Hello,

Small note before we begin. I wrote this article with inputs from Sumanth Neppalli. Give him a follow if GameFi as a theme interests you.

I hope you are doing well. I wrote about Axie Infinity early last year. Much to my disappointment, I did not buy the token at $0.7 when I wrote about it and saw it rally to over $140. A year and a few million users later, Axie is about to launch yet another token, and it has had my attention for well over two months. I wanted to dive a little into why it matters and what it means for the ecosystem in today’s piece. For those not following what is going on - Ronin is a general-purpose chain launched by Sky Mavis, the parent company behind Axie Infinity. For the past few months, it has been in use as a settlement layer for economic transactions on Axie Infinity.

Understanding Ronin

Ronin is an Ethereum sidechain explicitly built for the Axie ecosystem. It is optimized for near-instant transactions and nominal fees, allowing millions of in-game microtransactions. The network is the backbone of Axie Infinity, powering all of its transactions and holding its assets - Axies, Land, SLP, AXS, Wrapped ETH (WETH). Currently, the network uses a proof of authority based consensus system. This means it has fewer validators (7) but has much faster transaction confirmation times. The set of validators on the network currently includes Binance, Ubisoft and Animoca brands.

Ronin seems like a gaming-specific layer one built with a focus on on-boarding gaming studios and a growing network of indie gamers to give them the necessary tools to bootstrap token economics internally. It could emerge to be very similar to Solana or Binance smart chain in functionality. They could likely just build off one of those networks. Then why bother with a stand-alone network when the alternatives already exist?

Because gamers are historically a price-sensitive user segment. The average cost of a transaction on Ethereum has trended towards $30-$50 in the past year, making it prohibitively expensive for new users.

Transaction finality on a layer one like Ethereum is likely not the best use-case for a network as decentralised as Ethereum. Keeping track of spam transactions from a game does not require complete decentralisation for the most part.

By launching a stand-alone chain, Sky Mavis has gone from being the service provider behind Axie Infinity to an infrastructure provider for games of all kinds to be built. Joel Monegro’s fat protocol thesis should explain why this matters. The value of Ronin - the underlying network should (theoretically) be more than all the apps it powers.

Sky Mavis’ launch of Ronin looks the opposite of what protocol layers do. Historically, the trend is to raise a large sum and spend years building a layer one to launch it alongside an ecosystem fund. Millions are then spent acquiring developers who often have little incentive to make in the absence of users. Whilst not intentional, Sky Mavis seems to go about launching an L1 through an entirely different approach. Through acquiring users on Axie Infinity and then building a general-purpose chain around it, they have solved the most significant challenge new networks face - users. Once the developers notice a few million users on the network already, it will only be a matter of time before more of them begin building on Ronin. This scenario is largely similar to the mobile operating system playbook from the mid-2000s. The reason why Blackberry eventually lost to Android and Apple’s iOS was not a shoddy product alone. Back then, users of blackberry messenger could not communicate with iPhone users or vice versa. As alternatives emerged, Blackberry’s userbase dwindled, which in turn meant developers had lower incentives to build apps for their devices. This, in turn, as you may have guessed, meant customers had fewer reasons to buy a Blackberry, and the cycle continued. Layer 1s today have the same battle going on. Large ecosystem funds attempt to attract developers in the absence of users. With its ~3.75 million monthly unique users, Ronin is likely hacking the entire process and suggesting: here are the users, come build on us.

