Hello,

I wanted to see how traditional credit scores are coming to DeFi today. The challenge with DeFi today is that almost nobody outside the ecosystem can use it. Individuals without tokens cannot deposit collateral and thus cannot get a line of credit. Similarly, those without digital assets cannot offer it on platforms like Curve to generate yield even when the returns are in multiples of what a bank offers. People have to care about the industry if we are anticipating a generation of large firms from the industry. Lowering the barrier to entry has been a common tactic in financial markets. Mortgages on housing and car ownership are what has fuelled consumption in much of the developing world. For blockchains to be able to replicate the same success they need to be able to intermingle with the traditional ecosystem. However, in doing so they may become vulnerable to censorship and surveillance. This has already played out in some ways with USDC & USDT freezing certain addresses.

This debate of whether DeFi should be interoperable with existing financial infrastructure will be at the crux of all DeFi related discussions in the months to come. Can a financial application scale with limited data? How significant a role will the financial ecosystem play in this transition? One way to think about it is with the example of email. The arrival of email did not immediately make traditional mail redundant, but its use-case switched for transfer of goods and critical documents.

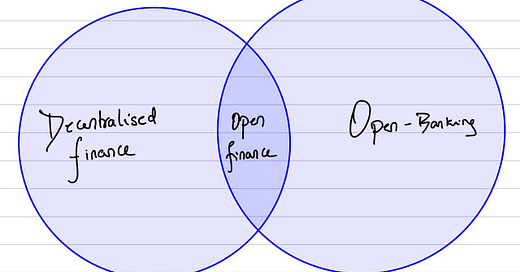

Similarly, the scaling of DeFi in the future will not necessarily make traditional finance redundant. On the contrary, DeFi will need to rely on traditional finance to get on its feet and find mass adoption. Start-ups that are at the intersection of the two will be able to accrue large user-bases by offering cost-effective services at better prices. Broadly - I see the intertwining of the old and new as "Open-Finance'. It is also where I see the next generation of blockchain unicorns arriving, and the earliest sector for these unicorns will be lending.

Programmable Vaults

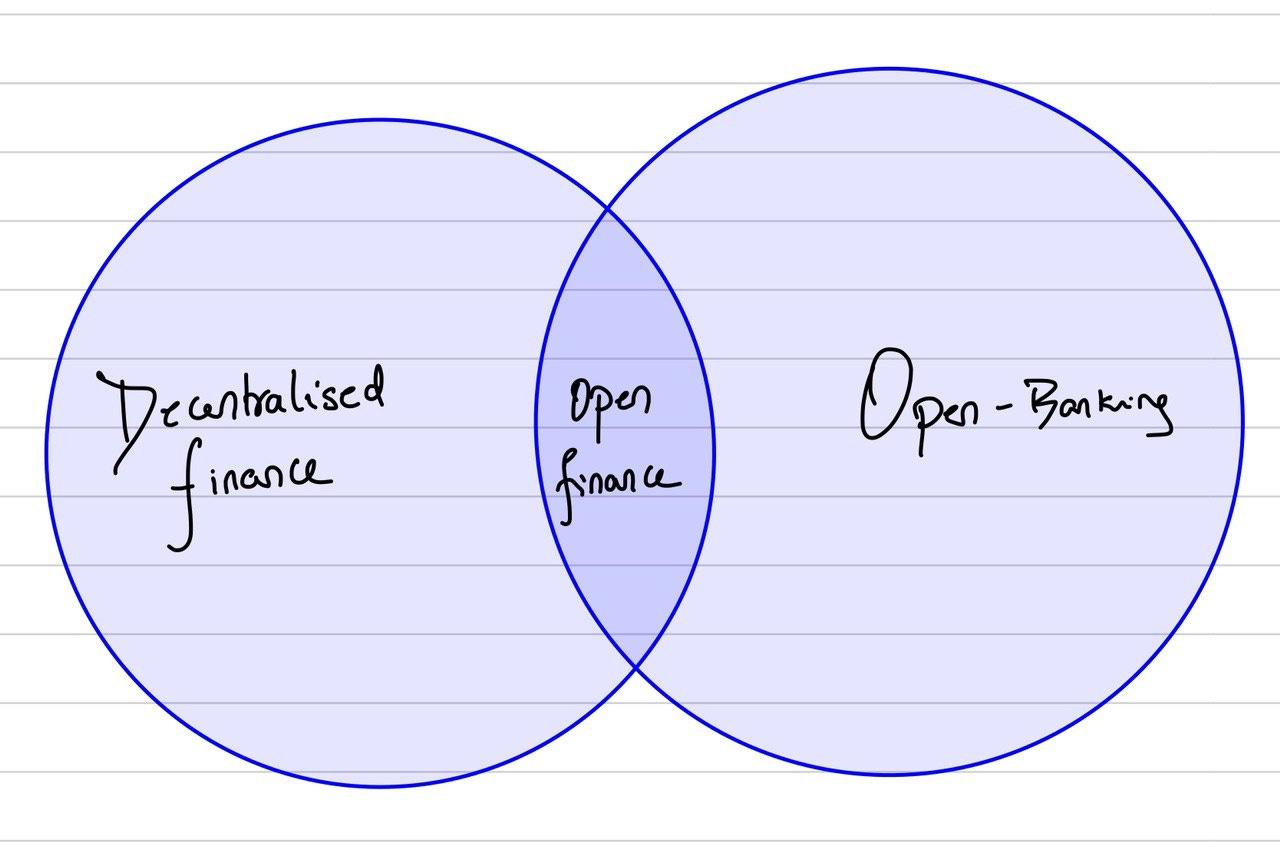

Since I published my last piece, two key releases happened. One of them is Aave's Credit Delegation facility. It allows users with cryptocurrency to act as the last guarantor for a third party who does not have the necessary collateral to take a loan. These lines of credit to third parties are secured by an OpenLaw contract that may make them legally binding (at least in some jurisdictions). Why does this matter? For one, it allows individuals who are willing to take the credit risk on third parties to offer a loan while holding onto their underlying asset. This can be of use in high trust environments where individuals are willing to take the risk that a borrower will repay in the future. One example of the use-case here could be remote-first companies that run entirely through on-chain transactions. A decentralised exchange, for instance, has digital assets accruing from transaction fees. These assets may appreciate in value in the future. To offer a prospective employee with a short term loan to acquire a car (eg: Uber) or laptop, they could use the assets they hold as collateral. We will go into why this matters further in this article.

