User Behavior On Polygon

Observations on on-chain behavioral patterns

Hey there,

We have crossed ~15,000 unique readers. Decent progress. I appreciate everyone taking the time to read, share and write back to this newsletter. It means a lot to me and those contributing. I wanted to start a series looking at how different prominent networks are doing. We'll dig into Polygon for today's piece - an emergent layer two solution enabling DeFi and NFT applications to scale.

Blockchain scalability has been a long-discussed aspect within the digital asset ecosystem. The number of transactions a network can enable determines what it is used for. Bitcoin allows around 4.6 transactions per second. Using it for micro-transactions within a game is likely not feasible. Ethereum has a limit of 30 txns per second. We see the impact of this limitation every time there is an NFT drop. Costs involved in doing transactions rise exponentially, making these systems prohibitive for new users. This is not a bug but rather a feature. Longer consensus times and costs for transactions generally indicate higher security in blockchain-based payments systems. Layer 2 solutions and cross-chain implementations are now slowly emerging to tackle this situation. One instance this has played out already is in the realm of gaming. Remember Axie Infinity? A significant part of what has helped them scale is launching a stand-alone layer two solution named Ronin. We see similar approaches within DeFi too. While there are multiple contenders in the Layer-2 ecosystem, we will be focusing on Polygon today. This piece has three components. We begin with comparing Polygon to Ethereum and Binance smart-chain, then assess how users behave differently on Ethereum and Polygon's variation of Sushi and end with observations on retail users holding the token. If you wish to learn more about how Polygon works, I strongly suggest reading this piece breaking down the journey of the founders and the protocol itself.

Distribution Matters

I have restricted the data from September 2020 onwards as that is when Binance Smart Chain and Polygon data sets became readily available. Before reading the piece, an added caveat to mention is that it may not be fair to compare Ethereum’s statistics with that of Binance Smart Chain and Polygon’s given the difference in security models, consensus, and on-chain transaction fee. The first data set I considered was the total transaction count on each of these networks. Ethereum has had a somewhat flat-lined transaction frequency over the past year. Binance Smart Chain has had a year-long lead and the distribution that comes with Binance as an exchange to establish the higher transaction frequency. The launch of multiple digital assets on projects like Pancake swap combined with the low-cost environment has enabled BSC to have considerably more transactions than Polygon. What I found interesting is that there was a temporary period where Polygon had a higher transaction count than Binance Smart Chain. The timelines closely aligns with emerging FUD on Binance and rising interest from Chinese regulators on curbing mining in the country. Capital-intensive BSC activity took a temporary dip during June then saw a rapid rise as market sentiments stabilised. Given the lead and network effects Binance currently holds, Polygon may take a while to catch up to where BSC is in terms of transaction count.

A different way to measure the on-chain activity of the three networks is to look at the total unique addresses in each of these projects. They indicate three completely different growth trajectories, and that is pretty normal given the age of each protocol. Ethereum for instance, has been around for over half a decade and has steadily added close to 50 million wallets to the network over the year. In comparison, Binance Smart Chain had a phase of parabolic growth where it went from a few million to over 50 million in a month in Q1 2021. A large part of what may have fuelled this is Pancake swap and retail frenzy during the bull rally of 2021. If you notice, Polygon has a somewhat exponential growth pattern that kicks off around March of this year. It aligns perfectly with their integration of Aave. Given that Polygon’s adoption has been more recent, it will be a while before the unique address count flips that of Polygon. Part of what could change this for them is their increasing usage in NFT and gaming-related ventures.

