This piece was made possible with a sponsorship from Nansen. The platform saves analysts and traders hundreds of hours each month by allowing them to grab network level data with a simple click. No APIs, no going through network scanners or pulling contract addresses. Nansen visualises network level data on user behavior & transactions in a fraction of the time their peers do. Get started with a trial here or simply play with their dashboards here.

Hello!

TL:DR- Today we dive into how founders can tap into web3 ecosystem grants to build an MVP before ever having to speak to venture capital funds. I have collaborated with Madhavan from Questbook to break down how grant programmes are designed and what founders need to know to extract value from them. They were kind enough to share data regarding multiple grant programmes for this piece.

I have been thinking of how technology evolves from being used by a niche subset of users to a wider public. I won’t be summarising crossing the chasm for you today. What I wanted to look at specifically is how grant-based capital plays a role in enabling the growth of applications in Web3. We will look at why they matter, how they are being used and how you can tap into them to build cool things.

Let’s start with the internet. We talk a lot about the dot-com boom and how the likes of Napster, AOL and Yahoo changed how we interact with the world. But for a good 30 years prior to that, it was government-funded research that enabled the internet’s evolution. The internet was initially a defence research project.

The government helped create an environment where enough researchers could ponder long enough about a hard question which led to the internet becoming a thing. Tim Berners-Lee was working for a government-funded organisation (CERN) when he wrote the first proposal for what would eventually become the “worldwide web” in the 1980s. Behemoths like Google and Facebook also trace their inception back to academic institutions. It is quite clear that the foundational aspects of much of what eventually became the internet were a product of capital being deployed without a clear mandate to create a quick profit.

Flywheel of Adoption

Web3 does not yet directly benefit at a very large scale from government investments. What it has instead are protocols issuing grants. It makes sense if you see each of these networks or protocols as the future of nation-states but that’s for another time. The proposition for a protocol to give grants is quite simple. The higher the number of useful apps deployed on a chain, the more the number of users - and thus, the higher the use of the underlying protocol itself. Users can be onboarded to a chain for a single application but once they have bridged their assets over, they can seep over to different dApps within that ecosystem. And why does that matter? Well, think of the Fat Protocol Thesis. Here is how Joel Monegro described it some 6 years back.

”The market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer”

So, if you can get more developers to build applications on top of a protocol it will inevitably lead to the underlying protocol’s value rising in proportion. This is a playbook that has been used time and again in the past. Ethereum benefited hugely from Consensys being an active player in helping developers find their way through building on Ethereum. Solana, Polygon, Harmony and FTM have each had a variation of this. This metric is so predictive of price appreciation that some investors actually track the number of developers building in an ecosystem and base their investments on that.

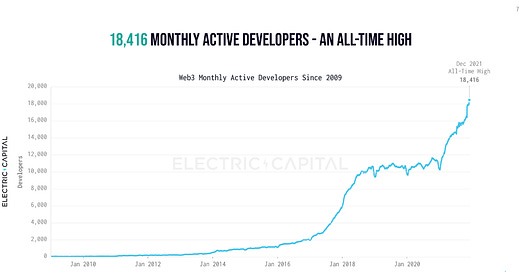

Image Source : Electric Capital Developer Report

For all the noise surrounding developers, there are only about 18,000 monthly active developers in the Web3 ecosystem. Some 34,0000 developers entered the ecosystem in 2021 - the highest ever recorded. But we are barely scratching the surface here. If Web3 has to grow to be able to onboard the entire world, it needs considerably more developers. There are a number of reasons why developers don’t join the ecosystem yet. MakerDAO’s Sustainable Ecosystem Scaling core unit recently published a report shedding light on some of the reasons. You can read the whole deck here.

1. Ideological alignment - Extremely smart individuals have been caught up with the idea that proof of work-based assets literally burn down the planet. While there is a lot of room to debate on both sides regarding this matter, I believe the perception that the technology harms the planet keeps a lot of smart developers from entering the space.

2. Technical Depth - The sheer amount of noise surrounding NFTs and trading often means the technical innovations of Web3 as an ecosystem are lost in the noise. When these discussions do happen they involve a substantial amount of name-calling and toxic rhetoric as there are clear financial incentives and skin in the game for those talking about these things.

