State of Stablecoins - Q2 2020

Q2 breakdown of stablecoin activity

Note: This is the first issue of the newsletter that is being sent out via e-mail. I have been using Cipher & Decentralised.co as landing pages to build an audience. Those that signed up on Decentralised.co have also been ported to this list as I will be retiring that domain. I will be launching a paid variant a few months down the line. Those that had signed up so far will have free access to all of it.

Now that I have reached a meaningful figure, I will be dropping in with numbers & start-up updates every alternative day. Drop me a line in case you need me to unsubscribe you from the list.

I dug into stablecoins for the first time in December 2019. If you had told me then that the market-supply of tokens in the space would cross $10 billion and user-count could be close to 100,000, I might have written you off as an optimist. And yet, here we are in June 2020 looking precisely at that at the late stages of a pandemic. As of writing this, combined stablecoin market-cap of the seven most significant projects is at $10.5 billion (across chains).

In writing this piece, there are a few considerations I made

You will often see me offer two separate charts for Tether and other coins. This is because Tether is in a league of its own and using logarithmic charts may not do justice on shedding light on leading contenders in the non-tether group of coins. In making this piece, except the market-cap, all data is derived from the on-chain activity on Ethereum. I have discounted Omni, Tron and Algorand for the time being due to their nascent ecosystem and aim to dive into them at a later point in time.

There is a sad irony at play in the industry today. Of the leading seven stablecoins in terms of market cap, only Multi-collateral DAI has some relation to being "decentralised". I will be following up with a piece on the state of MakerDAO to shed more light on the project. The rest are tokens issued with reserves in the bank. I hope that reading this piece will make people more aware of how big the market size is and mindful of the need to consider non-banking alternatives to build this space.

I have sliced data into market-caps, transaction count, on-chain volume, active wallets, tokens held in exchanges, token velocity, nature of transactional frequency and volume to get the numbers behind each of these chains. With that out of the way, lets dig in.

85% of all stablecoins are in USDT

The supply of Tether in the market has gone from $4 billion at the beginning of the year to over $9.2 billion as of writing this. The changes in supply came from issuance of $1.6 billion in addition to the supply and another $1.4 billion in May. USDC imitates this in March and April ($138 million and $148 million) but has a decline in supply for May. There is a distributed power law at play once you exclude Tether. The likes of USDC, Paxos and BUSD are beginning to have an equal split of market share between them which is healthy as customers have a mix to choose from. However, much of them are representations of dollars held at a bank and may come directly under the FSB’s ruling from April 2020. This is part of the reason why collateral backed and algorithmic stablecoins will matter quite a lot going into the future.

Key metrics set new highs

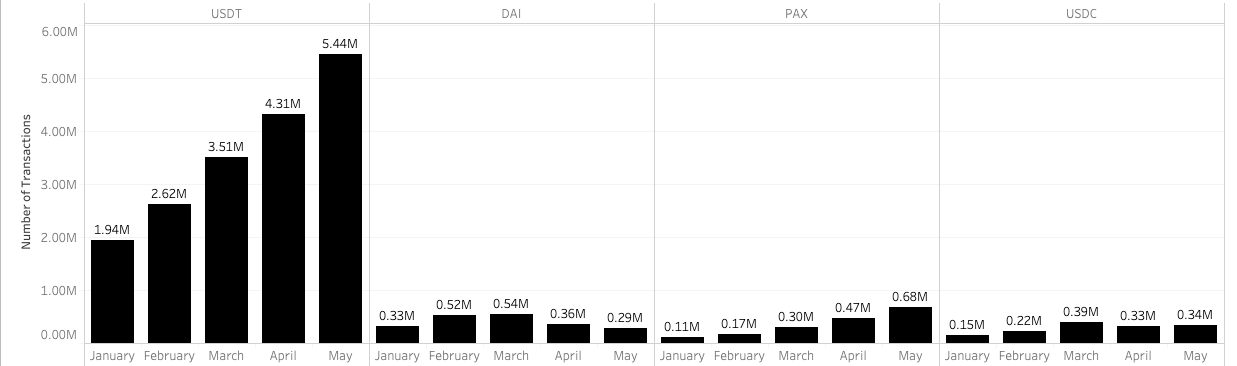

Count of monthly transactions soared from 2.65 million to 6.8 million

The total number of transaction on stable-coins have roughly tripled over the past five months. The bulk of that growth was captured by USDT in frequency. It could be because USDT already had an impressive ~2 million transactions being handled on its own in January. In terms of percentage growth, Paxos takes the lead with an almost ~600% jump in the number of transactions. If current trends hold, 2020 will see a doubling of on-chain volume enabled by stablecoins.

Average daily on-chain volume has doubled

The amount of stablecoins moved on-chain in January was at $26 billion. For May, that figure stood at $49 billion. The bulk of this growth in dollar terms again comes from USDT. In other words - the amount of Tether moved on-chain has roughly doubled while its closest peer (USDC) has only seen a 50% uptick over the past six months. Strong contenders like DAI have seen a decline since the oracle issue of March and have been slowly recovering. For now, Tether dominates.

And retail activity may be driving numbers higher.

