Financialisation of Social Networks

Turning eyeballs to dollars.

Note: I rarely mention our portfolio companies in the newsletter, but today is an exception. I mention two of them. The reason is that we have been actively researching the decentralised web before it was dubbed Web3 and have had the joy and pleasure of working with some of the best minds in the industry.

Today’s piece is a bit of a request for pitches to startups that are building consumer-facing technologies using blockchain primitives. We continue to learn from, invest and build alongside the founders that are enabling a new internet.

If you are one of them, consider dropping in your details at the link below.

TL:DR: Blockchains move capital at the speed of data. They are also able to fractionalise and scale economic interaction between participants online in a way traditional fintech companies cannot. We do not entirely understand the aftereffects of this phenomenon on human interactions.

Human behaviour shifts when capital formation and speculation meet attention markets. Polymarket and PumpFun are predecessors to the future of social networks. The next big

exchange will be a social network. The next big social network could be an exchange.

Hey there!

I want you to consider the chart above from Ben Evans. Published in 2019, it highlights the revenue made by newspapers up until 2019. Newspapers were historically a human institution that was part of our morning routines. We replaced them with doomscrolling and a dose of memes. In the age of clicks, the relevance of a story does not matter. What matters is how much emotion it could incite. This is why Elon Musk acquired X instead of going for the Washington Post like his fellow Billionaire Jeff Bezos did.

Media in the 21st century has become about clicks. We have made a parallel world where attention is commoditised, quantified and sold like pastries at a bakery. Except, in this case, what is moulded is not flour. It is the human mind. And there is a cost attached to it as with most markets. The chart by Ben Evans simply shows a number going down. Filterworld by Kyle Chayka shows the after-effects of this on culture and society.

As the web evolved, our perception of what counts as “good stories” changed. We are no longer optimising for how relevant a piece of information is, but rather how far it can go in terms of virality. Or even worse, how much emotion it can incite. So the local newspaper that once highlighted a charity event around the block, or the foreign correspondent that put herself in danger to highlight struggles that may not be seen, no longer has relevance.

We would much rather have our feeds plastered with cats, dogs, and a sprinkle of political highlights cut to exactly 30 seconds.

Present day social networks work the way they do because they are fundamentally exchanges. At some point in the early 2010s, folks who would have been a quant at Wall Street decided to skip the markets–thanks to the crisis of 2008– and joined emerging social networks like Facebook instead. This talent pool then sliced, diced and sold human attention to the highest bidder. In the process, social networks became exchanges, except these exchanges hold much of the value.

Neither the supply side (creators) nor the demand side (users) capture any of this value for itself. Surely, Twitter is trying to distribute ad dollars to its top creators and that is a model that might work. But in the process, it is tearing democracies apart and making weekend dinners insufferable. Is there an alternative?

We’d like to think so. Qiao Liang from Degencast collaborated with us on this story. He has been building Web3 social primitives for over a year and made a few observations that got us thinking. Here is the crux of the argument: blockchains are instruments for the transfer of value.

As they scale, money will move at the speed and frequency of all other data. In such a world, can social networks change their business models? Let’s explore.

Incentivised Networks

Over the weekend, multiple AI-related tokens were released. Think of them as LLMs that are plugged into Twitter’s API. The largest among them ($GOAT) trades at a market cap of $400 million at a time when most start-up founders struggle to justify why their work is worth $10 million. What makes capital flow like this? And why do people invest tens of thousands of dollars into such assets?

A simple explanation is that meme markets are an instance of markets speed running greater fool theory. People buy in hopes of selling to someone else, at a higher valuation. Owning 1 token does not make you any less a community member of GOAT than owning 10,000. But people size up because such narratives have the power to find their own distribution and, thereby, attention. Consider that Matt Levine, one of my favourite writers, has written about both WIF and GOAT in his newsletter in Bloomberg. An early-stage start-up would struggle to get the same media attention.

Meme assets, be they create networks of humans that are incentivised to give attention and capital. They are a lot similar to social networks in that they are gatherings of humans on the internet. But their incentives are not spiteful comments or meaningful commentary. Instead, the incentives are in capital formation and speculation. The crowd benefits so long as it has a meaningfully large influx of new users. Taken to the extreme, a meme asset–without lindy effects like that of Doge, can sound closer to a Ponzi scheme than a social game.

