From JPEGs to AI Models

A look at how Ordinals are evolving.

It is not every day I get to recommend following a newsletter from one of our readers. I have been using Launchy for a quick brief on all the events going on in the industry. They compile all the relevant research, funding events & data you need to operate in Web3 and publish daily. Look at their newsletter here to stay on top of the latest.

Hey there,

As Bitcoin continues to rally, the world seems to be split into three camps. Those who don't care, those who believe Bitcoin is worth zero, and those who take it for granted that the asset should be worth much more. We don't have a view on the price of Bitcoin itself. Instead, our piece today explores the applications built on the Ordinals ecosystem atop Bitcoin.

If you're reading about Ordinals for the first time, we recommend reading this piece we sent earlier for context on what they are. Nick Hansen from Luxor Technologies helped us with much of the heavy intellectual lifting in this piece. For those not in the know, Luxor Technologies is the 7th largest Bitcoin mining pool in the world.

Last week, as we were sending out the piece on Ronin, Twitter changed its policy around Substack. Users could no longer share a direct link to Substack because Musk no longer found it cool that the platform was launching a possible competitor called Notes. Fortunately, the blog is hosted in its own domain - and the piece did pretty well. We crossed over 100,000 views between Sky Mavis’ distribution and ours.

But it made it apparent that having a central overlord that can decide whether one’s work is discovered may be extremely harmful. The “value” of Bitcoin’s censorship resistance quickly became apparent as we realised how platform censorship works. Thank you for the headache Elon Musk. In a follow-up piece, we will explore how Web3 is fighting against behemoths like Twitter. For today, it’s back to Ordinals.

A Premium For Permanence

Any content we consume from a millennium back is likely edited for easier consumption. That is because no permanent, verifiable work record goes back centuries. Quite recently, some of Roald Dahl’s books were “edited’ for modern times. Editors removed words to make the text more politically “correct”.

There is very little a creator can do to ensure their work stays as long after they are gone because the mediums on which they are stored are not immutable. You can edit them to match an agenda before distributing them to the masses. Fortunately, as we saw in our initial piece on Ordinals - there are tools to help you keep a permanent record of some forms of data in a way that cannot be edited or taken down.

Bitcoin has been an outlier in the financial markets over the last few months. While banks have been facing the threat of bank runs and a possible recession lurks around, Bitcoin has comfortably rallied over 80%. Arguing whether Bitcoin is an inflationary hedge is beyond the scope of this article, and we’ll do that later - but it is safe to say that people have begun giving it a premium. Unlike other assets in the mix, as the data below shows.

One of the reasons for the outperformance could be that it has become apparent that one does not truly "own" their money in the modern banking ecosystem. You give it to a bank, which is expected to provide a return over time. The assumption is that your capital will be readily available if you decide to go one fine day and ask for the money to be returned. Banks take your deposits and invest in instruments like treasuries to make a return. They accept deposits that could be called back in the short run and invest in instruments that yield a return in the long run.

This strategy works until everyone wants all of their money back - at the same time. What we witnessed with Silicon Valley Bank last month was a scenario in which VCs urged startups to withdraw the capital they held at the bank. Fuelled by the network effects of social media, one startup making a quick withdrawal became an entire ecosystem rushing to get its money out.

After SVB experienced a bank run, Silvergate decided to shut down, Signature was shut down (as a part of Operation Choke Point 2.0?), and Credit Suisse is being sold to UBS for cents on the dollar. The banking industry is facing tumultuous times. At one point, depositors did not know if they would get their total deposits back. Thankfully, Uncle Sam and the mighty Fed came to the rescue by guaranteeing that depositors would be made whole (you can read an excellent account of how the bailout came about here).

Within the past two quarters, it became pretty evident that there would be a need for censorship-resistant, self-custodied assets. Surely, there are gold and land, but Bitcoin fits in the mix as a digital variation of hard assets. There's one more reason for Bitcoin's outperformance. With NYAG labelling ETH as a security in March 2020, it is one of the only crypto-assets that may function outside regulatory reach. Historically, all you could do with Bitcoin was hold it and hope its value went up. Ordinals changed that equation by enabling users to host data directly on Bitcoin's blockchain.

