The Balance Sheet

What's left of FTX

Hey there,

My timeline looks happy again after a long time. Chat rooms on Telegram that have been dead are hearing the sounds of a million retail users coming back to bang on the ‘buy’ button. Terra and FTT are trading as though gravity is imaginary. But things were not always this way. Around this time a year back, FTX filed for bankruptcy. Close to 140 firms were shut along with it.

I wanted to study the FTX estate’s books and see how they have performed over the last year. Today’s post is an analytical ode to the user deposits and creditor balances in the estate. The timeline below should act as a quick refresher on what played out over the year.

A recurring question pops up when one discusses the FTX bankruptcy. Much of the assets owed to customers were liquid assets like BTC, ETH, SOL, and USDC. These assets could be liquidated and returned to the customers. Why is there such a fuss in giving it back? Couldn’t these assets be simply returned to the customers?

After all, liquidations make sense when assets are in illiquid form, like land or buildings; breaking them into pieces to hand over to investors/claimers is almost impossible. So, you sell the asset to the highest bidder and pass on the dollar amounts. But it appears that matters are a bit more complicated than that.

As I looked into documents, I realised how naïve I was.

Firstly, there were 102 debtors (companies that owe things to creditors), out of which 3 have been dismissed. So, there are 99 debtors now.

Secondly, except for 36,075 customers who filed for claims worth $16 billion, $65 billion are filed across 2300+ filings. These entities include Genesis, Celsius, Voyager, and the Internal Revenue Services (IRS).

Since the creditors extend beyond customers, it’s difficult to distribute assets as they are. The situation necessitates liquidating assets, which will then be distributed pro rata.

One of the parallels we have is Mt. Gox. About a decade ago, around 850,000 BTC (then $460 million, ~6.5% of the circulating supply) was stolen from the exchange. The exchange recovered ~20% or 170,000 BTC (now $6.12 billion, assuming BTC at $36,000). Creditors still await their repayment.

In this case, creditors could choose how they want their payout – either 90% in September 2023 (now delayed to October 2024) or an unknown amount at the end of civil litigation. The two largest creditors, representing 20% of the total payout, chose the first option.

Another example of large-scale bankruptcy proceedings is Enron, which took about a decade to conclude. Investors had sued Enron for over $42 billion in losses and received over $7.2 billion. With all that context out of the way, let’s dig in.

Liabilities or Claims

As in any bankruptcy proceeding, the burning question is how much FTX creditors could end up with. The answer lies in the value of assets FTX holds and how much the claims are. Note that claims can be disputed. Not every claim made is considered at the time of distribution of liquidated assets. For example, when you arrange claims in descending values, you’ll find a claim worth $1.7 trillion. Very likely, this won’t be entertained in the final proceedings.

