State of Blockchain Funding - Q1 2021

I mean, the title is kind of self explanatory here..

Today’s issue is dedicated to Shakti - founder of Devfolio. He succumbed to Covid over the weekend. His work enabled a generation of developers to transition towards working with blockchains. The crypto ecosystem in India has lost one of its greats. RIP Shakti.

Hello,

Practically every asset in the public markets are either at an all-time high or has trended towards it since I sent my last piece. Elon Musk shilling dogecoin on SNL is an accurate representation of where we are in the market cycle. One way to think about it is that individuals are simply repricing assets for potential inflation. The other angle is that retail investors are bored sitting in the confines of their home and investing has become entertainment. The truth likely lies somewhere in between. I have been writing these state of funding reports since the bear market of 2018 to help guide founders and investors. Nothing has prepared me for the madness Q1 2021 was.

If past trends hold, I believe 2021 could be the best year for blockchain venture financing so far. I lay my case down with the help of ten charts and a broad macro-economic context below.

$2.5 Billion Raised In Q1 2021

Historically, there has always been a correlation between public markets and private market investing in crypto. Every time there is a surge and pull-back in Bitcoin’s price and the broader token economy booming, venture investors have a new problem. They need to re-allocate capital to deals. If you look at 2018 Q2, there was a surge. 2019 Q2 displayed similar spikes. However, this quarter was different because of the amounts raised. The $2.5 billion figure I mention comes after cleaning out post-IPO equity investments, debt-raises, and associated ventures like Robinhood. Most financing calculations take “associated ventures” into account. These are businesses with a blockchain angle to them but derive the vast majority of their revenue from other sources. I tend to keep a purist mindset and focus only on businesses that use crypto at its crux to calculate these figures. Even by that conservative lens, this quarter has exceeded all expectations. Having that said, the picture is not all too rosy. We need to check where the capital has gone to understand how venture investors are investing in the space.

