Observations on Africa

Market trends, aggregating trust and the next big frontier nobody's talking about.

Hey,

Have you ever thought about why most of the internet is influenced by Silicon Valley? I have had a running theory for a while. The telecom industry in the US was well aggregated and defined by the time the internet took off. The physical infrastructure required to bring AOL to people’s houses was already in place when Napster was wreaking havoc on the music industry (The Information by James Gleick is a good book on how the telecom wars played out). Since the largest market for the internet was the US, most of the capital financing and initial innovation came from that region. Why does this matter?

Think about what happened in the late 2000s. As mobile devices became increasingly cheaper and connectivity no longer relied on physical lines, emerging markets worldwide came online. This meant competition from local variants in each market. I saw a version of this between Amazon and Flipkart (acquired by Walmart) in the mid-2010s in Indian e-commerce. Uber had to concede to Didi in China. Careem seems to be competing with Uber in Dubai, where I now live.

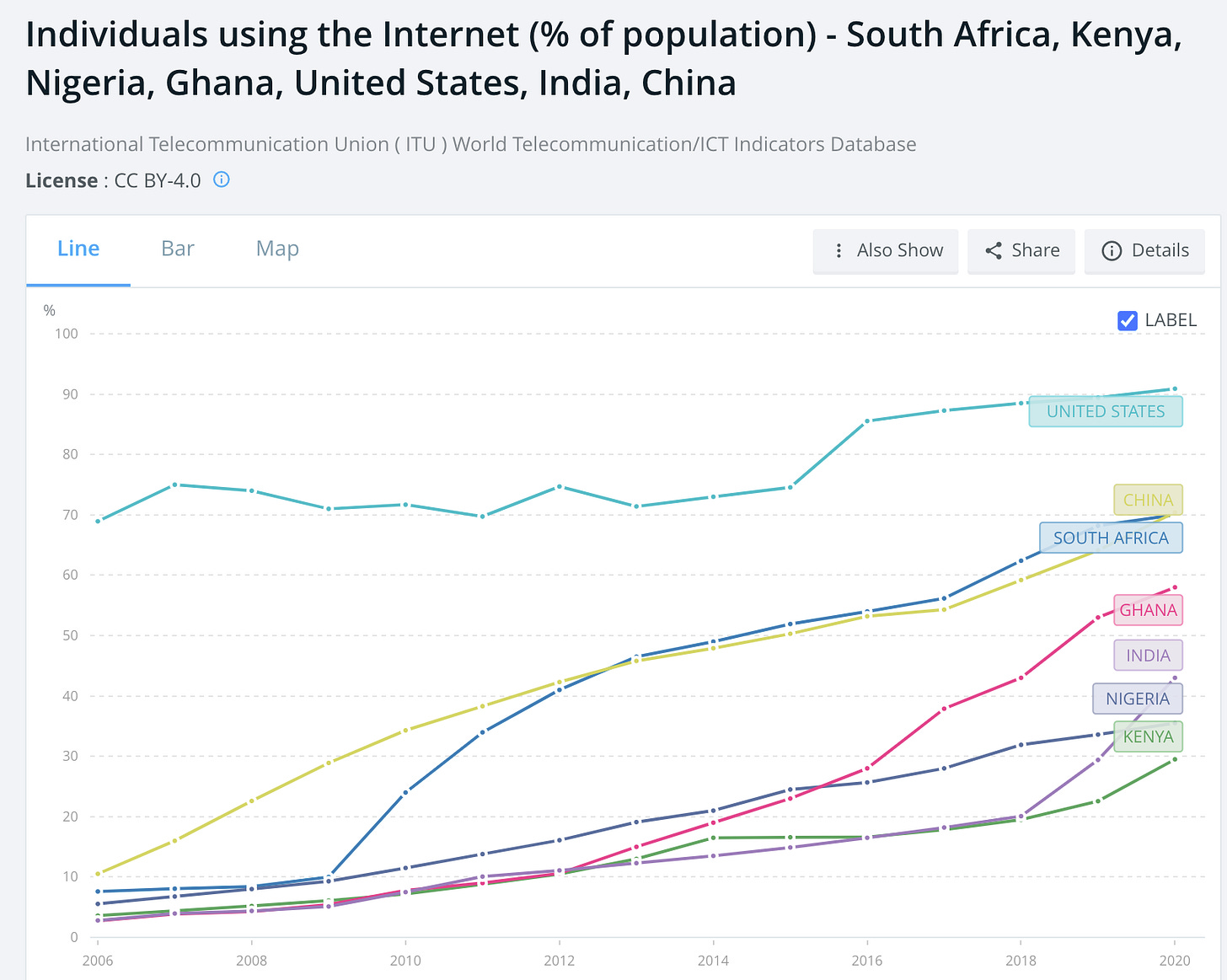

The chart above supports the claim. Until the mid-2000s, much of the world trailed far behind North America. China saw massive VC investments in spite of lower internet penetration due to the fact that it had four times the population and talent flow between Silicon Valley and China (Sebastian Mallaby’s Power Law has a whole chapter on this and is a joy to read).

