Hey there,

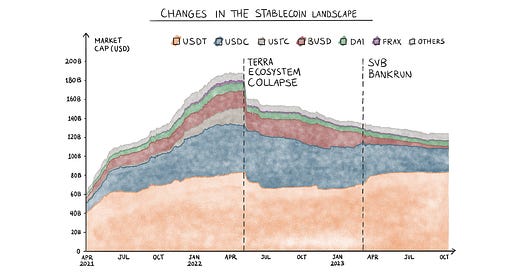

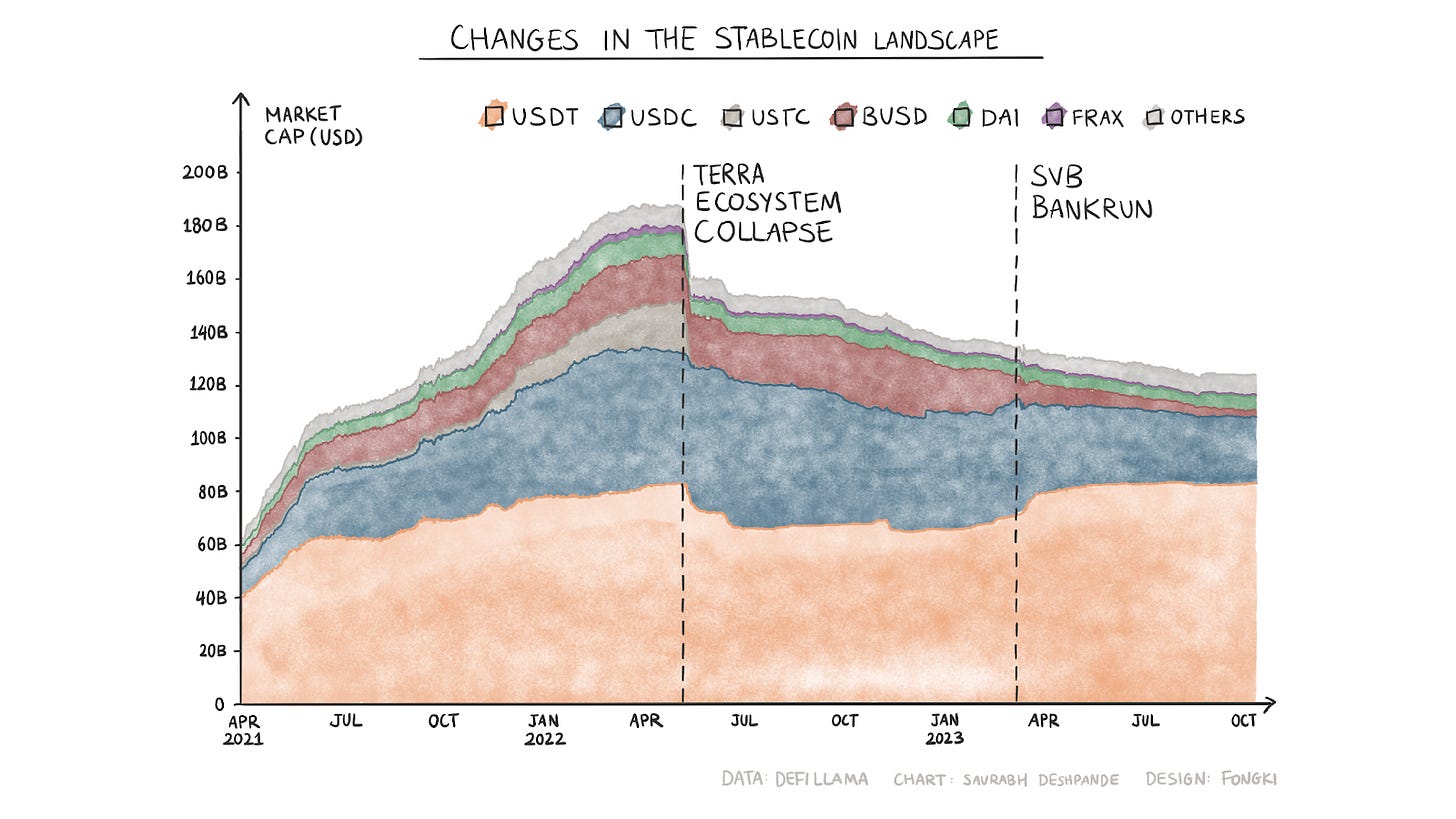

Stablecoins are one of the few parts of crypto that have seen meaningful PMF. Despite the bear market, stablecoins maintain a market capitalisation of over $123 billion. Several types of stablecoins make up the market, from USD pegged to the ones pegged to other currencies like EUR or commodities like gold. The success of USDT, USDC, and DAI has led to the proliferation of several different projects launching their stablecoins with many (not so creative) designs.

Stablecoins maintain their desired pegs through various mechanisms. Most do so by holding underlying assets at least worth their respective market capitalisations. The stablecoin issuer takes collateral from minters. They typically use the collateral to earn yield via short-term instruments. The health of the business depends on how the issuer balances redemption demand and earning yield since the capital is locked when earning yield.

It is tempting to think that involvement on the issuer’s part can be a source of inefficiencies, which pushed the industry to explore algorithmic stablecoins. If you have a central party (like Tether) taking deposits (in dollars) and issuing an on-chain representation of it, you add to the fees. So much for ‘decentralisation’. You have a risk of simply imitating central banks on the blockchain. Except this time, they are private corporations.

Algorithmic stablecoins have been intellectually intriguing due to the possibility of replacing these centralised parties altogether.

The Devil Is In The Details

