What The Future Of The Creator Economy Looks Like

A breakdown of the the layers that will empower tomorrow's creators

Hey there,

I clubbed the Monday and Wednesday issues into today's piece. Between spamming your inbox with half baked ideas and missing out on sending the newsletter, I'll likely always choose the latter. This piece took a little longer than I had anticipated. Working out the timelines better on my side. Thank you for understanding.

Last week was monumental for the creator economy. First, Visa paid over $150,000 for a jpeg. A more nuanced way of putting it would be saying that the cryptopunks community now counts Visa as one among them. They also issued an 18-page report on NFTs and how the firm is evolving to adapt to the new paradigm. I find this far more interesting than enterprise blockchains or banks offering crypto to users as it signals a giant payments network acknowledging how our notion of "value" is evolving. On the other side came the somewhat surprising news that made me think about where the internet as a whole is trending towards. OnlyFans, a platform that allows creators to sell subscriptions for personal content, moved towards banning adult content. I found this to be surprising as much of their business predominantly depends on individuals buying adult content. The reason cited? Payment networks. Players like Visa and Mastercard have long been pushing creator platforms to scrutinise content uploaded to check for authenticity of who is creating it. Mastercard requires documented consent from performers adult sites displaying content to process these payments.

Adoption of adult content and the evolution of the web have historically gone hand in hand. Necessity drives innovation. Middle Men, released in 2010, perfectly captures how digital payments adoption skyrocketed partly due to the adult entertainment industry. It is on Netflix in case you'd like to watch it this weekend. Onlyfans has been at a similar inflexion point in history. The platform marked the arrival of an age where anyone can sell subscriptions to content from themselves. For a sense of scale, Onlyfans has over 300 creators earning at least $ 1 million annually and roughly 16,000 earning north of $50,0000. To date, the platform has paid out over $3.2 billion. Half of the revenue on the platform comes through subscriptions - most of which is recurring monthly. This post on the unit economics of Onlyfans has an elaborate breakdown of how creators on the platform have been earning. According to Axios, part of the reason why Onlyfans moved towards disabling adult content is that constant scrutiny from payment processors could spell disaster as the venture tries to scale. Especially if regulatory authorities choose to target the platform. On the flipside, payment processors would rather stay away from supporting the platform as they could be held responsible if an investigation finds that non-consensual, adult content was hosted on Onlyfans.

The Creator Economy And Web 3.0

I found the move from Onlyfans to be fascinating for several reasons. On one end, you have a business doing incredibly well in terms of cash flow. The core asset the firm has is its IP and hardware required to service more users. Both of which don't grow exponentially in terms of cost. The bits that make the platform valuable are its creators and subscribers. Strong moats. Over the past five years, Onlyfans has made it "acceptable" to subscribe to an individual with one's credit card. The behavioural change on the demand side takes years to establish because adult content is freely accessible on the internet. It takes just as long to build up the supply side. That is individuals who are willing to spend time creating content. The lockdown induced loneliness should have only driven more people to sign up and use the platform. So why would Onlyfans stop serving adult content? In my opinion, it boils down to the payment streams. If the platform cannot capture recurring payments from a global userbase through credit cards, it has more liability (in potential lawsuits) than cash flow. The move away from adult content is about legitimacy and scale while simultaneously holding on to the pipelines that bring money to the platform. But there are reasons to be alarmed here. It marks an era where financial intermediaries determine the nature and form of content that is shared online. If tomorrow a financial intermediary threatens to stop servicing a news outlet because statements made by the outlet irked somebody in power, we give up our freedom of speech. This has happened in the past when Visa or Mastercard was no longer servicing Wikileaks. It is a threat that stands looming on our democracies at a time of prevalent misinformation and algorithmic echo chambers. More importantly, leaving the decision of who should be serviced to financial intermediaries can leave millions of people underserved as employment goes increasingly digital. The average 18-year-old today has the opportunity to build and sell to a global audience. Something the most privileged individuals from just a few decades back may have struggled to ever do in their life. Building tools that enable one to create, distribute and earn from their creations will be paramount to creating equitable opportunities on the web.

