Contextualising Compound

A breakdown of how Compound is changing on-chain lending.

Hello and welcome back from the weekend.

If you have been following the markets closely, you would have noticed that Compound and “yield” has taken over the psyche of the markets quite strongly. I wanted to explore the concept of yield, how it applies to DeFi and broad trends we will see concerning it in today’s issue. Since this piece is kept with a more general audience in mind, you may want to skip the bit right below this if you are comfortable with financial terms..

Understanding Yield

Yield in the context of financial investments is the return or income generated from a sum. It is the percentage figure of the initial investment that is returned over the course of a year. This includes compounding interest too from returns over the year. What are some examples of yields?

1. Assume you put in $100k into buying a house and rent it out. Over the year you make ~$12,000 from rental income on the property. Discount $2000 from that for maintenance and other expenses. Your net return would be $10k, and therefore 10%. This is discounting the appreciation of the underlying asset itself

2. Another form of yield is dividends on equities. A reason why P/E (price to earnings) is such a critical factor in deciding equity valuations is that before stock trading being such a common practice, it used to be common for investors to rely on dividends from equity holdings to meet their day to day expenses. So long as dividends were higher than returns from deposits in a bank, investors were comfortable with it. More recently, dividends have declined, and stock buybacks have become the norm.

In simple terms “yield” is the reward an individual receives for parking their capital with an entity. This figure tends to vary depending on the amount of risk involved and other factors such as performance fees paid to managers, taxes and the legal environment the capital is parked in. It is also linked to inflation. In India, you can receive about 6% on a bank deposit with almost no risk associated with it. Compare that to Singapore where interest rates are below ~1%. The reason for this variation is because India’s currency tends to decline in value on an annual basis. It is part of the reason why capital flight is so prevalent in emerging economies.

For more on capital and the role of networks - I strongly suggest reading these books

1. Square and The Tower

2. Lords of Finance

3. The Cash Nexus

With that out of the way, let’s understand yield in DeFi

Putting Crypto to Work

The challenge for any early adopter of crypto-currency that holds a large number of tokens today is (i) battling a potential diminishing value of the token and (ii) earning from the tokens they hold. Yields in DeFi solve for both with one stone. About ~75% of all ETH tokens have not moved in a year. It is common for large whales to acquire and sit on them as the underlying asset itself is anticipated to grow over time. The challenge then is how do you monetise this idle asset? That is where smart contracts come in.

Historically - any lending activity on cryptocurrency was challenging as it was almost impossible to reclaim the asset once it was converted to fiat. I have given some context to this challenge in this piece from 2017 if you’d like to learn more. The critical difference smart contracts have made for lending and on-chain trading-related activities is that they made it possible to

(i) track price sources through oracles and

(ii) settle/liquidate without human intervention.

What does this mean?

(i) When a loan on MakerDAO is not sufficiently collateralised, there is nobody ringing up the counter-party and asking them for more collateral. The system automatically keeps an eye on the price and has it liquidated through a network of users that are incentivised to do so.

(ii) There is no banking personnel looking at how orders are routed on Curve.fi, Kyber and 0x. The system is able to check order books and do it on its own.

Automation on its own is not impressive here. It is the ability to verify where the flow of currency has been and the price at which it settles is what makes DeFi powerful. The ability to do this is part of what makes it possible to trace hacks with the speed we currently do. How does any of this matter in the context of yield? We need to take three forces at play in consideration.

1. There are massive amounts of idle capital in the crypto-ecosystem today that is looking to be put to work.

2. The knowledge and infrastructure layer for settling trades is in place as the last two-three years have given teams like Maker and 0x to sufficiently test and scale their systems

3. The application layer is now coming of age and it is where we see the most activity (as we saw in my piece on stablecoins)

Idle assets, maturing infrastructure and emerging applications with ample venture capital funding is the perfect storm for a new wave of adoption. In some sense, that is already happening today. Yield is simply the hook with which the masses are on-boarded to DeFi

The basis for yield in DeFi is primarily trading activities today. There is always a demand for

(i) more liquidity on decentralised exchanges and

(ii) access to margin for trading.