3. Reputational Risks - Developers find it risky to fully transition to Web3 given the number of scams, hacks and literal Ponzi schemes in the space. The way media outlets cover the platform does not help the situation either. It keeps talent that has tackled many of Web3’s biggest problems in the traditional markets away from fully transitioning to the industry.

Many of the Web3 enteprises I have backed at the really early stages intentionally raised from the likes of Accel and Sequoia in their growth rounds just so they could convince talent from traditional parts of the market that they are a legitimate business. In a region like India, telling your mum that you are quitting your job at a “fancy large firm” to go work with an “organisation backed by the fund that invested in Facebook”, may just fly. ( I am looking at you Accel) .

To be fair, some protocols like Polygon have crossed the chasm and entered a realm in the public psyche where parents and significant others do recognise the name. Sidenote: I have friends that use their employment at Polygon as a signal on dating apps like Bumble or Tinder. Interestingly, it works. Sadly - it doesn’t work if I use this blog’s name.. yet.

Large funds realise the extent of legitimacy they bring and have specialists internally that help portfolio startups hire individuals from traditionally secure roles. The signal value of traditional venture funds comes into play as firms scale and desperately try to hire talent in short timeframes. So what’s the fix? One way to circumvent this scenario is to make it possible for talent within the ecosystem to build without worrying about paying the bills. Grants can play out in two ways.

1. They incentivise talent that is looking to enter the space with capital. The money acts as a reward of sorts for developers, creators and marketers to engage with Web3 native firms.

2. They reduce the cost of experimenting for those wanting to build a Web3 native venture. Historically, if you wanted to transition out to founding a firm you had to convince a group of seed investors that you can build.

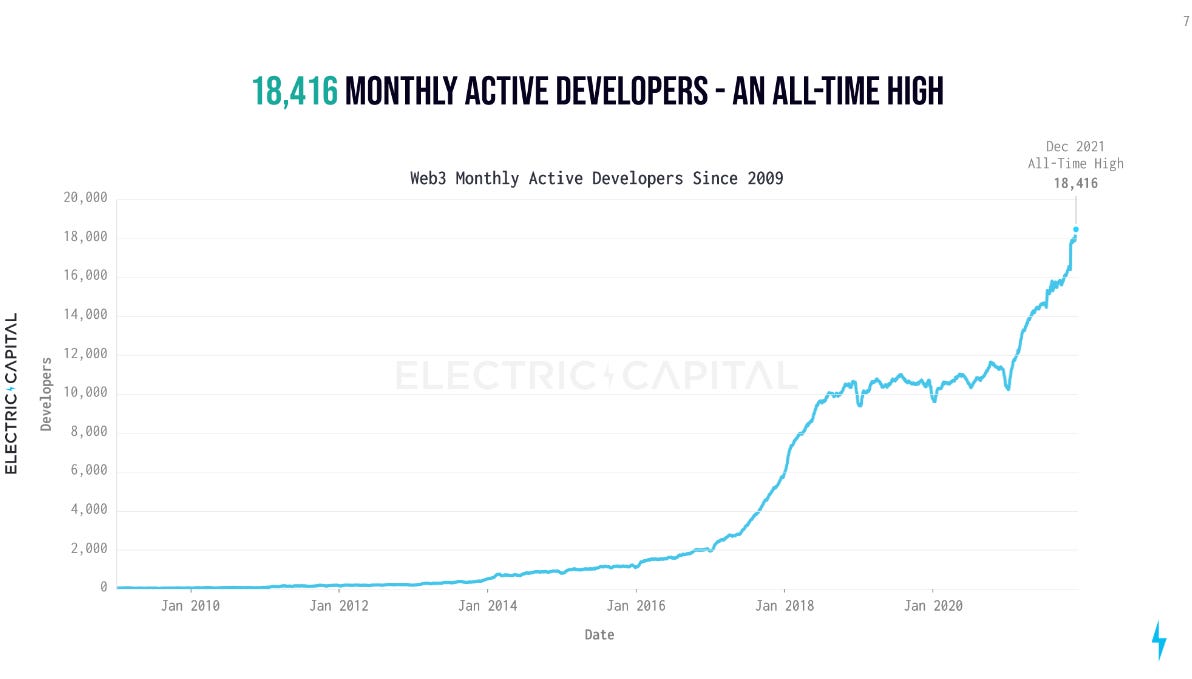

Data Source : DeepDAO.io

Why do protocols bother to do this? In most instances, there is no clear profit mandate for the protocol itself. Unlike a venture fund, there is (usually) no external capital that is delivered into ecosystem funds. The capital comes from protocol revenue (often) or a portion of the protocol’s native tokens (mostly) that have been kept aside to be given as grants for new talent. The chart above from DeepDAO looks at the ten largest DAO treasuries tracked by them. We were curious to know where most of this capital is being deployed and how it varies across ecosystems. The team at Questbook was kind enough to compile this data and share it with us. Here are some observations.

