The Future of Venture Capital Will Be Decentralised

Or why your Tier 1 VC will likely soon be replaced

Hey there,

Joseph Schumpeter coined the term creative destruction in 1942. Its core idea is that over time, capitalism tends to shift systems towards efficiency. Replacing old, outdated ways of doing things. Web3 and its constant evolution means we can see this occurring in a much shorter period than traditional businesses where it tends to take centuries. I think the last few years have been an excellent example of the venture capital industry undergoing creative destruction. Given the early-stage nature of the technology, the amount of capital available for founders building in it and the individuals deploying it have shifted seismically within less than a decade. Here is how I break it down into three phases.

2012 - 2015 - This was when digital asset venture investing was almost entirely done by traditional venture capitalists. For venture funds, these were high-risk investments made at the periphery of where technology was trending towards. Blockchain investments were not made for "here and now" but for the distant future.

2015-2017 - ICOs were at the periphery and far from an "accepted" way of raising funds. Networks like Ethereum and Cosmos raised between these years, leading to what would eventually become the ICO boom. A few venture funds focused on investing in digital assets (the tokens), but they were not yet considered comparable to traditional venture funds.

2017-2021 - ICOs took off around March 2017, and depending on the source you go with, they raised anywhere between $8 billion to $25 billion. Markets underwent a bear market, and every fund was preparing for the worst, at least until May last year. It laid a perfect storm for newfound funding primitives to take off. This era gave rise to the first generation of significant token-based funds. It also birthed many angels that found exits as the protocols they were working on started going public.

Multiple protocols that launched around 2017-2018 had the tokens or assets vesting to founding team members vesting by now. It empowered a new generation of capital allocators that were both capital-rich and experienced when it came to helping other founders navigate the industry. Venture funds in the digital asset space also have to compete with hedge funds that are now allocating capital aggressively towards the industry. In other words, everything we have known about venture funding in the digital asset space has upended in the brief period of four years. Part of what is driving the change are venture DAOs. They could be considered DeFi primitive that have emerged over the past 3 years to help allocate resources to emergent businesses within the digital asset space. Remember the DAO that got hacked in 2016? Its objective was to give resources to ventures and receive tokens in exchange. A predecessor to the ICO era. A few years later, projects like Metacartel began taking active positions in ventures alongside traditional funds.

Understanding Venture DAOs

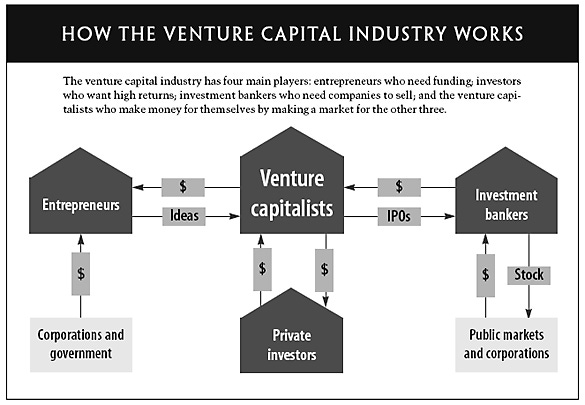

In a traditional venture fund, the key source of capital is usually large pools like pension funds, endowment funds and strategic corporate investors. Individuals with massive pools of money as part of an exit or family offices also tend to invest in a venture fund with the idea that it is an excellent way to build exposure to emergent startups early on. There is a middle layer here in the form of a fund of funds, but we will not go there for this piece. Historically, this came with an access problem. Large pools of capital may often not have access to the best fund managers on the rise. On the flip side, the best fund managers may struggle to find good sources of capital. Who you raise from often matters as much as what you invest into when running a fund. This is part of the reason why many of the fund managers that Julian Robertson of Tiger Global initially seeded made it big. The concept of a network goes on steroids when you consider capital markets.