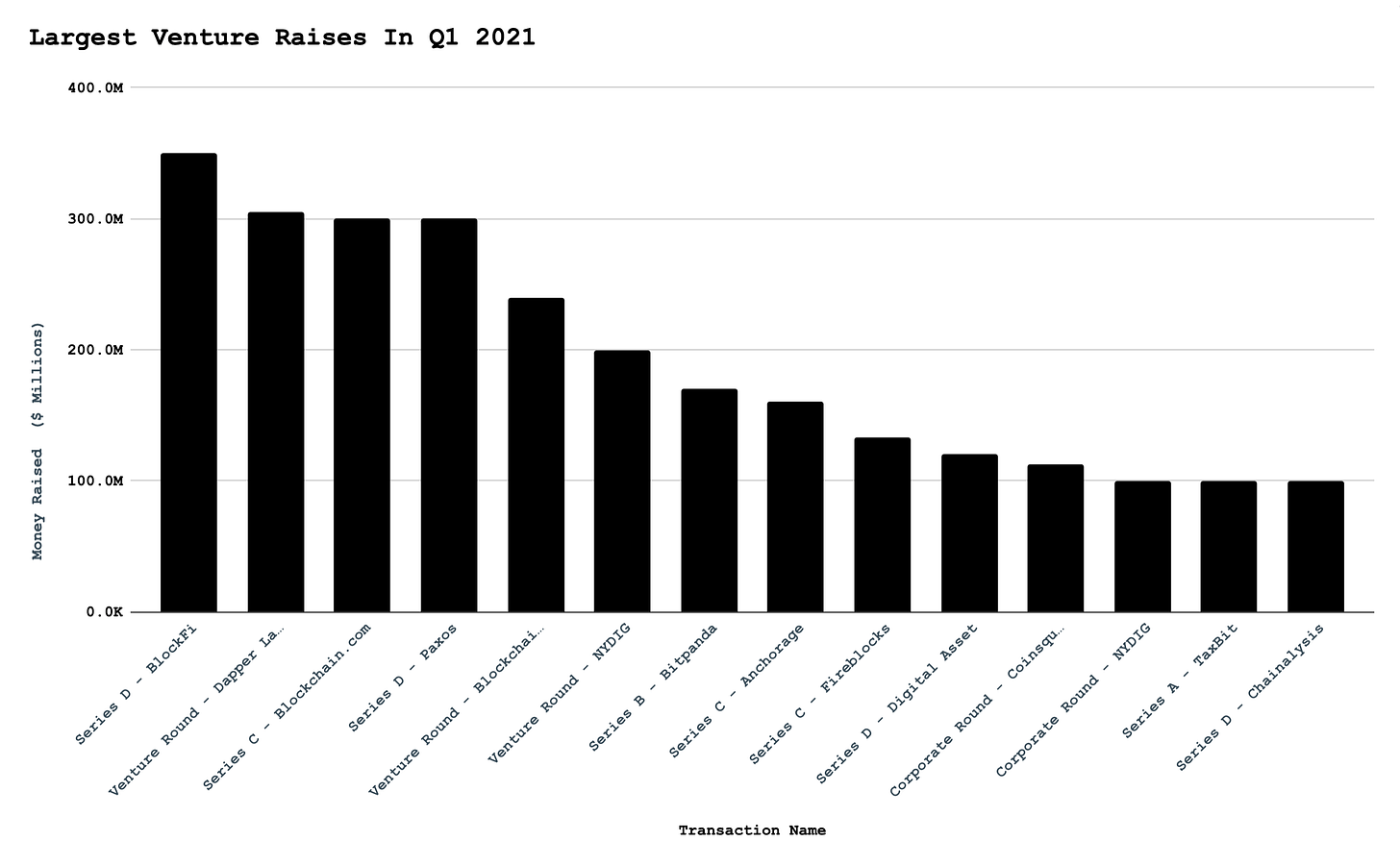

During the bear market reports I published in Q1 and Q2 2020, I had predicted that we would see a reduction in seed and Series A deals. Much of the capital tends to go to late-stage organisations that need survival money for a prolonged bear market. Follow on rounds have been done for those investments to help establish them as category leaders. Eleven deals in the past quarter have been north of $100 million each. There are two forces at play here. One is that traditional funds that have historically avoided crypto for being too small a market now have good reason to deploy money in late-stage ventures that have shown product-market fit. The other is that the boom in tech stocks as a whole means capital allocators look for more risky frontier tech categories to invest in.

Lastly, Coinbase’s listing sets precedence for equity venture exits in the industry. As we see more projects going public, we will see larger rounds becoming the norm for established ventures. Why? Because public market equity valuations give investors a fair value to benchmark against. So long as private market valuations are set only between VCs, nobody knows the fair value for a firm. If we have more listed firms - we can predict a better estimate of the market’s appetite for valuations of crypto ventures. Historically, the pathway to liquidity for ventures in crypto has been gradual tokenising or acquisition by a more prominent player. Coinbase’s gigantic 6000x return for early backers is now the bar most private market investors would be looking to attain. Packy McCormick wrote about this tendency in the broader tech markets in his newsletter a few months back.

