The Future of NFTs

___________________________________________

Sponsor Mention

This piece was made possible with a sponsorship from Nansen. The platform saves analysts and traders hundreds of hours each month by allowing them to grab network level data with a simple click. No APIs, no going through network scanners or pulling contract addresses. Nansen visualises network level data on user behavior & transactions in a fraction of the time their peers do. Get started with a trial here or simply play with their dashboards here.

_________________________________

Hey,

Here's a random thought I had. We used to function in a transaction economy. We transferred wealth, culture and ideas in exchange for goods or services. You will find traces of ancient gold and cultures from Rome if you explore Kerala in India (where I am from). As the internet emerged, we shifted from transaction economies to attention driven ones. This was not a quick shift. According to attention merchants by Tim Wu, attention-based economies emerged through newspapers. Publishers began using ads as a way of reducing printing expenses. Televisions and radio further accelerated the pace at which attention based economies emerged. They captured the public psyche, changed culture and unified narratives at scale. But none have been as consequential as the internet and now - AR and VR. Why? People earn back their money in transaction economies over time. In an attention economy, lost time is not regained. You cannot go back in time to spend your time not scrolling on Instagram.

Why does all this matter? Because I think - NFTs represent your attention expressed as a financial good. Unlike text messages or e-mail spam, if an NFT has a financial price linked to it, you will give it attention and repeatedly check on it. This could change how commerce occurs in the next decade As more brands release NFTs, the cost of each may trend to zero, but for now, we are in the experimentation phase of NFTs - which means brands are trying everything. Hoodies linked to NFTs? Adidas is doing that for Bored Ape Yacht Club members. Lifetime passes for concerts as NFTs? FTX is helping Coachella do that. What about NFTs as proof of attending classes? POAP has been helping event organisers do that. The possibilities are endless. But to understand where we are going, we need to know how we came here.

How We Came Here

Four phases mark our economies' evolution. They can be broken down based on resource expenditure and ownership. Early human economies were resource-intensive and gave little respect for ownership. Class hierarchies ensured only one subset of people rarely owned what they worked on. As time passed, giving ownership of what one spent time on became the norm. Think about how we have gone steadily from daily wages to splitting profits and now employee stock options. Here's a brief look at how things have evolved.

Transaction Economies - These are marked by the exchange of money for goods or services. Most of human history ran on transaction economies. Think of barter, the silk route or eventually, colonisation. Transaction economies were the backbone for all of them. The focus was on local markets until technologies like ships and trade routes arrived. It lasted right until the arrival of the printing press.

Attention Economies - The printing press collapsed the cost of replicating information. But literacy rates did not surge till the 18th century for a captive market for books to exist. Newspapers, as mentioned earlier, were the early forerunners of our present-day platforms. An attention economy is one where you sell attention (to a third party) instead of a good. In 1995, A&T brought the model online with the first-ever banner ad on HotWired. Last year alone, Youtube made $29 billion selling eyeballs. They have little to no production costs, and customer stickiness is high. You can scale it to the size of a country, like Facebook did, without worrying about costs rising in proportion.

Platform Economies - Platform economies connect sellers and service providers with potential buyers. Amazon gained revenue of close to $489 billion doing that. Uber scaled its revenue from $100 million in 2013 to $13 billion in 2020 following the same model. Value accrues to the platform due to discovering and trusting vendors found on the platform. Most mobile apps we use daily today have a platform play going on for them. The costs are in vendor curation and trust retention with a large enough userbase.

Community Economies - Community economies are an evolution of co-operatives. We don't talk about the macro-economic backdrop of DAOs, but here's how I perceive it. The internet gave us access to global markets (2010). Smart contracts enabled us to trust one another without an intermediary (2020). The pandemic has reminded us that our time is short, and one should work on what one owns. It taught us that one could do everything right and still get screwed by life. The great resignation is proof of this. So we have been in an explorative phase for alternative economic models. This is where DAOs fit in (You can argue that DAOs are the Gen-Z equivalent of Occupy Wall Street but lets not go there today). They connect individual autonomy with economic opportunities that did not exist earlier.

