The Funding Environment

We are all just indexed bets.

Hey there,

I started writing this post to update founders about the funding environment in Web3. But then I realised it is not rocket science to conclude the environment is bad. Most founders raising in this market have been stuck for months. Venture capital funds are in the middle of raising for themselves. And consumer apathy is at the worst levels we have seen for quite a few quarters.

It is like suggesting one's limb is broken. We all know the limb is broken. Because it hurts. You don't need me to explain the extent to which it is broken, as we all feel the pinch in the market. So I decided to zoom out and understand what is happening in venture-land. In today's piece, we will study whether everybody's limbs are hurting instead of explaining how and why our limbs are broken. Maybe we could find ways to fix our limbs in the process. (No more limb references, I promise)

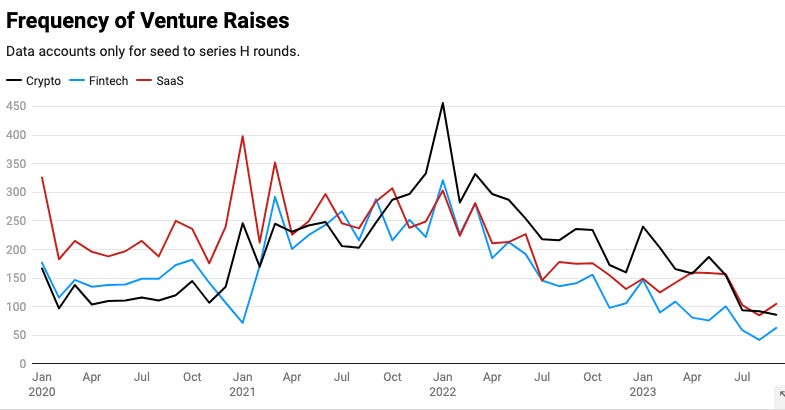

Before we begin, consider the chart below comparing the frequency of investments into SaaS, fintech and crypto-related ventures since 2020. I had to bring data from around ±25,000 investment events over the last few years to make the chart below. (It seems like it was worth the effort).

When we read crypto fundraising news, the general assumption is that capital inflows have reduced drastically over the year. And that is indeed true. But to suggest that without context on what is happening is ingenuine. I took fintech and SaaS verticals as comparables here due to their relative maturity compared to blockchains as a technology. But as you can see, there's a draw-down applicable across the industry, much like an increase in appetite for risk a while back.

What does this look like in terms of the amounts raised? I cleaned up the data to account for raises only from seed to Series H, as otherwise, I'd have to include IPO data. From the perspective of venture capital investment comparables, it did not make much sense to add it here.

Interestingly, SaaS and crypto as sectors peaked around the exact amounts of dollar values going towards them each month (around $7 billion). I presume SaaS and fintech rallied in late 2020 partly because of COVID-19. People spent all their time in front of screens, often hitting the buy button hard for intellectual stimuli as the world shuts down that year.

Notice how crypto trails a few months later? That is because pension funds, venture capitalists and hedge funds recognised they were deep in the money on their portfolios during the pandemic. Across asset types, the risk appetite increased substantially as portfolios turned green. It helped that interest rates were at their lowest in a while, and consumers had excess money through stimulus or savings from lockdowns. A mix of these factors made crypto rally.

More mature verticals would often have fewer investments (in frequency) but higher amounts of money going to them. But the point is, we are all indexed bets on some pension fund's appetite for risk. It is not that crypto fell off the rails. It is that the economy itself had a rude awakening, and capital allocators stopped dreaming about what they could do with NFTs and on-chain ponzinomics. (I'll explain what this means for founders in a bit.)

The Relevance of CAC

So where do we go from here? All great ecosystems have, at their core, a mix of good talent and patient capital. As capital in the market dries up, so does latent talent willing to continue building in the industry. Given the opportunity cost of not working on something hot (like AI), most firms will have to pay more to employees if they hope to retain them. Either in cash or equity.

