A Look at InstaDapp's Numbers

On-chain numbers from Instadapp

Note : I have no commercial relationship with InstaDapp. I've known the team since 2018 and have followed them since.

Market places are interesting due to how they bring networks to commodities. Produces that may not sell individually often find buyers when they are listed alongside other goods that go well with them. Think about essentials like mint or coriander leaves. I doubt anyone ever walks into a store to buy them alone. But pair them with broth, meat and vegetables and you are on your way to making good soup in some parts of the world. One could argue that in this example, putting the leaves next to the other produces is what generates demand for it as on its own, it may be useless. The point of this blogpost isn't to explain how to create demand for soup ingredients (I wish I knew more about it), but the same approach may be key in generating demand from DeFi users. We talk about adoption but without making sound business models around them, even in the presence of users - we may be doomed to fail much like the multitude of search engines that launched prior to Google and went nowhere.

I tried my hands on studying how Instadapp users behave and understanding the model behind it. Here's my attempt at summarising it.

Note : I have no affiliation to the project barring the fact that I have massive respect for the founders and their story over the past year. This post was shared with them prior to publication to cross-check for any inaccuracies.

All data was received from Covalent HQ

What is InstaDapp

InstaDapp is a single site web interface for wallets to interact with multiple DeFi products at the same time. In some sense, a WeChat for the DeFi world. As of today (15.10.2019), the product is plugged into Compound, MakerDAO and Uniswap pools. The first two are primarily used for offering or taking loans while the last is used for exchanging tokens between one another. It is a bank account as you can store your stable tokens (USDC, DAI) on a wallet plugged to instadapp and convert it to tokens of your preference (eg: wBtc, Kyber etc) in a single click.

At its crux, InstaDapp solves for 2 key challenges

Opening debt positions

Instead of going to Maker or Compound separately to understand which offers a more competitive interest rate, individuals can simply search through the offerings on Maker and open a collateralised debt position. The "ease" that comes here may not seem like much for a user holding a large trove of say Kyber tokens, this interface reduces the amount of work involved. The individual can simply convert their Kyber tokens to Eth using the uniswap pool that is plugged into the project. Then, they can compare the interest they will pay on opening a position on Compound or Maker and then pick and choose where they want to open it. Instead of visiting three different platforms, the UX makes it possible to do it at a single point.Switching between competitive rates

Assuming there are two banks that offer loans at different rates depending on market demand, customers would flock from another to another if there is no contractual agreement in regards to doing it. The current state of token based debt is such that an individual can simply choose to repay debt at Maker and re-take the same loan at Compound for cheaper interest rates. This may not seem like much, but we'll work out the numbers further below. As maker expands to multi-collateral DAI, it is likely that Maker and Compound will compete on interest rates if they both support the same underlying digital assets. Think about instadapp as the product that does all the paperwork (on smart contracts, without actually taking your cash - aka being non custodial), between the banks at play here (Maker and Compound).

In niche markets, solving for niche problems can often be lucrative. InstaDapp's numbers explains why

A look at InstaDapp’s numbers

Instadapp had a total of 26,646 transactions from 4753 users. In order to come to this assumption, we go with the belief that each individual wallet is a new user. There were substantial pick ups in July 2019. I believe the launch of InstaDApp’s CDP bridge combined with the high volatility of token lending rates in the month may have lead to the pick up in steam. Based on exports I had received from another source, there are some ~30,000 wallets that plug into DeFi products in some capacity. At ~4750 individual wallets, InstaDapp was able to attract about 15% of the total market in terms of userbase.

In order to understand why, we should look at how the CDP bridge (Instabridge) itself is performing.