Much of the internet works on an attention-financialisation spectrum. When you interact with Twitter, you are on the attention side. Users looking at TikTok videos, sacrifice attention for dopamine hits. Crypto as an economy enables the other end of the spectrum. When users gathered around Gamestop on Reddit, their incentives were financial. Taken to the extreme, you have PumpFun, a meme coin platform where users come for the token and stay for the social interactions that exist underneath each token. Fundamentally, both are mechanisms to attract and retain users. You either give them something that incites dopamine, or you give them capital.

This is what I was trying to highlight in my article last year on how volatility can drive product adoption.

At the time, I did not fully comprehend the extent to which capital can put together new social networks. Farcaster and its preferred meme asset, Degen, launched in the months after. During the earliest days of Farcaster, user onboarding was personal. Dan Romero used to famously schedule calls with potential users and give them invites. This early subset of core users, mostly founders and builders within crypto, became the social graph that fuelled Farcaster’s early usage. And then Degen came along.

Degen had a tipping system that allowed community members to tip initiatives or users adding value to the ecosystem. As of writing, close to 10 million transactions have occurred on Degen. There are about 784,000 wallets that own the asset. Degen separated the social network (Farcaster) from the financial incentives of being on it. Suddenly, a creator who gave meaningful value to the network could find themselves with vast sums of money tipped towards them.

In the following months, multiple Farcaster communities launched their own tokens. Much of them have declined in value, but it showed an interesting aspect of how the financialisation attention spectrum can blur. If Reddit were to launch in 2024, it would likely run with a single base token (say RDIT) and millions of sub-tokens that are issued to moderators of individual communities. The value of these tokens could be driven by how many members join these subcommunities and partake in meaningful engagement.

But that was never the case with Farcaster. As a user, I stopped logging back into the product because, at some point, the quality of content declined a bit. And there was only so much time to be split between Twitter and Farcaster.

One of the projects taking such a tipping model is Bonsai. Originally a meme token, the product allows tipping of artists across social networks in a cross-chain format. Initially launched on Lens, the network integrates with social wallets like Orbs Club to allow users to collect, reward and tip assets across zkSync and base. In effect, they are making attention markets composable by allowing users to hold and tip across networks. You can practically be in a group chat and tip one another or purchase reaction stickers using the base asset.

We have seen an early variation of such a model that incentivises attention with T2 World. Users' tokens are linked to the community in proportion to how engaged they are to a piece of content. But why does this matter? The history of protocols within Web3 offers some clues. Early developers in Ethereum could continue to contribute and build the ecosystem because they had exposure to ETH, the asset. The new wealth created a new generation of entrepreneurs. The same never happened for community contributors who came on-chain in the last two years.

We saw brief blips of what a world like that could look like with the NFT boom (creator royalties) and Farcaster (Degen tips), but they did not sustain.

The reason is twofold. For such communities to be sustained, there needs to be continuity and relevance. Bored Apes, on their own, were an interesting subculture. But the quality of their games or distribution of the IP struggled to find any meaningful relevance. The beauty of current algorithmic platforms is that they can reel into the new constantly and keep users engaged.

The closest comparables we have for this phenomenon today are prediction markets and meme tokens. PumpFun tends to be a great source for pet names as individuals routinely rush to release tokens associated with them. Similarly, Polymarket is becoming a go-to hub to keep track of what a market believes would be the outcome of an event. In fact, if you go to individual markets such as this one for Presidential Elections in the US - you will be able to see how a user’s views are linked to their stake in the outcome. This helps understand the motives behind a stance.

Polymarket and PumpFun are both responsible for billions of dollars having flown through them. As of last week, Polymarket ranked #1 in the app store for a brief while. We are past the phase of “crossing the chasm”. We are quite possibly at the part where consumers wonder "Where are the apps I can spend time on?". In order to build those apps, we will need to create sufficiently financialised social networks. In our view, they will have a handful of tenets.

Sufficient Financialisation

One cannot have all they desire, even when it comes to designing social networks. Varun Sreenivasan argued in a famous piece titled "Sufficient Decentralisation of Social Networks" that expecting every user to run their own servers would be a faulty mechanism for scaling a social network. He then proceeds to lay a brief of what trade-offs can be made such that a system is sufficiently decentralised without bothering user preferences.

What has been missing on the internet is fast-paced, low-cost, micro-transfers of value that are bi-directional. When you see an ad on Instagram, that is value transfer happening in a single direction. You trade your attention for content. But this format of the web happened when Stripe was in its infancy if you consider social networks to be the birth of the attention economy. Banks were barely online if you take Craigslist to be where it all started. The toolsets we have since then have evolved.

