Will All L1s Move to Ethereum?

Build airlines not airports ✈️

Hello,

Sid and I have been in Singapore over the past few days. I have been enjoying my share of Ramen and being introduced to Muro Coffee in Chinatown. I will be on a panel tomorrow at Token2049 discussing all things M&A. If you are in town, come say hi! We hosted one of our first in-person events yesterday and had the opportunity to meet several of you for the first time.

Before we begin, I want to say thanks to all the lovely souls who came and hyped us up on Twitter on our last post. The quote-tweets on that post will serve as a source of courage to work through writer’s block for months to come.

Someone dear to me told me recently that humans are never perfect. If we were, we’d be walking around like Barbie dolls. Enterprises and consensus-based systems like blockchains are made up of humans. And these imperfections also reflect on them. The beauty of life is that it allows us to evolve. So does technology.

Today’s issue reflects on how this principle applies to Ethereum. We are seeing a multitude of blockchains returning to Ethereum as the protocol evolves. We teamed up with the kind folks at Hazeflow to explore the reasons why. In editing this, I had to wonder, are we delivering an economic story or a technical one? One way to think of it is that technical updates slashed roll-up costs by 95%. Technical changes often have very economic after-effects. This piece explores what they are.

As always, if you are researching consensus mechanisms, on-chain markets or launching new primitives, reach out to us at venture@decentralised.co. We’d love to chat.

Joel

Please note that this article has been updated after receiving feedback from the Ethereum community.

Whenever I fly, I realise how airports divide various aspects of the journey. There is a clear split of responsibilities. The airport authority operates security checkpoints and patrols the perimeter. The control tower maintains a single, reliable log of takeoffs and landings, coordinates runway and airspace safety, and publishes records that everyone trusts.

Airlines don’t manage airport security or logs of all the flights. Every airline managing its own security would be chaotic. They handle flights in the air and on the ground, including boarding, luggage, gates, and schedules. After each flight, the records flow back into the tower’s log.

In the early days of the Internet, Computer scientists Jerome Saltzer, David Reed, and David Clark described the same split on the early Internet. They called it the End-to-End Principle. The idea was to keep the core reliable and straightforward, and push features to the edges.

Ethereum took after this idea. Layer 1 remains small, focusing on agreeing on the order of transactions (consensus) and ensuring the availability of raw data (data availability). Rollups live at the edge. They do the heavy execution, then write their results and data back to Layer 1 so anyone can verify. This is why the roadmap invests in cheaper data and neutral block building at the core, as well as faster and cheaper execution on rollups at the edge.

Running your own L1 means running the whole airport. You must hire and pay validators, maintain security, and publish records everyone trusts. Then, you must persuade users and developers to join your network.

You have complete freedom to operate as you wish. The trade-off is that you bear all security costs and must work to concentrate liquidity in one place.

Building as an Ethereum L2 means flying on a shared airport. You manage your schedules, fee model, and execution, then write results back to Ethereum’s log. You inherit security and liquidity from day one. The trade-offs are real. You live with Ethereum’s upgrade cadence and proof rules. You design around withdrawal timing and sequencing. But the operational burden and the cost of trust drop by an order of magnitude.

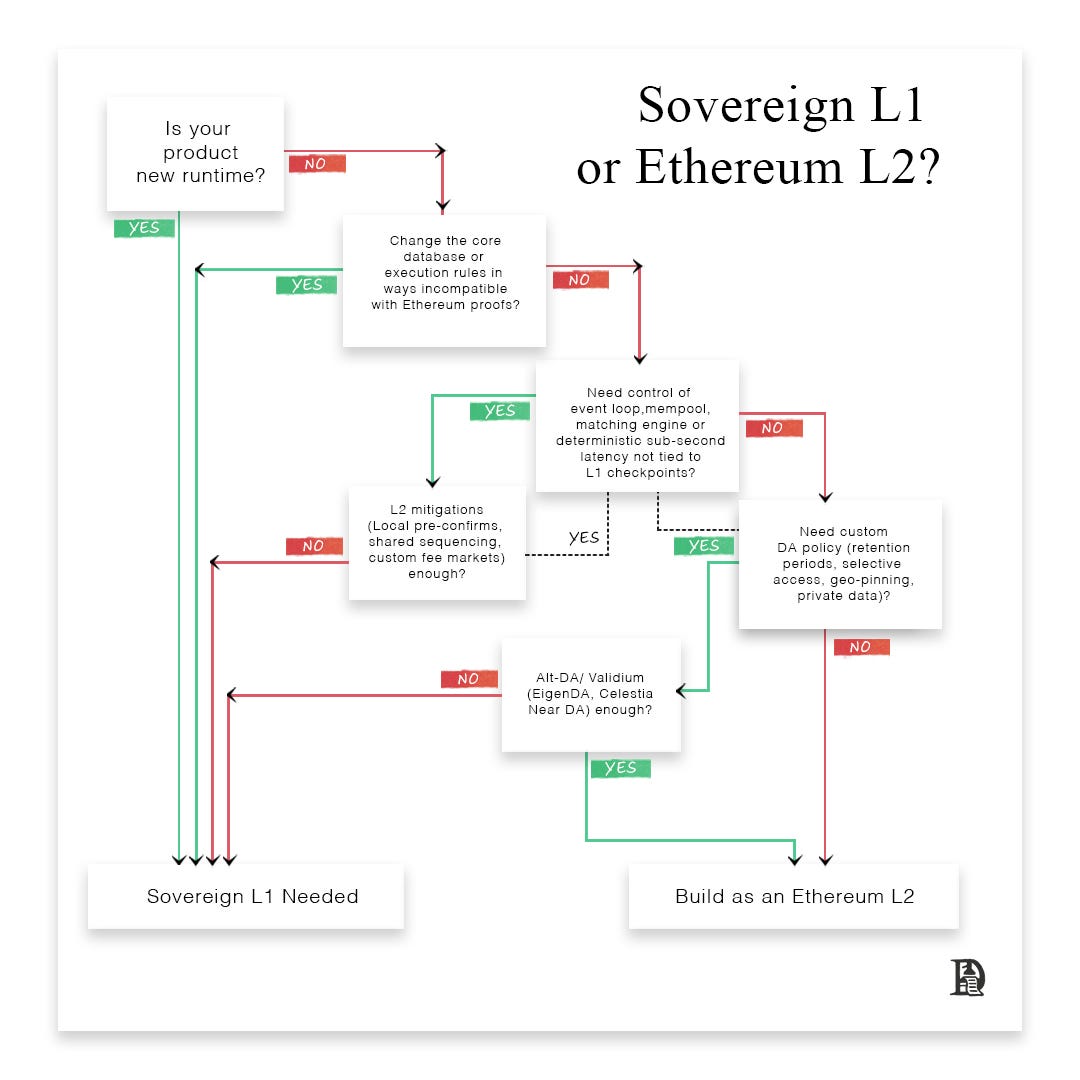

So, this is the theme of the piece. Who should run an airport, and who should just fly more planes? To us, the answer is to adopt a new trust model, non-EVM execution, or governance you should build outside Ethereum. Choose L2 for product speed, user reach, and access to capital.

We demonstrate how Ethereum-enabled rollups, the changes that unlocked the rollup-centred roadmap, and why recent migrations confirm this. Ethereum did not initially plan to use rollups as its scaling solution. Initially, the idea was to shard or break Ethereum’s execution itself, which involves splitting the network into multiple parts that execute different smart contracts. As a result, the raw throughput is higher, but it complicates building across shards. It adds more complexity in terms of coordination and introduces new security and user-experience risks.

How did Ethereum make rollups work?

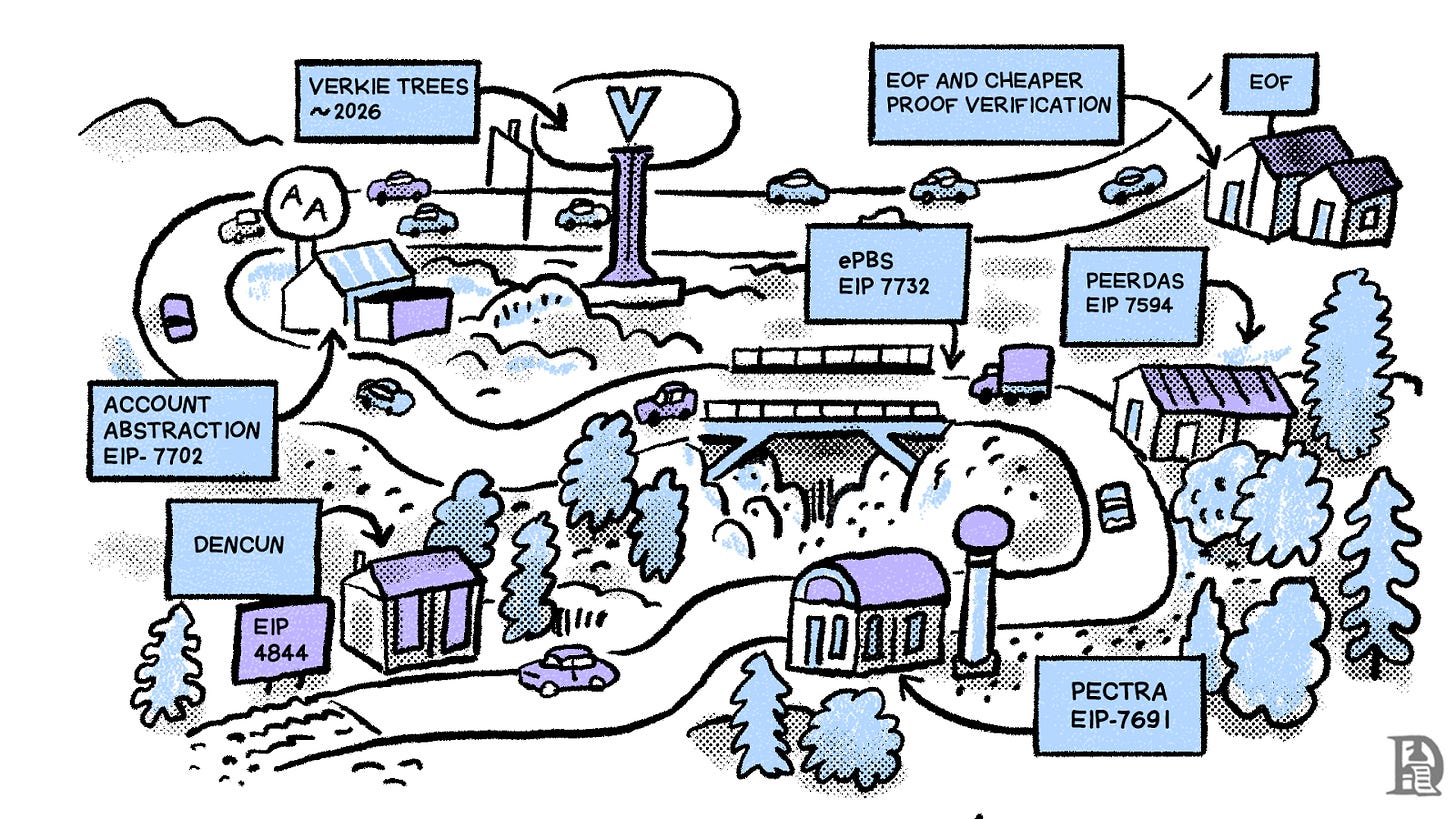

Ethereum’s recent upgrades explain why L2 adoption is accelerating. Each upgrade either reduces data costs, enhances neutrality, or improves the user experience. Together, they turn rollups into a practical place to build.

EIP‑4844 aka Dencun

Ethereum added a new space called blobs to store rollup data with this upgrade. Previously, rollups used a method called “calldata” to store data on Ethereum. Think of it like the “memo field” that tells a smart contract what function to execute and with what parameters. This data would be stored permanently in Ethereum blocks. Rollups paid dearly for this data storage.