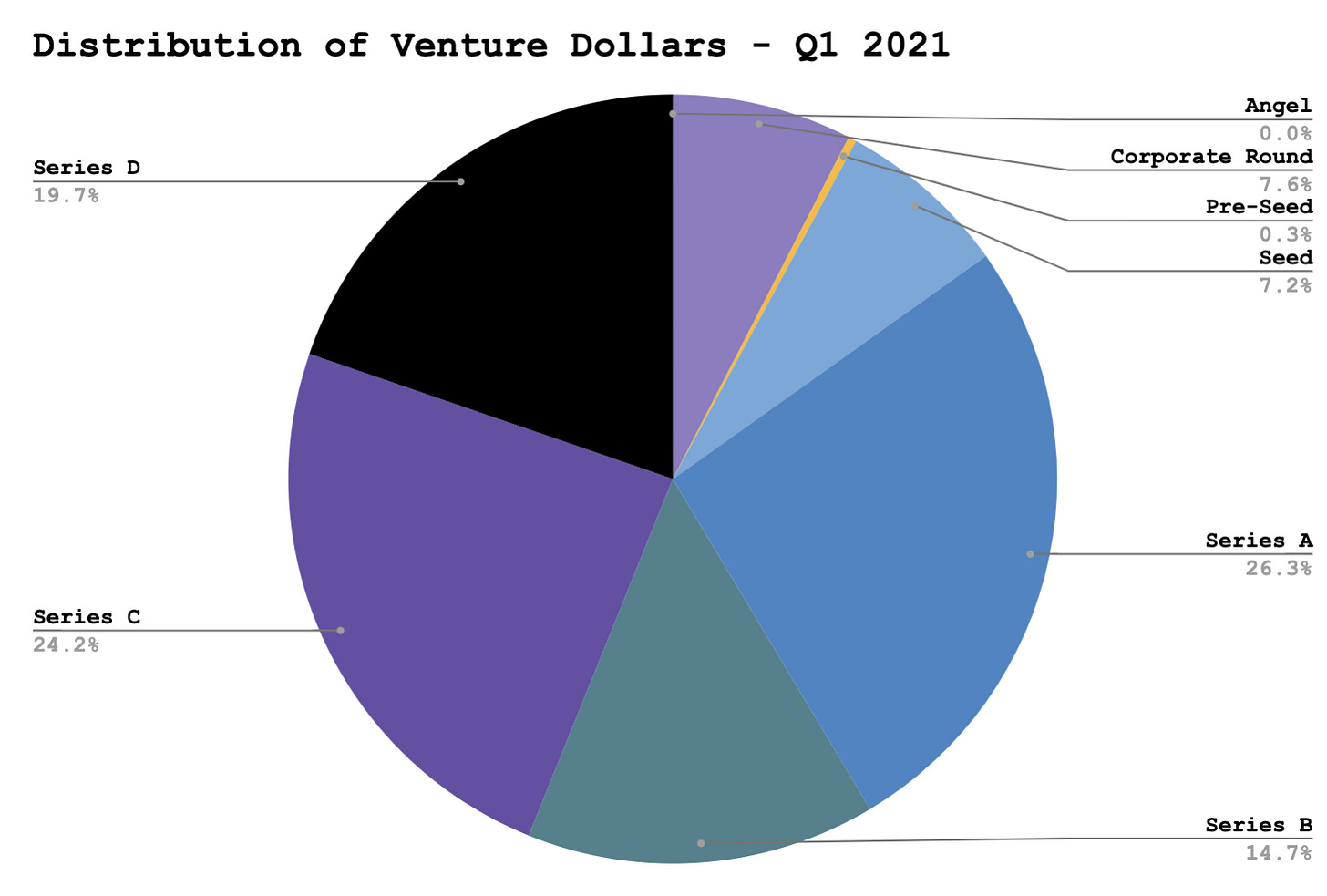

Seed Raises Account Only for 7% of Capital Raised

In my understanding, that concentration of capital going to late-stage ventures is somewhat cyclical. The significant raises we see create exit liquidity for early-stage venture backers. This creates more risk appetite among those backing early-stage, highly risky ventures with no clear paths to tokenising. It means, over the next two quarters, we will likely see a substantial surge in the amount of capital going towards seed-stage raises. Q1 trends already indicate this.

The fact that seed raises account only for 7% of capital raised can be interpreted in two ways. One that we are seeing an excess of money flowing towards later-stage ventures. Much of the deals that happen at around Series A levels could be anticipating a potential token launch soon. The other is that seed rounds have been tiny in crypto, considering the alternatives that exist in the form of simply launching a token. Founders in the space have to choose between raising in tokens and dealing with community, listing and token economics. The other option being that they don’t tokenise and have to deal with a possible competitor that tokenised hacking growth through token-based incentives. As we go further into 2021, the art of choosing the right time to tokenise will be one of the most strategic moves an early-stage venture will have to make. There will also need to be funds that are willing to come in through equity into ventures with no clear plans of tokenising any time soon.

Does this mean it’s all doom and gloom for seed-stage ventures this quarter?

Well, look at the pie chart below.

If we account for the frequency of raises, seed and pre-seed raise account for close to 65% of all occurring. There is an influx of new talent that is entering the industry due to several reasons. One - the bull market meant individuals working with protocols earlier holding vested assets could practice liquidity and move on to the next stage of their life. Typically this meant setting up their fund or starting a new venture. The other is that simply holding digital assets could have helped create a cushion of sorts that allowed individuals to transition towards building in crypto as a full-time career. Lastly, the mainstream media’s coverage of cryptocurrency as an ecosystem has created increased awareness about what the industry can offer to founders looking to tackle complex problems. If my understanding is correct, we will likely see the highest number of seed-stage ventures backed in a single year, assuming there is no massive decline in Bitcoin’s price. For me, that figure would likely be sub $20k levels. Here is why I think that is the case

The chart above shows the frequency of each venture round that has occurred. Figures for 2021 only account for the first three months. We are already halfway through meeting the highs for series B, 1/3rd of the high for series A and 70% for Series C. Seed-stage investments, in comparison, are at a mere 25% of what we witnessed in 2018. When a market evolves, investors tend to explore low-risk, high transaction opportunities to deploy large sums at scale. That is what we saw in Q1. However, as these opportunities saturate or trend towards irrational exuberance, investors are bound to look for earlier-stage investments. Some of these occurrences are so cyclical, we have seen them repeat again and again since 2017. Long story short - if you are a seed-stage founder, now is likely an excellent time to be raising money.

Where does this leave funds? In my understanding, what differentiates funds in a period of an abundance of capital is not money but its managers. The challenge here is that human hours are not scalable. This means fund managers will have to be picky about who they work with. Or a different way to think of it is - founders will need to optimise incentives for the best managers to work with them. We are in a stage of the market where ventures can “choose” who they give allocation, but when the pendulum swings in the other direction in a bear market, managers choose who they work with. The smartest founders I have seen tend to give favourable terms as an alignment mechanism to ensure they have suitable funds by their side. It is the classic skin-in-the game conundrum.