The CDP bridge is used by users to swap between protocols when one offers better interest rates than the other. One reason why this occurs in DeFi products is due to the limited supply of digital assets engaged in lending. If individuals are bullish on Eth, there will be a high number of individuals tying up Eth for DAI, and using that DAI to buy more eth. This gives them an effective leveraged position. As the demand for DAI increases, the peg with dollar DAI holds may break and it begins trading above $1. This is when Maker typically reduces interest rates to make it cheaper to take a loan, thereby (i) increasing supply side of DAI as more loans are taken and (ii)incentivising individuals to open more loans. On the contrary, if the peg breaks and trades under $1, then the interest rate increases to increase demand for DAI as traders look to close their position. This variance in interest rate on Maker and Compound has individuals flocking into different protocols at different points of time.

A total of $44 million has switched between the bridge protocol from a total of 871 transactions. This means the average transaction is worth $50516, but that isn't the case as we'll see soon. Bridge utility often spikes when the interest rates vary as users have no incentive to take the risk of a switch or pay the fees for doing so. In other words, Bridge utility is far more seasonal than a product like exchanges or opening of loans. (Keep this statement in mind too, we have some math stuff to do later)

If I were to plot the wallet address that engaged with InstaBridge and the amounts they have plugged into the product, the powerlaws of the product becomes slightly obvious. Well, alarmingly obvious.

The point of this post is not to criticise InstaDapp for volume concentration on single wallets. That will be akin to suggesting centralised exchanges can't scale because most of the volume comes from a few accounts. If we are to draw parallels to centralised exchanges, it is safe to suggest the first few wallets here represent the likes of institutions, market-makers and trading bots. For the sake of better understanding the users here, we'll exclude them and flip the chart to look at the power laws at play here.

Alright, now that's better. We have excluded the largest 3-4 wallets to understand how the smaller users behave. For context, the largest wallet here on the previous image had moved volume worth ~40x the volume on the second graph. But lets focus on this image for the moment. It highlights the key issue with DeFi products today. Although projects will see substantial scale in volumes early on due to the high asset concentration with a few users, it is likely that a volume or transaction based fee model would best work for these. For context, if InstaDapp was charging each user a flat subscription fee of $10, their monthly revenue would have come to a total of $48,030 USD and that would be it.

The problem here is that this could become an on-going price war to the bottom if the underlying contracts are open-source. As has often been worried about, if a product's code is open-source, then savvy users would likely remove the fee element and run their own variations. The largest parallel we have here is with Brave browser. There have been moves to fork the token itself out of the browser but none of them have seen substantial traction yet. So fork-activism in essence, without a community or large enough user-base may not be a big deal. However, if transaction size based revenue is unlocked, it could likely increase the revenue by upwards of 3 to 5 times.

The product could take an additional fee on the bridge. The problem here is that the bridge's utility is highly seasonal. Individuals switch positions between the bridge only when there is interest rate arbitrage to be made or in simpler terms, a high % of difference between two lending platforms. This means a monthly subscription fee may not be the best model to take as users will choose to subscribe only on specific months. Perhaps a more likely approach they could take here is the % of transaction model.

As a base assumption, I have taken 0.1% of the tx size as the fee here as the spread (difference between lending platforms) should be at least a percentage or two for the user to worry about switching their CDPs. Paying 1/10th of that in fees would be rational behavior. It should also restrict users from abusing the bridge and spamming transactions. This comes to a total of $44,000 over the past few months

There is an added layer of complexity that can be bought here. As the volume an address contributes to the smart contract increases, the fee could reduce further in size. For instance, if an individual is moving $10 million between platforms in a single month, charging them a fee rate of 0.1% would convert to around $1000. At that kind of scale, they would rather be setting up their own "toggle" bridge since the smart contracts are open-source. Platforms need to be careful in terms of making the product attractive enough in terms of price for large wallets while ensuring they are used to generate revenue. A tiered fee structure that reduces fee as volume increases serves two functions. On one side it relays confidence as the volume is taken as a key metric for new users that are looking to try the product. In that sense, it is marketing dollars that don't have to be spent to change perception of users. On the other, it unlocks dollars to keep the lights on for the startup.