However, rollups don’t need to store the data on Ethereum forever. Through this upgrade in March 2024, Ethereum added a sidecar to its main block. It was referred to as a blob and given a lifespan of 4,096 epochs (~18 days). Since blobs free up disk space for validators, they are significantly cheaper than calldata, approximately 95% cheaper.

This is equivalent to how cloud storage costs dropped to a point where it made sense for businesses to store their data on different clouds. This upgrade enabled Ethereum to transition more effectively from a B2C business model to a B2B2C model.

The Dencun upgrade is the first step in making rollup costs more affordable, and it achieves this by making rollup data ephemeral.

EIP‑7691 aka Pectra

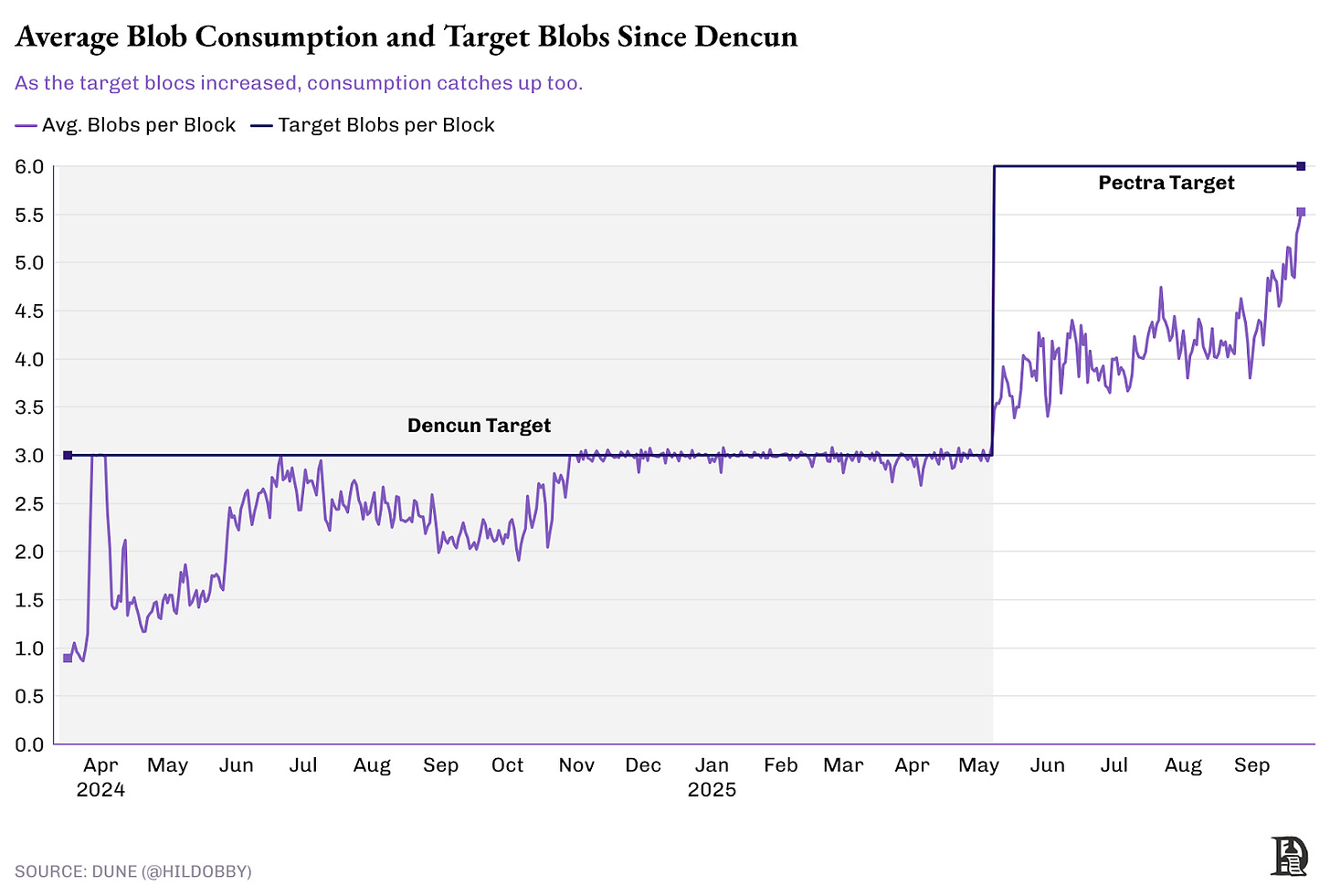

This upgrade increased the number of blobs per block. While the first step was to create a separate space for rollup data, the second step was to increase the capacity of that space. Within months, the initial capacity was used by the rollups. In May 2025, Ethereum took the next step to increase this capacity (target moving from three to six, with a maximum of nine). More supply pushed the price of blobs down, creating room for higher-throughput uses, such as real-time games and micropayments.

Since Pectra (May 2025), rollups have posted about 28,000 blobs per day, up from around 21,000 before. That works out to roughly 3.9 blobs per block on average (Ethereum makes ~7,200 blocks/day). During busy periods, blocks often reach six blobs, and sometimes the 9-blob cap is reached. The capacity is being utilised, and we will hit the ceiling again without PeerDAS, an upgrade that will be explained later.

After Dencun, the blob target per block was three. You can see that this target has been consistently being hit since November 2024, resulting in congestion. With Pectra, the target was raised to 6 blobs per block. You can see that gradually, the actual utilisation is reaching the target.

EIP‑7594 aka PeerDAS

This introduces data availability sampling, which suggests that there is no need to check everything. With a new data storage mechanism, Ethereum brought down the cost of posting data, but verifying this data still required the same effort. A complete node has to download all the blob data to confirm that the data is indeed present. PeerDAS is about a new approach to sampling data that significantly enhances the efficiency of verifying data availability.

Each node checks small, random pieces, and together the network is confident that the complete data is available. With sampling, Ethereum can raise the capacity from today’s ~6‑blob target to roughly 48 blobs per block (with a possible cap near 72) without forcing home stakers (small validators) to upgrade their hardware.

At the Pectra settings (6-blob target and 9-blob max), Ethereum offers approximately 8.15 GB/day of blob space; at a 48-blob target, which increases to roughly 65 GB/day. More supply pushes blob prices down and lowers L2 operating costs. Client tests also show that consumer hardware can handle 16‑blob blocks when optimisations like distributed blob building are used.

PeerDAS ships as part of the Fusaka upgrade, expected in December 2025. Beyond data availability sampling, Fusaka includes gas limit increases and introduces blob base fee bounded by execution cost, ensuring blob fees can’t drop to zero. This pricing floor maintains sustainable economics for validators and rollup operators alike, preventing demand from overwhelming supply as blob capacity expands.

EIP‑7732 aka ePBS

With this, Ethereum aims to increase transparency in the block-building process. Today, block production depends on off-chain relays, which can be opaque and prone to censorship or MEV concentration. With ePBS, the proposer (who wins the slot) and the builder (who assembles the block) are formally separated at the protocol level.

The most impactful feature of ePBS is delayed execution. While Ethereum slots are 12 seconds long, validators only have about 4 seconds (the attestation deadline) to download a block, execute all its transactions, verify everything is correct, and then vote (attest) on it.

This tight timing forces a trade-off: either keep blocks small and cheap to process, or risk that slower validators can’t keep up. With delayed execution, validators can vote on a block’s consensus validity (whether it arrived on time and follows the rules) without waiting for full transaction execution. The heavy execution work gets deferred to the next slot, giving the network much more time to process larger, more complex blocks without forcing validators to upgrade their hardware.

For rollups, ePBS strengthens Ethereum’s role as a neutral, high-throughput settlement layer. The delayed execution model reduces the risk of censorship and improves Ethereum’s capacity to handle more rollup data. It ensures rollup transactions are finalised fairly and efficiently, which is a key requirement for large-scale apps and institutions moving onto L2s.

RISC-V

In April 2025, Vitalik proposed replacing the Ethereum Virtual Machine (EVM) bytecode with RISC-V as a long-term upgrade to Ethereum’s execution layer. RISC stands for Reduced Instruction Set Computer. It will have a major impact on proof generation for ZK rollups. Proof times can be reduced from minutes to seconds, achieving up to 100x efficiency gains.

Currently, ZK rollups don’t post data on Ethereum as frequently because proofs take longer and costs are higher. Both proof times and size will decrease with RISC-V implementation, making ZK rollups much cheaper.

Dencun added a new way of storing rollup data that cut costs. Pectra raised this capacity. PeerDAS will raise it again without overloading nodes. Even if revenue per transaction falls as fees drop, operating costs fall faster.

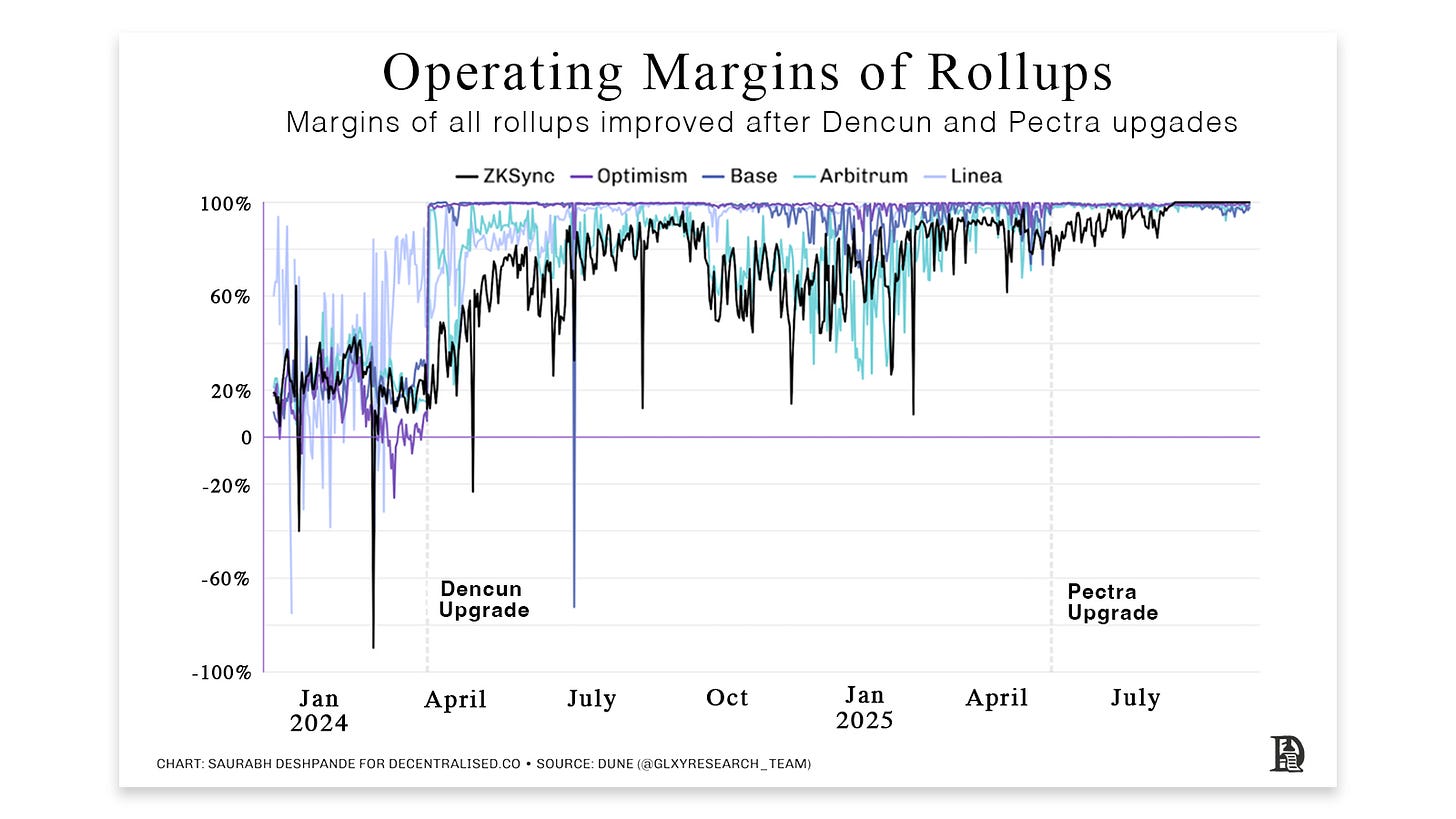

Galaxy Research estimates that after Dencun, rollup operating costs fell from about $1 million per day to roughly $135,000 to $200,000 per day, which pushed optimistic rollup margins toward 90%. If PeerDAS multiplies blob supply again, costs should fall further. In plain terms, rollups are starting to resemble software businesses, with gross margins ranging from 80% to 95%. That is a signal for L1s and apps to migrate.