This convergence of immutability, censorship resistance, and positioning beyond regulatory reach makes ordinals quite interesting. So, we spent the last few weeks studying use cases that go beyond just holding a JPEG on Bitcoin's blockchain. These are the emergent trends we observed.

Models On The Blockchain

Nation-states around the world have been scrambling to regulate AI. Italy quite recently imposed a ban on ChatGPT. On March 22nd, over 1800 signatories, including Elon Musk, signed a letter proposing research on AI should be paused. But the proverbial cat is out of the bag. For instance, Meta's LLaMA (Large Language Model Meta AI) leaked online via a downloadable torrent file on 4chan on March 2nd. The model eventually made its way to Github, where it received a DMCA takedown notice.

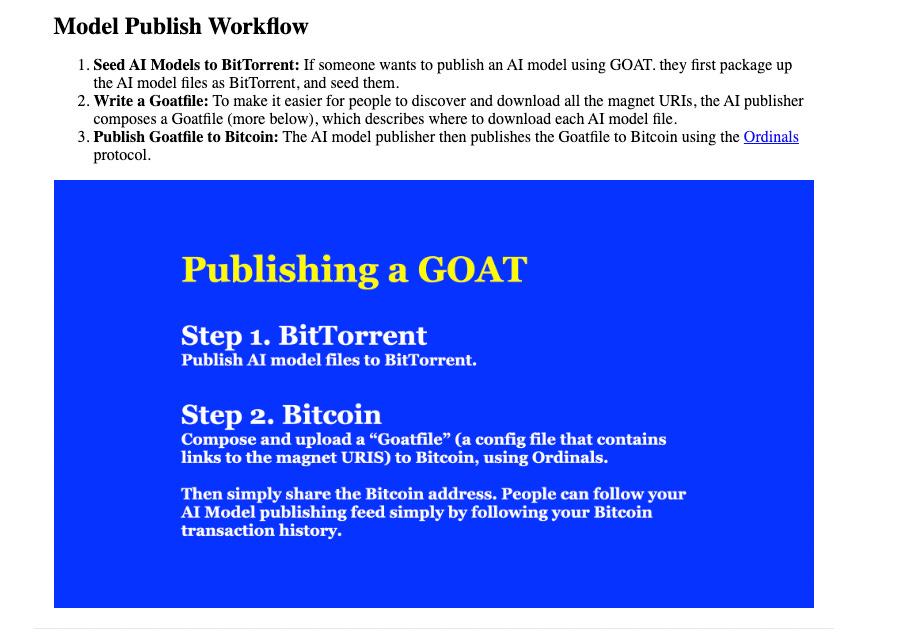

While Meta was scrambling to take down its model from the internet, a Twitter account named Cocktail Peanut posted a way to get AI models like those onto Bitcoin so that takedowns are almost impossible. The GOAT (Globally Open AI Transfer) protocol is simple but elegant. Whoever wants to publish an AI model packages the file as BitTorrent and seeds it, then creates a GOAT file that makes it easier for people to download all the files related to the model.

Finally, the publisher publishes the GOAT file to Bitcoin using Ordinals. Seeding is hosting a file on your computer and allowing a third party to download it. In the early 2000s, torrents were how much of the world got its hands on music, games, and movies.

Now keep in mind the models themselves are not being hosted on-chain. Bitcoin's blockchain is not ideal for hosting large files. What is being hosted are instructions (magnet URLs) on how to connect to a peer-to-peer network (BitTorrent) where the files are hosted. To download a model from a known publisher on the Ordinals network, a user refers to the transaction history of the Bitcoin wallet of the publisher. You only need a Bitcoin wallet address to access complex models that may be banned, leaked, or proprietary.

It is worth noting that when the GOAT protocol went live, the landing page itself was hosted on IPFS. A handful of users were already seeding the model - but the data with the instructions that would help BitTorrent download the data were not on Ordinals yet. Instead, Cocktail Peanut suggested that a third-party user could pay $10-$20 to push it to Bitcoin's blockchain as a text file and be the founder.

