State of Stablecoins- Q3 2020

Q3 look at how stablecoins are being used.

Hey there,

It has been an interesting few weeks for the industry. Paypal began opening up to integrating support for digital assets, Singapore's largest bank announced plans of launching their exchange and Bitcoin's price has rallied to a stable YTD high. Safe to say that going into 2021, we are in a different environment in comparison to 2017. I decided to spend a while exploring stablecoins in this issue of the newsletter. We will be exploring Bitcoin, Ethereum and several DeFi projects in the coming week's issues.

Side note: If you are new to DeFi consider reading this primer, ecosystem map or recent post for introductory notes.

DeFi made the noise but stablecoins took the prize for now.

The consensus is often that Q3 2020 was when DeFi as a sector took off within the industry. What is missed in that conversation is the fact that stablecoins established themselves without much hue and cry during the same period. For context, we expanded from about $5.7 billion in supply to over $22 billion over the last ten months. Even if we take the substantial uptick that came around Q2 with investors choosing to move to stablecoins to avoid Bitcoin volatility, Q3 shows a ~120% growth in stablecoin supply by expanding from $10 billion as of May to over $22 billion as of writing this.

Tether has continued to establish itself at the top spot with a supply figure that is close to six times larger than its closest, regulated peer. Tether’s dominance in the market is equal parts awe-inspiring and problematic, given the lack of publicly verifiable audits. (Note: I could not find any audits. Do write back if you do). In doing these pieces each quarter, it becomes increasingly clear that market preference for digital assets has slowly switched from speculation to utility due to the desire to use a “stable asset’. One of the reasons I believe this is the case that much of the market today trades against Tether instead of Bitcoin. In being the default currency, people sell against, stablecoins may have helped dampen the volatility of Bitcoin, which was historically the reserve asset. This is a theory I have been thinking about and may be able to verify once I check for wallet activity against Bitcoin in the coming days.

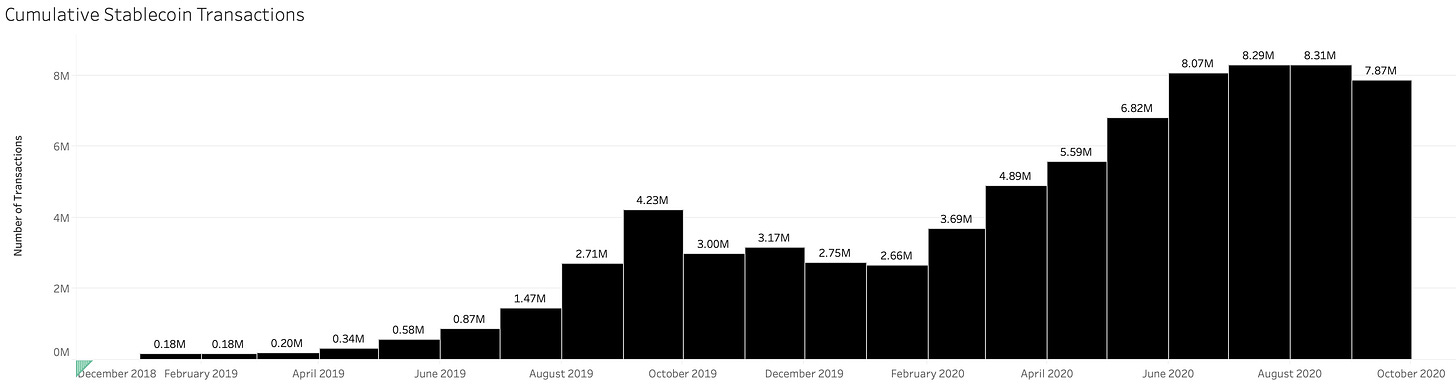

Transaction counts steady As L1 limits inch closer

The pace at which stablecoin transactions occur may be slowly inching closer to its limit with each month seeing around ~8 million transactions. Part of the reason for this is high gas costs associated with moving tokens on Ethereum. The withdrawal fee for USDT on Ethereum’s network via Binance is around ~$4 to $6 today depending on network congestion. The solution for this is now emerging with tokens like Tether and USDC considering layer two solutions or alternative networks. The ecosystems there, however, have not evolved as much as that on Ethereum’s yet. In terms of growth rate, Q3 2020 saw a mere 20% uptick in comparison to almost ~100% in Q2.

As with many other metrics, Tether owns the bulk of the growth within these. In 2020 (YTD), its dominance in the share of transactions has been at 80%, higher than 2019’s 75%. What is interesting is that DAI and USDC have roughly the same share of transaction count inspite of one being a fully regulated, centralised entity and the other being a decentralised alternative. This matters because it emphasises how much a community can replace a centralised entity. Tether’s 80% dominance is mostly the result of exchanges integrating the asset early on.

In comparison, USDC has primarily focused on application-specific use cases (e.g.: Remittance) and institutions looking to have a token-based transfer mechanism. DAI, on the other hand, is mainly a community-driven experiment that has been successful at acquiring similar market shares without the regulatory blessings USDC holds today. When we look at different metrics, it becomes clear that DAI is slowly emerging as a leading contender for a relatively more decentralised stablecoin mechanism.

$428 billion moved on-chain this quarter

My understanding in writing the Q2 state of stablecoins article was that interest in trading due to the heightened volatility in the post-covid lockdown markets was the key driver of growth for stablecoins. In Q3 we see consistently higher volumes, every month. September of this year alone saw more money move on-chain than the entirety of the first quarter. Part of the reason for the renewed interest is likely DeFi. The ability to receive returns on a non-volatile asset (like USDC, DAI) may have fueled growth in stablecoins this quarter.