Impact on Rollup Economics

Technical upgrades are great, but at the end of the day, rollups are also businesses. Unless they are profitable and sustainable, why should anyone run beefy machines that execute transactions to settle on Ethereum?

For rollups, revenue is generated from the gas fees users pay for their transactions (and fee sharing if you are a part of a collective like the OP Superchain, but we don’t want to complicate things). The cost is the fees rollups must pay Ethereum for settlement and data availability. Of course, rollups incur fixed costs in terms of hardware and its maintenance costs.

We examine some numbers to determine whether the technical upgrades implemented by Ethereum over the years have made life easier for rollups.

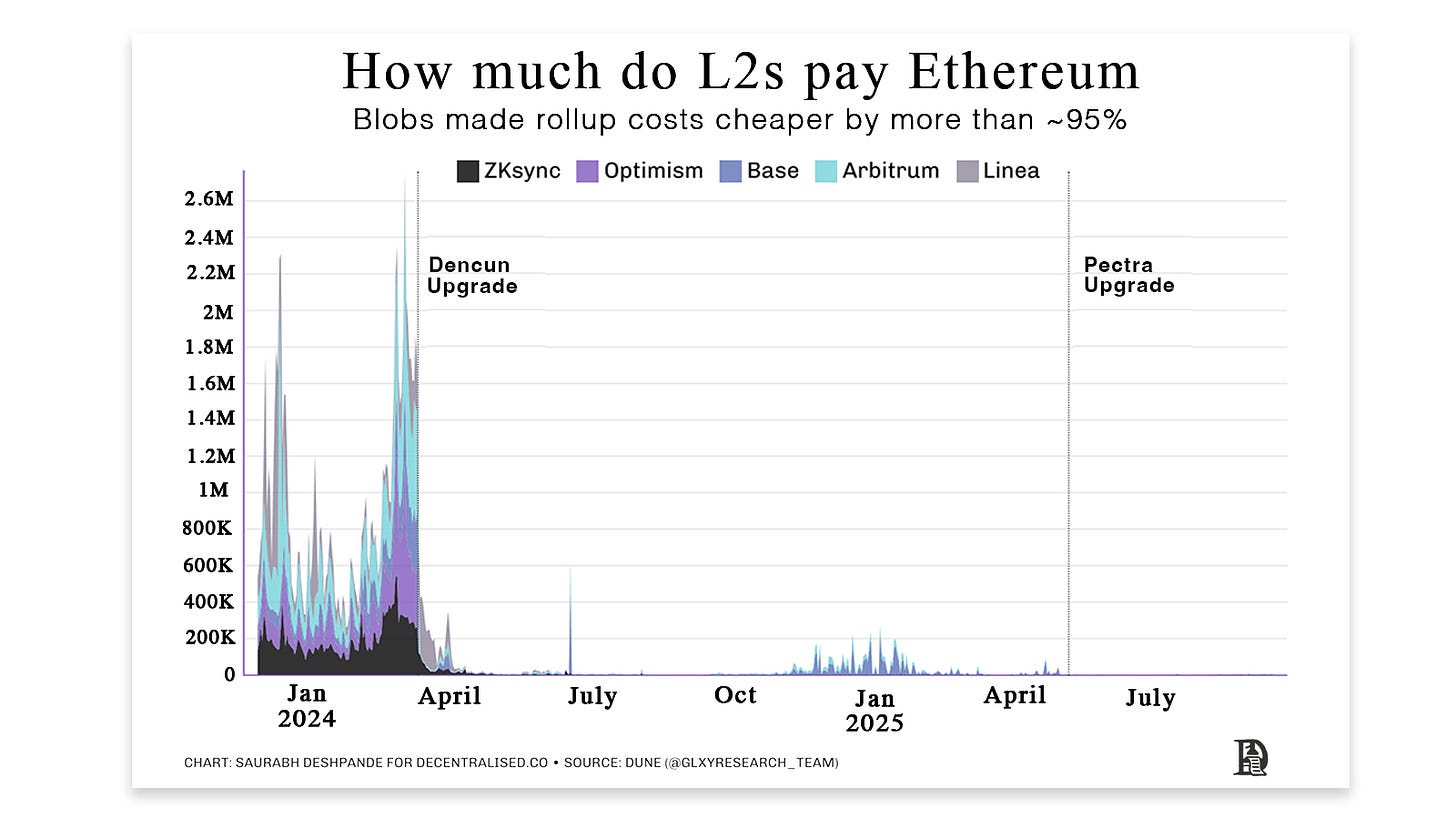

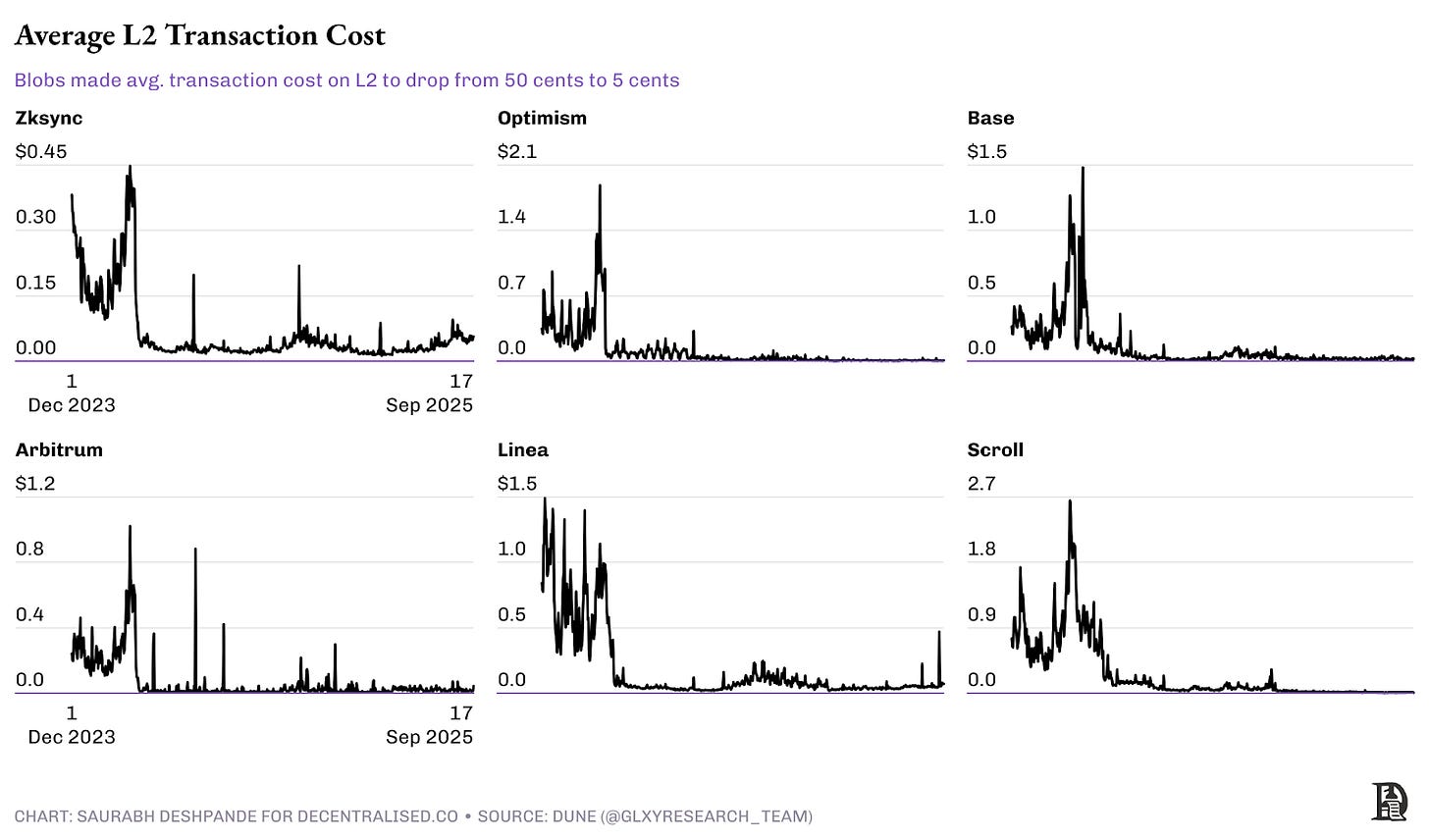

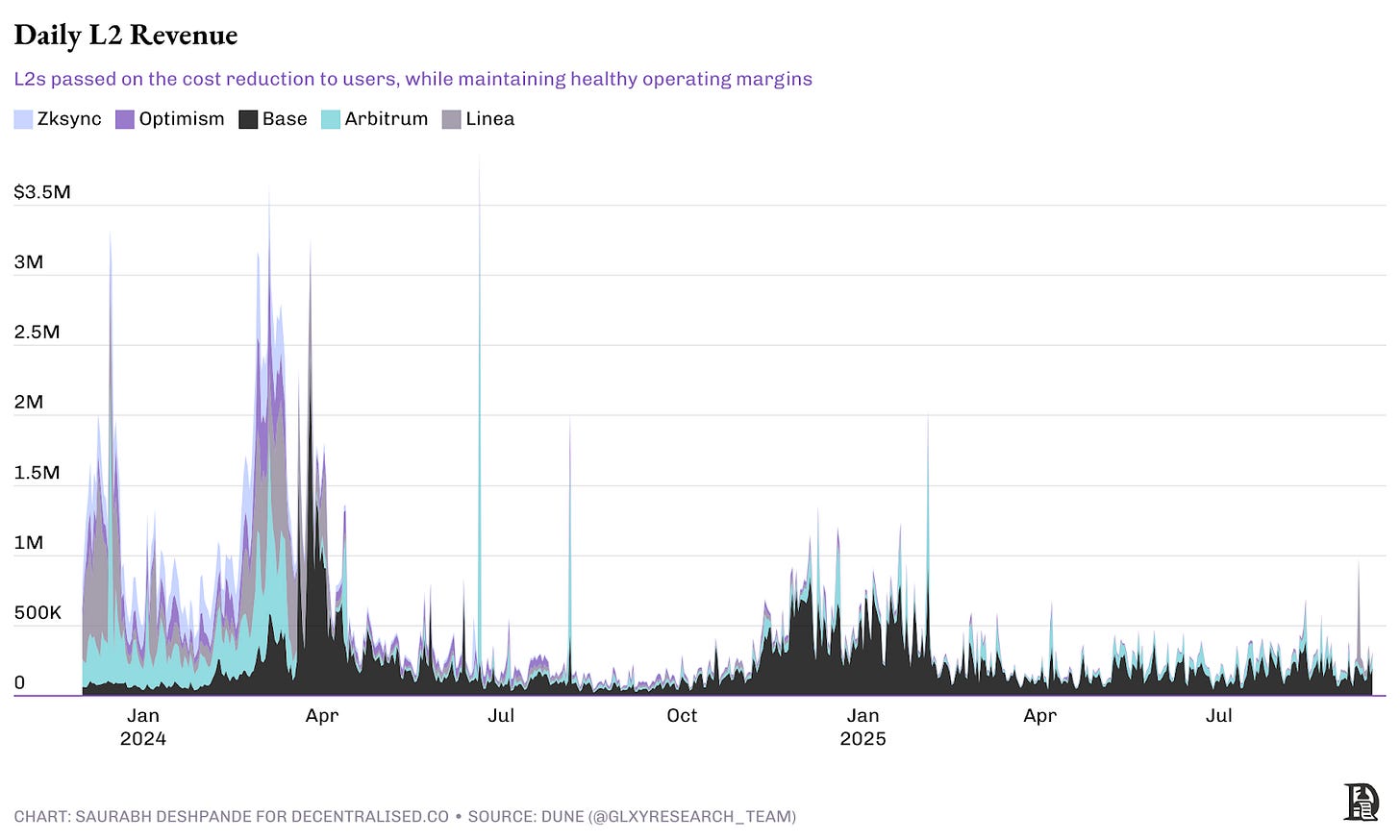

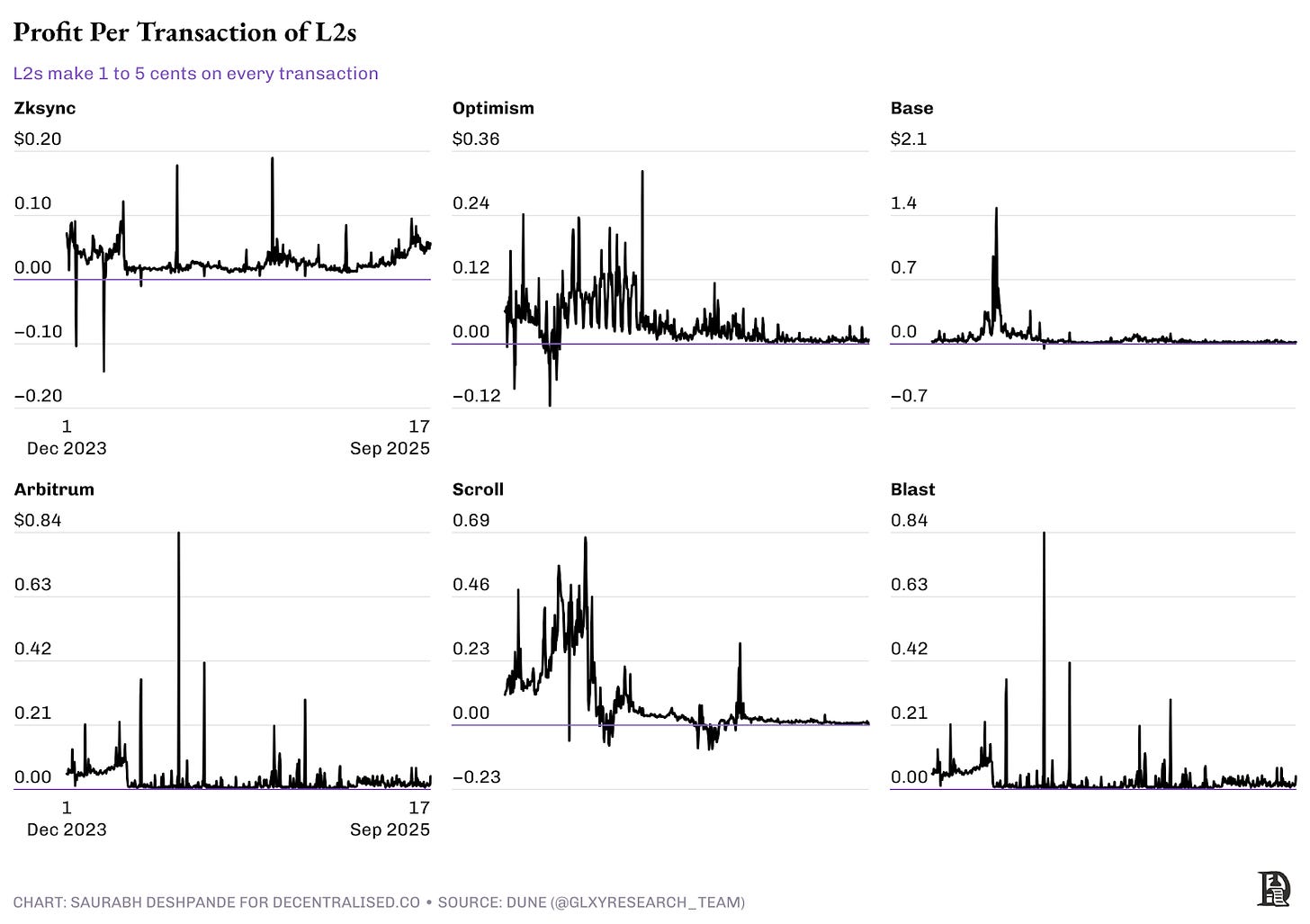

The first is the operating margin. It is the difference between revenue and cost. Most rollups enjoy an operating margin of over 90%. You can see that with the Dencun upgrade in March 2024, blob costs or the cost of posting data on Ethereum dropped by 90%. Naturally, operating margins improved for all the rollup operators.

There have been periods, such as December 2024, when the operating margins for rollups dropped. This was because of blobspace congestion. The limit at the time was three blobs per block. As demand constantly hit this target, rollups had to bid higher fees to get into blobs. This is what resulted in higher costs and reduced margins for rollups. The Pectra upgrade in March 2025 increased the number of blobs per block from three to six, resulting in healthier margins for rollups.

We can double-click on the margins to explore the cost and revenue sides. All the rollups used to pay well over $1 million to Ethereum every day for storing data in the form of calldata, blobspace, and ZK proofs. With the Dencun upgrade in March 2024, this daily cost dropped from over a million to just a few thousand dollars every day.

Rollups passed on the reduced cost benefits to users. The result was lower L2 transaction costs. Costs that used to hover around 50 cents dropped to about 3-4 cents.

Consider how expensive airline tickets would be if airports were operated individually by each airline. The costs of security, maintenance, and record maintenance, among others, would all be passed down to customers. When multiple airlines share the same airport infrastructure, all the costs get divided among them. This is what is happening with Ethereum and rollups.

This coupled with apps developed on L2s, resulted in increased activity across L2s. The bulk of the daily active addresses comes from Base (~1 million) and Arbitrum (~300k).

Thanks to sustained activity, rollups like Base and Arbitrum have maintained a decent revenue run rate. While Base generates over $100k in daily revenue, Arbitrum surpasses $50k. Base’s EIP‑1559 auction system lets the sequencer capture arbitrage and ordering value that would otherwise dissipate.