Farcaster Frames and Solana Blinks are instances of what happens when bi-directional value can be transferred on-chain. A user can “mint” an NFT directly from their Farcaster feed. The user, in turn, could be mapped out on-chain and be rewarded in the future in the form of airdrops. Consider us, for instance. As a publication, one of the things that bothers me the most is that we do not have an on-chain graph of users that consume our content. In a Farcaster-driven world, each of our articles could probably be an e-mail embed. A user could “collect” each newsletter and receive an NFT after reading the article.

Why does this matter? There are two ways of looking at it.

One is the top-down approach. Any time a brand wishes to interact with our audience, we could simply ask them to incentivise our on-chain audience subsection instead. In such a model, I am splitting our incentives with our engaged audience.

The other is that of community-driven growth. In such a model, as a publication, we become redundant over time and instead allow the community to drive itself. We simply become the hub where these minds gather, discuss and collaborate.

In the second model, a community’s dependence on stand-alone creators is largely diminished. Platforms like FriendTech struggled partly because financial outcomes were heavily dependent on the creator who had created the handle. If the creator went rogue or decided to simply not care anymore, the community would be left holding the bag. Ironically, in the case of FriendTech the creator of the platform itself decided he no longer cared and abandoned the platform. In such instances, tooling for stronger, more resilient communities begins to matter.

A different reason why standalone, individual creators should not become tickers is that they are ultimately human. Tying their value to a ticker and trading it feels unethical because it sets precedence for levels of pressure a creator may ideally not want to stand up to. Would Van Gogh have been a great ticker while he went through his depressive episodes? Would we want to bet on Nikola Tesla during his manic phases? An individual’s economic value should ideally never be quantified and traded upon because price at any given point in time is reflective of what a person is at that point in time. Humans are bundles of potential that explode over time. Adding elements of speculation does not truly aid the creative process.

In this regard, communities are closer to nation-states while individuals are like citizens. A strong community can be resilient to the pressures of a market, even when its stand-alone members struggle to deal with what is needed to survive. Perhaps, this is why so much of civilisation’s evolution hinged on tribes. Anyway, I digress.

