10 Bitcoin Charts

Understanding how Bitcoin is evolving through on-chain numbers

Hello,

There’s an odd thing about change. It may seem as though it happens overnight. But the catalysts that enable them don’t sprout out randomly. They are seeded, nurtured and grown over time. This is as relevant for technology as it is for social, political and personal changes. In 2017 when CNBC and Twitterati could not stop talking about Bitcoin, it felt as though we are at the cusp of “change”. That a post-dollar economy is finally here. Many learned in 2018 that change was not here yet. Most of what we saw was euphoria from Bitcoin’s price rising ~30 times in the course of slightly more than a singly year (Nov 2016 to Dec 2017.). We may be at the same point in history again. Or maybe not.

My friends on Instagram have begun mentioning Bitcoin, the ecosystem’s influencers are on CNBC, and JP Morgan thinks Bitcoin is digital gold for millennials. My gut says prices will likely increase, and crash. Some will create inter-generational wealth. And some will be wiped out. Bitcoin has to be seen for what it is instead of a get rich quick scheme. P2P, censorship resistance, hard money with a pre-defined monetary system that is maintained by proof of work. As we enter a period of what seems like euphoria again, I figured it may be useful to explore the state of Bitcoin in terms of wallet activity, on-chain metrics and new developments. Do share it with friends and family that are wondering what is going on with “that weird internet currency.”

Note: This is not investment advice. Nothing in this post suggests anything regarding the potential movement of Bitcoin’s price. I have attached a list of resources to help understand the technology at the bottom of this e-mail.

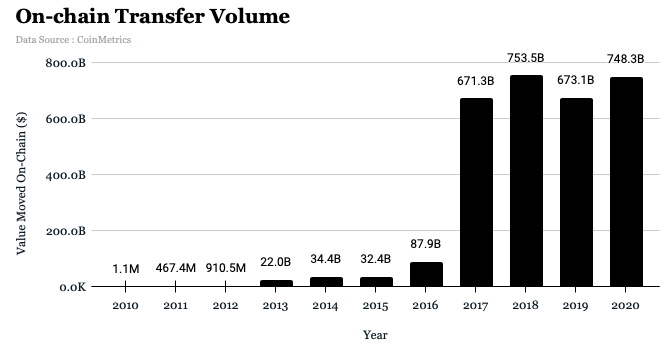

Bitcoin sets ATH for volume moved on-chain

Bitcoin’s use as a monetary unit is primarily determined by the number of people using it to store value and how frequently they move the asset itself. The simplest metric to measure this is to look at the volume that is moved on-chain. Although the price of Bitcoin itself fluctuates year after year, exploring the dollar-denominated movement helps us measure it in a steady unit. I relied on Coin Metric’s data for transfer value adjusted in dollars. Every year since 2017 has seen a higher amount in volume moved on-chain. This interesting because years like 2018 barely had substantial market-movements. We have also witnessed the rise of stablecoins being used for value transfer. My assumption is that Bitcoin is still relied on as the preferred route to move substantial amounts of money. The reason why I believe this is the case is that the mean transaction on Bitcoin’s blockchain today is north of $50,000. For a stablecoin like USDT, the same figure is at around $10,000. Whales still prefer Bitcoin for large transactions given the censorship resistance and immutability.

8.5 million+ wallets hold more than 0.01 in balances

To understand how user-segments in Bitcoin are growing, we split them into retail and whale based wallets. This gives us an idea of how the ecosystem’s evolution has been with time. If retail users are not engaging with the ecosystem it means there is no “new money” or adoption occurring. If large whale wallets are drastically reducing, it could indicate a lack of conviction on the moneyness of Bitcoin. The figures here speak for themselves. Both segments we check for in the small balance categories (0.01 and 0.1 Bitcoin) have been growing consistently since 2017 and have set new highs. In fact, the number of active daily wallets set a new all-time high on the 18th of November.

