To Infinity And Beyond

Understanding the origins of Axie Infinity

Hello,

NFTs have been the talk of the town lately. We may have either entered a new paradigm in the market's growth or entered peak bubble territory with Mike Shinoda's likes launching their own NFT art. He auctioned it for $30,000. A non-fungible token is a non-divisible representation of an asset on a public, permissionless blockchain. It gives an alternative way to enforce digital scarcity as the asset cannot be broken down to reduce entry barriers. Digital instruments like Bitcoin and Ethereum can be fragmented into much smaller parts. Which in turn makes the entry barrier for owning a bitcoin or Ethereum much lower. Instead of having to spend $2000 on buying a whole ETH token, an individual could buy 0.01 ETH for $20.

A non-fungible token on the other hand requires complete ownership. One way to think of non-fungible assets is as holdings that lose their value if you break it down into parts. An art piece for instance is of value only in its entirety even if a group of people own it. If a small part of the Mona Lisa painting was torn off, would it still be valued at half a billion? I doubt it. Blockchain-based NFTs allow verification of the source of an art-work, the past owners it has had and the pseudonymous identities of who owned it by simply running a query on Ethereum’s blockchain. Similarly, it allows programmatic functions such as automated selling on receiving a bid matching the seller’s requirements or distributing different art pieces or access rights across a high number of wallets. NFT enabled business models are touted to soon be disrupting everything from events to music and gaming. Last month, I spoke with Aleksander Leonard Larsen from Axie Infinity to discuss how they have been using NFTs and what the team’s journey has been. This article is the aftermath of that conversation. We explore what Axie Infinity is, the team’s journey and how blockchain-based gaming is slowly coming of age. Do note - this is going to be one of two stories. The second one will dive deeper into potential business models within NFT based gaming.

Tokenised Property From Digital Realms

Every generation has a metaverse it grew up in. It may likely have been the thrill of sharing pirated content on Napster and talking to strangers on MSN messenger for the ones slightly older to me. For my generation, it was Farmville. The joy of building assets, clout and proving to be better than peers with digital wealth at a time banks went belly-up, and our parents dealt with a looming economic recession in 2009. Then came the likes of Pokemon Go and Fortnite. Over time, as a generation grows older, the metaverse it grew up in could become less relevant. Because people grow up and their preferences change along with them. In December 2020, Zynga announced that they would be shutting down Farmville. With it, a generation's memory of digital interactions went down the drain. This made me think quite a bit about the concept of ownership. In creating this "new internet" we refer to as web3.0 - we keep repeating that individuals must own their data. That is an abstract way to suggest the playlists, curated boards and photos we share on these platforms must be owned by the user. Users having the right to download their generated content and plug it into third-party platforms could new business models that weren't possible earlier. We see the early after-effects of this within the gaming ecosystem in crypto. I highly recommend reading this resource from Opensea to understand the basics of NFTs.

