Hello,

Today's post is focused on what transpired during a recent foundation transaction being done by one of the fastest-growing automated market-makers. For context - almost two weeks back, 0xmaki, the founder of Sushi posted a proposal suggesting the foundation conducted a transaction worth $60 million of Sushi tokens towards 21 different VCs that were pre-selected. The terms - a 6-month cliff and 18 months vesting in exchange for a 30% discount. What transpired since then is a fascinating look at where the state of venture financing in crypto is. Before we proceed any further - I want to clarify that this post is an attempt to share where I think the market is. Like many of you, I am a student of the markets and my opinions will change over time. The reason I publish this is for critique and feedback on how the industry can evolve.

It is hard to summarise the entirety of the 200 comments that have since been posted on the forum. But I will try to summarise it.

1. Sushi has had a record month in terms of volume in the past month. The community finds it wrong to sell tokens at a discount while the asset has had a massive draw-down.

2. The value adds that prominent investors bring to the table are not entirely clear. Unlike an early stage protocol that has not found a protocol-market fit yet, Sushi has meaningful revenue and buy-in. The community has been questioning why this is needed now.

3. The number of sushi tokens involved is a substantial part of the treasury, and the team may benefit by choosing to sell a tranch when the price of the asset is higher.

For context, foundation transactions are not a new innovation. Teams in crypto liquidate a part of their treasury to investors they wish to align at a slight discount to market from time to time. The discount typically serves two purposes from the point of view of an investor

It dampens the impact they will take in case the market draws down another 50% during a prolonged bear market

It increases the upside they can generate if the market does rally

The upside for the team is that they can align an external investor that could help without necessarily selling much into the open market.

