The Economics Behind Axie Infinity

Breaking down Axie's internal token economy

Hey there,

Today's piece is written in collaboration with JX. In past lives, he was involved with handling venture arms at Fenbushi and Binance. Make sure you give him a follow on Twitter for incredible alpha.

Axie Infinity has been the talk of the town lately. I had written about them in December of 2020. If you are looking to get up to speed on them, I strongly recommend reading this piece by Packy. The game has practically changed how the perception of blockchain-based ventures have evolved due to a number of reasons. To begin with, they are one of the few games to have had mass-market appeal in emerging economies. While NBA top shots and Sorare focus on sports, Sky Mavis - the parent company behind Axie Infinity has created an entirely new theme within the gaming market. Some call it to play to earn. Some others call with GameFi - indicating the idea that gaming and finance can converge. In today's piece we will look at how Axie Infinity's token economy has been structured, what the expected yield for new players are like and how it compares to income in large economies of today's world.

Before we begin, I wanted to explain some terms used in this piece for readers that may not know about Axie Infinity

1. Axie Infinity - The game we are talking about

2. Axie NFTs - The characters used in the game mentioned above

3. SLP and AXS - Two tokens used within Axie Infinity for incentivising users and charging them.

With that out the way, lets dig into how the game's economy is built.

Sidenote: I would love to discuss how traditional gaming economies like that of GTA 5 compares to those of emergent ones in the digital assets space today. Please drop me a message if you have spent time on it.

Internal Loops on Axie Infinity

The economic activity in Axie infinity currently relies on two functions - battles and breeding. A battle requires players to hold an Axie team (involving 3 Axie NFTs) to play. They are rewarded what is known as a "Small love portion" token for winning. The game has a ranking mechanism that rewards the best-ranking players with a small chunk of Axie tokens each month. As shown by the graph above, the ecosystem has three forms of interaction within a closed loop. This involves players, Axies (the NFTs) and the core tokens (AXS and SLP). The two loops represent the value consumption and value creation angles of the network. In the outer loop represented by the green circle going counter-clockwise - users enter the ecosystem buying Axies which cost actual dollars to buy. They then engage with the network to spend AXS tokens and SLP tokens to do what is referred to as breeding - generating more individual NFTs for themselves. Lastly, they are anticipated to stake. The inner loop in orange color going clockwise represents how value itself flows in the ecosystem. Players are able to generate income through the sale of NFTs or by winning SLP and AXS tokens through battle. The vast majority of users simply buy these tokens from an exchange. Money enters the system through users buying tokens to acquire NFTs to play with and leaves the system when a user sells their existing NFTs or AXS tokens that came from winning a match with other players.

Earning Possibilities

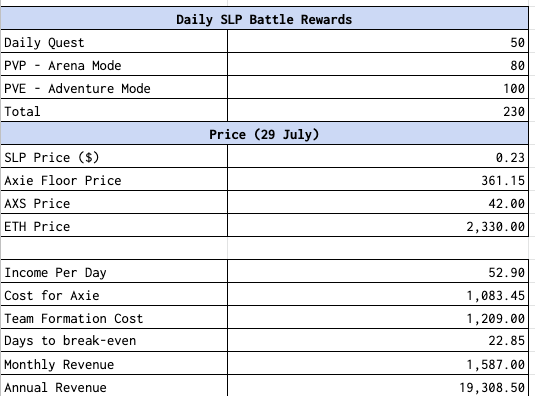

In order to estimate how much a user can make from Axie Infinity, we explore what the rewards look like for each function. The game has a daily activity open to anyone with 3 native NFTs called "daily quest". These give users 50 SLP tokens. These are fixed rewards given out on a daily basis to keep users engaged and coming back. Once this is done, users have the ability to play within the game's environment. This yields anywhere between 1 to 20 SLP and has a cap of 100 SLP tokens for each day. In our model, the assumption is that players will be able to generate these 100 SLP tokens by simply playing. The final mode of the game allows users to play with one another and generates anywhere between 1 to 12 SLP tokens in each game. Gamers that have higher rankings in Axie will be able to generate more SLP tokens in each game. At a protocol level, we take the average to be 8 SLPs and assume that a player can play 10 matches in a given day with other players. This would come to 80 SLP tokens. The earnings breakdown and costs involved have been represented below.

