A look at Ethereum's numbers

Q1 2020 observations on Ethereum's traction

Ethereum set out to be the world computer. On the way, it has choked trying to trade kitties, needed a reset due to a colossal hack, enabled dissent against authoritarian regimes and created a new financial infrastructure. A sweeping statement suggesting it is money, a failure, a mutable ledger or any single thing would not be a fair judgement. Much like a knife is a weapon and a tool simultaneously, Ethereum is a different thing depending on who's using it. With this in context, I sat down to explore what is going on with Ethereum. Much of my interest came from writing a map of decentralised finance in May 2019. I was intrigued by the fact that almost all of it was being built on Ethereum. This piece is the result of my attempts at summarising the numbers around it.

For this article, I have avoided any direct comparison with Bitcoin. Similar to how the financial ecosystem has space for multiple commodities, currencies and financial instruments, I believe the digital asset ecosystem has space for various experiments. If we do believe in decentralisation then one of the mechanisms to enable it is by having multiple ledgers as backups in the event that one fails due to a black swan event. A world where ledger maximalism is the norm does not allow that kind of experimentation to happen. Due to the same, my mind keeps space for multiple ledgers so long as they serve their purpose and do not make false claims. In writing this piece, I hope it is taken as a measure of Ethereum's progress instead of an attempt to belittle either Bitcoin or Ethereum.

Wallet Growth & Activity

Of the 69 million total addresses on Ethereum, only about ~250,000 are active on a given day. Within these, a surprising 50,000 are new addresses. Given that the cost of setting up a new wallet or moving assets within Ethereum is marginally lower than most networks, these numbers are not impressive on their own. What I did find intriguing is that active address counts and new wallets are higher than what they used to be during the ICO boom of 2017. A key contributor to this may have been the transition of USDT to ERC-20 standards and the rise of mixers within Ethereum. Some ~226,000 unique wallet addresses have interacted with DeFi over 2019. It is likely that these users are "power" users and routinely interact with their wallet. While DeFi as a segment is intriguing, what may power the future of wallet activity on Ethereum may be NFTs and digital gaming. The likes of Axie Infinity and Gods Unchained are powering a new generation of users to interact with the network without ever being aware of it. One way to think of it is as the transition we made from IRCs to WhatsApp over time. IRC was functional, Whatsapp was mainstream. As projects abstract away the complexity of interacting with the ledger, we may see higher numbers for active wallets.

Ethereum has handled 900 million transactions so far

If active wallets and growth of new wallets is taken as a measure of how many people interact with Ethereum, count of transactions is a measure of how often they do. We see an eery similarity with the previous graph here too. The number of transactions and transfers have not dropped off on a given day substantially in comparison to the year of ICOs. Much of this could be attributed to Defi and liquidity pools coming of age. Had the total number of addresses dropped off for Ethereum, the argument could have been that the users that remain are power users and do multiple transactions. However, neither metrics have fallen off - indicating that

(i) new users are compensating for the drop off that has happened since 2017

(ii) they transact just as frequently as the folks that were investing in ICOs.

What did change substantially, is the metric that comes next. The average size of a transaction on Ethereum

Moving $2.1 Trillion in Volume

The average size of a transaction peaked on 11th August 2017 at almost $40,000. The total volume moved on Ethereum's blockchain peaked at $33 billion on 14th January 2018. The two numbers being so far spread out could be linked to what Ethereum was being used for at the time. August 2017 marked the first month an ICO investment rally paved the way for over a billion dollars to be invested in ICOs by the end of September. January 2018, on the other hand, was the peak of an alt-coin boom that followed a price correction of Bitcoin in December 2017. The future, however, is not built by obsessing on the past alone. Where active wallets and count of transactions show how many and how frequently transactions occur on this ledger, the average transaction size indicate how much is moved. Average transaction size as of writing this is at around $138. The democratisation of digital assets is quite evident when we see these metrics together.