Other L2s are adopting similar methods. For example, Arbitrum’s new TimeBoost feature lets users bid (auction) for express execution slots, with the sequencer pocketing the proceeds. All these fee streams flow into the L2 operator’s coffers, allowing teams to fund R&D, grants, and growth directly from operations, rather than relying on token sales.

Rollup unit economics resemble those of a fintech. You sit on top of someone else’s rails and earn a small take on each transaction while paying fees upstream. A payments app pays scheme and interchange fees.

A rollup pays blob fees, L1 gas, and proof costs. Gross margin is the spread between what users pay and what Ethereum charges. Both rollups and fintechs have fixed costs that remain constant with each additional transaction. The more volume they push through, the cheaper each transaction becomes on average, and margins improve. For fintech, that is compliance and risk systems. For rollups, that is, sequencer infrastructure, monitoring, and audits.

Both live and die on retention to recover customer acquisition cost. Working capital gets tied up in buffers. Fintech keeps chargeback reserves and settlement float. Rollups hold bridge liquidity and wait through fraud windows. Margins are sensitive to base layer rules. Fintechs are sensitive to interchange caps. Rollups are sensitive to blob pricing and data rules.

Extra revenue comes from priority and MEV share in rollups, much like premium tiers, FX spreads, and treasury income in fintech. Rollups generate approximately $0.01 to $0.05 of gross profit per transaction.

To L2 or not to L2?

The most crucial operational difference between being your own chain or a rollup sequencer is the validator set. When you are a sovereign chain, you manage your own validators. On the other hand, when you are a rollup, you outsource the validator responsibility to Ethereum. It’s like an airline that operates its own airport, rather than sharing it with other airline operators.

Validators are often businesses that operate nodes for different chains. Often, it’s about which chains consistently make them more money. When you are a sovereign chain, you want different validators to run your chain; that is, your software. Naturally, you must compete with other chains so that the validator revenue of your chain is comparable to theirs.

Typically, validators make money through token incentives and fees. This means that you must keep the incentives high enough and hope that, at some point, fee revenue takes over. All of this is not for acquiring users, developers, or things that help you grow. It is simply that the chain continues to produce blocks; it remains in existence.

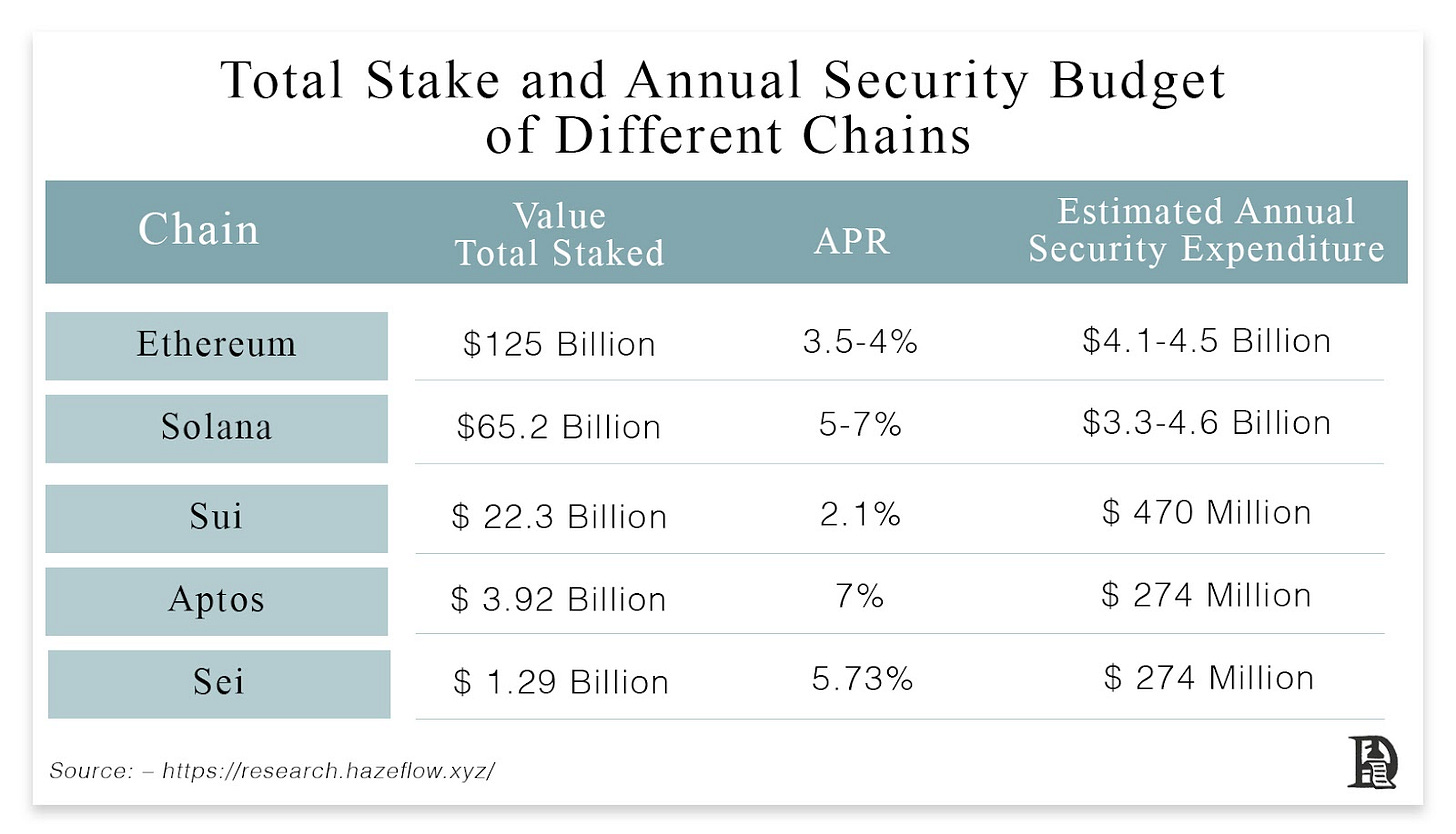

Here’s a rough estimate of what you are up against. Large proof-of-stake L1s spend billions of dollars annually on validator rewards. For example, Ethereum currently has approximately $125 billion staked at a rate of around 3.7% APR, spending roughly $4.5 billion per year on security, while Solana has approximately $65 billion staked at a rate of around 6% APR, spending around $3.9 billion per year on security. As an independent chain, you will have to spend tens of millions of dollars a year just to keep producing blocks.