Why am I saying all of this? Because a new form of network is rebuilding the internet. When Web1 and Web2 took off, much of the emerging world was lagging—trying to get online. That has now changed. Web3 is the first evolution of the web where everybody starts together at the starting line (Yes, North America has strong financial markets and Europe produces incredible research, but SEA+Africa has the consumers as seen through applications like Axie Infinity).

My thesis is that regional markets will create stand-alone competitors that appeal best to local culture in the next phase of Web3. Of course, there will be exceptions here that benefit from network effects and size. These will be internet first, digital consumption platforms like Mirror. But anything that interfaces with the locals will likely be dominated by regional founders that better understand the region's nuances. This instance recently played out with Coinbase taking a step back from India after pressures from the regional regulator. RIP globalisation, and open markets.

If that is the case, Africa is likely the next big market for blockchain-related investors. We spent the last few weeks understanding the region and the startups emerging from a few nations there. A few incredible founders were willing to speak to us about their experiences. This is what we found.

The Lay of The Land

I will start with the caveat that for the purpose of this piece we looked almost exclusively through the lens of start-ups and technology. There are 54 countries in Africa. This piece is limited to observations on four of them. Africa is a vast continent with extremely varied cultures. I am not the best to opine on the complex geopolitics of the continent. I am also not a social scientist - so we will not be discussing metrics that are not (i) financial or on (ii) networks. This piece is more or less an open invitation to people smarter than me to collaborate on exploring how technology can help in the region. With that out of the way, let’s dig in.