The creator economy is somewhere between $50 billion to $100 billion in value as of today. It employees close to 50 million individuals from across the world. While governments are busy arguing about the need to police platforms due to their monopolistic natures, some of these businesses are creating economic opportunities where there were none earlier. However - risks like being de-platformed, dependency on algorithms for distribution and moderation policies that may be ruled against creators put these jobs at the hands of those running the platforms, as is the case with most gig economy platforms. One way regulators can mitigate these risks and empower creators is by rebuilding platforms to empower those contributing to them. This is not rocket science. The basics are already and we can see them in action on Web 3.0. Platforms like Mirror.xyz allow creators to be paid directly in Ethereum for selling partial ownership of an essay. The play to earn model created by Axie Infinity allows gamers spending the most time on the platform to have partial ownership of the network.

Most of what we see in DeFi in the form of yield farming is a means to create partial ownership for the most active users of the platform. This builds skin in the game for users and thereby paves the way for better stakeholder-driven governance. Redesigning the creator economy is not about shoving crypto-based payments where banks don't facilitate transactions. It is about re-thinking incentives and stakeholder alignment for the future of the internet. Proponents of web2 platforms like Facebook and Instagram have been open about how the incentives on their platforms are at odds with user interests. Hackers designed them to create sticky behaviour that keeps users coming back. Rebuilding the creator economy gives us a chance to fix what went wrong with the internet 15 years back.

To avoid forcing a solution where a problem does not exist, I break down some of the driving issues I see with the creator economy and how Web 3.0 native alternatives are creating modular solutions for it. (Note the term "modular solutions" - we'll be discussing that further below). Any meaningful recreation of the internet should start with the understanding that users are not looking forward to jumping onto a new platform. Most Web 3.0 platforms lack the network effects that a product like Facebook or Whatsapp has. Users stick with Instagram inspite of being tired of seeing what someone else ate for breakfast because their social graph already exists there. If we go back in time to when p2p file-sharing took off with Napster, we may see clues for what would make users switch. Ease of use & incentives. Users could buy albums offline at the time, but it is unlikely that a regional store had a catalogue as extensive as Napster's. Every new platform launched in a Web 3.0 native fashion will have an inflexion point where it makes more sense to switch than to stay. We saw this when users switched from MySpace to Facebook. From Blackberry messenger to Whatsapp. But to make that transition happen, we should focus on what creators need today.

Ownership - When Thomas Friedman conjured up ideas of where globalisation can take our economies in the 20th century, little would he have thought about the role platforms would hold in the distant future. Applications like TikTok are tools to diffuse culture globally, but the outcomes could often be uneven. The biases we hold in real life tend to transmute to digital outlets. This means the source of a dance move, music or work of art may have minor claims to ownership. Earlier this year, Black creators on TikTok observed a strike calling this out. NFTs have blown up in the public psyche because it links ownership to the individual that created a piece of work in the first place. The lack of ownership creates compounded risk in the context of being de-platformed. A creator that finds themselves unable to export their content may discover years of their work gone to waste with little to show. Ownership in the context of Web 3.0 will have two counterbalancing angles to it. One is the intellectual property behind a piece of work, and the second is ownership of the platform itself.

Decentralisation - Present-day democracies are at risk in two ways. On one end, platforms hold the power to determine who gets access to what kinds of information. That is they can restrict the distribution of content to create uneven playing grounds. More dangerously, they can sell data to counterparties that misuse it. The Cambridge Analytica incident is one instance where data from social networks was used to tear apart societies. On the other end, it gives governments an incredible amount of power in terms of censoring dissidents. India, where I write this newsletter from ranks the highest in terms of takedown requests and internet-based censorship. Decentralising creator economies in Web 3.0 should ideally ensure consumers and creators have a say in what is censored and what is left online. I do not believe complete censorship resistance or immutability is a desirable state when it comes to decentralisation. Especially in the context of revenge porn or intellectual property being leaked. Platform decentralisation in the context of Web 3.0 would require tools to minimise censorship while simultaneously creating instruments to moderate platforms. One way this is happening online already is through vote based systems such as those on Reddit and Hackernews. These have their own inherent flaws. A different angle decentralisation takes in the context of Web 3.0 platforms is in terms of data ownership. In an ideal world - users should have the right to export, permit and trace access to their own data-sets