When everybody is fighting for survival, we will see funds fighting primarily for their vested interests. It has become common for certain early-stage ventures to entirely pass on deals north of $20 million for conceptual ideas with no meaningful traction. A similar dynamic is commonplace among late stage, tokenised ventures doing foundation transactions with vesting to align managers that bring value to the table. Discounts are offered on their existing valuations to onboard funds. As with most things - the ideal solution lies somewhere in between. Founders optimising for the best valuation they can get and fund managers are pushing towards valuations they feel comfortable with.

For founders that need a reference point, here is the average for raises in each round over the past few years.

Since some of you will definitely write to me asking for the median amounts - here’s that too. I like those nerdy emails though, so keep them coming.

So What Next?

Investing in crypto is no longer the contrarian choice. It is what you do to remain relevant. This means fund managers and startups have to evolve from the niches they currently cater to and think about the broad consumer market. Early adopters tend to stick to old ways at a time chasms are crossed. The industry’s surprise at TikTok influencers shilling dog based tokens is one instance of this. Sorare’s meteoric rise in the past few months is an example of a unicorn being built by focusing on what counts. While founders and funds will be distracted in the short run with short-term games, looking at where the industry is heading overall is likely what will differentiate the greats from the ones producing mediocre returns. Personally, my thesis is built on the following three themes.

1. Crypto is changing money - NFTs, creator economies, DAOs and even the ownership economy is built on the same theme. The idea of money as we know it is evolving. The difference between how it changed in the closed circles of Wallstreet during the early 2000s and now is that these systems are globally accessible. Capital markets are evolving to be internet scale. This will create distinctly new forms of user incentivisation (e.g., yield farms) and behavioural patterns (e.g., staking). In the bear markets of 2018, experimenting and bringing these ventures to scale was difficult because the users were not there. Today, they are here. Finding means to create long term moats for capital and users will differentiate the best teams from one another.

2. Distribution matters - In 2013, Bitcoin was often associated with individuals looking to buy drugs on the dark web. In 2021, we have Nas singing about his ownership stake in Coinbase. The greats of the venture world from web2.0 are building on crypto and using their pre-existing distribution to build captive audiences for the “new internet”. The fastest-growing venture in the industry will likely be a blend of grass-roots, community lead efforts (e.g.: YFI) or ones that have massive distribution in place already. This is why most highly academic projects in blockchains die before they find product<>market fit.

In 2018, it used to be commonplace for a venture to survive solely on the pedigree of its founders. The state of the market today is such that if you are unable to communicate what you are building effectively and rally resources around it, you may see the venture die a quick death. More blockchain teams need to consider hiring for community and marketing early on to avoid this situation.

3. Venture funds will increasingly specialise - We are undergoing a period of a massive influx of capital in the industry. Venture funds will increasingly need to be able to differentiate in expertise. Gone are the days when funds could be on panels and comfortably receive their allocations in rounds that are being put together. The best founders will continue to optimise for operator VCs who can build alongside them. The best deals will be a function of founders referring other founders to funds. It will be interesting to see how different firms evolve to address this challenge.

The market's state makes me think we are in a frenzy driven market that could be soon due for a correction. Regardless of where prices go, it is a great time to be a founder due to the influx of talent and capital. If you are building, make sure to drop me an email at joel@ledgerprime.com. We have created a portfolio of 25+ companies over the past two quarters and have no plans of slowing down.

Stay safe and wear your masks,

Joel

Disclaimers

1. None of this is investment advice

2. Views expressed here are of my own and not of entities I am associated with

3. Data sourced from Crunchbase after excluding figures for post-ipo-equity, debt, grant and ICO based raises.

Update on the Axie Infinity Give-away

I had promised some Axie scholarships in my last email. Since it’s been a while, I will be sending 1.5x the amount promised to make up for the delay. If your name is Calvin and you had submitted an address ending in 803, you can expect to hear from me to confirm your wallet address.

Hiring

Multiple portfolio companies that have been raising capital are looking for business development, community and marketing related talent. Ideal candidates should know crypto well, have an understanding of NFTs, staking and DeFi. Past experience in marketing would be requisite. If you are looking for non-technical roles, please drop me an e-mail with relevant information about yourself and I will connect you to the relevant teams. All roles are focused on slightly senior individuals with healthy allocations for ESOPs/ token based compensations.

Consider subscribing if you enjoyed reading this.