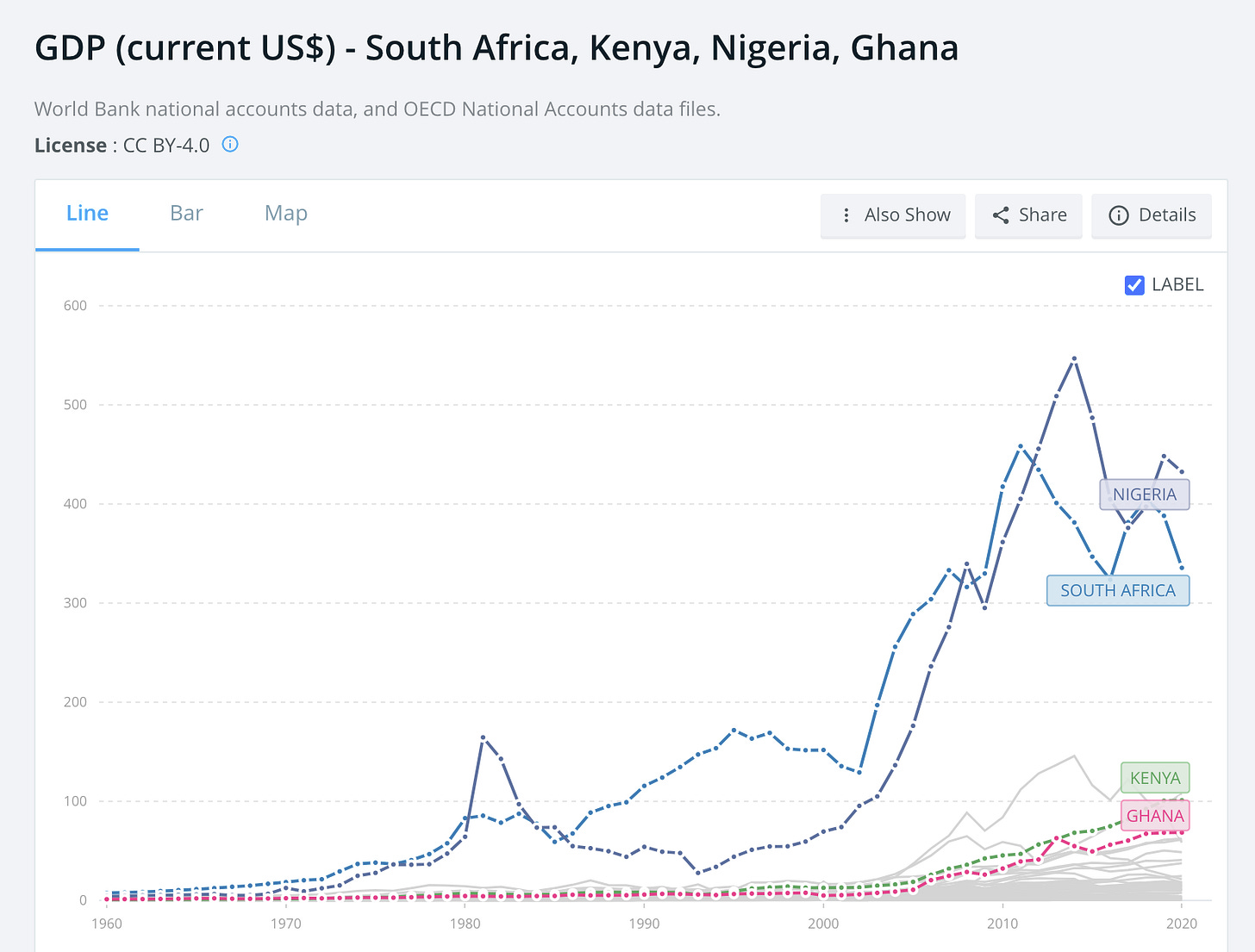

The largest nations in the region in terms of GDP are Nigeria, South Africa, Kenya and Ghana. Much of the digital story in the area today is concentrated on Nigeria. The country currently ranks 3rd highest after the US and India in terms of teams accepted by Y Combinator. $5.2 billion was invested into startups originating from Africa last year. Up 20 times the amount financed in 2015 ($275 million).

That growth is healthy - but consider that the region barely saw ~3300 funding rounds occurring since 2015 compared to the ~73,000 the United States saw. With its strong corporate law and tax structures, Singapore has attracted as many venture funding events (~3300) as all of Africa has seen since then.

So venture funding is on the lower end of the region, and a few nations have much higher GDPs than their counterparts. So what’s the opportunity here? I believe two factors will contribute to the ecosystems in the region. First will be the rapid pace at which individuals come online in the region. We will see extremely steep curves with a more significant fraction of the region’s population coming online.

The United States had ~70% of its population online by 2006. As of today, that figure is at around 82%. China is at 70%. In comparison, Kenya grew from having a mere 11% of its population online in 2011 to close to 30% as of 2020. Ghana seems to be coming online even faster, with close to 60% of the people coming online in the last decade.

India trails at ~42% as of 2020, but a large part of that was a single internet provider collapsing the cost of Internet in 2018 when internet penetration in the general population was at around 18%. The 2010s marked an era where large parts of Africa came rapidly online. By extension, this should mean the economic structures in the region should change? Yes. Sort of.

The big four nations I mentioned online have an increasing share of their population storing money at financial institutions. Kenya has 80% of its population banked. Ghana has close to 57%. The average in the region is around 40%. We keep talking about banking the unbanked any time technology and emerging markets are mentioned together.

