Volatility As A Service

On social networks, status and risk in Web3

Skip this Section

Look at you. Quite the rebel. Reading the parts I specifically asked you to ignore. We have a few ad slots left unsold for the next few months. See that white space up there? With our custom-made, hand-drawn, lost stick figure? Yep. That one. It is up for sale. He seems annoyed about us wanting to move him out of there.

We have been writing long forms for some of the brightest people in our industry for over six months. They make decisions at enterprises, build products and allocate money. You know—the movers and shakers of our industry.

Your brand could be seen by people who can be highly impactful for your product. Right now, they are staring at an idle, lonely stickman. I think we could do better than that.

You might wonder - “How do you even pitch an unknown newsletter to your marketing committee?” Isn't it safer to go with our larger peers? Nobody looks stupid pitching IBM. We get it. But we have the numbers.

A quarter of our mailing list opens our newsletters within two hours. 42% of our readers would have read it by the weekend. 150 enterprises are part of the mailing list. Over 10,000 people will have read this article over the coming weeks.

And if that doesn't convince you, consider reading the story below. You'll understand what we do and how we differ.

Contact us on Passionfroot for more details.

Hello!

This was initially meant to be a piece for our paid subscribers alone. But it ended up being a long form that I had to get into everyone’s inboxes. The e-mail may get clipped in your clients. Click on the read online button above in case that happens. Here we go..

Every once in a blue moon, I think of Archegos Capital. Started by a Tiger cub named Bill Hwang, this firm imploded during last year’s stock market pullback. Firms blowing up are nothing new in finance. They happen every once in a while. And people recover from them.

For example, the guys from Three Arrows Capital have been running an exchange while simultaneously dodging Uncle Sam after defaulting on their loan obligations. You get the gist. Funny business is expected in finance.

The bit that makes Archegos interesting is that Bill Hwang had attempted to monetise social capital. He had taken loans from multiple investment banks like Credit Suisse against shares he held. The problem? Bill was using the same shares with numerous firms to open up various lines of credit.

So instead of $100 of equity backing a $80 line of credit, he had $100 of equity, giving him up to $600. You know, good old leverage. It all blew up last year, and the story ended with him being margin called.

What does this have to do with today’s newsletter, you ask? Bill Hwang’s case is a person using “social” capital to access real money.

For the longest time, social capital and net worth were separate. The status could be purchased and signalled with money. But constantly talking about how wealthy you are is considered uncool. The media has separated the process of declaring wealth and status.

For instance, the Midas list tells you how rich a VC has gotten. Or the Forbes 30 Under 30 is a list of potential billionaires.

Separating social capital and net worth has historically been important. Rising inequality has often led to political unrest, as many in 19th century France learned the hard way. Political and social order is maintained by accruing influence but never giving it a price.

When markets "price" political power, we call it corruption. Social platforms emerging on crypto today are inverting this relationship in theory. This piece examines why volatility as a service is emerging as a recurring theme across crypto applications and what could be expected from it in the coming years.

But before we do that, consider the chart below. It explains a lot of trends going on within the industry today. Volatility for Bitcoin is at the lowest range it has been since 2016.

It means most tools and products that see volume during periods of high volatility now struggle to find users. Let me explain

People have no incentive to borrow one digital asset (say ETH) against another (like Matic?) if they don't think ETH will outgrow Matic soon.

Options products see little to no volume if the markets do not anticipate quick volatility within short time bounds.

Perpetual or decentralised exchange products see volume drying up if traders cannot make money in the short run through trading an asset.

Most products in the crypto space today rely on volatility to be relevant. This is a feature, not a bug. Crypto’s core value proposition has been the trustless movement of money over the last decade. And we have delivered on it. The entirety of the DeFi ecosystem was built, grown, and capitalised on during a bull market because of the volatility we were in at the time.

But times have changed, as the chart above makes evident.

Rising interest rates, unemployment, and fatigue of the multiple Ponzis in the industry have translated to a lack of interest in existing product suites. There's a reason for what. During a bull market, traders are incentivised to take an abundance of risk.

Products designed to cater to them see high volume too. But as volatility craters, a market accustomed to being risk-on would find itself bored. Naturally, this pushes users towards where they can discover volatility today. It explains why products pitching volatility as a feature attract the most users off late.