Let me put it in simpler terms..

1. Count of transactions have gone up 6 times since Feb 2017

2. Active wallets have increased roughly 10 times since Feb 2017

3. On-chain volume has increased ~12 times (from $11 million to ~$128 million)

4. But the average size of a transaction has declined by ~99.5%

As NFTs come of age that number is likely to reduce. People using Ethereum for general purposes do not need to move large quantities of ETH. More people using the ledger for smaller transactions is likely the best metric for traction possible. Another metric backs my hunch for why this could be the case - the amount of Ethereum held in top accounts.

Largest 100 wallets own ~30% of ETH

ETH's democratisation becomes slightly more evident once we consider the percentage of ETH holdings that are in the top 100 addresses. Inclusive of wallets owned by exchanges, this comes to around ~32%, or 1/3rd of the network. That figure in itself may seem scary for a project enabling "decentralised finance", but if trends indicate anything - it has been reducing over time. For a sense of comparison, roughly ~11% of all Bitcoin's in circulation are in exchanges (as per glassnode data) vs 8% in Ethereum. Ethereum whales seem to have been consolidating ownership since November 2018. There are a handful of explanation for this behaviour

Investors that had diversified their wealth around the peak of 2018 are now accumulating again. A smaller allocation of their current USD holdings can get back the same amount of ETH they sold

Investors choosing not to sell any more ETH due to the high draw-down since ATH could mean this figure stays stagnant and does not drop considerably

As more retail investors buy ETH, the $ amount needed to own a percentage of ETH increases. Making it increasingly difficult for new whales to be minted on the network.

The ability to lend and receive dollar-denominated loans without engaging with traditional financial infrastructure may be another reason why large whales do not liquidate their holdings any more. This is evident if we look at the power laws in DeFi today. 3-5 whales often account for 60-80% of the volume on the product. (Refer my piece on InstaDApp for more on this). Another way to interpret this data is that the large holders who exist on Ethereum today are no longer leaving the network due to their faith in its ability to grow into something more significant. I'd take that as a vote of confidence.

