Trading Optionality

The case for on-chain options

Hello,

Last year, I wrote a note on how volatility will be a driving factor for product adoption. This was before meme coins took over the market. Today, we play along the theme to explore a product segment that we believe will grow a hundred times in the next three years: Options.

While Hyperliquid has made perpetuals trading mainstream, the market for options has been lagging far behind. Today’s piece explores the reason for it, lays historical context for the emergence of on-chain options and breaks down what needs to be fixed for options to take off.

We have been speaking to market-makers and founders about how liquidity will emerge in these new primitives. If you are a founder building alongside these instruments, we’d love to chat. Drop an email to venture@decentralised.co.

Joel

On to the story now..

Remember Sam Bankman-Fried? He used to work at Jane Street before conducting experiments in effective altruism and embezzlement. Over the last month, Jane Street has been in the news for two things

Potentially aiding a coup (allegedly).

Conducting experiments in arbitrage in the Indian options market. (Also, allegedly, as I can’t afford the kind of lawyers it takes to beat them in court).

Some of these experiments were so huge that the Indian government decided to ban them from the region altogether and seize their money. Matt Levine wrote this beautiful brief on the matter last week, but to make a long story short, here’s how the “arbitrage” worked.

You sell put options in a market with deep liquidity (say $100 million)

You steadily go long the underlying asset in a market with thin liquidity (say $10 million in volume)

In a market like India, options often trade in multiples of the underlying stock. This is a feature, not a bug. Markets tend to find liquidity even when there isn’t enough of the underlying asset. For instance, there are more gold ETFs in existence than gold. Or consider the 2022 GameStop rally, which was fueled in part because there were more GME shorts in existence than the stock itself. Anyway, back to Jane Street.

When you “buy” a put option, you are betting that the price will go lower. Or, you are buying the rights to sell at a price agreed upon. The strike price. The inverse happens when you buy a call option. You buy the right to buy something at a preset price. Let me explain this with PUMP’s token, as it is due for launch later this week.

Say I want to bet that Pump’s token would open below $4 billion in FDV, driven by a morbid hatred for VCs and meme markets. I’d buy puts. The person selling me these puts may be a VC that has an allocation in Pump’s token and thinks the price will be higher when it lists.

In exchange for selling me these puts, the VC gets a premium. Say I pay him $0.10. If it opens at say, $3.10, and my strike was $4, I would get $90 cents if I practice my put options. My effective profit would be $0.8. The VC, on the other hand, would be forced to sell tokens at the lower-than-expected price ($3.10), effectively covering the $0.90 difference, and taking the loss.

Why would I do this? I get a great amount of leverage. I put up $0.1 and get to short a $4 asset. And why do I get the leverage? Because the person selling me the option (the VC) thinks it would not go under $4. Worse yet, the VC (and his network of friends) may simply go buy Pump at $4 so that when the time comes to settle, it trades at $4.5. This is what the Indian government has been accusing Jane Street of doing.

In Jane Street’s case, though, they were not trading PUMP tokens. They were trading stocks from India. The NIFTY bank index, to be specific. A market where retail users often trade options due to the high leverage it offers. All they had to do was something like this — buy some of the relatively illiquid underlying stocks that comprised the index.

Then sell calls on the index at a higher premium as the index price increases due to spot buying. Buy puts on the index. And then sell the stocks to drive the index lower. The profit here is the call premium and puts payout. You might lose a little bit on spot buying and selling. But the puts payout is usually more than enough to cover this loss.

The chart above explains how the trade worked. The red line was the price at which the index was trading. The one in blue is the price at which the options were trading. In effect, they sold options (pushing prices lower, collecting premiums) and bought the underlying (pushing the price higher and without having to pay for the options). Everything is an arbitrage.

What does this have to do with today’s story?

Nothing. I just wanted to explain how puts, calls and strike prices work for people who are new to these terms.

In today’s issue, Sumanth and I explore a simple question. Why has the market for options in crypto not exploded? On-chain perpetuals have become hot again with Hyperliquid leading the narrative. Stock market perpetuals are also almost here. But what about options? As with most things, we start with historical context, then go through the specifics of how these markets work and lay out what to expect. Our assumption is that if perpetuals are here to stay, options will follow.

The question is, who are the teams building it, and what are the mechanisms they will implement to have differing outcomes from the boom era of 2021 DeFi summer?

We don’t have all the answers, but here are some clues.