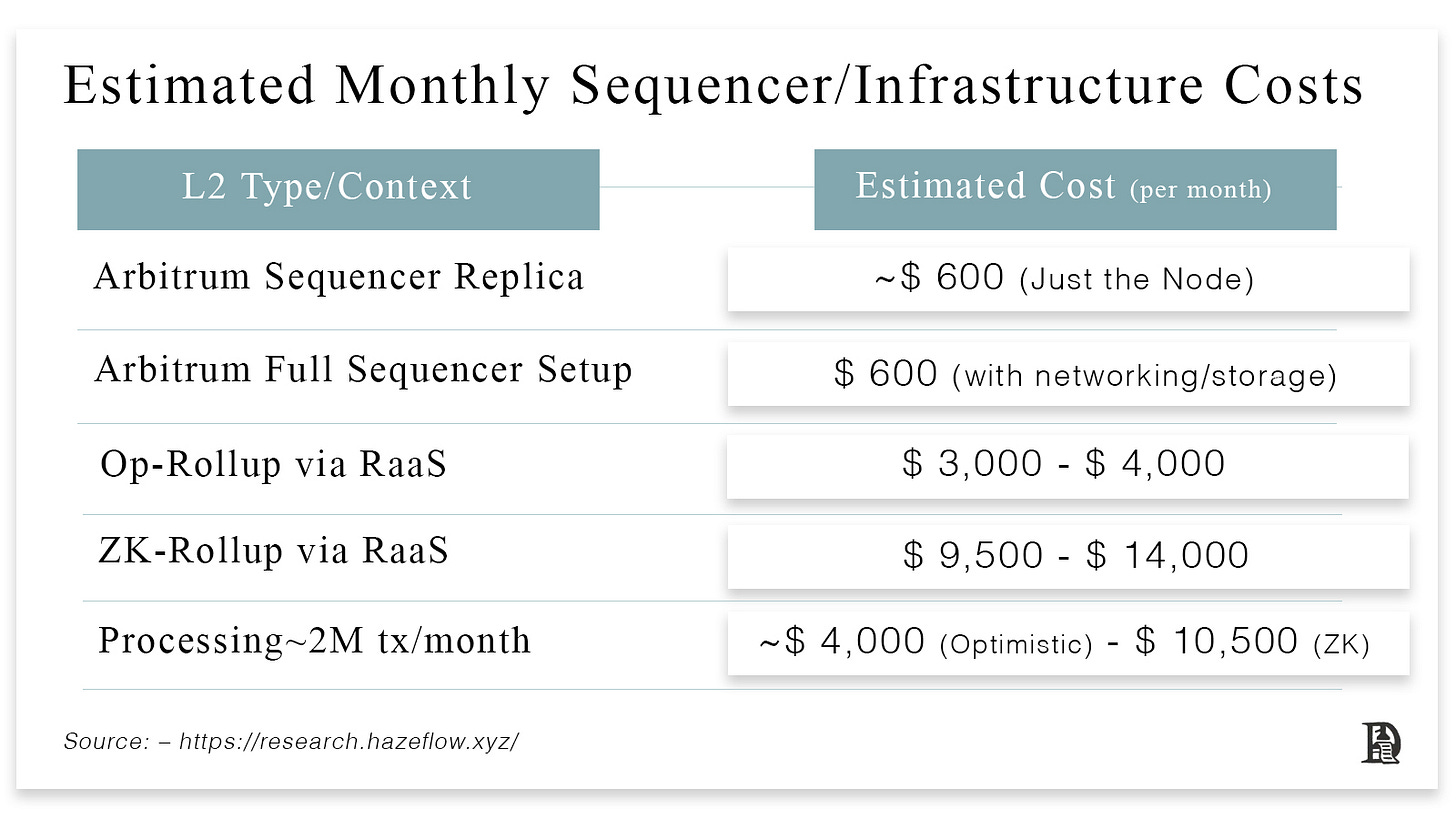

On the other hand, running an L2 sequencer is cheap. These are the estimated costs.

The next concern for an independent validator set is the number of validators. That is how many different machines run your chain’s software. The diversity of Ethereum’s validator set is unmatchable. It has over a million validators and has run without a single hour of downtime ever since the PoS network went live in 2020. Most chains with smaller validator sets have faced issues.

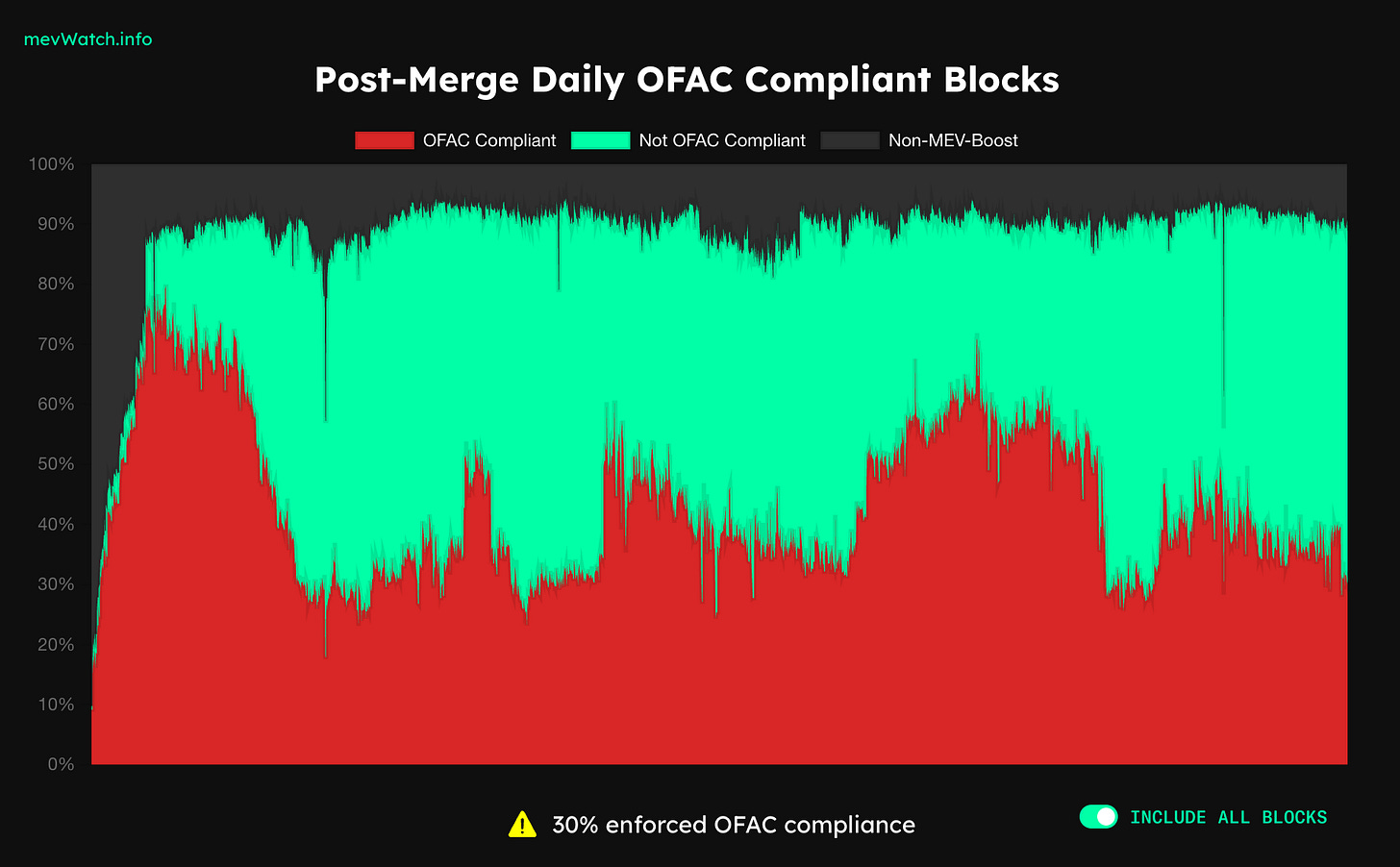

The size of a validator set matters fundamentally for censorship resistance. With hundreds of thousands of independent validators distributed globally, no small coalition can persistently block transactions. A government, attacker, or group of colluding operators would need to compromise or coordinate an enormous, decentralised network. By contrast, chains with just dozens or a few hundred validators create concentrated points of failure where censorship becomes logistically and economically feasible. This is evident from the following chart, where non-OFAC compliant validators keep producing blocks consistently.

Rollups inherit this censorship resistance through force-inclusion mechanisms. Even when a rollup sequencer has centralised control over transaction ordering, users maintain an escape hatch: they can bypass the sequencer entirely and submit transactions directly to Ethereum’s base layer. This gives rollups what’s called eventual censorship resistance. A sequencer might delay your transaction temporarily, perhaps to extract MEV or respond to external pressure, but they cannot block it permanently. If the sequencer refuses to include your transaction, you force it through by posting directly to L1.

Optimism allows immediate force-inclusion, while Arbitrum enforces a roughly 24-hour queue. In both cases, the underlying guarantee is the same: censorship cannot persist indefinitely because users always have the option to route around the sequencer. The sequencer’s power is limited to temporary ordering control, not permanent gatekeeping.

Cosmos Hub has about 180 validators, and Monad is estimated to start at around 200. Even well-funded L1s struggle to achieve meaningful decentralisation when they’re competing for validator attention with established networks that offer better economics and proven track records. Note that this is not because they can’t decentralise further, but because they have to make a trade-off between speed and decentralisation.

Most independent L1s are asking users to bet billions of dollars on consensus algorithms that have existed for only a couple of years. When Ronin suffered a hack, the attack didn’t require sophisticated exploits. The majority of the nine (yes, 9!) validators were compromised, resulting in the theft of $600 million.

This security model creates what amounts to an elaborate theatre performance. You’re constantly trying to convince users that your few hundred validators are more trustworthy than Ethereum’s hundreds of thousands, that your few hundred million in staked tokens provide better security than Ethereum’s $125 billion, and that your two-year-old consensus mechanism is more battle-tested than the network that’s never gone down.

