Welcome to yet another issue of the newsletter. If you haven’t subscribed already, join us at the link below.

Do note: The newsletter may break in your client, given the length and forms of media used. It may be better to read it online by clicking on the title.

It seems as though Generative AI has taken over the world. One can create essays, images and even videos using just prompts. But how do you ensure property rights are respected when everyone is an artist? Can you use NFTs with AI models that enable speech?

Today’s issue is a sponsored deep-dive written in collaboration with a protocol building towards that vision for over three years.

Alethea AI is building at the intersection of digital assets and the emerging world of generative AI models. They enable individuals to

Bring AI to their static assets, such as NFTs.

Build intelligent dApps with specific skill sets, such as copywriting & charge for access.

Develop community-owned, censorship-resistant AI models that can be managed as a DAO.

All of this may seem like it is something from the distant future. In today's piece, we break down what this means for you as a reader and the entirety of the web. Read on to understand how parts of this vision are already a reality.

Hello,

Artificial intelligence has been all the rage since late 2022 when OpenAI’s ChatGPT went live to the public. Santa came early and gifted humanity with a machine that answers most questions! It is the fastest app to grow to a hundred million users, and like many venture-backed startups, it has been burning millions of dollars every day.

That is not much cause for concern anymore, as Microsoft has just invested $10 billion into OpenAI. Combined with hardware from Azure and Bing’s distribution (something I never thought I would say), ChatGPT’s popularity has crossed the proverbial chasm.

It is not just Microsoft that is in the race though. After a demo of their generative AI product failed, alphabet lost $100 billion in stock value. Alibaba and Amazon have each announced their entrants to fight ChatGPT for AI dominance. And Apple will likely use Siri as a front for pushing its play into the market.

This explosion in AI tools came about because people can now actually use AI. When trends like crypto, drones, or self-driving cars enter the market, there is a high entry barrier to them. You could use AI to cheat on your homework right now. And ChatGPT could even make you seem attractive on Bumble - today. With crypto, you can only buy a token and pretend it's the entirety of your personality.

Arthur C. Clarke once said, "Any sufficiently advanced technology would seem indistinguishable from magic.” AI has transitioned to convincing large enough sections of society that it is magic. Some $17 billion of funding was pushed into AI-related firms in Q2 of 2022 alone. This combination of interest from the FAANGs, VCs, and retail investors makes the technology seemingly ready to capture retail attention.

We have been spending the past few weeks trying to understand what is going on with the sector and how significant its impact might be over the coming decade. This piece summarises our (limited) understanding of the sector and why we think blockchains and AI will intermingle during the next ten years. But before we head there, let’s revisit some basics from economics.

Note: I switch between saying AI models and models throughout the piece. For ease of reading - any mention of the word “model” refers to a generative AI model.

Collapsing Scarcity

Our story as a species is defined by our fight against scarcity. It is believed that humans began migrating tens of thousands of years ago in search of greener pastures. Once we learned to harness the power of fire and agriculture, our ancestors prospered, and entire civilisations emerged. We went far and started to trade across oceans to ensure societies had the resources we needed.

Once a civilisation no longer needs to worry about food or protecting itself from the elements, humans focus on competing for status. The Great Wall of China, the Egyptian Pyramids, the Taj Mahal in India, and Europe’s renaissance cathedrals are all, in their right, status symbols that played a role in the socioeconomic constructs of their eras. And humanity could pursue these endeavours that required tens of thousands of people and decades of work because we were no longer worried about whether or not we would be able to eat this week.

As we transitioned to status-seeking societies, skills and services became scarce. Outside of politics, by the 14th century, we celebrated war heroes less and started admiring entertainers, artists, and inventors more.

Think about the works of Shakespeare, Michelangelo, or Banksy. These artists had unique ways of interpreting the world, which required decades of immersion in cultural experiences. You cannot create culture without being deeply embedded in it long enough.

Scarcity became less about commodities we consumed for physical sustenance and more about what inspired our mental states. It takes decades for a “once in a generation” artist to emerge because the situations that produce them are difficult to emulate. Even when hundreds of people had the same experience of living in the Bronx in 1990s New York, only one came out to be the multi-billion dollar, rap mogul Jay-Z is. And one rarely ever knows where or how these outliers emerge.

A society where skills became scarce rewarded exceptional talent with exorbitant sums. We often hear about artists that worked on cathedrals in renaissance era Europe being commissioned for years at a time. But for most of the last few centuries, economic output was linear to the energy that went into it. We either burned energy (to power factories) or had humans spend their energy to produce.

Wealth production primarily relied on the number of people (or resources) you had access to. This is why we have painful episodes such as slavery in our history. Wealth grew on a linear trajectory that often relied on subjugation.

Code and servers changed this path in the 20th century. Suddenly, you no longer had to invade distant lands or subjugate people to your torture. As Naval put it, code and media are the new leverage. Writing code allows you to put an army of robots at your service. Think of Instagram or Tiktok:

The number of people employed by these platforms is often not proportional to the number of users. You scale by adding more hardware to support more users.

This era of abundance may have been marked first with the arrival of the internet in the early 1990s. For instance, spam resulted from the cost of communication collapsing. Limewire and Napster were representations of digital storage and bandwidth collapsing. Games and social networks are digital townships where millions of people meet, but we no longer care about the scarcity of “space” to accommodate that.