The Perpetual Puzzle

Do you guys remember the pandemic? Glorious times when we sat home wondering how long the great social distancing experiment of our lives would last? It was also a time when we saw the limits of the perpetuals market. As with many commodities, Oil has a futures market that allows traders to bet on its price. And as with all commodities, oil is only useful as long as it is in demand. Pandemic-induced restrictions meant oil and oil-related products were not as much in demand.

When you buy a future with physical delivery (not cash-settled), you are buying the rights to receive the underlying at a price you agree upon today. So if I went long on oil, I’d be “receiving” oil when the contract expires. Most traders do not bother with taking custody of the commodity but instead sell it to a factory or a counterparty with the required logistics in place (like shipping tanks) to take the oil.

But in 2020, things broke down. Nobody wanted as much oil, and the traders who had bought these futures contracts had to take custody. Imagine I’m a 27-year-old analyst at an investment bank with a million gallons of oil waiting to be “delivered” on contract expiry? My 40-something-old compliance lead would first ask me to sell it all. And that is what happened.

In 2020, the price of oil went negative for a while. This is a beautiful example of the limits of futures for physical items. You have to take custody. And custody comes with its own costs. If I’m just a trader betting on oil, chicken or coffee bean prices, why would I want to take custody? How will I even ship it from the source to the ports of Dubai? This is the structural difference between futures markets for crypto and the traditional world.

In crypto, the underlying commodity can be claimed with little to no expenses. It is simply transferred to a wallet.

And yet, options in crypto have not exactly exploded. In 2020, the US markets for options trading settled around 7 billion contracts. Today, it does close to 12 billion contracts worth a notional $45 trillion. The options market in the US is roughly 7 times the size of the futures market. Nearly half of this activity comes from retail traders punting short-dated options expiring on the same day or by the end of the week. Robinhood built its business around providing quick, easy and free access to options and monetising it via Citadel through a model that’s called payment for order flow.

Crypto derivatives, however, tell a different story. Perpetuals process roughly $2 trillion every month, around 20 times the volume of options that clear around $100 billion per month. Crypto markets didn't inherit traditional finance’s toolkit; they developed their own ecosystem from scratch.

The regulatory landscape shaped these divergent paths. Traditional markets operate under CFTC constraints that require future rollovers and create operational friction. U.S. regulations cap stock margin leverage at roughly 2x and ban anything resembling "20x perpetuals. Options became the only way for a Robinhood user with $500 to turn a 1% move in Apple into a 10%+ gain.

Crypto's unregulated environment, dealing purely in digital assets without physical delivery, created space for innovation. It all began with Bitmex’s perpetual futures. These futures are unique in that, much like the name suggests, there is no “delivery” date. They are perpetual. So you do not take custody of the underlying but simply trade in and out. Why would traders use these? Two reasons:

Compared to trading spot, perpetual futures have lower fees

The availability of margin is much higher on perpetuals.

Most traders prefer the simplicity of trading perpetual contracts. Options, in contrast, require understanding multiple variables simultaneously: strike selection, underlying price, time decay, implied volatility, and delta hedging. Most crypto traders evolved directly from spot trading to perpetuals, completely bypassing the options learning curve.

BitMEX shipped perpetuals in 2016, and they instantly became crypto’s favourite leverage toy. In the same year, a small Dutch team launched Deribit, the first venue dedicated to crypto options. Bitcoin sat under $1000, so most traders wrote it off as unnecessary complexity. 12 months later, the mood flipped. BTC was sprinting to $20k, and miners sitting on windfall inventory started buying puts to lock in margins. Ether options arrived in 2019, and by January 2020, open interest topped $1Bn for the first time.

Today, Deribit clears more than 85% of crypto options flow, revealing how thin the market remains. When institutions need real size, they don’t touch the order book, they ring the RFQ desk or chat over Telegram, then settle the trade through Deribit’s interface. A quarter of Deribit’s volume comes through this private channel, highlighting the dominance of institutions in what seems to be a retail-focused space.

Deribit carved out a unique spot by allowing cross-market collateral. Say you went long on a futures position (Bitcoin at $100k), and you purchased put options at $95k. If the price of Bitcoin went down, your long position would be in the negative, but the increase in the value of your put options would keep you from being liquidated. There are variables here, such as when the options expire or how much leverage you took on the futures. But the ability to have cross-market collateral on Deribit was a key reason for its dominance.

