Alpha Leak Generators

On Nansen's emergence as a leader in the analytics space

Hey there,

There’s a simple but effective method of preparing for venture capital long before having any money to deploy. Find interesting startups, use their products and offer critique to their founders. Building those relationships early on creates a network of people that are making cool things. Some of those ventures inevitably go on to set the industry standard and your track record in finding good bets early on speak for themselves when you do land an opportunity to talk to a venture fund. During the early stages of a venture, founders are keen on user feedback and will likely respond to a well-written e-mail. I wanted to share the story of one such venture I have been in work with since Q1 of this year. I was their first paying customer. Weird flex - I know, but I take a lot of pride in it.

Nansen.Ai is an exception in the data-visualisation space for blockchain network data. They were one of the few that could go from pre-revenue to scaling substantially during a year marked by a pandemic. They have been a staple at the heart of the decentralised finance boom of 2020. Last week, I realised that most of my stories had been data-driven but rarely accounts for the stories of the people behind them. And that is something I wanted to do since I started writing this newsletter a year back. So I reached out to Alex Svanevik to see if he would be open to giving me the inside story of how a side project cracked the way to making six figures in annual recurring revenue and what lies ahead for one of DeFi’s favourite on-chain analysis projects. He was kind enough to agree, and this is the transcript of our conversation.

Sidenote: Turns out I have lots of incredibly kind people in my network. Over the next few weeks, I will be dropping interviews with an M&A expert that worked on a $400 million acquisition, CEOs of two of Asia’s fastest-growing exchanges and some of the industry’s most prolific investors.

On-chain detective starter pack 🕵️

The beauty of blockchain-based transactions and balances is that they are mostly verifiable and trackable on-chain. One could calculate the Gini coefficient of a network or amounts held by the largest wallets. Unlike stock-market transactions, even movement of assets out from the wallets of leading figures in a blockchain project could signal a potential price movement. Traders and funds have long made this observation. For example, tools like WhaleAlert tweet out every time a large transaction occurs on Bitcoin or via stablecoins.