The marginal cost of accommodating one more person’s needs has declined drastically as long as the service is delivered digitally. The bulk of the internet being “freely” accessible symbolises how scarcity as a concept gradually collapsed as our worlds became digital. Naval explains this newfound “abundance” in the video below.

Developers are similar to the skilled artisans of the renaissance era. They hold power to gain leverage and make a massive multiple for their time-building tools. But that is slowly changing. And few things capture that stark contrast as much as Microsoft simultaneously laying off 10,000 employees and investing $10 billion into OpenAI, the firm behind ChatGPT, the same week.

I don’t mean to incite fear and suggest developers will soon be redundant. They won’t. But we will see an era of other forms of work being empowered by AI. And that is what is happening with generative AI today.

Generating Abundance

We live in a period of abundance when it comes to digital consumption because the means of distribution don’t cost much. As I write these words, I know distributing this to 1,000 or 100,000 readers would cost me the same. Substack does not charge based on views because the infrastructure that powers the distribution can quickly scale. So while we have pipelines to distribute content to many more people, there is scarcity on either end of the scale that is enforced by limits to human attention.

As an author, I am limited by how much meaningful output I can create in a period. There is only so much you would want to read from me as a reader.

We are seeing an explosion with concepts like ChatGPT and generative AI because the unit economics around production and consumption are being disrupted. The last time we had something so profound was likely when the printing press came around. Books collapsed the cost of storage and distribution of human ideas. It took four centuries for literacy rates to rise from 5% to 50% in the UK, but people were now reading ~2 hours a day.

This change in intellectual behaviour directly powered the enlightenment era, a period marked by rapid advances in science and philosophy where the likes of Kant, Voltaire, Rene Descartes, and Adam Smith altered our worldview forever. We do pretty cool things each time we figure out how to store, share, and iterate on ideas. Be it in cave paintings or documents in Google.

Let’s start with understanding what generative AI can do today to look at how it collapses the cost of production and consumption. Currently, apps like ChatGPT and Midjourney serve a single purpose: They create convincing outputs based on data they have been fed. The data is generally from what is already available out in the open.

OpenAI’s ChatGPT uses data from books, Wikipedia, and journals to create its text responses. Stable Diffusion, a service that generates art, initially relied on stock images. Github’s Copilot uses billions of lines of code from the platform to assist developers.

In essence, generative AI takes publicly available information, synthesises it, and processes it according to the user context. The context here can be to “explain Bitcoin like I am five” or to show “cryptocurrencies raining over Dubai.” These prompts given to AI platforms, in turn, create machine-generated responses in minutes.

Often, the outputs are not convincing enough, but with sufficient tweaks, you will eventually get something that can pass as human-produced. As long as the topic is generic and you do not expect elements of personality.

So how far along are we? The map above from Sequoia’s blog gives a good outlook on current affairs. AI models can now take text input, edit it in real-time and change tone. The same happens with images and code. The reason for this is the availability of large data sets that could be used to train the generative AI models. If we can consume and synthesise knowledge from multiple books or generate art in a fraction of the time it historically took, we will inevitably reach a point where there is too much to consume. Much human involvement is needed for something more complex, like editing movies or music. But AI does make the process more efficient.

Ironically, AI is already being used to summarise and provide key insights from large bodies of work. The challenge here is the lack of attribution and verifiable provenance. For instance, ChatGPT can give me wrong answers for specific queries without information in the public domain. It gives no attribution to what data was used to generate a response. This is where the peril with generative AI in its current form lies.

We can create endless amounts of work with no traces of what or who inspired it. And at some point, we will rely on it to process these unlimited amounts of content and tell us what matters from it.

Without the infrastructure to trace the source or mechanisms to verify the AI model, generative AI will imitate the internet today. A giant pile of fake news powered by algorithms that push content based on what retains users the most. While Generative AI can make everyone an artist, it may sideline the people who made the initial bodies of work the AI models use to train themselves. This will be the defining challenge in the age of abundance - how do you ensure work (in the form of art, text or code) used is attributed and commercialized efficiently when everyone benefits from it?

The internet already has answers to this question. Platforms like Instagram’s Reels and Tiktok hugely rely on music from third-party artists. Users “remix” the audio clips to make catchy, trendy, and short clips involving anything from dance moves to cooking. TikTok released SoundOn to help artists upload and monetise their work. In these cases, the platform is liable for licensing and paying royalties. A straightforward task when the medium is usually the same (audio tracks) and the distribution is owned by you.

You are likely tired of reading halfway through, and this piece is long. So before we go to the more complicated parts of this piece, consider taking a break and watching this remix I recently saw on Instagram. It’s a sweet work of art and a copyright lawyer’s nightmare.

Also an excellent example of how culture “fuses” when digital mediums collapse distance and costs of remixing bodies of work.

Okay, back to work..

The dynamic changes when multiple bodies of work are taken and remixed - by users outside your platform. Remember how I mentioned rewriting Harry Potter in Shakespeare’s style? It may still be easy, given that you are looking at just two people’s work. What if we rewrite Harry Potter with plot twists from Game of Thrones in Shakespeare’s style? It’s three people that split royalties there.