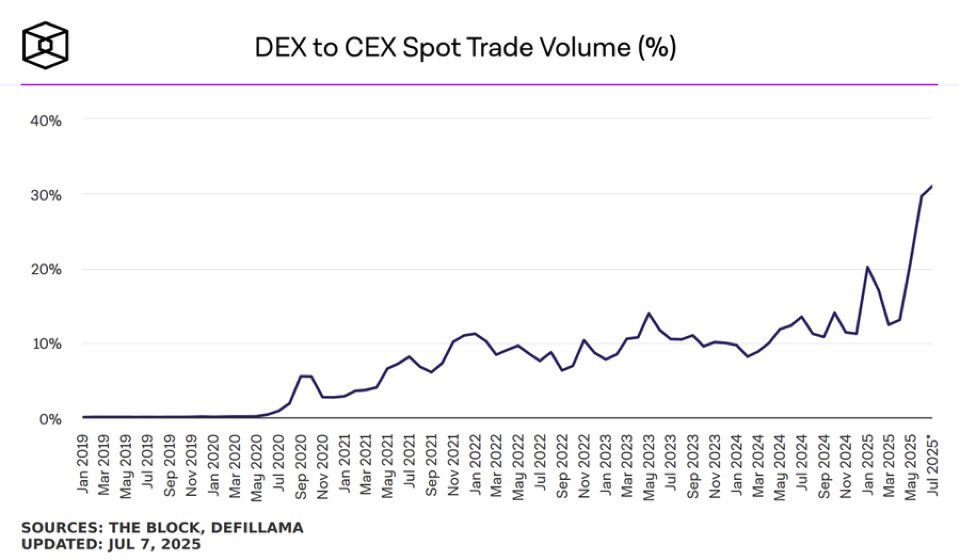

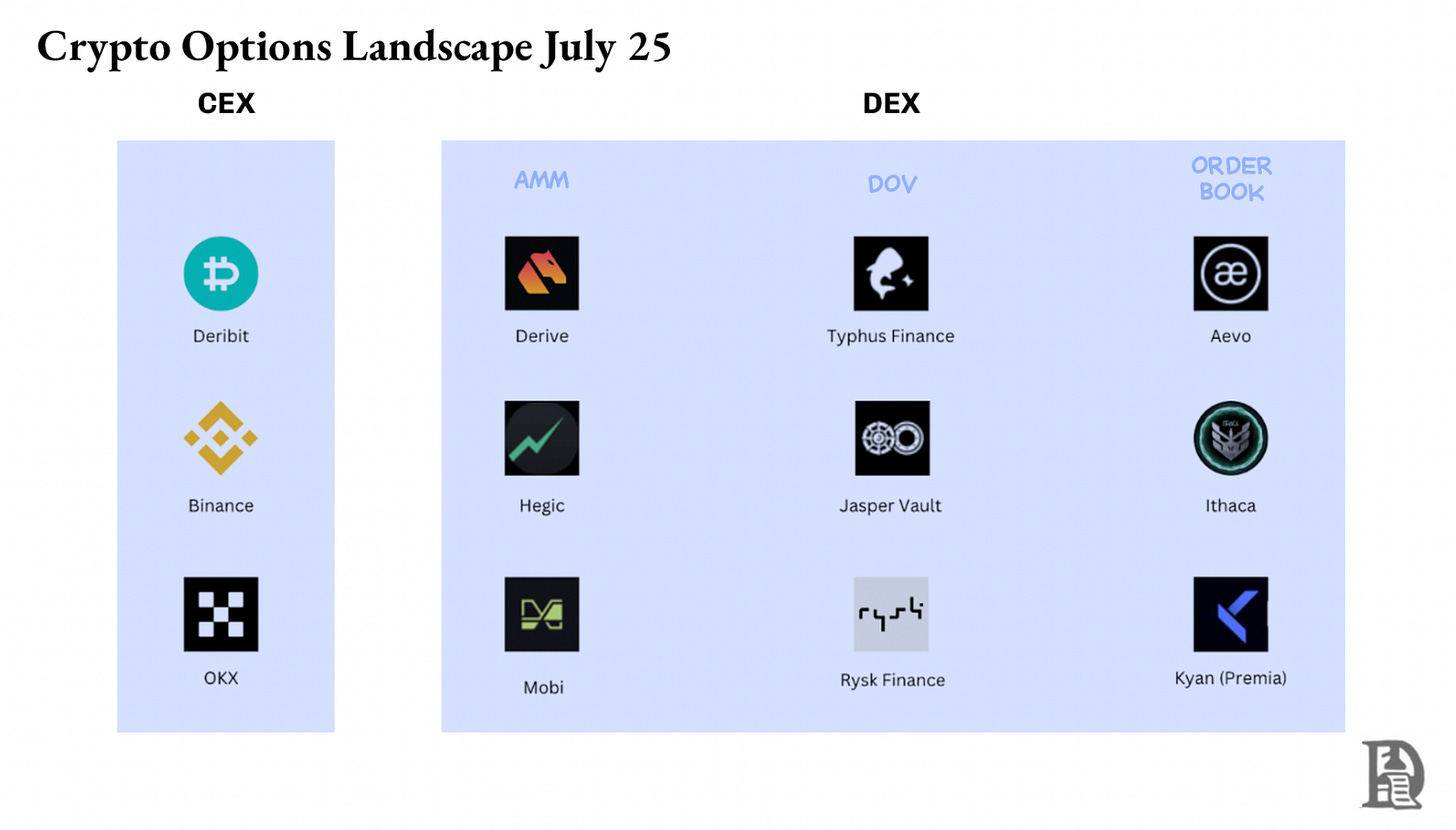

Moving options on-chain looked easy on paper. A smart contract can track strikes and expiries, escrow collateral and settle payouts without middlemen. Yet, after five years of experiments, Option DEXes combined still capture less than 1% of option volume. Compare this to Perp DEXes, which own roughly about 10% of futures volume.

To understand why, we need to go through the three phases of the evolution of on-chain options.