Algorithmic stablecoins were all the rage until Terra crashed last year and $40 billion of value evaporated. In simple terms, such stablecoins were typically backed by make-believe assets with no apparent reason for their value. I get that the value of all assets is subjective. But I think subjectivity of value is a spectrum.

Value depends on the number of people who believe an asset (like equity or altcoins) is worth a given number of actual dollars and their willingness to trade for it. This number depends on several factors, such as who creates the asset, how it is created, how and where it is used, and the volatility of the asset’s price.

The value of the USD is less subjective than an algorithmic stablecoin backed by a governance token. When the belief in the asset that backs a stablecoin gets shaken, it loses value, and the stablecoin loses its peg. What happened to the Terra ecosystem is a case in point. Since then, projects have been getting creative about structuring their stablecoin’s collateral.

As yields in decentralised finance (DeFi) dropped while interest rates surged, protocols like MakerDAO adapted to incorporate real-world assets (RWAs) into the mix. As of October 12, 2023, the RWA component contributes ~67% to the revenues and ~60% of the collateral for DAI.

MakerDAO’s success with RWAs was a proof of concept for many upcoming projects. They built models around RWAs such as US Treasuries, real estate, corporate debt, etc. This aligns with the theme we covered a couple of months ago, where we observed that the boundaries between traditional finance and crypto/Web3 are blurring. While combining features from both worlds, the design choices likely borrow bad practices from both.