Community economies are instances where users govern what they use. These economic models leave on-chain proof of economic interactions, leading to open-access data about participants in these economies. Community economies differ from platform and attention economies in that data about participants is often not siloed on corporation owned servers. Anybody can query and build on top of that. Gitcoin, ENS, Covalent, Biconomy and NFT based DAOs like LobsterDAO are instances of this. Are shareholder driven companies a community economy? I don't quite know the answer to that yet. You could argue GameStop fits the definition, but back to NFTs for now.

Where Are We Now?

Now that we have a historical context let's look at where things are at right now. Venkatesh Rao from Ribbonfarm broke down modern economies on a quadrant split across relatedness and finement in 2011. We remixed it a bit (below) to be relevant for present-day brands. The X-axis looks at relatedness. Relatedness here looks at the relationship of parties in an exchange. The closer a relationship, the harder it becomes to engage in highly quantified and thoroughly negotiated transactions. Think about negotiating with your mother commercially regarding what's cooked for breakfast. Awkward? Yea, that's what we are talking about here. On the Y-axis, we break down economic interactions based on refinement. It is the degree to which a seller can define the value proposition before a transaction and the speed at which a customer can receive it. Consider Amazon's one-day delivery. You know what you are buying into and when it will arrive at your doorstep.

Brands representing capitalism in all its glory are likely on the extreme top left of the above spectrum. Buyers often know what a Rolls Royce or Gucci product offers in value and its cost. I don't think you can negotiate what a Louis Vuitton item would cost. They rarely need endorsements because the trust is established and the value proposition is clear. Attention economy platforms are often low on trust. We rarely ever buy directly from brands on there. This is part of the reason why you see less of your friend's breakfast and more of what is irritating your local influencer on your Instagram feeds these days. Attention economy platforms have been optimised for influencers because they come at the right balance of personal content and commerce. Influencers with sufficient reach (and trust) sell direct goods in the form of subscriptions that can be recurring. Substack and Patreon fill this model. The challenge is that creators can be biased, burnt out, and outright wrong. That is why a community matters in modern-day commerce.

Communities like Product Hunt change the relationship between participants and turn them from random strangers meeting on the internet to collaborators who are driven by a shared vision. On Product Hunt, it is finding new app launches. For token and NFT based communities, price is often the glue that holds people together. Communities decrease the amount of friction in conducting transactions. Price discovery generally occurs on an open competitive bidding model because there is minimal information asymmetry. Web3 native firms take this to an extreme. Most teams simply host a bounty board instead of sourcing contractors one by one. Individuals interested in doing the task then complete it and submit in hopes of being paid in tokens.

This breaks the typical employee <> employer dynamic that has historically existed. Contributors work with multiple teams whilst teams can pick from a much larger talent pool. There is also the fact that since bounties are often paid in native assets of the network - the contributor can choose to sell to a stablecoin or simply hold the token in anticipation of a further upside as the network or venture scales. Having the token also makes the contributor mentally and financially vested in the network - thereby increasing retention. Think of it as ESOPs given at a smaller amount but higher frequency.

Where Are We Headed?

NFTs take this dynamic to the extreme. Since NFTs on average cost more than a fungible token - you are either all-in or out. (This is assuming an average retail participant does not have enough idle capital to buy multiple NFTs at extreme prices). Going forward, brands will use NFTs as a way of sparking consumer segments that are power-users. Running a health-tech app? How about airdropping NFTs to the 1000 users with the most activity. What about consumption apps like Deliveroo or Grubhub? Use NFTs to encourage healthy behaviour or signal the most active users of the product. Think of NFTs as participation certifications that have gone on-chain. But why? Because it can unlock new customer perks. Historically, brands held all the data pertaining to a user and an independent third party developer cannot incentivise these users directly. Using NFTs enables just that.