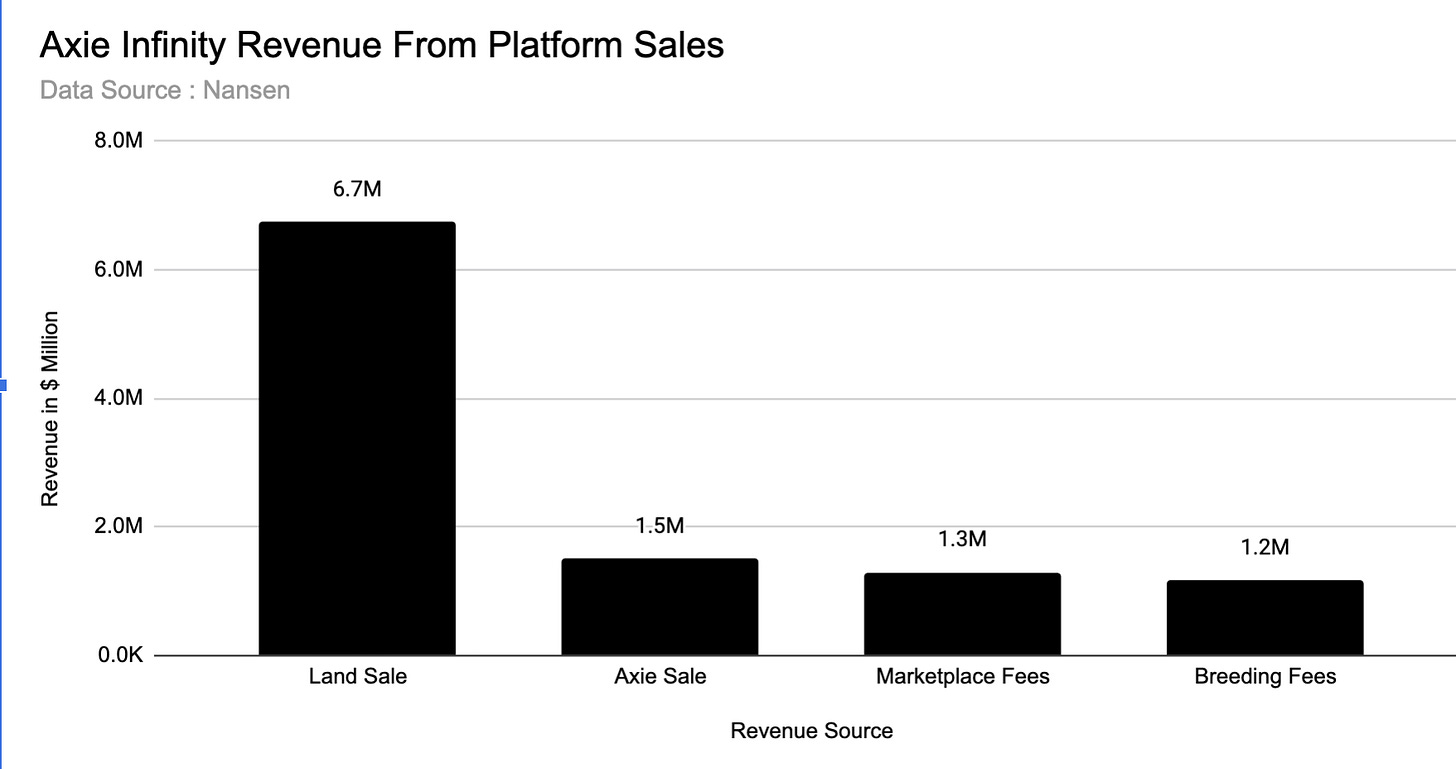

Axie Infinity is one of the fastest-growing DApp in the Ethereum ecosystem today. DApp.com suggests that the venture has over 20,000 users. Their marketplace has enabled close to $1.5 million worth of transactions in the past 30 days alone. These numbers matter because, unlike conventional games, Axie Infinity requires you to spend ~$150 acquiring tokens to play the game or spend ~30 hours generating a potion needed to begin playing the game. This is the cost users pay to make the team to begin playing the game. There is a heavy entry barrier compared to traditional mobile apps that can be downloaded and played right away. Axie Infinity clubs Pokemon-style gaming with fictional characters, each holding their abilities and powers with a market to trade body parts that enable these powers. Think of it as a graphical representation of card-based games you played as a child with a real-time, global scale market. If you are into gaming and wish to know more about how the game's economics works, I highly recommend reading this piece by Delphi Digital from when they spent ~$160k (or an MBA's worth of money) for on-screen toys.

Chat-rooms are the new startup-hubs

Axie Infinity's inception was in the chatrooms of Cryptokitties. In the bull markets of 2017, the project came to the limelight for clogging the Ethereum network. People were unable to move their assets as users were busy trading digital pets with one another. The team behind Axie Infinity were slightly disappointed with the limited functionality crypto kitties offered and wanted to take things one step further. Combining rare in-game assets with a gaming experience could mean a venture that could scale meaningfully. They put together a plan to raise about $700,000 in exchange for digital assets during early 2018 and got to work on an alpha version. Alexander initially joined as an advisor but eventually quit his job in Norway and moved to Vietnam to be with the rest of the team. For a very long time, the team was just nine members building out of Vietnam. The bear market of 2018 meant a declining appetite for on-chain gaming and the product was still in its nascent stages. The team survived the harsh conditions of the time and did a second round of funding for $1.46 million in 2019. The venture round in 2019 involved a broad mix of investors including Animoca Brands - a global leader in blockchain-based gaming. Other investors of the round involved Hashed and Consensys. The capital infusion clubbed with the incredible developer talent in Vietnam and low burn-rate helped the team wade through till they found product-market-fit.