The challenge with generative AI today is that you are looking at hundreds of people’s work. To create thousands of outputs. And none of them is identified, attributed, or tracked.

Often, there is no cost incurred in creating these bodies of work. I could be on ChatGPT running hundreds of prompts daily until I get a response that suits my needs. Social media networks today function a lot, similar to casino slot machines. In that, users spend hours looking for that one piece of content that gives them a massive dopamine hit.

With the advent of generative AI, we are incentivising people to keep running prompts till they find an output that can pass as desirable. But there is a way around it, and that involves enforcing cost. We have an early variation of this with NFTs.

Verifiable Truths

The copy-paste buttons have been around since the 1970s. Scroll through any millennial’s Instagram captions, and you will realise we use them in abundance. A simple technology changed how we think of copying. NFTs.

Surely, you can copy the image of a bored ape! But there is only one way to own it, which usually involves giving up a fortune when acquiring it. This shift of having a unique asset become desirable even when it can be easily replicated was caused by blockchains. Blockchains made it possible to verify that you own the real thing - in real-time at a global scale.

One could argue that this technology does not have many real-life use cases. But once we consider generative AI, the two tools blend. Much of generative AI will shortly rely heavily on copyrights. Large studios like Disney or Netflix own the rights to characters we have grown fond of during childhood and teenage years.

AI will enable these studios to create customized and personalized variants that speak to their audience by tapping into their most profound, treasured memories. What if Tony Stark could teach a kid math? How about Darth Vader giving dating tips? Maybe that’s what will get many of us out of being single.

Surely, studios can own and release these AI-generated variations of chatbots or interactive characters. But combining blockchains would allow them to track, verify, and claim royalties. Instead of restricting the kind of applications built to what developers working in the studio can produce, they can enable an open marketplace where anyone can come and build. In effect, any firm holding substantial IP can transition to being a platform at scale by allowing for derivative work.

Let me explain what that means. Imagine I decide it would be a good idea to have these long forms I write for you to be read by Chester Bennington from Linkin Park. (RIP). The estate that holds his IP and the studios that hold synthetic versions of his voice could very soon license his sound to me. But this would be a long, laborious process involving lawyers and a mind-boggling amount of paperwork. It may seem stupid, but an entire industry already revolves around dead celebrities and IP rights.

Let’s imagine that the rights for Chester’s voice were on-chain. It could be licensed out to hundreds of individuals around the world. Surely, there is cause for concern that the voice could be misused. Perhaps in a deep fake. Or for outputs that the late artist may not want to see their voice tied to. But if the rights are priced high enough, the entry barrier would filter out most bad actors.

There is one place this already played, and that is with memes. I recently saw a series of posts on Instagram from Raj Kunkolienkar - one of the founders of Stoa. The guy had remade several popular memes using his images—a fascinating use case for what generative AI could do.

Memes are culture, and they are publicly owned. There were some attempts at making NFTs of them. But if we are to “remake” culture in our own identities, I’d think there needs to be verifiable provenance for them. And it should be possible to reward the original faces behind the memes we use.

Should Raj have “licensed” the right to re-make these images? Should culture be monetised? I don’t know. The guy was likely messing around on a Saturday morning in beautiful Goa, but it seems there is a pathway to do it.

Historically, IP rights like those representing superheroes and game characters were considered easily relatable to their audience. Nobody finds it odd that people dress up as Batman or Darth Vader at a Comic-Con event! And it is unlikely that we will invent a world where fans are expected to buy licenses to dress up like their favourite characters.

But it is indeed possible that a subset of the fanbase does put together resources to acquire rights to legally remake and release novel bodies of work to add to the original creators’ thoughts.

You may think this is far-fetched, but it is already a reality in the Web3 ecosystem. Last year, a community put together $47 million to acquire the constitution of the United States at an auction held by Sotheby’s. Though the bid failed, thousands of individuals pooled their hard-earned cash to contribute to the effort. Users were eventually allowed to claim a refund or hold the native token $PEOPLE. As of writing this, some ~17,000 users own the token, which now trades at ~$140 million valuation.

Tokens and on-chain provenance enable communities to rally together to acquire intellectual property rights, which can be used with AI to create fan-created derivatives of art.

This combination of human ingenuity and machine-produced output is already occurring at scale. In June of 2022, Cosmopolitan Magazine released magazine covers created using DALL-E. They made a version with Darth Vader on the magazine cover but chose not to publish it.

The playbook, in such instances, will rely on DAOs if large communities are to be activated. The studio itself issues on-chain instruments that represent these rights. It could be a single NFT that a community acquires through crowd-pooling. Tokens are issued proportionately to the amount of capital contributed towards acquiring the IP. A DAO then determines how to govern and handle the use of the license.

The community could mandate a minimum number of tokens to be needed to be able to use the license. More complex functions like creating generative art could need a DAO vote. The DAO could generate cash flow by requiring a portion of the revenue said IP makes to be paid back to the DAO.