Liquidity and Network Effects

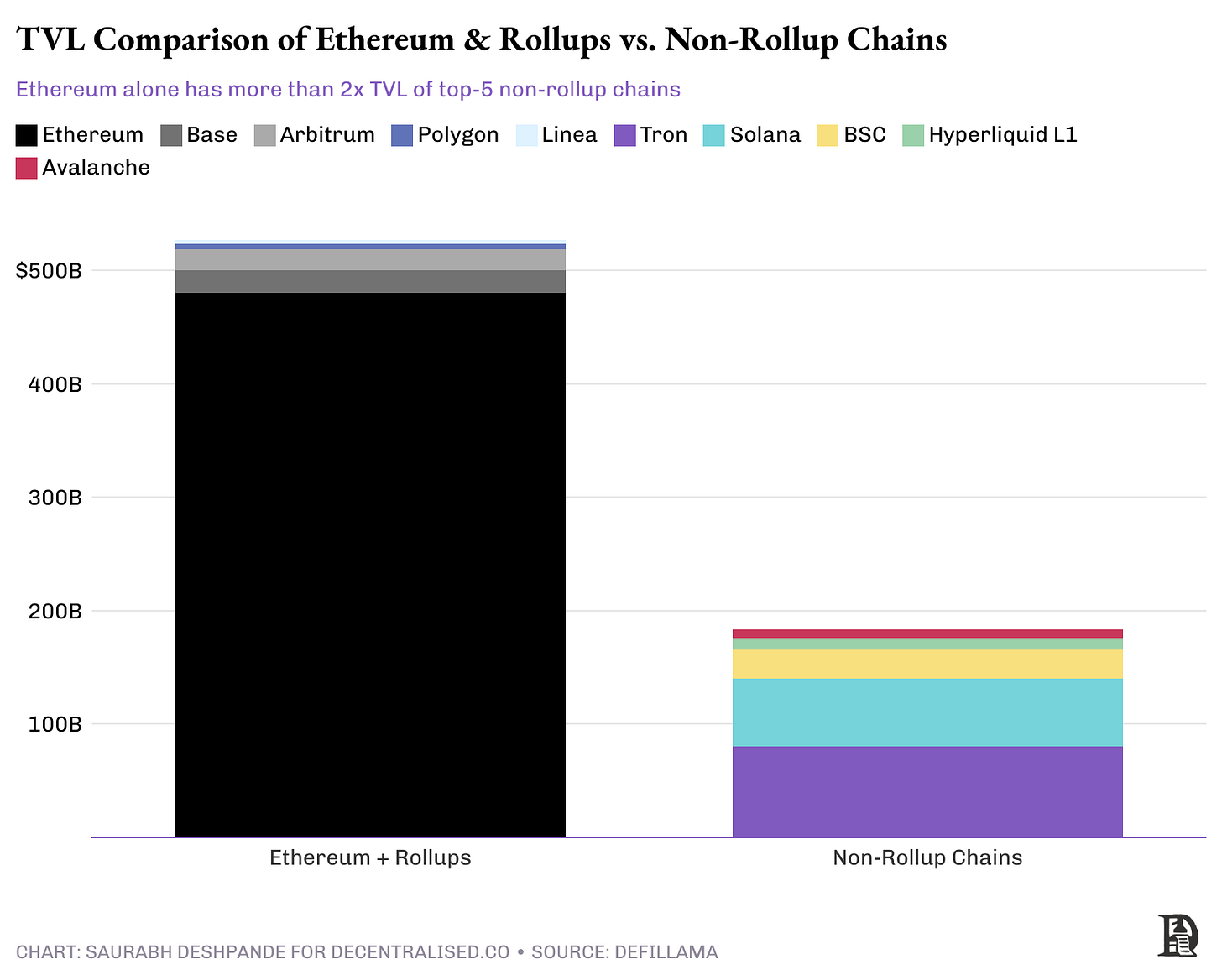

One of the most underappreciated advantages of migrating to Ethereum L2s is instant access to liquidity. Ethereum and rollups house more than double the value of the top five non-rollup chains.

Chains built on the OP Stack or Arbitrum Orbit inherit Ethereum’s liquidity from day one. This happens in two ways.

Canonical Ethereum bridges. These are smart contracts on Ethereum that lock assets on L1 and mint equivalent representations on L2. Users can transfer assets from Ethereum to the new L2 through these bridges.

Once a new rollup integrates existing third-party bridges, an application with user traction can obtain liquidity from the rest of the Ethereum and rollup network.

When a sovereign L1 launches, it starts with empty pools. Every dollar of liquidity must be bootstrapped from scratch. Teams spend months convincing market makers to provide capital, negotiating with exchanges for listings, and building bridges to other chains. Meanwhile, users fragment their holdings across chains, each with its own version of USDC, its own wrapped assets, its own liquidity pools.

Base didn’t need to convince Circle to support USDC because it was already there. Celo’s migration provides instant access to the deepest DeFi pools in the crypto space. They plug directly into Ethereum’s ~$500 billion in total value, thousands of trading pairs, and the infrastructure that institutions already trust.

However, this liquidity inheritance comes with costs and baggage in the form of fragmentation and the seven-day problem, which nobody likes to discuss.

Fragmented Liquidity

Liquidity is spread across multiple rollups. It must be moved to where it is needed. Third-party bridges do a good job of maintaining liquidity across rollups, and it’s not really a problem at a scale of small users moving a few thousand dollars. As the scale increases to millions or tens of millions, liquidity fragmentation becomes a significant challenge.

Withdrawing to Ethereum from optimistic rollups takes seven days because the fraud-checking window lasts for a week. The situation worsens when you need to transfer large sums between rollups. The safest approach is to go back to Ethereum first (wait seven days), then send to the other rollup (another seven days). That’s two weeks plus high fees. Faster “bridges” exist, but they rely on trusted intermediaries (such as multisigs or liquidity providers). So, you give up some security for speed.

As a result, liquidity is trapped. Traders can’t quickly buy on Arbitrum and sell on Optimism. They usually want to do this when there’s a price differential to arbitrage. Farmers can’t easily switch their funds between Base and Polygon.

Although optimistic rollups have a seven-day window, it’s not a challenge for ZK rollups. And going by the consensus within the Ethereum community, most rollups will include some form of ZK proofs. This makes the week-long window problem sort of temporary.

Intents Unifying Liquidity

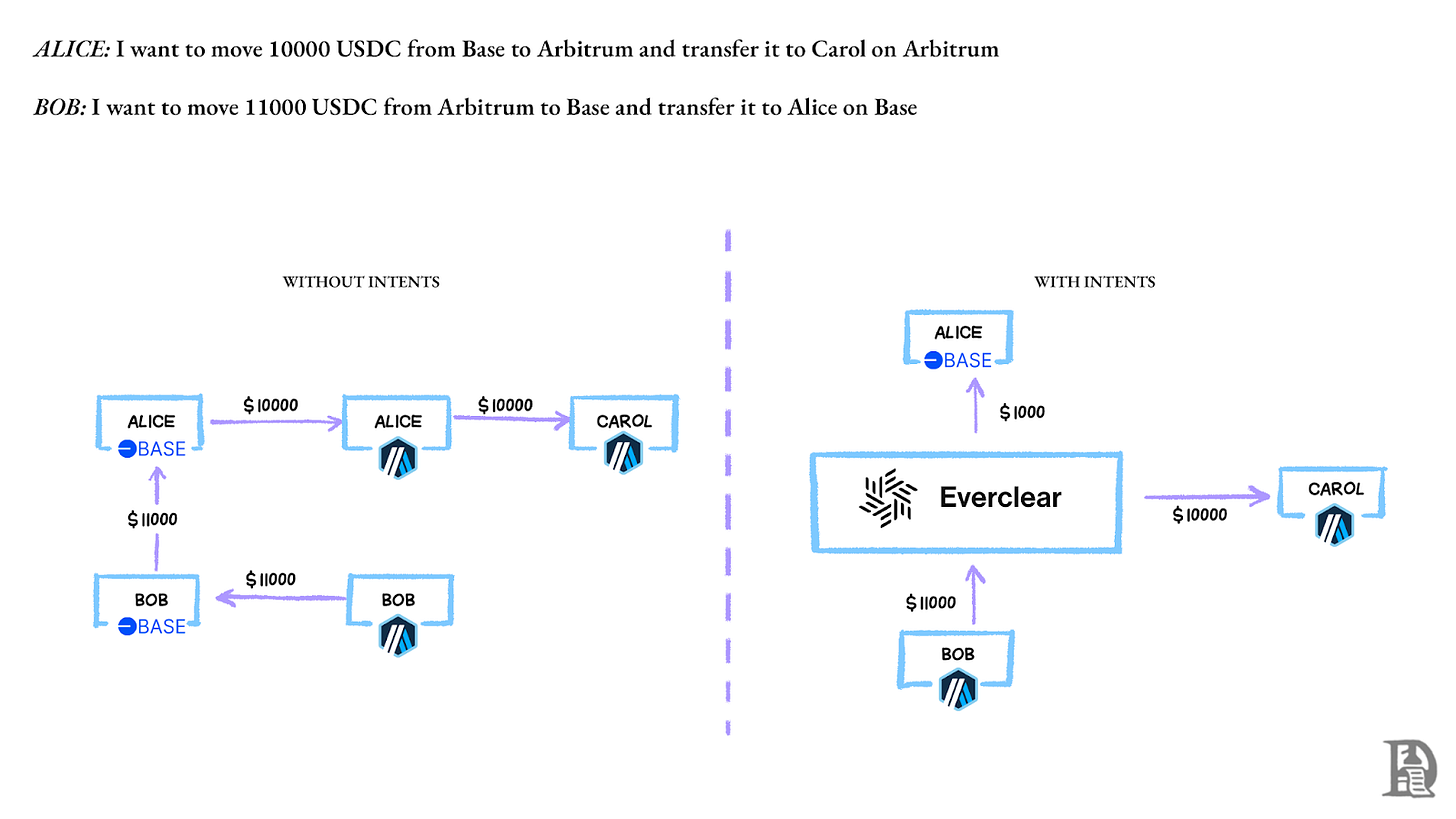

Intent-based interoperability is emerging to resolve this tension. Instead of manually bridging, swapping, and waiting, users declare their desired outcome: “I want 10,000 USDC on Arbitrum.” A network of solvers competes to fulfil that intent, managing all the complexity behind the scenes.

Protocols like Across, Everclear, and UniswapX have already implemented this model. Everclear goes further by netting opposing flows across chains.

Alice wants to move $10,000 from Base to Arbitrum, to transfer it to Carol on Base

Bob wants to move $11,000 from Arbitrum to Base and transfer it to Alice on Base

Everclear matches them. The liquidity never actually moves. Only the accounting changes. Users see funds appear almost instantly, while settlement happens later using canonical bridges.

This approach fundamentally rethinks cross-chain interactions. Users express their intents, solvers compete on execution, and security is ensured by the underlying canonical bridges. The seven-day delay still exists, but professional market makers can manage the working capital and abstract it away from users.

New Ethereum standards are being developed to improve the UX of intent-based solutions, solving liquidity fragmentation.

ERC-7683 defines a universal language for expressing cross-chain intents. Any wallet can create them, any solver can fulfil them, and any rollup can process them—no more custom APIs for every bridge.

ERC-3770 proposes chain-specific address formats to prevent costly mistakes. Instead of copying the same address across chains and hoping for the best, addresses would include chain identifiers, such as “arbitrum:0x123...” or “base:0x456...”. Simple, but it could prevent millions in lost funds.

CCIP-Read (ERC-3668) provides a standard way for smart contracts to fetch and verify off-chain or cross-chain data. A contract on Arbitrum can trustlessly read state from Optimism without a bridge. This enables complex cross-chain applications that feel native and seamless.

Together, these standards push toward a future where rollups no longer feel like separate blockchains. Using Base feels the same as using Arbitrum, which in turn feels the same as using Ethereum itself: one liquidity pool, one user experience, and one ecosystem.

With all the proposed improvements, Ethereum is moving towards a system that brings liquidity across all rollups together to be shared by all. Liquidity via rollups is a positive-sum game. Obviously, having liquidity in your own application is the best, but sourcing it with a clean UX and better security guarantees is the second-best option.

Assume that two L1s with $150 million and $250 million liquidity join Ethereum, and they both can access $400 million. Yes, they can do so via a separate bridge, but that bridge would not be as secure because Ethereum gives you better security guarantees with its validator set.

When does Ethereum’s liquidity of capital, users, and applications become unified? It’s a difficult question to answer. After all, Ethereum’s development is often slow, and for good reasons, primarily involving security.

How L2s Strengthen Ethereum

A persistent concern about L2s is that they might parasitically drain value from Ethereum. The fear goes like this: if all the activity moves to L2s, and L2 fees are cheap, what happens to ETH demand? Won’t L2s vampire attack the base layer?

L2s dramatically extend Ethereum’s capacity while strengthening its economic foundation. On L1 today, block gas limits and 12-second slots translate to only about 10 to 30 transactions per second of user activity. L2 rollups bundle large batches of transactions into single L1 commitments, currently averaging more than 250 TPS across all rollups. This multiplication of capacity happens without weakening Ethereum’s settlement integrity.

Every rollup transaction ultimately anchors on Ethereum. Optimistic rollups compressed calldata and rely on fraud-proof windows. ZK-rollups submit validity proofs on-chain. Rollups reduce L1 congestion while still utilising Ethereum as the ultimate authority, thereby preserving decentralisation and security while increasing throughput.