The Traction So Far

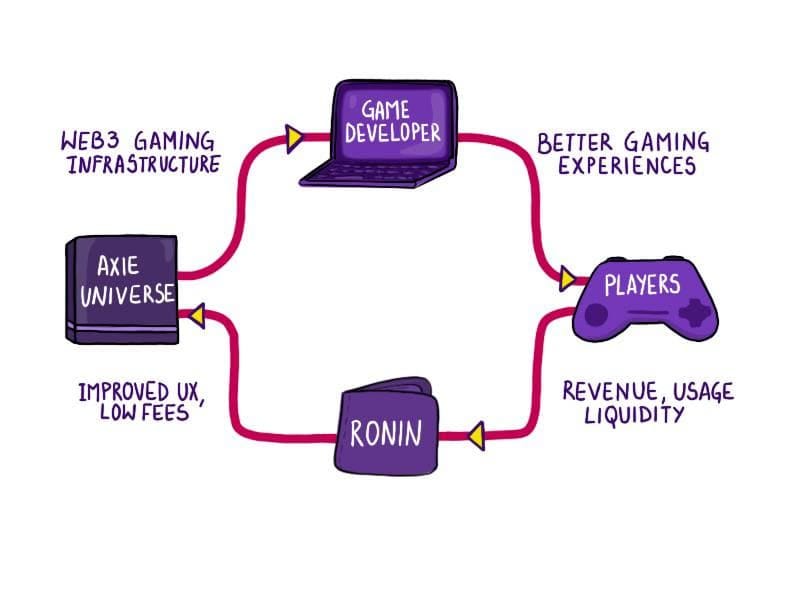

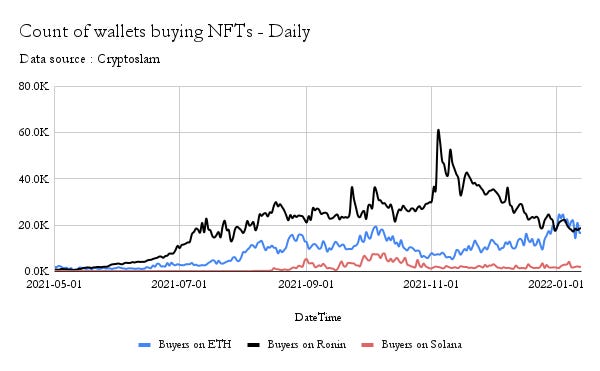

We will dig into what this means for the firm shortly, but before we reach that point, it may help to understand how far Axie has come since last year with Ronin. They did a cumulative $4 billion worth of NFT sales on Ronin Network in the past year through some 1.5 million buyers on the network. Staking on Axie has attracted over a billion in AXS locked. Ronin Network has roughly twice as many buyers of NFTs as Ethereum does and accounts for ~20% of the volume compared to Ethereum. This is large because the average transaction of an NFT currently on Ronin is likely roughly equal to what it costs for gas on Ethereum. Additionally, whales likely still prefer Ethereum’s security model for storing NFTs of high value, such as Bored Apes and Cryptopunks. Ethereum will continue being the destination where high-value transactions that require strong security exist. The gap in the market is for consumer applications where transaction frequency is much higher, but the size of each transaction is much smaller. That is what Ronin is beginning to fill in.

It is worth noting here that so far, the use behind Ronin has been oriented towards Axie Infinity. As a result, all of the transactions we see on the network are based on a single game, whereas Ethereum, Solana and Flow have multiple gaming ecosystems. So ultimately, Sky Mavis's real innovation is not delivering the layer one itself but developing the know-how on designing gaming economies where asset velocity (number of time tokens or NFTs change hands) is on par with other prominent layer ones. This fact is driven home by the number of buyers for NFTs you see on Ronin compared to something like Solana.

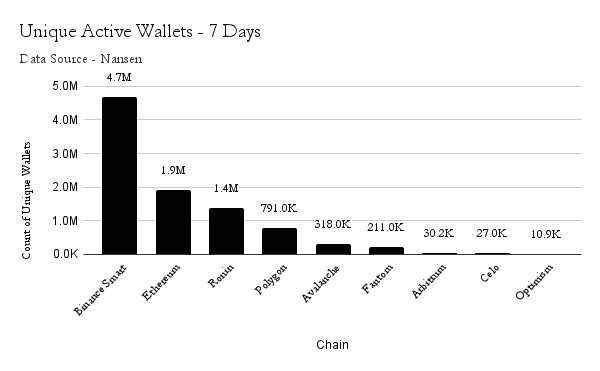

A different way to gauge the number of users moving to Ronin is by comparing the active users on Ronin in the past week. Ideally, Ronin should be faring far behind the likes of Fantom and Polygon due to the difference in the age of the networks and the number of applications built on them. Like I had said earlier - Ronin currently shows all of these metrics with only one game, and it is likely that we will see these numbers trending higher as more games are built off Ronin. As of 27th January 2022, Ronin had 1.4 million wallets - almost twice as much as Polygon did in the last seven days. The numbers may be slightly off for Polygon as the network was in the process of an upgrade in the past week, but it shows why Polygon has been aggressively investing in Polygon Studios. Just yesterday, it was revealed that the former head of gaming at Youtube will be joining their gaming arm.