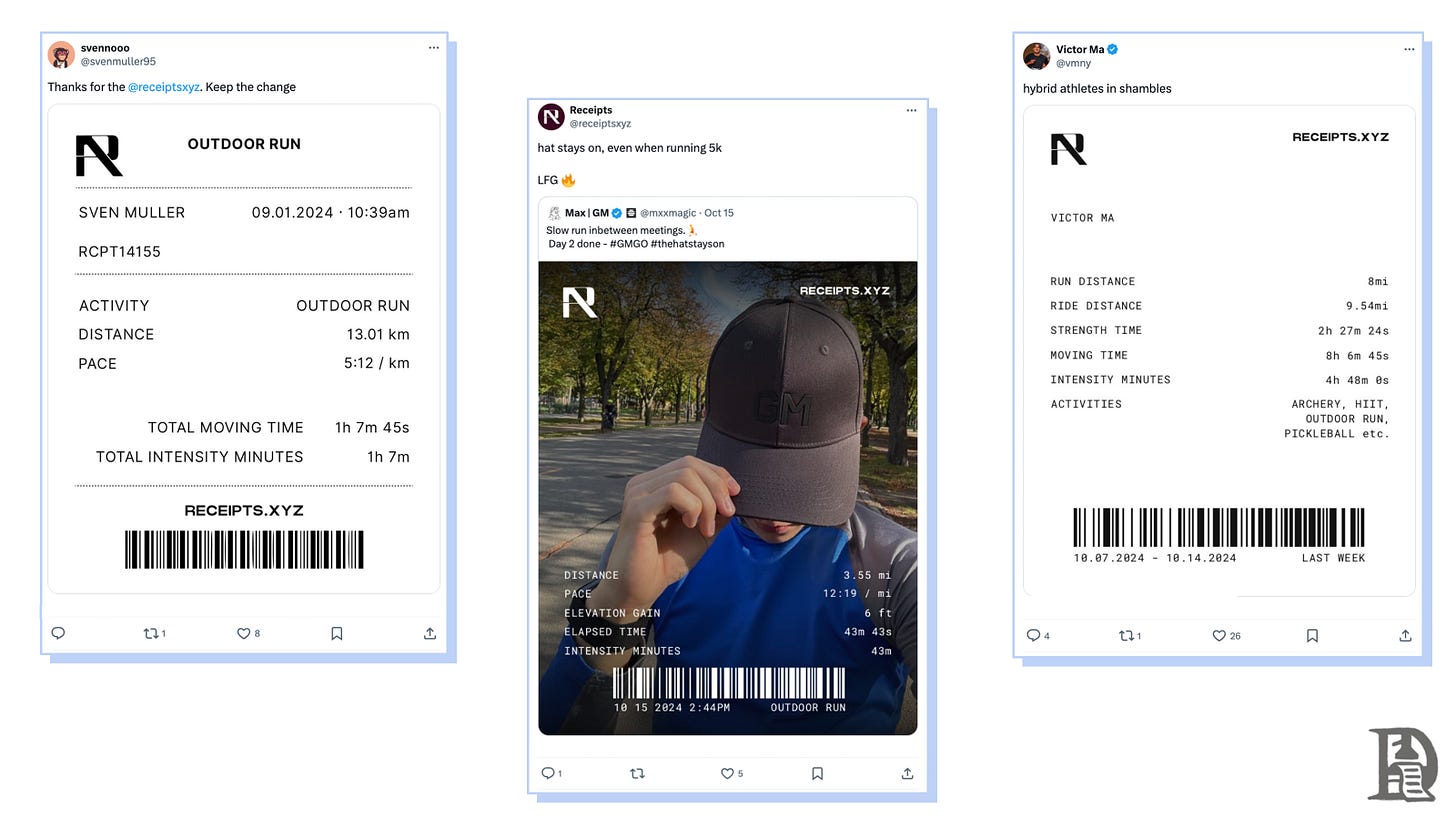

If communities are indeed the best way to formulate capital and trade it, then what are the primitives that hint towards it being possible today? Most communities that emerge as social networks will be niche-specific ones that use a quantifiable metric to define rank and community. These will be consumer applications with very little resemblance to extreme speculation the way we see it on Pump. The best instance of such a product is Receipts.

Receipts gathers data from fitness trackers like Apple Watch or Garmin to issue points. Users routinely flex “receipts” of their workout on Twitter for clout and community. If a user plugs in their Farcaster account, they would also be able to be ranked for what is called “intensity minutes”. These are minutes of elevated heart rates that occur when a user is in a workout. The “receipts” themselves are issued on-chain and interestingly enough, there are some 2100 receipts “on-sale” on OpenSea. Why does any of this matter?

