Meta's Botched NFT Plans

What we missed out on, and why.

Hey there,

I had promised notes between pieces in our newsletter's last edition. I don't want to commit to these notes' periodic publishing because we are still determining how to scale our publishing frequency without compromising quality. Still, every once in a while, we have tidbits worth sharing.

These notes will be posted on the Substack as subscriber-only content. If you enjoy reading them, leave a comment and share them with people who may enjoy them. These don’t even go on the archives on the landing page. So consider these notes an insider secret among subscribers.

In the last piece, I mentioned Meta is dropping plans to integrate NFTs into their core products – Facebook and Instagram. There should have been considerable noise around this if the market was not too busy panicking about the banking collapse we witnessed. As with most fatalities in bear markets, this is one more inconvenience we would rather not discuss. However, it is worth observing what has played out.

To begin with, it's worth considering why Web2 matters for instruments like NFTs. The average person spends most of their time on platforms like Facebook and Instagram. To understand their effect on users, go a few years back to when Instagram 'replicated' Snapchat by adding a single feature. Up until then, Snapchat was where young teenagers went to share bits of their day as images that vanished in a day.

After two failed attempts at acquiring the startup, Meta began rolling out stories on Instagram and Whatsapp. Consumers (including myself) began using these products to share stories and memes, as their social circles were already on the platform. A few years later, when India banned Tiktok, Instagram steadily rolled out Reels, their attempt at short-form videos users can scroll through.

Do you see a trend here? Large platforms can drive user behaviour, so allowing users to verify their NFTs on Twitter or link an NFT to their Instagram profile is a big deal. (We will get back to this in a bit.) For a sense of the scale of Web2 platforms, consider that Reddit's NFTs have seen over seven million mints on the Polygon network. Web3 products must go where users are.

But it seems like Meta has no interest in digital assets like NFTs as a core part of their strategy. Why?

In a nutshell, NFTs became considered cringe. Social media platforms like Instagram are machines for status-seeking. Users compete based on filters, locations and lifestyle to climb the social ranking system. We measure these 'ranks' quantitatively through likes and engagement.

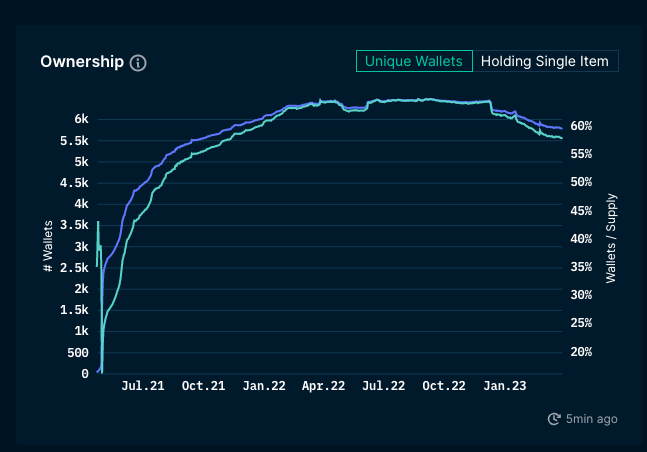

When Meta enabled access to NFTs, the company likely thought NFTs would be a mechanism for users to flaunt their assets or loyalty to a brand. However, with large NFTs like Bored Apes having less than 5800 wallets holding them (according to data from Nansen), focusing on this niche user base of early adopters became a hassle rather than a productive use of the few employees left at Meta after its layoffs.

But why is it cringe? NFTs went mainstream, with celebrities endorsing them relentlessly over the last few years. However, after the FTX saga and the lawsuits, celebrities have little reason to speak about their JPEGs on a blockchain. So, the signalling from people of 'taste' no longer exists for these goods. For NFTs to be fundamental signalling tools, they likely must pass the test of time. Harvard, Louis Vuitton and Bitcoin have the same cause for their popularity regarding signalling. It boils down to the Lindy effect.

It is a simple idea suggesting that the life expectancy of non-perishable things, like ideas or brands, is proportional to their current age. Considered this way, religion ranks the highest when it comes to Lindy effect. But I digress. NFTs, such as Bored Apes and the many animal-like images, failed to become relevant to a broader user base. Those linking their costly NFTs were a small subsection of tech elites flexing their wealth. Unlike a Louis Vuitton bag, these goods 'value' could be measured in real-time.

An additional element to the story is that the average person with a Bored Ape NFT likely did not want to prove their NFT ownership to their social circles. The social networks originating from crypto and offline spaces (through school, dates or work) are different. Signalling your involvement in a niche community of crypto-bros who were often in the news for all the wrong reasons was likely an undesirable feature.

