What Winter Looks Like

A post March-12 breakdown on why VCs reduced investing

We previously compared how funding trends have performed in Q1 2020 in comparison to the previous first quarters. Since looking at the first quarter by itself is not going to help much, I have spent time exploring what the trend has been for the past 15 months. I believe a fundamental issue with most reporting on funding trends within Blockchain today is bad data tagging. For instance, Crunchbase considers Figure and Robinhood to be a "blockchain' firm, but whether they have meaningful contributions to Web3.0 is something I am not entirely clear on. The reason why this matters is that as an industry, we may be looking at bad data altogether. As fewer firms raise larger rounds, we may be lead to believe that blockchain funding is on an uptrend. But for any founder that is at the early stages of their venture, reality may be drastically different. My objective of writing this piece is to put into perspective what we are dealing with. Let's start with the count of deals that have happened each month since 2019 January

That marked decrease in blockchain funding frequency is by far the healthiest measure of investor appetite for this industry. It matters because of two reasons

If fewer seed-stage companies are backed, we will not have a healthy crop of growth-stage firms 18 to 24 months from now. The powers laws at play dictate that we have a large enough crop of firms at the early stages to continue optimising for the late stages

The decline in early-stage financing could translate to a reduction in human resources within the industry. If there is a flight to other ecosystems, there very well will be talented individuals that may not come back for a very long time. The absence of traditional venture capitalists in the space will also spell disaster in terms of the ecosystem fledging towards where it needs to be over 3 to 5 years because the sources of financing that will come may not necessarily have the best interest of the founder himself at play.

One way to think about it is in terms of ecosystem funds from tokens. If Sean Parker were still investing and deploying in this space - he'd likely have made it clear that a billion-dollar ecosystem fund is not what's cool, a billion users are. We will go into why token ecosystems on their own can't move the needle towards the end of this piece. Let's take a look at what's happening in terms of dollars invested in the early stages.

To put it in simple terms - if you are in the pre-series B levels, there is only about $50 million that gets deployed on the average month. A significant cause for LP concern is the fact that while venture capital dollars are being deployed since ~2013, if we look at actual use-cases, the industry has not gone beyond financial applications yet. An in-depth study of where Series B financing has gone will reveal that if we discount infrastructure (Bison Trails), the vast majority of funding has gone to exchanges, lending or similar financial applications. That is the critical dichotomy most venture investors within blockchains have to deal with today.

If venture financing goes solely to web3.0 firms or deep-tech firms built on similar veins (think data marketplaces, grid payment settlement layers etc.) - the lack of follow on financing could mean firms die before they have sufficient traction. On the flip side, without hefty investments, most of these applications may not even take off. It makes me believe over the next 18 months; we will see two trends emerge

There will be a rise in M&A from traditional web2.0 players looking to enter the blockchain space. This will likely be acqui-hires with their current backers making break even. During the bull-run, we saw cryptocurrency firms acquiring traditional web2.0 players to expand rapidly. During the downturn, the flipside will become the norm. It is s part of the reason why startups need to start considering real-life metrics such as MAUs and DAUs instead of node count or on-chain transactions alone. The convergence of the world we live in and the one we have been building towards is far closer than people recognise. That is also a key reason why founders need to look at the broader market (e.g.: DeFi < Fintech, Social Media > p2p content payments) instead of obsessing over the small niches if they care about commercial viability. Scale does not care about our feelings.

Funds with dry powder may begin to invest more considerable sums early on to expand the runway. We have some anecdotal evidence of this when we consider median Seed and Series A raises. The logic here would be that longer runways translate to more extended periods kept away from wondering how the next raise should be planned for. Which in turn, converts to focus on expanding market share while competition struggles to keep pace. Firms that have not yet deployed capital with raises from the last year are in a very sweet spot to execute on this.

Maturing, not declining.

A narrative evolution that could occur over the next quarter is that the funding allocated for early-stage ventures have declined as a result of the macro-economic environment. But if we study the QoQ funding trends since early 2019, there has been a clear down-trend in funding events at the early stages. To be clear of my inference- this is not bearish in itself. There will be a decline in the number of firms being found and raising ventures since the bull market. If anything, things look good because Series A and Series B raises have not declined drastically.