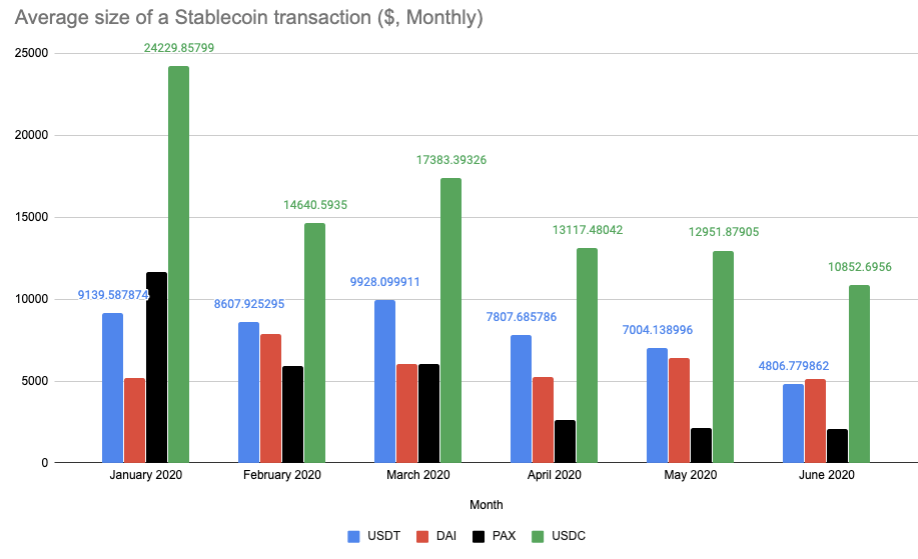

One of the ways to benchmark stablecoins is by looking at the size of the average transaction on each network. To do this - I have added the total volume moved on-chain, then divided by the number of transactions. In doing so, it became quite clear that while volume has doubled, the frequency of transactions has also increased incrementally. This meant the size of the average transaction has declined over time. In Tether’s case, this meant going from $24,000+ to south of $11,000 over the year. USDC has seen a similar decline making me think this trend is not specific to USDT alone. Higher frequency of retail transactions is a key contributor to this trend.

Thinking of average sizes without looking at how active accounts have changed would make no sense. To get a gauge on this, we measure the number of active recipients over a day on each chain. For a sense of scale, this figure peaked on 7th of June at north of 211,000 users across the prominent stable-coin projects. On the 13th of March - that figure was around 89,000. If we take the weekly figures, every week in the post-pandemic world has set a new all-time high for active recipients of stablecoins. It was inching close to 700,000 as of writing this. A good measure of how much interest in trading has emerged since the pandemic lock-down has kicked in.

DAI emerging as a leading contender

Naturally, the next question is whether the growth of stable-coins is concentrated with Tether today. The power-laws at play here is quite intriguing. On one end, you have Tether being the clear dominant leader with over 70% of both transaction count and volume. However, DAI has shown the more transaction count than some of its centralised peers and has been a leading contender in terms of volume too. This may be because of its usage in DeFi. Exchange-based stablecoins, being primarily used for OTC transactions have considerably higher supply (in market-cap) and larger average transaction sizes. However, since those using DAI typically use it to trade with leveraged positions or use in a DeFi protocol - the frequency of transactions is higher. In other words, as a currency, DAI is likely way more used than its peers on a routine basis.

It becomes evident once we account for the token velocity of the asset (in this case - defined as the total on-chain volume (6 months) / existing market-cap of the asset). DAI inspite of its low supply has far more usage than some of its peers. A significant contributor to this is the fact that DAI’s supply is relatively small as its issuance is reliant on the assets that are used for CDPs in MakerDAO. On the flipside, USDT has a considerably lower velocity. It makes me believe much of USDT is used for one-time transactions and storage of dollars on a digital ledger. Value is simply moved to an exchange and held there instead of being used in a decentralised product like a dex.

Retail users on the rise

One way to gauge the nature of users of stable-coins is to study how much money is being transacted through the network. We could look at both the volume and the count of transactions to understand what is driving value. My assumption here is that there is no reason individuals would keep doing hundreds of low-value transactions due to the nature of the Ethereum fee model. Therefore, higher the number of low-value transactions, higher the number of retail users doing these transactions. The largest sub-category here is individuals doing transactions of size between $100 and $1000. Over 750,000 transactions have occurred in this category most recently in a single weel. The figure is at around 450,000 for those between $10 and $100.

But whales dominate volume

While larger transaction sub-groups have not increased in the pace at which retail traders have been entering the market, they have not paled either. In fact for those transacting over $100k-$1mil a recent high for monthly transaction count was set in May at over 71,000. While these graphs don’t make me think “institutions are rushing in”, it does give some anecdotal evidence of stable-coins being used as a money remittance system by those that have the means to move weight.

A better display of the impact of this on the volume is evident when you look at the total on-chain volume contributed by each transaction sub-group. Transactions over $1million in size were responsible for ~$21 billion moved on-chain. In may that figure was at $18 billion. Those doing transactions of upto $1000 in size did a mere $1 billion in on-chain volume. Seems like whales dominate how value moves in the industry.

Exchanges are still a driver for adoption

Tether is a controversial project, but as I have said earlier - it has been critical for adoption. Almost "too big to fail" at this point. The ~20% or so of Tether supply being on exchanges also makes me believe much of the distribution to the end-user likely happens through OTC desks. For some strange reason, that reminds of Liberty Reserve. Bad memories aside - it is likely that by the time I write an update to this piece, the stablecoin ecosystem diverges into what could be trading and financial applications. We are seeing some instances of this with crypto native individuals using USDC for payroll management and DAI for purchasing NFT. That transition from a trading first utility to digital currency used for alternative use-cases will likely be the most significant leap stable-coins have to make going forward.

I will leave with this chart showing the exposure of major exchanges to prominent stablecoins on basis of their wallet balances. Yes, much of it is concentrated on Tether with the exception of Coinbase. Make of it what you will..

See you on Friday with some charts explaining how stablecoins may be upending the fat protocol thesis.

Data sources : Nansen and Santiment

Peace.