A final step to benchmark activity on Ronin is to observe the number of transactions that occur on the platform. A total of 289 million transactions have happened across some 9.6 million wallets on Ronin so far. Polygon and Binance Smart Chain seem to be doing healthier multiples each day at around 7 million and 5 million, respectively. Ronin Network has historically shown that it can considerably handle up to 5 times the number of transactions Ethereum does per data from Nansen. What we found interesting in going through these numbers is that the average user in Ronin does roughly the same number of transactions as the average user on Ethereum. The transactions per user per day trend to be slightly north of 1. I would have anticipated it to be higher for Ronin given the lower transaction cost. Still, it is likely the same as Ethereum because users primarily use the app for gaming instead of merely trading.

Valuating Ronin

There have been multiple attempts at creating a mental model for valuing Ronin. I cover two of them below and link to a few more. A total of 1 billion $RON (ticker for Ronin) tokens are expected to exist over time, of which ~100 million will be distributed to users to provide liquidity on Katana - Ronin’s native AMM. The only way to receive Ronin tokens at the anticipated launch was to provide liquidity over the past quarter. The perpetual instrument listed on FTX currently values each RON token at ~$3. With a supply of ~100 million tokens released in the coming days, the circulating market cap is anticipated to be at ~$300 million. But let’s keep that aside for now and slice the valuation through the lens of fat protocol thesis.

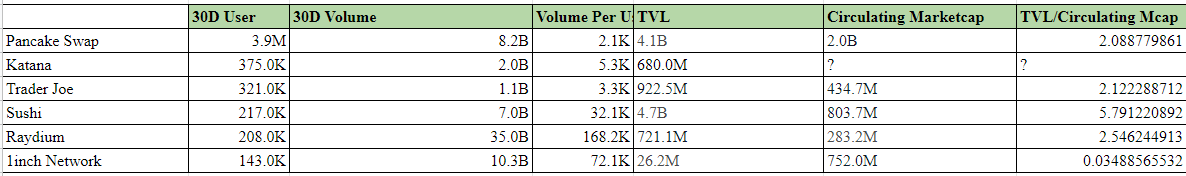

I had earlier hinted at why Ronin’s launch is about capturing value at the base layer. One way to estimate the valuation would be to look at how the applications are doing and benchmark valuations on their performance. Keep in mind - I am not taking into account revenue from Axie Infinity and focusing only on Katana. First, I took a look at the largest decentralised exchanges from DappRadar in the last 30 days. Katana ranked #2 with an engagement of ~375,000 users. The data itself does not feed into helping us land a valuation figure but gives context on how Katana ranks. As you can see, Katana does considerably lower volume per user than Sushi or 1inch. Part of the reason is that the other exchanges cater primarily to DeFi native users who usually exchange in large sizes.

Based on the above data - we can extrapolate what a growth curve for Katana would look like in the coming year. For my estimates, I took the initial figure for volume ($2 billion) and predicted it for a year. The $2 billion figure is from the volume we have seen on Katana in the past month. We assumed that the platform would start with a 60% MoM growth rate and said the rate would decline ~10% each month. Calculating from this scenario would give us an annualised volume of ~280 billion. This figure is on the conservative side, given that the yearly DEX volume on Ethereum alone currently comes to around ~1.5 trillion. Conservatively, an estimate for DEX volume across all chains is likely ~3x of that - at $4.5 trillion. We assume Ronin captures slightly north of 5% of that volume with a $280 billion annualised volume figure. Katana’s fee model involves 0.25% of the trade going to LPs and 0.05% to the Ronin treasury. We combined this as 0.3% of protocol revenue for ease of calculation. We then created scenarios based on this revenue figure to get a fair valuation for what Katana should be worth.