Volatility As A Feature

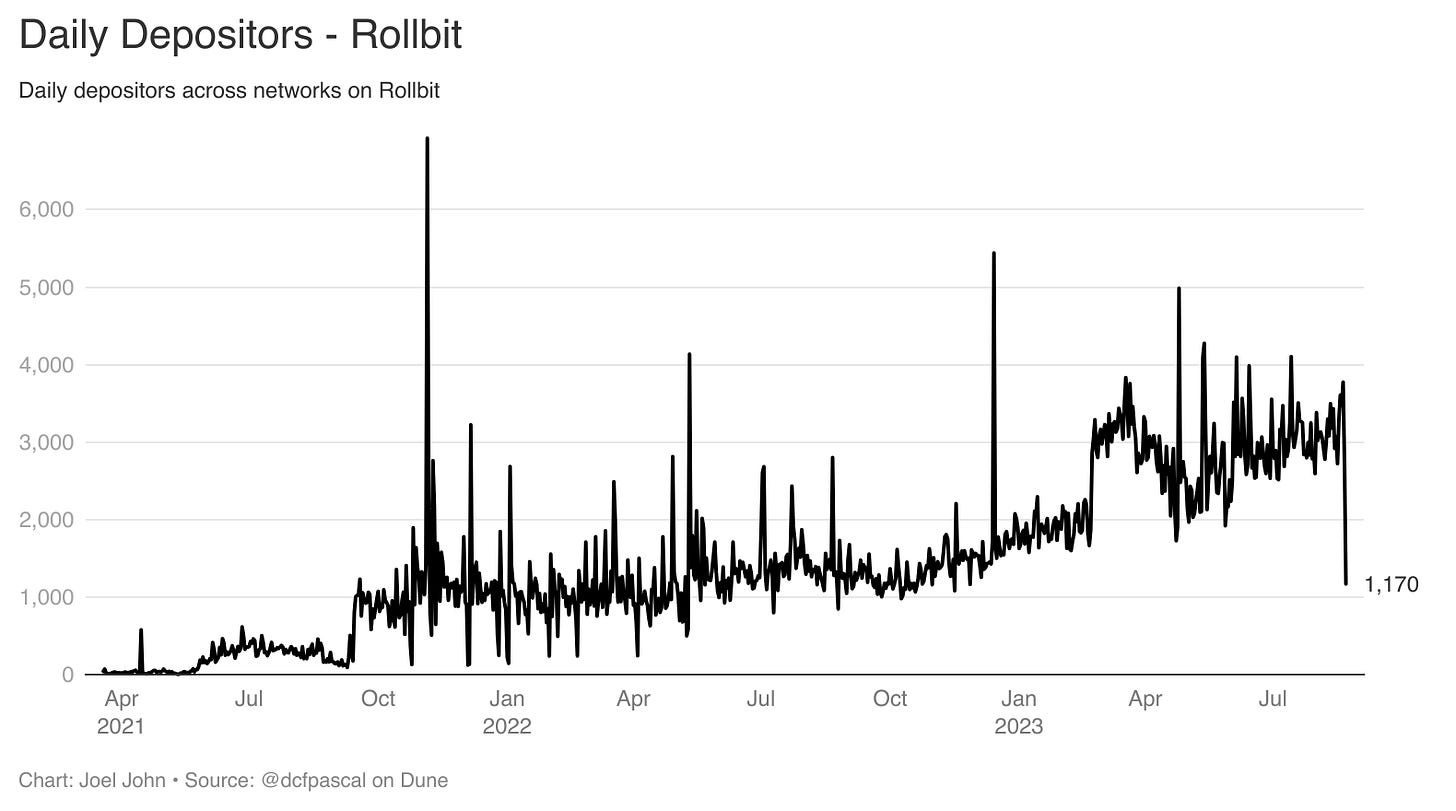

The chart below shows the number of users on Rollbit over the past few months. The product sees close to 4,000 users on any given day depositing money. For comparison, OpenSea sees around 6,500 users on a given day. This is not to suggest Rollbit is a category leader in gambling. Instead, it reflects how users are flowing from NFTs to high-volatility products.

There are some $46 million deposited on Rollbit as of writing this. The FDV of the token they released is at $800 million, almost 100 times since one year ago

While Rollbit is explicitly a platform for trading highly volatile instruments and gambling, Unibot facilitates users looking to buy the long tail of digital assets. The app’s value proposition is quite simple. It bundles setting up a MetaMask wallet, managing its keys, signing into Uniswap, and finding the right pair of tokens for anyone looking to make a quick trade.

The average user on Unibot generates about $2,600 in volume daily; each transaction is around $600. A total of 3,400 users trade through it on a given day. That’s a far cry from the numbers we usually see on exchanges, but it has generated nearly $2 million in fees since May of this year.

Where Rollbit is a casino, Unibot is a tool that facilitates trading low-cap altcoins that usually do not see much volume on a CEX. $PAAL, $DUUBZ, $RAT, $WAGIEBOT - recognise any of these names? Likely not. These tokens have seen the highest volume on Unibot over the past few days.

Unibot is interesting because it ignores a lot of the conventional wisdom in building products in crypto. The private keys are relayed as raw text on Telegram. The product uses a conversational interface instead of the complex ones on Binance. It does not even require you to set up a login!

You have to paste smart contract addresses if you are purchasing a token. And yet, it sees close to $5 million in volume daily. A feat that most venture-backed DeFi products struggle to achieve.

Apps are being built with similar philosophies on Telegram. They are aggregating attention and capital. You could easily argue that crypto-native traders spend most of their time on Telegram. Having an interface that combines notifications of new tokens being released with MEV protection and conversational orders would be powerful.

But to me, it sheds light on a different fact. The pool of money in crypto floating between products is going higher up the risk spectrum due to a lack of volatility.

This becomes even more evident with FriendTech. Yes, I have written extensively about them in the past. We will not go into the specifics of why the product is good or bad right now. But here are some statistics that you should be aware of:

Cobie, the top creator on FriendTech, has made $142,000 in the past week.