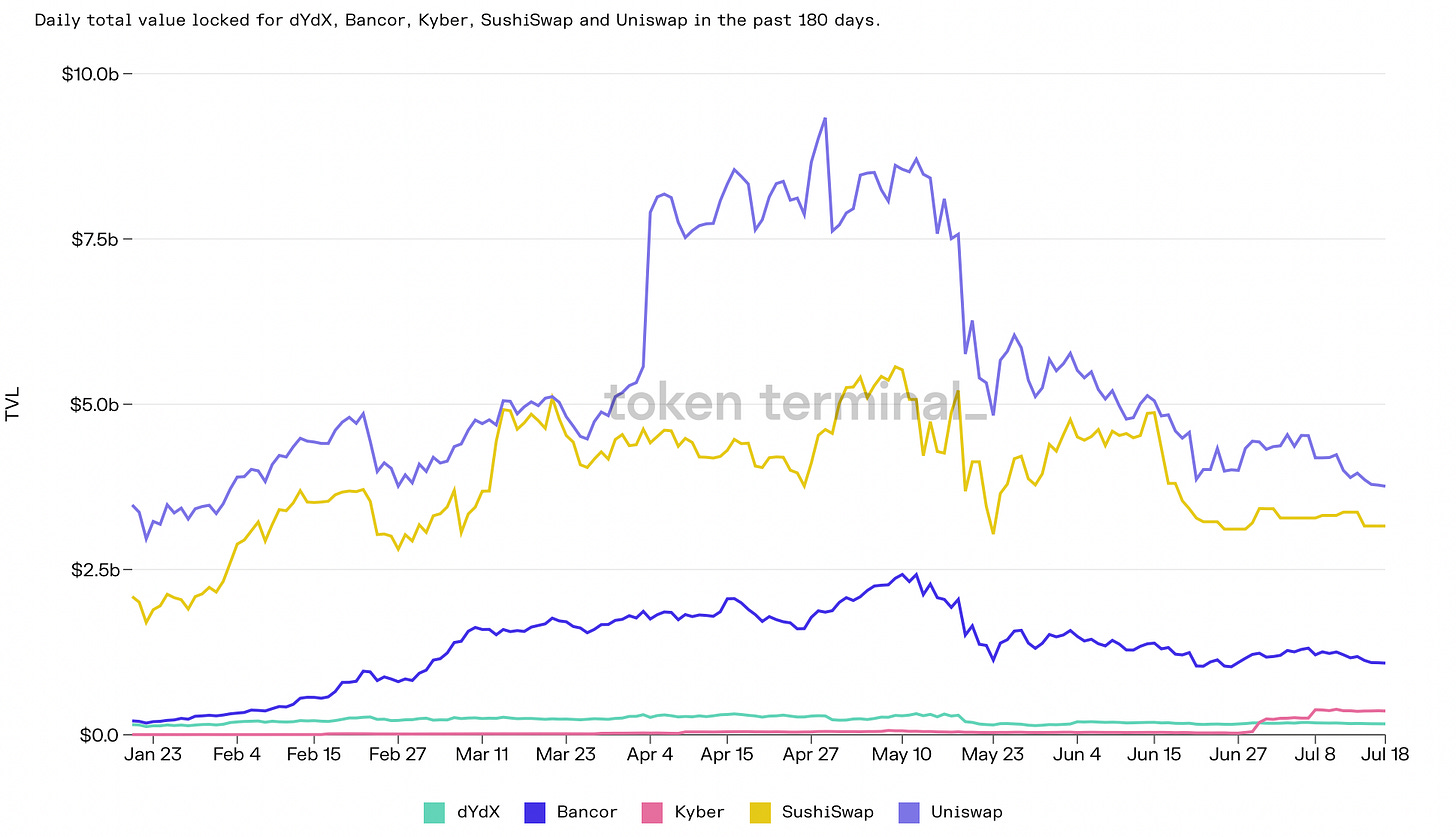

Sushi's instance is unique because of the number of investors involved and the fact that it is for a growth-stage asset. It has a large community and substantial traction alongside what looks like a product-market fit. In other terms, this would be the equivalent of Amazon raising capital from me as an investor. There's frankly nothing I can do to help Jeff Bezos' creation get any more efficient. Bit of an exaggeration comparing a 20+ year-old firm to an open-source project, but you get the point. The other thing to note here is that Sushi is in close competition with Uniswap to be a leader in the automated market-maker space. Given how power laws work, the difference in key metrics such as TVL and revenue can be huge between #1 and #2 when it comes to being a category leader. This is why the community should be more sensitive to a foundation transaction at this point. For context, consider the TVL figure among major exchange-related projects in the chart above.

The State of The Markets

What has gone missing from the discussion is the amount of capital that is sitting on the sidelines at this point. As Ryan Watkins mentioned in this tweet, more capital inflow to crypto does not necessarily add value. In my experience - the industry has three forms of capital competing against one another across stages. One is the seed-stage traditional VC fund in the industry that has been around for a few years. They understand that a project will gradually tokenise. The second type is hedge funds or in-market asset buyers that have substantially large AUMs built on liquid market investing. The third new entrant is traditional VC funds that handle billions of dollars allocating a portion of their assets to the market so they can begin building a risk appetite. This may be a gross generalisation and I mean no disrespect to specialist VCs (you get a mention below). For a sense of the scale of the amount of capital entering crypto today consider A16z's newest fund. It is at a massive $2.2 billion in AUM. If they dropped $1 million each week in a new venture, it would take them ~40+ years to complete deploying it. This is part of the reason why the average size of a raise has gradually increased over time.

There's too much capital chasing too few deals of good quality. A good reason for many investors to go up the value chain to do liquid, in-market investing into growth-stage assets. As an investor, I see the other side of this. Early-stage valuations for first money-in deals were at $7 million in Q3 2020. Today it is generally at $20-$30 million. A fund manager has two options under such circumstances. They avoid investing altogether, miss out on a great deal and end up looking stupid because their RoI is a fraction of what others generated. On the other end, they invest aggressively alongside others and risk creating diminishing returns because every investment is overcrowded. It is a delicate balance between passing and investing in these circumstances. If you are a founder, read this post by NFX on using it to your benefit. Don't try it with me, please.