The Stone Age of Options

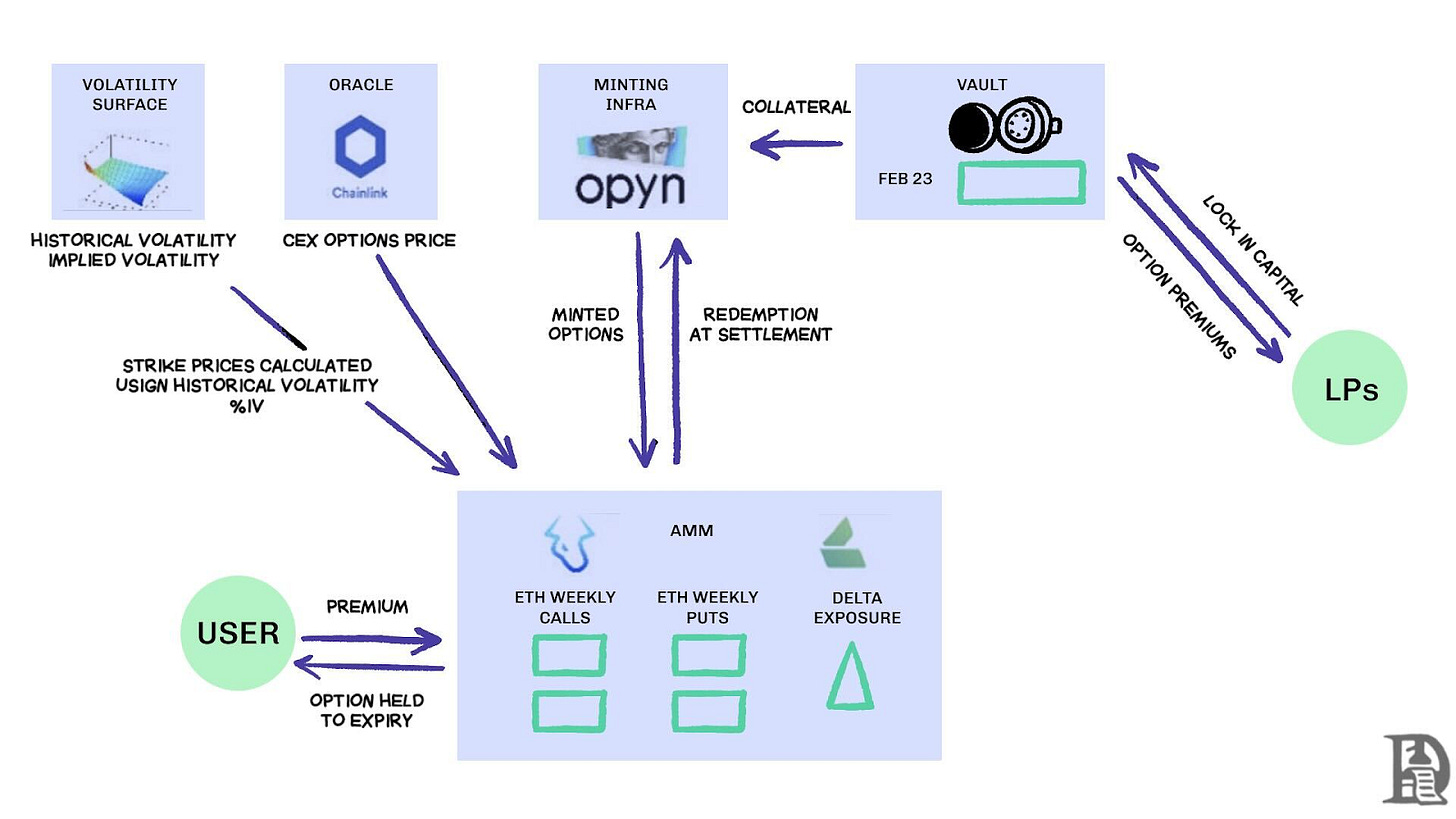

Opyn kicked things off in March 2020 by democratising option writing. Lock ETH as collateral, choose a strike and expiry, and the smart contract would mint ERC20 tokens that represented the claim. These tokens traded in a peer-to-peer fashion anywhere ERC-20s were accepted—Uniswap, SushiSwap, or even direct wallet-to-wallet transfers.

Each option became its own tradable token. A July $1,000 call was one token, a $1,200 call another, creating a fragmented UX but a functional market. At expiry, holders who finished "in the money" could exercise their options, receiving their payoff while the contract released the remaining collateral back to writers. Compounding the problem, writers had to lock up the full notional amount. Selling a 10 ETH call required freezing 10 ETH until expiry to earn half an ETH in premium.

This system worked flawlessly until DeFi Summer arrived. As gas fees exploded to $50-200 per transaction, writing a single option often cost more than the premium itself. The model collapsed virtually overnight.

Builders pivoted to a Uniswap-inspired pooled liquidity model. Hegic led this transformation, allowing anyone from retail traders to whales to deposit ETH into communal vaults. LPs pool collateral into one bucket and let the smart contract quote the price for buying and selling options. Hegic’s UI lets you select the strike price and expiry date.

If a trader wanted to buy 1ETH call option for next week, the automated curve (AMM) used the Black-Scholes model for pricing, taking ETH’s volatility data from an external oracle. If the trader clicked Buy, the contract carved out 1ETH collateral as collateral from the pool, minted an NFT that recorded the strike and expiry and pushed that NFT straight to the buyer’s wallet. The buyer could sell the NFT on OpenSea anytime or wait until expiry.