You don't need NFTs to unlock customer perks - loyalty cards do that today. What they can enable in the future is permissionless targetting of communities in ways that are value additive. Lots of jargon. So let me break that down a bit for those visiting us from the Web2 realm. Say you made it the mission of your life to make everyone in your locality fit. You could set up a gym opposite the local McDonalds and do targeted banner ads. But someone visiting Mcdonald's would likely not care about how much they can lift at the gym. But say you airdropped them an NFT - and said NFT could be redeemed for a free workout, access to other McD enthusiasts looking to work out and a discount on access to the gym going forward. You may have just set up a new dynamic altogether. Why? Because the presence of a community reduces the cognitive load of commitment needed to start going to the gym. If they do not want it, they can sell to someone else in the free market (like giftcards) in exchange for another NFT. And voila - you have made a financial product out of what was once an ad.

Naturally, anybody can target user segments in this fashion. Therefore, you have an open economic system where any business can target users and create subsets of communities. Why does this matter? Because it allows human ingenuity at scale. In 2019, when I first wrote about DeFi , I mentioned that the most powerful element about the ecosystem would be the fact that it takes the power of making financial instruments from bankers and democratises it. That has resulted in a $249 billion locked in DeFi apps outcome. Now think of what can happen if we democratise the ability to create physical or digital experiences on the basis of transaction history.

Note: There is a lot to debate here and I would really appreciate healthy skepticism in your e-mail responses. One aspect I am not covering is what would happen if NFT spam occurs. Won't the price simply crash? In my opinion, the most priced NFTs will be on Ethereum main-chain. The transaction costs there by default will mean people don't spam. Another point is that it is a game and theoretically a flawed strategy to keep spamming people with NFTs. Brands don't see value emerging out of it. I will write more on this later.

Charlie Munger famously said, "show me the incentives, and I will show you the outcome". Web2 platforms drive platform addiction to our screens because their incentives are based on selling ads. The more time you spend staring at funny videos on reels, the longer the possibility of the platforms showing you ads. This is why they are built on variable rewards. NFTs may be our pathway to changing that dynamic in the new internet. Instead of slowly nudging users to make purchases they don't need, brands could use on-chain data to target users with perks and access to communities from which they may benefit. Why have users sitting around on your platform when they can just see all the offers open to them in a single go the following day. This means rewiring how we as users choose to spend our time. I won't go so far as to say NFTs can fix the loneliness epidemic plaguing society today, but they do offer the tools to make it happen if on-chain transactions take off at scale. Of course, there are privacy concerns here. For instance, can a person attending a geo-specific location in real life be tracked on-chain? This is where solutions like zero knowledge proofs become increasingly of relevance.