Since large incumbent studios will likely not have enough appetite for such risk, it would possibly be new artists that embrace such a business model. It may seem far-fetched, but any time we have arrived at a new form of distribution or the means to engage better with an audience - artists are the first to embrace it. Spotify and Soundcloud have been the defining instrument for emergent artists to be discovered in the past decade. Over the next ten years, artists will combine financialisation through on-chain primitives and generative music to accelerate their careers.

Rethinking the Stack

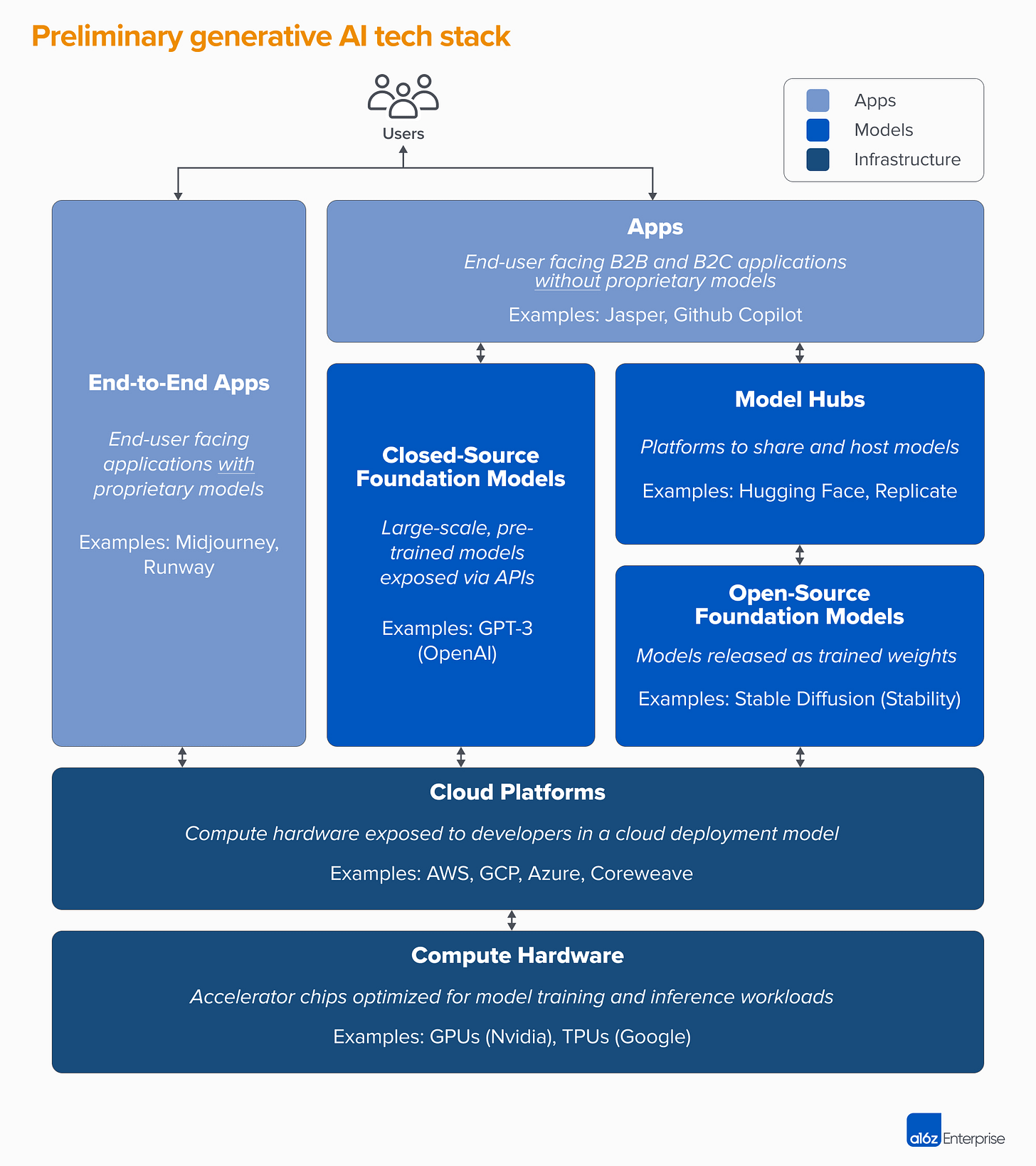

I wanted to understand which part of the generative AI stack could be disrupted and which parts have shown meaningful growth. The map above is from A16z’s piece titled “Who owns the platform” has meaningful light on where value has been accruing over the past 18 months.

From the article

We’ve observed that infrastructure vendors are likely the biggest winners in this market so far, capturing the majority of dollars flowing through the stack. Application companies are growing topline revenues very quickly but often struggle with retention, product differentiation, and gross margins. And most model providers, though responsible for the very existence of this market, haven’t yet achieved large commercial scale.

In other words, the companies creating the most value — i.e. training generative AI models and applying them in new apps — haven’t captured most of it. Predicting what will happen next is much harder. But we think the key thing to understand is which parts of the stack are truly differentiated and defensible. This will have a major impact on market structure (i.e. horizontal vs. vertical company development) and the drivers of long-term value (e.g. margins and retention). So far, we’ve had a hard time finding structural defensibility anywhere in the stack, outside of traditional moats for incumbents.