A total of $52 million has gone as an inflow to the product. About $2.7 million in fees has been distributed to users.

1.4 million transactions have occurred on the platform across 113,000 buyers and sellers.

(Yes, I’m branding it as FriendTech, because I don’t know what the product’s actual name is).

All of this is on a product that is barely seven days old. FriendTech had ten times the active users Lens Protocol had over the last week. A 100k verified users with Twitter logins, compared to close to 9k on Lens, according to data from Tokenterminal. And as with most social networks, it has its version of emergent power laws.

The chart below shows how much the top “creators” have made on FriendTech over the past week.

There are several things FriendTech got right:

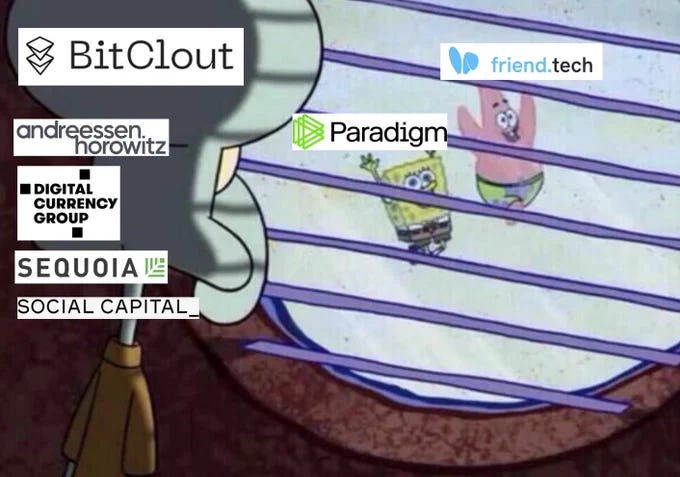

The market would have ignored the social app without a backer like Paradigm. The fund gave "signal" value to the product when they tried to onboard influencers.

It is becoming obvious there was a round involving influencers for the product. Aligning incentives for individuals with large distribution likely helped with narratives.

There is incredible genius in launching the product on Base instead of Polygon (where Lens is currently).

Given its stage and nascency, it is the chain with the most attention. They could have leveraged the Lens social graphs, but they went out and created their own.

Could the product have been built or Arbitrum, Optimism, Polygon - or any other L2? Possibly. But none of those protocols command the attention projects on Base do today. Something the $Bald token rugger knew exceptionally well. Remember these points as we go through the following bits of this article.

Status Meets Capital

There's a reason why I dumped all those numbers on you. Crypto's culture is built on moving money. It makes sense. We built technology that settles ledgers globally and is therefore incentivised to create products that use these ledgers.

What's the best use of moving money if you can't use it for real-life products? Well, you can use it for investments. Compress those investments' growth (or decline) into short cycles, and you have a narrative casino.

Everything is a gamble; the differences are the timelines and odds involved. Crypto works with shorter timelines and worse odds from time to time.

Over the past few quarters, there have been emergent narratives across tokens. NFTs, GameFi, AI, Infrastructure - each quarter brings a brand-new narrative. Part of this is because we like stories.

Even when there are no fundamentals to back a token, having a story we collectively believe in helps form conviction in a trade that might eviscerate your net worth. You lose money in a bad trade, but at least it had a strong narrative to back it.

What tools like Unibot, Rollbit, or FriendTech are solving for is this lack of stories and volatility. FriendTech takes it to a different level, likely giving us a view of how Web3 social products could evolve.

Eugene Wei’s “Status as a Service” provides a good framework for how social networks have historically evolved. In the early 2000s, the “intellectually” easy thing to argue was that social networks would become much like traditional social networks. Yet, by some accounts, there were close to 300 social networks of different kinds in the era. Remember Orkut, MySpace, and Friendster?

They all died sad deaths, like many of the altcoins during their rallies in 2017. What made Facebook, Instagram, and TikTok different?

Eugene’s article is a masterpiece worth reading - but I’ll summarise it in a few points for the sake of this article. But before we go there, take a look at the image below.