It helps to have a perspective on investor motivations at this point. For some context, let's look at what raised money last week.

The conservative, somewhat apprehensive tap of liquidity at large venture funds is slowly opening up for select ventures. What do these ventures do? IYK provides infrastructure to verify the authenticity of physical goods using NFC chips. The next time you purchase an Adidas sneaker, you could receive an on-chain reward for it by just tapping it with your phone.

SupraOracles and Rated are both infrastructure plays oriented towards data. These are firms where you can show some form of meaningful traction. Investors lean towards what is novel, new and viral in markets like the one we are in now. Why is that the case?

There's the obvious reason that most investors likely have sufficient exposure to primitives, like NFTs and DeFi, that are deep underwater, and they may not want to add to that exposure. On the other hand, novel applications see rising demand from users seeking something new. This translates to traction and, by extension, the lowest CAC a firm could have.

That last bit – CAC – determines everything at this stage in the market. During past bull markets, firms could allocate tokens to acquiring customers. Their treasuries were ever-expanding. If you were a venture that raised equity and planned a token launch, you may rarely have had to worry about where users would find you. Greed (or market incentives) did the marketing for you. Investors knew they would have liquidity from their investments through tokens. Founders knew they would have an ever-expanding treasury once the token became liquid.

During bear markets, consumers and investors rarely have a reason to care for products where a token is not on the horizon. Your effort to make them care could be distilled and measured as your CAC. One way to measure a protocol or dApp’s appetite for consumer acquisition is through tracking their token treasuries. In a bull market, managers at these protocols are comfortable taking risky bets as the value of their treasuries rise substantially. Concerns of protocol revenues do not exist as the token becomes the product. In a bear market, this effect works in reverse.

The ability (and appetite) to use tokens for consumer acquisition rapidly dwindles as firms recognise that selling tokens at low prices could hurt an already illiquid market for their tokens. The lack of focus on CAC or revenue is not a problem endemic to crypto ventures alone. AirBNB, Uber and WeWork are each instance of ventures that were not highly profitable for prolonged periods. The difference is that with crypto, the incentives are liquid and volatile if a token exists. It has a direct impact on CAC.

Layer3 is a quest platform with one of crypto's largest top-of-the-funnels. They help brands discover users through running quests. According to Brandon's latest tweets, they have 800k users. If I presumed the market in crypto for active users is ~2.5 times that, we are all hunting for a portion of 2 million users. That would be the total market size in the industry today if I had to think of "how many people are active?"

There is the caveat that these are the users doing transactions. The market for users whose mindshare is close to crypto is likely 10x [at 20 million], and for users who have used crypto at some point, it is expected to be 100x [at 200 million]

Any founder who has ever raised a penny is chasing a portion of this small user base. For B2B leads, the number is even smaller. In a bear market, as firms reduce spending, the CAC would reduce in tandem. But that is often not the case as the total number of active users also reduces faster when token prices reduce. This is where viral products (like FriendTech) stand out as conservative bets, even when you know activity can drop off if the airdrop is released. They have the lowest amounts in CAC.

Projects that raised money in 2021 (or earlier) with products at their core must find mechanisms to keep CACs low while maintaining morale as their runways dwindle. This is why we wrote about Telegram and churn over the past few weeks. CACs determine a firm's ability to survive at this market stage. Founders with traction are increasingly becoming the ones who set the price for their rounds. The ones without are often stuck in loops of adding feature sets in hopes that a superior product will attract users.