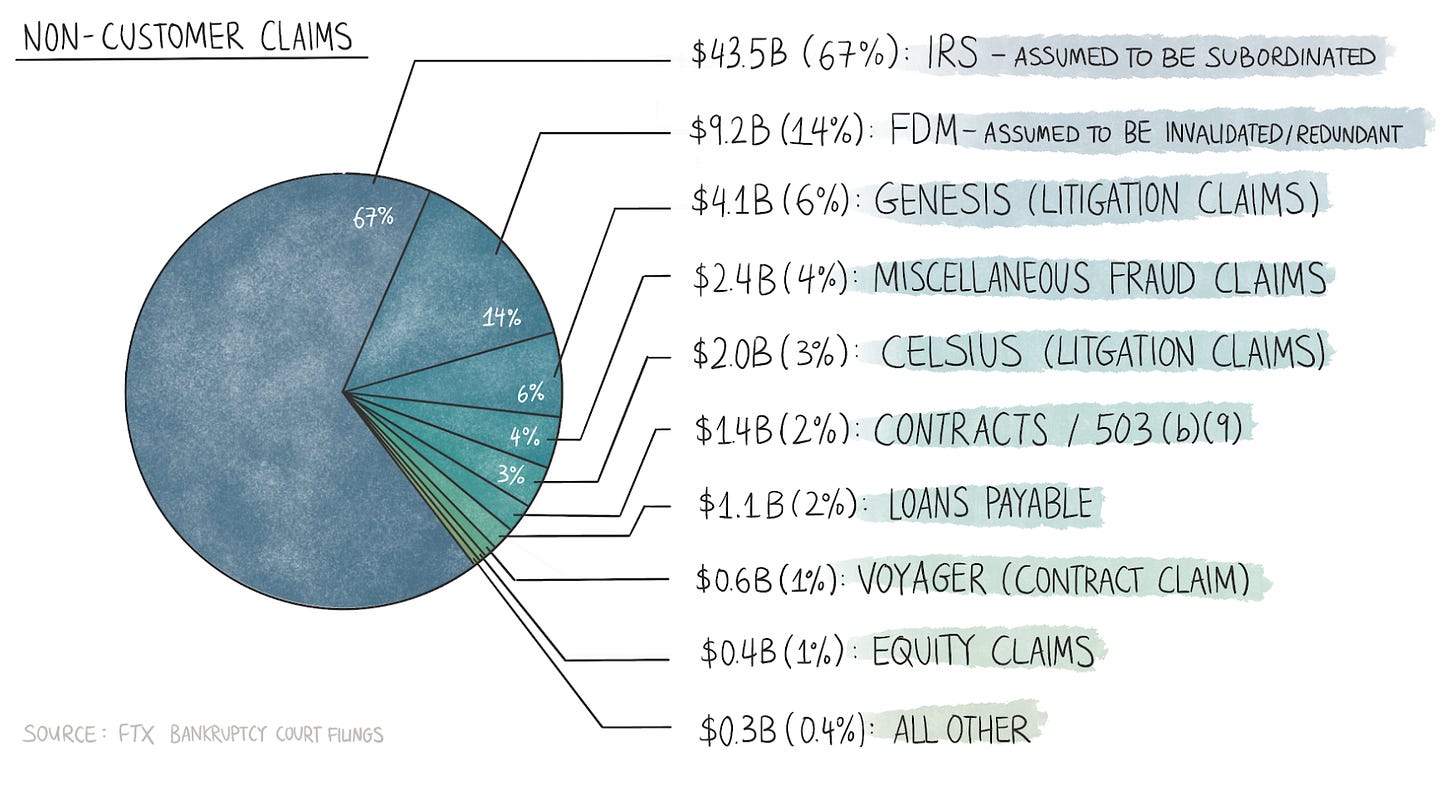

According to the debtor presentation submitted to the bankruptcy court on September 11, 2023, the total claims are $81 billion. Out of this, $65 billion are non-customer, and $25 billion are customer claims.

Of the $65 billion non-customer claims

$9.2 billion are assumed invalid or redundant.

$43.5 billion by the IRS is assumed to be subordinated. This means that the IRS claim falls below other claims. Therefore, these claims will be paid only after other claims are fulfilled.

The remaining $12.3 billion worth of claims will likely be considered at the same priority as customer claims.

Out of the $25 billion customer claims:

$10.9 billion in claims are scheduled. That is, the bankruptcy court will consider them.

$16.6 billion in claims are disputed, although some disputed claims have been scheduled.

So, if we consider $12.3 billion from non-customers plus $10.9 billion from customers, the total liability is $23.2 billion. Please note that not all of this will be agreed to. Some of the claims will be disputed. But let’s assume this to be the starting point.

How much of this will be paid? Well, there’s no straightforward answer. It is a function of the asset mix and how the assets can be liquidated. I looked at the organisation’s books to come up with a guesstimate.