Thanks to mobile networks taking off, the infrastructure required to bank the unbanked almost already exists for large parts of the continent. What is now needed is more ways for those with access to the internet and financial services to increase their income levels. That is where Web3 becomes relevant.

A few months back, I wrote on aggregation theory and Web3. At the crux of the piece was an argument that blockchains collapse the cost of verification and trust. Historically, what has made it hard for emerging markets to command higher premiums are points of local friction.

This could range from corruption to high fraud or bad work output. This leads to my second reason to be bullish on Africa. I believe blockchains will collapse the cost of verification and trust in the region - leading to higher income, faster processes and better outcomes. Regulators need to be focusing on that. Unfortunately, I don’t work at a regulator’s office yet. We will dig into the how later in the piece. Let’s zoom in a little more into the existing crypto-related ecosystem in Africa.

The Web3 Ecosystem In Africa

The most authoritative statistic on Africa comes from Chainalysis’ Geography of the crypto report. At $106 billion, the region accounts for less than ~3% of total crypto moved between July 2020 and Jun 2021. The average day sees about $20 million transacted through P2P exchanges. Extrapolating that annually, we have about ~$7.5 billion transacted annually. A fraction of the $48 billion that goes towards Africa in remittances. These are very early days.

Binance obviously saw this as an opportunity a few years back and set up shop in Uganda in 2018. Yele Bademosi had joined them as a director responsible for sourcing and leading blockchain ventures in the region. Today he runs Nestcoin - a venture arm specialising in helping ventures focused on DeFi, metaverse and digital art in the region.

We asked him what are some of the key drivers for digital asset adoption in the region early on while researching for this piece.

1. Earnings - Africans have embraced crypto as it allows the creation of alternative streams of income. The informal economy consisting of drivers, fishermen, traders in open markets and SMEs account for some 70% of the economy in Sub-Saharan Africa. Regional unemployment among young individuals ranges from 25 to 60%. The internet offers an alternative that regional markets do not offer today.

2. Inflation hedges - The exchange rate for a Nigerian Naira has gone from $0.008 to $0.02 since 2008. An 80% loss in the last ~15 years. Kenyan shillings have seen a similar fate, with their value dipping close to 50% in the previous decade. In addition, Nigerians cannot save in USD or invest in foreign markets to protect their wealth because of limits set by the government. “The purchase limit to buy something abroad or invest with your Nigerian card is $20 per month, madness. You can’t even pay for Github and Zoom with this limit” said Ugo of Xend Finance. The startup - backed by Binance and Google Launchpad - focuses on offering interest-bearing accounts through stablecoins.

3. Remittances - One would think that a large customer base in a small region would lead to better costs. But that isn’t the case if the numbers are an indication. As mentioned earlier, Sub-Saharan Africa sees some $48 billion in remittances. Nigeria sees roughly half of it. Despite the high volume and concentration in a small region, the average remittance transfer can cost anywhere between 7% to 10%.

For a sense of the demand for better remittance solutions, consider that Chipper Cash, valued at over $2 billion, has 4 million users by providing free cross-border payments. They recently raised $250 million in a funding round extension, led by FTX. Chipper doesn’t use P2P remittances as a model yet, but it is likely a possibility.

These are hard facts that could be verified by checking the world bank’s databank - as I had done for most of the initial parts of this piece. But there is a different way to look at it. And that’s through observing what the smartest founders and investors in the region are looking at. We mapped out 48 startups in the ecosystem and then filtered out 34 of them for which we could validate data from reliable sources. These are ventures that have raised a minimum of $100k.

The Venture Landscape

Of the ~$5.3 billion that has gone into venture financing in the region, only about $170 million has been for crypto-native firms—a meagre 3%. Only one firm is valued at Series B levels (Valr). 20 of the 30 firms we tracked were still in the pre-seed or seed stages, and another five were in Series A. Much of the capital financing in Africa for ventures has been concentrated in the fintech ecosystem. There’s a similarity in Web3 native firms too. Most of the money goes to payment processors, remittance firms and exchanges.