That total revenue figure of $840 million may seem outlandish but keep in mind most of it goes to liquidity providers. I was curious to see if this is realistic. One proof point I do have is that in the last year, Uniswap made ~1.6 billion in protocol revenue as per data from TokenTerminal. Based on this $840 million figure, a number of scenarios can be calculated for Ron’s eventual valuation if Katana was the only application on it. To get a projected valuation off this figure, we again considered the price to earnings ratio from TokenTerminal. This metric divides the fully diluted valuation of a venture with its annualised revenue.The multiple ranges from as high as 655x for Kyber to as low as 1.74x for LooksRare. There is no clear benchmark here. For context, according to their data, Axie Infinity is at a 55x multiple. I would presume the multiple reduces over time but could spike up and be in the multiple 100s if interest in the asset is high at the time of listing. One way to vet the PE multiple is by comparison to traditional securities. As it stands the PE multiple for Activision is at 23, for Ubisoft at 65 and for Take Two Software it is at 32. The multiple comparison here is not entirely fair given differences in how a governance token works when compared to traditional equities but it gives an estimate of whether we are being outlandish with the multiples.

(Okay, maybe not. I understand why too- feel free to write back to me arguing for an alternative though)

Keep in mind that the valuation here looks only at Katana as an AMM. The revenue from Axie Infinity or any third-party apps are not accounted for. Furthermore, the figures are optimistic, given that we don’t know of any external gaming studios or indie apps deploying on Ronin yet. Fat protocol thesis generally suggests that the value of a base layer should be higher than all the applications running on it. If that is indeed the case and an optimistic scenario for Katana's valuation is ~$40 billion then a $40 RON is not out of the question. The problem is fat protocol thesis does not play by the book at all times. During the bear market the value of stablecoins on Ethereum was higher than Ethereum - the network's valuation. It can only be used as guidance for a potential pricing for the network at this point in time.

Note: One reason to not add Axie Infinity revenue to this revenue calculation is that the value capture there happens in Axie Infinity token already.

A different way to look at Ronin’s possible price is to consider the opportunity cost of yield farming it over the last quarter. As I had said earlier, one of the only ways to accrue Ronin tokens was to provide ETH, AXS or SLP tokens in liquidity to Katana. The price of all three tokens has declined over the last quarter. There is also the opportunity cost angle. While an individual trader could consider countless opportunities, the estimation here is that a power user willing to put large sums in liquidity towards Katana likely knows how to yield farm elsewhere. So we tried to calculate the price based on (i) an estimated average TVL over the last quarter (ii) the projected yield an individual could generate with said assets on that single quarter, and (iii) the number of coins that come to market next month.

The assumption here is that entities that had an opportunity cost of making, say 10% in return the last quarter on idle assets, would likely not sell it unless they make a multiple of said return. Because or else why bother with the risk of providing liquidity at all. Until the token reaches a price point where someone yield farming in volume is comfortable selling to recoup opportunity cost and base yield levels, a potential sale is unlikely to happen when the token goes live. This is not to say retail participants who were yield farming in the last few months will not sell. Farmers that have taken major drawdowns on SLP and AXS price in the last few months will sell to book profits, but their RON holdings' size will be too small for this to matter. Part of the reason I suggest this is due to data from Ronin's bridge. According to data from Nansen, the last week alone saw some $320 million move into Ronin through their bridge - but only about ~390 addresses did that. The network is likely whale dominated if the average deposit per wallet is $820k. It makes me think none of them will be selling for low yield returns.

The final way to compare Ronin is seeing it through the lens of layer two valuations. Ronin is by default a Layer 2 and could become a comparable to Boba Network, Polygon, Avax and Fantom. I have not undertaken that analysis here as the good folks at Arca have already done so. However, I highly suggest taking a look at their breakdown for a price estimate for Ronin token in the long run.

So What's Next

I did not anticipate Sky Mavis to grow 100 times in valuation over a year when I wrote about them last year. I missed two things in observing them at the time -

(i) consumer-focused applications have far more exponential growth curves than the typical DeFi native ventures I see

(ii) Axie Infinity’s mobile-first focus was part of what empowered their adoption early on.