Governance - Individuals giving attention to an emergent creator are paying something they cannot redeem later on. Their time. Creators understand this fairly well and use audience input to iterate on the content they create. With individual creators like MKBHD branching out into their own brands, it becomes important to create systems that allow each party in the value chain to derive equitable value. Creator economies are fairly similar to start-ups in that there is an inherent risk involved, uncapped upside and multiple individuals can contribute with specialist skillsets as a creator takes off. DAOs are a primitive that can solve for exactly this. Distributing partial ownership in a creator's work is one way for individuals to create distribution and interest in what they are creating. A different mechanism would be rewarding individual contributors for what they bring to the table. We talk about DAOs specifically in the context of venture and hopefully soon enough, SaaS businesses. But in my opinion, individual creators going the DAO route will be the fastest way to reduce the barrier to entry for the average retail user on the internet.

Financialisation - The current state of the web uses view counts, likes and retweets to measure an individual creator's success. Creators are incentivised to make what appeals to the lowest common denominator in comprehension and pack it with the most clickbaity titles to grab attention. One way creators are circumventing this is through focusing on the revenue generated from their audience. Substack writers like Packy have launched their venture funds. Selling merchandise is another way creators generate income. There needs to be avenues and outlets that allows creators to financialise what they are doing to assist individual creators with finding scale. Selling a portion of future revenues to sustain themselves until they make a meaningful audience may solve for this. Fan tokens and social tokens are early variants of this. Platforms like Rally will inevitably make it easy for everyone to financialise their success but it will be a while before there is regulatory clarity on the nature of these instruments.

I set out to think about how a Web 3.0 native creative economy could be built with these matters in mind. There are a few inherent flaws I could see at the outset. For instance, I still don't have the answer for how content removal and moderation could occur. In addition, I am fairly confused about whether every user on the internet wants to be involved in the governance and trading of a creator's content. 90% of the internet lurks, while 9% contributes, and 1% are the power users that create the vast majority of content. Lastly, I am not entirely clear on how regulators would react to the rapid decentralisation of the internet. It is equal parts desirable and undesirable for them. While platform monopolies left unregulated create bad outcomes, they also have someone interfacing as the "face" of the company if something goes wrong. How would that play out for a purely decentralised network? These are questions I am still pondering on. I will love to hear from you if you have been spending time thinking of it. Maybe I could set up a clubhouse to discuss this if there's sufficient interest.

The model shown below is heavily influenced by the convergence stack pioneered by Lawrence Lundy. I had the pleasure of working with him early on in my career. I have also taken help from Mason Nystrom's recent NFT market map. Also, make sure to read Kyle Samani's piece on the Web 3.0 stack piece from the Multicoin website. He wrote about this way back in 2019.

A Web 3.0 Native Creator Economy

Back to where we started at the beginning of this piece. A stack that empowers creators worldwide to create, deploy and distribute content without interference from financial intermediaries. The market map shown below is by no means comprehensive and is designed only to lay out what would be needed to create a truly decentralised creator economy. Each of these layers will have entirely different incentivisation models as the stakeholders are wildly different. Arweave, for instance, offers storage and is designed to reward miners by providing storage space. On the other hand, a platform like Mirror is focused exclusively on those creating content and as such does not reward individuals plugging hardware into the network. Similarly, each of these layers will have applications differentiating on the use-case and need. Under interfaces, for instance, I have both hardware-based authentication systems like HTC's Exodus and a simple browser like Brave marked. I will explain why as we go through each section. With these caveats out of the way, let's dig in.

Hardware

AWS played a critical role in enabling the likes of Facebook and Instagram to scale. The AWS of blockchains is still AWS. My reasoning for this argument is the number of nodes of networks that currently exist on AWS already. A new generation of ventures in the ecosystem are solving for what AWS cannot today in terms of decentralisation and censorship resistance. Storage systems such as those offered by Storj, Filecoin and Arweave can offer immutable file storage at competitive rates for developers looking for storage. Golem allows individuals to rent out idle compute power to earn tokens from a decentralised network. These are still early days in the hardware marketplace stack, though. About 783 providers exist on Golem's network today who collectively hold approximately 31.68 TB of memory for computation between them. About 776 unique providers are running north of 3000 miners on Filecoin's network. In my observation, contrary to what most would believe - the problem is not with the supply side for hardware markets but rather the demand side. Developers may avoid using decentralised alternatives unless they know that the costs and uptimes can be reliably predicted. There is likely a thin layer to be built as a marketplace for decentralised hardware providers here. Do write to me if you are making that.