Polygon Wallets Conduct Six Times More Transactions

To understand why I believe that could be the case, we have to consider the number of transactions each wallet does over the day. You take the transactions conducted on the network and divide them by the number of active wallets on a given day to estimate the network-level average transaction count for each wallet. For Ethereum, this figure stands at around four today. Binance Smart Chain has roughly twice that at about eight. In the case of Polygon, the figure is at 37. Naturally, I find it hard to believe users are doing so many transactions in a single day. The case is likely that there are automated trading or transactional bots on Polygon given the low fee environment. This is not necessarily bad when you put it in the context of what I said when I started this piece. A network’s transaction throughput and cost of transacting determine what it is used the most for. A low-fee, high transaction fee network is best suited for algorithmic trading and retail use cases such as gaming micro-transactions and NFT transfers.

The impact of lower fees on Polygon can already be verified by observing how users engage with protocols while using the same decentralised application. Consider Sushiswap for instance. It is supported on both Ethereum and Polygon. To assess user behaviour, I studied two critical metrics for USD-based markets on the app.

The number of times an average user swaps on the network

The amount of capital swapped during a transaction.

Brandon Rochon from Covalent was kind enough to export this data using their API. Polygon based Sushiswap had a far higher count for users in the USD markets at around 14000 in comparison to Ethereum’s 5600 average users over the past 30 days. However, Ethereum based conversions had a higher average daily volume at $200 million compared to $42 million on Polygon. There are several contributors to this trend. To begin with, there is far more capital on Ethereum’s network than there is on Polygon and whales tend to do large trades if slippage is low. The low slippage can be a function of the pools on Ethereum based Sushi having more idle assets parked in them. Secondly, the capital concentration on Ethereum is indicative of the (perceived) security the chain holds today. Individuals are comfortable having millions of dollars on the network, whereas, Polygon is still in the process of building that trust. Lastly, bridges play a crucial role here. Moving assets between Ethereum and Polygon has a high degree of friction involved. As ventures like Hop and Biconomy’s Hyphen take off, we will likely see more capital accruing on Polygon based Dapps. For the moment, it is safe to say Polygon is a retail-friendly chain that allows a higher frequency of transactions for retail-sized swaps. This hypothesis can be confirmed by the chart below. Users on Polygon tend to do smaller transactions with higher frequency. A different way to interpret this data is that market-makers and automated trading systems find it easier to engage with Polygon due to the low cost of conducting transactions on the network.