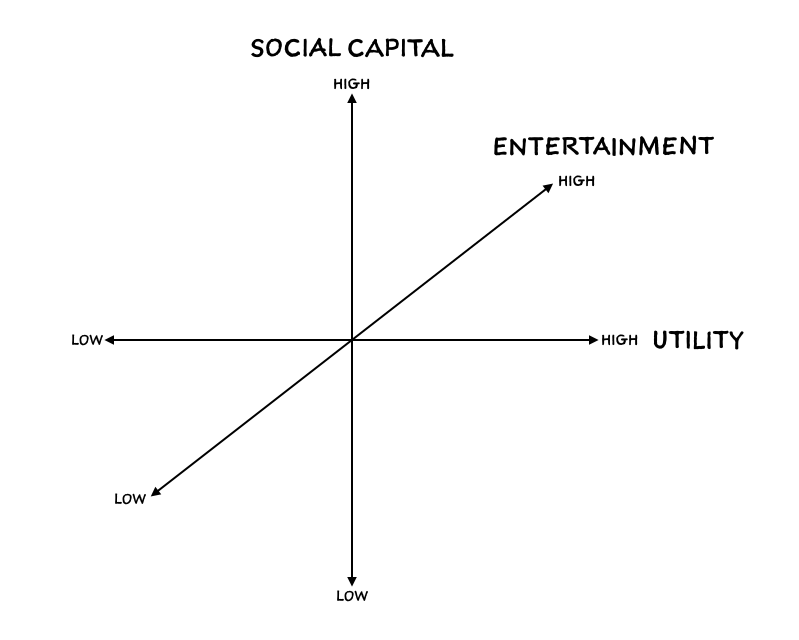

According to Eugene, a social network takes off on these three axes. It needs to be high in conferring social capital (status) to individuals posting on it, high on its entertainment (dopamine), and have some form of utility. Quora gives you answers, Pinterest gives you faith in your taste, and TikTok makes you wonder if the future of humanity is worth waiting for.

Each of these apps ticks off all three of the axes mentioned by Eugene.

But how do you confer status in an emergent app? You need proof of work. And the kind of people that can do the proof of work early on in a social network become the “elite” on it. TikTok, for instance, primarily leans towards the young because dancing on the application gets you more views than doing a long-form video on YouTube, as Ashwath Damodaran does. It is not that the dean of valuations can’t get enough views on TikTok. He may not get as many views as a 20-year-old dancing to the latest tunes on the platform.

The converse is also true. Text-heavy platforms, like Twitter or Substack, confer status to individuals who can write eloquently. Sinocism by Bill Bishop was one of the first publications on Substack. It granted status to the publication more than it did to the author because Bill, at that point, was already a successful writer. Years later, when Packy built Notboring during Covid, Twitter celebrated his writing ability.

Status on social networks is highly contextual, depending on the skills needed to show proof of work. In crypto, speculatory gains roughly translate to “proof-of-work” if you are a trader.

All social networks start as a competition for status between those that can generate proof of work during the early days. Consider Thread’s recent launch. I spent half a day on the application thinking Meta’s Twitter clone would be a great distribution channel for this newsletter. Much to my disappointment, the product had already broken two core rules mentioned by Eugene.

Threads gave status to individuals that were already influencers on Instagram. A product that was built by posting highly-edited photos and entertaining video reels. Users with a large following on Instagram started with more followers on Threads.

Given the difference in context, style and content, users on Threads no longer received any meaningful utility from the product. One could go to Instagram to see edited photos. The lack of followers that actual writers saw on Threads meant they had no incentives to leave Twitter (or Substack) and start all over in a product dominated by influencers.

The “competition” for human attention on the product did not feel fair and equal for users that were good in the medium Threads was looking to enable.

As I write these words, Threads’ active user base is down to 10 million from the 50 million users that flocked to the app during the early days. For people to do the “work,” they need verifiable rewards and a fair game they feel like playing. A social network crosses the chasm of apathy when it has sufficient people putting in the work and an audience base that sees utility in it.

Web3 native social products have long touted “utility” in the sense that they are claimed to be:

Composable - users could use multiple clients to interact with or consume content.

User-owned - in that a handle on Lens Protocol is unlikely to be seized by a centralised company.

Decentralised - the storage and query layers could be relatively distributed compared to Meta's servers to run Facebook or WhatsApp.

There are other attributes like censorship resistance and immutability at play. Still, I will stick to these three core features because you cannot have retail-scale Web3 social products without moderation. The problem is that these “utilities” do not attract users sufficiently to want to post on a product.

A user posts on Twitter (or Substack) today because that is where the eyeballs are. Discovery, appreciation, and interaction is the “utility” on Web2 native platforms. Social networks in the traditional world are dopamine machines. Users are comfortable with their data being exploited by centralised providers because they get many more eyeballs than they would on a decentralised platform.

Creators accept these trade-offs on Web2 in exchange for the scale (of attention) they enable. In the current environment, the only way to switch a creator from Web2 social to Web3 native primitives is if capital is involved. Money is an excellent incentive on its own and is a precursor to social capital.

The genius of FriendsTech is replacing the need for “utility” with capital.

If I were to re-do Eugene Wei’s axes, it would be like the graph below.