Whale wallets show an exciting replacement of assets from those holding 100 Bitcoins to those holding over 10000 Bitcoins. At about ~20,000 USD - 100 Bitcoins is over $2 million. Naturally individuals will incline to book profits around those levels given that it is a "life-changing" amount of money for an individual. And that is likely what has happened. On the flip side, those holding over 1000 Bitcoins have set a new all-time high. The rapid surge in wallets holding more than 1000 Bitcoins makes me believe that large funds and institutions are indeed here and accumulating at a rapid phase. It stands at 2228 wallets as of writing this.

500k Bitcoins moved out of exchanges in 2020

The amount of Bitcoins held in exchanges has tripled since 2017. The reason for this is likely an increase in the number of hedge funds focused on digital assets today. These institutions have a reason to leave a share of their holdings on exchanges to source liquidity to go back to the dollar when required. The total amount of Bitcoins held in known exchange wallets have declined from 2.9 million to 2.4 million as of writing this. This trend will likely only increase with an increasing number of Bitcoin investors looking at it as a store of value instead of a speculatory instrument. With players like Paypal and DBS (Singapore) now involved in being an on-ramp for Bitcoins, this chart could look fundamentally different in the next update depending on how they choose to enable custody and withdrawals. Consider playing with this tool by Entropy to learn how Bitcoin’s flow between exchanges has been for the past few years.

40% of Bitcoin’s supply has not moved In 2 years

Another data point that I found interesting in conjunction with the fact that over half a million Bitcoins have moved out of exchanges is that Bitcoin dormancy has been on the rise. It is a measure of what percentage of Bitcoins have been sitting idly in wallets. As of writing this, 44% of Bitcoin’s supply has not moved in the past two years. For more on this metric I suggest learning about Hodl waves. This number is in direct contradiction with the idea that Bitcoin’s essential use is for crime-related transactions or enabling money laundering. A large part of the network simply holds the asset in idle wallets. Individuals likely see Bitcoin more as a store of value than a payments network given the fees involved in transacting on it. The average Bitcoin holder probably uses it to hedge against inflation and as an alternative investment instrument. I explain why this is the case in the paragraph below.

99.70% of UTXOs are in profit

Suggestions to “hodl” in the Bitcoin ecosystem is likely grounded in some wisdom. We have anecdotal evidence that merely buying and holding the asset could be profitable. The percentage of UTXOs in profit is a measure of the estimated number of individuals that are in profit on Bitcoin’s network. They check for the difference between the current price and the time a transaction was made. Historically they have been a good measure of market tops - as the closer you are to 100% for this measure, the higher the likelihood that you are reaching all-time highs. The only way people could meaningfully lose capital with this in context is if they were repeatedly trading on exchanges or taking levered positions that got liquidated.

Monetary velocity signals bitcoin’s use as a store of value

Another signal for people’s changing perception of Bitcoin is the monetary velocity associated with it. Velocity is defined as the monetary value of an asset moved on-chain divided by the market cap of the asset. It is an anecdotal indicator that shows what amount of the asset moves on a given day. For Bitcoin the value is at 0.018. For Tether it is at 0.13. This comparison by itself is not fair given that Tether’s transaction fees are a fraction of what it would cost typically to move amounts on Bitcoin. However - it is fair to suggest that an increasing number of individuals use Bitcoin in cases where decentralisation, immutability, and censorship resistance are of utmost importance. Stablecoins on the other hand are seen more as an alternative to traditional fintech payment rails. This makes me wonder if stablecoins have a far smaller total addressable market than I initially thought. 🤔

Stablecoin supply ratio trending towards new lows.

The stablecoin supply ratio in Bitcoin is a measure that compares the purchasing power of Bitcoin with that of stablecoins in the ecosystem. It divides the supply of Bitcoin by the value of stablecoins denoted in BTC. When Bitcoin’s price is rising and stablecoin supply is stagnant, the figure increases rapidly. Similarly, when Stablecoin supply increases substantially and Bitcoin’s price remains stationary, the figure decreases. One way to interpret this data is as a measure of people’s preference for a volatile asset instead of exposure to the dollar itself. The other is as an indication of how much Bitcoin a unit amount of stablecoins can acquire. You can read more about the SSR ratio here. What SSR value declining typically indicates is that the purchasing power of stablecoins that are in the market today is declining by the day. This may change if there is a market-correction in Bitcoin’s price and stablecoin supply stays where it currently is at ~$25 billion.

Bitcoin trading volume up 4 times since 2018

A large part of what drives interest into Bitcoin is its trading in public markets. Retail users typically go down the rabbit hole, observing its volatility and take that path to understand the macro-economic implications of the world we currently live in. Trading is essentially the “hook” with which Bitcoin attracts corporations and individuals into a new monetary system. This is why keeping an eye on Bitcoin’s trading volume in the spot markets matter. On one end, it shows the number of individuals that are active in its market as speculators and on the other, it represents the multitude of large financial institutions that are now servicing the industry. On an annual basis, Bitcoin is about to have its most successful year in terms of spot volume with roughly 8.7 trillion traded this year. In 2018, the same figure was at just $2.2 trillion.

Bitcoin on Ethereum scaled to $2.5 Billion In Value

I understand this chart may annoy at least some of my readers but given Bitcoin’s role as a store of value, its use in DeFi matters. Porting Bitcoin to Ethereum’s smart contracts enables individuals to generate yield and use it for productive activities instead of lying idle. More importantly, it sets up a standard reference rate for lending Bitcoin. As of today, platforms like Blockfi and Nexo can offer bitcoin lending markets, but they are centralised. And as we saw with the recent bankruptcy of Cred, the lack of information on how they handle these assets could to disastrous results for users that rely on digital assets for banking. The amount of Bitcoin in DeFi is a measure of demand for new financial services to be built for the average retail user in frontier markets like India. It won’t be long before we see a new generation of lending, remittance and derivatives instruments that club Bitcoin and Ethereum launching with on-ramps in frontier markets.

Side note: Write to me if you are thinking of building a bitcoin-based INR lending firm for India.

I wrote this piece as an intellectual exercise for me to understand how Bitcoin is evolving. Every time I write these, I am amazed at the speed and pace at which things change in this industry. Bitcoin embodies what could happen when human ingenuity and borderless innovation happens at scale for me. Maybe in the future, we will see similar models playing out for other pressing matters like education reform, healthcare and agri-tech. After all, money is not the only instrument that needs change in modern society.

Hopefully, this article could be of use to you when you discuss cryptocurrencies and the on-going rallies in the market with friends and family over Thanksgiving holidays.

Here is the reading list as promised at the start of the article

This compilation of blockchain for dummies articles.

I have been exploring meta-stable currencies and indices in the DeFi ecosystem. I hope to share notes on them in the coming days.

Peace,

Joel John

Note: Nothing I mentioned in this article represents the market-views of any of the organisations I am associated with. These are personal interpretations of publicly available data that could be subject to corrections in the future.

Glassnode Shoutout

The vast majority of data-sets used in this piece comes from Glassnode as indicated in the charts shown above. I highly recommend signing up for their product if you trade or do research about digital assets often. In addition to having low latency, high-frequency data-sets on Bitcoin and several altcoins, they have a broad mix of metrics that are not readily available elsewhere. If you need excel / google-sheets to work with their data-sets, the team has a one-click CSV export option too. This is in addition to their highly reliable API.

In case you are wondering, I am not sponsored by them. I happened to fail to mention their use in the previous piece I wrote on Bitcoin and just wanted to make up for it. Also because I really like Glassnode.

I will be a little extra nice to family members during the holidays if you share this with a friend. Consider sharing it with strangers too. I don’t mind. Just don’t spam them.

I write rarely, but when I do, I appreciate being able to send it straight to your inbox. So please consider signing up if you have not already.

Drop me a note on what Bitcoin means to you. I may have a surprise waiting for a random person writing back. I don’t have Bitcoins to give you. Maybe a book.