Over the last few years, NFTs were in their infancy. You had small communities, and fraud did not reach the average person. Large platforms like Meta could enable NFT scammers to reach your aunt on Facebook. All Web2 platforms have their share of bots and fake identities, but verifying a user is pretty straightforward: You ask them for their real-life documents. But when a fake NFT is linked to a person's wallet, what do you do? What happens when third-party intellectual property is used in an NFT owned by a user?

Laws in the United States protect platforms from liability for user content. That protection is why Zuckerberg is not subpoenaed whenever someone posts propaganda on your family's WhatsApp chat. To a large extent, it is unlikely that brands will sue platforms directly, but fake NFTs could be used to propagate scams. What would that even look like? I came to know of this from bitsCrunch. If you remember, I mentioned them in the newsletter during their early launch phase several months ago.

The models they developed could detect instances of the McDonald's brand being used by a collection called Coodles. You may think this is nothing, but consider that some ~434 NFTs in the collection have a McDonalds-related IP. According to bitsCrunch, collectively, these NFTs have generated over half a million dollars in volume. And what portion of that goes to McDonald's? Likely none because we could not find anything connecting Coodles to McDonald's.

This may seem like nothing on the surface, but let's go back to how we thought NFT business models would work until Blur came around. The idea back then was that a brand could release a list of assets (as NFTs), and the community would trade those assets. A portion of the royalties would return to the brand. From the point of view of a platform like Meta or Twitter, there are two emergent challenges:

Firstly, if brands cannot detect, censor and take down fake NFTs representing them, there are no incentives to push it to users. Imagine you purchased a 'fake' version of Nike's sneaker NFTs and signalled it to your friends on Facebook. On the one hand, the brand loses money; on the other, a user feels scammed.

Conversely, there's the risk that royalties have collapsed as a concept. In such an instance, building the feature sets allowing users to trade NFTs on-platform becomes useless. Facebook can get a cut of every transaction by focusing on the payment rails or traditional marketplaces, which they already do in abundance. Now all of this is not to say NFTs are dead. They are very much here to stay, and we are witnessing a transition from 'high-cost Veblen good' NFTs to 'low-priced consumption goods'. What would those look like?

NFTs must be as ubiquitous for purchase as the general media-app subscriptions today. You do not think much when you buy a Netflix subscription. The same applies to Spotify. In the future, NFTs will likely be embedded in platforms as event tickets; this is nothing new. NFTs have existed for a while and have not taken off yet. However, the dual forces – of celebrities signalling them and social media networks providing a safe outlet to buy them – could make tickets as NFTs possible.

Now, I am pretending there isn't a complex network of players behind a concert coming together. However, the case for tickets as NFTs on social platforms becomes clearer when considering these tickets could be sold between users, which occurs at scale already. Users who purchased a specific ticket could use it to network with others attending the same event. In fact, what better way to signal a commitment to an artist than to show a collection of event tickets, verifiable as self-owned, displayed on your social media profiles? Ticketmaster is already tinkering with this model.

The capabilities to detect IP rights infringement on-chain are at their infancy. The team behind bitsCrunch showed me a demo of a Discord bot notifying them of brand logos used on NFTs. Their system automatically scans NFTs frequently and flags cases where IP rights infringements may occur. It is still early days, but it is interesting to see how the tooling around NFTs has evolved from merely on-chain analysis to scan what's on the NFT itself.

I was talking to Nameet Potnis from Asset.money about this whole situation. He added that no single player has managed to onboard over 5 million users to NFTs as a platform. Sure, there are millions of wallets on Reddit. But you cannot verify these are actual users as of yet. The reason for this is that the wallet experience is elsewhere. Today, you connect to Metamask to verify you own a wallet. Platforms will have to roll out their wallets to be serious about Web3. This opens them up to scrutiny as they did when they launched Libre and Diem.

All that effort may not have been worth the effort for the management at Meta.

Let me know what you think about the future of NFTs regarding traditional platforms in the comments!

Joel

P.s- Turns out Substack doesn’t let you post an article to subscribers only without sending an e-mail out. Will let this stay public till I figure out how to do subscriber only posts with no e-mails :)

If you liked reading this, check these out next:

Interesting thesis Joel. I suspect there are contradictions. Amazon for example has fairly large number of 'dodgy' goods and counterfeits and they do get delivered into USA. Cheap medicine is another large hole in enclosure in USA with shipments leaking thru.

Maybe some more elements are also contributor and maybe velocity of trade and volume may have been less the bother at this point in time. Once crypto hots up organizations 're-discover' crypto