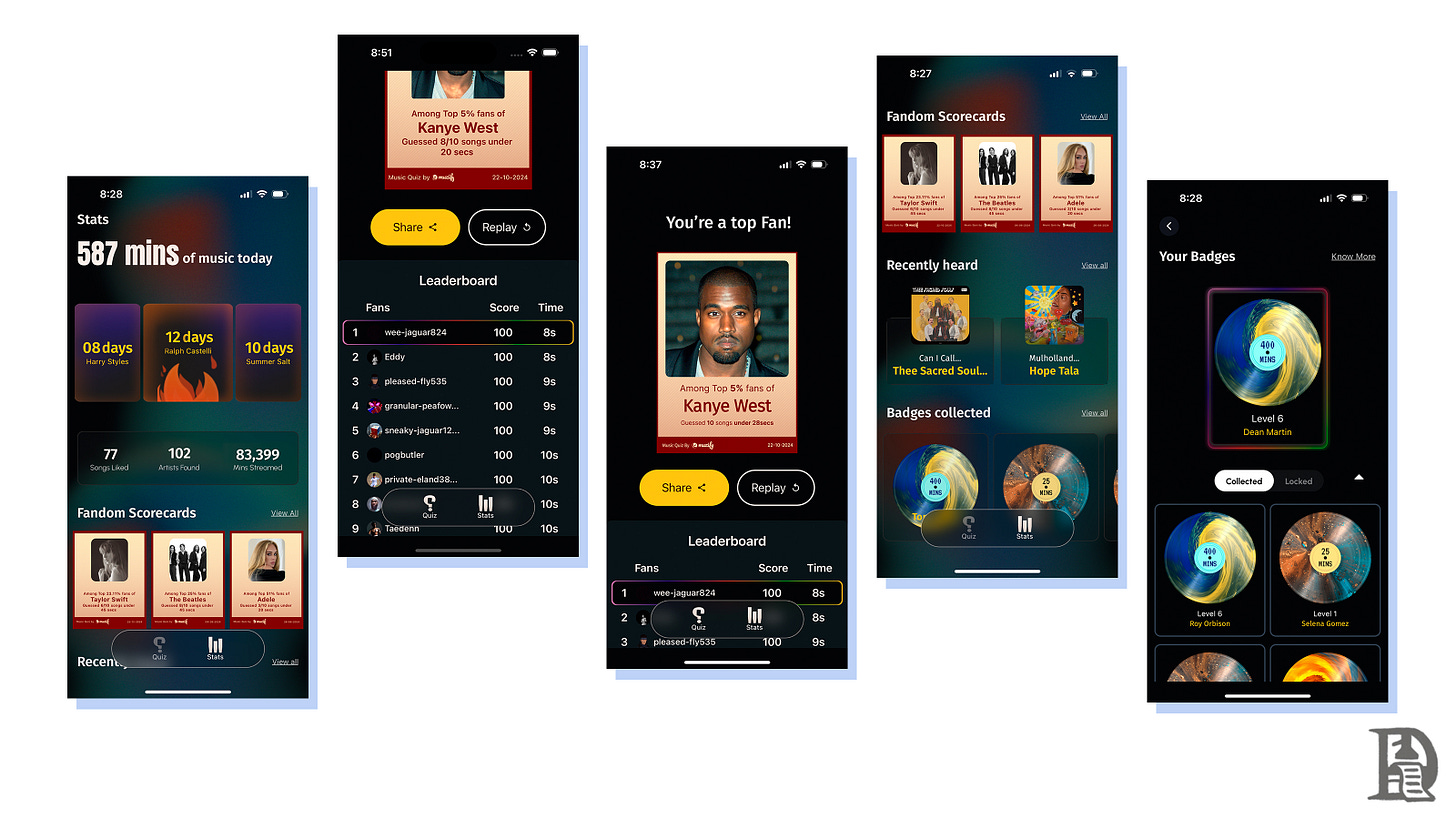

What they have created is an on-chain graph of sporting enthusiasts. We have seen a variation of this with Music in one of our portfolio companies too. Muzify allows users to plug in their Spotify account and receive a relative rank of how often they stream an artist’s music. Close to a million users have interacted with the product in the last few months. As more users flock to the product, Muzify would be able to take this graph of “verified” music enthusiasts and offer them free concert tickets or early access passes to indie artists who often have little to no data about who their most committed audience base is.

Nameet, the founder of Muzify, shared two interesting observations with me. Firstly, that Kanye West is the most streamed artist in his user base. No surprise, I guess. And secondly, that the real “clout” for users is finding obscure, relatively unknown artists. Users routinely want to “flex” their knowledge of lesser-known artists to display taste.

One of our readers, Jaimin, has been building a similar product. It helps users “check-in” to niche websites using a browser extension. So if you are early to a site being launched (like Google in 1998) and it blows up and becomes huge, you’d have an on-chain credential that is time-stamped in your wallet to prove it. What’s the use of this check-in? At this point, it is nothing. It simply signifies a user’s ability to be early to trends and discover new websites before they blow up.

For such niche social networks to evolve, they will need a critical mass of users. Both Receipts and Muzify currently curate the user's experience to build that critical mass of users. Over time, the platform evolves only when user-to-user interaction increases within their platforms. And that is when they become a social network.

But how do you maximise the financial outcomes here? What is the business model? Is it simply bundling users and offering them to the highest bidder like it already happens? Probably not. For such businesses to scale, there need to be three core elements.

First, asset issuance. A user contributing to a Web3 social network should be able to have an asset for their contribution. Receipts and Muzify use NFTs for this today. In the future, it could be points that are redeemable for tokens.

Second, context and trading. A single asset, issued with nothing to do with it becomes irrelevant over time. Polymarket functions because it has multiple tokens on it with varying prices that are linked to how attention flows to specific topics. The same could be said of PumpFun.

Third, coordination. Of the 2.5 million tokens launched on Pump, less than five have a market cap north of $100 million today. The reason is that most of these tokens are launched to play a game of volatility. Whenever these assets are linked to a real community that requires on-chain coordination (through a DAO), we will see more value in the tokens and the platform that facilitates it.

A mental model to be used is that blockchain networks are the dynamic part of a social network. Events that occur on-chain, like the price of an asset moving, or a user moving large swaths of assets can become the basis for a social network. It is what would happen if Venmo was a social network. Except, in this case, the stream of transactions you witness is global and far more interesting. One of our portfolio companies (0xPPL) has been building on top of this thesis.

Blockchain rails can enable the financialisation of existing social graphs, too. Telegram has close to 800 million active users monthly, and they are now being monetised through the TON network. According to TONStat, close to 23 million wallets exist on the network. Why does it matter? TON’s extremely heavy density of retail users is a powerful distribution outlet for emerging apps to find a footing.