In hindsight, most of what worked for Axie Infinity has to do with the team's persistence. Version one of the product required both parties to sign each move by the characters of the game. Leading to a terrible gaming experience and added to the cost of using the product. Gradually, the team worked towards making the non-essential components of the gaming experience centralised. As the group continued to iterate and much of the craze around crypto kitties itself dwindled, users looked for an alternative. Axie Infinity was in the right spot to capitalise on that. Community members slowly began porting over to Axie Infinity. This, in turn created much-needed feedback loops for the team to iterate with. The team realised that the community was as vested in the product's development as the team was. They were with them as it evolved, giving critical feedback and a userbase to test the product. They had a moat that could not be forked away by a larger gaming studio that came overnight. That said, teams should be worried about asset concentration in a handful of wallets early on. Whales hold power to hold a team captive and influence how they develop products. There is a delicate balance between community ownership and a team's vision that every builder in this space needs to tread through.

Game publishers like the team behind Axie Infinity have good reason to create an ecosystem in the future. This would allow them to cater to a wider audience range while simultaneously building independent NFT based economies in each. This would be similar to traditional gaming publishing houses like how Rockstar Games has titles like Grand Theft Auto, Red Dead Redemption and Max Payne under the same studio. The difference here is that users could port their assets or reputation from one game to another. For instance, if I spent 50 hours playing GTA 5 today when I port over to Red Dead Redemption, all that effort goes to waste. In an NFT based ecosystem - Sky Mavis (the team behind Axie Infinity ) would be able to allow a user to sell all their assets from one game and buy assets in another to have an edge. The other angle to building an ecosystem would be to enable cross-game compatibility of reputation. Doing specific actions or unlocking a certain level in one game should affect another. In today’s siloed environment, it is hard to pull that off. Only air-dropping access tokens to addresses or user wallets that have a certain amount in Axie assets would be a simple way for Sky Mavis to build towards that vision.

Alternative Infrastructure For Gaming Economies

The fundamental value proposition a blockchain-enabled network brings to the table is alternative financial infrastructure. Games like Counter-Strike have had in-game economies since 2011. Rockstar's GTA 5 did over 6 billion in revenue by as early as 2018. The difference is the financial rails on which these assets are traded are centralised and often inaccessible to those in developing economies. The risk with centralisation is simple. Platforms could decide that a rare item a player holds is no longer valid. Or even worse, restrict them from trading it with another player. When games get taken down, gamers have no recourse to port their reputation or assets to an open-source alternative. Assume a player finds a scarce in-game asset and decides to sell it with Paypal as a payment method. It will be hard for them to receive any meaningful amount of money for that transaction without having Paypal shut their account down.

Crypto based payment rails make it possible to trace assets and enable payments with little to no friction. This is the core value proposition for many that turn towards NFT based gaming today. Verification of ownership of an asset and payments have little to no friction. Whether regulators wake up to this reality and mandate stricter AML/KYC at off-ramps is something we will need to watch. There is one more reason that in-game assets make sense as an NFT category. They allow users to have context, utility and community. A non-fungible token on its own may not be desirable without a community that determines that an in-game asset is worth something. For comparison, a t-shirt issued by Supreme is not desirable on its own. Its value is derived from the community of people that desire it. You could make the same argument for degrees, startup investments and invite only clubs.

Similarly, in-game items can help people level up faster in games, which could create income for them. Asset ownership within games also makes it possible to enable users to have a say in the project's governance. Historically, a gaming studio's feedback loop relied on market demand to see if gamers enjoyed what they were building. Currently, the price of the underlying assets (NFTs and tokens) fluctuating in response to the developer's shifting priorities act as a proxy for how users think about new decisions being made. It also allows the average user to fund specific initiatives and upgrades within the game. This is governance in real-time.