In other words, since the number of users are still slowly increasing in DeFi looking at the subscription model to unlock value may not be the best case. Although there is heavy seasonality in how the bridge itself functions, charging a small transaction fee may make more sense given that users may not mind paying that as a convenience fee. The same model is evident in centralised exchanges today where the entry barrier is kept low without a subscription fee. However, a percentage on each trade done ensures that the platform has thee revenue it needs to thrive.

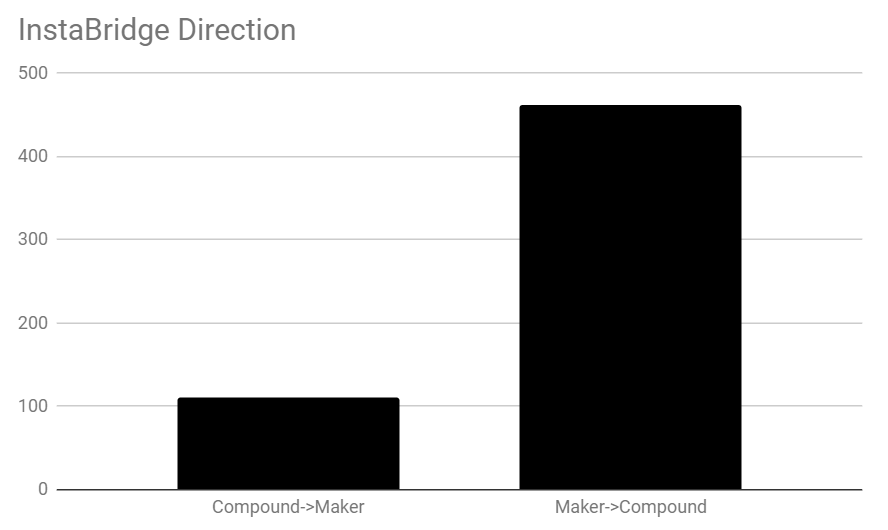

Another model that could hypothetically work here is in terms of charging platforms for relaying users. If we take a break down of the % of users that went from MakerDAO to Compound and vice versa, we'll notice that the vast majority were users switching from MakerDAO to Compound. Although one does not want to re-do the advertising models of Web 2.0, it could be possible that a revenue agreement could be done between lending platforms and InstaDapp. In this context, InstaDapp would receive a small share of the interest paid by the user that chooses to switch over time.

Jenga Blocks In DeFi

(Read Totle's piece on Money Blocks for context)

The model works for InstaDapp as they are gradually adding product elements that work with one another. For instance, launch of a simple UX for opening CDPs attracted users that engage with tokens for loans in the first place. Then they realised that a Dex model would make sense as users often have to switch between assets to open debt positions. That is how the Uniswap integration happened. And then they added the Compound element to ensure users have the best interest rate. In each move, InstaDapp has optimised for efficiency in terms of users receiving the best rate and in doing so, they unlock value for users. If InstaDapp's core value proposition is that they can aggregate the best tools in DeFi, provide a single gateway for engaging with all of them, comparing their rates and switching between them, then InstaDapp effectively becomes the go-to source for DeFi users as a marketplace. In doing so, they could very well be the largest source for discovery, volume re-direction and market efficiency in DeFi

In this context - individual platforms that plug into InstaDapp and see value flowing from them are vulnerable in two ways

Hypothetically, InstaDapp could simply choose not to list an open-source project with better rates and thereby enable competitors to acquire market share

Understand user behavior on platform to roll out their own DeFi tools over time and compete against the products they have integrated with currently.

Neither of them would be "unethical" and in-fact is already being done by the likes of Amazon that has been busy launching its own brand variants for items that sell well. The challenge that InstaDapp on the other hand faces in being the go-to source as a marketplace is in terms of

Very likely seeing cheaper, low-cost variants of the product being built once a fee element is added in any form. In order to escape this, InstaDapp would need a much larger market-share and brand (like Brave) to a point where user-confidence in the product justifies the costs involved.