For users, it felt almost magical— a single transaction without any counterparty and premiums streamed to LPs (minus a protocol fee). Traders liked the one-click UX, and LPs loved the yield; the vault could write many strikes/expiries at once without active management.

The magic lasted until September 2020. Ethereum had a nasty crash, and Hegic’s simple pricing rule had sold puts far too cheaply. Put option holders who were in the green exercised their options, forcing the vault to hand over real ETH it never expected to lose. A single brutal week wiped out a year’s worth of premiums, and LPs learnt a harsh lesson: writing options might seem like easy money in calm markets, but the first storm can empty the pool without proper risk management.

Lyra (now Derive) tried to fix this by combining pooled liquidity with automated risk management. Lyra calculated the pool's net delta exposure after every trade—the sum of all option deltas across strikes and expiries. If the vault had a net short delta exposure of 40 ETH, it meant that it would lose $40 for every $1 increase in ETH’s price. Lyra would establish a 40 ETH-long position on Synthetix perpetuals to neutralise this directional risk.

The AMM used Black-Scholes pricing, with expensive on-chain calculations handled by off-chain oracles so gas stayed tolerable. This delta hedging cut vault drawdowns in half compared to unhedged strategies. Though this was elegant, the system was dependent on Synthetix’s liquidity.

When the Terra Luna crash spooked traders and they fled Synthetix staking pools, liquidity dried up, causing Lyra's hedging costs to spike and spreads widened dramatically. Sophisticated hedging requires deep liquidity sources, something DeFi still struggles to provide reliably.