So long as DeFi can offer competitive spreads (the difference between buy and sell price) and better interest rate than centralised exchanges (eg: Bitmex lending rates) there will be demand from users looking to trade. DeFi could likely charge a premium in comparison to a centralised margin trading platform like Binance due to the low AML/KYC and hold-up periods involved in taking a significant position. Once the interest rate or spreads get considerably higher than centralised offerings, whales will have no reason to continue using DeFi apart considering the smart contract risk involved.

Why do people take loans in tokens? The lowest hanging fruit is to go short on the asset the individual is taking a loan for. When whales take a loan of BAT tokens with USD - the assumption is that the price of the asset will decline over the coming weeks. So they take a loan against USD, liquidate it on a decentralised exchange - and repurchase it once the price is lower. The difference between the price of the asset when they got the loan and when it was repaid is their profit once you account for the lending rates too. In the case of tokens with a governance component involved like Maker, we will also see activist investors levering upon their votes by taking the underlying asset on loan. In other words, crypto-lending feeds into both governance and price prediction in its current form.

“Comp”-ounding Behavior

Now that we have understood yield, how it functions in DeFi and common sources of yield, we can explore why the last week saw so much discussion around yield farming. Compound is a prominent lending project that has had multiple iterations on its token economy since 2018. They have been a leading contender to MakerDAO and slowly took their token live in the last week.

The critical difference in their offering was that they incentivised borrowers and lenders to have access to a pool of compound tokens that were distributed every day. The activity was rewarded in tokens. In comparison, Maker’s tokens are used for voting (not as a reward) and Aave’s tokens are used to reduce the interest payment amounts. The dollar figure for the compound tokens distributed each day comes to around ~$860k (assuming 2880 tokens at 300 USD each). Since individuals can redeem their compound tokens almost instantaneously and sell it, it became common for people to move large amounts of money to the lending markets in Compound to receive the yield and token rewards. The incentive mechanisms worked in two key ways..

1. Large whales could park their idle USDT/USDC for a few days and receive Compound tokens which could then be liquidated for a profit.

2. Smaller users could receive yield of up to 1% in a matter of days given that both the lend and borrow side increased substantially. Compare that with the 0.1% some countries have on an annualised basis and you will see why this spread like fire.

The user behaviour on Compound could more or less be explained in the below image. Inspired by Nir Eyal’s Hooked. Here’s how it worked

A. Whales lend and borrow in huge sums from Compound

B. Large wallets are rewarded in swaths of tokens which are then sold in the market as prices rose

C. The rising price combined with heavy lending activity leading to high APY attracts more users to offer liquidity on altcoins (eg: BAT tokens)

D. Volume on the supply side is quickly eaten up by borrowers looking to margin trade with it.

Side note: I hope Nir Eyal does not sue me for this little image crime. Consider buying his latest book Indistractable. It is a nice read.