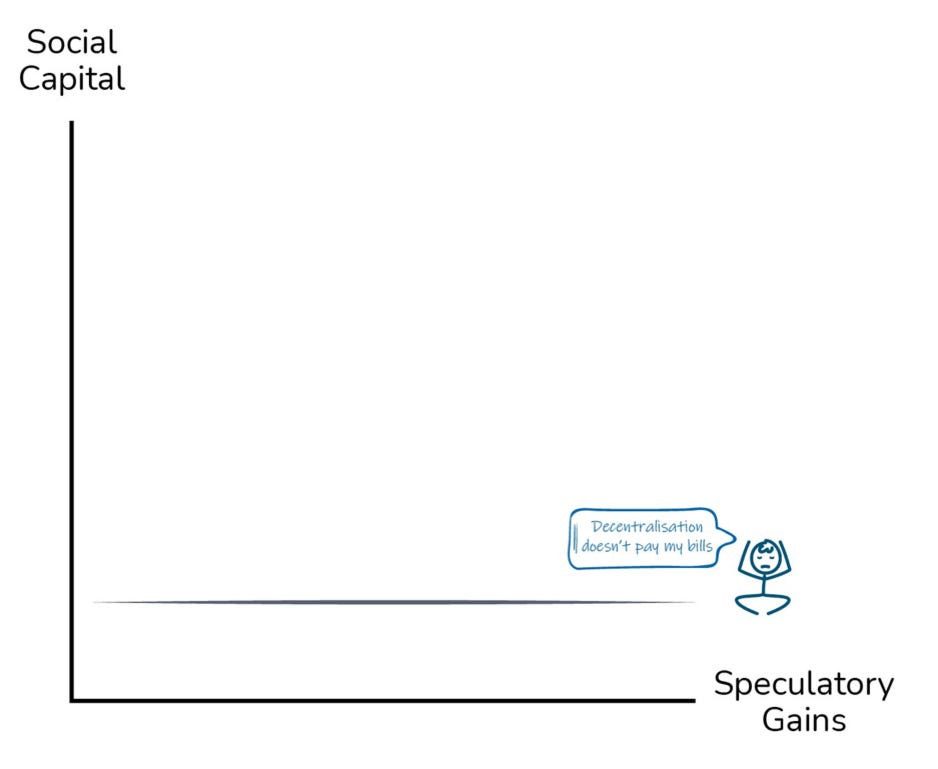

It is fair to suggest crypto is entertaining. We do many things wrong, but entertainment is something we’ve figured out (especially if financial crime thrillers are your genre of preference). I will remove the entertainment angle from this graph and solely compare social capital and speculatory gains.

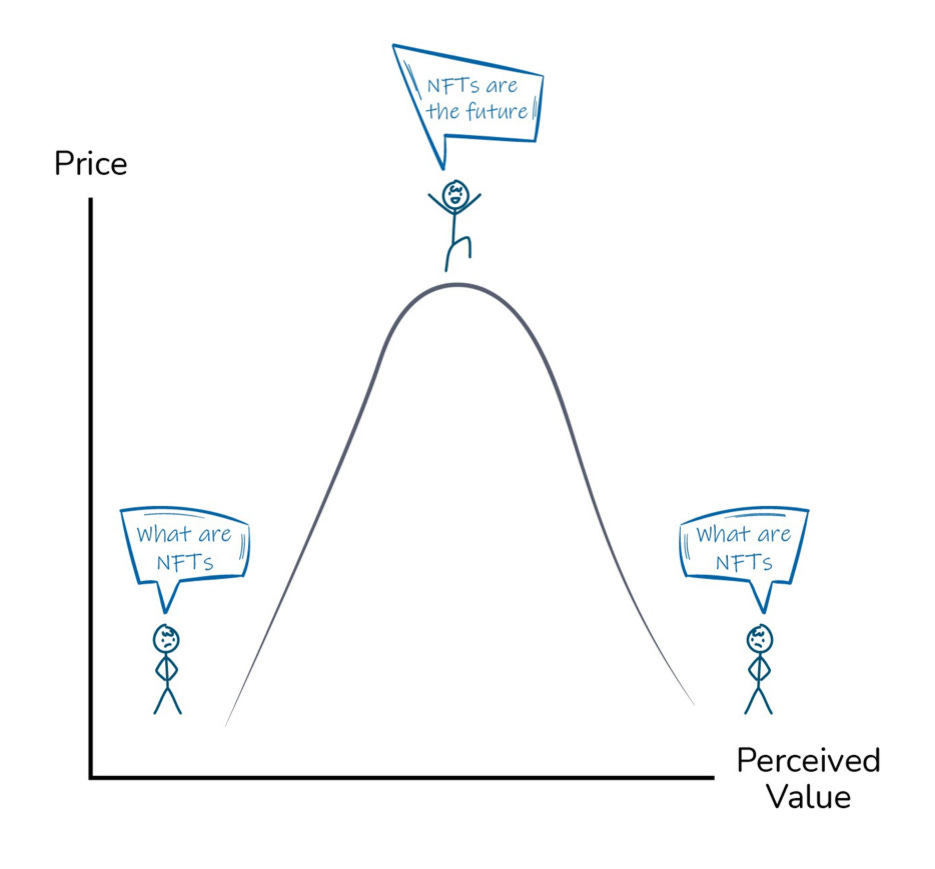

DAOs and NFTs follow a very similar arc in their early days. Entrants that can move in early on a product make tremendous speculatory gains, which infers status on them. As the narrative dies, the possibility of making more money on the trade (through acquiring an NFT like BAYC) diminishes.

The users that minted BAYC on its launch day had little to no status, but they made the most speculatory gains as they were early. Once the "status" was established through the multitude of celebrities signalling their ownership of the NFT, the profits to be made declined. And buying at peak meant there was only one way the trade could end for you. In losses. The chart would look like something below.

At its peak, NFTs (like Bored Apes) conferred status. Their utility was opening up networks by being part of an elite group of individuals. It either signalled you were resourceful enough to mint an NFT early or rich enough to buy it in due time. Owning an NFT conferred status to you based on who else held it. But as its price collapsed, the “utility” (in the context of status and social networks) quickly vanished.