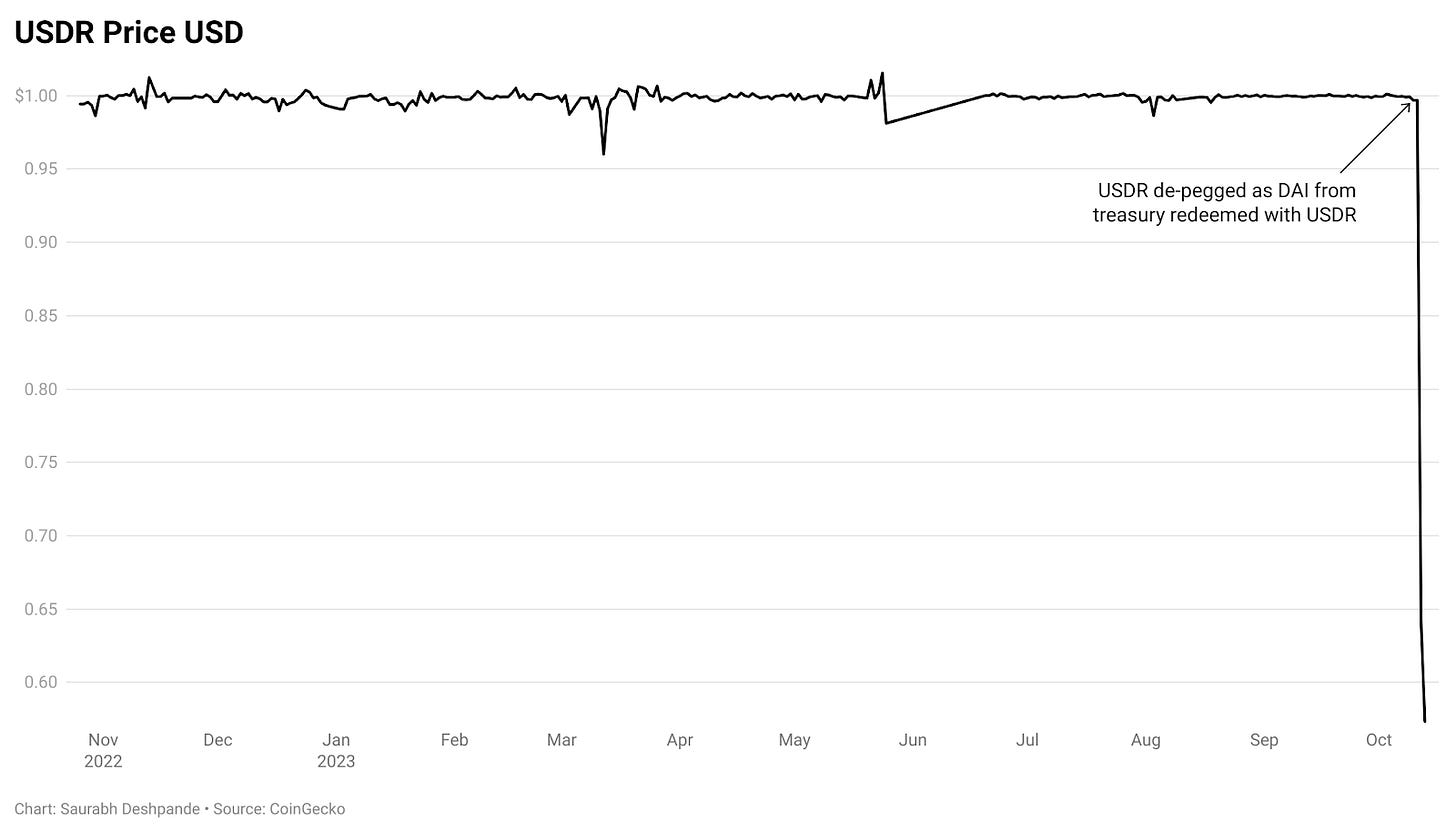

Tangible used a ‘Terra-esque’ design due to which, under certain circumstances, the stablecoin could become partially backed. This resulted in its stablecoin losing its peg to trade around $0.5. This piece explores what happened with Tangible’s stablecoin and its effect on the RWA space.

