Spotlight Series: Supermind

Making analytics a collaborative sport.

Hello,

Today, I will shed light on a platform that helps crypto-native analysts navigate through the noise in the ecosystem. Working in the crypto-ecosystem means having your mind pulled in many directions. One needs to stay on top of what is happening on Twitter, Discord, Telegram and on-chain. The number of places an analyst has to give attention to means there's rarely time for deep work. More importantly, it means there's a never-ending list of matters to "catch up" on. Platforms like Messari's Governor and Nansen's hot-contracts appeal to different work styles.

Fragmented Islands

Messari's product compiles and hyperlinks to relevant governance discussions. Nansen uses on-chain activity to point to what may be happening. A variation of this is TokenTerminal. They allow you to download CSVs with all the relevant on-chain data you need. Analysts can then figure out what is most important to them. Dune's "trending" dashboards on their landing page are a different avenue for analysts to find what they need.

The data most data platforms share today is based on the same resource—on-chain user behaviour. They differ in how they repackage the data and deliver it to the end-user. The process fragments how data points are discovered, contextualised and collaborated on today. You may find a trending dashboard on Dune and have no way to talk to the person behind it (except through Twitter). There may be a platform with a spike in fees generated on TokenTerminal, with no reason to be found on-chain

For a data point to be relevant in an analyst's workflow, it needs three things: intent, relevance & retrieval. When an analyst starts a workflow they may have a varying degree of awareness and precision of intent. This “intent” usually goes from fuzzy to more well-formed. And this is an iterative process till the information needs are met.

The second layer is relevance. Given a well-formed intent - return what’s relevant. And lastly, reliably and frictionlessly “retrieve” what the analyst has consumed in the past to build up future workflows on.

Any crypto researcher rarely has all three ready at hand. But new collaborative tools can help. That is where Supermind is focused today with their lead product that focuses squarely on search & discovery as the wedge as the entry point to collaboration.

Building Bridges

I met Ekta a few months back through LinkedIn - where she had reached out in a cold message. I had been trying to reduce calls and politely declined but asked for context. She said she was building a new analytical tool and wanted to stay in touch. Over the next few weeks, I observed her do countless user interviews through the Telegram community I run and was intrigued by what she was doing. Generally, you find founders excited about something but their interest wanes with market conditions. Ekta was more systematic with how she was doing her research, so I reached out, and we spoke.

She used to lead data platforms and feed personalisation at Sharechat. Before this, she exited a venture in 2020 and spent nine years in varying data-science roles. Ekta was looking for a new opportunity that would allow a 10x improvement to users and grow for the next 20 years. She stumbled on web3 apps and began spending four to five hours a day. A common theme she found was a general lack of data on users and how a new tool could improve it. Today’s data products allow you to look at what has already occurred. But few of them focus on predictive capabilities or collaboration.