Bring Credit-scores On-Chain

The other project that is intriguing is the recently-launched Teller Finance. The San Francisco based team closed $1million dollars in funding to bridge data from traditional credit bureaus to the DeFi ecosystem. V1 of their whitepaper suggests that the system will use remote-cloud based nodes to retrieve and run credit-risk algorithms on them. What this means is an individual will be able to pull transactional data from their bank's APIs and have an open-source algorithm run on it to verify their credit-worthiness. They could also plug in with traditional credit bureaus and income verification sources. Depending on the risk variable involved, Teller offers a line of credit with varying levels of collateral requirement. The risk parameters observe the individual's cash-flows, balance and jurisdiction when it comes to verifying the possibility of their repayment. They claim that each document will have to be cryptographically signed and will be stored in a GDPR compliant fashion where needed. Teller's model requires consent to allow regional debt collectors to contact individuals if they fail to make timely payments. The recollection process will mostly be plugged to the traditional way of collecting a faulty debt position.

While Teller Finance is designed to have its own liquidity pool that transfers capital automatically, my understanding is that the company will build its moat by building credit scores for applications. Here is why - Capital is cheap, information is not. More importantly, start-ups will probably want to avoid the liabilities that come with collecting data needed for checking individual credit scores. The source for capital in Teller will probably be institutional funds that are comfortable taking longer periods to recollect their capital as long as their yield is higher than what a bank can collect. In exchange, they will receive access to a more global pool of underserved borrowers. Yield hunters on DeFi will not likely be the individuals tying up capital in Teller's pools as they will want the ability to pull their money out as and when they desire in chase of higher APYs.

Clubbing Teller with something like Aave can empower users to source liquidity from multiple avenues. Remember the example I gave earlier of a remote-first firm using Aave? In that particular instance, the employee may very likely be unable to take a loan in their region no matter how high their income is. In India for example, one needs to offer their office address (within India) to receive a personal loan. How does one do that if their HQ of their office is in Delaware? This is where Teller can come in as a data service (On Teller, it requires consensus between ⅔ of the nodes to approve a loan). and use Aave as infrastructure. Using Teller Finance allows the firm to verify the creditworthiness of the individual, and Aave could then be used to give a customised lending agreement.

Okay, so what next?

The initial resistance I heard about this concept was that existing credit bureaus by themselves are inefficient because data sources have been disrupted by the on-going pandemic. The fact is DeFi can plug into multiple data sources to create a new credit score for an individual. So while traditional services like Experian will still play their role, alternatives with open-source algorithms like Teller will emerge as an alternative over time. We will see fintech applications using multiple data sources using a blockchain (for security and provenance) in the future. This is already happening with the likes of Provenance Blockchain. I would not be surprised to see service providers using Chainlink to source data to assess the risk of lending to an individual. It won’t be long before we see off-chain collateral such as real-estate also being used in DeFi. The other risk is debt recollection. Depending on how efficient or inefficient an application is in terms of re-collecting payments, we will see variable premiums on loans. This means individual applications at the regional level have strong incentives to plug in with collectors. This is part of the reason why I see multiple applications being built on top of Aave and Teller in the years to come.

Would this be an alternative to traditional lending? Likely not. However, it allows individuals to have the infrastructure to collect, verify credentials and disburse loans the same way a bank does. The democratisation of that infrastructure is what will lead to changes slowly, then gradually. Almost akin to how AWS reduced the cost of setting up and scaling ventures. What Aave and Teller are creating is not the final application itself. In emerging markets, they will likely need individuals to build on top of them as these two teams may lack the nuance of offering loans in those markets. More importantly, they will struggle to communicate and recollect debt without a physical presence in the region. For enterprising individuals, the upside is a global pool of capital that can be tapped for servicing regional needs. This comes with its own risk, but if the world were waiting for 100% assurance on loans being repaid, much of the commercial debt market would not exist.

When we look at the history of exchanges, it becomes obvious that a great degree of centralisation will play out initially. From Coinbase to Binance and then IDEX and now Uniswap, the process of decentralisation has been slow and gradual. It starts with a high amount of centralisation and then gradually gives in to slow and steady changes. We can anticipate the same when it comes to data to assess the credit-worthiness of individuals for on-chain lending in the future. There is a gigantic market to be captured once one steps aside from decentralisation theatre and explores what’s the best way to serve users.

P.s. - For more on how collateral types are expanding in DeFi, consider reading this piece I wrote in partnership with Delta.exchange. There’s also this brief primer I wrote with Dgen.org exploring how DeFi will evolve in Europe.

Peace,

Joel John

Written with help from Marc Weinstein and Ashwath Balakrishnan

Job Opportunity

Alkemi is looking to hire a lead backend javascript and Web3 developer. They are building the future of prime-brokerages and have multiple spots open for technical talent. Apply here to join a rocketship.

Consider leaving a note if you have a different opinion on this matter

And subscribe so I can notify you when the next piece is out