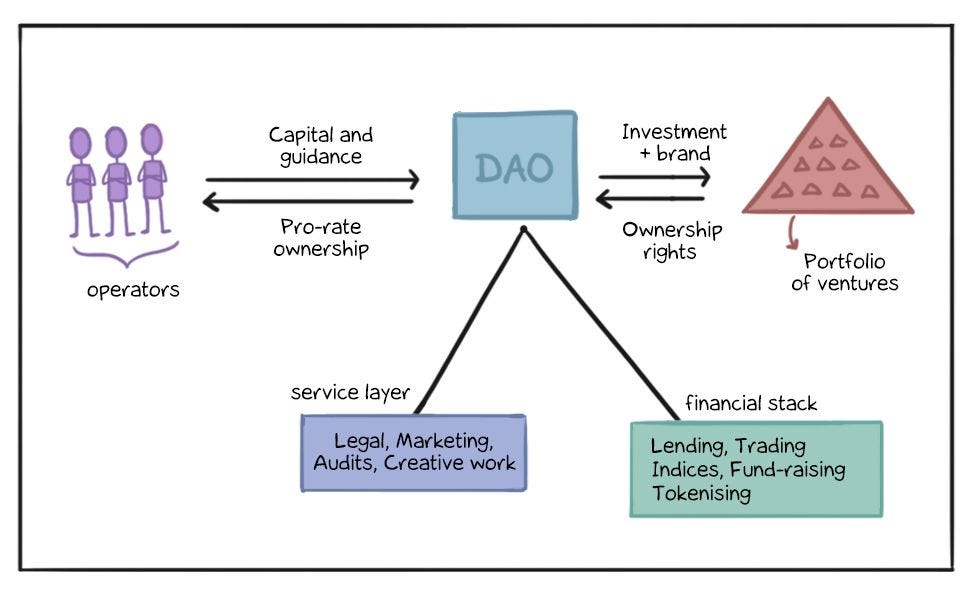

A venture DAO disrupts this relationship. Hypothetically, it should allow any cooperative in the world to come together and start a venture fund. The assets involved are digital, traceable on-chain and performance is verifiable. This should be a better model for venture fund management than the traditional, opaque alternative. Why? For starters, it makes the venture game a more global one. This matters in cases where geo-specific venture investments or niche themes come into play. Anybody should be able to set up a DAO based entity, rally decision-makers behind it and source capital. Early variations of this are already here in the form of ventures like YGG. Instead of sourcing capital, they source assets and connect them to a labour marketplace. Primarily, today DAOs offer several critical differentiators in the venture landscape.

Venture DAOs typically have a far more diverse set of members that are often more experienced than traditional venture funds. The members are often venture operators that can meaningfully bring value to the venture.

Decision-making processes should theoretically be transparent. Either a pre-selected committee or an open-access DAO based vote determines whether an investment should be made. Capital allocations are made through digital currencies that can be transferred instantaneously.

Venture DAOs typically tend to invest in digital assets. It makes it easier to distribute the assets they have invested into towards members. Decisions to liquidate holdings can happen at the DAO level or at the individual level. A protocol that has raised money from a DAO can track when and if a DAO chooses to exit. Similarly, it becomes easier for those contributing capital to a DAO to see the liquid portfolio of the DAO at a moment's notice.

In my understanding, the world of venture capital is diverging into two paths. On one side, you have sectorial experts setting up their standalone, single GP venture funds as solo operators. Elad Gil's $300 million fund is likely the best indicator for this trend. On the other hand, funds will specialise as standalone units that shoulder part of scaling an organisation. A16z has practically perfected the model. Founders working with the fund get access to some of the best talent in marketing, compliance, growth and finance as part of the value add they bring to the venture. DAOs are at an intersection of the two. A DAO can simultaneously allow collaboration and independence. As a result, early-stage angels can see a far better deal flow working with one another and have a closed circuit of individuals they trust enough to help the venture scale. All while not being under the kind of non competes a centralised fund would typically mandate. There are several DAO based venture funds in the wild today. We look at some of them below.