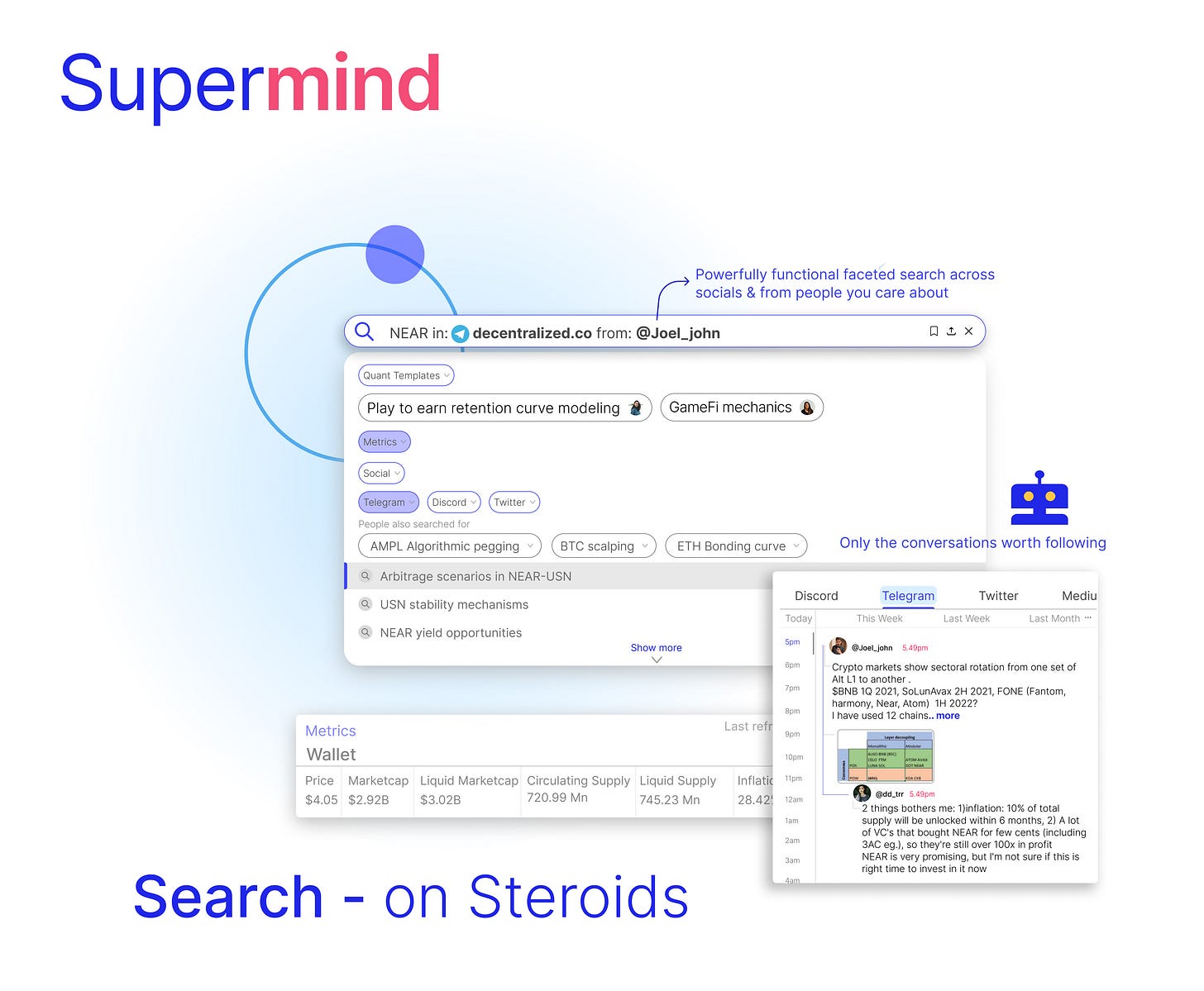

I mention all this because the product she is building uses search as the basis for redefining analyst workflows. When an analyst searches for information - about Avalanche or Near- Supermind first shows all the relevant conversations from relevant accounts on publicly available chats on the product. If you look at how search currently is on Telegram or Reddit - it is clunky workflows that analysts get around with. The primary mode of discovery anchors on text search. But what if you wanted to go deeper.

An example she gave me was - searching across channels for people you follow or macro attributes of people such as "content shared today from people who run protocols, or are web3 founders". At this point, it starts to get interesting and reflect how analysts actually search and discover. In this case, the product indexes the context around which a relevant person had the conversation on different platforms.

Once an analyst has found the required information, they can query on-chain data on the platform and collaborate on the data set with other analysts. The data and workflows are native primitives of the platform. The analysts do not need to go through the flow of downloading the data and cleaning it or syncing data sets constantly. The platform will have tools to visualise, collaborate and share analyses with others.

Analysts can also open-source pre-defined templates on the platform for others to plug in new data sets and collaborate with them. In my mind, I find the tool to be a hybrid of Kaggle, Tradeview and Twitter. The data itself is not the product. The network effects of multiple analysts discovering and collaborating on the platform are the product.

The hardest bit for analysts working with on-chain data today is community and collaborators. Someone may be data-savvy but lacks the necessary context around a new protocol. A lot of times, decision-makers may not be technical enough to set up streams of data or work with SQL either. Collaborative tools like the one being built by Supermind reduce the barrier to entry for new analysts too. Ideally, much like Dune and Nansen have done - they can also be a gateway for more accountability on what goes on in the industry.

Supermind's stack focuses on multiple layers of what an analyst typically needs. They start with indexing conversations that can be queried and revisited at any time. Then, to ensure the accuracy and latency of the data, the team indexes much of the data in-house. Analysts can then use platform tools to visualise and collaborate with others. In its ideal form, I believe that Supermind will have a feed of emergent analysis from users of the platform. This makes me think about how collaborative research is eating into how markets operate today.

Social Trading vs Collaborative Research

There were multiple attempts at making social trading a thing in crypto throughout 2021. During a bull market, there is enough retail liquidity in the space to create a venture like that. But I doubt it would stick at a time when most individuals are losing money. Very few social trading platforms took off meaningfully inspite of last year's euphoria. The lack of regulations and general incentive misalignment is part of the reason why. If someone can genuinely trade on something and make a buck - they are likely better off trading it on their own.

It is a whole different story with collaborative research so far. The GameStop short saga started with a person posting on Reddit. We collaborate on financial research because it brings a different lens to a decision without any individual necessarily committing capital upfront. Instead, each person decides when is an excellent time to enter or leave a position based on information available to everyone. That shift towards more users wanting to collaborate on research is at the crux of Supermind’s bet.

Existing data analytics platforms understand this. Dune, for instance, allows setting up "teams" where multiple analysts can collaborate on queries. Nansen has taken a more social approach allowing NFT holders and VIP members on the platform to chat with one another. It is increasingly evident that more data platforms will evolve to create a social layer atop the query stack they have already built. This serves two functions. Analysts will spend more time on-platform before bouncing elsewhere. More importantly, it enables the network effects of one analyst asking another to join the platform to work on something.

Stage & Getting Involved

Ekta has been conducting user interviews over the past month. She has spoken to 35+ analysts, and the platform will go into private beta in the coming weeks. So I decided to write this breakdown to help with finding more individuals that could help with feedback on the product and share their workflows. If you are an analyst or independent researcher interested in shaping the product - fill this form here. Alternatively, you can reach out to her directly on Telegram at @Supermind_inc or via email at ektagrover@supermind.tech

I will see you guys tomorrow with a breakdown of how the venture markets have been evolving in the past few quarters. Join us on Telegram if you enjoyed reading this.

Joel John.

Tell us about yourself

If you are a founder building cool things at the pre-seed stages, we want to get to know more about you. We are structuring grants, investments and well, this spotlight series. Quite a few things have been cooking in the background.

Fill in information about what you are building in this really short form - here.