In the calculations above, we consider the costs involved in engaging with Axie Infinity as a game. Currently, a minimum of 3 Axie NFTs are required to begin playing. Each of these costs a minimum of $361 to begin playing, so a player will need to spend $1083 to start playing. Forming a team requires 3 Axie tokens, so we add that to this sum to come to 1209. That is what a player can expect to spend at the least to begin playing the game. But how would this translate to income?

Given that SLP tokens have a free market, we could consider that users could sell their tokens to generate income. The 230 SLP a user can hypothetically sell each day comes to be worth$52.9 today. Thus, a user spending time on Axie infinity can expect to make about $1600 from the game on a monthly basis. However, if everybody was constantly selling their generated SLP tokens, it could have collapsed the market a long time back. This is where the functionality of breeding comes into the game.

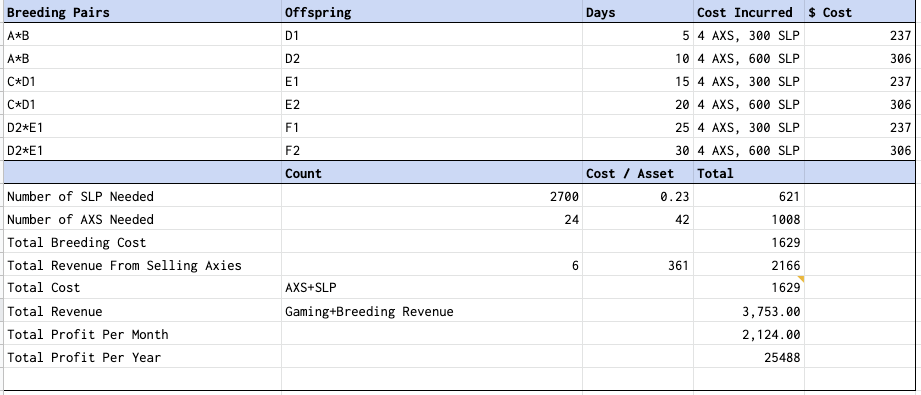

Breeding.. as the word explains - involves using two existing NFTs to create a third one. A single Axie can be bred seven times, but the cost of breading increases each time it goes through a breed cycle. The game's design prohibits users from breeding siblings, and parent NFTs cannot breed with their offspring. Axies take five days to reach maturity. Generally, users have no reason to sell an Axie in the free market until the cost of breeding on it exceeds the income it can create. For context, the first round of breeding a pair could cost ~$25 but doing it the seventh time could cost $500 in SLP tokens. Interestingly, JX found a strategy to keep breeding Axie NFTs without incurring high costs. He names this a breeding tree. In each case, you take the third external axie and breed to avoid the rising cost. Once an Axie is bred twice, it can be sold to accumulate capital.

In the scenario above, we consider three Axie NFTs named A, B and C. We call the offsprings they produce to be D,E and F with different series numbers for more straightforward calculation. Hypothetically, a team of 3 NFTs can be used to breed six Axie NFTs over a month. This would incur costs as explained above. On a monthly basis comes 2700 SLP Tokens and 24 AXS tokens, which cumulatively costs $1629. If we take a base price of $361 for each Axie NFT - this would mean a player can generate roughly $2166 worth of NFTs in a month. Reduce the costs incurred for SLP tokens and AXS and it comes to $537. Combining with the gaming income of $1587, the gamer can roughly make $2124 each month. In this case, I discount the initial expense of $1083 for the initial 3 Axie's as that is an asset in hand that keeps rotating. That is, you always have 3 Axie NFTs at the least with you to play with, and those are not sold. In our view - there are three levers to the economy in Axie Infinity and they interact with one another in different ways at different stages of the venture. They are the floor price of the NFTs on Axie Infinity, SLP (the token used to breed) and AXS (the core, native token. The cost of these three assets counter-balance one another at different points.

Economic Life-cycle

The image shown above is quite similar to the Merril Lynch Investment Clock. The game's internal economic cycle behaves somewhat similarly in four stages

Stage 1 -> Stage 2

The game has just been launched and there are few gamers in the internal economy. The price of the assets stays low but an initial uptick is seen thanks to early adopters buy AXS tokens and Axie NFTs to start gaming.