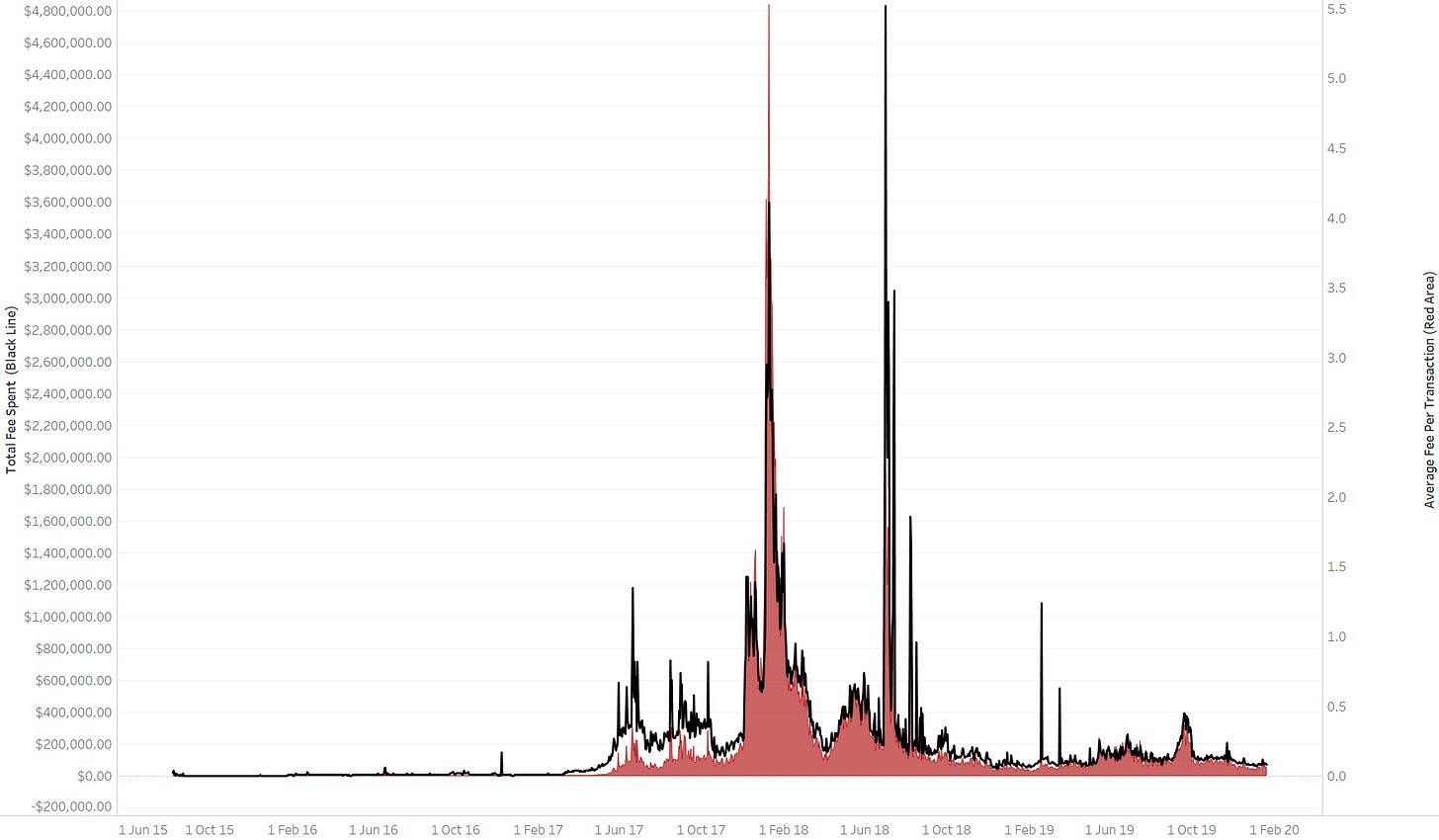

ETH Transactions Have Generated ~$242 million in fees

A total of $240 million has been spent on fees for transactions in Ethereum network. Interestingly the high for this was not in 2017 during the ICO boom but in 2018, when a total of $160 million was spent on fees. 2019 in comparison had a mere $34 million spent in fees. Somewhat similar to the figure for 2017. Costs for each transaction soared in Feb of 2018 when it was at $5.5. Today it is at $0.1. Considerably lower but a multiple of the $0.03 it used to cost during Feb 2017, before the boom cycle for Ethereum. The variable fee component and the extent to which it swings could often impede products being built on ETH. Individual developers have to account for the transaction costs that may come from a micro-transaction. Services facilitating decentralised compute and storage services often need to hedge against gas costs surging to a point where it no longer makes sense for their clients to be using them. A few projects are working towards solving for this. Gasless by Mosendo, for instance, allows individuals to transfer DAI without holding ETH to pay for gas.

Similarly, there are API layer projects that will soon be able to enable a transaction on behalf of an end-user that does not hold ETH while charging the business directly. Nuo Network has an early variation of this currently live and implemented. On the long run, if Ethereum takes off substantially, there will be a complex world of derivatives and futures that hedge transactions fees at scale, much like how it is done in the commodities world today.