The piece suggests that while multiple verticals have shown revenues north of $100 million, there are concerns about profitability and retention. Nobody knows what defensibility looks like when the underlying AI models (like Stable Diffusion or ChatGPT) are offered to everyone. And it is difficult to accurately predict how long users would stick around once the novelty wears off.

Most of the value capture occurs on the hardware and cloud platform side. AWS, Google Cloud, and Azure have spent decades perfecting the storage and computing side of things to offer large-scale hardware at unit economics that makes sense. Players like Filecoin, Render, and Akasha have become Web3 equivalents for this.

Still, in its current form, I find it hard to see how crowd-sourced hardware can beat the reliability and scale that centralized providers offer today. According to A16z, value can accrue in three places: the physical infrastructure, the AI models, or the applications. We believe that in Web3-based AI, moats will be built around curating niche users (through token incentives), making data streams and monetising models that scale through community participation.

There are a few places we see this happening already.

Niche Users

We have a primitive MVP of this with Numeraire. The firm behind the token releases standardized data sets on the stock market to researchers. The researchers then run their proprietary AI and ML models on the data to return a “signal.” The signal in simple languages measures where they think the price of an asset would trend. The signals are weighted based on the amount of NMR (the native token) the person giving the signal staked.

Users providing false signals have their tokens burned. Since these tokens trade in liquid markets, users are disincentivized from giving faulty signals for real money. Researchers providing accurate signals, on the contrary, are rewarded. What effectively happens over time is that you have made it possible for a section of your users with accurate predictions to collect more NMR tokens and thereby influence how the firm deploys money. All of this may seem fugazi.

Can a decentralized collective of researchers incentivised through tokens beat the market? That is indeed the case. The fund has returned ~48% since inception. According to the firm's website, some ~$55 million worth of NMR tokens has been rewarded to data scientists producing over 5000 models.

In the case of Numeraire, the data itself is not proprietary. The network of data scientists who trust the product enough to stake their tokens and share outputs from their models is what is valuable. The network uses token incentives to create a niche-specific community of data scientists. And for what it’s worth, that’s a moat in itself.

Data Streams

Plugins could be used at the browser or hardware level to collect, anonymise and pass on data to third parties that can benefit from it. The internet, as it stands, already does this. Our data is collected and passed on to firms that advertise things we don’t need.

Instead of platform monopolies like Google or Facebook, such a system would rely on a protocol that standardizes the nature of collected data and offers it in a marketplace. Firms could offer benefits (such as premium access) in exchange for users being willing to share their data. We are seeing a very early variant of this at Pocket.

The team behind it is creating a standardised protocol which structures data on behalf of its users allowing businesses to ask Pocket users to share that data in a form they can readily use. Users can choose what they share based on the perks it unlocks. We have a very early variant of this with Brave Browser’s BAT rewards.

Model Monetisation

A different way Web3 native products and AI would interact is possibly through leasing out AI models. An early variation of this is available on Ocean Protocol’s marketplace today. In such instances, research collectives could develop and license a AI model to third parties that bring on their hardware and data.

Part of the argument is that in a world where models are open-source, there would be no primitives to verify the origination of an output. Combining crypto-economic primitives such as DAOs or tokens with open-source models would allow alternative ways of creating cash flows from the work researchers put in while verifying the output's provenance.

The supply side (of AI models) is maintained and kept updated through a cooperative of researchers who receive a portion of the cash flow generated through leasing the AI model. Think of generative AI models as NFTs and researchers as artists in this context. It may fit in situations where the data is too sensitive to be shared, such as healthcare data, proprietary financial numbers or user data. An early variation (without any Web3 elements) can be seen on platforms like Hugging Face and Replicate.

The post released by A16z ends on a pertinent note about value accrual:

There don’t appear, today, to be any systemic moats in generative AI. As a first-order approximation, applications lack strong product differentiation because they use similar models; models face unclear long-term differentiation because they are trained on similar datasets with similar architectures; cloud providers lack deep technical differentiation because they run the same GPUs.

The only way generative AI firms will meaningfully differentiate is by passing ownership and control to users. As things stand today, the data is often crowd-sourced. The AI models are open-source, and value flows downwards to cover hardware expenses.

Incentivising users to share data or AI models could reduce the team's liabilities and expenses. In turn, it could lead to outputs generated by generative AI platforms being considerably better whilst the models are governed by a community instead of stand-alone gatekeepers.

This seems far-fetched, but teams in the industry have been combining primitives (like NFTs), copyrights and generative AI already. We see an early variation of what it looks like with Alethea AI. But before we go there, it may be good to get you up to speed on what’s happening in the generative AI companions world.

Generative AI DApps

Last Tuesday,

from released an article on Replika. It is an exciting read that sheds light on the issues users of generative AI-based products will face in the coming years. To keep it short, Replika was an app that allowed people to have romantic interactions through chat. Unfortunately, the GPT model powering the app at some point decided it may be a good idea to harass users and send NSFW content to children under 13. So the developers behind the app disabled all adult content from the app in a rush to get the situation under control.

The app had initially promised companionship and possibly steamy conversations. Users were given an expectation, the app delivered on it, and suddenly decided it no longer wanted to continue delivering on the promise for users. It was a meaningful escape for many users who struggle to interact with others or form meaningful bonds in the real world. Then, all of a sudden, the escape no longer existed.