Of the ten high funded blockchain-related ventures in the region, only two were exchanges. Yellowcard and Valr. We observed that capital is instead going towards alternative ways of bringing people to the ecosystem. Jambo, for instance, has raised close to $40 million from players like Paradigm, Alameda and Coinbase. They are focused on being a super-app for the region. Apps like Jambo will be crucial in bridging the cultural gaps between local users and Dapps built continents away. Remember when I said apps led by local founders would dominate in emerging markets?

Another way apps are penetrating the market is by simplifying the process of saving on digital assets. These applications don’t necessarily make it easy to speculate on the price of Bitcoin or Ethereum but rather help users save in a basket of assets. Xend and Revix are currently focused on this as a model.

These applications reduce the effort required to filter good assets and onboard people with relatively lower risk. I recently invested in Coinmara’s $23 million venture round through LedgerPrime to support the same vision. I see them as gateways for the next billion in emerging markets to come online.

6 of the 10 highest venture-funded African Web3 startups consider South Africa their home base. Nigeria had three and Congo had one. This concentration of startups will likely lead to agglomeration economies. We see startups concentrate around Silicon Valley, Bangalore or Singapore because the presence of other startups in the region reduces the costs incurred in setting up a new venture.

Nigeria for instance had 18 of the 30 startups we were tracking for this piece. Part of the reason for this would be how talent flows. According to Google’s Africa Developer report, only about 9% of the region’s 700k+ developers are proficient in blockchain development. So talent will concentrate where other talented folks are.

Investing in founders who have worked in giant tech behemoths is one way this skill transfer is currently happening. Individuals that have worked in other hubs and have moved back to their home bases in Africa tend to raise more capital. A recent analysis by the Big Deal revealed that founders exposed only to the regional ecosystem alone managed to raise less than their foreign-educated counterparts.

How less? Well, only about 28% of capital allocated to African ventures go to founders that were educated in the region. There is a strong leaning to back founders that have either worked or studied abroad. This is now being solved as African founders begin investing in other founders from Africa. That is one sign of an ecosystem’s development.

A Glimpse of The Future

So far, we have observed that an increasing portion of Africa is coming online, has access to digital banking, and the region’s capital allocation has been increasing. But what does the future look like? I think the big opportunity for Africa is in leapfrogging how their digitisation efforts look like. Remember how I hinted at aggregation theory in the context of emerging markets earlier in the piece? Let me explain what that looks like in my (limited) vision.

As payments become less reliant on traditional banking outlets and work becomes increasingly digital, income levels in Africa will have a meaningful shot at rising. We have already seen this with a tiny fraction of artists in the region using NFTs to make a livelihood. I wrote a long form on one such artist a few weeks back. You can read it here.

A different sector that is meaningfully taking off is gaming. Although still in its early days, we will likely see the play-to-earn ecosystem take off in the region. Mvm.gg is a gaming guild focused on the region. Gaming on its own may not create sustainable livelihoods, but it can support expenses as individuals upskill through other routes.

You can (rightfully) argue, “Ok Joel, that’s cool but not everybody will be playing games or selling NFTs”. This is dumb. My observation is that these transitions from gamers and artists are just early-stage switches. As stakeholders in the region see the possibilities that blockchains allow, we will see their use in more traditional, rigid industries. The most straightforward use case is for agriculture.

Know why Kobe beef, Parmesan or Spanish Iberian ham cost so much? These goods can only be produced in particular parts of the world to be considered authentic. (These items are hyperlinked to videos that should explain how that works). Restricting production to a specific region allows goods to retain authenticity while reducing supply and increasing price. This is no secret, but historically, low-trust societies like India struggle to command high premiums for their goods.

Part of the reason for that is the extent of fraud, tampering and mismanagement of goods in the supply chain. Focusing on integrating blockchains (and sensors) across the supply chain could help restore trust in the system and thereby increase the consumer base for these goods. This is not some far-fetched utopian vision. IBM has an enterprise solution that already tracks commodities on a blockchain. Last year, E-Stock global partnered with Mastercard to store cattle-related data on-chain.