Finding Fire

Decentralised Option Vaults (DOVs) emerged in early 2021. Ribbon Finance pioneered this model with a simple strategy. Users deposit ETH into a vault that sold covered calls every Friday through off-chain auctions. Market makers bid for the flow, with premiums flowing back to depositors as yield. Everything reset the following Thursday when options settled and collateral unlocked, ready for the next auction cycle.

During the bull run of 2021, IV hovered above 90% so weekly premiums translated into eye-popping APYs. Weekly auctions consistently generated attractive returns, and depositors enjoyed what seemed like risk-free income on their ETH holdings. When the market peaked in November and ETH’s value started dropping, vaults started posting negative returns. Premium income no longer covered the dip in ETH’s value.

Competitors Dopex and ThetaNuts cloned the model and added rebate tokens to soften losses during bad weeks, but the core vulnerability to large movements remained. In both AMM and DOV models, capital remains locked till expiry. Users who deposited ETH for earning premiums are trapped if ETH drops, unable to exit positions when needed.

Order Book

Learning from AMM’s limitations that crippled early option protocols, teams on Solana pursued a radically different approach. They tried to replicate Deribit's central limit order book (CLOB) model on-chain with sophisticated order-matching engines that settled almost instantly and onboarded market makers who would act as the counterparty writing every option.

The first generation of products, such as PsyOptions, tried to push the order book on-chain. Every quote consumed blockspace, and makers had to tie up 100% of collateral, so they quoted sparsely. The second generation of products, like Drift and Zeta Markets, moved the order book off-chain and settled on-chain once there was a match. The Ribbon team re-entered the arena with Aevo, placing the order book and matching engine on a high-performance Optimism L2.

More importantly, these products supported perps and options on the same platform, with a portfolio margin system that calculated the net exposure of market makers. This helped makers re-use collateral, the same feature that made Deribit successful.

The results were mixed. Spreads tightened because market makers could update quotes frequently without prohibitive gas costs. The CLOB model's weaknesses became apparent, especially during off-hours trading.

When professional market makers in the U.S. went offline, liquidity evaporated, leaving retail traders with wide spreads and poor execution. The system's reliance on active market makers created temporal dead zones that AMMs, despite their flaws, never experienced. Teams like Drift fully pivoted to Perpetuals, moving away from Options.

Some teams like Premia are pursuing a hybrid AMM-CLOB model, a middle path between fully on-chain order books that provide 24/7 liquidity and market makers who can introduce depth. However, TVL didn’t grow beyond $10M, so slippage remained high for large clips requiring market makers to step in.

Why Options Struggle

Option liquidity has been drifting away from AMMs towards order books. Derive (rebranded from Lyra) retired its on-chain AMM and rebuilt the exchange around an order book with a cross-margin risk engine. This upgrade attracted desks like Galaxy and GSR, and the platform now handles roughly 60% of all on-chain options volume, becoming DeFi’s biggest options DEX.

When a market maker sells a $120K BTC call and hedges with spot BTC, the system recognises these offsetting positions and calculates margin requirements based on net portfolio risk rather than individual position requirements. The engine continuously evaluates every position: underwrite January 2026 120 K calls, short next-week weeklies, buy spot BTC, and ask traders to post margin based on net directional exposure.

Hedges cancel out risk, freeing collateral to redeploy into the next quote.