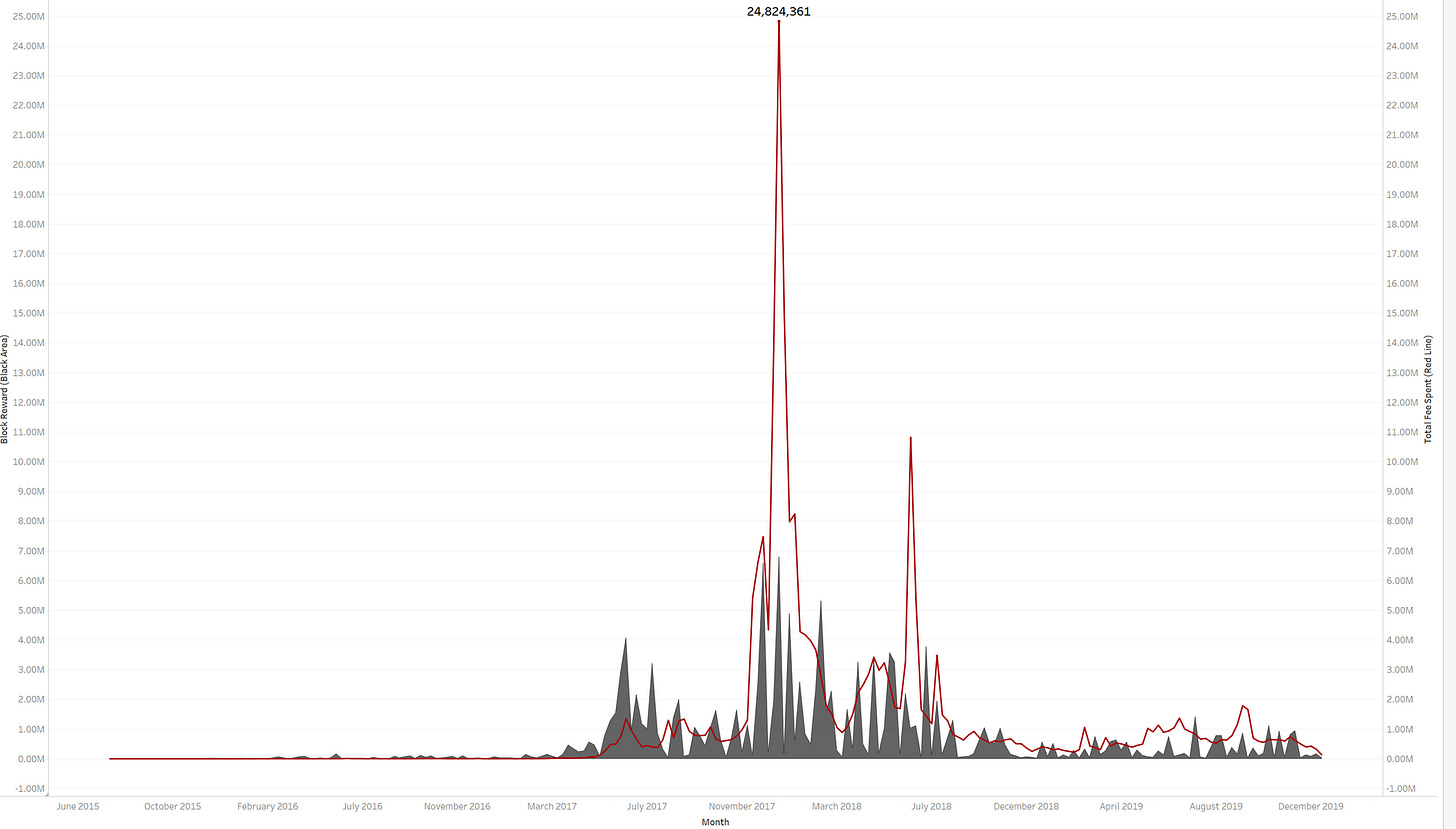

An interesting attribute about Ethereum becomes evident once you compare block rewards against fees accumulated over time. Block rewards, come to a total of $150 million over the past five years. it could be said that some ~300 million has been paid out to miners so far. A paltry sum in comparison to the $16 billion that has been paid to miners so far on Bitcoin. Judging by the volume we see in derivatives markets, it is safe to suggest that mining interest in Ethereum is a fraction of what it may be on Bitcoin due to the fee economies surrounding them. A common interpretation I also find is that ETH mining may be being done alongside Bitcoin mining as a handy side-operation and miners routinely remain net-long with the intention of riding upswings. This belief is further substantiated by observing how Miner balances have swung between price swings.