Tangible’s Design

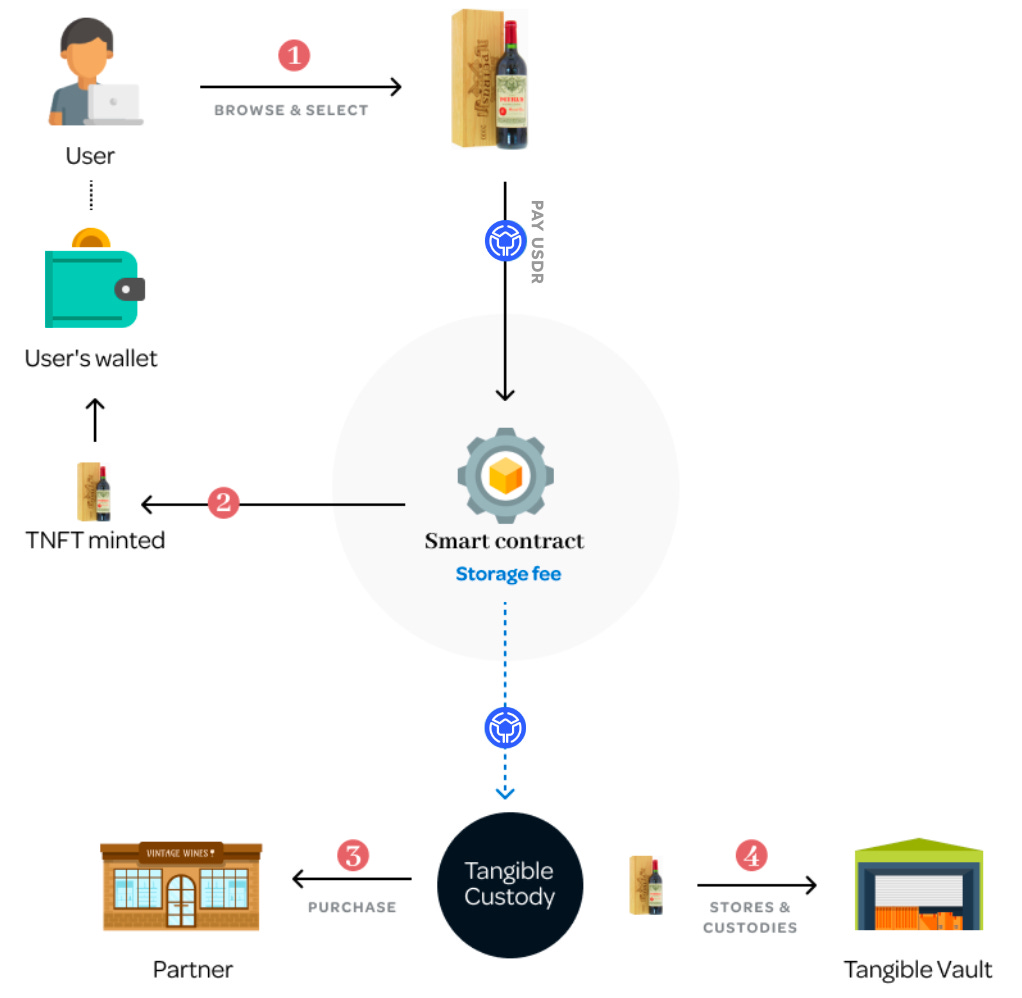

Tangible uses real estate as a core asset to build its protocol. It describes itself as an ecosystem of tokenised RWAs. It uses its native real estate-backed stablecoin, Real USD, or USDR, to let users access tokenised and fractionalised RWAs through its marketplace. When users buy tokenised assets on the platform, they get what are called TNFTs. These assets could be redeemed for actual products later.

How does real estate come into the picture? Tokenised properties that can be easily rented out are used as partial backing for USDR, along with DAI, insurance funds, and Tangible’s governance token – TNGBL. It is designed so that the USDR that can be minted with TNGBL never exceeds 10% of the USDR minus the USDR redeemed.

Tangible buys properties that can be easily rented out, which Blackstone does on a massive scale. The rent from the properties is the yield. The image below shows how the protocol works. This article is excellent if you want to learn how it works.