More importantly, L2s open new MEV opportunities that can be redirected to Ethereum. In conventional rollups, the sequencer would capture front-running and back-running profits. But new designs aim to share or burn this value in alignment with Ethereum. Based rollups let Ethereum’s own proposers and builders sequence the L2, so any MEV from rollup ordering automatically flows through Ethereum’s transaction mechanism.

As Justin Drake notes, in based sequencing, “MEV originating from based rollups naturally flows to the base L1,” which both bolsters L1 security through more fees for stakers and, if burned, increases ETH scarcity.

Explicit Value Alignment

Some L2 projects have made explicit commitments to strengthen Ethereum. ConsenSys’s Linea network plans to burn 20% of all transaction fees in ETH, making it the first L2 with an on-chain ETH-burn mechanism. This creates direct deflationary pressure from L2 activity.

Taiko, in its early operation, contributed 423 ETH burned and 283 ETH in validator tips. These numbers may seem small compared to Ethereum’s total activity, but they represent just one rollup in its early stages. At a scale of millions of daily transactions, the contribution becomes substantial.

But this is not the case with all L2s, or at least not with the ones that matter. Take Base and Arbitrum, for example. As mentioned earlier, they share very little with Ethereum. But what if Ethereum asks for a profit/revenue share tomorrow? (It is almost certain that this will never happen) Obviously, these rollups can go their own way as independent chains. But that means paying tens, if not hundreds of millions, in security budget. If what Ethereum asks for is much less than independent security spend, why not pay Ethereum?

Remember, we said that Ethereum is to rollups what cloud service providers are to software businesses. What happened after the cost of using cloud services dropped? The demand grew, and so did the revenues of cloud providers. AWS is the cleanest example here. It continued to cut prices for customers and still grew like a utility.

As of April 2021, AWS has lowered prices more than 107 times since launch. At launch, S3 storage was $0.15/GB-month, and data transfer was $0.20/GB in or out. Today, S3 Standard is $0.023/GB-month for the first 50 TB per month. Despite all the cost reduction, AWS revenue climbed from about $4.6 billion in 2014 to $108 billion in 2024.

We can expect a similar outcome to occur with Ethereum. As the cost drops, demand to transact on L2s increases, and the competition to enter data into blobs increases. As a result, fees paid to Ethereum increase, and more ETH is burned. As L2s grow, the use of ETH grows in three significant ways:

First, users still need ETH to enter the ecosystem, even if they primarily transact on L2s. Bridge deposits lock ETH on L1, reducing circulating supply.

Second, L2 operators must hold ETH reserves to cover the costs of blob submissions and emergency operations.

Third, as L2 activity increases, so does the volume of L1 settlements, proofs, and data posts, all of which are paid in ETH.

The security budget tells the clearest story. Ethereum currently spends about $4.5 billion annually on validator rewards. This cost gets amortised across all L2 activity. Instead of each chain spending tens of millions on security, they share Ethereum’s massive security budget. The more L2s that join, the more efficiently this security spending gets utilised.

L2s transform Ethereum from a blockchain into something resembling a network state. The base layer provides the constitution (consensus rules), the supreme court (validity proofs), and the treasury (ETH). L2s act like provinces or cities, each with local governance and economies, but ultimately subject to the federal layer.

This structure creates resilience through diversity.

The vampire attack narrative misunderstands the relationship. L2s need Ethereum to exist. Their security depends on it. Their liquidity bridges through it. Their legitimacy derives from it. Far from draining Ethereum, they extend its reach into use cases and user populations that would otherwise choose different chains entirely. Every transaction on an L2 is a transaction that could have occurred on Solana or Cosmos, but instead, it was decided to settle on Ethereum.

Why are L1s migrating to Ethereum?

Over the past two years, some teams that once ran their own chains have chosen to rent security and data availability from Ethereum. Think of Ethereum as the cloud for rollups. You buy the complex parts as a service, focus on product, and tap into shared liquidity and distribution.

Three design choices shape this shift. The first is security. Running your own validator set is costly and requires a massive coordination effort. On Ethereum, you inherit a much bigger validator set that provides you with a larger security budget and a deeper set of guarantees. That matters more as the value at stake increases.

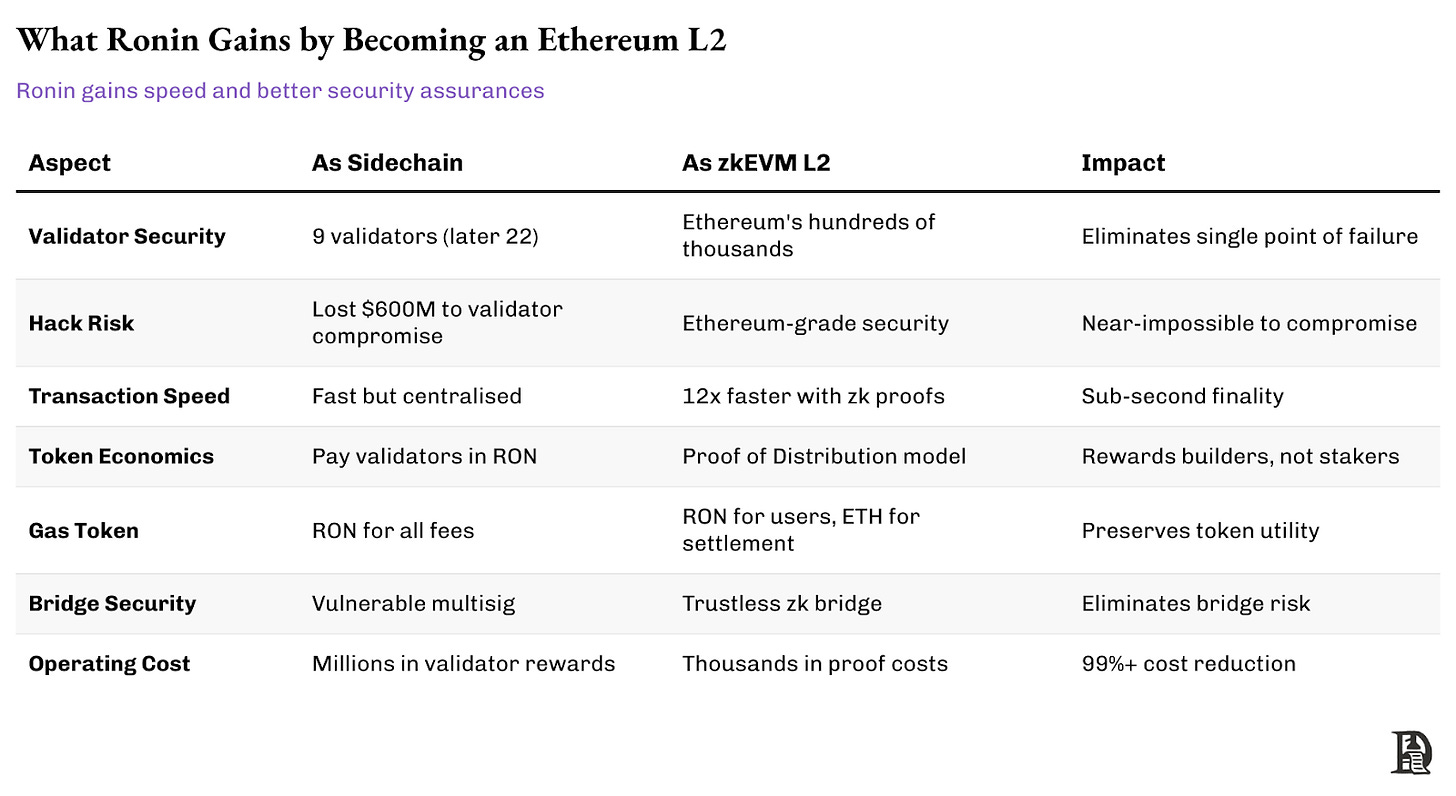

Built in 2021 specifically for Axie Infinity, Ronin operated as a sidechain when Ethereum couldn’t manage gaming-scale throughput. The chain processed millions of daily transactions with negligible fees, enabling the play-to-earn boom. However, the $600 million hack in March 2022 exposed a fundamental weakness: just nine validators secured billions in value.

The hack didn’t require sophisticated cryptography or complex exploits. Attackers compromised five of the nine validators and drained the bridge. This catastrophic failure forced a complete re-evaluation of security. Ronin added more validators and implemented additional safeguards, but the core problem remained. Maintaining an independent validator set for a gaming-focused chain is expensive and risky.

By 2024, Ethereum’s rollup ecosystem had matured enough to support gaming workloads. Ronin announced its transition to become a zkEVM L2, gaining several advantages. Moving from 9 (later 22) validators to inheriting Ethereum’s hundreds of thousands eliminates the centralisation risk that enabled the hack.

The new zkEVM architecture enables sub-second block times, crucial for gaming UX. Users still pay gas in RON tokens, but settlement costs on Ethereum are covered at the protocol level, preserving the existing token economy. Instead of paying validators, RON emissions shift to active builders through a new incentive system. Game studios, applications, and ecosystem contributors earn rewards rather than passive node operators.

The migration acknowledges the reality that Ronin was built when Ethereum couldn’t support gaming. Now that Ethereum can, through rollups and blobs, maintain a separate consensus, it makes little sense. Running an L2 costs far less than maintaining an independent validator economy while providing superior security.

The second is economics. Paying validators with inflation to secure a mid-sized L1 can strain the token and split liquidity. As an L2, you pay for data posting and proofs, not a full security budget. Fees decline, capital pools deepen, and bridges become simpler.

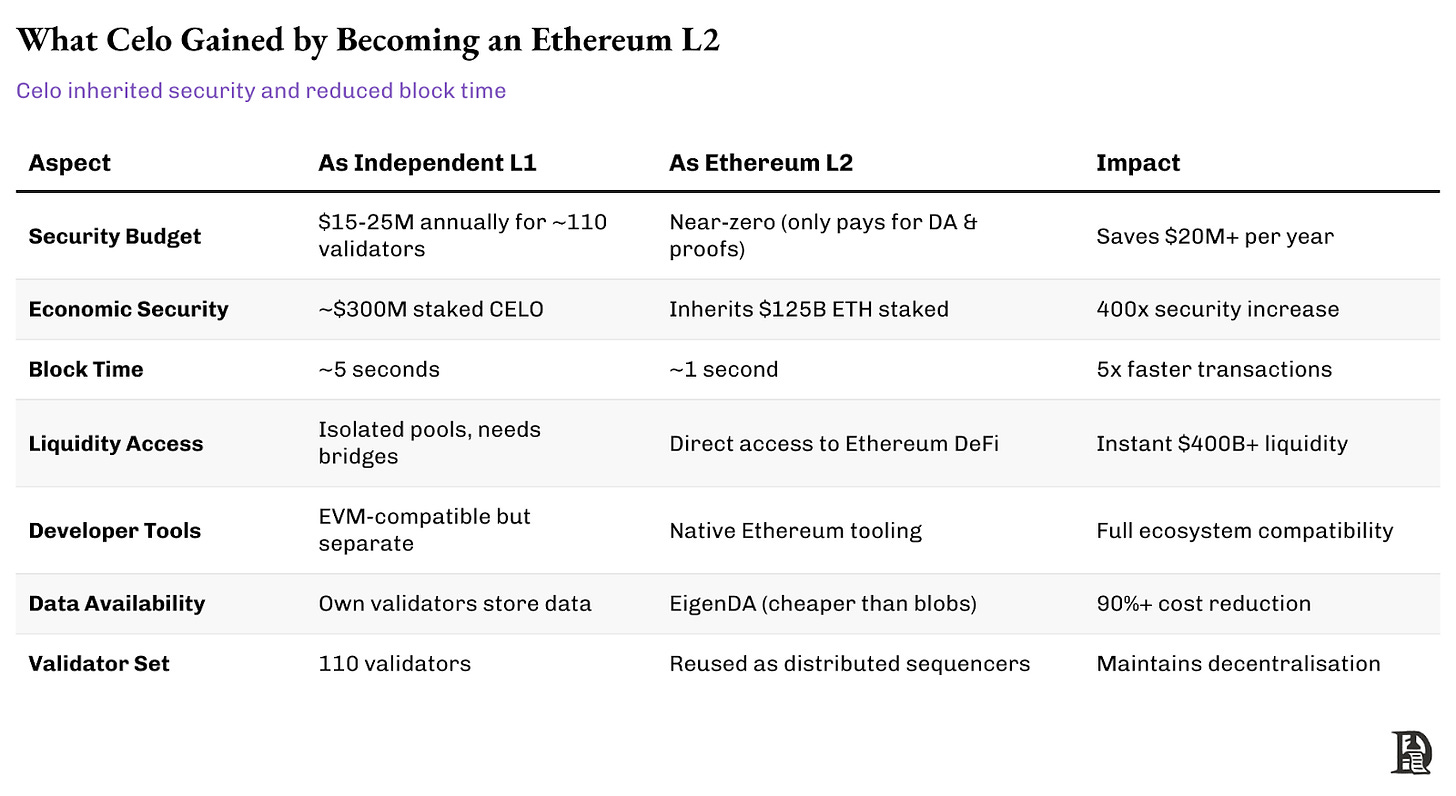

Celo launched in 2020 as an independent, carbon-negative, EVM-compatible L1 pursuing mobile-first financial inclusion. At the time, Ethereum lacked the scalability and affordable UX that Celo’s mission required. The chain peaked during the 2021 DeFi boom, reaching nearly $1 billion in TVL. But most traction came from multi-chain applications, such as Uniswap and Curve, rather than native projects. Celo became a side venue rather than a liquidity hub.