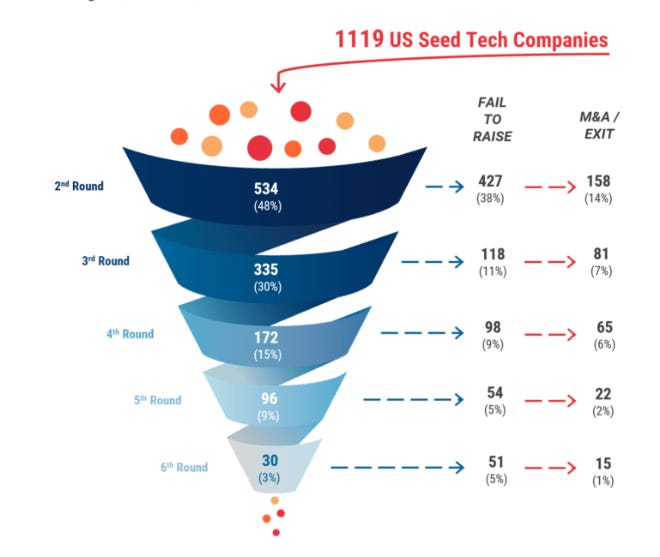

These are ugly truths. In a WAGMI world, we all would have made it, and every venture would result in an IPO. But we live in efficient markets where you have a 1% chance of becoming a unicorn. That metric was calculated in 2018. The number is likely even lower now considering how much more the competition has increased due to excess venture dollars going into startups.

This is a scary statistic that the venture world ignores, but as markets dwindle, it is worth repeating this to most founders. This is why I have been observing two things. A handful of founders have begun shutting their ventures or considering M&As. Some other founders have been job hunting while updating their investors about running out of runway.

In a bull market, you can spend time thinking of TAM.

In a bear market, your best bet for survival is to obsess about CAC.

There Is Hopium

Now that I have sufficiently scared you, I can get to the bit with hopium. The data below shows the frequency and amounts that have gone into seed stages. Naturally, there's a drastic decline from the highs of January 2022. But we are more or less in a return to rationality mode rather than an absolute collapse. Most of the data around the frequency and amounts raised looks at the draw-down from the peak.

But if you study the chart, it becomes apparent that we are still at 2020 activity levels for early-stage ventures. There is a decline compared to early 2022, but investor interest in Web3 has not vanished.

I mentioned CAC because in the early stages, a venture is an arbitrage on CAC. Your "valuation" is determined by the number of users you can acquire per unit dollar. We use a different mental heuristic for this in the market and ask, "Do you have traction?".

Naturally, not all products will have traction early on. Sometimes, founders have to raise capital to build a product in the first place. In such environments, signal value is shown through a handful of methods.

Firstly, if it is a profoundly technical product, you're better off explaining it properly and in-depth than building a broken MVP that puts off potential backers. Blog-posts, podcasts or hanging out in large communities and signalling expertise is a lever for grabbing investor attention.

Secondly, if it is a consumer application, you do have the possibility of bootstrapping a community of a few hundred people around the concept itself. Early communities don't scale quickly, so much of the building process would involve cold DMs and strong rejections.

Thirdly, most startups are built on secrets. Founders who can show they have a wedge in an underexplored market can likely raise funds simply due to understanding the market. When firms are similar, founders struggle to stand out.

The more I study firms struggling with raising funds, the more I see recurring patterns of founders holing up in a cave and staying there. Building is an incredibly long, hard and tiresome task. Speaking to users and investors is draining. You run out of energy at some point. But early-stage ventures are pivot machines. Founders can pivot (or conduct gradual iterations) several times to find PMF. But if you don’t speak to your customers, you don’t get to do any iterations.

But the shorter your runway gets, the more pertinent it becomes that you can form meaningful signals if you aim to raise. Signal value (of expertise or community) can be the bridge that helps a startup hire or retain employees, when people know that a startup may have to shut shop in 12 months if they cannot raise funds.

What Next?

I pulled up that chart comparing crypto to fintech and SaaS because I wanted to show the indexed nature of the venture ecosystem. If you build a startup reliant on venture dollars, you are inadvertently part of an indexed bet run predominantly by pension funds and family offices. That is an uncomfortable truth most VCs would not admit, but it is what it is. Flows towards venture investments will return if and when an ETF is approved or when Bitcoin rallies. (Boom, I said the obvious.)