Startups like Chekkit have also been helping consumers understand how their products are sourced, transported and sold. The challenge with fixing agriculture through blockchains requires massive coordination across cooperatives and national governments. In addition, regulations and their enforcements take time, even when pilot projects exist. An alternative way to open up opportunities is through empowering individual citizens with the drive to transition to web3.

It is my understanding that platforms like Questbook, Gitcoin, Mirror and OpenSea are enabling individuals to create meaningful, verifiable bodies of work that can be linked to a person. It is not far-fetched to believe that a person’s skill-sets would be identifiable through on-chain assets such as NFTs in the future. If this is the case, young talent in the region would soon benefit from building a presence online.

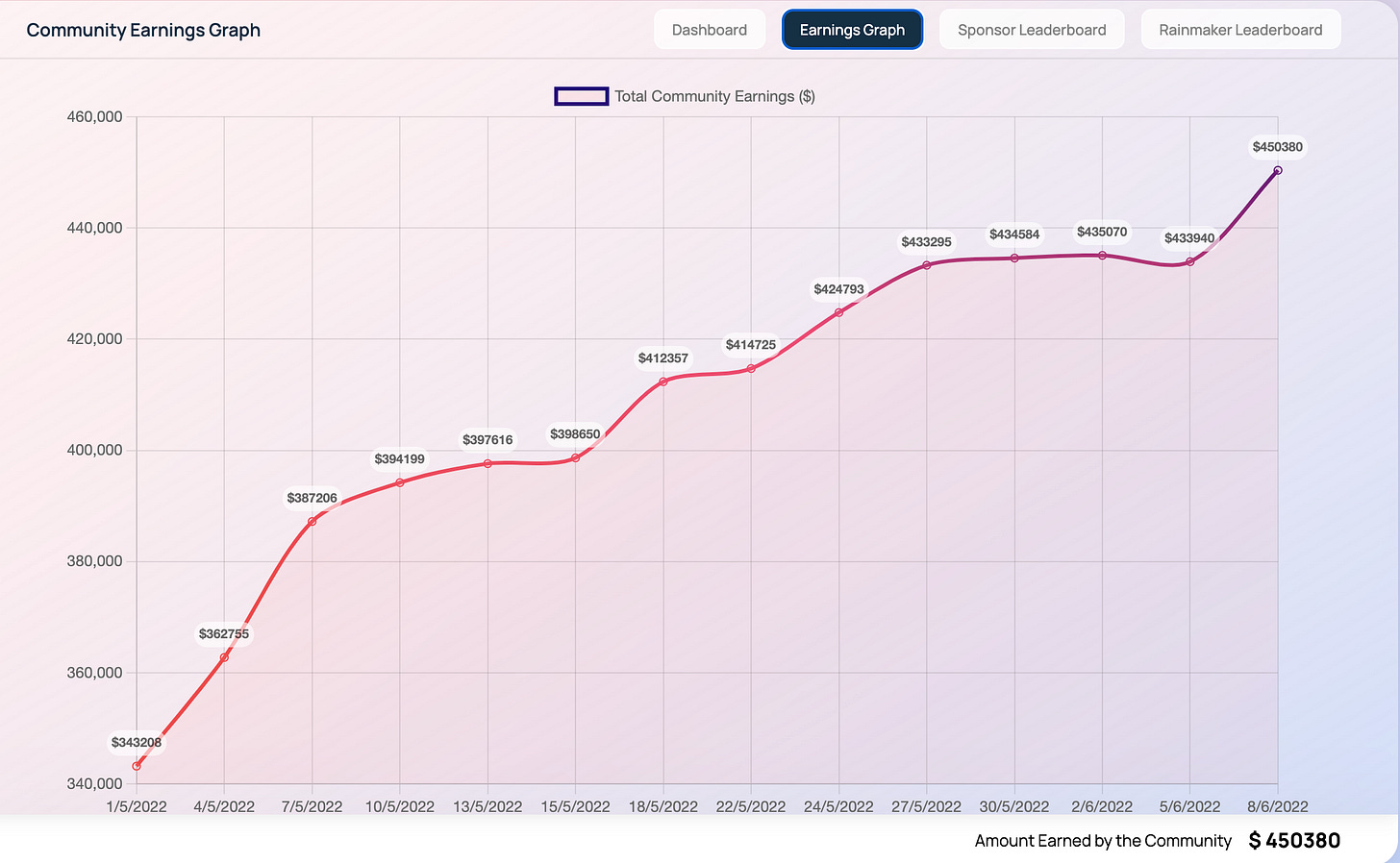

This has already played out in India. SuperteamDAO - helps individuals find meaningful work in vetted projects buildings on Solana through grants and bounties focused on using products. Close to $450k in grants have been disbursed by them so far. They are crucial in reducing the entry barrier for talent to flow toward Web3 and connecting great workplaces with talent that is hungry.

Historically - trends like remote work have benefited knowledge workers that already had access to strong educational institutions. These weren’t signals of skill - but ones of reputation. Earlier, the only way to acquire those signals was through passing exams to get admission to a contested college or being able to afford an education at a large university. Web3 more or less offers a new alternative. On-chain assets such as NFTs given through doing courses would collapse the time and effort it takes to signal skill-sets. I see a variation of this with analysts almost entirely being hired based on their Dune Dashboard quite routinely. Platforms like Rabbithole.gg and Layer3.xyz will be crucial in making these on-chain credentials accessible to everyone with a computer.

The Investment Opportunity

Every once in a while, I see prominent investors based out of the US mention how bullish they are on India. It is easy to do that when you are not dealing with the red tape and traffic in the middle of Bangalore. It is hard to be optimistic when you live through the hardships most foreign investors barely see. This piece is riddled with the same blind spots they have as I have not built in Africa. And I am no expert in what the average founder there is dealing with.