Ecosystem <> Stage Fit

The chart above breaks down how Uniswap has been deploying money over the past 1.5 years. Uniswap was also launched with help from a grant issued by the Ethereum Foundation. Of the nearly $5 million deployed by Uniswap so far, about half of it was deployed in Wave 6 alone.

It does not make much sense to fund external projects until the protocol grows to a size where it can be used by a large number of users. There has been no deployment of money towards governance until the last two waves. Instead, most of the grants have been broken between usability, tooling and RFP (request for proposal/challenge) grants. The reasoning for this is quite simple.

Remember when I said early on that grants produce a flywheel for developers? In most instances, these developers may not be working on a start-up worthy product that can scale to be venture-backed. On the flip side, they have niche, specific skill-sets to build tools that a protocol can use. So instead of having them raise money from VCs and bother with monetisation, grants incentivise building things that don’t scale with dollars. These kinds of tools usually answer very application-specific issues. For instance, it could be used to show the historic APY of a pool on Uniswap or track the lending rates of assets on Aave. These are usually tools that are extremely useful for a niche community but not necessarily monetisable to build a business out of.

Protocol <> Venture Fit

So where do founders that have venture-backable products go? In my understanding, the fix is on looking at protocols that are at an inflexion point. The ideal protocol is one that has sufficient technical advantages to support large numbers of users coming towards them while facing a deficit of skilled developers that can build applications.

If you think of it - most protocols have had a variation of this point in time in their history. Solana, Polygon, Avalanche, Near and Harmony have each had to launch developer-focused grants programmes of scale to find developers that can build applications of scale on them. Developers have to think which protocol may be the best fit for them as they raise their initial grants as each has a subset of investors that are active within them.

At LedgerPrime (where I work), we see a high number of DeFi applications coming from Solana. Avalanche has been coming up to speed thanks to its EVM compatibility. Polygon, on the other hand, is most definitely establishing itself as the go-to choice for developers looking to build B2C applications as the cost of transaction on them is relatively lower.