Assets

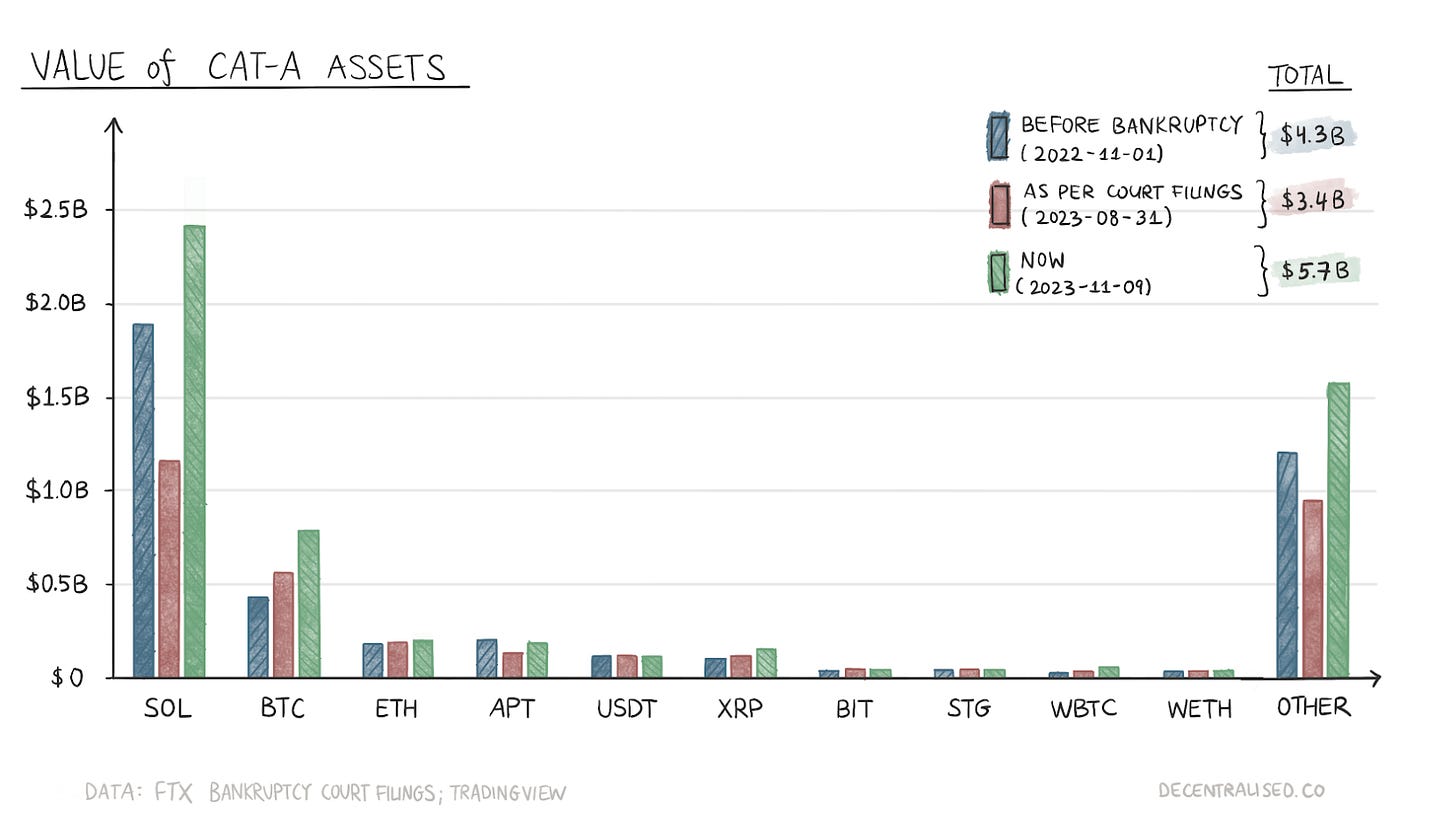

The following table shows the assets of FTX debtors. Digital assets in category A are more liquid assets, like BTC and ETH, while category B tokens are almost illiquid or largely controlled by the estate (tokens like SRM, MAPS, OXY, etc.). The values of all these assets are calculated based on their closing prices on August 31, 2023.

$529 million was held in brokerage accounts across Grayscale, Bitwise, and Blackrock Equity. Real estate includes 38 properties in the Bahamas with $222 million book value appraised at $199 million.

Out of the assets mentioned above, ~$7 billion in assets are marshalled. Marshalling is a legal principle the bankruptcy court uses to ensure creditors are treated fairly. It means that a creditor with a secured claim can require the debtor to use specific assets to repay the debt, even if the debtor has other assets that are not involved.