It represents the challenges users of generative AI products will face in the coming years. The people spending hours on these apps barely own any of the creatives, models or input that’s gone into them. A handful of firms with early mover advantages can benefit tremendously by building off what was openly accessible.

It shifts the power dynamic in favour of the firms releasing the generative AI models used. As a result, OpenAI could begin prioritising companies they have invested in and block out competition. One way to mitigate this risk is by focusing on keeping models open-source as public goods and having them governed as a community.

Alethea AI has been building towards this mission. They define themselves as the "property rights backbone of the generative AI economy". Say you have created a cutting-edge model and want only token users to be able to access it. Or perhaps, you want to embed an NFT with AI and transform it from a lifeless static asset into an interactive intelligent asset capable of conversing in real-time (usually done by interacting with one of Alethea’s models). Alethea's protocol gives permissionless access to developers and creators to do so.

To build intelligent dAPPs and Intelligent NFTs that are provenanced on-chain. Service providers specialising in niche generative AI domains such as copywriting, scientific research around protein folding or writing python code could share their offerings to train Alethea’s models.

Creators downstream could then plug their NFTs with particular skills from Alethea's models and train their Intelligent NFTs to offer services. The crypto-economic incentives underpinning such a marketplace of AI models and service providers & NFT users seeking AI services could be managed by Alethea as a protocol with all transactions.

There are some caveats. We are in the 2007 era of mobile apps with generative AI. Any time there is a new medium, it takes a while before more people start releasing their variations of it. People are still figuring out how to create AI models for niche verticals. I would have loved to offer a generative AI model that analyses on-chain activity each week and discusses it as a Bored Ape NFT. But I lack the skills to do so.

Much like we saw a gradual evolution from fintech apps to DeFi, there will be a phase of centralised, closed-source providers dominating the market. We will see more open-source, community-governed models only when teams recognise that passing ownership to a larger group of users could unlock network effects and data sources in ways a centralised firm generally cannot. A collective is formed around niche generative AI models, and the only way to join the collective (or have access to the AI model) is by uploading your data. Like liquidity mining, but for the age of generative AI.

Alethea demonstrated what it might look like last year. They released an iNFT (intelligent NFT) through an auction run by Sotheby’s. It sold for close to $500k. The NFT was an art form that could converse with you using OpenAI’s GPT-3. Web3 native firms have long been accustomed to the risks of building on centrally owned platforms. Games, wallets and exchanges are routinely de-platformed from app stores.