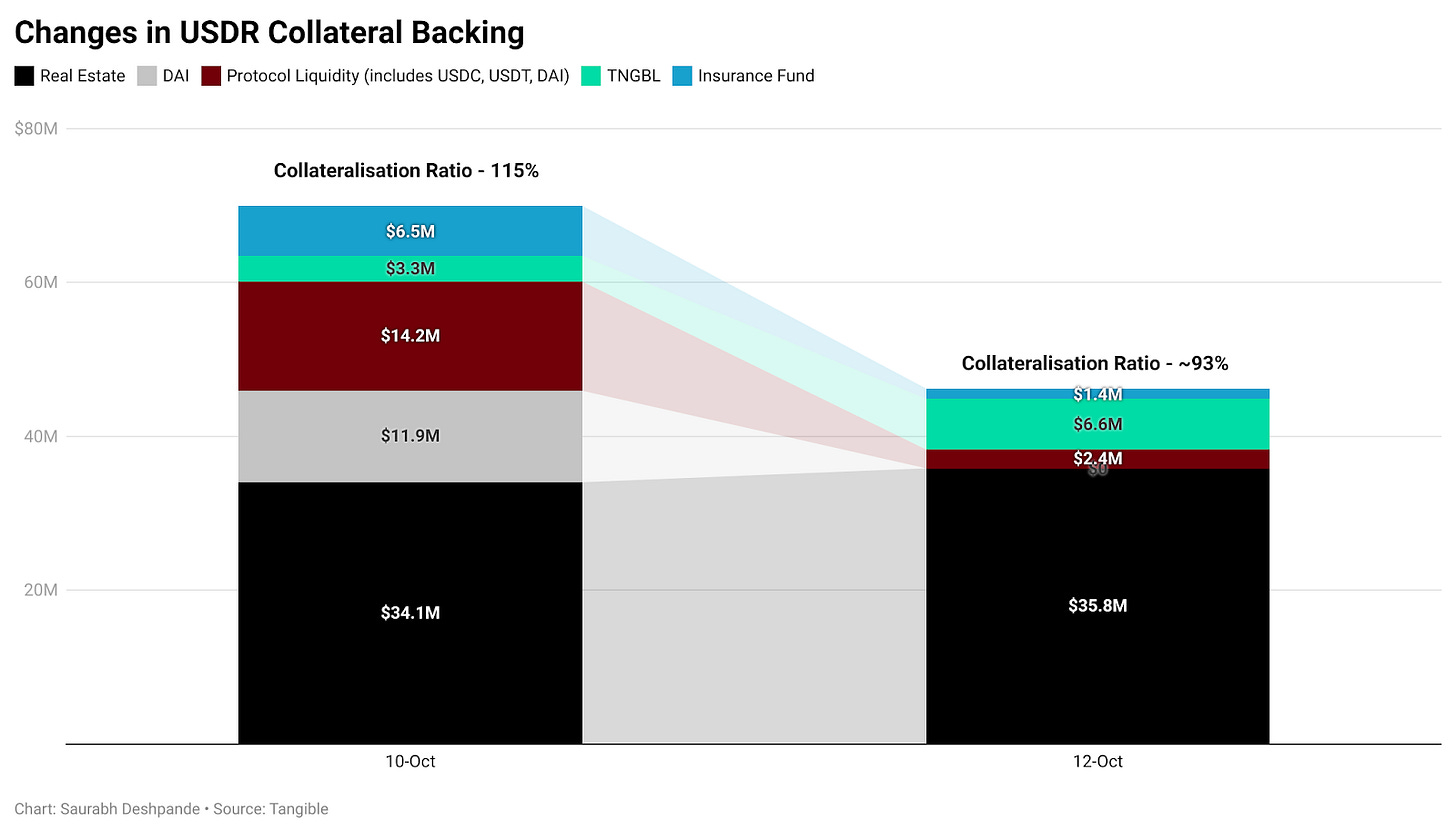

Between 10 and 12 October, all the DAI in the treasury, close to $12 million, was redeemed for USDR, resulting in USDR depegging by 47%. The collateral ratio dropped from ~115% to ~93%. This is where the problem starts. The collateral mix is vital for maintaining the perceived value of the stablecoin. We have seen what happens when this mix skews towards another asset (without any material cash flows attached to it) of the stablecoin issuer.

UST took three days to wipe out $40 billion worth of perceived value, so it’s critical that assets with network effects back stablecoins. Luckily for Tangible, not all hope is lost because most of it is backed by real estate. It brings us to the next problem with this design – the stablecoin was a liquid asset backed by an illiquid asset. Let me explain..

Right now, USDR is backed by $6.6 million worth of TNGBL. Learnings from LUNA dictate that we must mark TNGBL and insurance funds down to 0 to assess how bad the situation is. This leaves us with $35.8 million of real estate and $2.4 million of other stablecoins from protocol-owned liquidity backing 45.5 million USDR – an ~84% collateralisation ratio.

(Joel’s Note: That means $38.2 million worth of assets are backing $45.5 million in liabilities on the protocol).

But the problem is whether we can consider the real estate worth $35.8 million. If Tangible has to sell these assets, will it be able to sell for the entire value? If yes, how long will it take? This uncertainty is why, despite having provisions, the market is valuing USDR at 53% of its peg instead of 84%. Distressed assets usually sell at a discount. By limiting the stablecoin’s exposure to TNGBL, the team has only ensured that USDR doesn’t go to zero. But the design doesn’t help in keeping the peg to $1.