The existence of multiple chat groups users are already plugged into helps make social financial interactions a possibility on the network. In fact, Telegram’s adoption of TON is perhaps the best instance of where we have seen “sufficient financialisation” occur.

The application (Telegram) itself remains centralised. The network (TON) is a medium of global value transfer. As of May 2024, Telegram was also experimenting with sharing splits of ad revenue and sticker pack sales from Telegram with creators on the product. In such an instance, the elements of crypto are not used for open access or user ownership but rather for monetisation.

What the Future Looks Like

One of the things that becomes apparent when you study the nature of social networks is that incumbents are not disrupted by a better alternative. Instead, they are taken over by a vastly different product that serves the same function. TikTok was not a better Instagram was not a better Twitter was not a better AOL chat. Apologies for murdering grammar in that sentence, but you get the gist. The future of Web3 social networks will not look like a better Twitter. Instead, it would look closer to the attributes that the industry does well today. Those of speculation, verifiable rank (clout), and ownership.

Seen through this lens, our understanding is that the next big social network will be closer to an exchange. Today, when Binance lists an asset, it is quickly picked up by tens of millions of users. The next big social network could quite possibly be one that highlights assets users gather around and trade with. Moonshot and Pumpfun are two instances of this happening. But structurally, they do not solve the age-old problem of fixing media or the incentive systems that plague Web2 native social networks today.

Web3 native memes (like Goat) propagate on conventional social networks like Twitter already. Any time these LLM-run accounts tweet out content, users are quick to retweet and create distribution for the lore attached to it as they have a financial incentive. We don’t quite know what behaviour could look like if we did the same with community-created content. Would users distribute stories better? Can a locally run newspaper sustain if a community owned it? We don’t quite know. But here’s what is apparent.

Instead of everybody having their “fifteen minutes of fame”, assets will temporarily rally to $100 million in fully diluted value (FDVs) due to the amount of attention flowing towards it. Study the nature of meme assets like Moo Deng and you can see this live today. But how do you go beyond speculation?

The history of the web, has been one of bundling and unbundling. Niche products like Receipts and Muzify are stand alone applications where the users are not interacting with one another today. But that may change as users realise that the assets (NFTs or tokens) are inter-operable across the protocol (Base). When this occurs, we will see interfaces that blend on-chain primitives with feeds. They will empower users to discuss, own and coordinate on topics that are relevant to them. The products that manage to do that well, are best positioned to be the next big social network. Web2 social networks commoditised our attention and sold it to advertisers.

Blockchain-enabled social networks have the potential to return agency to users through a more nuanced mechanism: the ability to capture, trade, and benefit from the value they create.

What would that look like? Joseph Eagan from Anagram once shared an interesting analogy with me. The Gamestop revolt on Reddit from 2021 offers some clues. Users gathered together to hunt short positions held by a hedgefund against Gamestop that year. The content for the trade was posted on Reddit. The trades were executed on platforms like Robinhood. If our assumption is that an increasing amount of the world’s assets will be tokenised and on-chain - a Web3 native social network would have helped users

(i) Execute the trade

(ii) Split portions of the profits with the platform and

(iii) Reward the originator of the trade alongside the moderators of the community.

But that did not happen. Instead, much of the value (and risk) of that trade was captured by platforms like Robinhood that executed the transaction.

Can Web3 social networks bring back newspapers? Quite possibly, no. I think we are past that phase of media. Perhaps we are evolving into a phase of the web where community members own, curate, and monetise content on their own with less reliance on advertisers to aid content monetisation. Substack is a preview of the future of the web. They are (ironically) built on fintech rails, which restricts their ability to empower creators to give ownership to audiences.

If markets (like Polymarket) are the ultimate truth-seeking machines, then combining financial incentives with communities are perhaps a better model of monetising than the raw attention economies that exist today. Meme coins are a predecessor to what the web could look like. We are stress-testing primitives that can power the future. It rhymes with mania and is borderline comical occasionally.

But perhaps, zoom out a bit, and you’ll notice that the primitives we need to build the future exist here and now.

Seeking coffee beans,

Joel John

If you liked reading this, check these out next:

From Bluesky's funding round..

"This does not change the fact that the Bluesky app and the AT Protocol do not use blockchains or cryptocurrency, and we will not hyperfinancialize the social experience (through tokens, crypto trading, NFTs, etc.)."

https://bsky.social/about/blog/10-24-2024-series-a