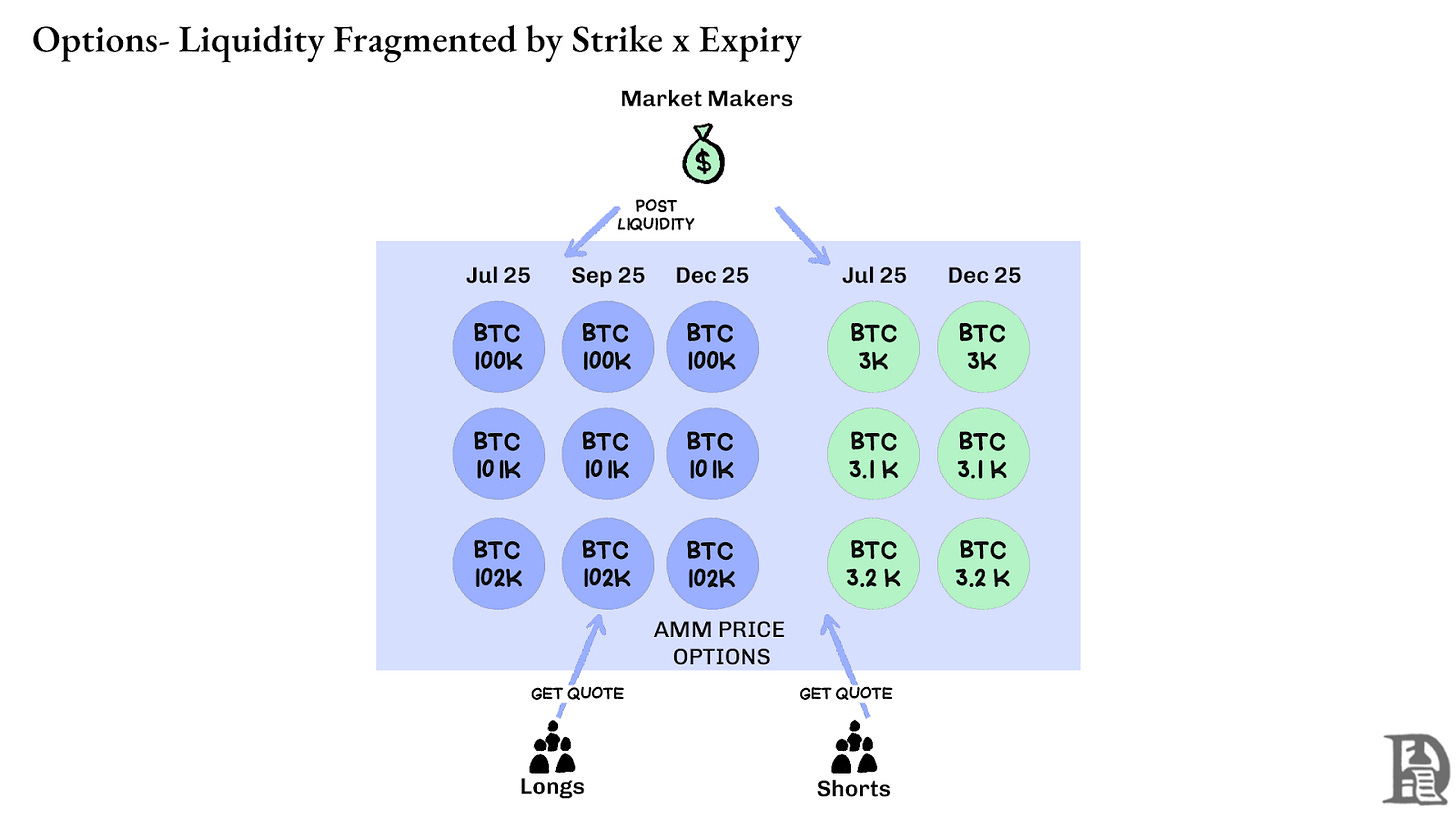

On-chain protocols break this loop the moment they tokenise each strike and expiry into its own ERC-20 silo. A 120 K call minted for next Friday cannot recognise the BTC-perp hedge. While Derive has partially addressed this by adding perpetuals to enable cross-margin within their clearinghouse, spreads remain significantly wider than Deribit's; often 2-5 times larger for equivalent positions.

Joel Note: Let me explain this in terms of Mango prices. Imagine I sold someone the right to buy a mango for $10, and got paid $1 for it. Said mangos will be at peak ripeness in three days. As long as I have the mangos (spot asset), I can collect the premium ($1) and not worry about the market price of a mango going up.

I do not lose money (therefore I’m hedged), except for any hypothetical appreciation in the price of the mango. If Sumanth purchased the option (by paying me $1), he can turn around and sell the mangos for $15, and collect his $4 in profit premium. The three days are the expiry date for said options. At the end of this transaction, it is guaranteed that I will either have mangoes or $11 in total ($10 for the mangoes + $1 premium).

In a centralised exchange, my mango farm and the market are in the same town. And they are aware of the guarantees of my transaction. Therefore, I can use them as collateral option premium paid by Sumanth to offset another expense, such as labour. In on-chain markets, the two markets are hypothetically at different locations with no trust in them. Since most markets work on credit and trust, the model would be inefficient from a capital utility perspective. I will lose money just wiring Sumanth’s payment to pay someone else for logistics.

Deribit benefits from years of API development and a deep roster of algorithmic trading desks that have optimised their systems for its platform. Derive’s risk engine launched just over a year ago and lacks the thick order books in both spot and perpetual markets that effective hedging requires. Market makers need immediate access to deep liquidity across multiple instruments to manage risk effectively. They can simultaneously hold options positions and hedge them through perpetuals with relative ease.