Several factors may have influenced miner behaviour over the past few years. This is how I interpreted it. Between Jan 206 and Jan 2017, it may have been a hobbyist project given the low prices ETH traded at during the time. If we notice, the first significant slump kicks off around late 2016 - during ETH's recovery after the DAO hack. The next drop comes on the heels of the rally to $40 as the Ethereum Enterprise Alliance was announced in March 2017. Miner balance reached a low as Ethereum's price surged and income from block rewards and transactions kept their operations sustainable. Over the past year and a half, it seems like they have been accumulating. For a sense of scale, ETH held by miners have surged from 600,000 to 1.6 million over the past 18 months. They genuinely are OG hodlers. But to study how those that dont hold behave, we'll need to look at what's going on in exchanges.

$11.5 Billion Worth Of ETH was held In Exchanges During Boom

A vibrant and active exchange ecosystem surrounding Ethereum may have been a crucial component for its scale and success. Unlike a new token launching today, ETH had lower barriers to being on Kraken and Poloniex - the largest exchanges of the time. The counter-argument to this is that had it not been for ETH reducing the barrier for asset issuances and building communities around them, we would not see a sea of what is some ~1600 digital assets in the market today. I have found it challenging to think about what a token ecosystem without ethereum would look like. The critical figure I noticed while putting these charts together is that a lower supply of ETH is on exchanges than that of Bitcoin's. According to glassnode, some 2.1 million Bitcoins are held by exchanges of an 18 million supply (~11.6%). ETH in comparison has about ~9 million out of a 109 million supply* (8.25%) . Slightly lower than that of Bitcoin. Much of this may have to do with the fact that Ethereum transactions are relatively quicker and come with lower cost. The speed of said transactions makes it easier to move assets during times of extreme volatility and profit from it.

Note : Actual ETH held in exchanges are likely a few percentage points higher as the sources I was looking at did not account for Coinbase balance

Here are two other observations I made on studying these figures

Between 2016 and today, the amount of ETH held in exchanges have reduced by 50%. A likely indication of the fact that fewer people see it as a speculative asset as of now.