By 2022-23, the bear market had shrunk TVL to below $200 million. Liquidity fragmented as developers concentrated on Ethereum and its growing L2 ecosystem. Meanwhile, Ethereum’s rollup roadmap matured with EIP-4844, making secure, low-cost scaling actually viable. By mid-2024, even as Celo hit record activity with 716,000 daily users and over 1 million daily transactions, its weak capital stickiness (hovering around $100 million TVL) made the economics clear.

The migration maths was straightforward. Celo was burning roughly 4-6% of its token supply annually, about $15-25 million, just to reward its 110 validators. After moving to an Ethereum L2 on the OP Stack, those costs vanish. The only ongoing expenses are data availability fees and proof submissions, which run thousands rather than millions annually.

Instead of relying on 110 validators securing roughly $300 million in staked CELO, the chain now anchors to Ethereum’s $125 billion economic security. Every transaction benefits from hundreds of thousands of validators rather than just over a hundred. A trustless Ethereum bridge lets Celo applications tap directly into Ethereum’s DeFi liquidity. No more maintaining separate pools or convincing liquidity providers to fragment their capital.

Celo reuses its validator set as distributed sequencers, preserving censorship resistance while offering one-block finality. This hybrid approach maintains some decentralisation while gaining L2 benefits.

Block times dropped from approximately 5 seconds on L1 to around 1 second on the OP Stack, making payments nearly instant. By utilising EigenDA for data availability instead of Ethereum blobs, Celo further reduces costs while maintaining security through restaking.

The cultural alignment matters as much as the economics. Celo can strengthen its original mobile-first, inclusive finance mission while “returning home” to Ethereum’s security and developer community.

The third is developer fit and reach. The market standardised on the EVM. Tooling, wallets, oracles, exchanges, and audits line up behind it. Builders want to ship where users already are.

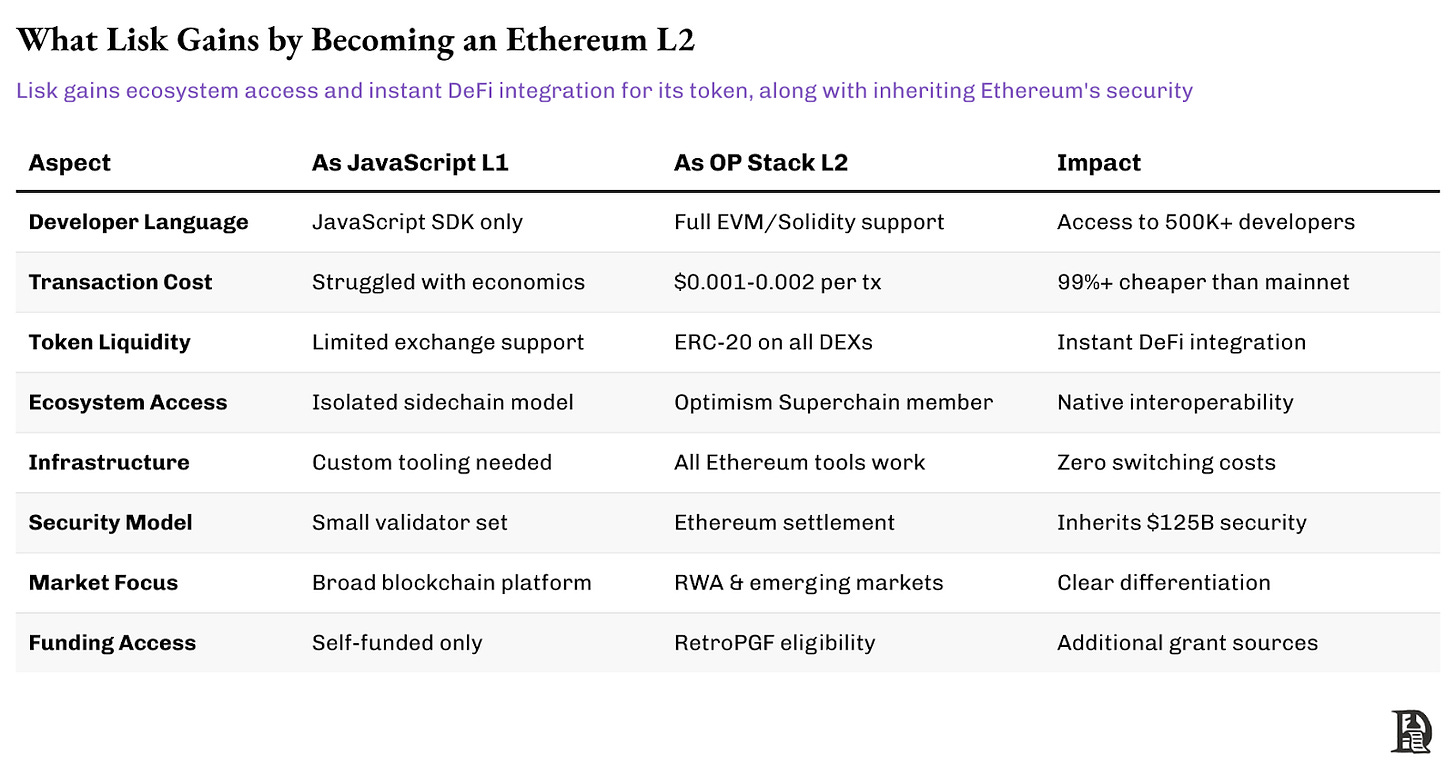

Founded in 2016 as a JavaScript blockchain platform with a sidechain architecture, Lisk bet that JavaScript’s popularity would drive developer adoption. The chain focused on making blockchain development accessible to web developers.

But the market chose differently. The industry standardised around Solidity and the EVM. Developers increasingly requested EVM compatibility. Integrating with existing Web3 infrastructure (oracles, wallets, DeFi protocols) became progressively more challenging. By 2023, Lisk faced a choice. Remain ideologically pure but isolated, or pivot to where developers actually build.

The migration to Ethereum L2 solved multiple problems simultaneously. As an OP Stack rollup, Lisk immediately works with all Ethereum tooling, wallets, and infrastructure.

LSK becomes an ERC-20 token, instantly tradeable on DEXs, supported by custodians, and integrated into DeFi. With Superchain membership, Lisk gains native interoperability with Base, Optimism, and other Superchain members, as well as access to retroactive public goods funding. Lisk pivoted to focus on real-world assets, off-chain assets, and DePIN in emerging markets (Africa, Southeast Asia). These regions require low-cost, dependable blockchain infrastructure, which is easier to deliver as an L2 than as an isolated L1.

The data validates the migration. According to L2Beat, Lisk now processes hundreds of thousands of transactions daily with median fees under $0.002. The chain maintains over $50 million in TVL despite being relatively new as an L2. Most importantly, developer activity has increased as teams can now port existing Ethereum applications rather than building from scratch.

When should a chain remain sovereign?

Most teams benefit from joining the Ethereum universe. You inherit security, liquidity, and a path to better UX. But sovereignty still has a place. Some products need freedoms that an L2 cannot give without twisting itself into knots. Here is the practical test.

The Airport Is Built. It’s Time to Fly.

The migration case studies reveal that each chain started as an L1 for valid reasons. Ethereum couldn’t support mobile payments (Celo), gaming (Ronin), or JavaScript developers (Lisk) at the time. But as Ethereum’s rollup infrastructure matured, the calculus changed. The costs of maintaining independent consensus now outweigh the benefits of sovereignty.

Celo saves $20 million annually. Ronin eliminates the security risk that potentially costs hundreds of millions of dollars. Lisk gains instant access to Ethereum’s entire developer ecosystem. Meanwhile, they all maintain their unique value propositions: Celo’s mobile focus, Ronin’s gaming optimisations, and Lisk’s emphasis on emerging markets.

The old dream was a thousand sovereign blockchains, each running its own airport. The new way is one massive, neutral airport with hundreds of airlines competing on service, not on who can build the safest runway.

This wave is the beginning of a larger trend. Near already runs an Ethereum L2 (Aurora). Polygon PoS, despite being one of the largest “Ethereum sidechains,” plans to become a proper L2 using its Type-1 zkEVM prover eventually. Even Cosmos chains are exploring Ethereum alignment through projects like Evmos and Celestia’s data availability services for rollups.

Liquidity is being stitched together through standards and new intent-based models. Withdrawals from optimistic rollups still take seven days, but that limitation has been almost completely abstracted away from users. Succinct’s Type-1 prover will bring zk-finality to OP Stack rollups.

ERC-7683 defines a standard for cross-chain intents. ERC-3770 avoids address mismatches by including chain identifiers. CCIP-Read allows contracts to read the state across chains trustlessly. Together, these changes mean that users will no longer notice which rollup they are on. Moving between Base and Arbitrum will feel like a swap inside one network.

L2s are also feeding Ethereum, not draining it. Rollups have lifted aggregate transaction capacity to over 250 transactions per second. Every batch still settles on Ethereum. Blobs carry two megabytes of data and expire after a few weeks, which keeps costs low without bloating the chain.

As rollup activity increases, more ETH gets burned, and validators process more work. Taiko alone contributed over 423 ETH burned and 283 ETH in tips. Sequencers pay blob fees. Some rollups, like Linea, have committed to burning a portion of their transaction fees in ETH. As rollups grow, they generate more value for the Ethereum base layer in the form of validator income and deflationary pressure.

The economic structure of Ethereum L2s may be extractive, for now. But settlement happens on Ethereum. Remove Ethereum, and L2s can no longer claim decentralisation. Liquidity also flows through Ethereum.

Validator income comes from blob fees, proof verification, and proposer tips. The more rollups there are, the more this system scales without compromising on security. This is what enables Ethereum to operate like a decentralised network state—one secure base layer with multiple parallel economies built on top of it.

Ethereum is becoming the Schelling point by the age-old, proven way of division of labour. Teams that spent years building validator communities don’t want to admit that those validators were always mercenaries, ready to switch chains for 2% higher yield. VCs that funded “Ethereum killers” don’t want to acknowledge that killing Ethereum was never the point; scaling crypto was.

But the market has spoken. Users don’t care about your consensus algorithm. They care about fees, speed, and avoiding losses due to bridge hacks. Developers care about liquidity, tooling, and users. Even validators don’t care about your chain. They care about sustainable revenue.

Build where your users and counterparties already are. Keep the core simple. Push features to the edge. It’s time to stop building new airports and start flying planes.

Thinking about DATs,

Saurabh Deshpande