The other option for most managers is to invest alongside other known names in a somewhat established protocol to reduce risk. This is slightly similar to a growth-stage investment in the traditional world and has several advantages.

Growth stage investing can attract more capital than the over-priced seed-stage valuation

Investing in an established team with product-market fit is less risky than taking bets on a mix of ventures that are not battle-tested

Skill-sets that a mix of investors bring can help teams grow faster.

As more investors from the traditional realm enter the digital asset space, we will see more investors chasing fewer deals, at least temporarily. All of this discounts the fact that a massive group of angel investors have emerged after the recent market cycle. These are investors who built through the previous bear market and have the risk appetite to invest in early-stage ventures.

Where Is Venture Capital Headed?

The thread on Sushi's raise is filled with scepticism for capital allocators. Part of what has fed into it is extremely short vesting cycles on pre-token raises in the past few months. It has become common for backers to invest in multiple pre-launch tokens and have their tokens with very short vesting cycles. Thus, in the public eyes, they bring no value except for the capital infusion at the early stages. However, it also considers what can VCs really do for a protocol once it reaches growth stages. In the early stage of a protocol, the value adds one can bring are more clearly defined. A raise, token economic modelling, assisting with research or helping figure product-market fit are quantifiable measures that make or break a venture early on. But what do you do once an open-source venture reaches scale if you are deploying money from an institutional point of view?

In my observation, venture capital will become increasingly specialised in the next few years. Protocols will choose to work with a fund on the basis of their public record of solving particular problems. Ideo VC is a good example of this. Their prowess was mainly in the design space. Today they have taken that expertise towards mechanism design. Similarly, Paradigm has been setting up an internal team to double down on research. Every venture fund within crypto will have to evolve from capital allocators to specialists because capital is cheap. Talent is not.

The other emergent theme within the line of discussion is the possibility of longer lockups. Traditional investors I have engaged with prefer 4-5 year lockups and higher valuation. It makes sense because it weeds out the competition in the short run from smaller funds while buying the founders sufficient time to find a product-market fit. The logical case is clear but that is not the point of a token economy. Digital assets induce behaviour that creates liquidity for stakeholders while pro-actively enabling them to contribute to a network. This could mean using the asset for staking, lending, or governance.

Tokens are incentive design tools at their crux. If they cannot drive a specific behaviour on a protocol, why bother with them at all? I ran a poll on Twitter to see what people think of this and the vast majority believed a 5-year lockup is ideal. However, a 5-year lockup creates a principal-agent problem. In my (limited) view founders and investors cannot benefit from short-term liquidity given the cyclical nature of markets. They are incentivized to sit idle until the lockups finish. More importantly, their incentive to continue working on the protocol with tokens as an instrument decline. In traditional, equity-based investments, a secondary sale is warranted once a venture reaches a certain stage. Why would that be barred from founders?

(That is an open question, not a statement. Hop in here and argue in case you have strong feelings on this)

Where Do We Go From Here?

It is important for capital allocators to understand that the game has changed. What we consider 'value" in the VC world needs to evolve. Historically, it meant helping with introductions or strategic advice. But how does that evolve when the internet makes everyone accessible and every bit of information available? What we are seeing with Sushi is the emergence of a new class of investors. Skilled, connected, committed capital that looks retail but has long-term commitment. They are gathering themselves. Through memes, on discord, sometimes as DAOs. Discounting them is a bad way to build a protocol. For those doing mechanism design for early-stage protocols, the challenge is to see how they can be worked with, not against. The other angle to think of this is to think more of how milestone-based financing can be used to tackle challenges related to when vesting for founders and investors are unlocked. However, if it can be measured - it will be gamed and therefore milestones alone don't solve this challenge either. There is a lot of nuance and complexity to this situation. Hopefully, over the next few months, we find better answers to them.

I'll see you on Wednesday

P.s - I have been discussing this with a small community of ~120 members here. Hop in maybe?

Peace.