This file-sharing model is intriguing because it shows an alternative way to whistleblow or share private information. The "sensitive" data here concerns a list of computers accessing the model data. Torrents in themselves are nothing new. They have been around since the late 1990s. But unlike torrent links hosted on centralised sites, this information is on the Bitcoin blockchain. It ensures that nobody can take it down later on, even if they want to, which is very intriguing. There is no going back if information is leaked through a system like this.

Nation-states are unlikely to put sufficient bandwidth behind taking such a system down if pirated content or corporate secrets leaks. But suppose there are top-secret documents, such as the ones released by Edward Snowden or WikiLeaks. In that case, the government may decide to go after users hosting the torrents to deter information leakage. It is a tricky future we are walking into.

Sovereign Rollups on Bitcoin

If you are in crypto, you know what a rollup is and why it is essential (you can skip to further below). For those who don't - rollups are a way to take the load off the Layer 1 (L1) chain, like Ethereum, by executing transactions on a different layer and bundling the final transaction data back to the L1. Think of five people doing transactions with each other in a game.

Maybe, you don't port the data about each transaction to Ethereum but capture the final balances after a unit period on Ethereum. This is useful in use cases where high transaction frequency and low costs are needed. You can read Vitalik's work on the matter here.

A rollup generally relies on a L1 like Ethereum to store transaction data and reach a consensus. That is, you port over details about final balances and relay (or agree) the finality of those balances globally using layer 1. Given the growth of DeFi and NFTs on Ethereum, the ecosystem has been quick to adopt innovations like rollups. Because it became quickly evident that the chain, on its own, couldn't scale to meet consumer demands at affordable prices. This is why we have seen projects like Matic, Arbitrum, and Optimism take off in the Ethereum ecosystem.

In 2022, validity rollups on Bitcoin became a topic of discussion when John Light published this research report. One of the most critical requirements to build a validity rollup on Bitcoin is the need to include new opcodes (short for operational code; one can think of them as commands used in Bitcoin's scripting language) that allow validity proof verification and building recursive covenants (a covenant controlled by another covenant; more on covenants in the paragraph below).

Validity rollups provide proof of the correctness of all the transactions included in a batch. These are referred to as validity proofs. Since Bitcoin currently has no way of judging the soundness of validity proofs, we need to introduce opcodes that will allow us to do so.

A covenant on Bitcoin is a category of proposed changes to Bitcoin's consensus mechanism, which allows certain conditions on coin transfers to be added. For instance, I could add a script that authenticates moving Bitcoins from a wallet that can send assets only to specific whitelisted wallets.

Okay, so where are we heading with all this? We mentioned all this because it may be possible to start having rollups on Bitcoin despite the lack of smart contracts on the chain. A sovereign rollup does not need a settlement layer. The bits of a rollup that are generally used to function off-chain might no longer be required.

What would that look like? Rollkit, a plug-and-play rollup enabler, recently released a mechanism that allows users to host the settlement layer data on Taproot. So yes, that part of Bitcoin's blockchain where we have been uploading memes and JPEGs could soon be used to host rollups—more on how this works in the talk below by Eric Wall.

This is great - you have a quick execution and settlement layer as a rollup and Bitcoin as data availability. What's the catch? There are limits to how much data can be passed on to Bitcoin's blockchain (throughput). The throughput is limited to what you can accommodate in a Bitcoin block (4MB). Secondly, you cannot build a truly trustless bridge, given that the ecosystem does not have smart contracts.

We are unlikely to see any immediate changes to Bitcoin's base layer. The last time any serious conversation about changes to the base layer happened was in 2017, and it came with a ton of drama and an abundance of volatility. Not much changes with how Bitcoin works and things will likely stay that way. Since we cannot have trustless bridging without expanding the existing opcodes in Bitcoin's scripting language, we are unlikely to have trustless bridges the way we see in the Ethereum ecosystem.

You can now roll up (bundle) transactions and host them directly on Bitcoin. And that is a massive deal for the oldest chain in existence.