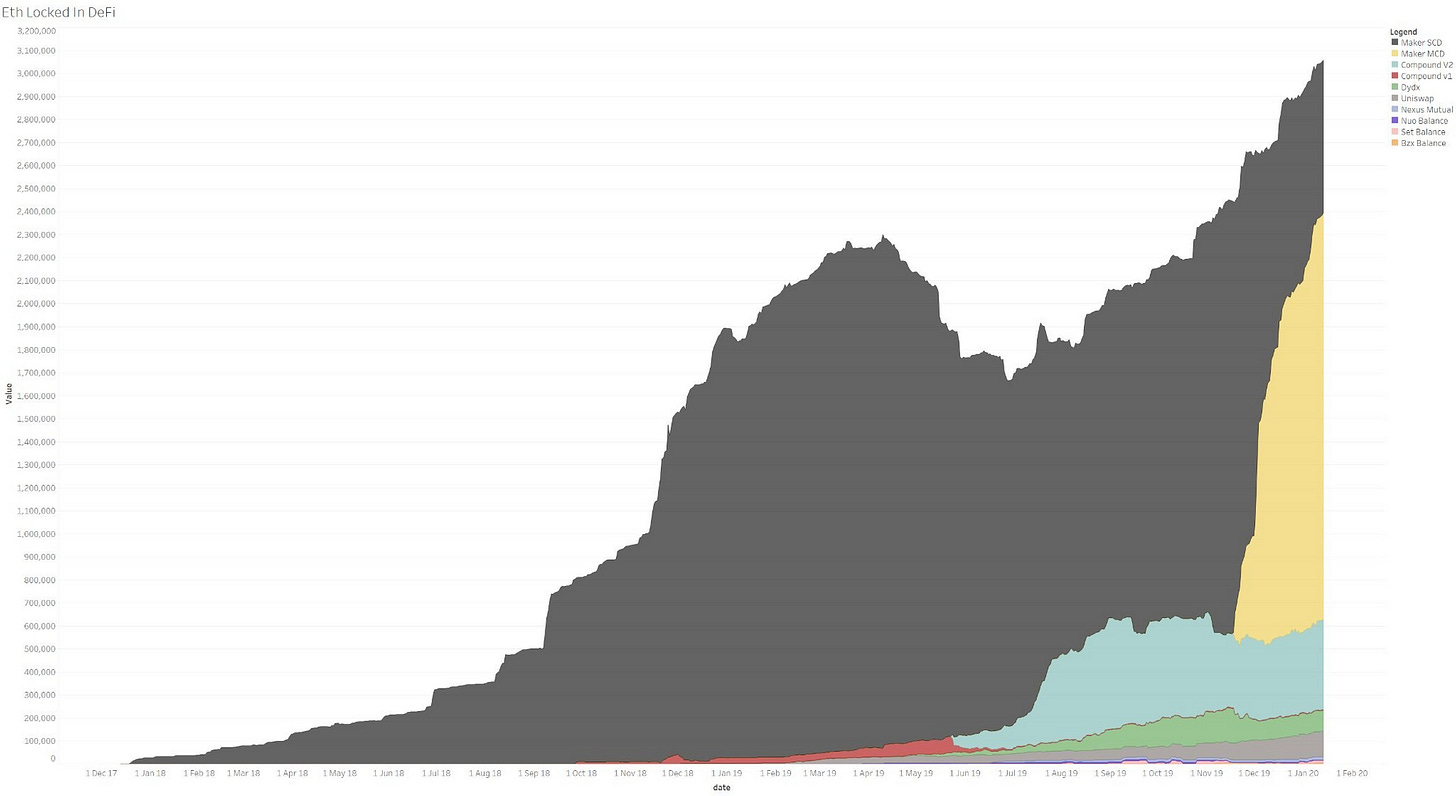

The value of ETH held in exchanges today is at $1.5 billion. In contrast, DeFi smart contracts have crossed half that figure at $875 million locked as of writing this. The real flippening will be when DeFi has more ETH than exchanges.