Metacartel - Ecosystem First Approach

A DAO counts the CEOs of Aave, Nexus Mutual, Ocean Protocol and Axie Infinity as members. One that has incubated Raible, Gelato Network and DAOHaus. That is Metacartel for you. The DAO was set up in the bear markets after 2017 to build an ecosystem of founders and builders. Entry to the DAO itself costs about 10 ETH for individuals or 50 ETH for an institution. This brings in capital to the DAO while curating who buys into the deal flow. Having money alone does not get you entry. Individuals are expected to pitch themselves to the DAO and have sufficient support to be a member. The DAO itself is comfortable being the first cheque in for early-stage organisations. Joining the DOA is a permissioned process that requires consensus from members, but exiting is permissionless. An individual leaving Metacartel gets their pro-rata share of assets held by the DAO. Being a venture fund is only one of the many things Metacartel does. The ecosystem also involves giving grants and finding strategic collaborations with organisations laying the foundation of web3 and community-based organisations.

The LAO - Taking The Legal Angle

The LAO takes a legal spin on how DAO based venture funding can occur. They have deployed north of $50 million into about 30 ventures so far. The LAO was set up in April 2020 as a Delaware corporation to interface with investing in traditional venture equity. The membership of the LAO is capped at about 99 accredited investors. Individuals being a part of the DAO are expected to give their AML-KYC documents. Cheque sizes vary between $50k to $100k and the voting period goes on for seven days. There are no designated "general partners". Everybody that is a part of the DAO has the right to vote. Ventures backed by the LAO stand to benefit from the vast network of mentors currently involved with the LAO

Impossible Finance - Decentralising Launchpads.

Remember Binance Launchpad? It used to be a way for new token networks to launch on Binance. Whenever a new network launches, founders struggle with two things: distribution and legitimacy. Finding early adopters for a new network when you don't have a massive social media presence can be costly. Additionally, market participants find it hard to find legitimate ventures to get involved with at the early stages. Binance solved both by doing due diligence on ventures and launching them through a sale of digital assets on the exchange. Impossible Finance brings the same experience to a DAO model. Founders working with the DAO are incubated and assisted with scaling the venture. Once the individuals behind the DAO are satisfied with the traction, an allocation is put on the launchpad. How do you choose whom to give allocations to? Impossible Finance has a native token that is used for staking and governance. Those staking the asset are given allocations to avoid competition or gas wars. You can find how the system works here.

4. Syndicate DAO - Infrastructure for investment coordination

The democratisation of finance takes different forms and routes over time. One way it has occurred is through the emergence of angel investing and syndicates. Platforms like Angel.co and Republic have made it possible for individuals to invest in early-stage ventures from anywhere in the world. SyndicateDAO is building infrastructure to bring that to a web3 native ecosystem. The product allows groups of individuals to come together and collect capital for investing, donations or active management. The team has collectively raised north of $20 million to bring this goal to fruition. I had applied for their private beta and could not get access as of writing this but will most likely be an active user of the product once it opens up. SyndicateDAO's core bet is likely that capital management is now becoming a multiplayer game, and the infrastructure used today is not optimised for it. Collectives are being formed for everything from buying NFTs (e.g.: PleasrDAO, PartyDAO) to accelerating gaming (e.g.: YGG). I highly recommend reading A16z's post on their investment into SyndicateDAO here.

This is by no means a comprehensive overview of all the DAOs that are in the ecosystem today. I have not covered prominent players. I highly suggest reading Messari's piece on venture DAOs for a longer list of entrants in the space. In my understanding, we are seeing the emergence of an entirely new DeFi primitive that has largely gone unnoticed by the market. Unlike lending markets or AMMs, DAO based venture funds have slower monetary velocity in that capital allocation takes longer than conversion of assets. Over time some of these DAOs will very likely be billion-dollar entities in the future. The A16z of 2040 may be managed entirely on-chain by pseudonymous experts whose work and reputation can be tracked on-chain.