NFT Marketplaces

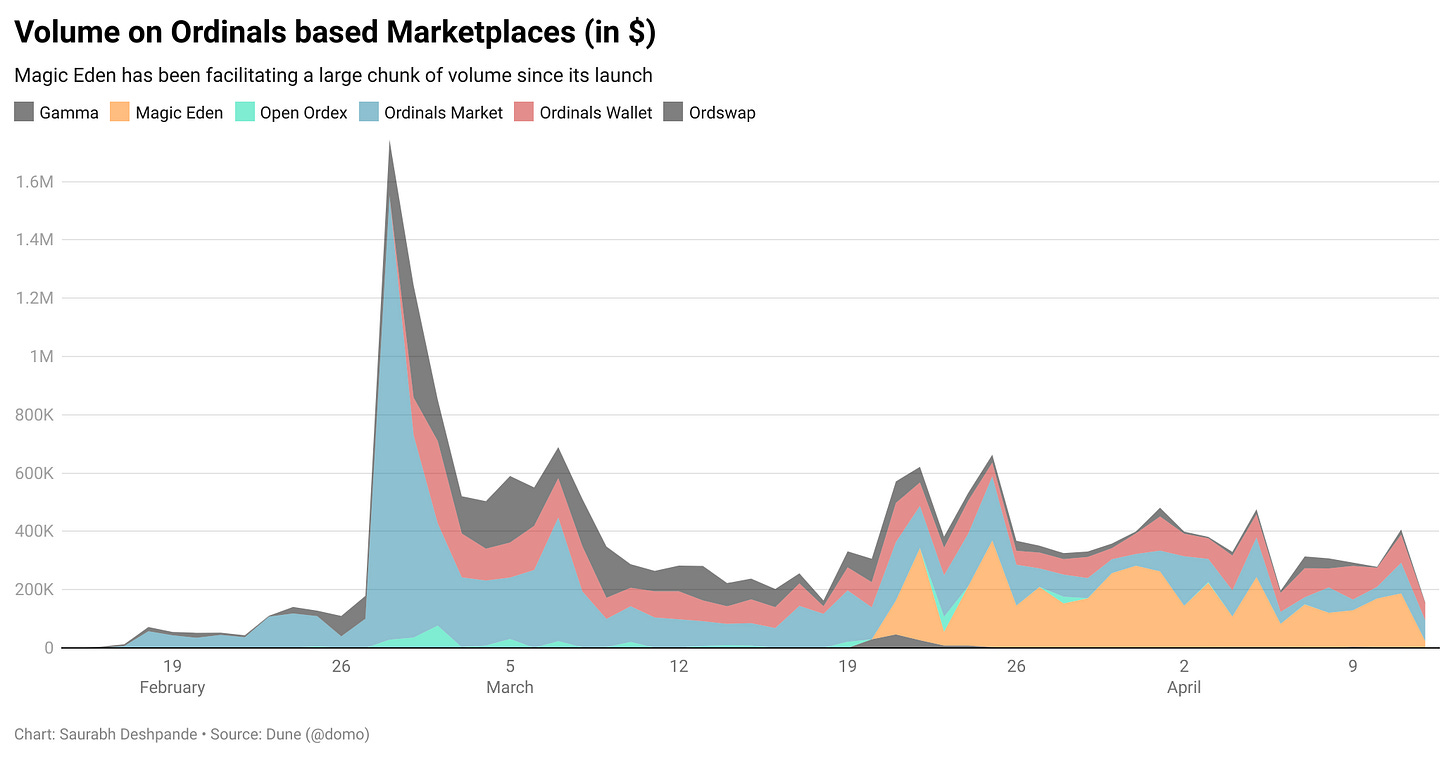

One of the ways Ordinals on Bitcoin are traded is through vaults on Ethereum. However, this still requires reliance on an external chain. As a result, marketplaces have been adopting standards to enable users to trade and settle transactions directly on Bitcoin. Recently, Magic Eden, the leading market on Solana, also announced support for Ordinals. It supports a mix of wallets and uses partially signed Bitcoin transactions (PSBT) as the core technology instead of smart contracts.

So, how does PSBT allow users to buy or sell digital artefacts? Say you want to sell an Inscription for 0.01 BTC. You create a partially signed transaction that you will fully sign later only if the buyer agrees to send you 0.01 BTC. The transaction allows the buyer to add their signature that states they will transfer you 0.01 BTC.