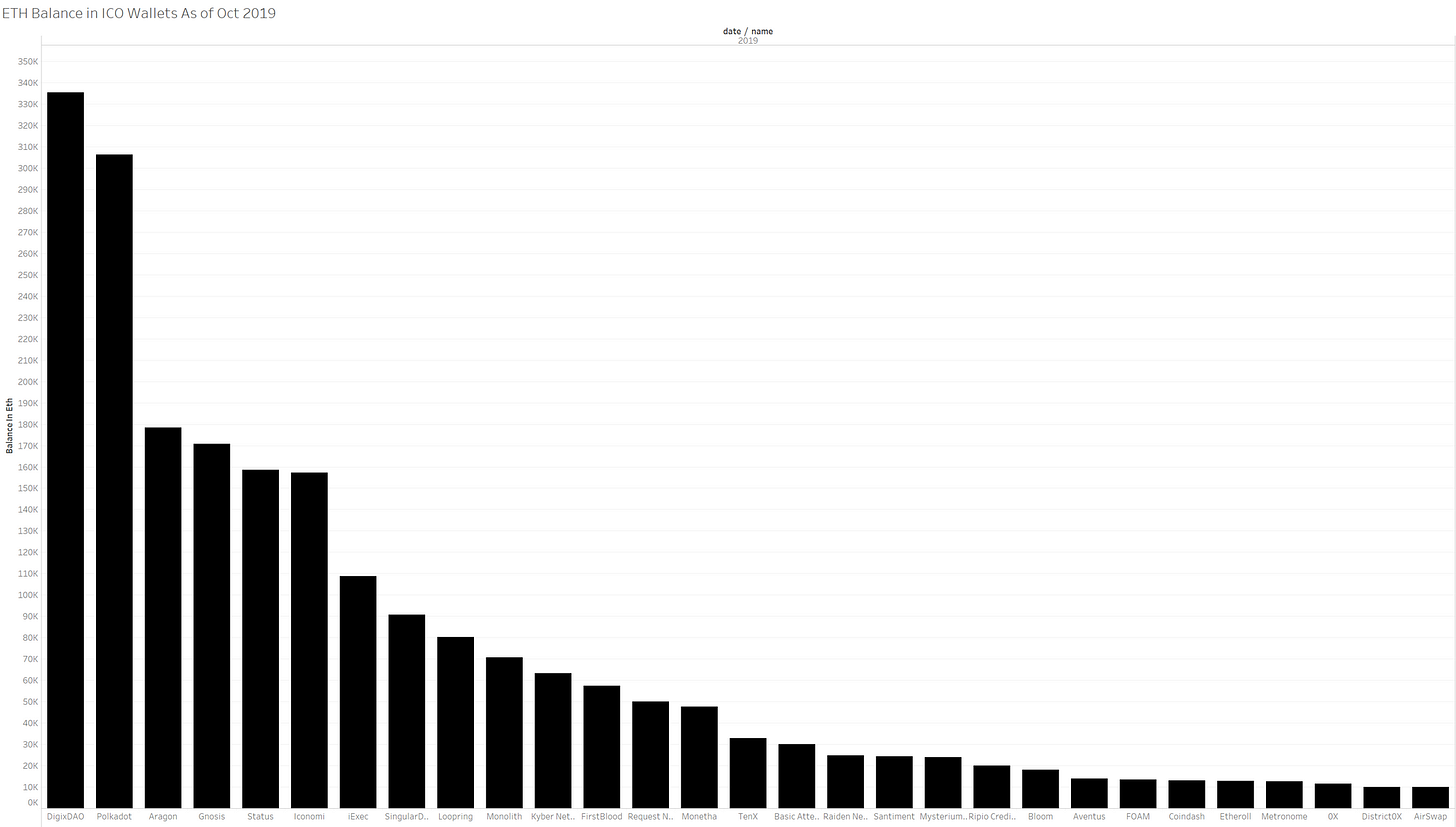

We will look at one last metric that worries me a little bit about Ethereum's ecosystem currently. ICO Balances.

ICO Projects May Have Only $500 Million Worth Of Runway Between Them

The ICO boom raised roughly ~$8 billion to $16 billion depending on who you source that data from. Today only about $500 million worth of ETH is left in ICO wallets. In addition to being quick to spend their raises, it seems like multiple projects have little to nothing for their burn over the past two years. For instance, EOS, inspite of its $4 billion raised and $30 million could not get their own social media platform to work on their chain. (smh, maybe try doing it on bitshares, lol). In cases where networks don't generate fees or platforms don't create revenue, teams will be forced to either raise venture capital funding or look to shut down their business in itself. We had already witnessed a high number of project shutdowns in the end of 2019. Going into 2020 - in the absence of a massive altcoin rally, rejuvenating interest in ICO tokens and increasing the value of the treasury these projects manage, I anticipate these projects to be in serious trouble. Primarily because

Teams may often have little to nothing to show for the extreme burn rates they have from the past two years

Their metrics will not match against their traditional counterparts and in the lack of hockey stick growth rates like those displayed by MakerDAO, I do not anticipate late-stage funding to continue.