In March 2023, Silicon Valley Bank (SVB) experienced a bank run and could not honour withdrawals. At the time, Circle held ~$3.3 billion in SVB. This write-off caused USDC to briefly depeg. But this was a time of contagion. It didn’t stop at the USDC depeg. Leading up to this event, MakerDAO had increased its collateral exposure to stablecoins, largely USDC. Intraday, USDC went down to ~$0.93. And since USDC was one of the collaterals for DAI, the latter also dipped to around $0.9.

MakerDAO realised that extending support to collateral assets increased risk exposure and left DAI vulnerable to de-pegging. The SVB incident ushered in a significant change to the collateral mix of DAI. The exposure to stablecoins was significantly reduced in favour of RWAs after the SVB bank run.

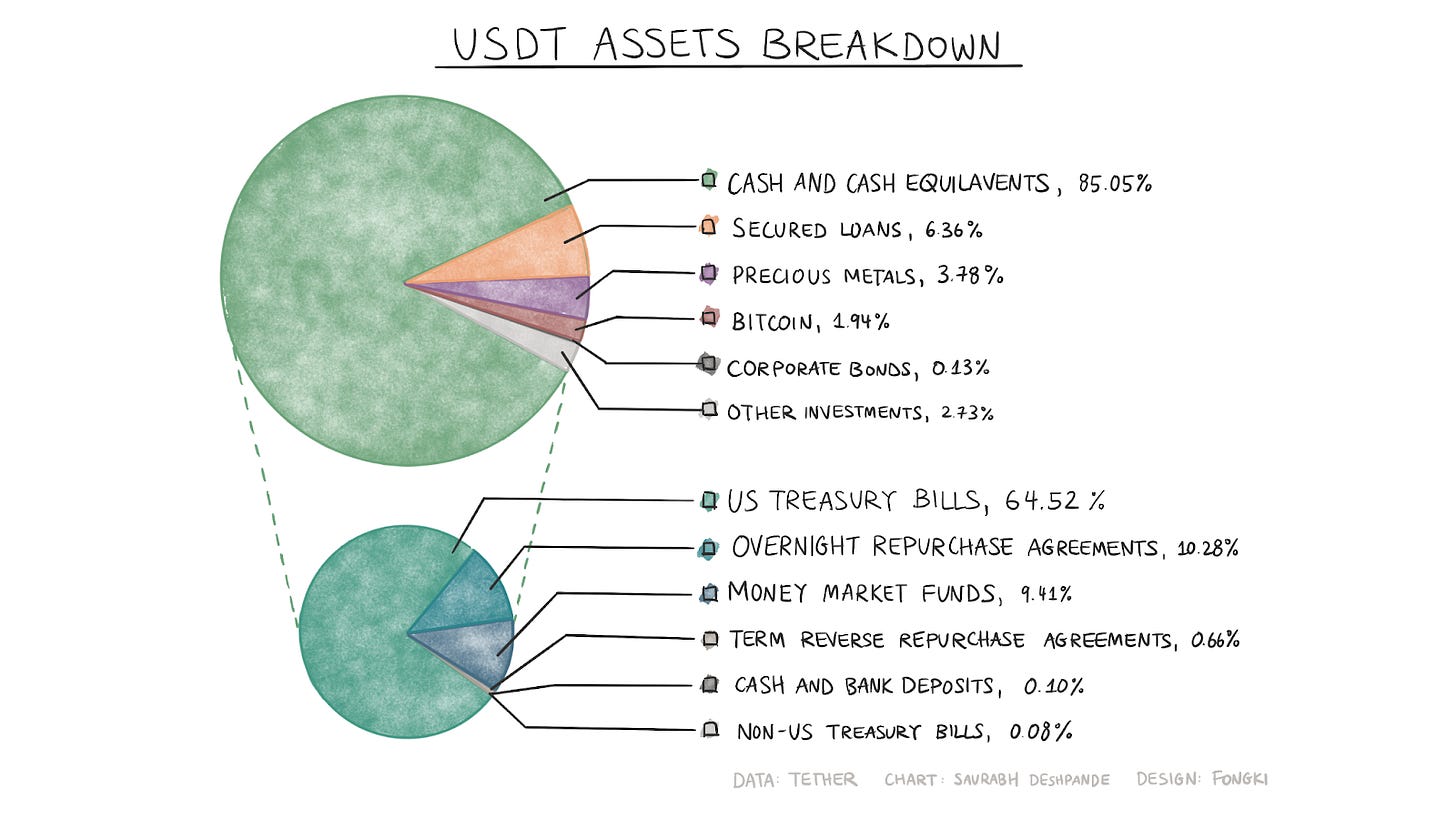

It’s worth exploring how Circle and Tether- the two largest stablecoin issuers, manage their assets. Both have allocated an overwhelming percentage of their assets to short-term US Treasuries, one of the most liquid assets. Indeed, the current high-interest rate environment is also why they choose US Treasuries. But this helps create a perception of safety in the mix of assets.

The RWA Connection

Growing a stablecoin that is even partially backed by your own asset is similar to countries trying to maintain pegs of their currencies at a much smaller scale. Stablecoin projects have a fraction of the resources that a country has. Despite disproportionately high resources, currency pegs have a mixed history. Evidence shows that sometimes pegs work, with examples like the Hong Kong Dollar’s peg to the US Dollar and the Singapore Dollar’s peg to a basket of currencies. But history is filled with instances where pegs proved expensive to manage or were simply not worth it.

Governments use levers to maintain currency pegs, such as spending their foreign exchange reserves, employing strict capital controls, and making frequent interest rate interventions. History is rife with examples of governments preempting unpegging their currencies (Switzerland did this in 2015) or abolishing currency pegs due to a crisis (the Asian currency crisis in the late 1990s forced Thailand to let go of the peg).

One of the primary reasons countries went off the gold standard is that it limits the ability of governments to respond to crises. Whether government intervention is good is not the point here. Not having a country’s currency (and, in turn, value) tethered to other assets allows governments to manipulate the supply depending on prevailing economic situations. Despite so much freedom, it is debatable whether governments get it right.