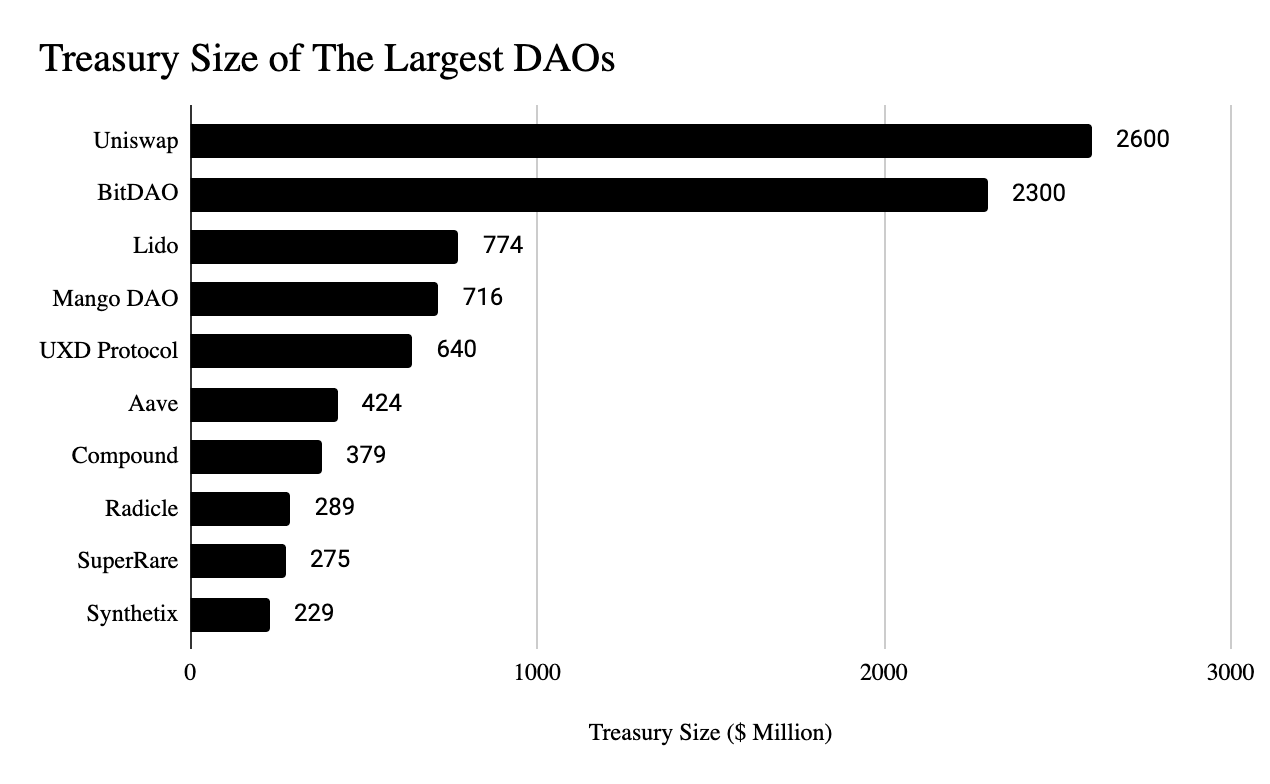

We assessed the number of grants being given in each ecosystem to understand where developers are currently flocking. Solana and Polygon are not mentioned as grants are given through multiple smaller entities and a conclusive number could not be arrived at. Polkadot, with its ±300 grants distributed, has the highest number of grants given so far. The Ethereum Foundation itself has done close to ±230+ grants. (The official number is closer to 300 but we have removed academic/research linked grants).

Uniswap, Aave and Compound have issued fewer grants in spite of the multi-billion dollar treasuries they hold. For founders looking to build applications that can then be scaled to venture capital-backed projects, raising grants from an L1 or L2 may still be the best place.

As a protocol evolves, it becomes necessary for those running grant programmes to run them on a whole-stack based approach. Developers will likely rely on grants to go from upskilling themselves to deploying their first app to eventually scaling an application. Capital is generally deployed across (i) user onboarding (ii) developer education and (iii) application scaling towards the late stages of a protocol’s growth. Structurally, most ecosystem grant programmes are optimised for deal flow. For example, consider how Harmony.one is deploying money.

I used Harmony in particular because their data was well arranged and available. They had recently announced a $200 million grant programme which is to be deployed over three years. It is also one of the faster-growing L2s on Ethereum today. In terms of maturity, you can consider it a middle-aged protocol as it has been around long enough to begin attracting users to its protocol but is yet to blow up and serve as a mainstream protocol (like Solana).

About 1/3 of their grants are stated to go to DAOs, with the average DAO receiving $750k. In comparison, firms identified as “partners” will be receiving close to $3 million each - however, only ±16% of the capital is to be deployed there. My understanding is that partners in this context will either be acqui-hires or accelerators that then re-distribute the capital to smaller ventures. For example, consider the fact that Filecoin collaborated with Tachyon, Techstars, Faber and Longhash over its growth cycle.

This makes sense as the protocol can outsource the work involved in managing deal flow, helping firms scale or handling investor relationships via a third-party firm that specialises in them. In the same vein, they have allocated roughly 16% to hackathons with each receiving $1 million.

Protocols benefit disproportionately from running hackathons in two ways. On one end, they find it easier to raise awareness among developers through multi-week long, global events. They are building emotional and mental commitment from stakeholders with a huge prize incentive on the other end.

On the other, they are able to curate a list of a few hundred applications that could possibly be built. For each "winner” at a hackathon, there are in turn multiple applicants that do not win anything. The tail end of developers, when retained, can build incredibly cool things. Even though Harmony itself may invest in very few deals directly, the grant programme they have structured is optimised to bring in hundreds of developers over time.

Aggregation Theory & Grants

In my previous piece, I broke down how blockchains will enable entirely new marketplaces as they reduce the cost of trust and verification. One of the places this will inevitably happen soon is with grants. Things like venture capital and syndication have existed for quite some time so when Angel.co came along in the early 2010s, there was roughly a model to be used.