Networks

Once we have a fairly distributed network of hardware providers, one needs to secure the networks that transfer information between them. If you were surprised by India's rush to take down content on the internet, here's one more fact. 70% of global internet shutdowns happened in India. So this is a matter that hits close to home for me. Taking down networks is seen as a tool to reduce dissent and make collaboration harder between protesters during riots. A variation of this was on display in Hong Kong too. However, it is not only state actors that take a proactive interest in taking down public networks. It could also be miscreants on the web. In 2016, a botnet named Mirai was used to take down the internet in Liberia. Web 3.0 native firms have been slowly decentralising systems here too. In an ideal, utopian world - we have satellites beaming down free, uncensored internet to the whole world, but we are far from there. Helium Network is a significant project backed by Khosla Ventures, SV Angels and Multicoin, incentivising the setting up of hotspots that beam out the internet in a vicinity. As of writing this piece, they claim to have close to 150,000 hotspots in 13,000 cities distributed over 119 countries. Effectively making them the largest LoRaWan hotspot network. While Helium focuses on creating a decentralised network, Handshake is focused on the naming system. Every time you enter a website on the internet, a naming system is used to redirect web traffic to the appropriate source. These can be censored or taken down at will. More importantly, they are managed by centralised corporations like Google at this point. Handshake allows creating a distributed, consensus-based naming system to keep a single party from taking down a website. Going into the technical aspects of how it works may be a distraction for this piece, but you can refer to their documentation here for more details. If you have the time, consider playing with Handshake and Blockstack this weekend.

Utilities

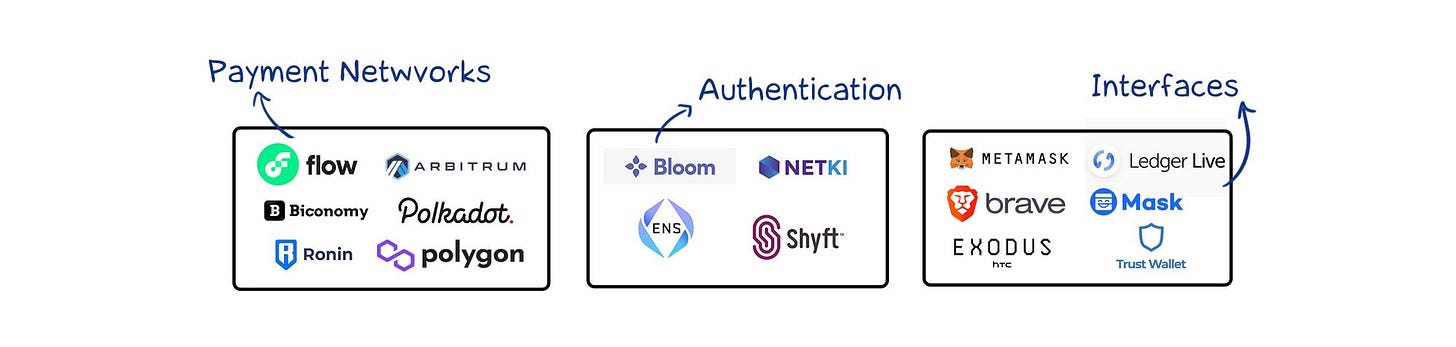

Once the networks and hardware layer are secured and decentralised, one looks for the interfaces that enable users to interact with the new internet. This can take multiple forms. Brave, is a browser-based interface, whereas Trust is just a mobile application that can plug into various DeFi projects today. In the future, it would be common to see the content pulled into your wallet interface so you can directly tip them through it. Super-Apps like WeChat in Asia are already pointing towards this being a possibility. A single app that combines payments, services, content and e-commerce securely makes it easier for users to interact with the new internet. In my opinion, this is one of the ways the new internet will seep into the average user's hands. Hardware will also play a crucial role here. HTC's Exodus device and Ledger's software integration through Ledger Live are two instances where hardware providers separate themselves from the rest. Lastly, interfaces may find distribution through being thin layers atop today's distribution networks like Twitter. Mask.io lets users post encrypted content that can be accessed only by those with the necessary permission.