Most ventures that raised funds in the last few years do not have a follow-on. Until a clear PMF exists, firms struggle to do a Series B or C. This means the trickle-down effect of appetite for earlier-stage investing has rapidly declined among VCs. An MVP shows your ability to build. Paying customers demonstrates your ability to sell. Firms with both have an edge.

The markets are crowded with too many variations of the same thing. Maybe some of the brightest minds I know should spend their time on options and perpetuals. I do not have an issue with these instruments, but they seem to discount how small the market is. The caveat is that a new generation of L2s can form customer experiences on-chain that are better than their centralised counterparts. One of the ventures I saw recently doing that is Synquote.

With most DeFi and NFT primitives, the models being built are from 2021. And as Blur showed last year, it only takes one new entrant to change the model (around royalties) entirely. Businesses that can change the model in novel ways will generate value for themselves and their shareholders.

This is easier said than done. The most innovation we have seen within DeFi has come from CowSwap, but their share of the AMM market is woefully low. In some sectors, even novelty does not translate to valuations rising.There is a mix of ventures that have not tokenised since 2021. They are battling the constant decay of consumer and investor attention. There will be friction internally as to when they should tokenise.

What is better? A firm with a token doing badly, or a firm that is dead because it ran out of runway? That's the decision many founders will soon have to make. And rather sadly for them, their investors may not respond when they want to have that conversation or think it through.Revenue multiples. Bull market revenue multiples were at 50–100x. So the unicorns we saw in 2022 likely have Series A levels of traction to show. Until they can build cash flow to a point where their valuations are 20–30x of multiples, many of them will struggle to do a follow-on. The good news is they have ample runway and could likely fix the problem with M&A.

This newsletter took a day extra to hit your inbox because I planned a trip with some (friends who are) developers to a desert near Dubai. Apart from Rust, Vim and several other things that flew above my head, they were discussing how during a bull market, the only thing they did was blow up their money on Luna or a random DeFi farm. Some saw a 75% pay cut compared to what they were paid last year. But they mentioned something that grabbed my attention. That building in a bear market is more meaningful because it is just fun to work on hard problems without the distractions of token prices.

The primitives we build in a bear market - be they intents, token-bound accounts or autonomous worlds, are intellectually stimulating for the brightest minds in our industry. People will continue to iterate and pitch them to users, regardless of whether venture dollars are flowing into the sector. As Paul Graham once famously explained in an essay, founders can be cockroaches.

The opportunity subset for VCs in this market is in finding the cockroaches. Because it takes a certain kind of conviction (or delusion?) to believe survival is possible after everything we’ve been through in the last two years. For founders, the opportunity is finding talent that finds meaning in continuing in the industry, even when mentioning blockchain at the dining table is awkward. Those still with crypto or Web3 in their dating profiles are likely golden hires around this market phase.

Talent that seeks opportunities based on what is trending is now building wrappers on AI and raising money for it. Even venture funds within crypto are rebranding themselves to capitalise on that opportunity. This means that there is very little competition within the industry when it comes to newer primitives that are coming of age. That lack of competition is the bull case for continuing to build even when crypto looks like a non-consensus bet.

Day and night. Bull and bear. Hot and cold. The world works in contrasts that are needed to balance one another. There is no way I can meaningfully argue it is a great time to build in Web3 without accepting the challenges that come with it. But as they often say, most things worth having in life come hard.

Off to eat dessert at Al Fanar,

Joel

Data Dump

The easy thing to do while writing this article would have been to dump the data around the frequency of raises and average amounts raised and call it a day. But I figured it would be intellectually lazy and useless to somebody building a startup in this space.

That said, doing a piece on venture funding would be unfair without the average raise amounts shared. So here’s the data for those that need it. E-mail me if you need a more detailed breakdown if you are a founder.

Median Amounts Raised

Round Frequencies

Total Amounts Raised

We’ll update this data on VCData.site in a v2 due for launch soon.

If you liked reading this, check these out next: