A look at ETH Account Balances

Observations on user behavior on Eth Network from Q1 2020

I was studying how different wallet account balance sub-groups on Ethereum's network was behaving. Basically I split the account groups into different categories. A little primitive approach to looking at it would be to see how retail, whale and really large (institutions?) balance behave over the course of time. In the case of ETH - there is also the bit that the asset is used for Gas so the number of account balances with dust (~.001) tokens left in them is also indicative of how the broader ecosystem is growing. We will see why this matters shortly.

Dust Wallet Behavior

I have broken down charts with upper limits of 0.001, .01 and 0.1 into 3 charts because their scales are quite different (so be wary of the scale on the right). As you can see, there are two broad things that have happened

Dust wallets increase in count in 2017 - likely due to ICOs the last time

Similar uptrend since the sell-off in March this year - likely caused due to DeFi

Point is, dust accounts with active balances is considerably higher than where it was in 2017 December where the previous ATH was hit. In some sense, this can be used as anecdotal evidence that the network is beginning to find product-market fit for itself. Since the chart may be a little difficult to read - here are the average figures for each sub-group. I have taken an average of the price for perspective

Retail Balances

One (primitive) approach to study how retail balances have behaved is to club wallets with upper limits of 1, 10, 100 and 10000 ETH respectively have behaved over time. This gives a broad mix of the new "entrant" trying to test the network to an individual with considerably more stake in the network. Keep in mind the figure for upper limits of 100 may have been swayed by the fact that 32 ETH is the current number of ETH tokens that will be needed for staking (if and) when Eth2.0 launches. Enough talk, here's the charts

If you compare this sub-category with the previous group, it will become quite evident that growth is less parabolic and relatively organic. What I find particularly interesting with this group is that although there have been sell offs (notice May 2018 - for 1-10 coins) - the numbers have more or less recovered in time. Multiple possibilities at play here

Individuals are splitting large balances to more smaller balances but maintaining a similar stake in the network

More individuals are buying into the network instead of selling and leaving it altogether

Or - there is a higher amount of new entrants entering the space than leaving it.

Either ways, for all the hype around the ecosystem, this is one of the most organic growth trends I have observed over the course of time. Here's the data in tabular format for easier reference

A larger sub-category here is individuals with wallet balances of between 1000 to 10,000 coins. This is likely the best indication of how users on the network are behaving as their balances are just at the right spot - in terms of large stakes and user-counts. This user category is quite interesting. The numbers for it peaked well after the ATH (indicating an accumulative phase) and dropped through the troughs of November 2018. The number has since more or less flattened around 6500 (down from a peak of 6900). It could be that larger accumulation is now happening in the sub-category with 100,000+ coins (given lower cost of the asset itself)

Thanks to 0xcat for pointing out I have missed this data - Link

Whale Wallets

I find this category of users quite interesting. You would think there is massive accumulation going on since the asset dropped over ~80% in price over time. I think these figures are slightly different because you will see there are (i) exchange balances, (ii) miners that may have been accumulating and (iii) old wallets that haven't sold. There could also be wallets from the highest category in this group (~1million+ tokens) that have broken down to smaller wallets. In the absence of data labelling on that (something that is being worked on by Nansen) - it may be inaccurate. For now, consider it to be anecdotal evidence. We use the same clubbing as previous groups here with upper limits of 10,000, 100,000, 1 million and 10 million here.

There are 3 key observations I made on looking at this

Those with upper limit balances of 100,000 ETH began leaving slightly after the top in 2017. That figure has more or less remained flat even in the recent sell off. This may highly likely be due to the possibility that early whales on the network divested and moved on to other things, a chance that large trading shops diversified how they handle their wallets and exchanges accumulating tokens into a single cold storage wallet as the markets entered a sell off phase

The category with the upper limit of 1 million tokens pushed further up from ~82 to 158 as of today. Almost ~2x. This makes me think there have either been larger prop-shops trading the asset or a massive accumulation on the network that has gone unnoticed. That spike you see around November may be inaccurate tagging at play - but the over-all growth is quite interesting.

There were some ~8 wallets with over a million tokens at ATH. That figure is now down to 4. It may require some on-chain analysis to know who they were and what happened to those tokens since then.

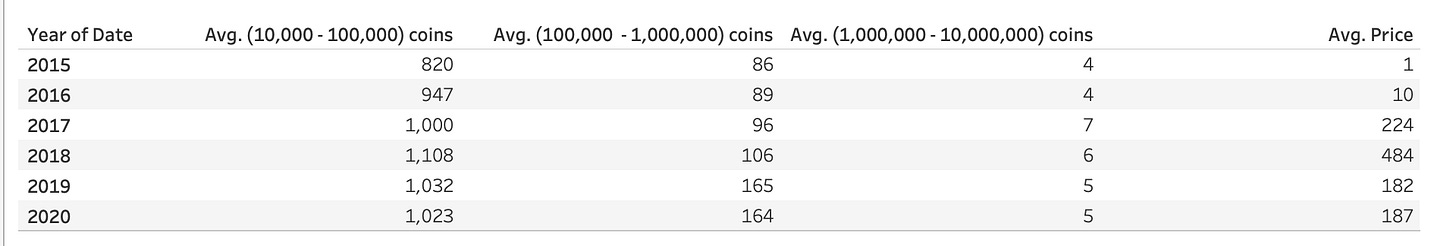

As with the previous two, here's the tabular form with yearly averages

What does all of this even mean

We have some anecdotal evidence of the following

The rise in dust accounts is indicative of the fact that people are using ETH. Even if they are tokens that are "forgotten" and un-used, the fact that they are out of supply for a while should bode well

There is evidence that retail wallets are increasing in the count. It seems the number of individuals entering the space is higher than the number of people leaving it regardless of what the media tends to suggest

We have reasons to believe massive wallets have been accumulating the whole time.

On a parting note - here's a dual-axis chart (that may be a bit of a crime) to put into perspective what's going on in the network.

Data sources : Santiment.net and Nansen Pro

Notes

1. Obviously this is not investment advice

2. Wallet behavior does not predict price action on their own. One angle to look at this data is through the pov of behavioral economics

3. Feel free to translate this. Ping me if you do

4. Don't quote this piece if you are a media publication without pinging me first

Consider adding to my data/books budget if this piece interested you and sign up. I am quite close to hitting my "product-market" fit for the newsletter :)