The thing is - we are so early in terms of crypto adoption that a 5 to 10 times growth from where we are today is still likely for consumer-facing apps. This is nothing new. In 2008, Zynga games’ Farmville was a leading reason for teenagers to sign onto Facebook. Gaming makes new technological paradigms relatable in a way discussions about complete decentralization or sovereign money cannot. One of the data points I have seen emerging from several consumer-facing apps is that ~70% of their traffic comes from mobile applications. Through Axie Infinity and Sky Mavis, Ronin has the unique advantage of distribution through mobile apps today. It would be interesting to see how that plays out over the year. What Sky Mavis has effectively built is a flywheel.

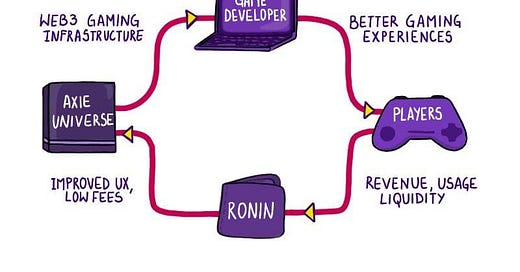

Refer to the image at the top of the newsletter for context.

Game developers may move to Ronin to give gamers a better experience,

- which in turn leads to more liquidity and transactions on the network

- the economy of scale makes servicing each new user on the network cheaper

- which in turn reduces the CAC for Sky Mavis' own games like Axie Infinity

- Revenue from these users are then re-invested back to game developers looking to build on Ronin.

Lastly, Ronin represents a shift in historically thought about gaming. The developers that contributed to the growth of AWS in the early 2000s saw no value come out of it for themselves. Neither did the users. It enabled Jeff Bezos' to eventually work on his rockets but I guess we can do better. Ronin’s distribution model philosophically puts users that own AXS or SLP first. The fact that anyone could earn SLP tokens in the last year (albeit exposed to price variations) means gamers will hold a large share of Ronin tokens. This is not to suggest VCs, hedge funds and Sky Mavis have not optimized for ownership of the network. But on a percentage basis, gamers own a more significant chunk of Ronin than they do of Activision, Blizzard or Electronic Arts. It will be interesting to see how that ownership element shifts gaming behavior in the quarters to come. The declining price of SLP has currently alarmed a large section of Axie Infinity’s userbase. There is definitely room to have a deeper conversation on how guilds and the play-to-earnings ecosystem will affect labour markets going forward. We will be writing a bit on that next week, but we come back to Ronin for now.

Over the next year, Sky Mavis (the parent company behind Axie Infinity) will essentially shift from being an application developer to an infrastructure provider in my opinion. Naturally, anybody can put together a bunch of servers and claim they have created a new layer one. However, that is not where the value lies. The value within the firm is in the last 3 years of experience building token economies, engaging with communities and the data that has been generated as a result of it. With the support of juggernauts like Ubisoft, Sky Mavis is in a better position than most other layer ones to enable indie developers to grow. Katana will be a massive liquidity sinkhole if we begin to see a huge suite of games alongside defi native applications being built on Ronin. That is where the actual bull case for Ronin currently lies. If I were to build something from scratch today, I would probably be building a lending market on Ronin. Write to me if that's you.

I will see you guys tomorrow with a brief on how a decentralised derivatives platform is evolving to combat front-running through a focus on hardware. Also make sure to come hangout in our little telegram group if you enjoyed reading this piece.

One last thing - this publication finally has a sponsor. You could figure out who it is if you see where I get most of my data from. More details on that tomorrow..

Peace,

Joel

Note.

1. Financial entities I am linked to may have exposure to assets mentioned in the article.

2. Not financial advice. Digital assets currently have a high amount of volatility. Do not invest what you cannot afford to lose.

3. I did not discuss this piece with anyone from Sky Mavis prior to publication.

_________________________________________________________

Job Board

We launched our Pallet a few weeks back. The plan has been to build a small curated list of jobs, ideally with ESOPS or carry from vetted founders in the Decentralised.co community. Make sure to check the list of 25 jobs we have listed if you are looking for something new. Roles cover everything from CTO roles to opportunities in VC and non-tech roles. Get in touch with us if you are looking to list a role there.

Apply here.

____________________________________________________