Grants in Web3 on the other hand are scattered all over and the incentives to give a single, unified interface are low. On the flip side, data pertaining to grants can be queried and verified far easier than most traditional grant or crowd-funding programmes. This is why Gitcoin's token is now valued at some $700 million.

Questbook took a different approach to the problem. They started out with curating lessons for developers in Q2 2021. Some 100 tutorials were made for developers looking to transition from Web2 to Web3. You can see how they collaborated with their community to build the content base here. As the number of individuals building on the platform scaled, it became clear that there was a need for tooling to enable grant discovery and payouts.

For protocols, the challenge is with finding distribution among vetted talent bases that are already educated on what it takes to build atop them. For developers, the issue is with finding relevant opportunities that are pre-funded. Questbook has been acting as a middle layer connecting the two. They claim to have distributed close to half a million dollars through their grant distribution tool so far.

There are a number of challenges here too. For starters, protocols often lack visibility into how and where capital has been deployed. Even when capital is deployed it becomes hard to track a venture over its growth cycle. There could often be cases where multiple protocols have given grants to a venture. These grant amounts can add up to be similar to a venture round of its own. Network participants today don’t have clear visibility on who has received how much money. Questbook is tackling this challenge through their easy to filter interface. On a long enough timeframe, it will make it easier to track the net value generated through these grant programs. Uniswap for instance may have single handedly returned all the capital that has been deployed through Ethereum related grants so far.

I think, in the next few years, applications that handle grants will work as a “verification” outlet. The number of grants received by an individual and the DAOs they have worked with will become a credentialing layer that signals better than traditional universities. Since the work of these developers can easily be verified on-chain, the trust deficit that exists in hiring individuals from remote economies will slowly vanish. This is why grant infrastructure has a credible chance of becoming a massive lever for how we think about the future of work. Why go into debt and spend years at university when you can upskill and get paid for it?

(If you hold an Indian passport like me, part of the reason is migration, but let’s ignore that for now.)

What’s Next

If I had to summarise everything I wanted to say in this piece it is likely that ecosystem treasuries have already evolved from being on-chain primitives to forces to reckon with in the financial ecosystem. Polygon conducting M&A’s worth some $700million+ is your reminder that it is no longer hedge funds and VCs that command how ventures scale in the industry. Protocol-owned cooperatives will very likely step in to play the role ICOs could not in 2017. Back then, the argument was that users would directly invest into apps and see them scale. Today, users vote (with capital investments) on protocols and the protocols in exchange deploy money through ecosystem grants.

This is a shift most developers I have spoken to in the recent past have not recognised. VC funds alone may not be the ideal way to build and scale a venture. Depending on the stage and nature of the application, there is some $12 billion that can be tapped into through different grants. Much of this capital is non-dilutive and target based. So you get to build something of value, without giving up large chunks of ownership. Few months back, I had written extensively on how the future of venture capital will be decentralised. This is one of the many ways I see it happening.

The end state for ecosystem grants will be to tackle problems traditional forms of financing cannot fix. These are usually public goods that require time and years of commitment. It will require individual protocols to be worth trillions to see this realised. For context, Bitcoin’s market cap is at around $800 billion at the time of writing this. Will we see outcomes as large as the internet emerging from ecosystem grants? I don’t quite know. But it will be interesting to see if we can tackle really large problems like access to the internet, healthcare and education using ecosystem grants at some point in the future.

Note: This piece was written with inputs from Questbook community. Make sure to check their app and give them a follow here.

Outstanding writeup Joel! I would love to collab on a follow-up piece to this with more attention paid to Founders of startups that are non-technical. For example myself I was a recipient of NEAR's Fellowship program as an Entrepreneur in Residence for 3 months. The funding I was given allowed me to build more ecosystem awareness for NEAR in my personal network where I recruited about a dozen individuals from developers to designers.

Im still seeking funding to work on cryptodir.co and schoolofwagmi.com, but as Im not a Developer, I have different challenges.

Thank you for the solid content and overview. It seems like a scenario with a watershed, red ocean vs blue ocean strategy. If web3 is about community and non extractive platforms, this is the real chance to create cooperation between players. Next Questbook, there is DAO Lens and other coming up.

What would be your view to support an organic growth?

I wrote this article an initial experimental use case for ecosystem strategy. Feel free to share your views and feedback: https://twitter.com/RenzoDan5/status/1617636952009998336