Asset-backed stablecoins, by default, have constraints on how the issuers can respond to crises. A more straightforward design for a real-estate-backed stablecoin like USDR is to eliminate the governance token as collateral. Keep the collateral composed of highly liquid crypto assets and RWAs. There’s a reason why DAI cannot be minted with MKR.

A drawback of not using your governance token as collateral is that you don’t have enough ‘use cases’ for the governance token, as governance as the only use case may not fetch enough premium. This limits the team’s ability to bootstrap and spend on user acquisition.

Using tokenised RWAs to help generate yield on-chain is critical if we want to blur on-chain and real-world boundaries. But the means to achieving this determine the sustainability of projects. What happened with USDR will serve as a lesson for Tangible and other teams; hopefully, we will see better designs in the future.

Enjoying the cricket world-cup,

Saurabh Deshpande

If you liked reading this, check these out next:

I have read these discourse on 'stable' coins and find them loosing the plot very early. Lets us consider the FX rate of HKD to USD or JPY to USD. HKD is kept in a narrow range by the Honk Kong Monetary authority using its pool and Bank of Japan concentrates on its 10 Year Bond yield using Yield control. BOJ issues or buys bonds and is reportedly has 80% of the Japanese bond market and a big slice of Equity too.

It has a trillion USD worth reserve to protect the Yield on 10 year bond.

Many other countries like India and China use a basket of currencies as a benchmark to 'manage' the FX rate. THERE IS NOTHING STABLE IN FX RATES. Even USD vs GOLD is unstable.

The requirement is smooth changes not saw tooths ....

The key insight that is missing is leverage. Traditional Finance uses 3X reserve . So if peak trading volume is 1 Billion that the algo or protocol or Central bank should have 3 Billion of reserves or more else it may be attacked

George Soros broke Bank of England as protecting FX meant interest rates were surging and they would hurt mortgages so badly

AFAIK a Algo stable coin is very much doable using a basket ( SDR of IMF?) and the trust in the market that the issuers will issue more as needed. Issue more is the key