The Bull-case for DAOs 🐂

Historically, VC firms have been predicated on closed access networks. In my view, venture related DAOs will unbundle this aspect entirely. Instead of waiting on an associate or analyst to do introductions, firms will post requirements in an open forum and individual members of the DAO can bid or offer assistance in a competitive way. It builds the angel investor's reputation transparently while simultaneously enabling the founder to have more optionality. Venture related DAOs will likely also engage with other guilds and DeFi protocols to receive the best. One way this could go is with freelancers coming together to form service-specific DAOs. We may see a group of lawyers developing a DAO to assist a protocol or writers collaborating to help a DAO optimise its portfolio's messaging. These will be DAO to DAO interactions instead of a corporation to corporation interaction. Why does that matter? Because a DAO can technically be open to far more people than a corporation can on its payroll. This allows both the supply and demand sides to seek what's best for themselves instead of tying itself down to arbitrary choices provided by a centralised VC firm

The more exciting bit for me is that a DeFi native venture DAO can choose to use DeFi projects to re-capitalise itself. Using token-based assets to take a loan on-chain to double down on a venture investment is not out of the question. Similarly, a venture DAO can offer its assets to indices, tokenise cash-flow from portfolio firms or simply yield-farm with it. Crypto-native venture funds already stake assets to improve returns. In a DAO model, this could go on steroids. More importantly, a venture related DAO can align incentives far better than a centralised organisation can. Darren Lau had recently written about how crypto-specific venture knowledge is concentrated with about 100 analysts at a global scale. The pay structures and incentive models used to incentivise those scouting deals and leading rounds can often be unfair, especially for analysts in the early stages. In a DAO model, carry, and fees can be embedded in the smart contract level - leaving little ambiguity to those putting in the work. One way this is already playing out is through token-based firms offering sectoral specialists tokens in exchange for guidance in the early stages.

There is a more critical macro-economic aspect to this. Venture capital historically used to be concentrated around Silicon Valley. Now it has become a global-scale game. Large funds like A16z, Sequoia and Accel have regional funds precisely due to this reason. DAO based VC funds can invest at a global scale much more effectively due to their ability to attract, compensate and retain talent in a way centralised firms simply cannot due to their reliance on centralised banking infrastructure and legacy institutions. Within crypto-native circles, it has already become commonplace to invest in new organisations using stablecoins. Soon enough, that will expand to non-crypto native themes, and that is where a Venture DAO will truly shine. Although venture capital as an asset class has ballooned over the past few decades, there is no reason to believe it meets the capital requirements of the market. As an industry, the space runs on consensus. DAOs can upend that model through routing capital to underinvested themes and individuals. Why restrain your income to 1000 true fans when you can have 1000 real investors? In my view, capital markets are undergoing the same evolution the creative industry did. Earlier, you needed a lot of credibility and underwent a curation process to be selected by a known publishing house. Platforms like Instagram and Facebook democratised the process. With decentralised exchanges and permissionless lending markets, the same process occurred with capital. We will see its after-effects with capital allocation in due time.

It is clear to me that the future will look nothing like the past. Venture funds will have to adapt to the new. One way this is playing out is through venture funds investing directly in DAOs. Members of VC firms today will evolve to be nodes of an ever-evolving network. Current fund models in comparison are hierarchical in nature in comparison. Instead of being gatekeepers to capital, those in venture funds should work on porting existing networks and know-how to the DAO based economy. The likes of Not 3Lau Capital and EGirl Capital are specialising specifically in this. They are primarily crypto-native analysts that have broken out to do their own investing under a banner they own in collaboration with multiple DAO based organisations. This transition from a centralised firm to a networked one will be the most significant transition for venture funds to make over the next decade. I bet that by 2030 we will have at least ten billion-dollar funds that are run purely entirely on-chain. Some of them by pseudonymous handles. It will be interesting to see the spill-over of crypto native capital to other emergent themes in technology that remain underfunded in the coming decade.

Off to make pho on my new instant pot,

Joel John

_________

Note for non e-mail subscribers : The cover image for this piece is a homage to the group of men that laid the foundation for what eventually became silicon valley. You can read more on them here and here.