The new internet will also need authentication and identification layers that allow individuals to have pseudonymous identities. Depending on the nature of the application and context, these will take entirely different forms. Shyft Network enables users to port their actual AML/KYC documents to an on-chain authentication system. They are already in talks with exchanges for being used. Netki and ENS, on the other hand, are systems that allow wallet identification through human-readable names and Bloom is focused on verifying financial documentation. Authentication systems on the internet today are increasingly trending towards single sign-on - which in turn gives firms like Apple and Google an incredible amount of both power and insights into user behaviour. Pseudonymous authentication systems allow users to engage with content without revealing much about themselves. We see early variations of this on Reddit, Discord and Telegram, where users are known by their handles more than real-life identities.

Lastly, context-specific payment networks will be needed to move value between consumer and creator. Depending on the use case, these could be entirely different. Flow and Ronin chains today focus on consumer-specific use-cases and have practically negligible fees. Players like Polkadot and Biconomy are more focused on cross-chain liquidity, while Arbitrum helps DeFi applications scale. Traditional fintech rails rarely have customisation, depending on the nature of the application. That is, we use somewhat similar payment rails for everything from Twitch streaming to remittance. Web 3.0 native payment rails have been creating entirely new use-cases by upending how these systems work. Superfluid is one example of this. They are a token standard that allows describing cashflows to program them. Sablier enables you to stream money over a given period. Creators and freelancers will mix and match these in unique ways to handle payments over the next decade.

Financial Layer

Creating meaningful employment would require a strong enough financial layer. I understand readers may think on-ramps and wallets are the same. I have categorised them differently because an on-ramp typically requires users to convert fiat currency to a digital asset. This is more or less like an investment. A wallet based interface can be used even through airdrops or tokens given away for free. One of the things I pondered on while writing is whether financial intermediaries can use on-ramps as choke-points. My conclusion was that so long as regulators do not declare an outright ban, users cannot be stopped from buying digital assets. The intermediary is not liable for what those assets are used for once in a user's wallet. I saw this play out in India, where the Reserve Bank did have a motion to stop banks from allowing users to do digital asset-related transactions. A year later, the Supreme Court had the Reserve Bank of India change its policy to allow users to do it. That separation of platform and financial intermediary could be instrumental as we tread towards the future of the internet. Why?

Because the nature of financial instruments in the creator economy will evolve beyond just payments. Platforms like Rally, Mintbase and Mintable allow individuals to create a digital good linked to an NFT and sell it. That is cash flow. That cash flow can be securitised and sold to individuals much like any business does. Creators would very likely want to take loans, crowd-fund or distribute revenue with their audience. Centrifuge allows users to create custom debt instruments that can be sold today. In the future, it may not be unheard of to invest in a creator's income stream. Much like it has become a status game to be an early investor in Uber or Facebook today, it could be a matter of great pride to be a backer of prominent artists and developers going into the future. These instruments in turn will be traded to give backers timely exits. That is where platforms like Rarible, Niftex and Uniswap play a role. Inevitably, at some point in the future, we will see a convergence of DeFi and the creator economy.