In working through the volume data, there were two other key observations.

USDC and DAI are quickly catching ground. In 2019, and Q1 2020, USDT's volume accounted for close to 67% of capital moved on-chain. The advent of DeFi may have pushed volume towards USDC and DAI. The former doubled in market-share by growing from a mere 10.7% to over 22 as of writing this. Inspite of hiccups with liquidations on March 12th, DAI seems to have done reasonably well by growing over four times in market-share on volume moved by evolving from 4% in Q1 to over 17%. Meanwhile, USDT's decline has been rapid in terms of volume from 75% in Q2 to 55% this quarter.

Whales may still be dominating stablecoin transactions. The share of transactions that are in the range of over 1 million has been growing the fastest. My understanding is that the bulk of the transactions that occur today on stablecoins are over $100k in transaction value due to the fee component involved. Until fees reduce to a few cents, it is unlikely that we see a substantial change in this. The median amount transferred on Tether has more or less stayed flat for the year. Part of the reason for this could be the low transaction withdrawals that typically occur from retail customers on exchanges. USDC and DAI have steadily spiked in mean transfer volume over Q2.

DeFi battles exchanges for adoption

In Q2 2020, one needed exchanges to have powerful distribution. DeFi based projects are slowly changing that. One of the reasons why I believe this is the case is that DeFi ventures now have larger stablecoin balances than CeFi based ones. Uniswap has more tether in its smart contracts than Huobi. Part of the reason centralised exchanges like Binance began offering yield based products this part quarter is because DeFi ventures now have better capital efficiency than their centralised alternatives. The other reason why I believe this is the case is that USDC and DAI - two of the projects that are critical to DeFi today have been sky-rocketing in terms of their percentage of supply locked up in smart contracts since Q2. In Q1 less than 20% of their supply was on smart contracts. As of writing this it is over half of their supply. DeFi projects are the new blackholes for stable assets.

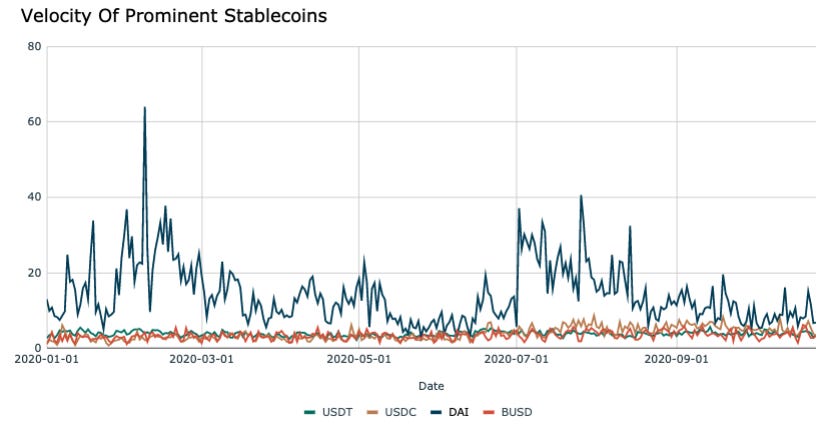

This belief is further cemented by the fact that DAI has consistently had a much higher token velocity than its peers. Velocity is defined as a measure of how quickly units are circulating in the network and is calculated by dividing the on-chain transaction volume (in USD) by the market cap according to glassnode. In other words, it tracks what percentage of a network is actively being used. Higher the usage - more likely that its network participants are finding “utility” rather than idly speculating on it.

So What’s Next

Over the next year, there will be three key paradigm shifts I anticipate

The emergence of layer two solutions making new retail applications possible. In its current state - as evident, micro-transactions are not possible on stablecoins yet. I believe users will rather deal with the pain of waiting 10 minutes for an XDAI transfer than wait 3 days for an international wire. It is the bull-case for layer 2. This, in turn, will create entirely new business models. Payroll management is one instance where this is already the case. Money as an API layer is about to become global, internet-scale and independent of traditional banking infrastructure.

Regulatory moats will become an increasingly important edge. One region where this is playing out is in Singapore. With DBS launching its exchange, the signalling is quite clear that the country is warming up to digital asset-based ventures. Similarly, Bermuda has opened up to experimenting on CBDCs. For ventures working on stablecoins, choosing a region that is friendly and encouraging will make a sea of difference in terms of how they grow. I am heavily biased towards Singapore given their proximity to the seven large economies of Asia.

The role of financers will change. In traditional markets, VCs were a requisite given the amount of time it took to build, deploy and scale ventures. In DeFi, projects like harvest.finance attract a billion dollars in total value locked without their identities being known. In 2014, user-education and on-ramps were critical. In 2020, ventures can rely on the power users that are here today to build a sustainable business and crowd-source a salary. In these instances, market know-how and expertise in taking ventures to scale will be more valuable than mere capital. It is the reason why the next big fund will not look like Y Combinator or Sequoia.

I could be wrong in all of these predictions. As with many of my other predictions. I will see you guys next week with numbers on Bitcoin and Ethereum ecosystem. Have a good weekend and try and find some time to go for a walk.

Data Sources: Glassnode, Santiment and Nansen.ai.

Peace,

Joel John

Consider sharing this piece with others if you enjoyed reading it.

Sign up so I can notify you every time something new goes live. No spam. Promise.