Shortening runways combined with reduced investor appetite and peers finding product-market fit (Eg: Bancor vs Uniswap) with a fraction of the funding amount will be a moment of reckoning for the industry and community. This does not necessarily mean doom and gloom. A funding crunch often converts to entrepreneurs turning to survival mode and focusing on their key performance indicators instead of splurging it unnecessarily. It also leads to entirely new business models that were previously not experimented with. Just be prepared to see a very high number of organisations shutting shop in the coming years

DeFi Grew 30x Since March 2018. Mostly Because Of Maker

DeFi has grown 30 times since the rally of 2017. Much of this has been captured by Maker. A key reason for this may have been stable coins being in vogue after Tether and token price volatility began explaining the need for a stable hedge for assets. In addition, as ETH price reached new lows (ie - $80), the likes of MakerDAO gave individual ETH whales an avenue to lever up on their ETH positions with a loan from Maker. Whatever be the case, the space has seen considerable growth over the course of the past 18 months. What is intriguing here is the clear power law that ETH locked in DeFi sees. SAI and DAI dominate much of the ETH locked in DeFi, with compound at a distant 3rd. Trading tools like Uniswap and DyDx see volume but not as much. It seems the market has made its decision in terms of which currency issuance protocol it prefers (for now). The likes of synthetix are experimenting with new asset issuance models that take Ethereum and its own native tokens (SNX) and have been showing traction. What the graph also represents is the need for new business models. ETH locked in the project or transaction fees alone may not be sufficient to run a profitable, for-profit enterprise. Hopefully, in 2020 we see more of that.

Ethereum's Super Power Continues To Be Its People

Ultimately, for everything Ethereum has, what makes it special is its people. And the more people it attracts, the more colors it has as a network. When people think about ethereum and the community surrounding it, they often nitpick on one controversial event (eg: ICOs, DAO fork etc) which seem very unacceptable to them. What is often discounted is that these events happen because of the network's ability to attract and retail all kinds of individuals. The bulk of these being developers today. In comparison to other networks (and their github activity), Ethereum dominates by a far lead and it seems to be maintaining that lead inspite of the pro-longed bear market. Ethereum is able to do what it does in terms of innovations in DeFi, NFTs or token issuances because it has kept doors open for innvoation. So long as that remains the case, there may be a reason the asset find traction in the market. Whether that "traction" is worth $10, $100, or $1000 is something I am not sure of personally. I leave that to efficient market hypothesis and time to figure out.

In Conclusion

For all the drama surrounding Ethereum on the surface and its past, I believe the network has meaningful progress. ENS, DeFi, NFTs and well, ICOs did not happen on other chains, no matter how much one thinks ETH is not worth the hype. There is a long way for ethereum and its community to go before it hits the mainstream. But the more I engage with the community and learn from its founders, I am forced to believe this looks a lot similar to Ubuntu/linux in 07-08 (when I first began playing around with them). The learning curve is steep, but there is a fun community to hang out with. The products are broken, and keep updating constantly - but it has slow grinding progress. And above all, there is a suite of products I can use on a day to day basis. I don't know whether all of this would convert to price appreciation. In my mind, ETH (and bitcoin, and many other tokens) can head to 90% declines and still be useful. ETH did just that heading down to $80. My focus continues to be on the "useful" side of things and seeing what's the quickest way to get some of these developments to the end-users. I understand this piece does not do justice to all the brilliant things going on in Ethereum currently - I hope to cover more of it in the coming weeks.

Attributes

All data sourced here are from Santiment, tokenanalyst and Glassnode. Feel free to ping me for reviews on each before making a purchase

Notes

If you are going to translate this, feel free to. There is no need to e-mail me about it seeking permission. The only thing I ask is you hyperlink to the website and tag me via a tweet/e-mail me.

If you are a university student and spend time translating this - hit me up for a free book

I won't be able to send a data export for free. There are brilliant teams that collect and process this data. This is literally their life's work. I only happen to put it together.

If you need the data, please pay them. (please do, I'll spend time helping you sift through the data)If you are a crypto-media publication, please don't quote me on these numbers without mentioning the website. It is not kosher. I see what some of you guys did with my last piece.

@joel_john on telegram, joel@decentralised.co for email and @joel_john95 for Twitter