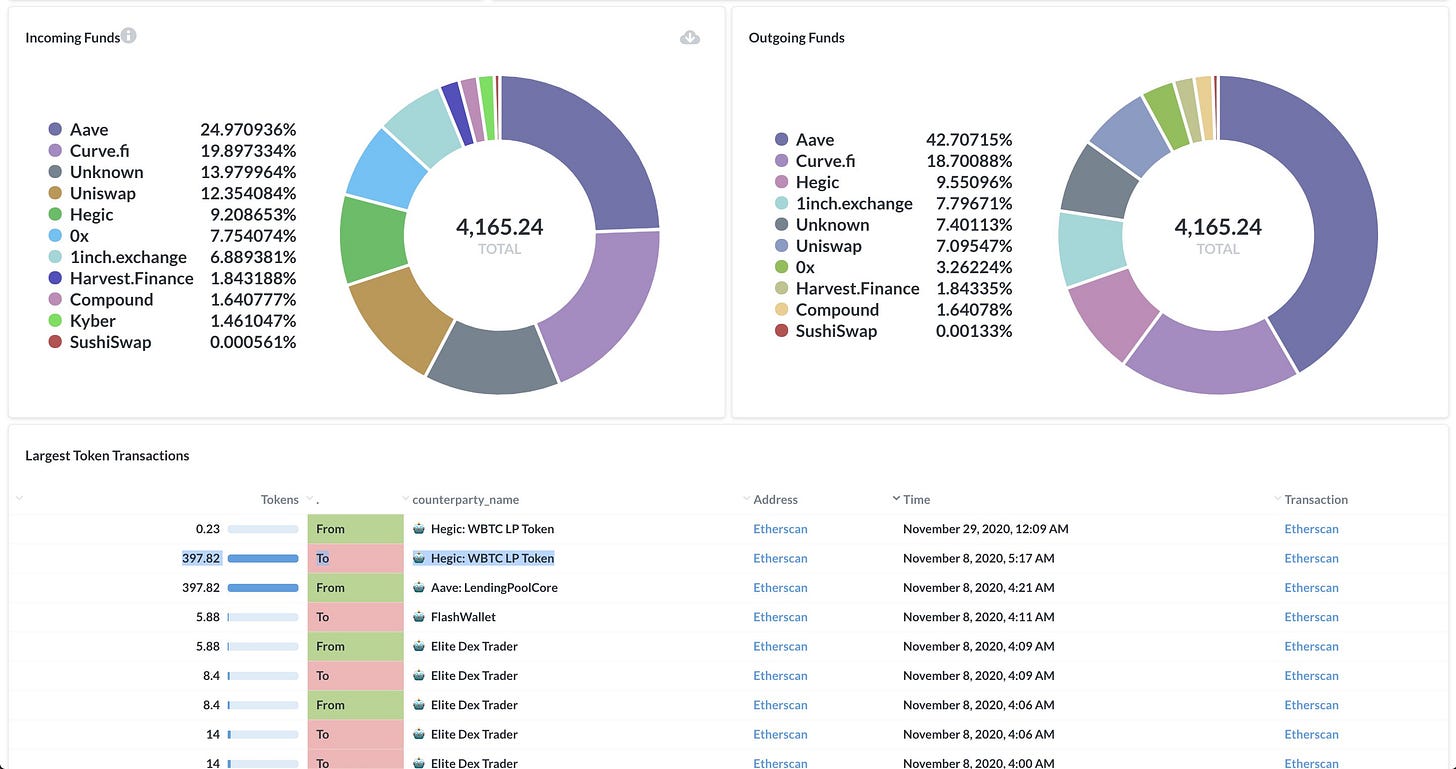

The challenge is when you need to do more complex queries on a network. One would want to know what percentage of those holding USDC also have DAI. In this instance, the query estimates the overlap of users of both stablecoins. Similarly, for reports like this one I wrote on Stablecoins, queries around average transaction sizes, wallet balances and the average count of transaction per wallet are not easy. Understanding who these wallets belong to can be difficult even when you do these calculations. Nansen does the vital job of tagging and naming over 40 million wallet addresses on Ethereums network. Suddenly, you can have both context and understanding of who is doing what kind of transactions on the network. Hedge funds and traders use this kind of information to get an edge over the rest of the market when taking trading positions.

Similarly, researchers use Nansen to understand the economic aspects of individual blockchain networks. Two professors from the University of Basel recently published a paper on how decentralised a protocol token’s distribution is actually. Nansen takes the hard job of tagging, slicing and arranging blockchain data and makes it consumable so that anyone in the industry can have the ability to see what is going on in new projects.

From here on, we have Alex explaining his foray into crypto, experiences in building data-based projects, experimenting with DAOs and reasoning behind raising venture capital

The Origin Story

I avoided entering the Bitcoin ecosystem for many years. One of the reasons for that was that I strongly felt even if blockchains and decentralised currencies took off, it could likely be that Bitcoin is not the right bet. In 2017, I began taking a look at Ethereum. Ethereum was positioned to be a platform layer instead of a layer one currency. It meant you could bet on a single position whose rise in value depended on an ecosystem of projects building on top of it. It was also the year of ICOs so I began playing around with the data aspects. I started looking at data in all its forms - from market returns to social data. But the one thing that attracted me the most was on-chain data. You could create indisputable, granular and non-biased claims when the wallet balances themselves are backing your claim. So I hired an engineer to help parse network data and draw insights from them. Around the same time, Evgeny Medvedev released Ethereum ETL - an open-source tool to export and visualise blockchain data. I reached out to him. We began collaborating. We were also working with a Hong Kong-based startup at the time.

In January 2019, we created a DAO called D5 - it was a way for us to work together without having a defined startup. It was a community to discuss ideas and share consulting work in the area of data science. We did that very successfully for a while and worked with several large clients. The next step was to explore what kind of products we built, so the DAO began positioning itself as a venture studio model. I had initially pitched an Ethereum wallet labelling API because many of the clients I had worked with had asked for this. So we began exploring how we could solve for this. We had Evgeny and Lars working together on making the first version.

After a while of initial testing, we realised that users wanted a holistic experience. Simply rolling out the labels would exclude the vast majority of users who were not comfortable with visualising the data. We worked for six months on building a public-access product. The venture was bootstrapped and was meant to stay that way initially. That meant we had to start charging people for access to the product. Our focus was to create a list of individuals willing to pay for the end product instead of boosting free members who did not add to the bottom line. We experimented quite a bit with the product model to see how we could charge customers. At this time, Evgeny and Lars were working part-time while I was working full-time on the product. We had a very clear outcome-oriented process that focused on expanding our label coverage or revenue per month.

Quick Observations 1. Alex and team began working on Nansen after understanding there is substantial demand for their product. The insight came from months of servicing potential future users. 2. Instead of spending venture-capital dollars on boosting vanity metrics, the team focused on building up a revenue structure. For early adopters it meant paying a small sum but getting extremely great customer service. 3. Nansen's initial pricing of $9 for a week's access could verify for individual willingness to pay without having them commit to spending a large sum of money on an untested, unknown product. 4. Nansen was also one of the first products to take users through USDC (stablecoins) at a time most data-analysis projects used only credit-cards. This was a hook for crypto-enthusiasts as it made them see the expense as an investment that went towards improving their trades.