NFT Led Growth

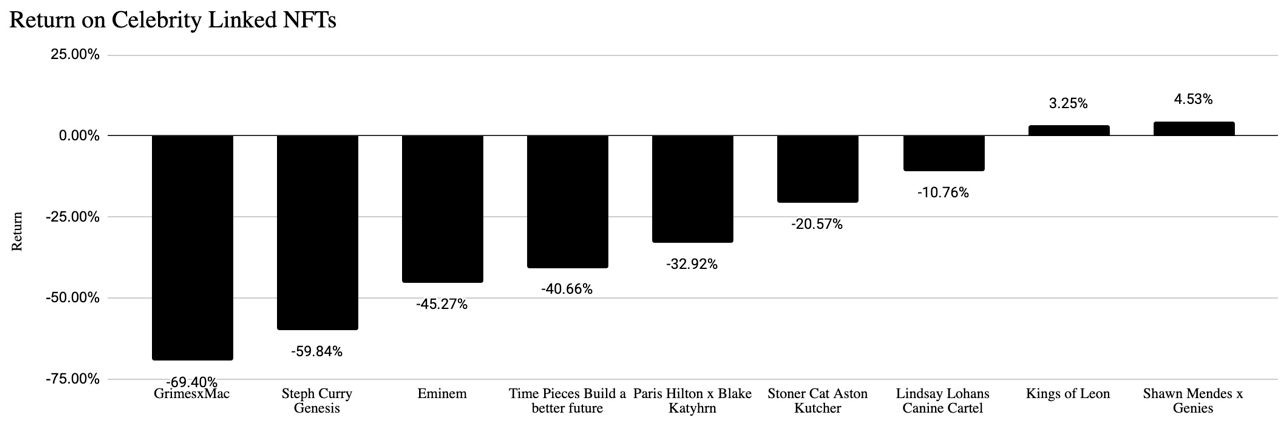

You may think I am crazy to propose that we will go from running our economies on ads to user-owned data. But several factors could contribute to this transition. Hardware or operating system changes such as those released since iOS 14 can reduce ads. The focus on breaking up big-tech, taken to its extreme, could lead to brands looking for alternatives. In fact, several platforms have already experimented with NFTs. Time launched TIMEPieces - a collection of over 4600 NFTs that gave holders access to the magazine. Well-known WWE star John Cena issued a collection of 500 NFTs to his 16.2 million Instagram follower base. Only about 37 purchased them. I guess the NFTs said.. "you can't see me". Melania Trump tried issuing NFTs only to buy them back herself. Perhaps Donald Trump managed to build a wall around them. One of my favorite games from Ubisoft tested issuing NFTs and accrued only $400 in sales. You see where I am going with this. It's not like we don't have enough people tinkering with the emergent asset class. Its that the vast majority of them have not led to good outcomes. We checked on a number of celebrity linked NFTs and the vast majority have trended downwards since issuance.

So what's the catch here? I think effective NFT based community building requires a lot of thought with regard to how users are targeted. When LooksRare launched, they had some ~22,000 wallets holding tokens.Some 18,000 wallets still hold those tokens. About 80% of them have held those assets for over a month. Do we see Web2 platforms literally giving away money, only to have the vast majority of users holding on to it? As I mentioned earlier, it played out like this because LooksRare targeted users that were historically active on NFT platforms. I see an extension of this with LobsterDAO. The DAO was launched by giving NFTs in proportion to user activity over three years in a community chat. About 7 DeFi primitives have launched through the community there so far. The NFTs are used to validate the identity of the user and reward tokens in exchange for conducting certain actions such as staking or adding liquidity. For teams, the tokens given away are the cost of acquiring users who have a history of participating in DeFi related conversations.

Startups should see NFTs to give their key users social capital. If you observe what Twitter has done, it is precisely the case. Twitter Blue's latest update allows users to verify they own an NFT. The big brains at Twitter likely understand the advertisement model may see the same fate of newspapers as user preferences evolve. By enabling users to show NFTs they hold as profile pictures, Twitter has effectively made everyone's personal identity an advertisement board and merged it with existing social graphs. Startups will soon be able to airdrop NFTs with pre-defined perks on power users, contributors and product ambassadors, effectively generating intrigue and curiosity in third party users. A different way this could play out is with education. Today, platforms like LinkedIn already allow users to claim they graduated from a university. As learning modes evolve from university to digital media, we will see on-chain NFT based credentialing becoming increasingly common. Lastly, if a platform is digital, it could simply give access to users by checking their assets on-chain. Two prominent research platforms - Water & Music and Global Coin Research - do this already. Bankless is another publishing platform that uses on-chain assets to run as a DAO.

Come For The NFTs, Stay For The Community

Remember when I defined NFTs as an economic representation of your attention in the beginning of this piece? I think this is the most under-looked aspect of the ecosystem today. Most NFTs have sub-cultures and inside jokes that keep people vested far longer than royalty programs can. They also give holders a way to discover and work with one another within a specific context. This is when a brand becomes an identity. Deep within, we are all looking for the same thing - a tribe we belong to. Sometimes, users go to extreme lengths to establish their dominance within that tribe. Sometimes, we pay to access the tribe. Be it NFTs or the merchants that lined up on the shores of Kerala almost a millenium ago to buy spices - we are all simply looking to discover our tribes. Commercial instruments like NFTs simply make the process of discovering and signalling within tribes easier.

Feel free to come argue about why everything I just wrote is nonsense on Telegram. Or just lurk. We like having more members there.

Peace,

Joel.

This piece was co-authored by Sumanth Nepalli. Make sure to give him a follow on Twitter for insights on gaming and web3.

Notes.

1. I will be revisiting this piece with a focus on privacy and surveillance capitalism. Drop me a note if you'd like to collaborate on it.

2. I hold exposure to some of the NFTs mentioned in this piece.

3. Commercial entities I am linked to hold ownership in infrastructure for NFTs.

4. I have been involved with LobsterDAO for ~3 years.