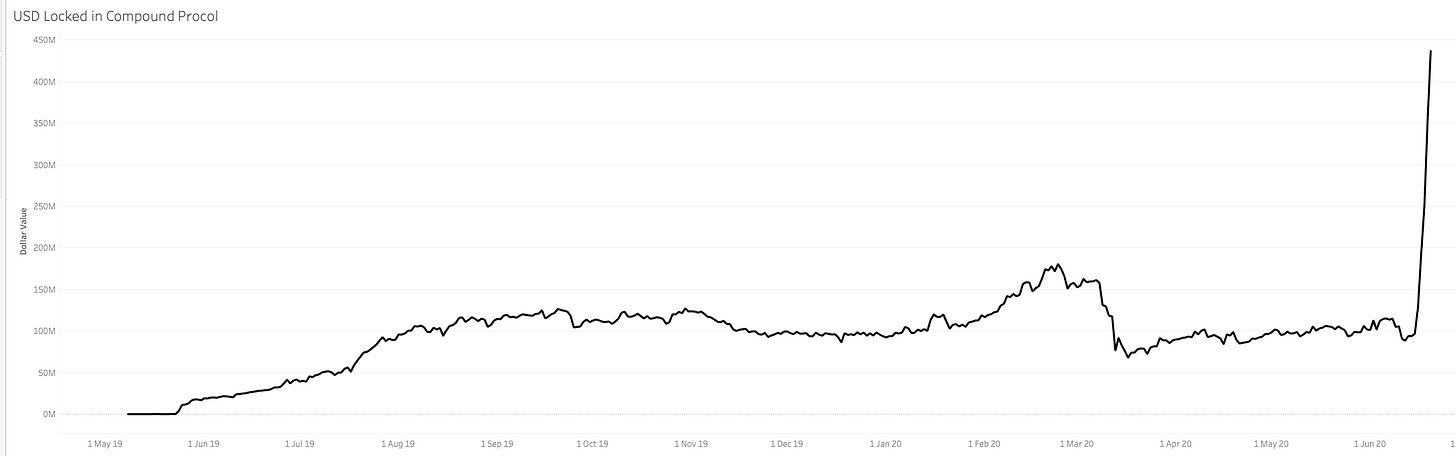

In case you are wondering what kind of impact this had on Compound, consider the amount of money that was lent on the platform over time. Take a wild guess on when the tokens were launched.

In a matter of two weeks, ~340 million was added to the protocol’s AUM. Interestingly, much of the demand side (borrowers) seem to be institutional players. In order to understand why - check this chart of the user types split on the platform. The introduction of the token barely about attracted ~800 borrowers (who had to absorb the $330 million) and over ~5000 new lenders.