Stage 2->Stage 3

The game's early players start competing with each other and start buying more AXS and NFTs to compete heavily with each other. This radically increases the demand for the underlying asset. Narratives spread for the success of the venture

Stage 3->Stage 4

The game is now in the scanner of the mainstream media. Journalists write about Axie as the future of work and the underlying assets trends towards bubble territory. It becomes prohibitively costly for new players to start playing. Incredible amounts of capital are deployed to start large-scale breeding operations, setting a temporary new higher floor price for the NFTs. But the new supply of NFTs starts bringing prices lower.

Stage 4->Stage 1

Due to the lower returns on investment, gamers that play the game just for commercial purposes start exiting the game entirely. This brings the price back to levels where new gamers that actually enjoy using the product can re-enter.

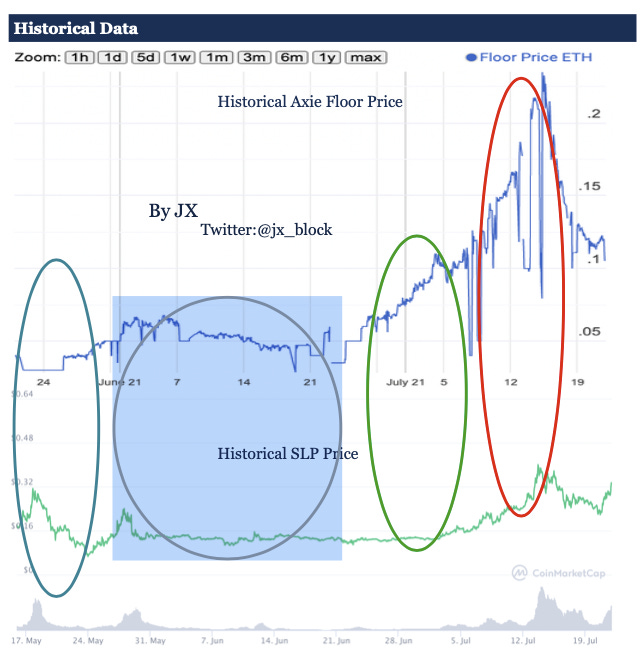

In fact, this has actually played out with Axie Infinity already. To understand how to consider the data below comparing the floor price of an Axie NFT with the price of SLP.

Consider the charts above. May 2021 to June 2021 can be considered the late stages of interest in Axie. The price of SLP tokens was at a high while that of the NFTs used in-game was flat. The declining cost of both SLP and Axie NFTs got the market back to stage 1, where new users could enter the gaming economy at a relatively lower price and start playing. As news of their success spread, we saw a phase of rapidly rising interest in the asset. SLP price interestingly stayed flat even now as there was enough selling pressure from previous entrants booking their profits. By early July, the asset was back in stage four. In this phase, the rational pricing of NFTs goes out the window, and asset prices reach new highs as investors seek to use the game to generate yield. Stage 4 for most assets is when valuations reset to create a higher low. This is just a general pattern we see with most new age productive assets.

Key Take-Aways

Axie Infinity is first and foremost a game. There have been attempts to financialise components of the play to earn model rapidly, but it comes with its restrictions caused by market forces. If Axie Infinity were a country, the average person's salary would be north of $2000. This ranks the network higher than Kuwait and slightly lower than Korea (at rank 25) in average income per person. A lot of what drives interest to Axie Infinity today is rising asset prices in crypto, and the economic design may be prohibitive to the average user. Sky Mavis has already been aware of these challenges and had rightfully released Ronin (a scalability solution) to tackle expense-related challenges for the average user. The market's auto-correcting is one way of ensuring the system is most attractive to gamers first. What we found intriguing is the counterbalance between the assets on the network. For ventures that are releasing in the play-to-earn model, understanding how changing prices of each asset affect players will be instrumental to finding scale.

Additional Material

1. Calvin Chu's thesis on gaming economies

2. Play to Earn

3. Unchained's podcast on Axie Infinity

I will see you guys on Wednesday with a long-form on another venture in the gaming space. If you enjoyed reading this, consider hopping in on our telegram channel here.

Peace

Joel John and JX

_____________________________________________________

Notes

1. Not investment advice

2. Authors of the piece may hold exposure to NFTs through entities they are involved with.