suffer regardless of any outcome.

EigenLayer's intersubjective forking could have offered a more dynamic solution to this dispute. If such a mechanism were in place, stakeholders could have triggered a fork in the market. It would create two outcomes: one where RFK Jr. is considered to have dropped out and another where he is still in the race. The community would then vote on which interpretation they believed reflected the true situation, with the most supported fork becoming the dominant outcome. This approach would allow for a more nuanced and community-driven resolution, adapting to new information as it emerges and aligning the interests of market participants with the accuracy and fairness of the outcome.

By incorporating EigenLayer’s intersubjective forking, prediction markets could better handle complex, evolving scenarios, ensuring that market resolutions are not only accurate but also reflective of the broader community consensus, thereby maintaining trust and integrity in the platform.

Remember that the EigenLayer system makes forks expensive for the challenger? They need to burn a certain number of existing bEIGEN tokens to create a challenge. If the community decides they are correct, they get the burnt stake on the new fork and can even get rewarded. But if the new fork turns out to be valueless, they lose out on the tokens they burnt.

Based on the challenger’s claim, the bEIGEN token holders can redeem the fork they support. The way the community leans is typically understood by which token (forked or original) they redeem. Multiple forks can co-exist, but their value will be different. This value is decided by the market. Ideally, the value of EIGEN = Sum of the values of bEIGEN and its forks. When one of the forks is heavily redeemed in comparison to the other, everyone knows what the community's decision is.

These examples aren’t just theoretical. They represent real-world scenarios that could occur on the EigenLayer network, highlighting the importance of having a flexible governance system that can adapt to complex situations. The ability to fork tokens based on community consensus is a powerful tool that can help maintain the integrity of the network.

Balancing Ecosystem Demand and Economic Challenges

EigenLayer presents a promising model for expanding decentralised trust, but it also introduces new challenges, particularly for AVS. While some AVS may be standalone applications that eventually seek to capture more value by operating independently, others are designed as foundational building blocks within the ecosystem. These building blocks benefit significantly from the interconnected demand generated by other services and products within EigenLayer.

For these AVS, being part of the EigenLayer ecosystem can drive utility and demand, helping them overcome the initial bootstrapping challenge. For them, sharing revenue with ETH/EIGEN stakers could be a reasonable trade-off for ecosystem-driven demand and shared security. This relationship might foster an interconnected network of services, though its long-term sustainability remains to be seen.

Standalone AVS, however, face a different set of considerations. One can think of these issues in the same light as standalone apps that want to be appchains. While they must share revenue with ETH/EIGEN stakers, this cost should be weighed against the alternative: bootstrapping security and liquidity on a separate chain. EigenLayer offers these services access to a substantial security pool and a pre-existing ecosystem. This advantage could reduce the resources typically required for a new project/chain to establish itself, potentially offsetting the revenue-sharing cost. However, as these services grow, they may question the continued value of this arrangement.

Navigating Complexity with Purpose

In essence, the EIGEN and bEIGEN tokens combined with the forking mechanism expand the scope of blockchain governance into new, uncharted territories. By enabling the community to address intersubjective disputes, EigenLayer enhances both the security and adaptability of decentralised systems, paving the way for more resilient and responsive blockchain ecosystems.

As the project evolves, several questions arise: Can EigenLayer maintain an environment where revenue sharing remains competitive compared to independent bootstrapping? Will this model truly foster innovation, or will it create new forms of dependency and centralisation?

Yes, it’s complex. Integrating this system with existing DeFi protocols isn’t straightforward, and there will be challenges. But that’s the point. Blockchain is supposed to be hard. It’s supposed to make us think, challenge our assumptions, and push us towards solutions that are as much about people as they are about technology.

In the end, EigenLayer isn’t just about restaking or earning additional yield—it’s about expanding the scope of decentralised trust. It’s about creating a system that can handle what is outside the chain, where community consensus is the ultimate arbiter of truth.

Signing out,

Saurabh

If you liked reading this, check these out next:

- Ep 12 - Mike Silagadze from EtherFi

- Ep-22 - Human Coordination Engines