The bankruptcy court will sell the assets subject to liens or security interests first to pay off the creditors with those claims. Close to half of the marshalled assets are liquid tokens whose values have surged since the day of the bankruptcy filing.

Digital Assets and Venture Investments

Digital assets, venture investments, and token investments can fluctuate from the assets mentioned in the table above. The total value of assets from category A was $2.46 billion at the time of filing (Aug. 31, 2023) and $3.11 billion before FTX went into bankruptcy (Nov. 1, 2022).

The total value of the top 10 category A tokens stands at $4.08 billion as of Nov. 9, 2023. After the bankruptcy court permitted the estate to liquidate assets, there has been an on-chain movement of assets towards exchanges. Ouroboros Research has captured transactions here. I’ve removed the number of tokens sent out by the bankruptcy estate until Nov. 9.

One of the things that becomes evident is that a good chunk of the assets has actually surged in value since the day of the bankruptcy.

The top 10 category A tokens shown above constitute ~72% of the value. The remaining (‘Other’ in the chart above) ~28% are worth ~$1.58 billion as of Nov. 9, 2023. Out of this, the estate has already sent $108 million worth of tokens to exchanges. So, the total value of category A tokens stands at ~$5.7 billion.

The estate listed the top 20 category B tokens. Outside of RON and BLUR, others lack enough liquidity to digest selling pressure. The current values (as of Nov. 9, 2023) of RON and BLUR held by the estate are ~$7.6 million and ~$5 million, respectively. All of these are liquid assets that are likely to be slowly sold off to recoup money.

What’s more interesting to me has been the size of the estate’s venture books and how it has performed in the year since. As of August 31, 2023, the total venture portfolio included 438 investments totaling ~$4.5 billion in funded assets.

The portfolio includes —

Equity investments like Anthropic, Yuga Labs, and Genesis Digital for a total of $2.93 billion

LP funds, like Paradigm and Multicoin for a total of $732 million

Token investments like Solana, Near, and Polygon for a total of $507 million

Loans to the likes of Dave and Consensys for a total of $368 million

Out of the $4.5 billion, the estate has been able to exit (liquidate) $752 million worth of investments; $3.78 billion remains illiquid. The top three equity investments made by FTX/Alameda were

Genesis Digital ($1.152 billion),

Anthropic ($500 million), and

Voyager ($110 million).

Voyager and Genesis Digital have filed for bankruptcy. FTX’s estate has reached a settlement of $175 million with Genesis Digital. On the other hand, the Anthropic investment brings hope to FTX creditors.

FTX invested in the company at a post-money valuation of $5.5 billion. The recent talks of Anthropic raising from Google at $20 billion to $30 billion. This means FTX’s $500 million could be between $1.8 billion to $2.7 billion. In other words, the returns generated by the Anthropic investment could cover the losses from Genesis Digital and Voyager within a year.

Keep in mind the venture book was not just equity investments. There were direct token investments that involved lock-ups too. They add up to a total of $506 million.

Post-ICO tokens involve investments in ecosystem funds like Solana ($137 million), Near ($80 million), Polygon ($50 million), Mina ($20), 1Inch ($10 million), and others ($84 million).

Pre-ICO tokens involve HOLE ($68 million), FUEL ($15 million), SWIM ($4 million), FAR ($3 million), GGX ($3 million), and others ($32 million).

All of these are subject to different lock-up periods.

Potential Avoidances & Lawyer fees

Entities involved in bankruptcy often transfer assets before filing for bankruptcy. The bankruptcy trustees can take legal action to claw back these assets. Such assets fall under potential avoidances. In this case, debtors have identified $16.6 billion worth of assets that fall under potential avoidances. Of this, $0.6 billion has been monetised as of September 11, 2023.

On the 11th of November, FTX sued Bybit with the intention of recovering $953 million of assets that were withdrawn a few days prior to the crash.