Social networks (like Meta) eventually removed NFTs from their platform because of the negative status associated with the primitives. Bored Apes became synonymous with scammers on Twitter and was no longer a status signal. On the contrary, it became a counter-signal, as evidenced by the countless apes who sold their NFTs (often at losses) and reverted to their original PFPs - their faces.

One way to think of NFTs is as primitive Web3 social technology. It mapped out users and gave you a simple social network (or community) depending on who else owned it. The problem these social networks had was that users were aligned with the money they stood to make by holding these primitives. As prices collapsed, the perceived value of being in that social network (of NFT holders) collapsed alongside it—a reverse veblen effect of sorts.

A different class of Web3 social products have avoided this trap by removing (or limiting) speculation from their products. The lack of algorithmic feeds mean user don’t find you for posting exceptionally great content on platforms like Mirror today. Unlike Substack or BeeHiiv today - most social networks built on Web3 native principals hold on to their idea of neutrality and do not entice creators with any meaningful incentives to switch to them.

This means a user posting on a Web3 social product stands to lose both status and potential gains by any inbound business that comes through the distribution of a product like Twitter offers.

Mirror’s genius is in permitting users to issue NFTs and possibly monetise. The challenge is NFTs are one-time sales with limited upside as a creator. You can always hope that royalties from the NFTs will continue to fund you, but that is hypothetical and not a given. So the platform, while rich in features, fails to attract users as it flatlines on the status and speculatory gains unless you are a known creator.

The chart below summarises my thoughts as I post my piece on Web3 native social products occasionally. When a product cannot generate wealth or distribute content - it fails its purpose as a dopamine-inducing machine. Users stick to their existing platforms (like Twitter) instead of bothering with a new one.

A product could be built on a chain that enables a million transactions for next to nothing while permitting users to own, filter, trade, or lend their data. But until the incentives align, users will not flock to it. Utopian visions of how technology must evolve rarely convert to reality until user behaviours are studied.

In the past, token communities were “social networks” consisting of individuals with aligned incentives. The product was the token’s price. Present-day social networks aim to expand beyond that niche of “token investors.”

The more retail audience bases in our products get, the farther we will be from design choices that community members considered normal in the past.

Merging Worlds

Historically, the social graphs you had on-chain never interacted with the social graphs you had off-chain. In Dubai, I prefer not to meet people from work on the weekends because they bring out a different personality in me. And I’d rather not be discussing degen behaviour in my time off. (I’m NGMI, I know, but it keeps me sane)

FriendTech explicitly merged a Web2 social graph with a Web3 social product. It used people’s Web2 social graphs to propagate itself as the product often tweeted from users’ Twitter handles without them knowing.

In doing so, the product managed to do what has historically been the most challenging part of bootstrapping a social network from scratch. Finding friends on a new social network. When you sign up on TikTok, Instagram, and recently Substack, the product asks permission to sync your phone contacts to their servers.

The products then map out the phone numbers to platform users and suggest them as friends to you. WhatsApp took this one step further and permitted you to text users whose phone numbers were stored on your phone.

By merging your off-chain social graph with your on-chain behaviour, the product reduced the “activation” energy a user needed to be hooked on the product. Users are no longer spending time setting up their wallets. One of the first actions you do on the product is ‘buying” your shares, which sets the expectation for what the product lets you do.

From there on, you can use the explore or trending sections to find your friends. These friends, in turn, are notified about you signing up for the product and thus incentivised to buy your shares.

The higher the value of your shares, the more the status conferred on you. What makes FriendTech interesting is that it has put a commercial price that is publicly verifiable for people’s social graphs. It is not about the size of social graphs either. Cobie has close to 740,000 followers on Twitter. 0xRacer, in comparison, has close to 16,000, but the latter has a higher market cap on Friend.

The product verifies the willingness of people to pay for your shares. It is a measure of the desire of your followers to put money where their mind (attention) is—a more distilled measure of popularity. In the age of everyone getting their 15 minutes of fame, creators that can make their $100k of royalties will separate themselves from the rest.

FriendTech is a funnel for translating your social capital into speculatory gains. The graph looks closer to the one below. Historically, it did not mean much outside the crypto realm if you traded altcoins and made much money on them. Web3 social products (like FriendTech) blur the gap between clout (in the real world) and wealth generated from your on-chain behaviour.

Historically, we used to think of the “on-chain” world as a limited subsection of wallets. Depending on the category or timelines involved, there are anywhere between 4 million (DeFi) to 15 million (NFTs) users in these product categories. In blurring the lines between social graphs on Twitter and the blockchain, FriendTech has released the proverbial cat out of the bag. (The last cat was Bitclout, and I know that didn’t end well).