NFT based gaming experiences are not reliant on the graphics alone. It is heavily intertwined with the economic angle of the game. For instance, a user needs to be cautious about spending too much acquiring an under-skilled character or listing a heavily desired Axie on the marketplace at lower prices. Developers of these games need to worry about the gaming experience and the economic angle at play. We have barely seen e-sports and NFT based gaming coming of age. In the not so distant future, we will likely see E-sports teams being able to sponsor themselves only by reselling NFTs they used during a game. Developers building for this crowd need to bring an in-depth knowledge of economics and network effects alongside traditional gaming.

In my view, NFT based gaming will likely be one of the fastest-growing sectors within the token ecosystem. We see the likes of NBA Topshot and Zora receive great attention because they have the distribution figured out. Once the average retail user realises they can have the same amount of notoriety as their favourite sports stars in gaming economies and make ridiculous sums of money, the amount of retention on these games will be a multiple of traditional applications. This is already happening. For instance, a single user was recently able to sell land-based NFTs worth $1.5 million on Axie Infinity. The team has also launched its own layer two solution with 1000+ ETH transacted between users.

Of Moats And Pitchforks

What I learned in writing this piece is that tokens can be a very strong retention mechanism too. Where traditional games require millions of players, a tokenised gaming ecosystem can become profitable with a much smaller userbase. The cost of acquiring new users is a fraction of what traditional gaming firms spend because the monetary incentives flipping items in these games offer is high. Most importantly, it allows users to have their voices heard through on-chain voting. Blockchain-based games are likely here to stay. Axie Infinity has the first-mover advantage here. Their ability to retain the top spot will entirely depend on the team’s capability to iterate and deploy new gaming economies at a pace that keeps users engaged. Being an early mover in this regard does have an advantage though. Axie has two years of experience building token economies, building communities and retaining talent. For a large studio to replicate that overnight will be beyond difficult. For Axie, strategically the focus now will likely be to scale up distribution.

One also has to think about moats in the context of NFT based gaming. The investment an average player makes in a non-asset-backed game typically tends to produce no return. I have spent hundreds of hours playing Age of Empires but none of that can be ported to real-world assets. This means I have every incentive to leave the game after a while. Years later, when I played Forza Horizon 4 on the Xbox, I noticed a similar trend. There is a diminishing marginal utility for the gaming experience. On the flip side, if it were an asset-backed gaming environment, the returns I make from the game itself would be exponential. The more I played the game, the easier it gets to accrue high-value items to my account. Power users in Axie likely stand to make a return for time invested in a healthy multiple versus the average leisure user. This commercial angle to their experience is the most extensive moat Axie has today. Users on the platform will be retained so long as a new gaming platform comes along and creates a new power dynamic. We see this on the social web already. Influencers on Instagram are not influencers on TikTok. There is often a new land-grab of sorts that happens when a new platform launches. Axie Infinity will be able to retain its initial userbase and have a healthy basis from which they can grow. Players on Axie are vested in the growth of the game, which changes how users behave. That is a very powerful moat to have. Aligned incentives are the most powerful retention strategy for early-stage products.

That’s all for today. I will soon be in touch with a brief exploration on how personal tokens are evolving and insights from the venture ecosystem in Asia. There is also a piece looking at how venture markets are currently reacting to the recent run up in token prices in the works. See you soon.

P.s - If you wish to collaborate with me on the emergent business models in NFT related gaming piece, just hit reply and drop me an email. My DMs on twitter are also open. Also I am definitely looking at dealflow within the NFT space for investments. Hit me up if you are building something in the space.

Off to grab ice-cream with a friend after a long day,

Joel John

Axie Scholarship + Free Airdrops anyone?

I have been thinking of making a list of users that would be open to beta-testing new projects and helping give feedback for it. Instead of spending $200-$300 on traditional marketing outlets, I figured a smarter way to compile a user-list would be to just offer an Axie Scholarship to someone looking to play it.

If you have been active in the space - consider filling up the form below and signing up for the newsletter. I will be in touch with one random user to set them up on Axie Infinity.

Do note - I will be getting in touch with those filling the form to beta test and potentially receive airdrops for some new DeFi projects I am helping bring to market. Everybody wins. Eventually.

What I have been reading

Enjoyed reading this? Consider sharing it with someone else that may enjoy it

Sign up for the newsletter so I can email you the next time I write something

Leave a comment. I like hearing from people that take time to read things I write