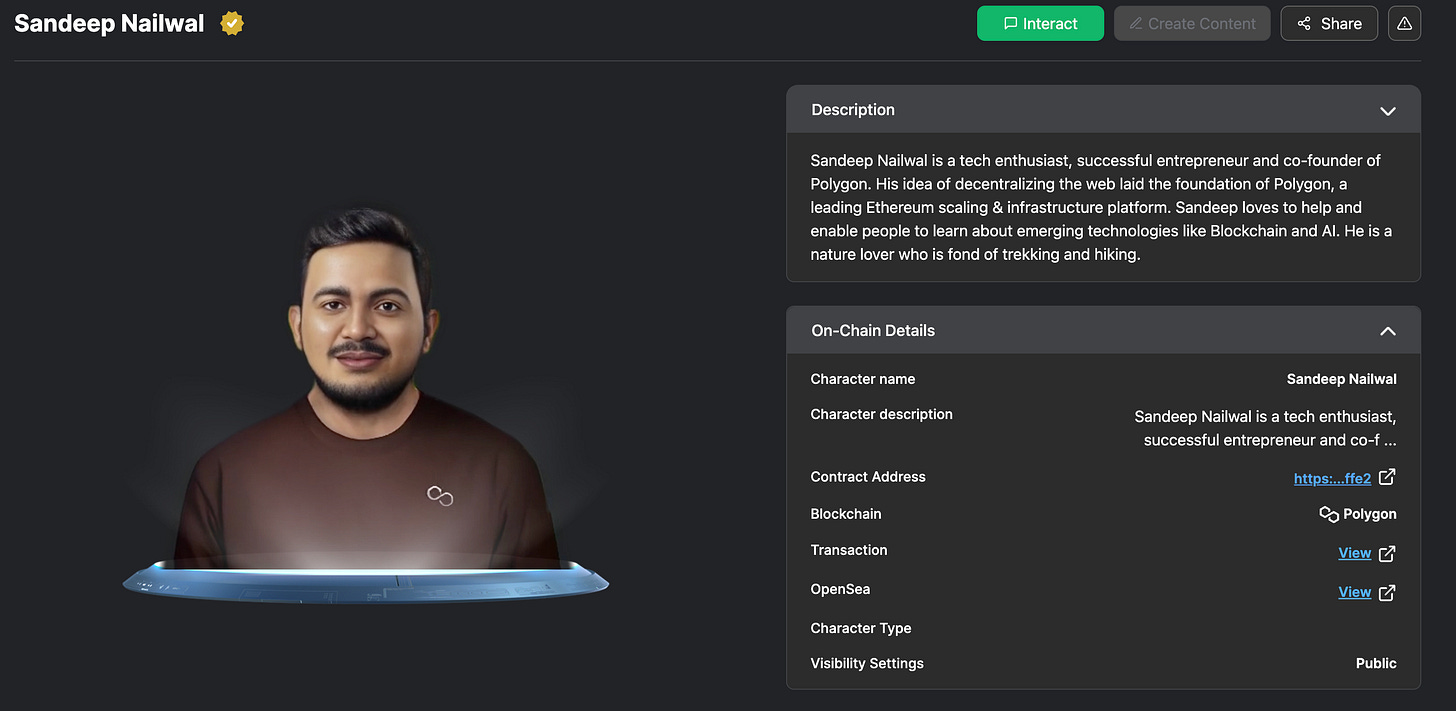

The same risks exist with NFTs relying on OpenAI. So the team behind the project developed their GPT model named CharacterGPT. Unlike the text-based responses you get on ChatGPT today, the model they developed is capable of synthetic voice generation, facial animations and personality. Some nuances here. Firstly, a generative AI model cannot be stored on-chain. And the kind folks at Alethea don’t think it would occur in the future. CharacterGPT, as it stands, is privately owned and centralised.

What may be possible is the gradual decentralisation of the model’s governance. A native token like Alethea’s (ALI) could decide how the model responds in certain situations. This does not necessarily mean the model would avoid self-regulation. If community members work out of self-interest, they would likely push fringe use cases that cause much trouble off. But it would still be a more decentralised process. Adam Smith’s invisible hands are on everything. Even in the frontiers of technology, where I propose a DAO could govern generative AI models.

Alethea itself only offers smart contracts, CharacterGPT and the protocol that connects on-chain primitives (like NFTs) with generative AI. The belief is that at some point, third-party developers would create DApps that serve a mix of services on top of it. You can try this through a third-party dApp built on Polygon - named Mycharacter. It lets you spin a synthetic character whose attributes can be tweaked and minted it as an on-chain NFT. You can speak to a digital representation of Sandeep Nailwal (with a scarily accurate representation of his voice) here.

A different dApp released to show how AI services and on-chain primitives would combine is Noah’s Ark. Users of a handful of pre-selected NFTs can use the product and host it as an AI character people can interact with. Let me explain how that works. Users “fuse” their NFTs with what’s referred to as a pod on the platform. Each pod sells for $300 on OpenSea as of writing this. Essentially, a pod is an access card to Alethea’s AI services. You connect a pod with an NFT to enable abilities such as reciting a song or telling you what the weather is.

These things look like toys in their current form. Surely, nobody is excited about talking to an NFT all day long. One of the benchmarks I use for consumer products - is whether it excites me to use it. I look forward to using my PS-VR device. But talking to a bot that looks similar to an NFT? Likely not as much. And that is where it helps to understand the implications of what the founders are building.

Alethea’s broad mission is not to build conversational interfaces alone. As things stand today, practically most of Web2 is a front-end to collect data for OpenAI. Even the users that use Chat-GPT or Stable Diffusion unknowingly contribute to its growth and capture none of that value. The thesis is that we will see multiple models owned by users emerge in the future. And no protocol makes it easy to discover and embed them with existing on-chain primitives. That’s the gap Alethea is pursuing.

But what would a future like that involve? To understand that, we need to return to where we started this piece - scarcity in the age of abundance.

Much like we saw at the advent of the internet - through torrents & P2P filesharing, we will have a period of copyright violation combined with chaotic confusion. Is it ethical to build an AI model that resembles Hitler? How should royalties be split if third-party developers use the intellectual property owned by studios? During such a period, it would help to bring IP rights on-chain. The tools to do that exist here and now already. With NFTs.

Studios & creators would both stand to benefit from this. All of a sudden, you have the chance to create cash flows out of assets that are lying unused. On the other hand, creators (of generative AI-based tools) can scale growth without wondering if they are breaking the law. Github’s Copilot feature allows you to take the help of AI in coding today already. But what if you could replicate the style of your favourite developer? How about inputs from Rick Rubin on a beat you are producing?

Someone used all of Paul Graham’s essays to build a bot that responds like him. You can see a demo of it in the tweet below.

How do you ensure copyright access and royalty payments in such instances?

Generative AI is about the scalability of human talent. Text and art are the prominent use cases we see around the technology because these are the two most recorded and easily available mediums of work to train the models. As the ease of creating models & the complexity of what can be fed into them improve, we will see individuals releasing their own AI services. Which in turn would reduce the time people spend answering rudimentary questions. It could be that a version of my AI recommends VC funds to founders. Or explains the perils of working with others.

The scarcer the intelligence and knowledge patterns needed to enable a model, the higher the cost users would pay to access these services. The real world functions on similar economics in that you pay excessively high premiums to access the service of increasingly niche providers such as lawyers specialising in Web3 or VCs that understand gaming well enough.

Community Vs Corporation

I have often wondered why DeFi surged through the early 2020s the way it did. The reason, in hindsight, was that people were incentivised through crypto-economic primitives like tokens to contribute capital and use these products. Historically, the cost of capital for a fintech firm engaging in trading or lending was substantially higher than what it would take to issue a token and offer that as a reward.