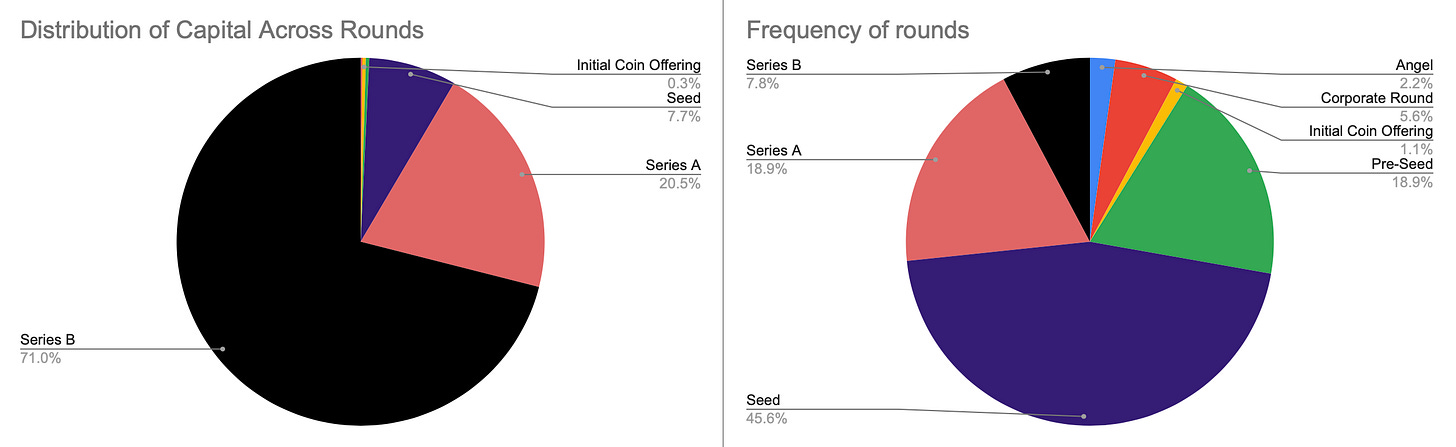

What has happened has been a marked focus on traction and metrics. It is the reason why Series B's today account for ~70% of all financing that goes into the ecosystem even though in terms of count - 45% of the ventures are at seed stages. (Note: I avoided looking at data past series B's due to their low count and enormous sizes) The key differentiator for firms closing Series A's against their peers was an ability to execute and demonstrate go to market with short periods. This is a significant part of the reason why firms need to consider how they communicate to users. There used to be a time when a surging telegram community was the mark of 'product-market" fit. Today teams need to focus on abstracting away the complexity of the product's use of blockchains (eg: Axie Infinity) while warding off competition from entrenched incumbents. This is also why we are seeing a marked focus on UX and scaling these days. Over the next two quarters, I anticipate a surge in investments made towards wallet management, on-ramps and payment gateways. A few players that are well-positioned to take advantage of these are Frontier Wallet, Argent, Mosendo, Rampand Linkdrop. As the need for scaling becomes more evident, players like Biconomy will be well entrenched to enable that transition. The need to understand user-behaviour better will also drive revenue from apps that have raised venture financing towards data providers like Nyctale, Covalent HQ and Blocknative.

It is becoming evident that investors have been preparing for a risk-off environment since the past year or so. This is part of the reason why DAOs and ecosystem funds will come into vogue. While equity investors pause to analyse the markets and re-align valuations, grants, corporate investments and DAOs will lead the way. The tricky aspect for anyone raising from those three forms of financing will be to re-align private ownership goals (eg: scale, profitability etc) with strategic interest. I do see an environment where DAO or ecosystem funds invest alongside accelerators and venture captialists. For DAOs or ecosystem funds, this means off-loading the burden of venture building and scaling to a third party while capturing the upside of leveraging the experience of individuals that have learned from investing into hundreds of funds. For VCs on the other hand, this means getting access to capital in an environment where LPs reel off from early stage ventures.

The current macro-economic environment only makes it so much more difficult to be making blind bets on teams without a track record or even worse - a viable business model. The good old days where telegram community (err bot) member count was taken as a measure of the team's ability to execute are gone. The kind of exuberance we have seen, first with ICOs and then with equity deals is not new or specific to blockchains alone. In the late 1990s, businesses going on the internet was the equivalent of firms using a blockchain in the past few years. Add to that the frothy venture capital markets the likes of Softbank have fuelled over the decade, and we will see why the end of the bull market of everything will reflect hard on blockchain ventures too. For a fair assessment of where we stand in the hype cycle, here is a comparison of blockchain fundraises with other technologies of varying maturity levels. We are slowly grinding towards the tail end of things.

All of this context building is not to scare investors or founders out of building in this space. Google came out of the early 2000s. Uber, Instagram and early remnants of Tinder were the byproducts of the 2008 crisis. Keeping factors of the pandemic aside (because I am not an expert on them) - if we are to observe things from a financial markets point of view, this is where the best investments will likely be made. One could argue that there are likely investments that could be made in the next six months that will generate a better return than those made in the past three years combined merely because of how market cycles work. The unicorns of this ecosystem are in the wild today. Many of them happen to be battered, starving and in the form of a wild donkey right now.

I'll see you guys later this week with a classification of digital assets in the token economy today. Adios!

Notes.

1. Two of the startups mentioned - Nyctale and Biconomy are portfolio companies at Outlier Ventures.

2. There is a very strong chance I don't respond to requests for data exports. Do not take it personally. Between handling an emerging pandemic and a financial crisis - I find very little time to take on more work than what's on my plate. I may however respond if you ask very nicely and remain patient.

3. If you are looking to translate - ping me before you do.