Beating Revenue Projections And Raising Capital 🚀

We have been doing multiple of our initial revenue projection at the start of the venture. Much of that growth can be attributed to DeFi’s growth over the last two quarters. That said, our growth is not focused purely on the rise of Decentralised Finance alone. Our focus has been primarily on building data infrastructure that makes it easy for us to add new projects and roll out content as each new sector in the blockchain ecosystem evolves. This means we can now expand into creating customised reports for networks or be auditors for them. From a product perspective, we are working on making a more holistic and personalised experience. The goal is to create truly unique experiences tailored to the user’s research ability without having all our users see the same data. We are now balancing between being a compelling platform layer and offering users the ability to personalise what they see to a great extent. We will also likely expand into the institutional segment going into 2021. We have many of the largest VC funds, hedge-funds and market-makers in our customer list. Each of them has distinctly different needs from the platform compared to the average trader investing ~$100k into the market. Our goal is to be able to cater to that market at a much higher premium.

It became quite obvious that we had to slowly evolve from being a DAO to a venture-funded company. My observation is that while DAOs are extremely useful in coordinating generalised resource allocation and venture building, once product-market-fit is cracked, you need to focus on giving specific roles and meeting very clear objectives. If we were to execute Nansen as a DAO, there’s no way we could crack the growth we have today. Early on you need more of an executive approach and not wait for people to have consensus. There came a point in time where we could not give our employees a predictable salary and a safe place to work without external capital. At that point, we had to focus on either giving the best talent home to work at and capture the market opportunity or play it slowly. That is why we went out and raised money. We spoke a bit with potential advisors and the timing seemed right in regards to capital availability. We were very fortunate to have investors that wanted to invest directly so there was not much outreach. Informal advisors like Spencer Noon (Variant Fund), Patricio Worthalter and Jane Lippencott (from Winklevoss Capital) helped us put together the round. We had roughly 50 investors that wanted to join in on the round. I think part of the hook of our story was that in the deck we made it clear that we had revenue growth. People were paying us at the time to use the product and that figure was growing.

Interim Thoughts 1. Nansen's story is proof that you can transition from a side-project to a revenue-positive venture if you know what the customer needs 2. The founders "hedged" their risk with the venture through working only part-time until a venture round was closed. Risk management matters when venture building 3. Alex had no issues closing the round because he was one of the very few data oriented ventures that were revenue positive in an industry.

What’s Next

When thinking about what lies in the future, DeFi intersecting with Fintech will likely be big. Anything that helps crypto reach a thousand times more customers than today. Within DeFi, lending and savings projects are still too early in the growth cycle. Blockchain-based gaming is still very early, but we see some form of product-market fit. Axie Infinity, where I am an investor, sees substantial traction compared to its peers in the industry. Founders should also consider exploring the ETH2.0 staking space. Several models could play out there. On the one hand, you can be a validator which accepts deposits like Bitcoin Suisse used for Bitcoin.

On the other hand, you could create DAOs around staking as a service like Rocketpool. There is also the rise of liquid ERC-20 tokens that give you representative ownership of Ethereum tokens staked in a network. They let you have liquidity for the Ethereum one has staked. These are then traded in pools against Ethereum on automated market-makers to get trading fees. Given that there are at least a billion dollars in total value locked in Eth2, it is likely that new models like these see substantial traction. There will very likely be new token-based incentive models that arrive around liquidity wars for Eth2 staking.

The plan for Nansen in the next few years differs based on whose perspective you are looking at it from. For the customer, our mission is to be the product that surfaces the signal. In a future not too far from now, we will be going beyond just analytics and entering the transactional layer of crypto and DeFi. From our team's perspective, my goal is to make one of the best workplaces in crypto to be working in. For our investors, the goal is to create an incredibly valuable company. Our future likely goes beyond mere analytics in the industry. The goal is not to solely offer data but to provide our customers with entirely different experiences. With Nansen, we have created a relationship with multiple funds and premium customers so one should not look at our recurring revenue alone as our moat. Our moat is the relationship we have built with our paying customers over the past year. And that means Nansen has a long way to go in terms of how the product will evolve

I find Nansen’s story particularly inspiring because they did not wait around to be funded to take the risk of building a data layer project. They launched right after the crash of March 2020 when many of their peers were shutting shop. Theirs is not the story of a classic venture-funded entity blitzscaling with ad-dollars either. Instead, Alex was online talking to each customer that converted. These conversations in essence became Nansen’s moat as they built out the platform. The story for me here is simple.

Understand who your customer is. Speak to them and build for those who pay

If you build something people want, it will raise venture funding on its own

Relationships can be a moat when products struggle to differentiate on their own

Tip-toeing into a venture should be glorified more often.

I will see you guys on Monday with thoughts on crypto-indices and synthetic instruments.

Peace

Joel John

Weekend Reading List

Nothing.

It’s the holidays. Take time out for a walk, spend time with family, call an old friend and have good food. Play with your kids and reach out to your grandparents. Its been a rough year. Have fun. Everything on the internet will be right there next week too. 🤷

Maybe make my year-end slightly better by subscribing?

Also, share with friends that are building in the ecosystem. Stories inspire.