Using the tokens for the governance of these DeFi products, in turn, gave people a sense of ownership. One that would not be easy to replicate in a privately held organisation. Surely, you can buy stock and lose money by claiming ownership, but it's different from the ownership that comes through using a product.

At the crux of the battle between Blur and OpenSea - is the same theme but in the context of NFTs. Out-sourcing liquidity through token incentives and passing on governance to users. The reason why Web3 and AI will collide will also be the same.

Communities will gather around acquiring the IP rights of creators they admire as DAOs. Creators like Mike Shinoda and Snoop Dogg have already been a part of the Web3 ecosystem. I don’t find it impossible that Snoop Dogg would not tokenise his voice and sell it to a community. He flexed his Bored Ape on an Eminem video recently.

He could use tools like Noah’s Ark to merge his voice with a board ape. Once the IP is tokenised & on-chain, it could be embedded in models that, in turn, derive its data from the general public.

This may feel far-fetched - but consider that Stable Diffusion is an open-source project that is now under trouble for using stock images from Getty. What if they had decided it may be a good idea to allow users to upload art they created over the years in exchange for the governance of the model?

Millions of creators could have contributed without feeling screwed in the process. A blockchain-based Stable Diffusion could easily track whose art went into generating an image and charge the person downloading the art. The royalty could then be split with the artists that contributed to it.

( I am not seeding ideas here, but this is the next OpenSea-like opportunity. A stock image website on stable diffusion, governed by artists. Reach out to us if you are building it)

The model above breaks down what it may look like. It is a remix of what A16z suggests the generative AI stack looks like currently. Web3 native AI platforms could benefit from crowd-sourcing datasets (like images) in exchange for token incentives. Contributors, like artists, could share their bodies of work, which in turn can run through models that return a specific style of art.

If a person conducting queries decides to use a piece of work, they can get an NFT minted that shows the models used and the data that went into it. Such generative art pieces would be just as valuable as NFTs have been in the past as their provenance is verifiable.

The next Open Sea would likely combine such forms of generative art, contributors who provide data or run queries and on-chain primitives to prove the components that went into a body of work. The same applies to models too. Cooperatives that maintain and optimise models could lease it to marketplaces where users want to mint NFTs. Alternatively, a large model used by millions of people could open-source itself and be run as a DAO. This empowers people to have more say in how generative AI tools are maintained and scaled.

You may think it does not matter - and this is a solution looking for a problem. But ask the users of Replika how they feel about product decisions being made in the app without consulting them.

Only small amounts of data are needed to train these tools today. So eventually, the artists who contributed to creating them in the first place could become redundant. One way to ensure equitable outcomes is by giving them tokens in proportion to how much of their work has been used.

Imagine if the artists that contributed towards OpenSea’s prominence during their early days were rewarded in equity or tokens in the platform. Then, perhaps, they would not have to be as worried about royalties as they are today.

I tried mapping out how approaches to AI differ philosophically between Web2 and Web3 below.

Web3 native AI comes off as a solution looking for a problem at first glance. It's what I thought for the past months. But notice how OpenAI has evolved over the past months. And you will understand our lack of tools to combat yet another platform monopoly. Between tokens, NFTs and on-chain provenance, there are ample tool sets the industry has created to battle the barrage of fake news & job losses we will see in the coming years. This is no longer about crypto. It is about enforcing systems in place to avoid AI-generated nonsense creating chaos.

We will need to use to principles of Web3 in the context of AI as it is too powerful a technology to leave in the hands of a few corporations. We did not have the tools to verify provenance or govern the platform monopolies we spent most of our time on when the web was emerging. Things are different now. DeFi platforms like Uniswap have shown us that a distributed, community-owned primitive and centralised alternative can run. It is only a function of time before we see the same occurring with generative AI models.

I’ll see you guys next week with some work we have been doing around airdrops and the emergence of the Stacks ecosystem.

Joel

Disclosures.

I am an investor in Pool Data - one of the firms mentioned.

Siddharth Jain is a token holder in Alethea AI. We have a policy of not trading any assets mentioned in the piece for three days before and after publication.

AI is an emergent theme where value accrual is not clearly defined. None of this is financial advice. Do not purchase assets with capital you cannot afford to lose.

From The Community

The Telegram community has been busy building over the week. Sharing some snippets from what the founders have released.

Bits crunch released their report on NFTs being washtraded.

2Lambro released this thread on delta-neutral farming.

Jumper Exchange is now accessible to the public.

Coinfeeds released a tool using Chat-GPT to query bankless podcasts.

Bluejay released a long form on emergent challenges with stablecoins.

Aquanow dropped yet another banger on how on-chain transactions enable real-time reporting.

Join us at Telegram and join in on the conversation with ±2700+ researchers, investors, founders & overall great human beings.

Easily the best piece I've read in a couple of months on Substack. Keep up the great writing, Joel. Stoked to read the other articles you referenced here.

Great article!

Powering AI through crypto will likely not just be a plus but a necessarily soon to prevent corporate-AI from eating up the world.

In other words, if people have an open source version of AI where they can share their creations publicly (and able to monetize their work) would be infinitely preferable to Big Tech AI owning all your data and maybe giving you pennies in return (and meanwhile using the profits to build ever-more powerful AI that can have a subversive influence on society/politics/etc.).