Having any one of the products they integrate with being hacked leading to user confidence in InstaDapp reducing. This is a common challenge with marketplaces where individual vendors act badly. Remember when users were scared to order online due to worries of a scam? Something like that. The challenge is that if any one of the vendors on InstaDapp goes rogue, or has an unexpected hack - millions of dollars would have flown in and out before they can put a stop to it.

In adding each new product, InstaDapp would have to balance the opportunity of attracting more users and the risk of them being possibly hacked and losing public faith in the product. Given the early stages of both DeFi and InstaDapp, this could be detrimental as competitors would likely use this gap to catch up.

Note : InstaDapp calls itself a "bank". I have compared them to a marketplace for the sake of this piece. I don't believe being a marketplace is in their roadmap at this point in time.

Was solely pointing out similarities between the product and the model. To be fair, it can be said that a bank and a marketplace converge on many levels and when you apply open-source culture to it, the difference could be hard to see through

Why Marketplaces Would Matter Going Forward

When one discusses DeFi today, the primary platforms most people link to are DeFiPulse and DeFi Prime. The reasoning for this is simple - an inventory of products in a niche market is useful. This happened in the growth of the internet too. Yahoo was literally called "Jerry and David's guide to the world wide web". Marketplaces and product listicles act as a map when a new segment with unchartered territory arrives. Having them vetted and listed for use allows individual customers to derive the most value from them. But most importantly, I see them contributing in two key ways

Bringing radical transparency and thereby efficiency

If interest rates can be compared and fees pre-calculated in real time, users would routinely switch between lending platforms to seek what works best for them. Unlike credit cards and traditional loans, these transactions would not have substantial fees attached to them. In addition to serving users, it will incentivise market players to compete against one another to provide highly competitive rates. My assumption here is that interest rates will compete increasingly towards the rates offered in the developed world (3-4%) with an added premium for token assets (1%). Once we see token loans at 5%, we may just have reached peak efficiency in lending

Note : I know MakerDAO was offering 0.5% at one point, but it doesn't scale.Becoming a search engine for DeFi

For many of us in the developing world, Google was the first website we had ever visited. Why? Because it was a gateway to the multitude of other sites we wanted to use. InstaDapp could hypothetically become the go-to product for any user looking to engage with DeFi. Given how the product currently plugs to multiple products their business model does not have to be predicated on ads but a percentage of the transaction itself. That is a sweet and comfortable spot to be in if they can scale up the number of users on their platform currently.

As with everything else - competition is good. Especially in a market as early stage as DeFi. I don't see CeFi (eg: Nexo) and DeFi not competing against each other. Over time, the two will compete and one of them may see premiums against the other. Marketplaces that combine the two will likely evolve to be the segment leader in this regard as they will be the ones that have the widest net ( ie - users that use both centralised and decentralised goods) and the most value to provide (ie - best rates on both DeFi and CeFi for a transaction)

Back to our soup analogy in the beginning. I also believe early stage trends such as NFTs (in-game assets, tickets) , STOs and even REITs could see traction from DeFi users if InstaDapp chooses to plug them in. Why? Because a full stack banking solution cannot be restricted to one asset class (ie - tokens) but should allow individuals to divest as they seem fit. The rise of synthetic assets (eg: Uma Protocol) and layer 2 solutions should make it considerably easier for a user to own stocks, REITs, in-game assets, dollars and a mix of diversified lending goods such as Income share agreements in a single wallet. individually, their value may not be much. Put them together, and you have a product that can serve the user for much longer periods of time. And much like soup, it could increase the longetivity of the user's lifetime in a marketplace.

Perhaps, that is what it takes for traction -

(i) a mix of multiple products to cater to the variable needs of users

(ii) a marketplace that ensures users have the best rates possible

(iii) and a system that allows transaction between all of them with the lowest time requirements.

Hopefully, we aren't too far from the days we see that happening.