But in my understanding, the African ecosystem is massively underinvested. Of the some ~$50-60 billion that has gone into crypto-venture (including ICOs), only about $170 million has been invested in Africa. That does not look right when you consider the number of people coming online and the fact that the region has one of the youngest populations in the world.

The opportunity in Africa is in investing in a generation that will work, earn and spend online. They would be able to do it with less reliance on traditional intermediaries through web3. There will be value created in bringing mundane, broken and divided processes into a transparent, open and verifiable ledger like the agricultural use case I mentioned. All of that will require financial infrastructure and technical know-how. That is why investors have been deploying there.

Last year, Chainalysis mentioned that the size of the digital asset market in terms of users grew 12 times in a single year. You can say that is the base effect. But unlike India, China or the US - the leaders in Africa are not yet determined. Nobody knows which app or venture will dominate. So the opportunity for Africa depends on two things. One is the ecosystem catching up with the rest of the world. The other is technology disrupting traditional intermediaries in the region and paving the way for considerably more economic activities. I do not see web3 as some magical elixir that solves system issues in the region - but it gives people a pathway to alternatives that did not exist earlier.

A famous paper from the 1970s titled “the market for lemons” explained how a lack of trust between buyers and sellers could collapse markets. The most significant constraint emerging markets have is the lack of insurance or reprieval if an economic interaction goes awry. Blockchains reduce the extent of friction involved in enabling trust on a global scale. Technology, when implemented correctly, can reduce our reliance on intermediaries that stand in the middle needlessly.

Change - in my view, would happen in two ways. First is a bottom-up approach where people transition to web3 to pursue higher income. As you may have guessed, the second is through policy changes at the government level. Given my own experience in India, my bet is on the former happening first.

If you enjoyed reading this, consider joining us at Telegram. That’s where most of the things I write find their initial roots.

Joel

P.s - Sumanth and Rohan did much of the heavy lifting in terms of research in this piece. Make sure to give them a follow on Twitter.

This piece was written with inputs from Yele Bademosi, Ugochukwu Aronu, Aadil Mamujee, Marvin Coleby, Wiza Jalakasi and Nilma Shah. They were kind enough to take time and give context from the point of view of founders building in the region.

Nice work