When the buyer signs the transaction, BTC is transferred to you, and they get your Inscription. Magic Eden is the first mainstream NFT marketplace to support Ordinals. Ethereum based marketplaces for Ordinals dominated the volume initially (remember, the ones that used vaults to store private keys to Inscriptions?). A variation of this used to take place on the P2P bitcoin exchange named Localbitcoins long back.

Volume is now beginning to concentrate on Bitcoin-based settlement, which makes us believe users don't mind trading on the Bitcoin blockchain itself. We have been internally debating whether costs would prohibit a Bitcoin NFT ecosystem from taking off. In our observation, the NFT trade on Bitcoin's blockchain cost can be as low as $3 to $10, keeping it within the range of Ethereum-based settlement.

For what it’s worth, the Bitcoin based NFT ecosystem is very much in its infancy. Cumulative daily volumes across the ordinals ecosystem are often lower than what a single NFT collection on Ethereum sees.

But it is unlikely that we will see random, in-game assets or JPEGs alone coming to Bitcoin's blockchain in the long run. People close to the industry argue that Bitcoin will become the go-to chain for all high-valued NFTs over time. That is a sound argument considering it is the most secure and decentralised chain. It could also be that high-value IP rights are hosted and settled through Bitcoin's blockchain. One place we have seen this happening is with Bitcoin Magazine.

The team behind the magazine has been covering Bitcoin since 2012 and recently released several Ordinals representing magazine covers from the early days. The lowest bid for the first cover is priced at 10 Bitcoin or $300k. Is it truly worth that much? Well, the market will determine. Given its emotional value, 10 BTC for the magazine covers wouldn't be much for somebody involved in the ecosystem since those days.

What’s Next

We have been discussing internally what this means for Bitcoin's miners. Nick Hansen suggested that Bitcoin's blockchain had been used chiefly for transferring BTC - the coin - for most of its existence. Only now have we begun seeing use cases beyond just holding the asset. Increasing adoption of ordinals and Inscriptions (marketplaces, Inscriptions-as-a-service) along with rollups (in the future) bring other avenues of extracting value from Bitcoin, similar to the MEV on Ethereum.

For Bitcoin miners, the value beyond rewards and fees exists in the form of inscriptions-as-a-service and bespoke blocks (such as the one created by Luxor for Taproot Wizards). Typically, these larger-sized transactions would not get included in a block (since nodes don't forward transactions beyond a specific size). Therefore, users approach miners like Luxor separately to execute these transactions. The fee for such transactions may also be decided off-chain (i.e., users pay the miner separately), as Luxor did with Taproot Wizards.

Ordinals have been around for less than a year, and the tooling required to hold, trade or even track data around the ecosystem is very much being built. Miners and early Bitcoin holders have the incentive to enable this new ecosystem as it may be the first time in years that Bitcoin becomes more “accessible” and “useful” to somebody that does not care about all the hard-money attributes of the asset.

However, we don’t quite know how the space would evolve because even within the Bitcoin community, there isn’t consensus on whether innovations like Ordinals should be encouraged. Perhaps, that lack of agreement is a feature and not a bug—a symbol of what happens when a protocol gets genuinely decentralised.

For now, we only know what Nick mentioned while wrapping up our conversation. That Ordinals are the most interesting thing to happen to Bitcoin since Q4 2017.

We will see you guys next with a dashboard we have built over the past few weeks. Yes. A dashboard. On Tuesday.

Have a pleasant weekend,

If you liked reading this, check these out next:

We are on Notes

I have been live on Substack notes for the past few days. Nobody quite knows what it is used for. I have been using it to share behind the scenes bits on our writing and thinking process. You can keep up with random snippets of what intrigues us by following me here. Drop me a text at @joel_john95 if you are active on Notes.

Meet us at Telegram

Join in on the conversation with ±2700+ researchers, investors, founders & overall great human beings. I may or may not release the dashboard we have been working on to the Telegram community first.

Great read. I suspect the Trading View Chart of YTD BTC Gold etc. has mixed up color labels. BTC is 80% not Gold or maybe order labels by the order of lines on right edge