Holding Patterns on Polygon Network

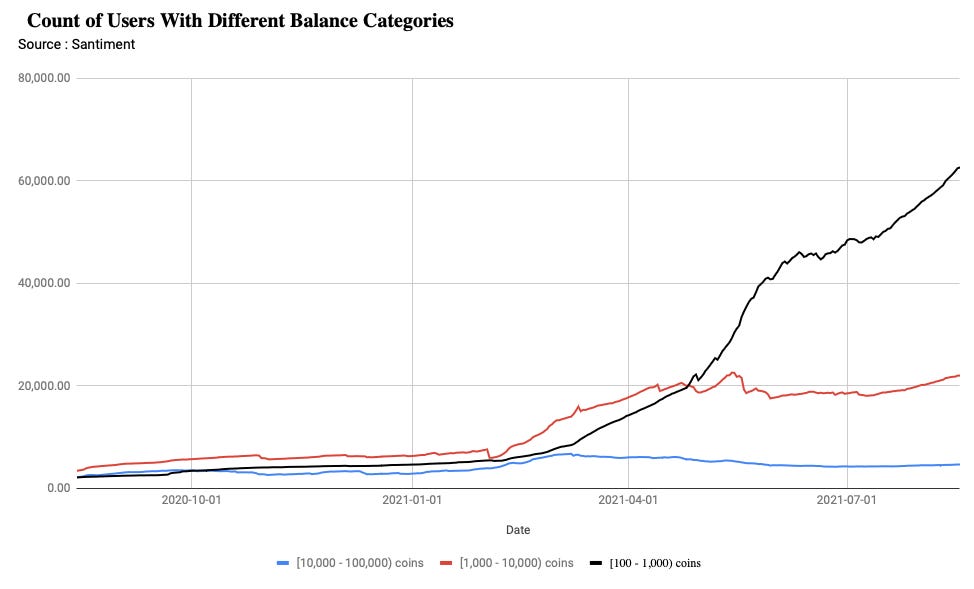

One proxy to vet if retail users are indeed the ones plugging into Polygon's ecosystem is through checking the on-chain behaviour of those holding the asset itself. I studied how users with different wallet balances behaved over time. The data is indicative as most investors tend to leave their assets on an exchange. It becomes evident that the count of users holding between 100 to 1000 tokens practically skyrocketed at the beginning of the year. The pullback among those holding between 1000 to 10000 coins may likely have resulted from users taking profit as the coin initially rallied. The count of wallets holding north of 10,000 coins has primarily remained flat while retail wallets have surged. This makes me believe there's been an influx of retail money into the network. The hold patterns of those with Polygon tokens tend to indicate the same.

The data below is from IntoTheBlock. They categorize users based on the amount of time an individual holds the asset. As you can see, alongside the number of active wallets holding small sums of Polygon rallying - the network has had a surge in the number of users holding it for more extended periods. These users move their tokens to a wallet (like Metamask) and let it sit idle. Over 100,000 wallets have held the network's tokens for a period longer than a month. These are predominantly users that hold small sums. According to Nansen, roughly 75% of the token's concentration is with wallets that have not moved the asset for at least a year. This figure may be skewed due to asset concentration in smart contracts.

The long-term holding pattern can be further verified by looking at the Matic tokens held in exchanges. This figure varies depending on the source. Santiment showed a peak of ~24% a year back, while Glassnode has the figure at ~40%. What is interesting to note is that Matic tokens have been leaving exchanges in large troves. While the figures vary from 2% to 6% depending on the source, it is safe to suggest that a very small portion of the token's supply is on exchanges. I considered comparing ZRX and SNX in the chart below as they were both projects launched around 2017-2018. Indicatively, their rate of leaving exchanges has now been more stagnant. To summarise

- Smaller wallets hold Matic tokens

- For more extended periods

- Outside an exchange.

A significant part of what could have fuelled this behaviour is Polygon assets in yield farming activities.

So What's Next

When considering the growth of networks, we rarely take into account the age of the network itself. Bitcoin had a head-start in comparison to Ethereum. The latter was around and well-established when Binance Smart chain took prominence. On a relative scale, Polygon is a young network. The network effects that come with multiple teams building on Polygon has not entirely taken off yet. In my observation, Polygon has to battle on two fronts. On the DeFi side - they will need to differentiate with Solana, Optimism, Arbitrum and the like. In NFTs, the competition is from the likes of Flow. Each of them has their own unique moats. Solana for instance has buy-in from multiple large market-makers and exchanges. Flow has an incredible amount of traditional, consumer-focused talent flowing towards it. Polygon's commitment to making networks more retail-friendly is evident from their recent plans of setting up a $100 million fund for NFT studios. Their recent acquisition of Hermez network is a means of building a moat around DeFi too. Part of what one needs to credit Polygon for is the way they have been able to dominate public narratives over the year. The chart from Santiment below compares social dominance of multiple polygon comparables. That is, the number of times a protocol gets mentioned in over ~1000 crypto-related social networks and media outlets. If you notice, Polygon has done far better than any of its peers. Through strategically enabling large, retail-oriented games and simultaneously building upon the DeFi stack, the team is building moats that let them continue to own the narrative. Maybe that is what ultimately determines a network's success. Its ability to drive, control and evolve narratives during different periods of its growth trajectory.

I am looking to do similar pieces on Near, Celo and Solana but the data-sets for them are not readily available. Drop me a text if you can help. I will see you guys soon with some thoughts on how DAOs are changing the venture landscape on Friday.

Peace,

Joel John

_____________________________________

Notes

1. This is not investment advice

2. I may have indirect exposure to the network mentioned.

3. Opinions are of my own and not of entities I am associated with.

4. Don't invest money you can't afford to lose into digital assets.