In the case of Enron, lawyers were paid $688 million against the final investor settlement of $7.2 billion. In the month of October alone, the bill for three firms is at $7.88 million. This number was $38 million in January, much higher than October’s bill. By July 31, lawyers had already billed for $326.8 million. If you take ~$5 million as a steady average monthly run rate over the next 10 years, lawyers’ bills could stack up to ~$1 billion. The following chart breaks down the October bill.

The Final Tally

Looking at the best- and worst-case scenarios, the amount to be recovered ranges from 100% to 38%. But if you take the best-case scenario for liabilities and the worst-case scenario for assets, you can expect ~60% recovery. After SBF’s verdict, the claims are trading at 57%. I put all the numbers from different headers in a table to look at the best-case vs. the worst-case scenario.

Based on the recent filings, the tally looks like the following:

Assumptions used for the calculations above are:

Customer and non-customer claims are as they are mentioned in the liabilities section above.

For digital assets in category A, I arrived at the number of tokens based on the value provided in the filing and the prices on August 31. I removed the number of tokens sent to exchanges from the digital assets section. The data was shared on Twitter by Ouroboros Research.

These were assumed to be sold and added to the Cash section as ‘Digital Assets Assumed Sold’. The remaining tokens’ value was calculated using the prices on November 9, 2023.Only Blur and Ronin tokens are considered from category B since FTX had a large position in others and will be unable to liquidate them without causing too much damage to prices. They are valued at $12.6 million cumulatively.

For venture investments,

Anthropic investment is assumed to have a valuation of between $20 and $30 billion from the post-money valuation of $5.5 billion when FTX invested. The investment value comes out to be between $1.82 billion to $2.73 billion.

Liquidated venture investments are moved to cash ($752 million).

Genesis Digital is marked down to $175 million from $1.1 billion per the agreed settlement.

Of the rest, 50% is placed in the best-case scenario, and the worst-case scenario assumes nothing more will be recovered from it.

Real estate value is used as it is provided.

BTC and ETH worth $834 million found during discovery are valued at $1.138 billion based on prices on November 9, 2023.

Out of the $16.6 billion in avoidance, the best-case scenario assumes 50% ($8.3 billion) will be recovered, and the worst-case scenario assumes nothing more will be recovered besides the amount already recovered ($588 million).

My best case assumes $1.02. A 2% return for all the pain and misery last year’s bankruptcy caused to people is not much. In fact, it may go to the IRS> But it is a desirable outcome when you consider that individuals could be made whole again.

In Hindsight

One ecosystem to be mentioned in the whole debacle is that of Solana's. It was closely intertwined with FTX and its activities in DeFi. In the months after the exchange went down, the capital on Solana's DeFi ecosystem went from over $1 billion to a little under $200 million.

Solana's recent price rally has the ecosystem coming back to life again. Would the L2 be better off without a significant exchange's support? Are there enough unique things to warrant the attention & capital flowing towards it? We will soon explore it in a long-form in the coming weeks. But here's the point I'm trying to make. The markets have slowly begun putting the FTX episode behind them.

Surely, the experience was painful. Money, livelihoods and entities that had nothing to do with the fraud went down with FTX. We may have been better off without the painful lessons of the past year. But much like nature, markets have a way of healing and standing back on their feet after a while. As with most things, it is a function of giving things time.

Hopefully, this time around, when the market recovers and a new bull market arrives, we will not forget the painful lessons of the last cycle. Or maybe we will repeat it all over again. Finance has a history of finding new ways to make the same old mistakes all over again.

Celebrating Diwali,

Saurabh Deshpande

Acknowledgements

Thank you to Amberdata, CCdata, and Nansen for helping us think through this data. Thanks to Larry Cermak for sharing the list of FTX investments. We have used data from Ouroboros Research to reduce the assets that were moved to exchanges by the estate.

Disclosures

Joel was an employee at LedgerPrime until last year. The organisation was a part of FTX from its LedgerX acquisition in 2021.

If you liked reading this, check these out next:

- Ep 21 - On Navigating Crypto Cynicism, Liquid Ventures, and DeFi’s Evolution

the genesis in the venture's book is genesis mining, not genesis digital, and your numbers on estate's Solana holdings is off