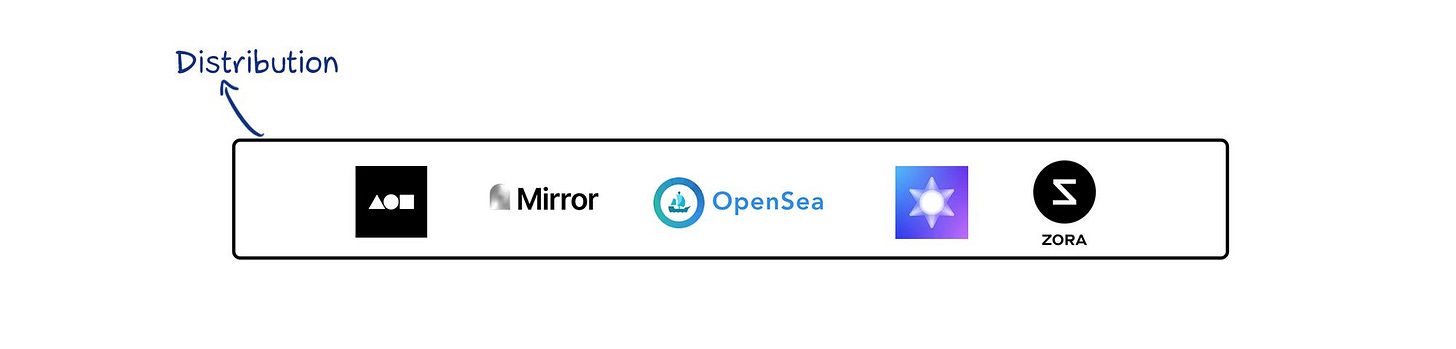

Distribution

As with much of the rest of the internet, users will need to find an audience and engage with them. In its current form, Web 3.0 has two ways of engaging with users. Through feeds (like on Mirror and ShowTime) or marketplaces like OpenSea and Zora. These distribution outlets capture the public psyche by having prominent celebrities and known brands issue assets on them. In March of this year, Time released a 3-pack NFT series covering the cover of a few major issues. Mike Shinoda from Linkin Park has been tinkering with NFTs. Public endorsement from known individuals have given these platforms much-needed credibility. The users will trickle in as an increasing number of creators think about better monetising their audience. Once you line up the incentives, creators transition and, with them, their follower base. The challenge I find here is with discovery. How do you realistically distribute content in a newsfeed without surveilling user data? What would a TikTok like app use to determine whether an upcoming video clip is interesting for a user? I frankly don't know. One way to do it would be to cluster transactional data and determine whether a user may be interested in a piece of content. For instance, if I have done a transaction on NBA TopShots, a video from a basketball-related creator could be interesting for me. More thought needs to go into this regard.

On Platform Modularity and DAOs Cooperatives

All platforms won't be decentralised right from the beginning. Depending on the use case, different aspects of the venture will push for decentralisation. One way this is playing out already is with NBA Topshots. The website and general user experience are off-chain. The core assets used to trade on the platform has gone on-chain. Hardware and network-based restrictions have not hit developers trying to scale applications just yet. The vast majority of "clogging" we see is on public blockchains trying to enable transactions. We may see the limits on decentralised storage and compute power when someone tries building a fully decentralised Youtube or Instagram. For the moment, it is safe to say that the internet is trending towards a period of modularity. Developers will mix and match different parts of the stack shown above. Gradual decentralisation may occur with platforms too. They start with only some parts of it on-chain and eventually trend towards being entirely on-chain with community members owning it. This leads me to my final thought on the creator economy.

Packy McCormick famously described cryptocurrency as an in-game currency in the great online game in this brilliant piece. Being one of the internet's most prolific creators today, he has written it from the point of view of someone that is constantly creating. I was thinking about how a truly decentralised Web 3.0 creator economy lets everybody play infinite games on the internet. When somebody consumes content online, they trade an intangible asset (time) for the piece of content. It does not necessarily have to be that way. Users can and should be rewarded for the time they spend on platforms. This creates increasing engagement and curates buy-in from people who genuinely care about the platform. Axie Infinity's play to earn economy is one instance where this has already happened. Instead of paying to buy assets (like in GTA 5), gamers are paid to play the game. All of a sudden, the shift has gone from mere consumption to partial ownership. How will those with ownership coordinate? In the form of a DAO. This may feel far-fetched, but publications like Bankless DAO are already turning into community ownership. I envision a future where more creatives allocate resources, sign contracts and distribute incentives entirely on-chain. Snippets of each creator's work could be distributed through modular interfaces unlocked with token-based payments. The ideal creator economy of the future is one that is not built on mindless consumption but a collaborative effort towards building a better future. That shift is one worth fighting for.

If you'd like to discuss elements of this piece further or simply argue about what parts of it are outright wrong - do hop on this Telegram channel. I am flying home to a tiny town in Kerala where I hope to read lots of Tim Wu books and ponder about networks and capital. I'll see you guys soon with a brief on another NFT venture that has been capturing my attention

Peace,

Joel John

Note: None of this is investment advice. DYOR.

______________________________________________

Setting Up A Job Board

I am thinking of setting up a job board alongside the reading list. Drop me an e-mail or DM me on Twitte in case you are looking to add jobs at your firm to the job board. Preference will be given for remote first, crypto-native profiles.

_____________________________________________