Perpetual DEXs solved the liquidity puzzle by eliminating fragmentation entirely. Every perpetual contract for a given asset looks identical: one deep pool, one funding rate, and unified liquidity regardless of whether a trader chooses 2x or 100x leverage. Leverage only affects margin requirements, not market structure.

This design allows platforms like Hyperliquid to achieve remarkable success, with their vault typically taking the opposite side of retail trades and distributing trading fees to vault depositors.

Options, by contrast, splinter liquidity across thousands of micro-assets. Each strike-expiry combination creates its own market with distinct characteristics, dividing available capital and making it nearly impossible to achieve the depth that sophisticated traders require. This is at the heart of why on-chain options have not taken off. However, given the amount of liquidity we have seen emerging on Hyperliquid, this equation may soon change.

The Future of Crypto Options

Looking across every major options protocol launch over the past three years, a clear pattern emerges: capital efficiency determines survival. Protocols that forced traders to lock up separate collateral for each position, regardless of how sophisticated their pricing models or sleek their interfaces, consistently lost liquidity.

Professional market makers operate on razor-thin margins. They need every dollar of capital working efficiently across multiple positions simultaneously. When a protocol forces them to post $100k in collateral for a Bitcoin call option and another $100k for a hedging perpetual position instead of recognising these as offsetting risks requiring perhaps $20,000 in net margin, it becomes unprofitable to keep engaging in the market. Put simply, you do not want to tie up a lot of money to make very little money.

Spot markets on platforms like Uniswap regularly handle $1+ billion in daily volume with minimal slippage. Perpetual DEXs like Hyperliquid process hundreds of millions in daily volume while maintaining spreads competitive with centralised exchanges. The liquidity foundation that options protocols desperately needed now exists.

The bottleneck has always been basic infrastructure: the "plumbing" that professional traders take for granted. Market makers need deep liquidity pools, instant hedging capabilities, immediate liquidations when positions go bad, and unified margin systems that treat their entire portfolio as one risk profile

We've written about Hyperliquid's approach to shared infrastructure, creating the positive-sum dynamics that DeFi has long promised but rarely delivered. Every new application strengthens the entire ecosystem rather than competing for scarce liquidity.

We believe that options will finally come on-chain through this infrastructure-first approach. While previous attempts focused on mathematical sophistication or clever tokenomics, HyperEVM solves the fundamental plumbing problem: unified collateral management, atomic execution, deep liquidity and instant liquidation.

There are a few core aspects to changing market dynamics that we see:

In the post-FTX crash of 2022, there were fewer market makers in the market engaging with new primitives and taking on risk. Today, that has changed. Participants from traditional avenues have returned to crypto.

There are more battle-tested networks that can take on the needs of higher transaction throughput.

The market is more open to some of the logic and liquidity not being entirely on-chain.

If options are to return, it may require a mix of developer talent that understands how the product works, market-maker incentives, and the ability to package these instruments in a way that is retail-friendly. Can there be on-chain options platforms where a few make life-changing sums? After all, that’s what memes offered. It had people dreaming of making seven figures from a few hundred dollars. Meme assets worked as they offered highgive volatility, but they lacked lindy effects.

Options, on the other hand, have Lindy effect and volatility, but are hard for the average individual to understand. We believe there will be a class of consumer apps that focus on bridging this gap.

Today's crypto options market resembles pre-CBOE Chicago— a collection of experiments without standardisation, dominated by speculation rather than hedging. But that will change as crypto infrastructure matures into genuine business operations. Institutional grade liquidity will come on-chain with reliable infrastructure that can support cross-margining systems and composable hedging mechanisms.

Respecting the pump,

Sumanth

Special thanks to Hansolar for sharing his views on the space.

Disclaimer: DCo and/or its team members may have exposure to assets discussed in the article. No part of the article is either financial or legal advice.

Hyperliquid is a great UI, great volume and great community incentive (lets see how well it does in a bear market but still). Options are a gold mine for fees. If you look at the success of Robinhood/WSB its people chasing with options. If decentralized crypto can find a footing in this market it will be huuuuge. But I am still waiting. Sure volume on options for things like BTC/ETH is important to start the ecosystem, but what gets traders going is finding the next GME / AMC/ NVDA /MSTR / RKLB and then piling in, pushing the market higher. I wonder if those same dynamics are present in crypto.. Great post nonetheless. Thanks