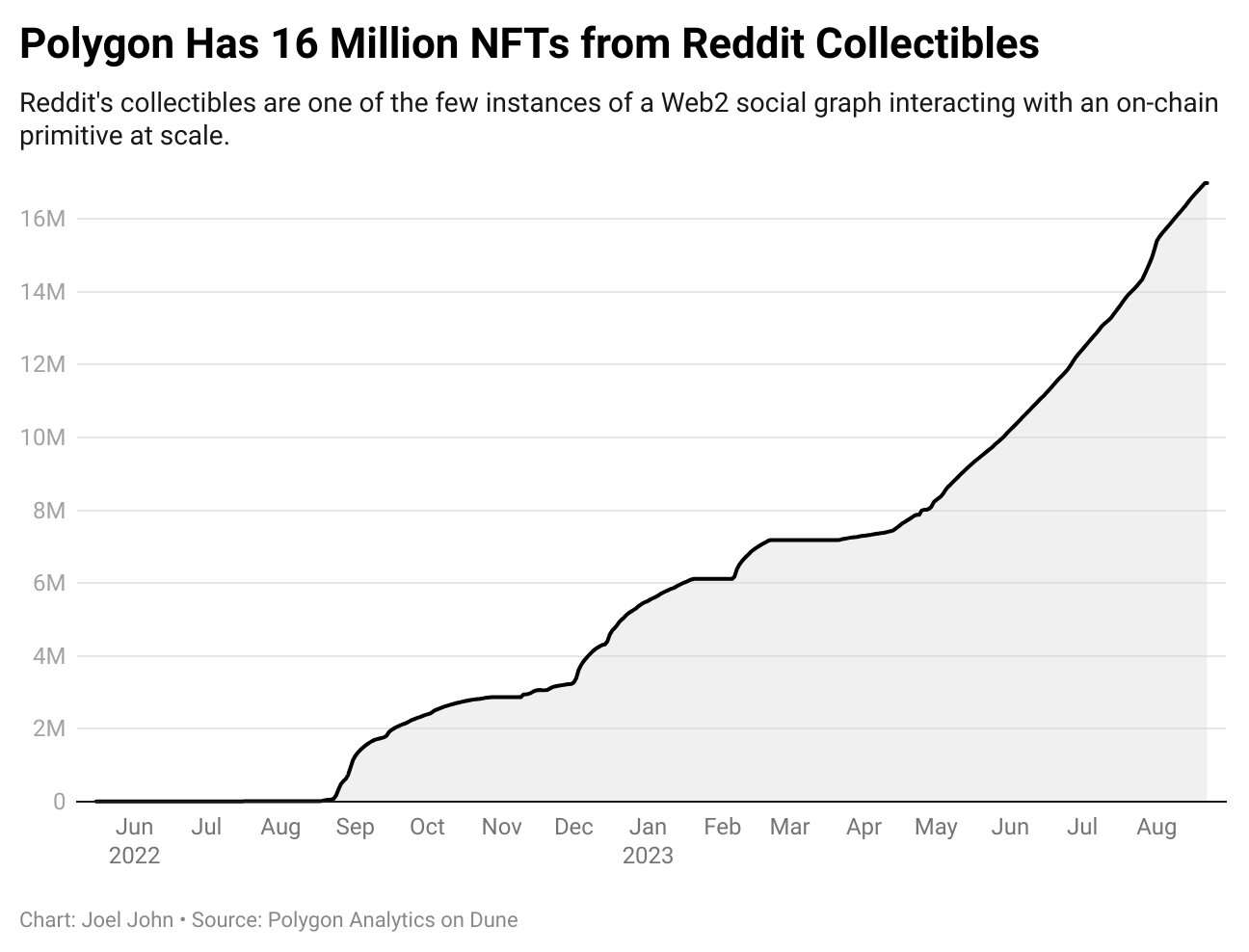

This “trend” of merging social graphs is not new. Twitter’s integration of NFTs into the product and Meta’s attempt at permitting users to link NFTs to their profiles were variations of blending social graphs. But the one place this has happened quite eloquently is on Reddit. Some 16 million NFTs have been minted on Reddit without spurring a speculatory boom.

The next category of Web3 social products will similarly merge social graphs and hack growth with volatility as a pitch. Mirror can integrate Twitter’s graph into the product. Lens (or products built on it) can attempt to make it possible to discover your Twitter followers with a Lens handle.

But until an element of speculation drives massive capital inflow, most of these products will (unfortunately?) not capture sufficient attention.

According to Eugene, if the product has enough utilities, a social network can sustain itself after users are tired of social capital games. Instagram’s integrations of vanishing images (SnapChat) or reels (TikTok) is an instance of a social network expanding its product suite to be relevant after the status games are played out.

The reason why Web3 native social products will have to lean heavily on capital inflow is that these utilities are not built yet. Volatility is the service until a sizeable social graph to retain users emerges.

Risky Behaviour

A product on the internet has reached complete maturity only when its users are flirting with one another. It occurs everywhere. From the beautiful corners of YouTube comments to Amazon Reviews and, I presume, even Uber. Web3 native products have not reached a point where there is sufficient user diversity to facilitate making new friends. Instead, we have capital sinkholes that may or may not generate value in the long run.

You can paywall content without crypto. You can run a paid Telegram chat. There is no need for a bonding curve to monetise your content. I doubt any creator needs Friend.tech to be a better creator. Think about it: John Lennon, Beethoven, and Michelangelo relied on elements of finance throughout their careers. But they did not need an on-chain Ponzi scheme to fuel their success. What Web3 social products will solve is the financialisation of everybody. Is that a desirable outcome? I don’t know.