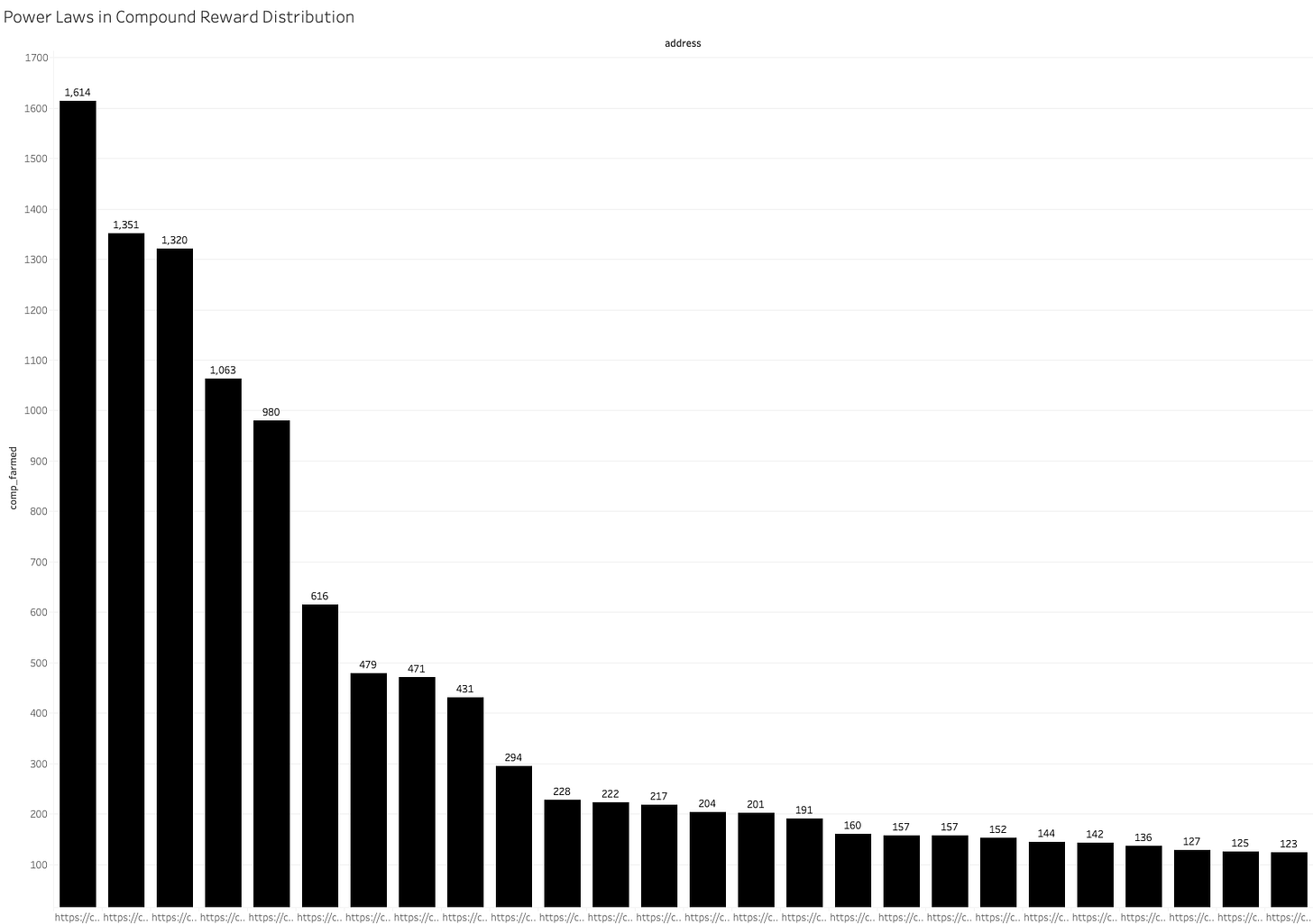

The distribution of Comp tokens also looks somewhat whale concentrated. Tagging the major Comp reward recipients gives you the graph shared below. About ~20 addresses received half of all Compound tokens as rewards. The median token reward deposited to the wallets was 0.07 Comp token. Or about $20.

The key take-aways for me are quite simple here

There is massive demand in DeFi for lending from institutional investors. They will likely continue to sustain demand. Compound is in a very sweet spot to capture it

The incentive for those lending on Compound today is the compound token itself. As the supply of the token increases, the price will collapse. Which in turn will reduce the amount to be lent on the platform too.

As of today only about 0.16% of the token’s supply is on exchanges. The valuation is likely way above what is rational.

The engrained incentive mechanism is an incredible growth hack. The challenge for Compound now is to diversify to other forms of lending (eg: Retail, fiat based) and continue to keep the token a core aspect of the governance process.

Whales run the show.

I do tend to think the concept of “yield farming” is slightly over-rated for the average retail user. For the risks involved, the yield may neither be sustainable nor rewarding in the days to come. Lending on Compound oddly reminds many of liquidity mining in centralised exchanges a year back. None of this is to suggest the project itself is doomed but to rather emphasise on the fact that diversifying from here on may be critical because a collapse in the price of the token could create a spiral loop of its own. We will only have to wait and watch what a rising supply of Compound’s tokens mean.

What this does prove however is that token-based incentives can indeed massively attract liquidity in short periods of time. Synthetix lead the way, Compound perfected it. It is likely that we will see DeFi projects competing on token economics and product efficiency to attract users in the months to come. Which in turn should translate to better products for the average user. That competitive spree will be something to look forward to.

Added reading for more context

1. Taylor Monahan’s list on black swans in DeFi

2. Tarun Chitra’s comparison of Mortgage-backed security and DeFi

3. Bradly Miles on Social Money

Peace,

Joel John

Data Sources

1. Nansen

2. TokenTerminal

Note : The post earlier said $4.5 million is distributed each day. The figure is $450k and 2800 tokens. Thanks to Gaurav for clarifying.

If you enjoyed reading that, consider subscribing so I can e-mail you every time there’s something new. Also, it gives me dopamine hits. I really like dopamine.

And share it with people that may enjoy reading it. Don’t be selfish. #SharingEconomy

Please let me know what you think about DeFi. Is this about to build something meaningful or just another case of blockchain escapism? Are we all wasting our time?