Historically, you either needed to launch a protocol (like Aave) or run a community (like BAYC) to generate wealth. Web3 social would enable everyone to create money off their social graphs at the click of a few buttons. Given the legal risks, multiple creators with large followings may avoid jumping on the bandwagon, leaving the industry with a curated subset of financial miscreants willing to take on the risks.

Remember Threads? We could see that with Web3 social quite soon.

This means we will continue to see risky behaviour involving money and reputation with these product categories. NFTs enabled celebrities to issue digital assets and monetise their social graphs. But they also resulted in countless scams. As with all primitives, we will see a period of exuberance, where Web3 native social products are touted as the future of content.

The capital incentives for creators and early adopters would push these financial primitives to users. But unless we can switch from being an industry of transactional products to one that can enable attention capture at scale, we may be doomed to repeat mistakes of the past. From a capital allocation perspective, it is becoming increasingly clear that crypto is dividing itself into two broad ends of a spectrum.

On the one hand, when you consider their volatility, you have assets that are becoming similar to hard assets (like gold). They will see cash flow from institutional capital allocators wanting an alternative asset class. On the other hand, you have highly volatile on-chain primitives that are driven by narratives and social graphs.

As for FriendTech, I will remain a sceptic for now. LooksRare, Blur, and many other products have previously humbled me. You start with an optimistic outlook only to see users flock elsewhere once incentives (airdrops) are switched off. As long as an airdrop and royalties are involved, you cannot verify what portion of a product’s users are real. FriendTech has an airdrop tab in the product. Creators on the platform are incentivised to distribute to more users because of the royalties involved.

One of the scariest outcomes that could occur for FriendsTech right now is a reverse network effect of sorts. Presuming a large portion of the userbase goes into losses holding shares of creators, the incentives to stick around engaging with creators tend to diminish. As a creator, making money is terrific. (Trust me, I know). You need to pay the bills. But having an audience subset that does not care is punishing in its unique ways. What tools like FriendTech do today is enable users to make portfolios out of social graphs. And portfolios, like many of our crypto-bags, can go deep into the red.

Historically, creators had to compete with other creators for attention. Web3 social products that combine elements of trading with reputation or content will make it possible for creators to no longer compete with a scarce asset—the amount of time people have to give for their content.

I have my scepticism, but for now, it is becoming evident that volatility is one of the strongest hooks for Web3 social products to come to market.

Here is why. Some 100k signed up to FriendTech over the last week. Those users are looking for risk, not content. You can build great products that target retail participants. But they do not have context on crypto. The only way products can reach sufficient levels of growth to kickstart network effects large enough to onboard retail users is through onboarding crypto-native users and making them rich through product royalties or airdrops.

Whether we like it or not, that process involves speculation. We can ignore it, but people don't care about decentralisation as much as we think they would. They care about what a product can do for them more than the number of PhDs deciding the consensus mechanisms used on a blockchain.

The "pitch" in crypto has been volatility for the longest time. Web3 social will bring elements of volatility and social graphs together. It could enable distilled, collective lunacy. It scares me when I think of how these things could evolve. But as with most technological cycles, I think it may bring back life into primitives like DAOs that have long been ignored.

Until the regulator takes action in some meaningful form, we will continue to see developers blurring the lines between what is acceptable and what is not.

Ironically, we have iterations of such experiments in the past. Steemit and Bitclout come to mind. The NFT boom was a similar cycle. It would be intellectually dishonest to presume that any capital allocation cycle in a new product category would not repeat patterns from that.

Crypto will have to transition from a "transactional" product to an "attention economy" product to reach the user base the internet has today. The tech stack needs to be able to facilitate use cases that capture our attention instead of our money. Web3 gaming and social networks serve that function quite well. We have no mechanisms to onboard creators with the right incentives just yet.

In 1997, there were some 13 million individuals on the internet. Today, there are 3 billion. The exponential arc of technology humbles the most cynical souls. (Including me). Web3 social products are speculative platforms today because we have not figured out how to onboard normal users without making them lose money.

Much of the work that needs to be done for the industry to scale is not in terms of the brand-new L2 or decentralised exchange. It is in figuring out business models that can use the technologies we have already developed. To borrow Janet L Yellen's words: speculation is a transitory feature.

I'll see you next with some work we have been doing on identity products in Web3.

Digging through fish-curry recipes on YouTube,

Joel John

If you liked reading this, check these out next:

Telegram, Pitch Decks & Referrals.

Join in with over 5000 researchers, investors, founders & overall great human beings. We don’t exactly talk much, but it would help you stay close to what we are focusing on & connect with others building cool things.

Fill out the form below if you are a founder building cool things and in the process of raising money or looking for feedback on what you are pursuing. We like the builders.

Enjoyed reading this? Consider sharing with a friend for access to the paid versions of our newsletter.

An insightful exploration of the dynamics between volatility, social graphs, and speculation in the crypto space. Interesting read, thanks for sharing your insights 🙌🏻🙌🏻.

Great knowledge